CEIC Russia Data Talk: Non-Government Pension Funds in Transition

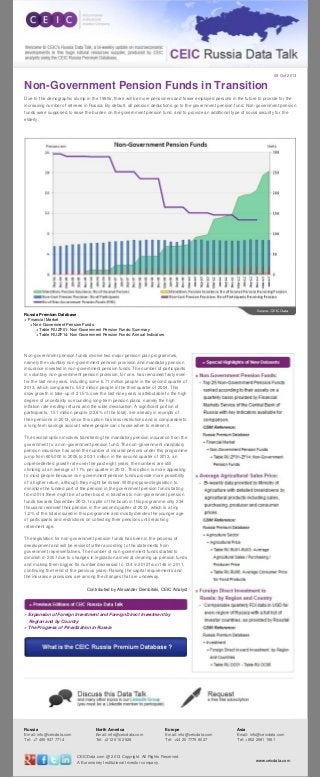

- 1. 09 Oct 2013 Non-Government Pension Funds in Transition Due to the demographic slump in the 1990s, there will be more pensioners and fewer employed persons in the future to provide for the increasing number of retirees in Russia. By default, all pension deductions go to the government pension fund. Non-government pension funds were supposed to ease the burden on the government pension fund, and to provide an additional type of social security for the elderly. Russia Premium Database + Financial Market + Non-Government Pension Funds + Table RU.ZF01: Non-Government Pension Funds: Summary + Table RU.ZF14: Non-Government Pension Funds: Annual Indicators Non-government pension funds involve two major pension plan programmes, namely the voluntary non-government pension provision and mandatory pension insurance invested in non-government pension funds. The number of participants in voluntary non-government pension provision, for one, has remained fairly even for the last nine years, including some 6.71 million people in the second quarter of 2013, which compares to 5.52 million people in the third quarter of 2004. This slow growth in take-up of 21.5% over the last nine years is attributable to the high degree of uncertainty surrounding long-term pension plans, namely the high inflation rate eroding returns and the ruble devaluation. A significant portion of participants, 1.51 million people (22.6% of the total), are already in receipts of their pensions in 2013, since this option has less restrictions and is comparable to a long-term savings account where people can choose when to redeem it. The second option involves transferring the mandatory pension insurance from the government to a non-government pension fund. The non-government mandatory pension insurance has seen the number of insured persons under this programme jump from 605,000 in 2005 to 20.31 million in the second quarter of 2013, an unprecedented growth rate over the past eight years; the numbers are still climbing at an average of 11% per quarter in 2013. This option is more appealing to most people because non-government pension funds provide more possibility of a higher return, although they might be riskier. With proposed legislation to minimize the funded part of the pension in the government pension fund starting from 2014 there might be a further boost in transfers to non-government pension funds towards December 2013. In spite of the boom in this programme only 234 thousand received their pension in the second quarter of 2013, which is a tiny 1.2% of the total insured in this programme and mostly denotes the younger age of participants and restrictions on collecting their pensions until reaching retirement age. The legislation for non-government pension funds has been in the process of development and will be revised further according to the statements from government representatives. The number of non-government funds started to diminish in 2007 due to changes in legislation aimed at cleaning up pension funds and making them bigger. Its number decreased to 134 in 2012 from 146 in 2011, continuing the trend of the previous years. Raising the capital requirements and the insurance provisions are among the changes that are underway. Contributed by Alexander Dembitski, CEIC Analyst » Expansion of Foreign Investment and Foreign Direct Investment by Region and by Country » The Progress of Privatization in Russia Russia Email: info@ceicdata.com Tel: +7 495 937 7714 North America Email: info@ceicdata.com Tel: +212 610 2928 Europe Email: info@ceicdata.com Tel: +44 20 7779 8027 Asia Email: info@ceicdata.com Tel: +852 2581 1981 CEICData.com @ 2013 Copyright. All Rights Reserved. A Euromoney Institutional Investor company. www.ceicdata.com