maxHeap Technologies Pvt Ltd (commonfloor)

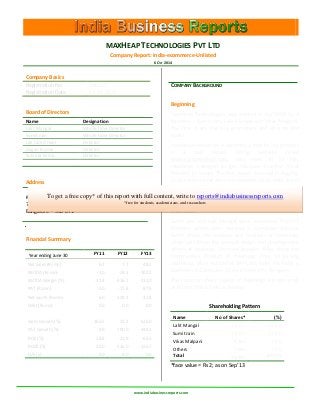

- 1. MAXHEAP TECHNOLOGIES PVT LTD Company Report: India-ecommerce-Unlisted 6 OCT 2014 www.indiabusinessreports.com COMPANY BACKGROUND Beginning maxHeap Technologies was started in Apr’2008 by 3 founders – Sumit Jain, Lalit Mangal and Vikas Malpani. The first 2 are the key promoters and also on the board. maxHeap focuses on e-commerce, and its key product is a real estate listing website called www.commonfloor.com. Very early in its life, maxHeap managed to get marquee investor Accel Partners to invest. The first round occurred in Aug’09, or just over a year after its inception. Since then, Accel Partners and Tiger Global have invested a further 4 rounds. Promoters Sumit Jain and Lalit Mangal were classmates from IIT Roorkee, where both majored in Computer Science. Sumit drives the strategy and business at maxHeap, while Lalit drives the product design and development efforts at maxheap. The third founder, Vikas drives the Communites Product at maxHeap. Prior to joining maxHeap, Vikas worked at SAP Labs India. He holds a Bachelors in Computer Science from VTU, Belgaum. The common share capital of maxHeap is quite small at 0.1mn. This is held as follows: Shareholding Pattern Name No of Shares* (%) Lalit Mangal 24,515 44.6% Sumit Jain 24,515 44.6% Vikas Malpani 4,260 7.8% Others 1,645 3.0% Total 54,935 100.0% *face value = Rs 2; as on Sep’13 Company Basics Registration No 046105 Registration Date 17.04.2008 Board of Directors Name Designation Lalit Mangal Whole time Director Sumit Jain Whole time Director Lee Jared Fixel Director Gagan Kumar Director Subrata Mitra Director Address #288,289, SGR Towers 7th Cross, Domlur Layout Bangalore – 560 071 Financial Summary Year ending June 30 FY11 FY12 FY13 Net Sales (Rs mn) 6.3 7.7 48.2 EBITDA (Rs mn) -2.0 -24.3 -102.2 EBITDA Margin (%) -31.4 -316.1 -212.0 PAT (Rs mn) -2.0 -17.8 -97.6 Net worth (Rs mn) 6.0 129.4 31.8 Debt (Rs mn) 0.0 0.0 0.0 Sales Growth (%) 162.5 22.2 526.0 PAT Growth (%) -2.9 790.0 448.3 ROE (%) -18.8 -21.9 -64.3 ROCE (%) -20.0 -116.0 -126.7 D/E (x) 0.0 0.0 0.0 To get a free copy* of this report with full content, write to reports@indiabusinessreports.com *free for students, academicians, and researchers

- 2. India-Ecommerce-Unlisted maxHeap Technologies Pvt Ltd 6 Oct’14 www.indiabusinessreports.com 2 Majority of the equity is preference shares of Rs 100 each, held by Tiger Global Six India II Holdings and Accel India Venture II (Mauritius) Ltd. The fully diluted equity for maxHeap could look like this (assuming no ESOPs or other forms of subscription by promoters) Estimated Fully Diluted Shares Shareholder Shares Held Stake Lalit Mangal 24,515 9.1% Sumit Jain 24,515 9.1% Vikas Malpani 4,260 1.6% Others 1,645 0.6% Tiger Holdings 1,59,820 59.5% Accel India Venture 53,800 20.0% TOTAL 2,68,555 100.0% Note this is an assumption by IBR, where we assume that each preference share will convert into one equity share and the excess of face value will be added to the premium of the preference share. BUSINESS HIGHLIGHTS Property Listing Website: maxHeap’s key product is www.commonfloor.com, a market place for buyers and sellers of property. According to its site, Commonfloor aims to be a one- stop solution for all apartment needs; from finding to managing and connecting with the apartment community. CommonFloor.com claims to have more than one lakh projects listed on their portal, more than any other property portal in India. It also currently has over 4 lakh active listings. Traffic stats: In a press release in Sep’14, Commonfloor claimed more than 2,00,000 users visiting the portal every day. It also claims to have witnessed a 100% increase in traffic, 125% jump in live listings and added over 25,000 communities in the last two quarters. The website also gets more than 25% traffic on its site via mobile app. Over 50% of the traffic to the website comes from urban India, especially metros such as Mumbai, Delhi, Bangalore and Chennai and close to 10% from overseas. Alexa Rank: As on Oct 6, 2014, Commonfloor was ranked 4th amongst leading Indian property portals: 99acres.com 137 Magicbricks 148 Indiaproperty.com 154 Commonfloor 163 Housing.com 560 makaan.com 929 Indiahomes.com 4192 People and offices: The company has a team of 900+ employees. CommonFloor has also expanded its geographic footprint with new offices in 11 cities – Jaipur, Chandigarh, Lucknow, Nagpur, Indore, Ahmedabad, Kochi, Coimbatore, Mysore, Kolkata, Mangalore. The company already had offices in Bangalore, Mumbai, Noida, Gurgaon, Chennai, Hyderabad and Pune. Acquisition: Earlier in the year, in Apr’14, Commonfloor acquired Flat.to, a site that helps students and singles find accommodation. FINANCIAL HIGHLIGHTS Revenues seemed to pick up slowly at Commonfloor in the early years. FY10 revenue was Rs 24 lakh (Rs 2.4m). For the next 2 years, the growth was slow, revenue reaching Rs 7.7m in FY12. It was in FY13 that there was some momentum, revenues jumped over 6x to Rs 48m. Profitability is sharply negative, with costs running 2- 3x more than revenue in FY12 and FY13. It is possible revenues may have continued to shoot up in FY14. The company is aiming for revenue of Rs 1500m in FY16, for which it will need continued explosive topline growth.

- 3. India-Ecommerce-Unlisted maxHeap Technologies Pvt Ltd 6 Oct’14 www.indiabusinessreports.com 3 FUNDING AND FUTURE PLANS Since its inception, Commonfloor (used interchangeably with actual corporate name maxHeap) has raised 5 rounds (till Series E). Accel Partners, the storied Silicon Valley fund, was the first investor and funded Series A. Tiger Global stepped in in the Series B. Both funds have since then pumped in multiple rounds. This is how the fund raising looks like: Date Round Who Amount (Rs m) Valuation (Rs m) 13.08.2009 A Accel 12 72 18.07.2011 A1 Accel 5 249 06.09.2011 B Tiger, Accel 136 490 03.04.2013 C Accel 27 1213 11.11.2013 D Tiger, Accel 640 3593 05.08.2014 E Tiger 1800 9609 As can be seen, the company has raised over Rs 2.6b (~USD 45m). The pace of fund raising has picked up since FY14. In the last 18 months, the company has raised 3 rounds aggregating Rs 2.48b, or most of its funding. The valuation has also shot up dramatically, reaching almost Rs 10b by the last round in Aug’14. Growth Plans: A press release post the latest round of funding stated that: “This round of funding will be used to invest further in our product and technology that will enhance customer experience. The company will continue to strategically scale-up its marketing and operations across the 18 cities where it’s currently present and expand to 22 new markets in India.” According to an article in The Economic Times, Commonfloor was aiming for revenue of Rs 150 crore by FY16. That would be 31x its FY13 revenue.

- 4. India-Ecommerce-Unlisted maxHeap Technologies Pvt Ltd 6 Oct’14 www.indiabusinessreports.com 4 FINANCIAL DETAILS P&L (Rs mn) FY10 FY11 FY12 FY13 Net Sales 2.4 6.3 7.7 48.2 EBITDA -2.0 -2.0 -24.3 -102.2 Margin (%) -83.3 -31.4 -316.1 -212.0 Interest 0.0 0.0 0.0 0.0 Other Income 0.0 0.0 7.0 6.3 PBDT -2.0 -2.0 -17.3 -95.9 Depreciation 0.0 0.0 0.4 1.4 Extraordinary Item 0.0 0.0 PBT -2.0 -2.0 -17.7 -97.3 PAT -2.1 -2.0 -17.8 -97.6 PAT Margin (%) -85.8 -31.7 -231.2 -202.5 Balance Sheet (Rs mn) FY09 FY10 FY11 FY12 FY13 Liabilities Equity Capital 0.1 10.4 10.4 17.4 17.4 Reserves 0.2 0.2 0.2 134.3 134.3 Shareholder Funds 0.4 10.6 10.6 151.8 151.8 Debt 0.4 0.1 0.0 0.0 0.0 Deferred tax liability 0.0 0.0 0.0 0.1 0.4 Other Long Term Lialilites 0.0 0.0 0.0 0.0 0.0 Total Liabilities 0.8 10.8 10.6 151.8 152.2 Assets Fixed Assets (net) 0.6 2.3 3.8 7.7 16.1 Other Long Term Assets 0.0 0.0 0.0 7.9 7.9 Inventories 0.0 0.0 0.0 0.0 0.0 Debtors 0.0 0.8 1.8 1.2 3.2 Cash 0.1 0.0 1.4 118.4 22.1 Loans & Advances 0.0 0.6 0.5 0.0 0.5 Other CA 0.0 0.0 0.0 0.0 0.1 CL & Provisions 0.5 0.8 1.5 5.9 17.7 Net Current Assets -0.4 0.6 2.2 113.7 8.2 Misc Expenses 0.5 2.6 4.6 22.4 120.0 Total Assets 0.7 5.4 10.6 151.8 152.2

- 5. India-Ecommerce-Unlisted maxHeap Technologies Pvt Ltd 6 Oct’14 www.indiabusinessreports.com 5 Ratios FY11 FY12 FY13 Growth (%) Sales 162.5 22.2 526.0 PBDIT -1.0 1129.3 319.8 PBT 0.0 785.0 449.7 PAT -2.9 790.0 448.3 Margins (%) PBDIT -31.4 -316.1 -212.0 PAT -31.7 -231.2 -202.5 Balance Sheet Ratios ROE (%) -18.8 -21.9 -64.3 ROCE (%) -20.0 -116.0 -126.7 D/E (x) 0.0 0.0 0.0 Inventory t/o (days) 0.0 0.0 0.0 Debtors t/o (days) 75.5 70.8 16.7 Payables t/o (days) 51.1 59.5 18.0 Cash Conversion Cycle (days) 24.4 11.4 -1.4 About India Business Reports India Business Reports (IBR) is an initiative of experienced professionals with comprehensive experience across wide domains – Research, Investment Banking, Private Equity Funding, Consulting, Branding and Marketing. The single minded objective at IBR is to generate insightful reports based on hard facts. Our expertise is relevant not only for the financial fraternity, but also global MNCs looking to do business with India, and Indian companies looking to fine tune their growth strategies. So be it India entry strategies, growth strategies, M&A opportunities or private equity investments, our reports can become a powerful tool in many ways. IBR typically does custom research, on request from clients. The reports shown on our website are sample reports for marketing purposes. These are available free for students and academia. We may impose a charge for corporate users. Disclaimer This note is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. The content in this note is solely for informational purpose and is not a solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Nothing in this note constitutes investment, legal, accounting and tax advice. India Business Reports or its owner-partners accept no liabilities for any loss or damage of any kind arising out of the use of this note. Contact reports@indiabusinessreports.com; +91 99 87 474021