Freeman Report

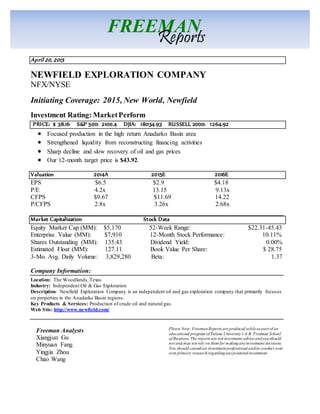

- 1. April 20, 2015 NEWFIELD EXPLORATION COMPANY NFX/NYSE Initiating Coverage: 2015, New World, Newfield Investment Rating: MarketPerform PRICE: $ 38.16 S&P 500: 2100.4 DJIA: 18034.93 RUSSELL 2000: 1264.92 Focused production in the high return Anadarko Basin area Strengthened liquidity from reconstructing financing activities Sharp decline and slow recovery of oil and gas prices Our 12-month target price is $43.92. Valuation 2014A 2015E 2016E EPS $6.5 $2.9 $4.18 P/E 4.2x 13.15 9.13x CFPS $9.67 $11.69 14.22 P/CFPS 2.8x 3.26x 2.68x Market Capitalization Stock Data Equity Market Cap (MM): $5,170 52-Week Range: $22.31-45.43 Enterprise Value (MM): $7,910 12-Month Stock Performance: 10.11% Shares Outstanding (MM): 135.43 Dividend Yield: 0.00% Estimated Float (MM): 127.11 Book Value Per Share: $ 28.75 3-Mo. Avg. Daily Volume: 3,829,280 Beta: 1.37 Company Information: Location: The Woodlands,Texas Industry: Independent Oil & Gas Exploration Description: Newfield Exploration Company is an independent oil and gas exploration company that primarily focuses on properties in the Anadarko Basin regions. Key Products & Services: Production of crude oil and natural gas. Web Site: http://www.newfield.com/ Freeman Analysts Xiangjun Gu Minyuan Fang Yingjia Zhou Chao Wang FREEMAN Reports Please Note: FreemanReports are produced solelyas part of an educational program of Tulane University’s A.B. Freeman School of Business. The reports are not investment advice andyoushould not and may not rely on them for makinganyinvestment decisions. You should consult an investment professional and/or conduct your own primary researchregardinganypotential investment.

- 2. NewfieldExploration (NFX) April 20, 2015 2 FREEMAN Reports STOCK PRICE PERFORMANCE Figure 1: 5-year Stock Price Performance Source: Yahoo! Finance as of April 20, 2015 INVESTMENT SUMMARY The analysis team gives Newfield a MARKET PERFORM rating and estimates that the target price by the end of 2015 will be $43.92/share. The target price will increase 33.33 percent from $38.16/share as of April 20, 2015. The team applied both intrinsic valuation and relative valuation to get the 12-month target price. According to the PV 10 calculation, the stock price is $24.06/share. Based on the valuation of Newfield reserves value, which is $89.9/share-$115.21/share and the uptrend of oil and gas prices in 2015, the team predicts that the Newfield stock price will increase. Thus, the team used the average of EV/BOE multiple and P/CF multiple to get the 12-month target price of $43.92/share. Newfield focuses on onshore exploration and the development of current operating regions such as Anadarko Basin, which has high production rate. Under successful management, Newfield has improved its production efficiency. It is certain that with the recovering of oil and gas prices, the company will be profitable in 2015. According to the 2014 financial report, Newfield had only $14 million cash on its balance sheet, indicating the poor financial condition of the company. However, after the reconstruction of the company’s financial structure, it has improved its liquidity and financial strength. How to maintain the good financial condition is the greatest challenge of Newfield. In addition, the company cannot guarantee that it can hedge all the commodity pricing risk, which adds possibility of losing profits. Despite the economic concerns, the analysis team has strong confidence that Newfield will perform well in 2015, based on its current strong fundamentals and good company strategies. INVESTMENT Under volatile commodity price environment, in order to maximize

- 3. NewfieldExploration (NFX) April 20, 2015 3 FREEMAN Reports THESIS shareholders’ value, Newfield Exploration slows down its expansion and makes disciplined investment to generate consistent cash flows. By focusing on its advantageous Anadarko Basin area with hedging, the company now shows stable developing tendency and organic growth potential. Disciplined capital expenditures balance expected cash flows Over the past four year, crude oil prices have been comparably stable until last six months. However, as production increased in U.S. and other global supply and demand factors, crude oil prices declined by nearly 50% over the last six months. In future, projected capital spending and drilling programs by exploration and production companies are expected to dramatically decline. With the uncertainty regarding the timing and magnitude of an eventual recovery of crude oil prices, Newfield has reduced planned capital spending in 2015 by approximately 40% compared to last year’s level. As a result, cash flows for 2015 are expected to balance the disciplined capital expenditures. Increased investment in higher-return Anadarko Basin areas continuously improves operation structure and returns Newfield decided to focus on high return areas across its portfolio by increasing investment in the higher-return Anadarko Basin of Oklahoma. Approximately 70 percent of the company’s planned capital investments in 2015 will be allocated to the Anadarko Basin, which is characterized by resilient economics at lower prices and a deep inventory of drilling opportunities in the SCOOP, STACK and Springer plays. This will also reduce the service costs to further enhance returns in these plays. In addition, Newfield planned to slow down its investment the Uinta Basin, Williston Basin and Eagle Ford plays. Derivative instruments manage the commodity prices volatility risk Because of global supply and demand imbalance, crude oil prices declined sharply during the fourth quarter of 2014, and this weak environment will continue into 2015. Under such unfavorable price, Newfield manages about 85 percent of expected 2015 oil production using derivative instruments against prices uncertainty. In this way, Newfield limits or reduces adverse impact on its cash flows of 2015 oil and gas production. The company currently uses five derivative instruments, including fixed-prices swaps, collars, fixed-prices swap with sold puts, collars with sold puts, and swaptions. Fixed-prices swaps ensure that Newfield will receive money if the settlement price is less than the swap strike price. Collars are favorable when the settlement price is below the floor strike price. A swaption is an option to give the counterparty a right to buy Newfield’s contract, which if exercised, will equal to a fixed-prices

- 4. NewfieldExploration (NFX) April 20, 2015 4 FREEMAN Reports swap. Newfield uses both single and combined instruments to hedge 14,640 MMMBtus of 2016 gas production and 732 MBbls of 2016 crude oil production Strategic acquisitions and divestitures demonstrate healthy cash flows and organic growth In order to increase financial strength, Newfield tries to focus on core areas which the managers think that they have more experience in exploration and understanding of technological process. After selected acquisitions and divestitures, managers can predict the drilling results with increased accuracy. Through 2012 to 2014, Newfield divested over $2.1 million non-strategic assets to focus on developing core areas. The company, in this way, improves exploration efficiency and guarantees no or few wasted resources on low-performance assets. In September 2014, Newfield sold its assets in Granite Wash, located in Texas, for $588 million. In October 2012, Newfield sold its remaining assets in the Gulf of Mexico to focus on its onshore business. In addition to divestitures, Newfield acquired oil and gas properties for $33, $72, and $9 million in 2014, 2013, and 2012 respectively. In the company’s recent acquisitions and divestitures history, Newfield went through a quick expansion period through 2005 to 2011, developing new plays both domestically and internationally. Afterwards, the company slowed down its expansion, and made adjustments to its asset structures to become a more “oil-focused” and “liquids-rich” onshore company. Accumulating certain exploration and technology experience, focused investment in existing areas can allocate the company’s budgets into its advantageous areas. Newfield tends to keep such developing speed into 2015 to increase proved reserves in high-performance, low-risk areas, and reduces investment in non-strategic areas. Because of the downward trend of oil and gas prices, Newfield’s investment strategy of highlighting high- grade resources can help the company ensure its production returns and cash flows. VALUATION The current stock price of Newfield as of April 20, 2015 is $38.16, so based on our valuation, the analysis team decides the target price of Newfield in 2015 is $44.40/share. The PV10 calculation shows that the stock price should be $24.06/share. In the valuation of Newfield’s reserve value, the team came out the range of $89.09-$115.21/share, according to the team’s base case and high case valuation assumptions. In addition, the intrinsic value calculated based on 2014 proved reserved only is $31.27/share, which is quite close to the current stock price. The analysis team also estimates that the oil and gas prices will be slightly higher in 2015 than they are in 2014. Thus, the company has the potential to have higher stock prices than today.

- 5. NewfieldExploration (NFX) April 20, 2015 5 FREEMAN Reports The analysis team decided our target price based on the average of EV/BOE multiple and P/CF multiple, using industry average as our comparable. The enterprise value is the market value of a whole business and the BOE refers to the production of oil and gas that a company is able to generate. The analysis team used the EV/BOE valuation because first enterprise value shows that how the market prices the company, and second, in the E&P industry, a company’s production can influence and predict the future cash flows of a company. First, the analysis team chose 16 companies based on the data the team got from Bloomberg in E&P industry and calculated the industry mean EV/BOE ratio. The analysis team then multiplied this ratio by Newfield’s BOED production data to reach an enterprise value of $9005.8 million. By adding market value of cash and subtracting book value of debt, then dividing the share number outstanding, the analysis team got the price of $44.4/share. Similarly, the analysis team calculated P/CF multiple, based on the idea that cash is the most liquidity asset, which shows the financial condition of a company. Thus the team got the price of $43.44/share. Taking the average of these two multiples, the team got the target price of $43.92/share. In addition, the analysis team calculated Newfield’s peer group’s average (SM Energy Company, Rosetta Recourses Inc., QEP Resources Inc., and Cimarex Energy Co.) EV/BOE ratio. The analysis team then multiplied the peer groups average EV/BOE by Newfield’s BOED production to get the enterprise value of $5953 million, and arrived at a target price of $22.28/share. The analysis team got the P/CF multiple of $41.47/share, based on peer companies. As mentioned above, the analysis team believes the stock price of Newfield will be higher in 2015, so the team believes that the stock price, which the team got from using the industry average, is more persuasive. In general, compared to the current stock price of $38.16/share, our target price is 33.33 percent higher. Thus the team believes that Newfield will be market perform.

- 6. NewfieldExploration (NFX) April 20, 2015 6 FREEMAN Reports Table 1: valuation method COMPANY DESCRIPTION & PROPERTY OVERVIEW Newfield Exploration Company (NYSE: NFX) started business in Delaware in 1988. Currently, the company is headquartered in the Woodlands, Texas. Newfield mainly operates in three fields: exploring oil deposits, developing, and manufacturing crude oil, natural gas and natural gas liquids. Because of the decision to sell Malaysian operation in early 2014, Newfield now focuses on its domestic operation. Thus, Newfield has possessed operation land, mainly located in the Mid-Continent, the Rocky Mountain region and the Onshore Gulf Coast. Internationally, Newfield is developing offshore business in China. History Newfield Exploration was founded by Joe B. Foster, the former Chairman of Tenneco Oil Company. In the beginning, the company had $9 million in capital. The first production property that Newfield Exploration purchased was Eugene Island Block 172. The company used the ticker ‘NFX’ on the NYSE at the end of 1993. After 10 years of development, Newfield Exploration expanded into southern Louisiana and the Texas coast to diversify its base. During 2009, Newfield made its first international attempt in Australia to acquire two producing oil offshore fields. After 2000, the company made an acquisition and increased its asset base in South Texas. Through this acquisition, Newfield established its focus on onshore plays. In 2004, the company started operations in the Rocky Mountain region and then established international operations with the Malaysian coast and Chinese coasts. In late 2010, Newfield was added into S&P 500. In 2011, Newfield moved its headquarters to the Woodlands, Texas. Business strategy In order to remain competitive and gain long-term benefits, which adds Current Price Target Price Note $24.06 $9.24 $31.27 $89.09 $115.21 Multiple Comparables Newfield Note:Peer companies Industry $24.62 Peers $22.02 Industry $43.44 Peers $41.47 Industry $31.50 Peers $36.35 Industry $44.40 Peers $22.28 Intrinsic Valuation SM ROSE QEP XEC $38.16 as of 4/20/2015 $43.92 PV 10 EV/EBITDA EV/BOE P/E P/CF Relative Valuation NAV 2014 Proved Reserved Only Base Case High Case

- 7. NewfieldExploration (NFX) April 20, 2015 7 FREEMAN Reports value through environmental friendly production, Newfield has developed five business strategies. Newfield Exploration tries to maintain a diversified assets. During its years of development, Newfield has changed its strategy from the conventional gas drilling to the unconventional liquids focus. Because Newfield has diversified assets located mainly in North America, it at most decreases its exposure to geographic risk and commodity price risk. Newfield Exploration focuses on improving and strengthening capital structure. Newfield’s major focus is on its domestic business currently. In this way, the company uses the proceeds from selling its Malaysian and Chinese business to improve financial liquidity. Newfield also hedges some commodity pricing risks and raises funds through derivative markets to ensure the success of its operation plans. Newfield Exploration combines an active drilling program and selects acquisition. Newfield’s quick growth comes from two parts: active drilling and select acquisition. On the one hand, while Newfield has kept its exploitation in focused land, it is also looking for a new drilling program. The company has kept its drilling programs under comparatively low geologic risk. On the other hand, Newfield continues to expand its drilling area onshore within the United States through a series of acquisitions. In 2013, Newfield acquired about 65,000 net acres in Oklahoma's Anadarko Basin "STACK" play. In 2011, it acquired about 65,000 net acres in the Uinta Basin. Those select acquisitions in different places hedge Newfield against geographic risk. Newfield Exploration tries to utilize assets and resources efficiently. Through effective management, Newfield is able to control its investments and expenses while using its assets efficiently. Newfield geographically concentrates on certain areas in order to improve asset utilization and resource allocation, as well as to have a better understanding of corporate responsibility on the environment and safety operations. Newfield Exploration’s strategy also includes reserving great human resources and taking shareholders’ interest as the first priority. Great human resources are always key to the companies’ success. Newfield values highly of talented employees. Newfield also hands out equity to employees so that they will make decisions in the interest of stockholders. PROPERTY OVERVIEW As the company strategy of focusing on North American business, 96 percent of Newfield proved reserves are related to domestic operations at the year-end of 2014, which mostly are located in the Mid-Continent region, the Rocky Mountain region, and the onshore Gulf Coast. Newfield also has operations in the offshore China, which contributes 4 percent of

- 8. NewfieldExploration (NFX) April 20, 2015 8 FREEMAN Reports the proved reserves. About 46 percent of Newfield proved reserves are in the Mid-Continent region, which includes over 400,000 net acres. In this area, Newfield has Anadarko Basin and Arkoma Basin, where it develops the Woodford Shale for decades. Another big region of Newfield Exploration’s operations is in the Rocky Mountain area, which represents about 43 percent of the proved reserves at the year-end 2014. The basic product in Rocky Mountains is oil, which characterized by long-lived production. Recent years, Newfield Exploration has focused on Rocky Mountains region and has developed more than 250,000 net acres in the Uinta and Williston basins. In 2014, Rocky Mountain contributed 32% of total domestic production and cost 45% of capital budget. The third largest operation area is in the onshore Gulf Coast, which represents about 7 percent of Newfield’s proved reserves. It has approximately 25,000 net acres in the Eagle Ford, located in the Maverick Basin of Maverick, Dimmit and Zavala counties, Texas. The Eagle Ford play produced about 11,000 BOEPD (52% oil and 24% NGLs) during the fourth quarter of 2014. Additional to domestic operations, Newfield has about 4 percent of its proved reserves, 23 MMBOE in China, mainly located in the South China Sea. Newfield is producing oil in three wells there, and plans to invest the fourth well in 2015 by $40 million. Figure 2: Operating region of Newfield Source: January 2014 Goldman Sachs Global Energy Conference Presentation

- 9. NewfieldExploration (NFX) April 20, 2015 9 FREEMAN Reports The largest production base The Anadarko Basin in the Mid-Continent region is now Newfield’s largest production area, which produced 54,000 BOEPD in the fourth quarter of 2014 and comprised 28 percent of its proved reserves. Now the Anadarko Basin has 300,000 net acres. Newfield plans to invest 70 percent of budget in 2015 to this region and estimates that the Anadarko Basin’s production will comprise 41 percent of total operations. Figure 2: Map of the Anadarko Basin Source: March 2015 Howard Weil Conference presentation LATEST DEVELOPMENT S AND RECENT ACQUISITIONS During 2013, domestic production increased 19 percent to 47.9 MMBOE, with a 38 percent increase in domestic liquids. Consolidated fourth quarter production was 138 MBOEPD (60% liquids). Proved reserves grew 14 percent. Company’s PV-10 increased 9 percent in total and 16 percent in domestic region, compared to the prior year-end number of $8.8 billion and $7.7 billion. Newfield has net developed well 232 in total in year-end 2014, and was in the process of drilling 15 net development wells domestically and one in China. Newfield plans to issue $815 MM common stock and extend credit facility to $1.8 billion. The company restructured its long-term debt to

- 10. NewfieldExploration (NFX) April 20, 2015 10 FREEMAN Reports reduce its domestic lease expense by 7 percent per barrel over 2013. Newfield sold $1.5 billion non-strategic assets in Granite Wash in September 2014 to align with the liquid-rich plays strategy and enhance liquidity. The company then uses the earnings to redeem its $600 million Senior Subordinated Notes due 2018. In February 2014, Newfield also closed its business in Malaysia to fund capital expenditure throughout the year. Previously, Newfield expected that the pearl facility in China would reach its peak in mid-2015, and included China business as discontinued operations for sale. Because of the greatly declined commodity prices in December 2014, Newfield did not find an acceptable offer, and decided to reclassify China business as continuing operations during the fourth quarter of 2014. To expand the operating areas, Newfield Exploration made several acquisitions in its core business. For example, Newfield Exploration increase its oil production in Rocky Mountain by gaining 65, 00 net acres in Uinta Basin in 2011. In 2013, the company make another acquisition, adding 65,000 net acres in Oklahoma’s Anadarko Basin, benefiting the operation in the Mid-continent region. The acquisition in 2013 makes the Mid-continent region the most productive field for the company. INDUSTRY ANALYSIS The petroleum industry includes business of exploration, extraction, refining, transportation, and marketing the petroleum products. The main products in this industry are oil and gas. Primarily, the industry consists of three sub-business sectors: upstream, midstream, and downstream. The upstream companies are responsible for exploring and extracting oil and gas products. The midstream business provides the service to carry the petroleum products nationwide and aboard with pipelines, trucks, barges, and other means of transportation. The downstream sector provides refining and processing services. Newfield Exploration (NFX) is in the upstream industry, focusing on the exploration and production of oil and gas onshore in the United States. Industry specifies On the whole, the oil and gas exploration and production sector has a massive size. Capital IQ listed an average $42.4 billion market cap for large cap companies, $8.3 billion for mid-cap companies, and $1.77 billion for small cap companies. According to Capital IQ sector growth data, the sector has total revenue growth rates of 14.3 percent in 2011, - 28.4 percent in 2012, 9.1 percent in 2013, and –3.3 percent in 2014. The unique nature of oil and gas cause the growth rate fluctuate, affecting revenues. The world crude oil prices have shown a sharp downward trend since last year because of oversupply. However, the capital expenditure in finding new drilling spots is also a big driver for higher revenues. Newfield Exploration’s role Newfield Exploration is a small cap company in the upstream sector. The company has seen fast growth during past two years in its four main

- 11. NewfieldExploration (NFX) April 20, 2015 11 FREEMAN Reports in the industry drilling areas through campaigns. In the Uinta Basin, the company focuses lowering the well costs by changing the design and well orientation. Besides, Newfield is among the first to try extended laterals technique, which proved to be profitable in Williston and Eagle Ford areas. Macroeconomic drivers Because of the globalization, the world market has a deep impact on the United States’ energy industry. For example, OPEC decisions, global supply and demands and currency exchange rates all bring volatility to the domestic oil and gas production. On the other hand, US GDP, regulations and price forecasts, seasonality are the domestic macroeconomic drivers of the energy industry. International drivers Organization of Petroleum Exporting Countries (OPEC) is an organization, through which members co-ordinate their production periodically to ensure the balance of oil price and supply. OPEC contributes about 40 percent of global oil and gas production. The organization is an important factor in global energy market. Generally, when OPEC cut its oil supply, the price rises. In addition, because crude oil transactions use US dollars to settle accounts, the buying power of US dollars against other currencies also influences oil prices. Mostly, the higher value of US dollars, the lower oil prices will be. Domestic drivers If the economy is good or people have positive expectation for the future, the demand for oil will rise, which will push the price up. However, if domestic supply can’t satisfy national demand, the difference between supply and demand should be fixed by importing, which will have a negative effect on GDP. On the other hand, price forecasts for oil and gas also have deep impact on the energy industry. For example, the predicted demand for oil is lower in 2015 than it was in 2014, which contributes to the drop in oil prices in the second half of 2014. Since the BP oil spill in the Gulf of Mexico in 2010, the federal, states, and local authorities gave put strict regulations on the oil and gas industry. The industry must obey regulations of drilling and production, and of environmental protection. Nature is also an important factor on the United States’ energy industry. Every year when the temperature falls below 65 Fahrenheit, oil demand rises. Seasonality increases the volatility of the oil price and consumption Microeconomic Drivers Microeconomic factors also influence oil and gas companies. Sunoco Logistics Partners Operation GP LLV, Royal Dutch Shell plc, Tesoro Corporation and other Monument Blue field oil production companies are major customers of Newfield Exploration. Sunoco Logistics Partners Operation GP LLC and Royal Dutch Shell plc have lower bargaining power than the other major customers. The great loss of revenue from Tesoro Corporation and other large purchases of Monument Blue field oil

- 12. NewfieldExploration (NFX) April 20, 2015 12 FREEMAN Reports production companies has a strong bargaining power. Therefore, Newfield Exploration has an advantage over most buyers except those large purchases of Monument Blue field oil production companies. Suppliers have important impacts because of their high bargaining power, such as drilling equipment, experienced employees, and many other resources. Threat of entry In oil and gas industry, the threat of entry is low because of high barriers to new entrants in this area. In addition to government regulations, high capital investment to the regular equipment is another important reason keeping new entrants out of the industry. The cost to start a business, including exploration cost, development cost, and operation cost is high. Despite those reasons, it’s hard for new entrants to find a place and survive under pierce competition. Bargaining power of suppliers The bargaining power of suppliers is moderate. Suppliers provide high- tech and expensive drilling equipment, and well trained employees. The market of drilling suppliers are concentrated, controlling oil and gas industry. Company cannot get oil and gas from reserves and cannot operate smoothly without the support of suppliers. However, the high prices will affect the production of Newfield, harming the profits of suppliers. Bargaining power of buyers Oil and gas buyers have weak bargaining power because the demands are inelastic. For example, the demand of oil doesn’t change dramatically after the falling oil price. Moreover, oil and gas take 60 percent of energy consumption in the world, meaning they are still the major energies. Although people are consuming renewable energy resource and coal in the daily life. These energies only take 29 percent of the energy consumption in the world. In other word, no perfect substitutes for oil and gas exist in the world, indicating a low bargaining power of buyers. Availability of substitutes Currently, few substitutes for oil and gas exist in the world. Although Gas Hydrate can be one of the substitute, it is hard to explore and exploit. Wind power, nuclear power, and water power are all the available substitutes for the oil and gas. However, the power come from those energy can’t meet the large demand. Cars driven by electricity are becoming popular nowadays. But such technology is not as mature as traditional technology. Moreover, most of the equipment in the daily life are driven by oil and gas. The oil and gas is still two major energy consumptions in daily life, thus the availability of substitutes is low. Competitive rivalry The competitive rivalry is high. Independent oil and gas companies, individual producers and other national oil and gas suppliers compete for potential reserves, human resources, equipment and advanced drilling technologies. Apart from small independent firms like Newfield, there are large corporation like Exxon, BP, etc. These companies incorporate upstream, midstream, and downstream fields together. Because of their

- 13. NewfieldExploration (NFX) April 20, 2015 13 FREEMAN Reports large size, these large corporations gain economics of scale. Small companies like Newfield are overcoming by getting into joint ventures with these corporation. PEER ANALYSIS Newfield Exploration is a company that focuses on oil and gas exploration and production. Different from the peer companies that only operate inside the United States, Newfield also has international offshore operations. Because Newfield directs about 80 percent of its investments to domestic drilling, companies that only operate in North America are good comparable peers. Four peer companies are chosen based on similar market capitalization, drilling locations, products, and strategies. Table 2: information of peer companies Source: Thomson One as of April 20, 2015 SM Energy Company (SM/NYSE) SM Energy, founded in 1908 and located in Denver, is an independent energy company that currently focuses on oil and liquids exploration and production. The company diversified its onshore operations in four major areas: South Texas and Gulf Coast, Rocky Mountain region, Permian region and Mid-continent region. Among these regions, SM focuses on developing its Eagle Ford shale program and Bakken/ Three Forks in Williston Basin. SM Energy has a market capitalization of 2.5 billion with total proved reserves of 547.7 MMBOE for the year end 2014. The strategy for SM is to expand its resource plays with a rather high speed and a reasonable cost. For year-end 2012, the company shifted its focus on gas reserves to liquids ones. SM has a smaller market capitalization than Newfield but has higher numbers in other metrics. QEP Resources, Inc. (QEP/NYSE) QEP Resources, Inc., founded in 1922 and located in Denver, is a company that provides oil, natural gas, and natural gas liquids exploration and production. QEP has two major operating regions: the Northern Region (primarily in the Williston Basin, the Pinedale Anticline, and the Uinta Basin), and the Southern Region (mostly in the Anadarko Basin in Oklahoma, Louisiana and the Texas Panhandle) of the United States. QEP is different from Newfield, which focuses on E&P, also operates in midstream service and energy marketing. With a low-cost structure, QEP’s strategy is to maximize project value by investing in the highest potential resource plays. The company has a slightly higher P/E ratio of 4.6x in 2014 than Newfield Exploration. Compnay Ticker Last PriceMarket Cap P/E P/BV D/E ROE SM Energy Company SM $57.42 $3.87B 3.9x 1.1x 103.50% 34.21% QEP Resources QEP $22.70 $3.98B 4.6x 0.9x 55.80% 21.05% Rosetta Resources ROSE $23.90 $1.47B 4.4x 119.80% 20.78% Cimarex Exergy XEC $127.03 $11.13B 18.3x 2.1x 33.30% 11.67% 7.8x 1.4x 78.10% 21.93% Newfield ExporlationNFX $38.16 $5.17B 4.2x 1.0x 74.30% 26.28% Average

- 14. NewfieldExploration (NFX) April 20, 2015 14 FREEMAN Reports Rosetta Resources (ROSE/NYSE) Rosetta Resources, incorporated in 2005 in Houston, Texas, is a company focused on exploring domestic onshore energy resources. As Newfield Exploration’s major production from mid-continent, Rosetta Resources has highest oil and gas production from mid-continent. Most of the oil and gas production comes from Eagle Ford, which located in South Texas. The second largest oil production region for the company is Permian Basin in West Texas. At the end of December 31, 2014, the company has 64,000 net acres in South Texas and 57,000 net acres in West Texas. To meet shareholders’ interests, ROSE keeps steady growth from its unconventional onshore domestic basin. Compared to Newfield Exploration, Rosetta Resources has a lower market cap but similar P/E ratio. Cimarex Energy (XEC/NYSE) The company explores oil and gas mainly in Oklahoma, Texas, and New Mexico. Climarex Energy made some important events in 2014. For example, the company average total production in 2014 is about 14.45 mmBOE and the company acquired Cana-Woodford assets for $497.4 million in May 2014. The strategy for Climarex Energy is to grow proved reserves and production for profit and to maximize cash flow for profitable reinvesting. The main business area for the company is Permian Basin, which covered West Texas and New Mexico. Like Newfield Exploration, Cimarex Energy has business in the mid-continent area, which included Oklahoma, Southwest Kansas, and the Texas Panhandle. Although Cimarex Energy has a small market cap, it has a higher P/E ratio than Newfield Exploration. MANAGEMENT PERFORMANCE & BACKGROUND Newfield’s management team consists of oil and gas professionals who are experts in the field. Many of the executive team members have over 20 years of experience in the industry and continue to successfully lead the Company today. Collectively, the management team sees a great opportunity for future growth by moving onshore. The return on invested capital (ROIC) measures management’s ability to allocate a company's capital efficiently and to generate profitable returns. By comparing after-tax operating income to a company’s invested capital, ROIC demonstrates the company’s ability to convert capital into returns. Newfield had an adverse return on invested capital in 2012. The company’s ROIC in 2014 was about 32 percent higher than it was in 2012. It indicates that the business management team has made efforts to improve its performance. In 2012, Newfield reduced its capital investments, which were 26 percent lower than it was in 2011. The decreasing of its capital investments mainly came from asset retirement obligation and capitalized interest and overhead. Newfield decided to sell its international businesses in China and Malaysia in February 2013. Because Newfield lifted and sold less crude oil in these two region than

- 15. NewfieldExploration (NFX) April 20, 2015 15 FREEMAN Reports previous years, its revenue decreased. On the other hand, Newfield invested more capital than previous years into its domestic exploitation and development. This investment has just started generating profits. Newfield decided not to sell its business in off-shore China in 2014. In addition, the company improved its financial condition. So its ROIC outperformed its peers in 2014. Table 3: ROIC comparable Source: Thomson One as of April 20, 2015 Management compensation Newfield offers incentive-based compensation packages to management that include competitive base salary, annual bonus plans based on company, team, and individual performance, and employee stock purchase program. The company also offers an employee savings and protection plan that is a defined contribution plan with a profit sharing component, a stock bonus component, and a 40lK. Lee K. Boothby Chairman, President and Chief Executive Officer Lee K. Boothby got his bachelor’s degree in petroleum engineering form LSU and M.B.A from Rice University. He joined Newfield in 1999, served as Managing Director in Newfield Exploration Australia Ltd. and managed the company’s operations in the Timor Sea from 1999-2001. Before 1999, he worked for Cockrell Oil Corporation, British Gas and Tenneco Oil Company. From 2002-2007, Boothby was Vice President, leading the Newfield’s development of the growing Woodford Shale Play in southeast Oklahoma. In 2009, he started serving as a member of the Company’s Board of Directors by Newfield’s shareholders and the Board nominated him as the Chief Executive Officer. In 2010, Boothby became Chairman at the Company’s annual meeting. Gary D. Packer Executive Vice President and Chief Operating Officer Gary D. Packer graduated with a bachelor’s degree of petroleum and natural gas engineering form Penn State University. Packer joined Newfield in 1995 as a manager of Acquisitions and Development in the Gulf of Mexico and was instrumental in the success of the Company's Gulf operations. Then, the Board named Packer as Vice President who Compnay 2014 2013 2012 SM Energy Company 18.58% 7.56% -0.48% QEP Resources 13.42% 3.93% 3.58% Rosetta Resources 11.12% 10.97% 16.70% Cimarex Exergy 9.52% 12.41% 9.18% Average 13.16% 8.72% 7.25% Newfield Exporlation 14.82% 3.94% -17.17%

- 16. NewfieldExploration (NFX) April 20, 2015 16 FREEMAN Reports founded Newfield’s business in Denver around Rocky Mountains. Since 2009, he has been Executive Vice President and Chief Operating Officer. George T. Dunn Senior Vice President of Development George T. Dunn has devoted himself to Newfield for over twenty years. Now, he is responsible of managing the Land, Drilling, Production and Reservoir functions. Dunn is a member of the board of directors of the Oklahoma Independent Petroleum Association (OIPA). Dunn graduated from the Colorado School of Mines, where he got a degree in Petroleum Engineering. Before Dunn became the senior vice president of development, he was the vice president of Mid-Continent and the vice president of Gulf Coast region. Before taking these positions, Dunn was the general manager of the Gulf Coast. Dunn was the general manager of Newfield’s Western Gulf of Mexico division. Dunn was an employee of Meridian Oil Company and Tenneco Oil Company before he joined Newfield in 1992. Matthew R. Vezza Vice President of Rocky Mountains Matthew R. Vezza became the vice president of Rocky Mountains in June 2014, responsible for planning the development of Newfield’s assets in the Uinta Basin. Vezza is a member of the Society of Petroleum Engineers. Vezza was a member of Marathon Oil Company for 16 years, where he served as a engineer before he became the general manager of the Rockies Business Unit in 2012. Vezza graduated with a B.S. in Petroleum and Natural Gas Engineering from Penn State University. Stephen C. Campbell Vice President of Investor Relations Campbell is a member of the Petroleum Investor Relations Association, the National Investor Relations Institute, the Public Relations Society of America and the Texas Public Relations Association. Campbell worked as the manager of investor relations when he joined Newfield in 1999. Before he joined Newfield, he worked for Anadarko Petroleum Corporation. Campbell graduated from Texas A&M University. John D. Marziotti Corporate Secretary and General Counsel Marziotti is a member of the State Bar of Texas, the Association of Corporate Counsel and the Texas General Counsel Forum. He became the legal adviser of Newfield in 2013. In August 2007, he became the general counsel. In May 2008, he became the corporate secretary of Newfield. Marziotti was a partner of Strasburger & Price L.L.P in its Houston office. Marziotti got a B.A. from the College of Charleston and a J.D. from Southern Methodist University. RISK ANALYSIS Newfield has many industry related risks as many other E&P companies,

- 17. NewfieldExploration (NFX) April 20, 2015 17 FREEMAN Reports & INVESTMENT CAVEATS as well as company specific risks. These risks mainly come from three aspects: operation, regulation, and financial statements. Different risk factors may affect the companies in different degrees, but they all will influence Newfield in the short and long term. OPERATIONAL RISK Several factors can contributes to company’s operational activities and performances. Commodity prices volatility and exchange rate risk Newfield Exploration’s profitability and future growth potential depend largely on market prices of oil, gas, and NGLs. Commodity prices can affect the company’s cash flows and ability to borrow capitals. Long- term lower market prices of oil, gas, and NGLs will adversely affect E&P companies’ profitability and revenue. Newfield cannot control the market price fluctuations, but it can focus its business on currently profitable commodities. Historical data shows that the commodity prices for oil, gas, and NGLs are always volatile. Because the continuous high global supply over demand, oil prices have drop dramatically since September 2014. The prices for crude oil are $47 per barrel (WTI) in January 2015, while last year the prices were $95 per barrel. Exchange rate adds risk to unsure commodity prices. Newfield has operations outside the United States. It needs to exchange foreign currencies to get the local prices of oil, gas, and NGLs. In addition, a large amount of capital mandatory purchases are denominated in foreign currencies. An unfavorable exchange rate can worsen the company’s financial situation in a lower commodity prices environment. Drilling risk Drilling is a high risk activity. Newfield’s technology to collect data cannot report a well comprehensively until the company really develops the well. Before that, people cannot clearly know whether oil or gas is present and economically productive. Also, the future cost and timing of drilling is hard to estimate. Drilling activities can be delayed or even cancelled, which depend on many factors, including costs of drilling equipment, volatile oil or gas prices, adverse weather patterns, equipment failure and accidents, and availability of required government permits. If the future drilling activities are unsuccessful, it can impose adverse impact on Newfield’s revenue and operations. Capital supply Newfield has substantial capital requirements to support its operation. Thus, the company needs capital to support its high-risk drilling activities, explore and acquire new reserves, maintain equipment, and develop existing reserves. A part of the capital comes from operating cash flow, and another part comes from outside fund-raising activities, for example, issuing debt and stocks. When cash flow cannot meet demand, or Newfield does not have access to the outside fund raising, a gap will exist between capital demand and supply, which will cause trouble for the business.

- 18. NewfieldExploration (NFX) April 20, 2015 18 FREEMAN Reports Reserve Estimates The reserve estimation process is complicated. Many factors may affect the quality and quantity of the reserve data, including geography, engineering methods, and production. Additionally, people, who estimate, show different judgment. Because of these factors, actual production and cash flows of oil, gas, and NGL reserves largely differ from Newfield’s estimation. Misleading estimates can lead to incorrect proved reserve information in the company’s database. Reserve Depletion E&P production companies will always face the challenge of the natural decline of reserves. Oil and gas volumes decline sharply after the first year operation, and will continue to decline in the economic life. Whether the company can find or acquire new reserves at reasonable costs largely determines the success of drilling oil and gas in the future. The failure to replace reserves can damage Newfield’s revenue and cash flows. Based on 2014 production, Newfield managers think that the current reserve life is thirteen years. Compared to its peer companies, which SM Energy has a reserve life of 9.9 years, and QEP Resource of 12.2 years, Newfield has a slightly higher number but can fluctuate based on yearly production. Newfield must continue to find, develop, and acquire new reserves against such reserve depletion risk. Cyber Security Newfield completes transactions with third parties through software, telecommunications, and other information technology. The company also uses third-party licensed software to manage its business. Cyber- attacks and computer viruses can interrupt normal operations and lead to a breakdown of the entire information system. REGULATION RISK Industry regulations, including domestic and foreign governmental regulations, taxation and environmental legislations, significantly impact energy companies. Some complex laws and regulations can influence company’s operation manner, increase operation cost, reduce liquidity, and delay business cycle. Companies must spend a large portion of their budgets on complying with environmental and governmental regulations. For example, regulations restrict the amounts and types of substances and materials released into the environment and require companies to report exploration, production, drilling and other activities. In addition, companies are also responsible for oil spill, property damage, personal injuries, and other accidents. Clean Air Act Industry legislation changes heavily impact oil and gas industry, including suppliers and customers. Governments, all over the world, have become focused on greenhouse gas emissions and have made some changes to control the climate change influence on mitigation and adaptation. Under the existing provisions of Clean Air Act, the Environmental Protection Agency has made some changes to ease greenhouse gas emissions. The new legislations cover certain onshore oil and natural gas production, processing, transmission, storage, and

- 19. NewfieldExploration (NFX) April 20, 2015 19 FREEMAN Reports distribution facilities. Clean Water Act and Safe Drinking Water Act Both acts regulate and restrict discharges of wastewater, oil, and pollutants into waters of the U.S. territory. Newfield should prepare and implement equipment to dispose the waste during the development of oil and gas, which can incur large costs, especially when those acts change. Hydraulic Fracturing Regulations All wells in the tight sand and shale should use hydraulic fracturing to make the production economically visible. Newfield also applies hydraulic fracturing technique to almost all U.S. onshore oil and gas assets. Although now Newfield does not use hydraulic fracturing in its diesel fuels, the company can face the regulation if the fracturing formula changes in the future. In the past several years, some states have adopted new opposition rules on hydraulic fracturing. The potential to accept new restrictions can impose Newfield additional operational expenses and delays in the development of wells. Dodd-Frank Wall Street Reform and Consumer Protection Act The Dodd-Frank Act includes significant derivatives regulations, which require that certain transactions be cleared through exchanges. The Act may requires margin for unclear swaps, and may post trading limits on certain oil and gas related derivative contracts. The implementation of the Dodd-Frank Act significantly increases the cost of derivative contracts, and thus reduces Newfield’s availability to hedge its commercial risks. The reduction in hedging can adversely affect Newfield’s operations and cash flows. FINANCIAL RISK To develop reserves, the Newfield Exploration needs to borrow large amount of money to cover its cost such as equipment cost. The debt can raise company’s financial risk. Credit Risk Debt is an important part in Newfield Exploration’s operation and investing activities. The Newfield Exploration issued $1 billion dollars of 5⅝ percent senior notes, which is due 2024, in 2012. As of December 31, 2013, the company had total indebtedness of $3.7 billion. In October 2014, Newfield repaid $600 million principal of Senior Subordinated Notes, which due 2018. As of December 31, 2015, the company had $2196 million of senior unsecured debt and $700 million of senior subordinated notes outstanding. According to Moody, the company has a Ba2 rating. Nevertheless, the rating on Fitch is BB+. In conclusion, the company has high credit risk because of high debt, and any downgrade in rating can increase its cost of debt. Liquidity risk Liquidity ratio is the ratio to measure the company’s ability to pay off the short-terms debt. Newfield Exploration uses three ratios to measure liquidity risk. First, current ratio, which measures company’s short-term solvency. Newfield Exploration has a current ratio of 0.85, showing company has an ability to pay back when the notes is due. Moreover, the industry current ratio is 1.03, which is much higher than Newfield

- 20. NewfieldExploration (NFX) April 20, 2015 20 FREEMAN Reports Exploration’s current ratio. Second, quick ratio, which excludes inventories from assets. The Newfield Exploration has a quick ratio of 0.01, showing the company has only $0.01 of liquid assets available to cover each $1 of current liabilities. The industry quick ratio is 0.81, which is higher than the company’s quick ratio. The large gaps show the company may not have enough liquidity assets to cover the current liability when the notes are due. Third, cash flow ratio, which measure company’s ability to use operating cash flow to pay back current liabilities. The Newfield Exploration has a cash flow ratio of 1.16, which is much lower than the industry average cash flow ratio. The industry cash flow ratio is 2.07. Therefore, the company may not able to meet its short-term liabilities in the future. Leverage risk A leverage is a method to help a company increase its potential return. An appropriate debt amount can bring taxation benefits. However, the imbalance between debt and equity can increase the risk on investment because company may not able to pay off all the debt. One way to measure the leverage risk is using operating cash flow to total liability ratio. According to the report, Newfield Company has an operating cash flow to total liability ratio of 24.31. The industry average operating cash flow to total liability ratio is 32.08. This ratio is higher than the Newfield Exploration’s operating cash flow to total liability ratio, showing Newfield Exploration has less operating cash flow to cover the debt. Therefore, Newfield Exploration has high leverage risk. Table 4: Peer ratio comparison Source: Bloomberg peer ratios comparison as of April 20, 2015 Hedging risk Newfield Exploration uses price hedging against commodity prices volatility. In 2015, Newfield’s hedged portfolio value will be about $750 mm, and will hedge approximately 80 percent of domestic oil production in 2015 and 2016. Newfield uses swaps, short puts, and 3-way structures as its main derivative method in 2015, and will increase the portion of 3- way structures in 2016. Those oil hedging contracts in 2015 can effectively reach a price $15.00 per barrel higher than the market value if the oil price is below $75.00. In addition, Newfield has entered into swap contracts that hedge 14.64 MMMBTU of 2016 gas production. These hedging contracts protect Newfield Exploration from oil and gas price volatility, but limit its potential profits from commodity price increases.

- 21. NewfieldExploration (NFX) April 20, 2015 21 FREEMAN Reports Furthermore, if using derivatives unwisely, without understanding the derivative products and the underlying production, reserve, and timing risks, Newfield can multiply losses in its production. SHAREHOLDER ANALYSIS & CORPORATE GOVERNANCE Newfield has 137.million shares outstanding as of April 20, 2015, of which 136 million shares are float (99 percent). Institutions hold 95 percent of the shares, and insiders hold 0.78 percent. Institutional investors The largest institutional investor of Newfield is Vanguard Group Inc., which holds more than 11 million shares. Newfield’s top institutional shareholders engaged in several large transactions. As of April 20, 2015, four top ten institutional investors made large position changes (over 50 percent). Citadel LLC increased its investment by purchasing 3.569 million shares, increasing its percentage by 71.45 percent. Millennium Management LLC bought 6.9 million shares, which is about 131.79 percent of its previous holding. Systematic Financial Management, L.P. increased its position by 3 million shares, which accounts for 100 percent increase. AQR Capital Management, LLC increased its position by purchasing 1.66 million, which is 142.6 percent of previous holding. These transactions indicates that institutional investors have great confidence in Newfield’s future performance. However, Fidelity Management & Research Company decreased its shares by 26.53 percent, which means Fidelity Management & Research Company sold about 2.7 million shares. Table 5: Top 10 institutional investors Source: Thomson One as of April 20, 2015 Insider transactions Until the most recent transactions on April, 20, 2015, 27 insiders hold the total insider holdings, 1.5 million shares. Most recent transactions show that the insiders are exercising their options, which means that the insiders are confident about the company’s future performance. The growth rate of the total insider holdings in 2014 was -5.22 percent. Investor Name % O/S Pos Pos Chg % Pos Chg The Vanguard Group, Inc. 6.88 11,195,321 161,056 1.46 ClearBridge Investments, LLC 6.16 10,016,019 2,870,544 40.17 Citadel LLC 5.26 8,565,044 3,569,528 71.45 Fidelity Management & Research Company 4.59 7,466,009 -2,695,693 -26.53 Millennium Management LLC 4.26 6,937,905 3,944,705 131.79 BlackRock Institutional Trust Company, N.A. 4.12 6,699,159 450,157 7.20 SouthernSun Asset Management, LLC 4.02 6,532,442 793,189 13.82 State Street Global Advisors (US) 3.65 5,931,247 545,513 10.13 Systematic Financial Management, L.P. 1.85 3,002,786 3,002,786 100.00 AQR Capital Management, LLC 1.74 2,826,189 1,661,220 142.60

- 22. NewfieldExploration (NFX) April 20, 2015 22 FREEMAN Reports Several main factors led to this decline. Four major insiders sold holdings worth more than 10,000 dollars during 2014. In addition, two other insider shareholders sent their holdings as gifts of more than 20,000 dollars. However, 13 insiders increased their shares in 2014, among which three raised the amount more than 10,000 dollars. These three increased their holdings primarily because of the conversion. The other ten insiders increased their holdings because of the acquisitions. Corporate Governance To ensure the trust of investors, Newfield has critical corporate governance principles. The majority of its directors are independent as defined by the NYSE and its three primary board committees are comprised exclusively of independent directors. Newfield has established an Ethics Line, so that investors, employees and other interested parties can anonymously report through a third party any practices thought to be in violation of its corporate governance policies. This Ethics Line can also be used to make concerns known to their non- management directors on a direct and confidential basis. Table 6:Member of the Board of Directors Source: Newfield official website, 2015 Compensation Newfield Exploration has Compensation & Management Development Committee. The committee includes five people who are board members. The committee recommended a new annual cash incentive compensation plan for employees, approved in 2010. The company gives not only domestic employees and but also other employees of foreign subsidiaries a 401(k) profit sharing plan. Newfield Exploration also sponsors a highly compensated employee deferred compensation plan. These two compensation plans contributed $10 million at the end of 2013. The company uses performance–based compensation to encourage employees to develop and maintain high quality performance. Name Title Independence Time Lee K. Boothby Chairman & Director No Since 2009 Pamela J. Gardner Director Yes Since 2005 John Randolph Kemp III Director Yes Since 2003 Steven W. Nance Director Yes Since 2013 Howard H. Newman Director Yes Since 1990 Thomas G. Ricks Director Yes Since 1992 Juanita M. Romans Director Yes Since 2005 John W. Schanck Director Yes Since 2013 C.E. (Chuck) Shultz Director Yes Since 1994 Richard K. Stoneburner Director Yes Since 2013 J. Terry Strange Director Yes Since 2004 Board of Directors

- 23. NewfieldExploration (NFX) April 20, 2015 23 FREEMAN Reports Table 7:Compensation & Management Development Committee Source: Newfield Exploration 10K, 2014 FINANCIAL PERFORMANCE & PROJECTIONS The analysis team’s projections for Newfield Exploration’s financial performance and projections are closely related to Newfield’s production in Anadarko Basin. The new company decision of focusing on the operation of Anadarko Basin makes the area extremely important for the company’s future production and revenue growth. Thus the efficiency and success of drilling plans in this area is critical. Based on the team’s estimate of commodity prices in 2015-2018, the team got the company’s future cash flows. Because Newfield strengthened its ability to finance its operation, the team also consider the company’s future risk level and liquidity condition. Production The analysis team forecasted Newfield’s oil and gas production in three major areas: Anadarko Basin, Williston Basin and off-shore China based on Newfield’s press release. Depend on the operation guidance for the company’s production in 2015, the team was able to forecast new wells in each of the three areas. In the team’s assumption, the time for each new wells to start producing is 25 percent each quarter in Anadarko Basin area and Williston Basin area, and 50 percent each quarter in off- shore China area. The team assumed that each new well can produce 2 mmcf and 500 bbl per day, with 49 percent of natural decline rate every year. The annual decline rate for existing wells are 30 percent. Based on historical data, the team assumed that the proportion of oil and gas production are similar to previous year in each area. Thus in Anadarko Basin, the proportion of oil and gas is 50/50, and in Williston Basin the proportion of oil and gas is 90/10. The analysis team assumed that Newfield would maintain similar drilling plan in 2016-2018. With strengthened financial condition and more capital expense in coming years, the team’s model predicts annual production will increase 41 percent by 2018. Commodity prices The analysis team set NYMEX gas price and WTI oil price of 2015-2018

- 24. NewfieldExploration (NFX) April 20, 2015 24 FREEMAN Reports as the benchmark. In the assumption, the team assumed that Newfield’s oil price is $2 lower than the benchmark, the company’s gas price is $0.5 lower than the benchmark in 2015-2017, and in 2018, the price is $0.25 lower than 2017. In addition, the team assumed that NGL prices would have similar proportion to the oil prices because of the seasonality of NGL prices. Thus, the team assumed the proportion of 40 percent, 30 percent, 33 percent, and 35 percent in each quarter of 2015, 35 percent in 2016, and 40 percent in 2017 and 2018. Table 8: Price estimates Operation Lifting cost, depreciation, depletion, and amortization (DD&A), general, and administrative expenses (G&A), and production taxes are major expenses related to operation. Because Newfield didn’t separate transportation cost from lifting cost in previous years, the analysis team put transportation cost into the lifting cost. The analysis team believe that lifting cost/ BOE will be lower in 2015- 2017, because of the massive production in the Anadarko Basin and the reduced transportation cost from fewer international business left over than previous years. DD&A measures the expensing of Newfield’s investment in oil and gas properties, and the depletion of its proved reserves. Because Newfield has sold its business in Malaysia, the team believes that it will reduce DD&A cost. The team estimates that the G&A cost will be slightly lower than prior because of the sales of Malaysia business and reduced production in Williston Basin, which reduced Newfield employees in these areas. According to historical data, the production cost is about 5 percent of Newfield’s revenue. Thus, the team choose 5 percent for the measurement of future production taxes. Investing Newfield Exploration provides a budget guidance of $1.2 billion planned capital spending in 2015. Compared to last year’s level, the company reduces the budget by about 40 percent because of the uncertain commodity prices environment. Newfield plans to allocate about 70 Avg.Price 1Q:15E 2Q:15E 3Q:15E 4Q:15E FY:15E FY:16E FY:17E FY:18E Gas -NYMEX($/Mmbtu) $2.84 $2.75 $2.86 $3.00 $2.86 $3.17 $3.46 $3.59 Oil-WTI($/Bbl) $49.00 $51.70 $56.52 $59.19 $54.10 $62.39 $65.18 $67.10 Gas -Company Avg. $3.00 $2.89 $2.92 $2.99 $2.95 $3.01 $2.76 $2.51 Oil-Company Avg. $52.68 $55.42 $58.28 $57.68 $56.01 $65.37 $64.60 $62.60 NGL-Company Avg. $19.60 $15.51 $18.65 $20.72 $18.62 $21.84 $25.84 $25.04

- 25. NewfieldExploration (NFX) April 20, 2015 25 FREEMAN Reports percent of 2015’s budget to its high-return Anadarko Basin. The team assumed that the capital investment will continuously increase in the next three years following 2015, as long as Newfield insists on its strategy of funding the capital investment with cash flows from productions in focused areas. Because Newfield allocates its budget to high- performance Anadarko Basin, and acquired oil and gas properties in focused areas, the team assume that the company can produce oil and gas economically, and reduce service cost to further enhance its production. In this way, the company can make profits by increasing the capital spending. Financing In its latest presentation, Newfield announces that it will issue $815 MM common stock, and repay borrowings of $446 MM under the credit facility. The analysis team assumed that the issuance of common stock and repayment of borrowings will happen in the first quarter of 2015. In 2014, Newfield sold its Granite Wash and other non-strategic assets, and used derivative instruments against the commodity prices volatility. The divestitures and hedging activities ensure the company to finance its core drilling programs. Newfield used the divested proceeds about $700 million to redeem the same amount of 71/8 percent Senior Subordinated Notes due 2018. The team assumed that Newfield will continue to redeem further its debt obligations through divestitures and productions, and the team didn’t see a problem in repayment of extended credit facility of $1.8 billion at current production levels. LAGNIAPPE / INDEPENDENT OUTSIDE RESEARCH Our team used various methods to conduct the report and get different perspectives about Newfield Exploration. The primary resources include latest SEC filings, company presentations, and press releases. Those documents provide helpful guidance about official financial and operational data, giving us thorough insights into the company. In addition, we used secondary sources such as Bloomberg, Yahoo Finance, Thomson One, and Capital IQ database to facilitate our data gathering process. In order to have a better understanding of the company, we also had a direct conference call with Newfield Exploration’s CFO, with the help of our professor Kenneth Carroll. In the conference call, we clarified our questions about the company’s 2015 outlook and valuation model.

- 26. Newfield Exploration (NFX) April 20, 2015 26 FREEMAN Reports (in millions, except per share data) FY:12A FY:13A FY:14A 1Q:15E 2Q:15E 3Q:15E 4Q:15E FY:15E FY:16E FY:17E FY:18E Oil, gas and NGL revenues $2,567 $1,789 $2,288 $401 $426 $474 $492 $1,793 $2,258 $2,493 $2,556 Operating expenses: 5% Lease operating 514 413 495 124 133 141 146 545 626 709 770 Production and other taxes 344 67 111 20 21 24 25 90 113 125 128 Depreciation, depletion and amortization 955 668 870 195 209 222 230 855 892 909 876 General and administrative 218 219 222 49 49 49 49 194 204 214 225 Ceiling test impairment 1,488 Other 15 3 15 Total operating expenses 3,534 1,370 1,713 387 411 435 449 1,683 1,834 1,956 1,999 Income (loss) from operations (967) 419 575 14 15 39 43 110 424 537 557 Other income (expense): Interest expense (205) (205) (200) (33) (33) (33) (33) (131) (131) (131) (131) Capitalized interest 68 53 53 35 28 28 28 120 120 120 120 Commodity derivative income 120 (97) 610 153 153 153 153 610 610 610 610 Other (4) 0 (6) Total other income (expense) (21) (249) 457 155 148 148 148 598 598 598 598 Income (loss) before income taxes (988) 170 1,032 168 163 187 191 709 1,022 1,135 1,156 Income tax provision: Current 195 (4) 5 0 0 0 0 0 0 0 0 Deferred 1 66 377 74 72 82 84 312 450 500 508 Total income tax provision 196 62 382 74 72 82 84 312 450 500 508 Net income (loss) ($1,184) $147 $900 94 91 105 107 397 572 636 647 Earnings (loss) per share Basic ($8.80) $0.94 $6.59 $0.69 $0.66 $0.76 $0.78 $2.90 $4.18 $4.64 $4.72 Diluted ($8.80) $0.94 $6.52 $0.68 $0.66 $0.76 $0.77 $2.88 $4.15 $4.61 $4.69 Weighted-average number of shares outstanding 135 135 137 137 137 137 137 137 137 137 137 for basic earnings (loss) per share Weighted-average number of shares outstanding 135 136 138 138 138 138 138 138 138 138 138 for diluted earnings (loss) per share Income statement

- 27. Newfield Exploration (NFX) April 20, 2015 27 FREEMAN Reports FY:12A FY:13A FY:14A 1Q:15E 2Q:15E 3Q:15E 4Q:15E FY:15E FY:16E FY:17E FY:18E Discretionary Cash Flow -174 938 2,196 375 385 416 437 1,613 1,963 2,093 2,081 Cash flows from operating activities: Net income (loss) ($1,184) $147 $900 $94 $91 $105 $107 $397 $572 $636 $647 Adjustments to reconcile net income (loss) to net cash provided by operating activities: Depreciation, depletion and amortization 955 930 903 195 209 222 230 855 892 909 876 Deferred tax provision 1 143 509 74 72 82 84 312 450 500 508 Stock-based compensation 35 43 28 7 $6 $2 7 21 21 21 21 Commodity derivative income (120) 97 (610) (153) (153) (153) (153) (610) (610) (610) (610) Cash receipts on derivative settlements,net 135 60 (39) (10) ($02) $9 16 12.4 12.4 12.4 12.4 Ceiling test impairment 1,488 Gain on sale of Malaysia business (373) Other non-cash charge 19 14 21 5 $8 $6 10 28 28 28 28 Changes in operating assets and liabilities: (Increase) decrease in accounts receivable (70) (62) 47 12 $2 ($04) (8) 2 0 (21) (21) (Increase) decrease in inventories (35) (11) 0 0 $2 $2 1 4 1 (10) (10) (Increase) decrease in other current assets 5 12 (30) (8) ($08) ($10) (13) (38) (10) (13) (13) (Increase) decrease in other assets 7 6 2 1 $1 $1 1 2 1 4 4 Increase (decrease) in accounts payable (77) 74 21 5 $8 $12 17 42 10 15 15 increase (Decrease) in advances from joint owners (14) (1) 5 1 $5 $3 4 13 3 1 1 Increase (decrease) in other liabilities 2 (7) 3 1 $1 $1 1 3 1 0 0 Net cash provided by operating activities 1,147 1,445 1,387 225 240 277 302 1,043 1,373 1,472 1,460 Cash flows from investing activities: Additions to oil and gas properties (1,758) (1,987) (2,064) ($290) ($290) ($290) ($330) ($1,200) ($1,500) ($1,700) ($1,900) Acquisitions of oil and gas properties (9) (72) (33) ($11) ($11) ($10) ($11) ($43) ($43) ($43) ($43) Proceeds from sales of oil and gas properties 630 36 620 $155 $191 $239 $147 $732 $732 $732 $732 Proceeds received from sale of Malaysia business,net (36) 809 $0 $0 $0 $0 $0 $0 $0 $0 Additions to furniture, fixtures and equipment (22) 1 (31) ($08) ($08) ($07) ($08) ($31) ($31) ($31) ($31) Redemptions of investments 39 $0 $0 $0 $0 $0 $0 $0 $0 Net cash used in investing activities (1,159) (2,058) (660) ($154) ($117) ($69) ($202) ($542) ($842) ($1,042) ($1,242) Cash flows from financing activities: Proceeds from borrowings under credit arrangement 2,844 3,263 2,949 0 0 Repayments of borrowings under credit arrangement (2,930) (2,614) (3,152) ($446) (446) Proceeds from issuance of senior notes 1,000 700 700 0 0 0 Proceeds from issuance of senior subordinated notes 0 $0 Debt issue costs (10) (4) 0 Repayment of senior notes (700) (700) 0 0 0 Repayment of senior subordinated notes (875) (600) 0 Proceeds from issuances of common stock 2 1 6 815 $0 $0 0 815 Repurchase of preferred shares of subsidiary (20) Purchases of treasury stock, net (7) (6) (11) (3) ($03) ($04) (3) (13) (13) (13) (13) Net cash provided by financing activities 24 620 (808) 366 (3) (4) (3) 356 (13) (13) (13) Increase (decrease) in cash and cash equivalents 12 7 (81) 438 119 204 97 858 518 417 205 Cash and cash equivalents, beginning of period 76 88 95 14 14 Cash and cash equivalents, end of period $88 $95 $14 $452 $119 $204 $97 $872 $518 $417 $205 Cash Flow Statement

- 28. Newfield Exploration (NFX) April 20, 2015 28 FREEMAN Reports ASSETS FY:12A FY:13A FY:14A 1Q:15E 2Q:15E 3Q:15E 4Q:15E FY:15E FY:16E FY:17E FY:18E Current assets: Cash and cash equivalents 88 95 14 452 571 774 872 872 1,390 1,807 2,012 Restricted cash 90 0 Accounts receivable 452 474 405 393 391 395 403 403 403 424 444 Inventories 132 163 33 33 32 30 29 29 27 38 48 Derivative assets 125 431 431 431 431 431 431 431 431 431 Deferred taxes 22 0 0 0 0 0 0 0 0 0 Other current assets 69 57 57 64 71 81 93 93 102 111 119 Total current assets 866 901 940 1,373 1,496 1,711 1,828 1,828 2,353 2,810 3,055 Property and equipment 14,346 16,650 16,384 16,530 16,640 16,701 16,895 16,895 17,706 18,717 19,928 Less accumulated depreciation, depletion and amortization(7,444) (8,375) (8,152) (8,347) (8,555) (8,777) (9,007) (9,007) (9,899) (10,807) (11,684) Total property and equipment, net 6,902 8,275 8,232 8,183 8,084 7,924 7,888 7,888 7,807 7,909 8,244 Other property and equipment, net 182 190 197 205 213 213 243 274 305 Derivative assets 17 26 190 352 507 651 788 788 1,385 1,983 2,580 Long-term investments 58 63 26 26 26 26 26 26 26 26 26 Deferred taxes 24 19 0 0 0 0 0 0 0 0 0 Other assets 45 37 28 28 28 28 28 28 28 28 28 Total assets 7,912 9,321 9,598 10,152 10,339 10,544 10,770 10,770 11,843 13,030 14,238 LIABILITIES AND STOCKHOLDERS EQUITY Current liabilities: Accounts payable 69 76 32 37 45 57 74 74 84 99 114 Accrued liabilities 801 978 880 880 880 880 880 880 880 880 880 Deferred libilities 0 0 0 0 0 0 0 0 0 Advances from joint owners 31 90 34 35 40 43 47 47 50 51 52 Asset retirement obligations 10 30 3 3 3 3 3 3 3 3 3 Derivative liabilities 6 54 8 8 8 8 8 8 8 8 8 Deferred taxes 42 62 144 144 144 144 144 144 144 144 144 Total current liabilities 959 1,290 1,101 1,108 1,120 1,136 1,156 1,156 1,170 1,186 1,202 Other liabilities 47 38 45 51 59 65 76 76 104 132 161 Derivative liabilities 15 0 0 0 0 0 0 0 0 0 Long-term debt 3,045 3,694 2,892 2,446 2,446 2,446 2,446 2,446 2,446 2,446 2,446 Asset retirement obligations 132 201 183 183 183 183 183 183 183 183 183 Deferred taxes 934 1,142 1,484 1,558 1,630 1,712 1,796 1,796 2,246 2,745 3,254 Total long-term liabilities 4,173 5,075 4,604 4,238 4,318 4,406 4,501 4,501 4,979 5,507 6,043 Commitments and contingencies Stockholders equity: Preferred stock Common stock 1 1 1 1 1 1 1 1 1 1 1 Additional paid-in capital 1,522 1,539 1,576 2,398 2,404 2,406 2,412 2,412 2,434 2,455 2,477 Treasury stock -36 (13) (10) (13) (16) (20) (23) (23) (36) (49) (62) Accumulated other comprehensive loss -7 2 (1) (1) (1) (1) (1) (1) (1) (1) (1) Retained earnings 1,300 1,427 2,327 2,421 2,512 2,617 2,724 2,724 3,296 3,932 4,579 Total stockholders equity 2,780 2,956 3,893 4,807 4,900 5,002 5,113 5,113 5,694 6,338 6,994 0 Total liabilities and stockholders equity 7,912 9,321 9,598 10,152 10,339 10,544 10,770 10,770 11,843 13,030 14,238 Balance Sheet

- 29. Newfield Exploration (NFX) April 20, 2015 29 FREEMAN Reports FY:12A FY:13A FY:14A 1Q:15E 2Q:15E 3Q:15E 4Q:15E FY:15E FY:16E FY:17E FY:18E Production: (mboe/d) 108.03 106.17 127.59 132.40 140.35 147.63 152.88 143.38 164.70 186.70 202.81 Gas (Mmcf/D) 394.23 318.10 321.20 296.52 323.41 342.28 355.93 329.53 388.86 447.55 490.51 Oil (Mbbl/D) 35.16 39.02 51.76 58.66 60.30 62.29 63.50 61.19 65.08 69.64 72.97 NGL (Mbbl/d) 7.16 14.13 22.30 24.32 26.15 28.61 30.39 27.37 34.81 42.47 48.09 Gas (Bcf) 143.50 116.10 118.20 26.69 29.43 31.49 32.75 120.35 141.94 163.36 179.04 Oil (Mmbbl) 12.80 14.20 19.05 5.28 5.49 5.73 5.84 22.34 23.76 25.42 26.63 NGL (Mmbbl) 2.61 5.16 8.21 2.19 2.38 2.60 2.77 9.94 12.70 15.50 17.55 Total (Bcfe) 235.94 232.28 281.72 71.49 76.63 81.49 84.39 314.01 360.70 408.88 444.15 Total (Mmboe) 39.32 38.71 46.95 11.92 12.77 13.58 14.06 52.33 60.12 68.15 74.02 Gas as % of Total 60.82% 49.98% 41.96% 37.33% 38.40% 38.64% 38.80% 38.33% 39.35% 39.95% 40.31% Avg. Price 33% 31% 34.11% 40.00% 30.00% 33.00% 35.00% 34.42% 35.00% 39.64% 37.32% Gas - NYMEX ($/Mmbtu) 2.79$ 3.73$ 4.29$ 2.84$ 2.75$ 2.86$ 3.00$ 2.86$ 3.17$ 3.46$ 3.59$ Oil - WTI ($/Bbl) 94.78$ 98.23$ 93.94$ 49.00$ 51.70$ 56.52$ 59.19$ 54.10$ 62.39$ 65.18$ 67.10$ Gas - Company Avg. 2.64$ 3.39$ 4.11$ 3.00$ 2.89$ 2.92$ 2.99$ 2.95$ 3.01$ 2.76$ 2.51$ Oil - Company Avg. 85.42$ 86.21$ 80.40$ 52.68$ 55.42$ 58.28$ 57.68$ 56.01$ 65.37$ 64.60$ 62.60$ NGL - Company Avg. 31.26$ 30.74$ 32.04$ 19.60$ 15.51$ 18.65$ 20.72$ 18.62$ 21.84$ 25.84$ 25.04$ Weighted Average ($/Mcfe) 6.58$ 7.65$ 8.09$ 5.61$ 5.56$ 5.82$ 5.83$ 5.70$ 6.26$ 6.10$ 5.75487 Weighted Average ($/Boe) 39.51$ 45.89$ 48.55$ 33.65$ 33.36$ 34.94$ 34.98$ 34.23$ 37.55$ 36.59$ 34.53$ Lifting Cost ($/Boe) 13.07$ 10.64$ 7.06$ 10.41$ 10.41$ 10.41$ 10.41$ 10.41$ 10.41$ 10.41$ 10.41$ Production and other taxes ($/Boe) 8.75$ 0.72$ 3.63$ 1.68$ 1.67$ 1.75$ 1.75$ 1.71$ 1.88$ 1.83$ 1.73$ Avg. Prod. Cost ($/Mcfe) 3.64$ 1.89$ 1.78$ 2.01$ 2.01$ 2.03$ 2.03$ 2.02$ 2.05$ 2.04$ 2.02$ Avg. Prod. Cost ($/Boe) 21.82$ 11.36$ 10.69$ 12.09$ 12.07$ 12.15$ 12.15$ 12.12$ 12.28$ 12.24$ 12.13$ Avg. Margin ($/Mcfe) 2.95$ 5.76$ 6.31$ 3.59$ 3.55$ 3.80$ 3.80$ 3.69$ 4.21$ 4.06$ 3.73$ Avg. Margin ($/Boe) 17.69$ 34.53$ 37.86$ 21.56$ 21.28$ 22.78$ 22.83$ 22.11$ 25.27$ 24.35$ 22.40$ DD&A ($/Mcfe) 4.05$ 2.84$ 3.08$ 2.72$ 2.72$ 2.72$ 2.72$ 2.72$ 2.47$ 2.22$ 1.97$ DD&A ($/Boe) 24.29$ 17.01$ 18.50$ 16.34$ 16.34$ 16.34$ 16.34$ 16.34$ 14.84$ 13.34$ 11.84$ Non-E&P DD&A G&A ($/Mcfe) 0.92$ 0.97$ 0.79$ 0.68$ 0.63$ 0.60$ 0.57$ 0.62$ 0.56$ 0.52$ 0.51$ G&A ($/Boe) 5.54$ 5.81$ 4.77$ 4.07$ 3.80$ 3.57$ 3.45$ 3.71$ 3.39$ 3.14$ 3.03$ EBIT ($/Mcfe) 6.07$ 7.62$ 8.60$ 0.19$ 0.19$ 0.48$ 0.51$ 0.34$ 1.17$ 1.31$ 1.25$ EBIT ($/Boe) 36.43$ 45.73$ 51.59$ 1.15$ 1.15$ 2.88$ 3.04$ 2.06$ 7.05$ 7.88$ 7.53$ EBITDA ($/Mcfe) 10.12$ 10.46$ 11.68$ 2.91$ 2.91$ 3.20$ 3.23$ 3.07$ 3.65$ 3.54$ 3.23$ EBITDA ($/Boe) 60.72$ 62.74$ 70.10$ 17.49$ 17.48$ 19.21$ 19.38$ 18.39$ 21.88$ 21.21$ 19.36$ Operational Information