Mutual Funds Weekly Performance Report Toppers & Laggards

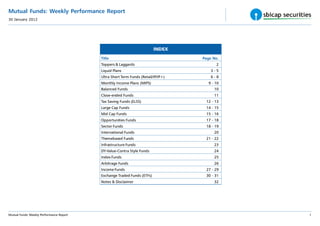

- 1. Mutual Funds: Weekly Performance Report 30 January 2012 INDEX Title Page No. Toppers & Laggards 2 Liquid Plans 3-5 Ultra Short Term Funds (Retail/IP/IP+) 6-8 Monthly Income Plans (MIPS) 9 - 10 Balanced Funds 10 Close-ended Funds 11 Tax Saving Funds (ELSS) 12 - 13 Large Cap Funds 14 - 15 Mid Cap Funds 15 - 16 Opportunities Funds 17 - 18 Sector Funds 18 - 19 International Funds 20 Themebased Funds 21 - 22 Infrastructure Funds 23 DY-Value-Contra Style Funds 24 Index Funds 25 Arbitrage Funds 26 Income Funds 27 - 29 Exchange Traded Funds (ETFs) 30 - 31 Notes & Disclaimer 32 Mutual Funds: Weekly Performance Report 1

- 2. Mutual Funds: Weekly Performance Report 30 January 2012 TOPPERS CATEGORY SCHEME NAME % RETURN CATEGORY AVERAGE BENCHMARK INDEX LIQUID PLANS Escorts Liquid Plan(G) 10.22 9.07 8.49 ULTRA SHORT TERM PLANS (RETAIL/IP/IP+) DWS Cash Oppor-Inst(G) 9.21 8.30 8.95 MONTHLY INCOME PLANS (MIPs) HDFC Multiple Yield(G) 10.49 5.94 5.99 BALANCED FUNDS HDFC Prudence(G) 32.84 19.46 17.15 CLOSE-ENDED FUNDS Sundaram Select Small Cap(G) 35.06 -7.50 - TAX SAVING FUNDS (ELSS) ICICI Pru Tax Plan(G) 35.32 23.94 24.17 LARGE CAP FUNDS ICICI Pru Focused Blue Chip Equity-Ret(G) 31.45 22.76 23.16 MID CAP FUNDS SBI Magnum Emerging Businesses(G) 45.34 31.75 26.52 OPPORTUNITIES FUNDS Reliance Equity Oppor-Ret(G) 38.95 24.78 24.62 SECTOR FUNDS Franklin Pharma(G) 49.99 27.25 - THEME-BASED FUNDS Birla SL MNC(G) 37.01 21.34 24.17 INTERNATIONAL FUNDS DSPBR World Gold-Reg(G) 11.22 -4.21 - INFRASTRUCTURE FUNDS Canara Robeco Infrastructure(G) 26.13 16.53 3.81 DY/VALUE/CONTRA STYLE FUNDS ICICI Pru Discovery(G) 40.75 27.78 0.00 INDEX FUNDS HDFC Index-Sensex Plus(G) 25.92 21.79 - EXCHANGE TRADED FUNDS (ETFs) GS Junior BeES 33.21 25.10 - ARBITRAGE FUNDS ICICI Pru Blended-B-II(G) 9.65 7.27 -1.13 INCOME FUNDS Canara Robeco InDiGo(G) 17.32 8.75 39.40 LAGGARDS CATEGORY SCHEME NAME % RETURN CATEGORY AVERAGE BENCHMARK INDEX LIQUID PLANS Templeton India CMA(G) 7.37 9.07 8.49 ULTRA SHORT TERM PLANS (RETAIL/IP/IP+) Fidelity Ultra ST Debt-SIP(G) 0.00 8.30 8.95 MONTHLY INCOME PLANS (MIPs) Principal Debt Savings(G) 2.15 5.94 5.99 BALANCED FUNDS Escorts Opp(G) 5.06 19.46 17.15 CLOSE-ENDED FUNDS Escorts Infrastructure(G) -25.42 -7.50 - TAX SAVING FUNDS (ELSS) Religare AGILE Tax(G) 11.77 23.94 24.17 LARGE CAP FUNDS Reliance Equity-Ret(G) 12.21 22.76 23.16 MID CAP FUNDS HSBC Midcap Equity(G) 17.47 31.75 26.52 OPPORTUNITIES FUNDS LIC Nomura MF India Vision(G) 11.89 24.78 24.62 SECTOR FUNDS Reliance Banking-Inst(G) -39.55 27.25 - THEME-BASED FUNDS Escorts Infrastructure(G) 3.09 21.34 24.17 INTERNATIONAL FUNDS Birla SL CEF-Global Agri-Ret(G) -14.51 -4.21 - INFRASTRUCTURE FUNDS Escorts Infrastructure(G) 3.09 16.53 3.81 DY/VALUE/CONTRA STYLE FUNDS UTI Contra(G) 16.06 27.78 0.00 INDEX FUNDS JM Nifty Plus(G) 12.44 21.79 - EXCHANGE TRADED FUNDS (ETFs) GS Liquid BeES 4.29 25.10 - ARBITRAGE FUNDS ICICI Pru Eq & Deriv-Volatility Adv-Ret(G) 2.38 7.27 -1.13 INCOME FUNDS Canara Robeco Dynamic Bond-Inst(G) -7.39 8.75 39.40 Mutual Funds: Weekly Performance Report 2

- 3. Mutual Funds: Weekly Performance Report 30 January 2012 Liquid Funds Scheme Name NAV 1 Week Rank 1 Month Rank 3 Months Rank 6 Months Rank 1 Year Rank AIG India Liquid-Inst(G) 1,349.73 8.93 75 8.92 79 8.98 60 8.93 59 8.90 54 AIG India Liquid-Ret(G) 1,331.94 8.63 90 8.62 90 8.67 82 8.62 81 8.58 79 AIG India Liquid-SIP(G) 1,355.62 9.03 66 9.02 69 9.08 54 9.04 53 9.01 47 Axis Liquid-Inst(G) 1,169.60 9.55 13 9.52 26 9.35 17 9.25 20 9.13 23 Axis Liquid-Ret(G) 1,145.42 9.10 62 9.07 64 8.89 68 8.78 73 8.75 66 Baroda Pioneer Liquid-Inst(G) 1,208.98 9.48 29 9.53 24 9.34 19 9.25 17 9.13 26 Baroda Pioneer Liquid-Reg(G) 1,832.40 9.48 30 9.53 25 9.34 20 9.25 18 9.13 27 Bharti AXA Liquid-Inst(G) 1,243.50 7.93 105 7.82 106 7.96 104 7.92 103 7.74 99 Bharti AXA Liquid-Ret(G) 1,226.73 7.68 109 7.57 109 7.71 106 7.71 105 7.60 102 Birla SL Cash Plus-Inst Prem(G) 168.99 9.56 11 9.63 4 9.34 21 9.24 21 9.17 13 Birla SL Cash Plus-Inst(G) 283.10 9.33 47 9.30 52 8.83 74 8.72 75 8.75 65 Birla SL Cash Plus-Ret(DAP) 115.89 8.60 91 8.75 85 8.12 102 8.13 98 8.08 94 Birla SL Cash Plus-Ret(G) 277.61 8.92 76 9.01 72 8.67 83 8.58 85 8.57 80 BNP Paribas Overnight Fund(G) 15.75 8.82 84 8.90 81 8.66 84 8.62 80 8.71 71 BNP Paribas Overnight Fund-Inst(G) 16.23 9.56 12 9.63 6 9.37 8 9.26 14 9.26 7 Canara Robeco Liquid-Inst(G) 1,908.06 9.11 60 9.14 60 8.92 64 8.83 66 8.72 69 Canara Robeco Liquid-Ret(G) 1,892.27 8.51 95 8.53 94 8.31 95 8.23 94 8.22 92 Canara Robeco Liquid-SIP(G) 1,283.31 9.51 21 9.54 22 9.33 24 9.24 23 9.13 24 Daiwa Liquid-Inst(G) 1,181.36 9.54 15 9.56 14 9.35 12 9.27 11 9.13 25 Daiwa Liquid-Reg(G) 1,178.91 9.54 16 9.56 15 9.35 13 9.08 46 9.03 44 DSPBR Liquidity-Inst(G) 1,510.49 9.44 32 9.42 40 9.27 31 9.20 31 9.09 36 DSPBR Liquidity-Reg(G) 24.99 9.24 57 9.22 56 9.07 55 8.99 58 8.87 58 DWS Insta Cash Plus-Inst(G) 16.57 9.30 48 9.33 49 9.14 48 9.06 47 8.95 53 DWS Insta Cash Plus-Reg(G) 17.53 8.67 87 8.73 87 8.57 86 8.51 86 8.51 82 DWS Insta Cash Plus-SIP(G) 137.12 9.49 25 9.57 11 9.35 14 9.28 10 9.17 14 DWS Treasury-Cash-Inst(G) 117.78 9.49 27 9.55 17 9.35 16 9.29 9 9.37 2 DWS Treasury-Cash-Reg(G) 11.53 7.52 111 7.60 108 7.36 110 7.26 110 7.62 101 Edelweiss Liquid-Inst(G) 10.89 9.21 58 9.37 46 9.27 32 9.21 26 Edelweiss Liquid-Ret(G) 12.15 8.29 101 8.47 96 8.38 94 8.38 90 8.21 93 Escorts Liquid Plan(G) 16.15 9.77 1 10.22 1 10.02 1 10.08 1 10.34 1 Fidelity Cash-Inst(G) 14.27 8.90 78 9.01 70 8.89 67 8.89 62 8.85 60 Fidelity Cash-Ret(G) 13.98 8.52 94 8.61 91 8.48 88 8.47 87 8.43 87 Fidelity Cash-SIP(G) 14.37 9.09 64 9.17 58 9.05 58 9.04 52 9.02 45 HDFC Cash Mgmt-Call(G) 17.16 8.65 88 8.31 100 8.44 92 8.17 97 7.68 100 HDFC Cash Mgmt-Savings(G) 22.03 9.29 52 9.40 43 9.10 52 9.03 55 9.02 46 HDFC Liquid-Prem Plus(G) 21.19 9.37 45 9.42 39 9.22 42 9.16 38 9.08 39 HDFC Liquid-Prem(G) 21.14 9.39 40 9.42 38 9.22 41 9.16 37 9.08 38 HDFC Liquid-Ret(G) 20.83 9.28 55 9.32 51 9.12 50 9.06 50 8.97 52 HSBC Cash-Inst Plus(G) 10.58 8.64 89 8.58 92 8.56 87 8.45 88 (28.54) 113 HSBC Cash-Inst(G) 16.94 8.39 98 8.33 99 8.31 96 8.19 96 7.99 95 Mutual Funds: Weekly Performance Report 3

- 4. Mutual Funds: Weekly Performance Report 30 January 2012 Liquid Funds Scheme Name NAV 1 Week Rank 1 Month Rank 3 Months Rank 6 Months Rank 1 Year Rank HSBC Cash-Reg(G) 16.72 8.25 102 8.18 101 8.16 101 8.03 101 7.81 96 ICICI Pru Liquid-Inst Plus(G) 259.83 9.03 67 9.07 65 8.92 65 8.82 67 8.74 67 ICICI Pru Liquid-Inst(G) 257.48 8.83 83 8.87 83 8.72 79 8.61 82 8.46 85 ICICI Pru Liquid-Inst-1(G) 152.19 9.28 54 9.32 50 9.15 47 9.06 48 8.99 48 ICICI Pru Liquid-Ret(G) 251.82 8.58 92 8.62 89 8.46 90 8.35 92 8.28 88 ICICI Pru Liquid-SIP(G) 156.04 9.39 41 9.43 37 9.25 36 9.17 36 9.11 33 IDBI Liquid Fund-(G) 1,132.41 9.55 14 9.54 23 9.34 23 9.26 13 9.11 31 IDFC Cash(G) 1,866.77 8.84 81 8.86 84 8.71 80 8.67 79 8.62 76 IDFC Cash-C(G) 1,283.83 9.42 36 9.41 41 9.26 34 9.20 28 9.14 20 IDFC Cash-Inst-B-(G) 1,884.09 8.94 74 8.96 76 8.81 76 8.78 72 8.73 68 IDFC Liquid-A(G) 1,446.29 3.21 112 6.25 109 IDFC Liquid-D(G) 11.58 3.13 113 6.11 110 IDFC Liquid-F(G) 11.04 2.90 114 5.68 111 ING Liquid-Inst(G) 16.49 9.09 63 9.10 63 8.95 63 8.90 60 8.77 63 ING Liquid-Reg(G) 21.96 8.99 69 8.99 74 8.85 73 8.80 68 8.66 73 ING Liquid-SIP(G) 15.74 9.29 51 9.30 53 9.15 46 9.11 45 8.99 49 JM Floater-ST(G) 16.71 8.38 99 8.02 103 8.20 100 8.07 100 7.79 97 JM High Liquidity-Inst(G) 17.38 9.47 31 9.52 27 9.31 26 9.24 22 9.16 16 JM High Liquidity-Reg(G) 28.79 9.40 38 9.43 36 9.21 44 9.13 41 9.10 34 JM High Liquidity-SIP(G) 16.54 9.57 10 9.63 5 9.42 6 9.35 6 9.22 8 JPMorgan India Liquid(G) 12.53 9.30 50 9.40 44 9.23 40 9.14 40 8.90 55 JPMorgan India Liquid-SIP(G) 13.68 9.51 19 9.61 9 9.44 5 9.35 5 9.12 30 Kotak Floater-ST(G) 17.27 9.29 53 9.35 48 9.22 43 9.18 34 9.20 11 Kotak Liquid(G) 20.17 8.31 100 8.39 98 8.21 99 8.10 99 8.27 89 Kotak Liquid-Inst Prem(G) 21.41 9.37 44 9.45 34 9.29 29 9.20 29 9.14 21 Kotak Liquid-Inst(G) 20.69 8.99 71 9.05 67 8.87 70 8.78 70 8.70 72 L&T Liquid(G) 2,083.92 8.52 93 8.53 95 8.30 97 8.23 95 8.45 86 L&T Liquid-Inst Plus(G) 2,122.51 9.43 35 9.46 33 9.26 35 9.16 39 9.03 43 L&T Liquid-SIP(G) 1,447.98 9.53 18 9.56 12 9.36 10 9.26 15 9.14 22 LIC Nomura MF Liquid(G) 19.21 9.13 59 9.10 62 8.87 71 8.69 77 8.58 78 Mirae Asset Cash Management-Reg(G) 1,148.57 8.19 103 8.05 102 8.05 103 7.80 104 7.14 105 Mirae Asset Liquid-Reg(G) 1,099.83 7.72 107 7.56 110 7.63 107 7.39 109 6.73 108 Peerless Liquid Fund - Inst(G) 11.46 9.30 49 9.36 47 9.12 49 9.06 49 8.99 50 Peerless Liquid Fund - Reg(G) 11.36 7.96 104 7.83 105 7.62 108 7.57 107 7.76 98 Peerless Liquid Fund - SIP(G) 11.52 9.61 6 9.68 3 9.46 2 9.39 3 9.34 3 Pramerica Liquid Fund-Reg(G) 1,125.72 9.63 5 9.62 7 9.45 3 9.36 4 9.19 12 Principal Cash Management Fund(G) 1,641.35 9.50 23 9.55 20 9.30 27 9.20 30 9.09 37 Principal Retail Money Mgr(G) 1,176.91 9.65 3 8.99 75 8.45 91 8.00 102 7.22 104 Quantum Liquid(G) 15.00 9.02 68 9.04 68 8.88 69 8.79 69 8.86 59 Reliance Liquid-Cash(G) 17.09 9.04 65 9.13 61 9.01 59 9.02 56 9.07 40 Mutual Funds: Weekly Performance Report 4

- 5. Mutual Funds: Weekly Performance Report 30 January 2012 Liquid Funds Scheme Name NAV 1 Week Rank 1 Month Rank 3 Months Rank 6 Months Rank 1 Year Rank Reliance Liquidity(G) 15.90 9.43 34 9.47 32 9.29 28 9.22 24 9.15 18 Reliance Liquid-Treasury-Inst(G) 25.69 9.64 4 9.56 13 9.26 33 9.11 43 9.10 35 Reliance Liquid-Treasury-Ret(G) 25.13 8.90 77 8.94 78 8.80 77 8.75 74 8.77 64 Religare Liquid(G) 1,415.48 8.39 97 8.40 97 8.28 98 8.32 93 8.26 90 Religare Liquid-Inst(G) 1,438.70 9.24 56 9.20 57 9.06 56 9.00 57 8.88 56 Religare Liquid-SIP(G) 1,450.21 9.54 17 9.55 16 9.37 7 9.29 8 9.17 15 Religare Overnight(G) 1,240.79 7.83 106 7.95 104 7.93 105 7.68 106 6.99 106 Sahara Liquid-Fixed Pricing(G) 1,914.32 9.38 42 9.28 55 9.09 53 9.04 54 9.28 6 Sahara Liquid-Variable Pricing(G) 1,930.26 9.40 39 9.29 54 9.11 51 9.05 51 9.33 4 SBI Magnum InstaCash-Cash(G) 2,338.33 8.99 70 9.01 71 8.91 66 8.88 63 8.83 62 SBI Magnum InstaCash-Liquid Floater(G) 1,818.78 8.88 79 8.96 77 8.96 61 8.84 65 8.98 51 SBI Premier Liquid-Inst(G) 1,676.12 9.37 46 9.39 45 9.19 45 9.11 44 9.05 42 SBI Premier Liquid-SIP(G) 1,659.23 9.38 43 9.40 42 9.24 38 9.19 33 9.11 32 Sundaram Money Fund(G) 21.13 7.71 108 7.81 107 7.62 109 7.49 108 7.35 103 Sundaram Money Fund-Inst(G) 21.80 8.96 73 9.06 66 8.86 72 8.78 71 8.66 74 Sundaram Money Fund-SIP(G) 22.25 9.51 20 9.55 19 9.34 22 9.25 19 9.15 19 Tata Liquid-HIP(G) 1,740.74 8.84 82 8.89 82 8.76 78 8.71 76 8.72 70 Tata Liquidity Mgmt(G) 1,419.88 9.50 24 9.48 31 9.05 57 8.89 61 8.25 91 Tata Liquid-RIP(G) 2,400.23 8.48 96 8.54 93 8.40 93 8.36 91 8.47 84 Tata Liquid-SHIP(G) 1,948.54 9.44 33 9.49 29 9.28 30 9.21 27 9.12 29 Tata Money Market(G) 16.79 8.71 85 8.69 88 8.48 89 8.43 89 8.66 75 Tata Money Market-Inst(G) 16.57 9.49 26 9.50 28 9.33 25 9.22 25 9.15 17 Taurus Liquid-Inst(G) 1,159.43 9.59 9 9.61 8 9.35 15 9.29 7 9.21 9 Taurus Liquid-Reg(G) 1,383.58 9.49 28 9.49 30 9.24 39 9.19 32 8.88 57 Taurus Liquid-SIP(G) 1,137.23 9.69 2 9.71 2 9.45 4 9.39 2 9.31 5 Templeton India CMA(G) 17.60 7.54 110 7.37 111 7.16 111 6.96 111 6.84 107 Templeton India TMA-Inst(G) 1,640.67 9.10 61 9.17 59 8.96 62 8.87 64 8.83 61 Templeton India TMA-Liquid(G) 1,514.18 1.59 115 4.76 112 Templeton India TMA-Reg(G) 2,576.15 8.85 80 8.91 80 8.70 81 8.61 83 8.56 81 Templeton India TMA-SIP(G) 1,569.92 9.50 22 9.57 10 9.36 9 9.26 16 9.20 10 Union KBC Liquid(G) 1,056.70 9.61 7 9.55 18 9.34 18 9.12 42 UTI Liquid-Cash(G) 1,690.81 8.71 86 8.74 86 8.64 85 8.58 84 8.48 83 UTI Liquid-Cash-Inst(G) 1,731.88 9.41 37 9.43 35 9.25 37 9.17 35 9.06 41 UTI Money Market(G) 2,921.22 8.99 72 9.00 73 8.81 75 8.69 78 8.58 77 UTI Money Market-Inst(G) 1,181.97 9.60 8 9.54 21 9.36 11 9.27 12 9.12 28 Average 9.05 9.07 8.90 8.60 8.29 Crisil Liquid Fund Index 8.64 8.49 8.43 8.30 8.25 Mutual Funds: Weekly Performance Report 5

- 6. Mutual Funds: Weekly Performance Report 30 January 2012 Ultra Short Term Funds Scheme Name NAV 1 Week Rank 1 Month Rank 3 Months Rank 6 Months Rank 1 Year Rank AIG India Treasury-Inst(G) 13.66 6.93 64 8.30 69 8.70 65 8.75 68 8.89 72 AIG India Treasury-Ret(G) 13.47 6.69 79 8.01 82 8.40 80 8.44 82 8.56 85 AIG India Treasury-SIP(G) 13.72 6.99 57 8.38 63 8.79 56 8.85 62 8.99 63 Axis Treasury Advantage-Inst(G) 1,172.56 7.42 16 8.78 27 9.11 25 9.19 28 9.22 38 Axis Treasury Advantage-Ret(G) 1,144.38 6.84 68 8.05 80 8.39 81 8.57 78 8.73 78 Baroda Pioneer Treasury Adv-Inst(G) 1,192.54 7.17 39 8.75 30 9.12 22 9.19 27 9.26 32 Baroda Pioneer Treasury Adv-Reg(G) 1,191.10 7.17 38 8.75 29 9.12 23 9.19 26 9.26 33 Bharti AXA Treasury Adv-Ret(G) 1,250.17 6.11 104 7.35 101 7.94 100 8.11 98 8.21 97 Birla SL Cash Mgr(G) 255.90 6.71 78 8.29 70 8.43 77 8.66 73 8.75 76 Birla SL Cash Mgr-Inst(G) 176.95 7.20 31 8.89 17 9.04 29 9.18 29 9.29 30 Birla SL Savings(DAP) 116.46 6.40 99 7.82 94 7.95 99 8.02 102 8.06 99 Birla SL Savings-Inst(G) 201.03 7.21 30 8.81 23 9.04 31 9.20 25 9.29 29 Birla SL Savings-Ret(G) 195.57 7.10 48 8.67 41 8.85 50 8.94 52 9.03 61 Birla SL Ultra ST(DAP) 118.28 7.04 51 8.80 26 8.91 43 9.08 39 9.07 54 Birla SL Ultra ST-Inst(G) 125.98 7.20 34 8.99 9 9.11 26 9.28 19 9.33 22 Birla SL Ultra ST-Ret(G) 190.43 7.04 53 8.80 25 8.91 44 9.08 40 9.07 53 BNP Paribas Money Plus Fund(G) 15.70 7.04 54 8.48 57 8.62 68 8.65 74 8.89 73 BNP Paribas Money Plus Fund-Inst(G) 15.98 7.43 14 8.95 11 9.19 18 9.22 23 9.31 24 Canara Robeco Treasury Adv-Inst(G) 1,730.98 7.23 29 8.64 44 8.88 48 8.92 56 9.05 56 Canara Robeco Treasury Adv-Reg(G) 1,718.32 6.80 69 8.12 76 8.33 85 8.38 88 8.61 84 Canara Robeco Treasury Adv-SIP(G) 1,600.09 7.46 11 8.92 12 9.18 19 9.23 21 9.38 17 Daiwa Treasury Advantage-Reg(G) 1,169.53 6.96 61 8.55 50 8.74 61 8.76 67 8.98 64 DSPBR Money Mgr-Inst(G) 1,467.41 7.12 45 8.52 56 8.76 59 8.90 58 8.95 66 DSPBR Money Mgr-Reg(G) 1,440.76 6.65 84 8.00 83 8.28 87 8.43 83 8.55 87 DWS Cash Oppor-Inst(G) 13.56 7.67 4 9.21 1 9.28 11 9.37 12 9.52 11 DWS Cash Oppor-Reg(G) 14.01 7.45 12 8.97 10 9.04 30 9.12 35 9.16 47 DWS Money Plus-Inst(G) 11.11 7.31 23 8.83 21 9.02 34 8.99 45 9.33 19 DWS Money Plus-Reg(G) 14.67 5.62 107 6.80 109 6.88 108 6.92 109 7.24 107 DWS Treasury-Invest-Inst(G) 11.84 7.13 43 8.91 15 9.16 20 9.22 22 9.53 10 DWS Treasury-Invest-Reg(G) 11.65 6.17 101 7.74 96 7.92 101 7.98 103 8.26 94 DWS Ultra ST-Inst(G) 12.47 7.33 21 8.81 24 9.29 10 9.38 9 9.54 9 DWS Ultra ST-Reg(G) 17.09 6.97 60 8.36 64 8.84 52 8.97 46 9.05 58 Edelweiss Ultra ST Bond-Inst(G) 12.71 7.71 2 8.85 20 9.02 35 9.13 34 9.22 39 Edelweiss Ultra ST Bond-Ret(G) 12.60 7.38 18 8.48 58 8.62 67 8.72 69 8.76 75 Fidelity Ultra ST Debt-Inst(G) 13.16 6.60 87 7.94 90 8.43 76 8.71 70 8.93 69 Fidelity Ultra ST Debt-Ret(G) 13.36 6.29 100 7.56 100 8.03 98 8.30 93 8.49 89 Fidelity Ultra ST Debt-SIP(G) 10.00 - 110 - 110 - 111 (46.93) 111 (20.17) 110 HDFC Cash Mgmt-TA-Reg(G) 22.78 6.58 91 7.98 86 8.21 91 8.36 91 8.62 81 HDFC Cash Mgmt-TA-WP(G) 23.14 7.04 52 8.54 52 8.81 55 8.86 60 9.03 60 HDFC FRIF-ST-Ret(G) 17.74 6.69 80 8.15 75 8.41 78 8.49 81 8.67 80 HDFC FRIF-ST-WP(G) 17.99 6.96 62 8.48 59 8.75 60 8.85 63 9.05 57 HSBC Ultra ST Bond-Inst(G) 14.19 4.29 108 7.15 106 6.99 107 7.50 106 7.62 104 Mutual Funds: Weekly Performance Report 6

- 7. Mutual Funds: Weekly Performance Report 30 January 2012 Ultra Short Term Funds Scheme Name NAV 1 Week Rank 1 Month Rank 3 Months Rank 6 Months Rank 1 Year Rank HSBC Ultra ST Bond-Reg(G) 14.03 4.08 109 6.92 108 6.75 109 7.25 108 7.36 106 ICICI Pru Flexible Income-Prem(G) 196.89 7.26 26 8.75 32 9.01 37 9.11 36 9.25 35 ICICI Pru Flexible Income-Reg(G) 118.94 6.79 71 8.17 74 8.29 86 8.36 90 8.53 88 ICICI Pru FRF-Option A(G) 160.36 6.71 77 7.99 85 8.16 92 8.22 97 8.31 93 ICICI Pru FRF-Option B(G) 173.27 6.65 85 7.88 91 8.03 97 8.10 99 8.24 96 ICICI Pru FRF-Option C(G) 163.83 6.91 65 8.32 66 8.40 79 8.42 84 8.48 90 ICICI Pru FRF-Option D(G) 156.60 7.35 19 8.75 31 8.97 41 9.07 41 9.21 40 ICICI Pru Ultra ST-Prem Plus(G) 10.70 6.80 70 7.60 99 8.09 96 8.63 75 (0.74) 109 ICICI Pru Ultra ST-Prem(G) 11.66 6.45 96 7.23 104 7.83 102 8.39 87 8.56 86 ICICI Pru Ultra ST-Reg(G) 11.67 6.40 98 7.13 107 7.72 104 8.26 96 8.44 91 ICICI Pru Ultra ST-Super Prem(G) 11.85 7.20 32 7.97 88 8.53 71 8.96 49 9.16 48 IDBI Ultra ST(G) 11.26 7.18 36 8.72 36 9.06 27 9.17 30 9.29 28 IDFC Money Mgr-IP-A(G) 16.01 6.42 97 8.32 65 8.37 82 8.58 77 8.97 65 IDFC Money Mgr-IP-F(G) 10.78 3.57 110 5.96 110 7.47 105 IDFC Money Mgr-IP-Inst-B-(G) 16.40 6.74 75 8.69 39 8.70 64 8.89 59 9.25 34 IDFC Money Mgr-TP-A(G) 16.86 6.58 92 8.00 84 8.27 88 8.41 85 8.61 83 IDFC Money Mgr-TP-B(G) 16.90 7.02 55 8.53 54 8.84 51 8.97 47 9.15 49 IDFC Money Mgr-TP-C(G) 12.54 7.06 49 8.58 47 8.89 47 9.02 43 9.21 42 IDFC Money Mgr-TP-D(G) 11.60 5.95 106 7.26 103 7.47 106 7.59 105 7.77 102 IDFC Money Mgr-TP-F(G) 11.44 6.60 86 8.02 81 8.26 90 8.40 86 8.62 82 IDFC Ultra ST(G) 14.58 7.25 28 8.70 38 9.35 7 9.30 16 9.58 8 ING Treasury Advantage-Inst(G) 14.25 6.95 63 8.44 60 12.73 1 10.88 1 10.02 3 ING Treasury Advantage-Reg(G) 14.07 6.87 67 8.28 71 8.47 74 8.62 76 8.71 79 JM Floater LT(G) 16.44 6.52 94 7.70 98 8.16 93 8.26 95 8.14 98 JM Floater LT-Prem(G) 15.86 6.58 90 7.79 95 8.26 89 8.37 89 8.26 95 JM Money Mgr-Reg(G) 14.58 7.69 3 9.18 2 9.59 3 9.67 3 9.91 4 JM Money Mgr-Super Plus(G) 14.90 7.53 9 9.13 4 9.34 8 9.38 10 9.33 21 JM Money Mgr-Super(G) 15.00 7.56 7 9.07 7 9.55 4 9.64 4 9.71 6 JPMorgan India Treasury(G) 12.59 7.16 40 8.68 40 8.98 38 9.10 37 9.03 62 JPMorgan India Treasury-SIP(G) 13.81 7.39 17 8.92 14 9.23 13 9.36 13 9.30 26 Kotak Floater-LT(G) 16.79 7.14 42 8.63 45 8.93 42 9.10 38 9.28 31 LIC Nomura MF FRF-STP(G) 17.05 6.60 88 7.85 93 8.10 95 8.09 100 7.84 101 LIC Nomura MF Income Plus(G) 14.04 6.74 73 7.95 89 8.33 84 8.29 94 8.36 92 LIC Nomura MF Savings Plus(G) 16.56 6.67 82 7.74 97 8.15 94 8.03 101 7.94 100 Mirae Asset Ultra ST Bond-Reg(G) 1,148.70 6.12 103 7.30 102 7.73 103 7.44 107 6.80 108 Peerless Ultra ST - Reg(G) 11.49 6.51 95 8.07 79 8.63 66 8.32 92 9.16 46 Peerless Ultra ST - SIP(G) 11.57 7.58 6 9.10 5 9.62 2 9.74 2 10.18 2 Pramerica Treasury Advantage(G) 1,063.30 8.32 1 8.57 49 9.46 5 9.58 5 Pramerica Ultra ST Bond-Reg(G) 1,124.28 7.42 15 8.78 28 9.22 15 9.35 14 9.49 14 Principal Near-Term Fund-Conservative Plan(G) 1,670.75 7.28 24 8.87 18 9.05 28 9.15 32 9.25 36 Principal Near-Term Fund-Moderate Plan(G) 1,647.25 7.20 33 8.57 48 8.89 46 8.92 54 8.92 70 Principal Ultra ST(G) 1,356.18 6.57 93 8.11 78 8.78 57 8.96 51 9.17 45 Mutual Funds: Weekly Performance Report 7

- 8. Mutual Funds: Weekly Performance Report 30 January 2012 Ultra Short Term Funds Scheme Name NAV 1 Week Rank 1 Month Rank 3 Months Rank 6 Months Rank 1 Year Rank Reliance FRF ST(G) 16.62 6.16 102 8.20 73 8.58 69 8.86 61 9.46 15 Reliance Medium Term(G) 21.87 6.69 81 7.87 92 8.47 73 8.81 65 9.20 43 Reliance Money Manager-Inst(G) 1,440.98 7.04 50 8.54 53 8.88 49 8.99 44 9.24 37 Reliance Money Manager-Ret(G) 1,421.42 6.74 74 8.21 72 8.56 70 8.67 71 8.90 71 Religare Ultra ST-Inst(G) 1,456.84 7.26 27 8.86 19 9.14 21 9.29 17 9.33 20 Religare Ultra ST-Ret(G) 1,421.38 6.66 83 8.12 77 8.45 75 8.66 72 8.74 77 Sahara ST Bond(G) 12.73 7.18 35 8.73 34 8.97 39 8.96 50 14.03 1 SBI SHD-Ultra ST-Inst(G) 1,377.68 7.13 44 8.65 43 8.97 40 9.05 42 9.17 44 SBI SHD-Ultra ST-Ret(G) 1,356.51 7.01 56 8.52 55 8.82 54 8.92 55 9.06 55 Sundaram Ultra ST Fund(G) 13.70 6.05 105 7.18 105 7.57 105 7.66 104 7.76 103 Sundaram Ultra ST Fund-Inst(G) 14.09 6.98 58 8.30 68 8.89 45 8.97 48 9.09 51 Sundaram Ultra ST Fund-SIP(G) 14.31 7.33 22 8.72 37 9.23 14 9.38 11 9.52 12 Tata Floater(G) 15.80 7.17 37 8.74 33 9.04 32 9.16 31 9.30 25 Tata Treasury Mgr-HIP(G) 1,401.28 6.88 66 8.31 67 8.74 62 8.92 57 9.15 50 Tata Treasury Mgr-RIP(G) 1,395.80 6.60 89 7.98 87 8.37 83 8.56 79 8.94 68 Tata Treasury Mgr-SHIP(G) 1,204.65 7.10 46 8.59 46 9.03 33 9.21 24 9.31 23 Taurus Ultra ST Bond-Inst(G) 1,241.13 7.53 8 9.00 8 9.30 9 9.45 7 9.62 7 Taurus Ultra ST Bond-Reg(G) 1,233.06 7.45 13 8.90 16 9.21 17 9.39 8 9.21 41 Taurus Ultra ST Bond-SIP(G) 1,247.01 7.60 5 9.09 6 9.40 6 9.57 6 9.73 5 Templeton FRF Income(G) 19.23 6.76 72 8.43 61 8.52 72 8.55 80 8.77 74 Templeton FRF Income-Inst(G) 16.02 6.97 59 8.66 42 8.77 58 8.80 66 9.04 59 Templeton FRF Income-SIP(G) 14.57 7.34 20 9.13 3 9.27 12 9.28 18 9.51 13 Templeton India Ultra-ST-Inst(G) 13.56 7.28 25 8.73 35 9.02 36 9.14 33 9.29 27 Templeton India Ultra-ST-Ret(G) 13.45 7.16 41 8.55 51 8.82 53 8.93 53 9.08 52 Templeton India Ultra-ST-SIP(G) 13.66 7.47 10 8.92 13 9.22 16 9.31 15 9.44 16 UTI Treasury Advantage-Inst(G) 1,423.08 7.10 47 8.82 22 9.12 24 9.23 20 9.38 18 UTI Treasury Advantage-Reg(G) 2,668.89 6.72 76 8.41 62 8.71 63 8.84 64 8.94 67 Average 6.86 8.30 8.59 8.29 8.62 Crisil Liquid Fund Index 8.64 8.49 8.43 8.30 8.25 Crisil Short-Term Bond Fund Index 6.36 8.95 8.79 8.31 8.34 NSE MIBOR - Overnight (78.58) 22.40 26.65 27.69 36.06 Mutual Funds: Weekly Performance Report 8

- 9. Mutual Funds: Weekly Performance Report 30 January 2012 Monthly Income Plans (MIPS) Scheme Name NAV 1 Month Rank 3 Months Rank 6 Months Rank 1 Year Rank 3 Years Rank 5 Years Rank Axis Income Saver(G) 10.65 3.25 13 1.15 34 1.08 37 4.40 38 Axis Triple Advt-Reg(G) 11.00 4.11 4 (0.15) 49 3.74 6 10.29 2 Baroda Pioneer MIP(G) 13.52 3.35 11 0.70 39 0.74 44 3.34 43 3.43 35 2.88 35 Bharti AXA Regular Return-Eco(G) 11.82 1.33 48 1.33 30 1.82 29 5.29 30 Bharti AXA Regular Return-Reg(G) 11.73 1.31 49 1.27 31 1.69 35 5.02 31 Birla SL MIP II-Savings 5(G) 18.81 1.42 46 2.57 6 4.40 2 8.80 5 7.75 22 10.23 1 Birla SL MIP II-Wealth 25(G) 18.43 3.33 12 0.38 43 0.80 43 4.93 34 11.30 6 6.43 24 Birla SL MIP(G) 27.66 2.18 33 1.19 33 2.42 19 6.24 20 9.42 17 7.63 16 Birla SL Monthly Income(G) 38.24 1.93 34 1.50 21 2.19 22 6.35 17 10.66 8 8.57 8 BNP Paribas MIP(G) 15.42 2.72 21 1.82 13 3.70 7 8.35 6 5.34 34 3.21 34 Canara Robeco MIP(G) 30.85 1.88 36 1.12 35 1.91 26 6.38 15 10.92 7 9.53 6 DSPBR MIP(G) 20.27 2.56 23 3.28 1 4.26 3 6.81 8 10.22 10 7.89 14 DWS Twin Advantage(G) 17.06 2.30 31 0.44 41 1.02 39 6.50 12 6.28 31 6.18 27 Edelweiss MIP(G) 11.09 3.68 7 1.50 22 1.76 32 6.20 21 FT India MIP(G) 29.04 2.53 26 0.83 37 1.70 33 6.48 13 10.00 11 6.94 20 FT India MIP-B(G) 29.04 2.53 26 0.83 37 1.70 33 6.48 13 10.00 11 6.94 20 HDFC MIP-LTP(G) 23.67 3.87 5 1.54 20 0.82 42 5.00 32 15.04 1 9.73 3 HDFC MIP-STP(G) 17.84 2.86 19 1.43 29 1.76 31 5.95 24 9.92 14 6.57 23 HDFC Multiple Yield 2005(G) 17.37 1.81 40 1.64 18 2.89 13 8.25 7 13.00 3 9.54 5 HDFC Multiple Yield(G) 19.21 3.01 18 2.39 7 3.82 5 10.49 1 13.53 2 9.58 4 HSBC MIP(G) 17.58 1.87 37 1.47 26 1.90 27 4.85 36 7.65 25 7.32 17 HSBC MIP-Savings(G) 19.66 3.10 17 1.24 32 1.24 36 3.94 41 9.33 18 8.14 10 ICICI Pru MIP 25(G) 20.31 4.43 3 1.79 15 1.90 28 6.31 18 12.19 5 6.94 19 ICICI Pru MIP 5(G) 10.54 1.59 43 1.63 19 3.65 8 ICICI Pru MIP(G) 26.95 3.46 10 1.99 10 2.15 24 6.63 9 9.55 16 7.22 18 IDBI MIP(G) 10.59 1.87 38 1.80 14 3.05 11 ING MIP(G) 15.10 2.54 25 1.50 23 0.88 41 4.24 40 6.77 29 4.30 30 JM MIP(G) 15.88 1.83 39 0.53 40 3.46 9 6.30 19 6.04 32 3.57 33 Kotak MIP(G) 16.25 3.24 14 1.83 12 2.19 23 6.05 23 7.66 23 4.29 31 L&T MIP(G) 20.50 2.47 29 1.48 25 2.31 20 5.49 29 7.23 27 8.95 7 LIC Nomura MF Floater MIP(G) 18.75 3.21 15 (0.15) 48 1.07 38 4.35 39 8.71 20 8.01 11 LIC Nomura MF MIP(G) 33.02 3.16 16 (0.13) 47 0.33 45 2.30 45 7.45 26 6.31 26 Peerless Income Plus Fund-Reg(G) 10.87 1.73 41 1.45 27 2.98 12 6.61 10 Pramerica Dynamic MIP(G) 10.46 2.55 24 1.43 28 2.46 18 Principal Debt Savings(G) 18.73 1.72 42 0.39 42 0.14 47 2.15 46 8.79 19 7.95 12 Principal Debt Savings-MIP(G) 22.18 1.34 47 1.71 17 2.49 17 5.60 27 8.46 21 7.92 13 Reliance MIP(G) 22.65 4.60 1 3.26 2 2.73 15 6.51 11 12.81 4 10.19 2 Religare MIP Plus(G) 11.27 2.20 32 0.29 44 3.84 4 9.30 4 Religare MIP(G) 10.77 2.50 28 0.18 45 1.00 40 4.93 33 SBI Magnum MIP(G) 20.82 1.92 35 2.06 9 2.08 25 4.83 37 7.01 28 4.45 29 SBI Magnum MIP-Floater(G) 13.98 1.44 45 1.93 11 2.74 14 5.60 28 7.66 24 5.23 28 Mutual Funds: Weekly Performance Report 9

- 10. Mutual Funds: Weekly Performance Report 30 January 2012 Monthly Income Plans (Mips) Scheme Name NAV 1 Month Rank 3 Months Rank 6 Months Rank 1 Year Rank 3 Years Rank 5 Years Rank Sundaram MIP-Aggr(G) 10.51 3.62 8 (0.02) 46 (2.05) 49 3.41 42 Sundaram MIP-Cons(G) 10.80 1.53 44 1.50 24 1.81 30 5.67 26 Sundaram MIP-Mod(G) 15.55 4.56 2 2.18 8 (0.01) 48 3.19 44 6.46 30 3.97 32 Tata MIP Plus(G) 16.70 3.80 6 3.00 4 2.27 21 6.38 16 9.62 15 6.82 22 Tata MIP(G) 19.52 2.40 30 2.81 5 3.29 10 5.90 25 5.89 33 6.36 25 Taurus MIP Advt-Reg(G) 11.14 2.86 20 3.09 3 5.21 1 10.16 3 UTI MIS Adv(G) 20.77 3.60 9 0.85 36 0.23 46 4.93 35 10.52 9 7.82 15 UTI MIS(G) 20.69 2.61 22 1.76 16 2.66 16 6.18 22 9.92 13 8.30 9 Average 2.65 1.42 2.09 5.94 9.04 7.03 Crisil MIP Blended Index 2.44 1.89 2.96 5.99 8.42 6.78 Balanced Funds Scheme Name NAV 1 Month Rank 3 Months Rank 6 Months Rank 1 Year Rank 3 Years Rank 5 Years Rank Baroda Pioneer Balance(G) 27.08 10.89 2 (0.99) 5 (4.38) 8 (4.82) 14 17.57 14 3.32 15 Birla SL Freedom(G) 30.91 (4.86) 11 (2.62) 11 7.21 19 1.91 18 Canara Robeco Balance(G) 59.48 5.46 19 (2.04) 14 (4.71) 10 0.69 4 24.62 5 9.12 6 DSPBR Balanced(G) 63.11 10.17 4 (1.26) 7 (4.88) 12 (1.89) 9 21.58 6 9.90 4 Escorts Balanced(G) 59.06 21.45 1 2.40 1 (6.88) 18 (2.59) 10 16.95 16 4.00 14 Escorts Opp(G) 27.53 7.72 14 0.25 2 (3.84) 6 (0.05) 6 5.06 20 1.28 19 FT India Balanced(G) 47.46 7.35 16 (2.24) 15 (3.29) 3 0.49 5 19.56 10 7.10 7 HDFC Balanced(G) 55.18 9.29 6 (1.63) 10 (4.89) 13 4.77 1 29.91 2 11.39 3 HDFC Prudence(G) 205.24 10.80 3 (1.17) 6 (5.76) 15 (0.61) 8 32.84 1 11.88 2 ICICI Pru Balanced(G) 46.03 7.12 17 (0.95) 4 (4.52) 9 3.42 2 21.56 7 5.11 11 ING Balanced(G) 24.54 8.82 11 (1.68) 11 (4.14) 7 (0.45) 7 19.37 11 5.65 9 JM Balanced(G) 21.47 7.12 18 (2.66) 17 (2.68) 2 (2.69) 12 17.81 13 (1.89) 20 Kotak Balance 21.02 8.09 13 (0.05) 3 (1.68) 1 (2.75) 13 14.59 17 2.62 16 LIC Nomura MF Balanced(G) 52.44 9.25 7 (1.70) 12 (4.93) 14 (5.49) 16 11.07 18 2.59 17 Principal Balanced(G) 27.83 9.09 9 (2.04) 13 (6.61) 17 (7.33) 19 17.50 15 4.39 13 Reliance Reg Savings-Balanced(G) 20.82 9.67 5 (1.44) 9 (6.09) 16 (4.93) 15 26.90 3 12.23 1 SBI Magnum Balanced(G) 45.45 8.37 12 (2.47) 16 (7.60) 20 (8.50) 20 17.94 12 4.62 12 Sundaram Balanced Fund(G) 44.74 9.15 8 (3.64) 19 (3.77) 5 (6.05) 18 20.80 8 6.26 8 Tata Balanced(G) 81.09 7.59 15 (1.40) 8 (3.54) 4 1.77 3 25.93 4 9.73 5 UTI Balanced(G) 74.59 8.99 10 (3.57) 18 (7.55) 19 (5.53) 17 20.38 9 5.61 10 Average 9.28 (1.49) (4.83) (2.26) 19.46 5.84 Crisil Balanced Fund Index 7.42 (1.39) (2.13) (1.13) 17.15 6.39 Mutual Funds: Weekly Performance Report 10

- 11. Mutual Funds: Weekly Performance Report 30 January 2012 Closed Ended Funds Scheme Name NAV 1 Month Rank 3 Months Rank 6 Months Rank 1 Year Rank 3 Years Rank 5 Years Rank Birla SL LT Advantage(G) 13.00 11.30 7 (3.92) 10 (7.74) 5 (5.66) 8 26.18 6 3.05 4 Canara Robeco Multicap(G) 14.69 5.84 15 (3.86) 9 (8.30) 7 (5.53) 7 30.04 2 Escorts Infrastructure(G) 5.65 25.42 1 (4.72) 13 (17.14) 17 (25.42) 17 3.09 14 ICICI Pru R.I.G.H.T(G) 11.99 8.51 12 (2.76) 4 (8.89) 10 3.36 1 IDFC Tax Saver(G) 13.53 9.00 11 (3.29) 7 (6.00) 3 (4.77) 5 23.92 7 ING OptiMix RetireInvest-I(G) 10.98 9.25 10 (5.02) 15 (9.03) 13 (8.88) 12 18.05 12 L&T Tax Advantage-I(G) 18.46 13.18 4 (2.48) 3 (7.75) 6 (10.26) 14 Reliance ELSS-I(G) 13.22 15.66 3 (1.99) 2 (8.91) 11 (5.34) 6 27.17 5 Religare AGILE Tax(G) 7.06 2.17 16 (3.68) 8 (4.34) 1 (6.12) 9 11.77 13 SBI TAX Advantage-I(G) 10.12 11.82 5 (4.98) 14 (14.09) 16 (14.02) 15 20.34 11 Sundaram Select Small Cap(G) 11.93 6.63 14 (3.18) 5 (9.06) 14 (2.28) 3 35.06 1 Tata Infrastructure Tax Saving(G) 13.21 18.20 2 (1.39) 1 (11.44) 15 (14.66) 16 Tata Tax Advantage-1 15.50 8.12 13 (4.14) 12 (6.16) 4 (2.19) 2 27.19 4 8.25 1 UTI LT Adv-I(G) 11.20 11.67 6 (3.20) 6 (8.42) 9 (9.39) 13 21.70 8 UTI LT Adv-II(G) 12.95 10.03 8 (5.75) 16 (8.42) 8 (6.63) 11 21.26 9 UTI MEPUS 46.31 9.32 9 (3.92) 11 (5.89) 2 (3.52) 4 21.23 10 4.89 3 UTI Wealth Builder(G) 14.99 (8.99) 12 (6.25) 10 27.85 3 6.81 2 Average 11.01 (3.64) (8.86) (7.50) 22.49 BSE MIDCAP 14.72 (6.42) (15.08) (14.87) 26.52 (0.76) BSE SENSEX 10.87 (3.21) (5.29) (6.32) 23.16 3.93 BSE SMALLCAP 17.07 (6.73) (21.84) (24.04) 25.31 (3.05) BSE-100 12.76 (2.74) (5.82) (6.27) 24.17 4.48 BSE-200 12.99 (2.95) (6.96) (7.60) 24.62 4.22 CNX Midcap 16.64 (2.07) (11.57) (10.04) 28.70 5.89 S&P CNX 500 13.24 (3.41) (7.66) (7.73) 23.49 3.59 S&P CNX Nifty 12.02 (2.91) (5.06) (5.58) 22.65 4.77 Mutual Funds: Weekly Performance Report 11

- 12. Mutual Funds: Weekly Performance Report 30 January 2012 Tax Saving Funds Scheme Name NAV 1 Month Rank 3 Months Rank 6 Months Rank 1 Year Rank 3 Years Rank 5 Years Rank Axis LT Equity(G) 12.05 8.99 33 (4.45) 33 (6.25) 10 1.57 3 Baroda Pioneer ELSS 96 21.61 13.62 8 (3.31) 22 (6.89) 17 (9.22) 34 22.23 25 1.76 22 Bharti AXA Tax Adv-Eco(G) 20.42 8.91 35 (4.80) 35 (7.43) 21 (5.99) 18 Bharti AXA Tax Adv-Reg(G) 20.29 8.91 34 (4.83) 38 (7.52) 23 (6.20) 21 Birla SL Tax Plan(D) 40.90 10.06 26 (4.66) 34 (9.75) 41 (6.63) 27 21.34 28 1.86 20 BNP Paribas Tax Adv(G) 13.60 8.62 39 (3.42) 26 (4.80) 5 2.33 2 23.55 20 -0.81 26 Canara Robeco Equity Tax Saver(D) 17.38 8.15 42 (1.86) 8 (6.56) 13 (1.92) 6 32.71 2 12.47 1 DSPBR Tax Saver(G) 14.99 10.63 20 (3.25) 19 (9.79) 42 (9.67) 37 25.61 16 7.70 8 DWS Tax Saving(G) 11.76 9.20 31 (4.93) 39 (10.65) 43 (11.88) 42 17.44 36 1.78 21 Edelweiss ELSS(G) 18.17 10.19 24 (1.41) 5 (5.95) 7 (2.47) 10 21.99 26 Escorts Tax(G) 37.65 19.79 1 (7.24) 44 (17.78) 46 (17.31) 46 12.65 39 -3.59 28 Fidelity Tax Advt(G) 20.41 10.39 22 (4.00) 31 (6.49) 12 (4.69) 14 29.64 5 9.55 5 Franklin India Index Tax 38.96 (7.47) 22 (7.58) 32 24.46 18 4.24 16 Franklin India Taxshield(G) 202.92 8.76 37 (3.38) 24 (4.18) 2 1.08 4 29.42 7 9.11 6 HDFC Long Term Adv(G) 125.55 10.17 25 (3.32) 23 (8.87) 34 (6.41) 23 29.23 8 5.51 12 HDFC TaxSaver(G) 212.45 10.46 21 (1.74) 7 (9.01) 37 (6.55) 25 31.89 3 7.54 9 HSBC Tax Saver Equity(G) 13.16 9.25 30 (2.31) 10 (6.79) 16 (6.42) 24 22.85 23 5.24 14 ICICI Pru R.I.G.H.T(G) 11.99 8.51 40 (2.76) 15 (8.89) 35 3.36 1 ICICI Pru Tax Plan(G) 131.32 14.30 7 (2.72) 14 (6.90) 18 (4.46) 13 35.32 1 6.80 11 IDFC Tax Advt(G) 18.09 11.93 14 (5.43) 42 (7.09) 19 (6.61) 26 22.45 24 IDFC Tax Saver(G) 13.53 9.00 32 (3.29) 21 (6.00) 8 (4.77) 16 23.92 19 ING OptiMix RetireInvest-I(G) 10.98 9.25 29 (5.02) 41 (9.03) 38 (8.88) 33 18.05 34 ING Tax Savings(G) 26.92 6.40 44 (4.81) 36 (9.33) 40 (7.49) 31 30.22 4 -0.71 25 JM Tax Gain(G) 6.11 15.47 5 (2.45) 11 (6.60) 14 (11.15) 41 16.67 38 JPMorgan India Tax Advantage(G) 17.10 9.94 28 (3.86) 30 (7.10) 20 (4.74) 15 19.62 33 Kotak Tax Saver(G) 16.57 12.05 13 (3.27) 20 (8.25) 28 (7.08) 29 23.26 21 2.41 19 L&T Tax Advantage-I(G) 18.46 13.18 9 (2.48) 12 (7.75) 25 (10.26) 38 L&T Tax Saver(G) 13.85 12.51 12 (3.01) 16 (8.10) 27 (11.05) 40 25.24 17 -0.34 23 LIC Nomura MF Tax Plan(G) 26.42 11.75 16 (7.55) 24 (9.28) 35 18.03 35 -0.65 24 Principal Personal Tax saver 83.47 11.47 18 (3.86) 29 (9.18) 39 (10.97) 39 22.89 22 2.60 18 Principal Tax Saving 65.32 12.64 11 (2.59) 13 (7.97) 26 (12.06) 43 17.16 37 -2.29 27 Quantum Tax Saving(G) 20.97 10.99 19 (0.24) 1 (2.79) 1 (3.93) 12 28.90 10 Reliance ELSS-I(G) 13.22 15.66 3 (1.99) 9 (8.91) 36 (5.34) 17 27.17 14 Reliance Tax Saver (ELSS)(G) 19.45 15.51 4 (1.59) 6 (8.50) 33 (2.41) 9 27.41 11 5.30 13 Religare AGILE Tax(G) 7.06 2.17 45 (3.68) 27 (4.34) 3 (6.12) 19 11.77 40 Religare Tax Plan(G) 16.59 10.31 23 (3.71) 28 (8.29) 29 (1.31) 5 29.11 9 10.24 4 Sahara Tax Gain(G) 35.32 14.51 6 (0.77) 2 (6.25) 11 (2.71) 11 29.44 6 10.35 3 Mutual Funds: Weekly Performance Report 12

- 13. Mutual Funds: Weekly Performance Report 30 January 2012 Tax Saving Funds Scheme Name NAV 1 Month Rank 3 Months Rank 6 Months Rank 1 Year Rank 3 Years Rank 5 Years Rank SBI TAX Advantage-I(G) 10.12 11.82 15 (4.98) 40 (14.09) 45 (14.02) 44 20.34 32 Sundaram Tax Saver(G) 40.26 12.68 10 (1.13) 3 (4.68) 4 (6.25) 22 20.69 31 6.88 10 Tata Infrastructure Tax Saving(G) 13.21 18.20 2 (1.39) 4 (11.44) 44 (14.66) 45 Tata Tax Advantage-1 15.50 8.12 43 (4.14) 32 (6.16) 9 (2.19) 7 27.19 13 8.25 7 Tata Tax Saving 41.91 8.22 41 (3.39) 25 (5.43) 6 (2.38) 8 26.58 15 4.52 15 Taurus Tax Shield(G) 32.36 8.74 38 (3.14) 17 (6.77) 15 (6.12) 20 27.35 12 11.55 2 UTI ETSP(D) 14.40 8.84 36 (4.82) 37 (8.34) 30 (7.28) 30 20.74 30 2.66 17 UTI LT Adv-I(G) 11.20 11.67 17 (3.20) 18 (8.42) 32 (9.39) 36 21.70 27 UTI LT Adv-II(G) 12.95 10.03 27 (5.75) 43 (8.42) 31 (6.63) 28 21.26 29 Average 10.93 (3.37) (7.80) (6.39) 23.94 4.64 BSE SENSEX 10.87 (3.21) (5.29) (6.32) 23.16 3.93 BSE Sensex - TRI 11.00 (3.06) (4.90) (8.71) 22.92 4.57 BSE-100 12.76 (2.74) (5.82) (6.27) 24.17 4.48 BSE-200 12.99 (2.95) (6.96) (7.60) 24.62 4.22 BSE-500 13.06 (3.36) (7.83) (8.17) 24.95 3.73 S&P CNX 500 13.24 (3.41) (7.66) (7.73) 23.49 3.59 S&P CNX Nifty 12.02 (2.91) (5.06) (5.58) 22.65 4.77 Mutual Funds: Weekly Performance Report 13

- 14. Mutual Funds: Weekly Performance Report 30 January 2012 Large Cap Funds Scheme Name NAV 1 Month Rank 3 Months Rank 6 Months Rank 1 Year Rank 3 Years Rank 5 Years Rank Baroda Pioneer Growth(G) 45.32 13.41 10 -3.60 41 -8.87 45 -11.69 46 21.30 25 7.68 10 Birla SL Adv(G) 139.50 11.39 18 -3.10 38 -8.88 46 -9.60 43 23.33 17 1.68 25 Birla SL Frontline Equity(G) 80.87 10.64 28 -3.01 34 -6.65 28 -5.92 31 26.33 7 9.20 4 Birla SL Top 100(G) 21.24 11.26 22 -2.68 28 -6.82 30 -3.66 18 23.44 16 5.48 16 BNP Paribas Equity Fund(G) 32.79 8.29 45 -3.05 35 -4.01 13 -0.67 8 19.74 28 3.42 21 Canara Robeco Large Cap+(G) 10.13 8.57 42 -1.07 8 -3.52 8 1.10 2 Daiwa Industry Leaders(G) 10.56 10.00 34 -3.47 39 -7.37 35 -7.85 37 DSPBR Focus 25(G) 9.68 10.65 27 -3.69 43 -8.55 43 -4.44 21 DSPBR Top 100 Equity-Reg(G) 97.03 13.13 12 0.39 2 -1.64 3 -0.81 9 24.62 14 10.53 3 DWS Alpha Equity(G) 68.65 8.69 41 -4.01 45 -8.31 41 -10.11 45 17.39 33 5.72 14 Edelweiss EDGE Top 100-A(G) 13.70 10.31 33 -0.44 6 -2.63 5 -0.44 6 Edelweiss EDGE Top 100-B(G) 13.77 10.34 31 -0.43 5 -2.62 4 -0.29 5 Edelweiss EDGE Top 100-C(G) 13.59 10.31 32 -1.88 16 -4.09 15 -1.88 11 Franklin India Bluechip(G) 206.73 10.57 29 -1.85 15 -2.81 6 -0.60 7 29.13 4 8.81 5 Franklin India Prima Plus(G) 210.24 9.07 38 -3.54 40 -5.31 22 -1.37 10 26.24 8 7.80 6 HDFC Growth(G) 82.45 12.27 15 -1.76 12 -4.05 14 -2.70 14 29.33 3 10.91 2 HDFC Top 200(G) 194.90 13.86 9 -1.65 10 -6.56 26 -4.91 23 30.88 2 11.48 1 HSBC Equity(G) 94.19 9.06 39 -2.49 24 -6.96 32 -7.44 36 17.83 32 5.11 17 ICICI Pru Focused Blue Chip Equity-Ret(G) 15.90 9.28 35 -1.85 14 -3.87 11 0.13 4 31.45 1 ICICI Pru Target Returns-Reg(G) 13.20 14.78 7 -0.08 3 -3.15 7 -2.44 12 ICICI Pru Top 100(G) 133.30 15.60 3 2.27 1 0.29 1 0.98 3 25.01 11 6.80 12 ICICI Pru Top 200(G) 102.30 14.93 6 -2.88 30 -6.79 29 -6.34 32 24.76 12 4.06 18 IDFC Equity-A(G) 14.99 11.32 20 -2.32 22 -4.58 18 -4.53 22 22.46 20 IDFC Equity-B(G) 12.37 11.32 21 -2.32 23 -4.58 17 -4.20 20 IDFC Imperial Equity-A(G) 17.79 8.47 43 -5.02 47 -7.68 39 -5.71 29 19.90 27 7.70 8 IDFC Imperial Equity-B(G) 15.33 8.47 44 -5.02 48 -7.68 38 -5.70 28 JM Equity(G) 32.18 15.44 4 -3.08 37 -6.47 24 -8.94 39 18.07 31 -4.12 29 Kotak 50(G) 95.85 7.01 46 -2.51 25 -5.99 23 -3.47 16 21.22 26 6.35 13 Kotak Select Focus(G) 10.84 9.08 37 -2.07 18 -6.63 27 -4.94 24 L&T Growth(G) 36.83 12.22 16 -1.26 9 -4.34 16 -3.56 17 25.58 9 2.48 22 LIC Nomura MF Top 100(G) 7.27 13.35 11 -2.88 31 -6.98 33 -9.95 44 13.62 35 Morgan Stanley Growth(G) 53.61 9.22 36 -4.22 46 -10.52 48 -12.36 47 21.62 23 0.52 27 Pramerica Equity Fund(G) 8.33 10.77 26 -3.81 44 -8.96 47 -9.06 41 Principal Growth(G) 44.66 12.98 13 -2.77 29 -8.37 42 -12.38 48 18.11 30 -2.98 28 Principal Large Cap(G) 25.52 11.20 23 -2.67 27 -8.14 40 -8.95 40 28.84 5 7.69 9 Reliance Equity-Ret(G) 12.48 17.27 2 -0.15 4 -6.86 31 -9.51 42 12.21 36 1.07 26 Reliance Quant Plus-Ret(G) 12.67 14.32 8 -2.24 20 -4.67 19 -5.32 26 25.38 10 Mutual Funds: Weekly Performance Report 14

- 15. Mutual Funds: Weekly Performance Report 30 January 2012 Large Cap Funds Scheme Name NAV 1 Month Rank 3 Months Rank 6 Months Rank 1 Year Rank 3 Years Rank 5 Years Rank Reliance Top 200-Ret(G) 11.81 15.04 5 -2.96 33 -7.48 36 -6.54 33 22.17 21 Reliance Vision-Ret(G) 243.54 17.51 1 -2.26 21 -8.81 44 -7.04 35 23.94 15 5.54 15 Religare AGILE(G) 6.30 2.44 48 -3.67 42 -3.82 9 -5.26 25 14.32 34 Sahara Super 20(G) 11.31 12.03 17 -1.78 13 -0.59 2 1.51 1 SBI BlueChip(G) 13.23 10.43 30 -1.93 17 -6.50 25 -5.77 30 22.47 19 2.04 23 SBI Magnum Equity(G) 41.09 11.36 19 -2.17 19 -5.04 21 -2.93 15 28.33 6 7.49 11 Sundaram Growth Fund(G) 84.10 12.92 14 -1.75 11 -7.51 37 -7.89 38 22.88 18 3.57 20 Sundaram Select Focus-Inst(G) 83.07 10.89 25 -0.69 7 -3.91 12 -5.60 27 21.99 22 Tata Pure Equity(G) 91.56 9.05 40 -2.64 26 -4.71 20 -4.07 19 24.68 13 7.71 7 UTI Leadership Equity(G) 14.02 10.92 24 -2.91 32 -7.15 34 -6.66 34 19.23 29 1.90 24 UTI Top 100(G) 27.18 6.71 47 -3.07 36 -3.82 10 -2.48 13 21.55 24 3.59 19 Average 11.21 -2.33 -5.73 -5.05 22.76 5.15 BSE SENSEX 10.87 -3.21 -5.29 -6.32 23.16 3.93 BSE-100 12.76 -2.74 -5.82 -6.27 24.17 4.48 BSE-200 12.99 -2.95 -6.96 -7.60 24.62 4.22 CNX 100 12.87 -2.75 -5.88 -6.24 24.13 4.94 S&P CNX 500 13.24 -3.41 -7.66 -7.73 23.49 3.59 S&P CNX Nifty 12.02 -2.91 -5.06 -5.58 22.65 4.77 Mid Cap Funds Scheme Name NAV 1 Month Rank 3 Months Rank 6 Months Rank 1 Year Rank 3 Years Rank 5 Years Rank Axis Midcap(G) 9.62 8.82 37 -3.70 13 -10.09 13 Birla SL Midcap(G) 95.75 10.43 28 -4.83 25 -11.74 22 -7.84 27 30.55 23 7.37 7 Birla SL Small & Midcap(G) 10.71 8.01 38 -7.27 35 -12.76 32 -7.28 24 30.98 21 BNP Paribas Mid Cap Fund(G) 9.01 11.53 19 -4.82 24 -9.08 10 0.48 7 31.20 19 -3.40 24 Canara Robeco Emerging Eq(G) 20.50 11.05 24 -4.70 21 -12.69 30 -6.22 21 37.67 7 4.53 11 DSPBR Micro-Cap(G) 14.05 12.89 11 -5.86 31 -10.69 16 -6.22 22 41.33 2 DSPBR Small & Mid Cap-Reg(G) 15.70 12.93 10 -7.57 36 -13.69 36 -7.39 25 35.97 11 7.83 5 Franklin India Prima(G) 249.67 9.28 34 -2.90 6 -8.40 9 -3.41 10 32.90 15 2.82 16 Franklin India Smaller Cos(G) 12.50 11.06 23 -4.43 17 -12.08 26 -8.09 28 30.79 22 2.23 17 HDFC Mid-Cap Oppor(G) 14.94 12.55 12 -2.17 3 -9.51 12 1.50 6 36.92 10 HSBC Midcap Equity(G) 16.14 17.36 2 -8.51 37 -18.59 39 -22.65 39 17.47 37 -5.02 25 HSBC Small Cap(G) 8.47 16.92 3 -12.19 38 -21.93 40 -28.50 40 19.44 36 ICICI Pru Discovery(G) 45.17 15.47 4 0.51 1 -7.61 7 -4.70 14 40.75 3 10.34 2 ICICI Pru Midcap(G) 28.18 17.71 1 -2.42 4 -13.21 35 -10.00 32 28.69 26 -1.31 22 IDFC Premier Equity-A(G) 31.39 9.80 32 -4.83 27 -5.70 2 1.53 5 37.18 8 17.77 1 Mutual Funds: Weekly Performance Report 15

- 16. Mutual Funds: Weekly Performance Report 30 January 2012 Mid Cap Funds Scheme Name NAV 1 Month Rank 3 Months Rank 6 Months Rank 1 Year Rank 3 Years Rank 5 Years Rank IDFC Premier Equity-B(G) 23.15 9.80 33 -4.83 26 -5.70 3 1.53 4 IDFC Sterling Equity(G) 16.65 11.64 18 -5.87 32 -12.04 25 -4.66 13 33.42 13 ING C.U.B(G) 13.41 -15.02 39 -21.99 41 -19.41 38 27.71 29 1.20 20 ING Midcap(G) 19.21 11.49 20 -2.93 7 -11.72 21 -4.95 16 29.15 24 1.59 19 JM Emerging Leaders(G) 7.12 0.00 1 -4.83 15 36.98 9 -9.45 27 JPMorgan India Smaller Cos(G) 6.96 11.19 22 -4.77 23 -13.11 34 -5.12 18 31.19 20 Kotak Midcap(G) 22.59 13.24 9 -4.52 19 -11.96 24 -5.67 19 28.64 27 1.71 18 L&T Midcap(G) 34.13 11.21 21 -2.98 8 -11.17 19 -11.35 34 31.89 18 4.19 12 L&T Small Cap(G) 4.59 -8.20 8 -7.27 23 23.21 34 Mirae Asset Emerging BlueChip-Reg(G) 10.67 11.82 17 -2.10 2 -7.35 5 4.97 2 Principal Emerging Bluechip(G) 24.62 13.25 8 -3.60 11 -12.29 27 -16.29 37 32.33 16 Reliance Growth-Ret(G) 415.18 14.39 6 -2.75 5 -7.58 6 -8.28 29 27.67 30 8.40 3 Reliance Long Term Equity(G) 13.61 12.31 14 -4.18 16 -12.72 31 -10.56 33 24.62 33 5.67 10 Reliance Small Cap(G) 8.59 12.34 13 -5.70 30 -13.73 37 -9.57 31 Religare Mid Cap(G) 13.57 10.87 25 -5.44 28 -11.65 20 0.44 8 37.93 6 Religare Mid N Small Cap(G) 13.60 11.93 16 -4.43 18 -10.59 15 -0.29 9 39.12 4 Sahara Midcap(G) 27.71 14.76 5 -3.39 10 -10.80 17 -6.19 20 33.38 14 8.26 4 SBI Magnum Emerging Businesses(G) 42.65 9.27 35 -3.05 9 -6.14 4 11.68 1 45.34 1 6.14 9 SBI Magnum Global 94(G) 53.65 9.16 36 -3.68 12 -9.13 11 2.78 3 38.55 5 3.10 15 SBI Magnum MidCap(G) 20.46 10.48 27 -4.70 22 -11.89 23 -8.29 30 28.13 28 -3.01 23 Sundaram S.M.I.L.E Fund(G) 26.80 14.19 7 -7.06 34 -14.20 38 -13.99 36 26.95 32 6.54 8 Sundaram Select Midcap(G) 137.49 10.76 26 -4.15 15 -13.10 33 -4.61 12 35.47 12 7.57 6 Tata Growth(G) 39.15 10.34 29 -4.04 14 -10.22 14 -5.10 17 28.72 25 3.40 14 Tata Mid Cap(G) 15.49 10.24 30 -4.56 20 -11.15 18 -7.69 26 27.38 31 0.87 21 Taurus Discovery(G) 12.72 9.94 31 -5.64 29 -12.58 28 -13.82 35 22.90 35 -5.56 26 UTI Mid Cap(D) 19.41 12.00 15 -6.73 33 -12.69 29 -4.34 11 32.33 17 3.53 13 Average 11.91 -4.92 -11.26 -6.49 31.75 3.23 BSE MIDCAP 14.72 -6.42 -15.08 -14.87 26.52 -0.76 BSE SMALLCAP 17.07 -6.73 -21.84 -24.04 25.31 -3.05 BSE-100 12.76 -2.74 -5.82 -6.27 24.17 4.48 BSE-200 12.99 -2.95 -6.96 -7.60 24.62 4.22 BSE-500 13.06 -3.36 -7.83 -8.17 24.95 3.73 CNX Midcap 16.64 -2.07 -11.57 -10.04 28.70 5.89 CNX Nifty Junior 17.72 -1.87 -10.07 -9.62 33.35 5.98 S&P CNX 500 13.24 -3.41 -7.66 -7.73 23.49 3.59 Mutual Funds: Weekly Performance Report 16

- 17. Mutual Funds: Weekly Performance Report 30 January 2012 Opportunities Funds Scheme Name NAV 1 Month Rank 3 Months Rank 6 Months Rank 1 Year Rank 3 Years Rank 5 Years Rank AIG India Equity-Reg(G) 11.89 8.66 44 (4.60) 39 (6.14) 17 0.72 3 28.63 12 Axis Equity Fund(G) 10.11 9.89 24 (2.22) 12 (6.91) 23 (4.89) 22 Bharti AXA Equity-Eco(G) 16.20 9.24 38 (4.48) 36 (6.74) 21 (4.54) 18 19.76 35 Bharti AXA Equity-Reg(G) 16.06 9.18 39 (4.58) 38 (6.90) 22 (4.80) 21 19.46 36 Birla SL Equity(G) 227.21 11.93 11 (4.41) 35 (10.04) 39 (11.51) 39 22.95 27 3.81 21 BNP Paribas Opp Fund(G) 18.43 (3.34) 3 1.80 2 23.49 25 (3.42) 27 DSPBR Opp-Reg(G) 76.67 9.41 31 (5.06) 44 (10.00) 38 (9.65) 35 25.71 20 6.10 14 DWS Investment Opp(G) 32.13 9.25 36 (4.72) 41 (10.82) 45 (11.83) 42 18.53 37 6.28 12 DWS Investment Opp-WP(G) 14.53 9.25 37 (4.72) 42 (10.86) 46 (11.94) 43 Fidelity Equity(G) 33.26 10.55 20 (3.25) 20 (5.33) 11 (3.63) 14 29.15 10 8.84 6 Fidelity India Growth(G) 11.56 10.62 19 (3.29) 21 (5.21) 8 (3.61) 13 29.72 8 Franklin India Flexi Cap(G) 30.24 11.91 12 (2.66) 17 (5.99) 15 (4.14) 16 29.14 11 7.01 10 Franklin India High Growth Cos(G) 11.36 11.57 15 (3.52) 25 (10.39) 40 (6.63) 29 28.28 14 Franklin India Opp(G) 28.72 9.98 23 (3.39) 23 (6.71) 20 (5.90) 27 21.55 31 0.93 25 Franklin India Prima Plus(G) 210.24 9.07 40 (3.54) 26 (5.31) 10 (1.37) 6 26.24 19 7.80 8 HDFC Core & Satellite(G) 35.23 8.99 42 (3.90) 33 (11.42) 48 (12.34) 46 31.88 4 6.22 13 HDFC Equity(G) 250.21 14.05 5 (2.24) 14 (9.79) 37 (8.18) 32 34.63 3 10.50 2 HDFC Premier Multi-Cap(G) 25.88 8.37 46 (5.03) 43 (12.39) 50 (8.59) 33 30.22 7 6.59 11 HSBC Dynamic(G) 9.52 9.32 34 (2.06) 9 (5.84) 14 (6.63) 28 15.33 40 HSBC India Opp(G) 33.22 9.70 27 (1.24) 4 (4.63) 5 (2.16) 8 20.04 34 2.27 23 ICICI Pru Dynamic(G) 101.90 14.69 2 (0.03) 1 (4.45) 4 (2.56) 9 28.47 13 8.26 7 IDFC Classic Equity-A(G) 17.92 9.34 32 (6.24) 46 (10.50) 42 (11.81) 40 16.39 39 1.85 24 IDFC Classic Equity-B(G) 14.24 9.33 33 (6.24) 47 (10.50) 43 (11.83) 41 IDFC India GDP Growth-Reg(G) 15.85 12.05 10 (4.62) 40 (4.98) 7 (2.71) 11 ING Core Equity(G) 35.66 14.22 4 (2.22) 10 (7.11) 26 (4.96) 23 24.43 24 4.78 18 JM Multi Strategy(G) 11.89 15.94 1 (2.26) 15 (7.40) 28 (14.55) 49 12.97 42 JPMorgan India Equity(G) 12.35 10.13 22 (3.76) 30 (7.08) 25 (4.55) 19 25.52 21 Kotak Opportunities(G) 42.35 9.52 29 (1.70) 7 (6.11) 16 (4.98) 24 24.90 23 7.48 9 L&T Multi-Cap(G) 16.27 (7.45) 29 (9.96) 37 23.48 26 (3.62) 28 L&T Opportunities(G) 38.14 11.65 13 (2.55) 16 (8.93) 34 (10.07) 38 26.40 18 5.97 15 LIC Nomura MF Growth(G) 11.60 11.30 16 (3.64) 27 (6.98) 24 (9.50) 34 22.07 29 0.71 26 LIC Nomura MF India Vision(G) 7.85 13.83 6 (3.89) 32 (7.90) 32 (13.00) 48 11.89 43 (4.80) 29 Mirae Asset India Oppor-Reg(G) 15.59 11.26 17 (1.34) 5 (5.22) 9 (0.73) 4 36.72 2 Morgan Stanley A.C.E(G) 13.08 9.25 35 (5.75) 45 (9.15) 35 (9.93) 36 30.33 6 Pramerica Dynamic Fund(G) 9.06 8.37 45 (1.74) 8 (4.73) 6 (3.92) 15 Reliance Equity Oppor-Ret(G) 34.17 13.54 7 (2.22) 11 (6.65) 19 (1.07) 5 38.95 1 9.08 5 Reliance Reg Savings-Equity(G) 26.44 14.32 3 (4.17) 34 (12.07) 49 (12.17) 45 28.22 15 10.36 3 Religare Business Leaders(G) 11.44 9.58 28 (3.38) 22 (5.53) 13 (4.59) 20 Mutual Funds: Weekly Performance Report 17

- 18. Mutual Funds: Weekly Performance Report 30 January 2012 Opportunities Funds Scheme Name NAV 1 Month Rank 3 Months Rank 6 Months Rank 1 Year Rank 3 Years Rank 5 Years Rank Religare Equity(G) 11.30 5.02 48 (3.00) 19 (9.38) 36 (8.13) 31 20.91 33 Religare Growth(G) 11.88 9.80 26 (3.88) 31 (7.76) 30 (5.11) 25 22.50 28 Sahara R.E.A.L(G) 7.04 11.20 18 (8.79) 48 (11.07) 47 (12.45) 47 15.22 41 Sahara Wealth Plus-Fixed Pricing(G) 19.07 9.02 41 (3.73) 28 (10.81) 44 (7.98) 30 21.99 30 5.15 16 SBI Magnum Multicap(G) 15.25 12.96 8 (3.42) 24 (10.40) 41 (12.05) 44 18.47 38 Sundaram Equity Plus(G) 10.62 9.51 30 (0.21) 2 5.12 1 Sundaram India Leadership Fund(G) 39.15 12.16 9 (1.57) 6 (7.84) 31 (5.76) 26 25.17 22 4.92 17 Tata Equity Opportunities(G) 73.64 11.60 14 (2.90) 18 (7.16) 27 (2.67) 10 26.55 17 4.17 20 Taurus Star Share(G) 52.85 8.77 43 (4.48) 37 (8.33) 33 (3.59) 12 29.36 9 4.29 19 UTI Equity(G) 52.14 9.81 25 (2.23) 13 (5.39) 12 (2.03) 7 27.16 16 9.33 4 UTI Masterplus(G) 77.75 10.44 21 (3.75) 29 (6.26) 18 (4.18) 17 21.49 32 2.68 22 UTI Oppor(G) 27.29 7.95 47 (0.66) 3 (1.73) 2 3.02 1 31.42 5 13.51 1 Average 10.57 (3.40) (7.37) (6.40) 24.78 5.07 BSE SENSEX 10.87 (3.21) (5.29) (6.32) 23.16 3.93 BSE-100 12.76 (2.74) (5.82) (6.27) 24.17 4.48 BSE-200 12.99 (2.95) (6.96) (7.60) 24.62 4.22 BSE-500 13.06 (3.36) (7.83) (8.17) 24.95 3.73 Crisil MIP Blended Index 2.44 1.89 2.96 5.99 8.42 6.78 Gold-India 4.52 1.38 20.25 39.40 26.46 S&P CNX 500 13.24 (3.41) (7.66) (7.73) 23.49 3.59 S&P CNX Nifty 12.02 (2.91) (5.06) (5.58) 22.65 4.77 Sector Funds Scheme Name NAV 1 Month Rank 3 Months Rank 6 Months Rank 1 Year Rank 3 Years Rank 5 Years Rank Birla SL Basic Inds(G) 87.69 (8.70) 16 (9.03) 19 26.28 19 4.54 13 Birla SL New Millennium(G) 17.70 1.96 25 (3.65) 21 (6.84) 13 (14.53) 27 23.93 22 (3.86) 21 DSPBR Technology.com(G) 28.19 2.25 24 (6.28) 27 (11.48) 28 (15.42) 29 27.38 18 2.05 14 Escorts Leading Sectors(G) 9.78 22.16 2 0.91 3 (9.76) 21 (7.34) 15 18.78 23 Escorts Power & Energy(G) 11.46 20.12 9 (5.46) 26 (16.73) 31 (24.46) 31 4.08 29 Franklin FMCG(G) 73.09 (2.94) 5 15.15 3 39.66 6 16.80 5 Franklin Infotech(G) 61.21 0.36 28 (1.37) 12 (1.20) 2 (10.74) 24 37.66 10 1.35 16 Franklin Pharma(G) 61.62 (6.25) 12 (0.97) 9 49.99 1 17.47 4 ICICI Pru FMCG(G) 76.57 1.34 26 (2.67) 17 (2.99) 6 24.44 1 35.03 12 13.03 6 ICICI Pru Technology(G) 17.04 3.21 23 0.12 5 (2.80) 4 (10.88) 25 40.69 4 0.55 18 IDFC Strategic Sector (50-50) Eq-A(G) 12.88 3.50 22 (5.37) 25 (10.15) 24 (9.46) 22 16.67 24 IDFC Strategic Sector (50-50) Eq-B(G) 14.11 3.50 21 (5.34) 24 (10.11) 22 (9.43) 21 Mutual Funds: Weekly Performance Report 18

- 19. Mutual Funds: Weekly Performance Report 30 January 2012 Sector Funds Scheme Name NAV 1 Month Rank 3 Months Rank 6 Months Rank 1 Year Rank 3 Years Rank 5 Years Rank JM Basic(G) 11.98 21.38 6 (1.20) 11 (3.64) 8 (14.21) 26 13.54 26 (10.11) 22 Reliance Banking(G) 91.35 22.07 4 0.06 7 (9.67) 20 (7.21) 14 35.11 11 18.49 2 Reliance Banking-Inst(G) 8.22 22.08 3 0.09 6 (9.61) 18 (7.05) 13 (39.55) 30 Reliance Diver Power Sector-Ret(G) 55.35 20.38 8 (6.55) 28 (15.21) 30 (22.76) 30 12.71 27 8.25 9 Reliance Media & Entertainment(G) 27.08 8.86 15 4.05 1 (1.40) 3 1.85 6 25.30 20 1.81 15 Reliance Pharma(G) 54.69 6.58 16 (1.42) 13 (7.34) 14 1.04 7 45.72 2 21.61 1 Religare Banking-Reg(G) 17.98 18.84 11 (2.71) 18 (11.08) 27 (6.31) 11 30.78 16 Sahara Banking & Financial Services(G) 26.47 21.59 5 (3.08) 19 (10.83) 25 (7.68) 16 37.68 9 SBI Magnum FMCG 33.32 3.64 20 (0.30) 8 0.21 1 20.20 2 40.76 3 18.05 3 SBI Magnum IT 21.56 0.75 27 (2.44) 16 (3.19) 7 (9.14) 20 40.19 5 (3.76) 20 SBI Magnum Pharma(D) 37.60 4.24 19 1.62 2 (3.89) 9 5.09 4 38.10 8 4.81 12 Sundaram-Select Thematic Funds-Fin Serv Oppor(G) 17.36 21.29 7 (0.50) 9 (11.01) 26 (8.29) 17 29.83 17 Tata Life Science & Tech(G) 65.26 5.60 17 (1.93) 14 (8.25) 15 (5.85) 10 34.73 13 5.27 11 UTI Banking Sector(G) 38.36 24.51 1 0.18 4 (9.61) 19 (6.44) 12 31.18 15 12.22 7 UTI Energy(G) 9.40 13.53 13 (4.57) 22 (10.13) 23 (9.88) 23 15.22 25 UTI Infrastructure(G) 27.17 19.22 10 (3.14) 20 (11.56) 29 (15.28) 28 9.95 28 (1.70) 19 UTI Pharma & Healthcare(G) 39.64 4.45 18 (1.95) 15 (5.28) 11 0.15 8 31.90 14 11.81 8 UTI Services Inds(G) 53.58 14.63 12 (0.50) 10 (8.91) 17 (8.38) 18 24.75 21 0.74 17 UTI Transportation & Logistics(G) 26.21 11.25 14 (5.04) 23 (4.55) 10 3.07 5 39.46 7 5.69 10 Average 11.55 (2.09) (7.58) (5.48) 27.25 6.60 BSE FMCG 0.41 (2.15) (0.71) 18.31 26.88 16.26 BSE Health Care 7.13 1.47 (2.48) 1.13 31.98 10.41 BSE IT (0.16) (1.86) (1.95) (11.51) 37.00 1.48 BSE Power 17.93 (4.29) (13.59) (21.66) 5.88 0.07 BSE TECk 2.91 (1.64) (4.92) (8.63) 24.38 (1.62) BSE-100 12.76 (2.74) (5.82) (6.27) 24.17 4.48 BSE-200 12.99 (2.95) (6.96) (7.60) 24.62 4.22 CNX Bank 22.25 (1.04) (9.91) (7.23) 31.10 10.42 CNX FMCG 0.13 (3.16) (1.70) 17.25 26.66 14.71 S&P CNX 500 13.24 (3.41) (7.66) (7.73) 23.49 3.59 S&P CNX Nifty 12.02 (2.91) (5.06) (5.58) 22.65 4.77 Mutual Funds: Weekly Performance Report 19