Dr. Reddy's 1FY15: Strong sales in key markets drive growth, margins

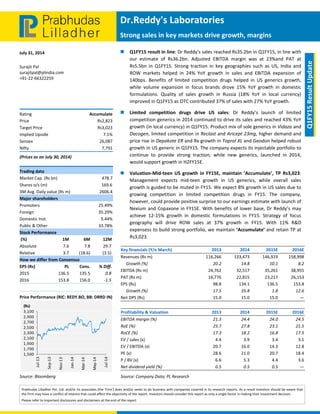

- 1. Dr.Reddy's Laboratories Strong sales in key markets drive growth, margins July 31, 2014 Prabhudas Lilladher Pvt. Ltd. and/or its associates (the 'Firm') does and/or seeks to do business with companies covered in its research reports. As a result investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of the report. Investors should consider this report as only a single factor in making their investment decision. Please refer to important disclosures and disclaimers at the end of the report Q1FY15 Result Update Surajit Pal surajitpal@plindia.com +91‐22‐66322259 Rating Accumulate Price Rs2,823 Target Price Rs3,023 Implied Upside 7.1% Sensex 26,087 Nifty 7,791 (Prices as on July 30, 2014) Trading data Market Cap. (Rs bn) 478.7 Shares o/s (m) 169.6 3M Avg. Daily value (Rs m) 2606.4 Major shareholders Promoters 25.49% Foreign 35.29% Domestic Inst. 5.44% Public & Other 33.78% Stock Performance (%) 1M 6M 12M Absolute 7.6 7.8 29.7 Relative 3.7 (18.6) (3.5) How we differ from Consensus EPS (Rs) PL Cons. % Diff. 2015 136.5 135.5 0.8 2016 153.8 156.0 ‐1.5 Price Performance (RIC: REDY.BO, BB: DRRD IN) Source: Bloomberg 1,500 1,700 1,900 2,100 2,300 2,500 2,700 2,900 3,100 Jul‐13 Sep‐13 Nov‐13 Jan‐14 Mar‐14 May‐14 Jul‐14 (Rs) Q1FY15 result in line: Dr Reddy’s sales reached Rs35.2bn in Q1FY15, in line with our estimate of Rs36.2bn. Adjusted EBITDA margin was at 23%and PAT at Rs5.5bn in Q1FY15. Strong traction in key geographies such as US, India and ROW markets helped in 24% YoY growth in sales and EBITDA expansion of 140bps. Benefits of limited competition drugs helped in US generics growth, while volume expansion in focus brands drove 15% YoY growth in domestic formulations. Quality of sales growth in Russia (18% YoY in local currency) improved in Q1FY15 as OTC contributed 37% of sales with 27% YoY growth. Limited competition drugs drive US sales: Dr Reddy’s launch of limited competition generics in 2014 continued to drive its sales and reached 43% YoY growth (in local currency) in Q1FY15. Product mix of sole generics in Vidaza and Dacogen, limited competition in Reclast and Aricept 23mg, higher demand and price rise in Depakote ER and Rx growth in Toprol XL and Geodon helped robust growth in US generic in Q1FY15. The company expects its injectable portfolio to continue to provide strong traction, while new generics, launched in 2014, would support growth in H2FY15E. Valuation‐Mid‐teen US growth in FY15E, maintain ‘Accumulate’, TP Rs3,023: Management expects mid‐teen growth in US generics, while overall sales growth is guided to be muted in FY15. We expect 8% growth in US sales due to growing competition in limited competition drugs in FY15. The company, however, could provide positive surprise to our earnings estimate with launch of Nexium and Copaxone in FY15E. With benefits of lower base, Dr Reddy’s may achieve 12‐15% growth in domestic formulations in FY15. Strategy of focus geography will drive ROW sales at 37% growth in FY15. With 11% R&D expensess to build strong portfolio, we maintain ‘Accumulate’ and retain TP at Rs3,023. Key financials (Y/e March) 2013 2014 2015E 2016E Revenues (Rs m) 116,266 133,473 146,919 158,998 Growth (%) 20.2 14.8 10.1 8.2 EBITDA (Rs m) 24,762 32,517 35,261 38,955 PAT (Rs m) 16,776 22,815 23,217 26,153 EPS (Rs) 98.8 134.1 136.5 153.8 Growth (%) 17.5 35.8 1.8 12.6 Net DPS (Rs) 15.0 15.0 15.0 — Profitability & Valuation 2013 2014 2015E 2016E EBITDA margin (%) 21.3 24.4 24.0 24.5 RoE (%) 25.7 27.8 23.1 21.5 RoCE (%) 17.3 18.2 16.8 17.5 EV / sales (x) 4.4 3.9 3.4 3.1 EV / EBITDA (x) 20.7 16.0 14.3 12.8 PE (x) 28.6 21.0 20.7 18.4 P / BV (x) 6.6 5.3 4.4 3.6 Net dividend yield (%) 0.5 0.5 0.5 — Source: Company Data; PL Research

- 2. July 31, 2014 2 Dr.Reddy's Laboratories Exhibit 1: Q1Y15 Result Overview (Rs m) Y/e March Q1FY15 Q1FY14 YoY gr. (%) Q4FY14 FY15E FY14 YoY gr. (%) Net Sales 35,175 28,449 23.6 34,809 146,919 132,170 11.2 Raw Material 7,843 7,500 4.6 8,072 38,199 31,432 21.5 % of Net Sales 22.3 26.4 23.2 26.0 23.8 Personnel Cost 6,488 5,930 9.4 6,815 24,976 24,936 0.2 % of Net Sales 18.4 20.8 19.6 17.0 18.9 Others 12,682 9,610 32.0 12,336 48,483 44,587 8.7 % of Net Sales 36.1 33.8 35.4 33.0 33.7 Total Expenditure 27,014 23,040 17.2 27,223 111,659 100,956 10.6 EBITDA 8,162 5,409 50.9 7,586 35,261 31,214 13.0 Margin (%) 23.2 19.0 21.8 24.0 23.6 Depreciation 1,872 1,613 16.1 1,956 7,533 6,598 14.2 EBIT 6,290 3,796 65.7 5,630 27,727 24,616 12.6 Other Income 185 376 (50.8) 471 2,498 1,839 35.8 Interest (481) 70 NA 81 1,046 24 NA PBT 6,955 4,102 69.6 6,020 29,179 26,432 10.4 Extra‐Ord. Inc./Exps. (54) (36) (48) (165) (174) Total Taxes 1,505 528 185.1 1,252 6,128 5,094 20.3 ETR (%) 21.6 12.9 20.8 21.0 19.3 Reported PAT 5,504 3,609 52.5 4,816 23,217 21,512 7.9 Source: Company Data, PL Research

- 3. July 31, 2014 3 Dr.Reddy's Laboratories Exhibit 2: Major Sources of Revenues (Rs m) Y/e March Q1FY15 Q1FY14 YoY gr. (%) Q4FY14 FY15E FY14 YoY gr. (%) PSAI (CPS & API) 5,537 5,868 (5.6) 6,641 24,551 23,974 2.4 % of Net Sales 15.7 20.6 19.1 16.7 18.1 India 775 791 (2.0) 979 3,993 3,787 5.4 % of Net Sales 2.2 2.8 2.8 2.7 2.9 International 4,762 5,077 (6.2) 5,662 20,557 20,187 1.8 % of Net Sales 13.5 17.8 16.3 14.0 15.3 North America 547 1,093 (50.0) 1,538 3,883 4,354 (10.8) % of Net Sales 1.6 3.8 4.4 2.6 3.3 Europe 2,681 2,093 28.1 2,370 8,993 8,770 2.5 % of Net Sales 7.6 7.4 6.8 6.1 6.6 ROW 1,534 1,891 (18.9) 1,754 7,681 7,063 8.8 % of Net Sales 4.4 6.6 5.0 5.2 5.3 Branded Formulation 29,002 21,903 32.4 27,318 119,375 105,164 13.5 India 3,999 3,493 14.5 4,101 17,297 15,713 10.1 % of Net Sales 11.4 12.3 11.8 11.8 11.9 International 25,003 18,410 35.8 23,217 102,078 89,451 14.1 % of Net Sales 71.1 64.7 66.7 69.5 67.7 Russia & CIS 4,861 4,489 8.3 4,519 23,416 19,819 18.1 % of Net Sales 13.8 15.8 13.0 15.9 15.0 Europe 1,459 1,573 (7.2) 1,774 7,398 6,970 6.1 % of Net Sales 4.1 5.5 5.1 5.0 5.3 North America Generics 16,468 10,871 51.5 14,964 61,194 55,303 10.7 % of Net Sales 46.8 38.2 43.0 41.7 41.8 Emerging Mkt Generics 2,215 1,477 50.0 1,960 10,070 7,359 36.8 % of Net Sales 6.3 5.2 5.6 6.9 5.6 Innovative Prod. (Proprietary Prod.) 634 679 (6.6) 851 2,994 3,032 (1.3) % of Net Sales 1.8 2.4 2.4 2.0 2.3 Net Sales 35,173 28,450 23.6 34,810 146,919 132,170 11.2 Source: Company Data, PL Research

- 4. July 31, 2014 4 Dr.Reddy's Laboratories Income Statement (Rs m) Y/e March 2013 2014 2015E 2016E Net Revenue 116,266 133,473 146,919 158,998 Raw Material Expenses 35,274 31,432 38,199 41,022 Gross Profit 80,992 102,041 108,720 117,977 Employee Cost 20,413 24,936 24,976 25,440 Other Expenses 35,817 44,587 48,483 53,582 EBITDA 24,762 32,517 35,261 38,955 Depr. & Amortization 3,859 4,804 4,848 5,142 Net Interest 1,018 24 1,046 973 Other Income 4,170 3,633 5,183 5,569 Profit before Tax 24,055 31,322 34,551 38,408 Total Tax 4,900 5,094 6,128 6,699 Profit after Tax 19,155 26,229 28,423 31,709 Ex‐Od items / Min. Int. 1,003 174 (165) (175) Adj. PAT 16,776 22,815 23,217 26,153 Avg. Shares O/S (m) 169.8 170.1 170.1 170.1 EPS (Rs.) 98.8 134.1 136.5 153.8 Cash Flow Abstract (Rs m) Y/e March 2013 2014 2015E 2016E C/F from Operations 13,317 7,168 35,007 19,079 C/F from Investing (13,944) (12,984) (12,333) (12,835) C/F from Financing (1,792) 10,198 (17,584) (7,011) Inc. / Dec. in Cash (2,419) 4,382 5,089 (768) Opening Cash 7,379 5,054 9,436 14,525 Closing Cash 5,054 9,436 14,525 13,758 FCFF 5,768 14,203 15,442 18,722 FCFE 10,140 25,877 (1,611) 15,674 Key Financial Metrics Y/e March 2013 2014 2015E 2016E Growth Revenue (%) 20.2 14.8 10.1 8.2 EBITDA (%) 4.3 31.3 8.4 10.5 PAT (%) 17.6 36.0 1.8 12.6 EPS (%) 17.5 35.8 1.8 12.6 Profitability EBITDA Margin (%) 21.3 24.4 24.0 24.5 PAT Margin (%) 14.4 17.1 15.8 16.4 RoCE (%) 17.3 18.2 16.8 17.5 RoE (%) 25.7 27.8 23.1 21.5 Balance Sheet Net Debt : Equity 0.4 0.5 0.2 0.1 Net Wrkng Cap. (days) 189 53 241 265 Valuation PER (x) 28.6 21.0 20.7 18.4 P / B (x) 6.6 5.3 4.4 3.6 EV / EBITDA (x) 20.7 16.0 14.3 12.8 EV / Sales (x) 4.4 3.9 3.4 3.1 Earnings Quality Eff. Tax Rate 23.7 18.4 21.0 20.5 Other Inc / PBT 12.0 6.6 8.6 8.3 Eff. Depr. Rate (%) 7.4 8.1 7.5 7.3 FCFE / PAT 60.4 113.4 (6.9) 59.9 Source: Company Data, PL Research. Balance Sheet Abstract (Rs m) Y/e March 2013 2014 2015E 2016E Shareholder's Funds 73,085 90,800 110,143 133,315 Total Debt 37,688 49,362 32,309 29,261 Other Liabilities (1,649) — (3,492) (4,052) Total Liabilities 109,124 140,162 138,960 158,524 Net Fixed Assets 52,322 65,670 65,190 71,000 Goodwill — — — — Investments 17,644 25,889 17,782 23,794 Net Current Assets 39,158 48,603 55,987 63,730 Cash & Equivalents 5,136 8,451 8,727 9,698 Other Current Assets 63,615 70,213 81,167 90,449 Current Liabilities 29,593 30,061 33,907 36,416 Other Assets — — — — Total Assets 109,124 140,162 138,960 158,524 Quarterly Financials (Rs m) Y/e March Q2FY14 Q3FY14 Q4FY14 Q1FY15 Net Revenue 33,575 35,338 34,809 35,175 EBITDA 8,456 9,762 7,586 8,162 % of revenue 25.2 27.6 21.8 23.2 Depr. & Amortization 1,733 1,793 1,956 1,872 Net Interest (291) (15) 81 (481) Other Income 637 177 471 185 Profit before Tax 7,651 8,161 6,020 6,955 Total Tax 793 2,521 1,252 1,505 Profit after Tax 6,903 6,185 4,816 5,504 Adj. PAT 6,903 6,185 4,816 5,504 Key Operating Metrics (Rs m) Y/e March 2013 2014 2015E 2016E India Formulations 14,560 15,713 17,297 19,373 US Formulations 37,846 56,606 61,194 62,930 Russia 14,050 16,300 19,232 22,116 PSAI 30,702 23,974 24,551 26,177 Source: Company Data, PL Research.

- 5. July 31, 2014 5 Dr.Reddy's Laboratories Prabhudas Lilladher Pvt. Ltd. 3rd Floor, Sadhana House, 570, P. B. Marg, Worli, Mumbai‐400 018, India Tel: (91 22) 6632 2222 Fax: (91 22) 6632 2209 Rating Distribution of Research Coverage 29.4% 51.4% 19.3% 0.0% 0% 10% 20% 30% 40% 50% 60% BUY Accumulate Reduce Sell % of Total Coverage PL’s Recommendation Nomenclature BUY : Over 15% Outperformance to Sensex over 12‐months Accumulate : Outperformance to Sensex over 12‐months Reduce : Underperformance to Sensex over 12‐months Sell : Over 15% underperformance to Sensex over 12‐months Trading Buy : Over 10% absolute upside in 1‐month Trading Sell : Over 10% absolute decline in 1‐month Not Rated (NR) : No specific call on the stock Under Review (UR) : Rating likely to change shortly This document has been prepared by the Research Division of Prabhudas Lilladher Pvt. Ltd. Mumbai, India (PL) and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of PL. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, PL has not independently verified the accuracy or completeness of the same. Neither PL nor any of its affiliates, its directors or its employees accept any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient's particular circumstances and, in case of doubt, advice should be sought from an independent expert/advisor. Either PL or its affiliates or its directors or its employees or its representatives or its clients or their relatives may have position(s), make market, act as principal or engage in transactions of securities of companies referred to in this report and they may have used the research material prior to publication. We may from time to time solicit or perform investment banking or other services for any company mentioned in this document.