Unleashing the power of sage payroll and hr

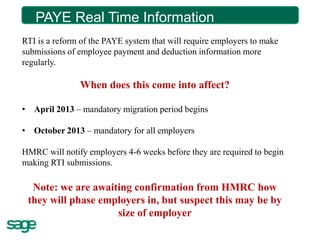

- 1. PAYE Real Time Time Information? What is Real Information RTI is a reform of the PAYE system that will require employers to make submissions of employee payment and deduction information more regularly. When does this come into affect? • April 2013 – mandatory migration period begins • October 2013 – mandatory for all employers HMRC will notify employers 4-6 weeks before they are required to begin making RTI submissions. Note: we are awaiting confirmation from HMRC how they will phase employers in, but suspect this may be by size of employer

- 2. PAYE Real Time Information What does this mean for Employers? Instead of sending information once a year at Payroll Year End, employers will be required to provide information to HMRC for PAYE, NIC and Student Loans every time the employee is paid.

- 3. PAYE Real Time Information How are HMRC preparing for RTI? HMRC are planning to run a number of different phases prior to it being mandated for all employers: 1. April 2012 to June 2012 - Pilot - HMRC will run a small controlled pilot to circa 320 employers in the UK. 2. July 2012 to October 2012 – Extended Pilot - HMRC are extending the pilot to another circa 1300 employers in the UK. 3. November 2012 to March 2013 - Soft Launch - HMRC will migrate circa 250,000 employers into RTI 4. April 2013 to October 2013 - Mandatory Migration – HMRC will start to mandate the migration of employers. It is still unknown how HMRC plan to migrate employers.

- 4. PAYE Quality Time Information RTI Real of Data is critical under Accurate employee and company data is absolutely essential for the success of RTI to ensure employees pay the right tax and national insurance contributions. The information you submit to HMRC about your clients every time you pay their employees will be matched against records HMRC store on their National Insurance and PAYE Service (NPS). If the records you are submitting do not match, you may trigger inaccurate tax deductions as well as HMRC communication and compliance checks of the data you store for your client’s employees.

- 5. PAYE Real Time Information Data Quality - Simple Do’s and Don’ts Ensure they have the correct details for their employees; wherever possible please check the information you need from an official source such as: • HMRC and /or Department for Work and Pensions documentation • Passport documentation • Birth Certificate Company Data - under RTI certain information is mandatory • DO – enter their Accounts Office Reference • DO – enter their full Company Name and • DO – enter their full Address • DO – enter their correct Tax District and Reference Number

- 6. PAYE Real Time Information Data Quality - Simple Do’s and Don’ts Employee Name – FACT - There were over 500 employees called A.N Other submitted to HMRC • DO – enter employee’s full forename and surname • DO – enter a double-barrelled forename or surname in full • DON’T – abbreviate - if HMRC hold records of ‘Robert’ don’t use ‘Bob’ • DON’T – enter an initial in either the Forename or Surname boxes Date of Birth - FACT - there were over forty employees over 200 years of age submitted • DO – enter the correct date of birth and ensure it’s in the format DD/MM/YYYY e.g. 05/05/1985 • DON’T – enter a default date of birth such as 01/01/1901 or make one up

- 7. PAYE Real Time Information Data Quality - Simple Do’s and Don’ts NI Number – FACT - there were 2,000 employees with a National Insurance Number of AB123456 • DO – only enter an employee’s correct National Insurance Number • DON’T – make up an employee’s National Insurance Number Important: For further advice on data quality please visit http://www.hmrc.gov.uk/rti/dip/data-quality.htm

- 8. PAYE Real Time Information The 5 new RTI submission types 1. Employer Alignment Submission – EAS Employer Alignment Submission (EAS) is a one-off submission that you’ll perform when you begin making RTI submissions. HMRC will use this data to match, align and correct the records they hold in their systems. Note: You will be required to submit an Employer Alignment Submission (EAS) prior to starting Real Time Information submissions.

- 9. PAYE Real Time Information The 5 new RTI submission types 2. Full Payment Submission – FPS The main and most common submission type consists of the employee payments and deductions that will be required each time an employer makes a payment to an employee. HMRC will use this submission to calculate how much PAYE and NIC is due (it contains similar information to what you would normally see on a P32). Note: This submission must be made on or before the date the employee is paid, and must be run after the Update Records process is complete.

- 10. PAYE Real Time Information The 5 new RTI submission types 3. Employer Payment Submission – EPS The submission will include data to enable HMRC to calculate employer liability that cannot be derived from the Full Payment Submission. Note: Only required where the employer needs to notify HMRC of adjustments to their overall PAYE and NIC liability for example where you are entitled to reclaim statutory sick or maternity pay.

- 11. PAYE Real Time Information The 5 new RTI submission types 4. National Insurance Verification - NVR Allows employers to validate an employee’s National Insurance Number (NINO) or request one where a new or existing employee does not have one. Note: Once the HMRC have processed the NVR submission, you will receive notifications from HMRC in your Secure Mailbox (this is not an automated process, it simply speeds up the existing process). 5. Earlier Year Update - EYU Allows employers to inform HMRC about changes made to a previous tax year figures.

- 12. PAYE Real Time Information What does PYE look like under RTI? What is no longer required? • You will no longer be required to make P14 and P35 submissions at the end of the tax year. • You will no longer be required to submit P38A returns for casual employees What will I continue to do? • You will continue to provide your employees with P60’s • You will continue to complete any P11D and P11D(b) for taxable benefits and expenses What is new? You will submit your final Full Payment Submission (FPS) for the year and then under PYE Routine complete and submit declarations to HMRC.

- 13. When does RTI impact employers? • From April 2012 HMRC are running a pilot with volunteer software developers and employers. • From April 2013 the mandating of RTI starts with large companies • From October 2013 all employers will be mandated to use RTI What is Sage doing? • We have been working closely with HMRC since the consultation paper for RTI was published • We have agreed to be part of the pilot and started to recruit employers for the pilot from July 2011 • We will be holding a series of Sage user forums across the Sage sites to inform our customers of the changes, these will be held in conjunction with HMRC • The HMRC technical specification has been published for us to work from and we are starting to build prototypes to take out to customers Sage will provide help and support during this implementation and would like to reassure our customers that we 13 will not pass on the cost of compliance

- 14. Legislation Changes PAYE Real Time Information (RTI Pilot)

- 15. What is Sage 50 HR? Sage 50 HR is a tool that allows users to record, store and track Human Resource information for Individuals within an organisation in one central location. Sage 50 HR provides a data capture and storage facility for Employment related data such as Absences and Holidays, Skills & Qualifications and Performance details that will assist you in managing employees effectively. That way a company can: • Ensure detailed employment history details are recorded and stored for each employee. • Ensure that individuals have the required training & support to effective perform their roles. • Record any Disciplinary Actions or issues that have arisen as well as steps taken should an employee raise a grievance. 15

- 16. Records Legally Required to Keep • Pay Rates • Payroll Information • Sickness periods of 4 or more days • Accidents, Injuries or Dangerous Occurrences Records Strongly Recommended to Keep • Training & Appraisals • Employment History • Absences • Personal Details • T&C’s • Disciplinary Actions 16

- 17. Sage Products Data Import/Export Data Import/Export Sage 50 Payroll MS Excel Sage 50 HR Complementary Sage 50 HR Advice Sage 50 Health & Safety Advice 17

- 18. Thank You – Any Questions?

- 19. Unleashing The Power of Sage and ACT Madingley Hall 26th April 2012 Cambridge House, 91 High Street, Longstanton, Cambridge, CB24 3BS Telephone: +44(0)1954 789978 Fax: +44(0)1954 782878 Email: enquiries@boldfield.com Web: www.boldfield.com

Notas del editor

- HMRC had intended to launch RTI from April 2012 but since consultation with ER’s ended in Feb they have re-assessed and have pushed back the reforms by one yearNow means April 2012 will be the start of a pilot with volunteer software vendors and employers with the mandating of larger employers commencing from April 2012 and continuing through medium and then small er’s until XXXXWhat we are doing:It is our intention to make the process of submitting Real Time Information as seamless as possible for our customers – ideally keeping the process as close to the one our customers are used to – that however is very much dependant on the technical specification that HMRC give us We have just received that technical spec now and are starting to work through what that meansCan re-assure you that we have been working very closely with HMRC and we have already shown them a POC (ahead of the technical specifications being received)We are committed to taking part in the pilot so will be aiming to have something in place for April 2012 (list of volunteer customers is far more restricted than we want 300 in total across all vendors – deadline of 10th June for list of customers)We will be hosting events with HMRC to make sure that you guys and your customers are educated on the impact of RTI