UK 200 Report Analyzes Law Firms' Real Estate Strategies and Trends

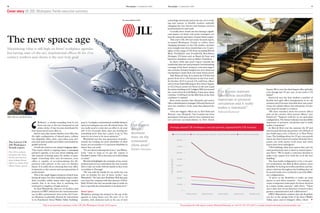

- 1. The Lawyer | 12 September 2016 The Lawyer | 12 September 201610 11 Cover story UK 200: Workspace Trends executive summary Matt Byrne and KimTasso technology and trends such as the rise of co-work- ing and remote or flexible workers radically changing the way lawyers and business services professionals live and work. Crucially these trends are also having a signifi- cant impact on firms’ real estate strategies, not least the amount and types of space firms require. This year’s UK 200 real estate-focused report, re-named Workspace Trends to reflect these changing dynamics in the UK market, includes more insights into these trends than ever. It spot- lights a wide range of UK firms including Bird & Bird, Fieldfisher and Freshfields Bruckhaus Deringer, US firms such as Ropes & Gray, and barristers chambers such as Atkins Chambers. In short, while this year’s report extends the traditional data-led and primarily benchmarking coverage of law firms’ property costs and usage it also includes detailed insights into how firms are attempting to make their real estate future proof. Take Ropes & Gray.In London the US firm has grown from 60 to 150 lawyers in just four years. In October 2015 it moved 235 staff from offices sub-let fromTaylorWessing in New Street Square to 45,210sq ft across two floors in the new Land Securities building at 60 Ludgate Hill,just around the corner from the Old Bailey. It has since taken a further 15,000sq ft on the fifth floor as the firm continues to expand. Real estate partner Iain Morpeth and senior office administration manager Deborah Eastwood were key members of the team that planned the move. “Our two biggest offices are in NewYork and Boston,” says Morpeth, “but London has been growing at a fast pace and we were crammed into our previous accommodation in New Street This is an executive summary of the UK 200:WorkspaceTrends 2016 report puts it,“workplace environment,worklife balance, and your workspace are now all critical issues. Do you really need to come into an office to do your job? A lot of people these days are looking for something more than just a place to go to. The issue for us is how to be more attractive.” Warmbold says the new generation of profes- sionals are looking for more flexibility in their hours, not necessarily 9-5, and more flexibility in where they can work. “It’s not about reducing the hours,” saysWarm- bold, “and so long as we get the output it shouldn’t matter.This is the issue we’re all looking at today.” Warmbold highlights the example of one senior professional services individual who was recently able to take six weeks with his family as they went on holiday to Portugal. “He was with his family for six weeks but was only on holiday for two of those weeks,” says Warmbold. “He had uber flexibility.Will that guy ever leave his company with that amount of flexi- bility? If that’s the way our people want to work,we have to provide the environment to let them do it.” Inner space Workplace strategy has jumped to the top of the agenda at many firms over the past 12 to 18 months, with elements such as the use of new The new space age Wellness’, a clunky-sounding term if ever there was one, is the new buzzword in real estate circles. It has become shorthand for how future-proof your office is. And in turn,that means whether your office has the right configuration of shared space, cellular but adaptable office units, open plan, tech, airi- ness and quite possibly pool tables surrounded by graffiti artwork. Clearly the reason is not simply bragging rights. This trend, which is topping many a managing partner’s agenda, is not just about making sure that instead of having space for armies of para legals crunching data and documents, your office is capable of accommodating the AI- powered robo-adviser of the (not too distant) future. It is really about ensuring that your office is attractive to the current and next generation of professionals. This is the single biggest property-related issue facing all major law firm leadership teams today. And crucially, unlike many other legal market trends, this is an issue that is anything but restricted to suppliers of legal services. As Karl Warmbold, director of facilities and property at DWF (which won the‘most innovative use of office environment’ prize at the 2015 Law- yer Business Leadership Awards for innovations in its Fenchurch Street Walkie Talkie building) t Our biggest design decisions were on the communal client areas” Bambos Georgiou The 2016 edition examines the data, trends and innova- tions behind firms’ efforts to make their offices future proof. The Lawyer UK 200:Workspace Trends report To purchase the full report contact Richard Edwards on +44 (0) 207 970 4672 or email richard.edwards@centaurmedia.com The feature staircase (above) was incredibly important to promote circulation and it really makes a statement” Deborah Eastwood Maximising value is still high on firms’ workplace agendas but having state-of-the-art, inspirational offices fit for 21st century workers and clients is the new holy grail In association with Square.We’re now the third largest office globally, even though just 25 per cent of our work is US linked”.` Eastwood says the firm trialled a number of flexible and agile office arrangements in its old premises and it became clear that there was a pref- erence for cellular offices, but with plenty of com- mon areas for people to connect. “We have standard sized two-person offices and, on the corners, three person offices,” says Eastwood. “Support staff are in an open-plan configuration.The feature staircase was incredibly important to promote circulation and it really makes a statement.” At Bird & Bird over the summer the IP and tech-focused firm has moved into 147,000sq ft of new-build space over 12 floors at 12 New Fetter Lane.The building allows for 25 per cent growth and as the firm’s head of London Nicholas Perry points out, both lawyer work areas and client spaces have been redesigned. “Old buildings often have spaces that can’t be used productively and so there is wasted space,” says Perry. “We’ve made a conscious decision to make every square foot work for us in the new building.” The base build configuration is for a two-per- son workstation, but Bird & Bird achieves more flexibility by having moveable partitions and fur- niture solutions throughout the building that can be moved easily over a weekend to provide differ- ent configurations. “It gives us the flexibility to make up team spaces as and when required – for example, to create a temporary team space for those involved in a major tender exercise,” adds Perry. “There was a clear view of our direction of travel to have greater communication and collaboration.” DWF’sWarmbold confirms that this flexibility was key to the design both of the firm’s Walkie Talkie space and its Glasgow office, where Cost(£)perstaff 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 Under £15m£15m-£25m£25m-£50m£50m-£100mOver £100m Average annual UK workspace cost per person, segmented by UK revenue cost per partner cost per qualified lawyer cost per fee earner cost per staff member

- 2. The Lawyer | 12 September 201612 Cover story UK 200: Workspace Trends executive number of firms that ever. Nowhere else is such a detailed analysis of the UK law firm real estate market available. The sample this year includes 105 firms with a combined fee income of £4.4bn and over 34,000 staff spending over £258m on 7 million square feet of offices in the UK.A third of this space (2.5 million sq ft) is in London. Where we have several years’ data from partic- ipating firms, it is possible to look at three-year trends which show a steady increase in the average cost per square foot from £36.71 in 2014 to £38.93 in 2016. The percentage change on 2015 is 1.03 per cent and on 2014 it is 6.05 per cent, suggesting that there has been a slowdown in the growth of average cost per square foot among the UK’s larg- est law firms. The average percentage revenue allocated to real estate cost is 6.6 per cent with 39 per cent of the sample spending between 5 per cent and 7 per cent.What is interesting is that 8 per cent are pay- ing over 9 per cent of their revenues on real estate – a very significant investment. Looking at the distribution of cost per square foot we can see that the majority of firms (57 per cent) are paying less than £40 per square foot. The average across the entire sample is £41 per sq ft. Just over a third (36 per cent) of firms in the sample are paying between £40 and £80 per sq ft. Only 6 per cent of the firms in the sample are paying more than £80 per sq ft. Highest users of space While the average amount of space used by the sample is 68,605sq ft there are significant differ- ences between the largest and smallest users of space. Last year, among those that provided data, the top five highest users of space – with a combined total of 1,821,129sq ft – were: Eversheds – 572,000sq ft DWF – 344,000sq ft Clyde & Co – 343,000sq ft CMS – 295,000sq ft BLP – 264,000sq ft the total space DWF now utilizes has reduced from 32,000sq ft to 18,000 (in London, where previously DWF operated out of two buildings, total space has reduced from 52,000sq ft to 43,000sq ft). “We recognise teams often need to be together but the whole team doesn’t necessarily need to sit together all of the time,” saysWarmbold.“So, for example, if you have a team of eight we will allo- cate them a set of desks on a permanent basis but less than they need. So they could, for example, book four desks if half of the team need to be together. But you also have to build in the flexi- bility in case the whole team is in on any given day so the team can still be connected.” The impact on desk utilisation has been dra- matic, saysWarmbold.Across the London market generally the rule of thumb is that a desk will be used 65 per cent of the time, he says. This is an executive summary of the UK 200:WorkspaceTrends 2016 report t Eversheds real estate statistics VARIABLE VALUE RANK Total sq ft 572,892 1 Total annual cost £24,271,115 1 Annual UK revenue £339,457,000 1 Number of UK staff 2408 1 Annual average cost per sq ft £42.37 55 Annual cost per person £10,079 67 Annual UK average sq ft per person 238 74 Annual UK average revenue per sq ft £593 49 Annual UK average revenue per cost £13.99 65 Sqftperstaff 0 300 600 900 1,200 1,500 Under £15m£15m-£25m£25m-£50m£50m-£100mOver £100m Annual UK sq ft per staff, segmented by UK revenue sq ft per partner sq ft per qualified lawyer sq ft per fee earner sq ft per staff member Workplace environment, worklife balance and your workspace are now all critical issues” Karl Warmbold “In our London office the rate is in the high 80s or early 90s,” he says. In short, the report significantly expands the coverage included in last year’s report, the first time The Lawyer focused specifically on real estate usage among the top 200 firms, and provides (in association with insights and data from JLL) clear signs as to the direction of travel in the UK legal market. Cost models Today’s feature is an executive summary of the full UK 200:WorkspaceTrends report, providing a snapshot of some of the report’s key findings (the full report is available for purchase from today, see access details below). And while there is a significantly increased focus on workplace trends, this year’s report con- tains more benchmarking data from a greater

- 3. The Lawyer | 12 September 2016 The Lawyer | 12 September 201614 15 Cover story UK 200: Workspace Trends executive summary To purchase the full report contact Richard Edwards on +44 (0) 207 970 4672 or email richard.edwards@centaurmedia.com Eversheds is spending £24,271,115 per annum on real estate which is 7.1 per cent of its UK rev- enue. However, in terms of the highest office costs as a percentage of UK revenue, Olswang is top of the list with 10.7 per cent. Across the sample only two other firms spent over 10 per cent of revenue on real estate – Mor- ton Fraser in Scotland (10.64 per cent) and ClarkeWillmott (10.08 per cent) which is primar- ily in the SouthWest and London. The amount of space per person in the 10 most modest users of space ranges from 30sq ft to 152sq ft – an average of 110sq ft per person – a massive difference to the 10 biggest users of space at 209sq ft. Client experience – the new priority This year’s report also contains several new sections, including insights into the growing importance of real estate in client experience management (CEM), with case studies from Mishcon de Reya in Africa House, Fieldfisher in Riverside House and Atkins Chambers barristers in Gray’s Inn. Mishcon in particular has gone the whole hog in transforming its client experience, following its move from Red Lion Square to listed building Africa House.New arrivals are greeted by a waiter offering coffee from the barista and providing wi-fi details on a card. As chief operating officer Bambos Georgiou puts it, the firm had an army of external consult- ants advising on the deal including principal architectsTP Bennett and Hambury Hird to help with the heritage issues relating to the listed status of the building. “The biggest design decisions were on the com- munal client areas,” adds Georgiou.“As with the lawyer offices upstairs we made clever use of glass to create a hybrid open-plan and cellular work- space. On each floor we have internal meeting rooms and kitchens (containing honesty fridges) as well as more informal spaces. The attention to detail in the choice of décor and fittings appears to have been worth it.As one of the firm’s clients, the former chair of the FTSE FD Club, puts it, “the front of house experience is the best in the City”. London vs the regions As already highlighted, this year’s report includes more data than ever before including real estate and office statistics from more than 100 firms across the UK. And while a third of the £258m real estate spend is in London, the full report includes in-depth analysis from JLL on the key regions around the UK. These commentaries include property deals tables and unique, in-depth case studies from sev- eral firms including Squire Patton Boggs, Pinsent Masons, DAC Beachcroft and Eversheds. The report also includes a particular focus on the dynamic Manchester market where the influx of firms such as Freshfields Bruckhaus Deringer and Latham & Watkins, both of which recently launched low-cost shared services centres, is shaking up the local market. The report also includes a focus on European, Middle East and international issues, including a case study of Trowers & Hamlins’ international real estate strategy. To buy the report,contact Richard Edwards,richard. edwards@centaurmedia.com This is an executive summary of the UK 200:WorkspaceTrends 2016 report Users of least UK office space (among sample) FIRM UK SQ FT UK SQ FT PER PERSON Keystone 6,830 30 Wallace 8,150 146 Bott & Co 8,584 90 Kerman & Co 9,009 127 Kemp Little 9,738 143 Seddons 10,000 97 Greenwoods 12,450 152 Hamlins 12,500 100 Hunters 13,000 118 Shulmans 15,000 93 Users of most UK office space (among sample) FIRM UK SQ FT UK SQ FT PER PERSON Eversheds 572,892 238 DAC Beachcroft 318,685 155 Weightmans 284,708 215 CMS 248,463 229 Berwin Leighton Paisner 233,400 215 Nabarro 194,330 n/d Mishcon de Reya 166,358 231 Blake Morgan 165,890 178 TaylorWessing 155,280 236 Osborne Clarke 144,943 189 Firms with the highest UK office expenditure (among sample) FIRM NAME ANNUAL COST (£) ANNUAL AVERAGE COST PER SQ FT (£) PERCENTAGE OF OFFICE COST OUT OF TOTAL REVENUE (%) Eversheds 24,271,115 42.37 7.1 DAC Beachcroft 14,882,028 46.70 7.8 CMS 14,672,069 59.05 6.7 TaylorWessing 10,261,000 66.08 8.1 Olswang 9,800,000 82.59 10.7 Charles Russell Speechlys 9,297,885 72.38 7.2 Mishcon de Reya 8,143,454 48.95 6.4 Kennedys 7,953,000 57.63 7.8 Weightmans 7,087,322 24.89 7.5 Osborne Clarke 6,824,000 47.08 6.0 Firms with the lowest UK office expenditure (among sample) FIRM ANNUAL COST (£) ANNUAL AVERAGE COST PER SQ FT PERCENTAGE OF OFFICE COST OUT OF TOTAL REVENUE (%) Porter Dodson 133000 4.03 1.3 Express Solicitors 197468 10.55 1.6 Fletchers 226761 8.56 1.4 Bott Co 234002 27.26 2.1 Brachers 279000 9.30 2.2 Roythornes 282000 7.05 2.1 BPE Solicitors 290000 12.08 3.2 Flint Bishop 294000 9.48 3.0 Aaron Partners 304000 nd 3.8 Roberts Jackson 322000 14.05 2.9 Old buildings often have spaces that can’t be used productively and so there is wasted space” Nicholas Perry Mishcon’s attention to detail led one client to call it ‘the best front of house experience in the City’ Law for an Uberworld The UK legal services market is at a cross- roads.There is much debate, commentary and research saying the industry must adapt or it faces the risk of being ‘Uber-ised’. I believe we are some way off this yet; how- ever, in the last 12 months it has become evident that a real momentum is building towards firms wanting to change the way they deliver legal services to their clients. This is still being driven by the need to focus on and improve operational efficiency as fee pressures remain high.While new entrants to the market are not so new anymore, they are really starting to challenge established players in some areas of legal service delivery, putting further pressure on the more traditional model to change and evolve with the times. The question around the role of the office has never been more important than it is today, and the legal sector is not alone in try- ing to answer it.With the rapid development of technology, rising popularity of alternative workspaces, such as co-working clubs, and greater focus on user experience-led design, the very raison d’etre of the office is being put under the microscope.What is its true function in the business world of the 21st century and what do employees of today and tomorrow expect from it? One theme that remains strong since last year’s report is that leadership teams are increasingly focused on maximising the best value they can get out of their corporate real estate as the war for talent intensifies and technological advancements continue to put pressure on businesses. A trend towards more agile workplaces and environments geared toward optimising employee experiences is really starting to ramp up. We are beginning to see offshoring coming back into the UK legal sector with some of the larger firms making wholesale changes to how they support their lawyers internally. Moving business services roles out of Lon- don, to either the likes of Manchester, Leeds or even Europe, is not uncommon.This enables the law firms to start right-sizing their portfolios and employee cost bases in one strategic move. There is also a separate subject of Brexit. As reported in JLL’s recent paper Making Sense of Brexit – Update III, after an initial period of market volatility in the wake of the vote, corporate occupiers are increasingly focused on portfolio assessment and scenario planning.With many businesses articulating a preference for the UK to remain within the EU, teams are engaging with executive leaders to assess and review CRE strategy. Internal groups are actively assessing opera- tional implications, risks and scenarios. One conclusion that emerged from this year’s report is that whilst the overall themes around corporate real estate remain largely the same, law firms are developing unique approaches to how they organise and manage their space.What works for one firm, may not necessarily deliver the same results for another. However, I believe those that are taking the opportunity to act now will benefit in the long term. Alexander Low, head of client develop- ment - Office Agency, JLL This year the top five providing data are using 2,484,949sq ft. It’s interesting to note that CMS has reduced its space by 46,757sq ft (no doubt as part of its move into the new Canon Street build- ing which was featured in last year’s report) and BLP has reduced its space from 264,812sq ft to 233,400sq ft – a reduction of 31,412sq ft. This suggests greater efficiencies in driving down the amount of space that firms use – which is interesting bearing in mind that the space In association with per partner, lawyer and staff member has increased. Many have commented on the more efficient new buildings which have much more usable space. The amount of space per person varies signifi- cantly in the top 10 users of space from just 155sq ft per person at DAC Beachcroft to 238sq ft per person at Eversheds.The average across the top 10 is 209sq ft per person. Lowest users of space Last year, the five lowest users of space were: Express Solicitors – 3,200sq ft Keystone – 5,800sq ft Bott Co – 8,600sq ft Kemp Little – 9,700sq ft Pemberton Greenish – 13,000sq ft Keystone (which featured in last year’s report) has increased its space by 1,045sq ft yet this year is the lowest user. However, Hamlins has reduced its space from 15,350sq ft to 12,500sq ft. Bott Co, Kemp Little and Shulmans are using the same amount of space as last year. WWW.NICKSTRUGNELL.COM