Investors Need Purchasing Power

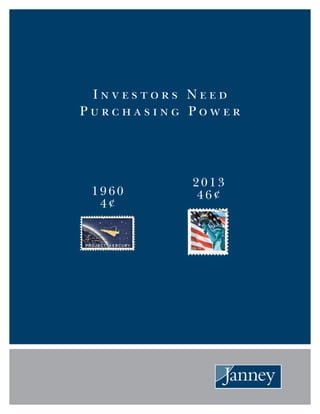

- 1. I n v e s t o r s N e e d P u r c h a s i n g P o w e r 1 9 6 0 4 ¢ 2013 46¢

- 2. W W W. J A N N E Y. C O M Mark Luschini, May 2013 There are a myriad of ways to determine the return needs of an investor. A comprehensive financial plan is probably the best approach for individuals and a consultative dialogue leading to an investment policy is likely the best for institutions. In either case, the key is to derive an investment goal that realistically achieves long-term objectives. While that goal is usually benchmarked to a stock or bond index, most often in some combination, it may be better for many to consider using purchasing power as an investment objective. In other words, the goal should be to grow capital at a pace that matches or exceeds the cost of living or encumbered liabilities. That is not to disparage the utility of capital market indices as a means to evaluate performance, but rather to introduce a more fundamental hurdle most investors need to consider when making investment choices.

- 3. 1W W W. J A N N E Y. C O M Inflation Can Erode Purchasing Power Inflation is a silent killer for investors who look to their portfolio to generate cash flow in support of meeting expenses. Recent reports of inflation running near or below 2% on an annualized basis belie what investors might actually experience as costs for shelter, healthcare premiums, tuition, and other items can rise at a much faster rate. Economic conditions over the last several years being subpar to historic trends has also contributed to tempering inflation, but a longer term perspective (such as that provided in Chart A) demonstrates that this period is unusual and higher inflation should be expected as the norm. Looking at the long-term average of inflation as being north of 3% gives an indication of the hurdle an investor must achieve just to break even. If the desire is to grow the portfolio so that it covers the projected cost of inflation, and generate a positive real return (excess return after adjusting for inflation), then target objectives of 4% or more are required. In a portfolio construct that is expected to deliver a return derived from the yield associated with the instruments that populate the portfolio, like one comprised of bonds, CDs or other conventional fixed-income investments, the income provided— while steady—may not change at all, or at least not rapidly enough to adjust for more sudden changes in prices. This is problematic even at today’s muted level of inflation, let alone in an environment where economic growth accelerates even a bit. Since yields have been deliberately held at low levels by the Federal Reserve, traditional sources of income, such as government, corporate, and municipal bonds, CDs, and money market funds, have been repressed. Thus, investors are faced with buying those fixed-income securities that in some cases requires one to look to the right of the decimal point to spot the yield. That condition is unlikely to change anytime soon. Even as the economy continues to show signs of improvement, the Federal Reserve has been clear in its intention to underwrite its reflation for a sustained period. In other words, its policy is to maintain very low interest rates until the committee members of the Federal Reserve’s voting body determine the economy to be strong enough to withstand higher rates. While the normalization of the Federal Reserve’s monetary policy is inevitable, under the scenario articulated by Chairman Ben Bernanke, it is not likely that rates will be altered at all, let alone greatly, for several more years. Currently, the yield on the 10-year Treasury bond, considered to be the bellwether against which other bonds are priced, is approximately 1.7%. At the moment, inflation as captured by the Bureau of Labor Statistics in a report known as the consumer price index (CPI measures the prices paid for a representative basket of goods and services), is running at 1.5% on a year-over-year basis. That Chart A: Average Annual Inflation by Decade (Source: Janney ISG) 12 10 8 6 4 2 0 –2 Percent 1913–1919 1920–1929 1930–1939 1940–1949 1950–1959 1960–1969 1970–1979 1980–1989 1990–1999 2000–2009 2010–2012 5.51 2.24 2.53 7.41 5.14 2.94 2.53 2.35 3.34 Long-Term Average 1913–2012 –0.86 –1.92 10.10

- 4. W W W. J A N N E Y. C O M2 means the buyer of a 10-year Treasury bond today will earn a real yield of just 0.2% (1.7% yield minus the 1.5% CPI). Should inflation rise to historical levels of 3% roundly speaking, the real yield on that Treasury security would be –1.3%. Chart B provides a picture of the yields for 10-year Treasury bonds, which have fallen for over 30 years and which now barely match—and sometimes don’t match at all— the pace of inflation. Chart B: Treasury and Real Yields (Source: Janney ISG, Bloomberg, BLS) © 2013, Janney Montgomery Scott LLC 0 Inflation: Tailwind for Bonds Real Yields The real yield is the yield in excess of inflation. When yields fall below the rate of inflation, spending power is actually eroded, because the coupon payment does not keep up with the increasing cost of goods. 10-Year Treasury Yield CPI (Inflation YOY change) 1981 2002 2005 2008 20121990 1993 1996 19991984 1987 16.0 14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0 (2.0) Negative Real Yields Need data For many investors, then, the conundrum is not just the search for a source of income, but rather one that also has the potential to produce an increasing stream of income. Purchasing power, or the ability to derive through growth of capital that is provided by a change in market value and/or an attractive income stream that can grow to offset rising costs, is the Holy Grail. The Individual Investor For many individuals, the loss of purchasing power due to rising prices ravages their lifestyle. A classic example is the price of the U.S. stamp. A quarter-century ago, a typical letter could be mailed for $0.22. Today, that same letter requires a stamp priced at $0.46, a double since 1988. While perhaps trivial in absolute dollars, the relative loss of spending power to someone mailing an envelope to pay a bill is significant. Maybe we could just chalk that jump in price to mismanagement of the Postal Service and hold that such a huge change is uncommon, but in reality inflation over that same period is also up roughly 100%! Chart C: Inflation and Wage Growth (Source: Janney ISG, BLS, BEA) If someone is working, the offset to inflation may be achieved through wage increases. However, as shown in Chart C, there have been many periods where inflation-adjusted wages (real wage growth) have either fallen or were flat. Of course, if one is not working but instead is retired, that ability is lost completely, leaving only retirement benefits and investments to compete with rising prices. Therefore, the case for striving to maintain pur- chasing power parity is relevant not just for retirees seeking to augment retirement income from port- folio distributions. Instead, it is broadly applicable to even include those working but not currently in need of income from their portfolios. The capital growth that can compound as income is reinvested, and possibly augmented by a rising stream of income to further magnify the process, is a powerful elixir. The Institutional Investor Institutional investors often have to fulfill spending policies or match liabilities in the form of payments to plan participants, and they similarly need to grow a portfolio to combat the year-over-year increase in prices or cost-of-living adjustments. It is no secret that the 5% spending policy historically employed by endowments and foundations was developed because a balanced portfolio could be expected to achieve a return that exceeds it by several percentage points. That allowed the distribution to consume only a portion of the total return, leaving some 3% or so expected in the portfolio’s growth to account for inflation.

- 5. 3W W W. J A N N E Y. C O M Institutions also face the prospect of matching the distribution needs over a time horizon measured in perpetuity, or meeting the obligations of payouts to retirees that are living longer than ever. This places a burden on the portfolio architecture to produce attractive returns in a 2% inflation environment like today, while anticipating the asset composition needed to deliver good results in a climate of 3–3.5% inflation—the historical annual rate. Adding to that challenge is the same feature of today’s landscape that individual investors face— low bond yields. The 8% return assumptions that a capital markets chart book can illustrate have been generated over nearly a century of returns. The issue, however, is that the “40%” component of the well-known formula of 60% stocks and 40% bonds for a “balanced” portfolio, had yields contributing to that return that have historically averaged at a much higher level than that which exists today. Therefore, that same 8% outcome is more likely to be achieved only by raising one’s expectation for returns from the stock portion of the portfolio (say from 10% annually to 12% assuming a 2% return from bonds), or by raising the stock allocation to 80% from 60% and assume a trend return. The additional stress placed on the portfolio from assuming a higher-risk profile may generate a level of volatility, or periods of performance negatively disparate from benchmarks, that may challenge the institution’s practice of policy fidelity. The Purchasing Power Solution Some investments have a strong reputation for performing well in an inflationary scenario. The classics include commodities, REITs, and stocks. The issue for investors who consider income as an objective is that commodities pay no dividends (unless bought in the form of listed stocks) or interest income. Publicly traded Real Estate Investment Trusts, or REITs, are stocks and are technically classified to be included in the financial sector of a portfolio. These companies typically own real estate in the form of commercial buildings, health care facilities, or apartments to name a few, and can increase rents to account for inflation. Historically, companies have been able to absorb inflating prices as they invest in productivity- enhancing equipment and can pass through costs to customers. While there is a limitation to how high inflation can go before it becomes detrimental to stock prices (historically above 4%), that does not appear to be an imminent threat. Therefore, we believe stocks offer a timely but lasting solution to address the quest for purchasing power. We posit that there are many attractive stocks to own and hold that provide an appealing current payout in the form of a dividend distribution, and have demonstrated a history of raising their dividend. It is that combination—high current income that is better than alternative choices, and the ability and track record to provide the shareholder a raise that helps to increase cash flow to match or exceed inflation—that ought to be sought by investors. Is it a one-size-fits-all solution? Of course not. Some investors may have the risk budget to seek capital appreciation at the expense of volatility and have no need for income; others may own bonds as a component of a diversified portfolio to stabilize returns and increase the predictability of longer-term return projections. And yet this “increasing dividend theme” should have wide appeal, given the potential for capital growth from the underlying business accompanied by the rising stream of income that can be used as cash flow to be spent or reinvested. The S&P 500 index hosts a substantial number of companies whose current dividend yield exceeds that of the 10- and 30-year Treasury bonds (as of 5/1/13). As a rule of thumb, earning a yield from a common stock (predicated upon its dividend payout) that exceeds what one might earn in the bond market is a soft hurdle to clear. While Chart D: Asset Allocation Risk/Return Matrix Asset Allocation Average Annual Returns Percent Positive Percent Negative Average Gain Average Loss Inflation Hedge (1) Inflation Hedge Standard Deviation1 year 5 years 15 years 30 years 60% Stocks 40% Bonds 14.7% 5.6% 6.3% 10.8% 75.9% 24.1% 15.3% -7.9% 84.3% 84.3% 13.4% (Source: Janney ISG, Barclays, S&P)

- 6. W W W. J A N N E Y. C O M4 we encourage that consideration be given to companies that may not be included in the index maintained by Standard & Poor’s, the fact that there are 287 of the 500 with yields in excess of the 10-year Treasury bond demonstrates that the pool of candidates is substantial (Chart E). appealing. But even with the higher yield, that says nothing about the prospect for appreciation if these businesses grow, or about the richer payout that might be fielded in time. The purchasing power may exist in the current payout alone, but the real kicker is in the form of the latter two that offer the potential boost to defend purchasing power. Consider that these four stocks have had their dividends increase by an average of 14% year-to-year over the last decade! Perhaps another way to articulate the purchasing power of a portfolio of dividend-paying stocks is to look at the potential for payout growth. For example, if an investor bought $1,000 worth of shares in each of Microsoft, ADP, J&J, and ExxonMobil in the beginning of 2003, the dividend yield of that four-stock portfolio would have been 1.7%. The dividend payout of that $4,000 portfolio would have been approximately $67. Fast forward, and that same investor who held onto those shares bought originally in 2003, would have received around $180 in dividends in 2012. That represents a 4.5% yield on the initial investment. And not only did the portfolio grow in value from $4,000 to $5,700 (price only) by the end of 2012, but the cumulative amount of regular cash dividends over the course of the decade was $1,181. Long story short, the 168% increase in dividend payout in 10 years is an example of the purchasing power that can be achieved by owning instruments, namely dividend-paying stocks, that can provide shareholders a regular boost in income. Granted, the risk associated with stocks, even AAA ones, is greater than that of high-quality bonds or cash equivalents. If, however, we are measuring the time horizon to evaluate the likelihood of a better outcome from this basket of income-producing companies that have a precedent for raising their dividends regularly in five to ten years or more, then we would argue the odds tilt favorably toward stocks. Chart F: Dividends Paid Per Share by Calendar Year Company 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Microsoft (MSFT) 0.16 0.32 0.32 0.37 0.41 0.46 0.52 0.55 0.68 0.83 Automated Data Processing (ADP) 0.50 0.58 0.65 0.79 0.98 1.20 1.33 1.38 1.48 1.62 Johnson & Johnson (JNJ) 0.93 1.10 1.28 1.46 1.62 1.80 1.93 2.11 2.25 2.40 Exxon Mobil Corp (XOM) 0.98 1.06 1.14 1.28 1.37 1.55 1.66 1.74 1.85 2.18 (Source: Janney ISG, Bloomberg) By way of an even more tangible example, consider Chart F. There are four AAA-rated companies in America, assigned as such by Standard & Poor’s, the renowned credit rating agency. These companies possess several common characteristics, including a fortress balance sheet and a capital structure that reinforces the quality of the enterprise. Most, if not all, are household names, but they also are dividend payers. Note in the table the dividend payouts of each company over the last 10 years—several things stand out. The first is that there has been no disruption to that payout, even during 2008 when the financial crisis sent the world into cardiac arrest and stock prices fell steeply. Also, there was only one occasion where a dividend wasn’t raised from one year to the next—and that was Microsoft in the 2004–2005 time period. An even commitment to each position today would produce a yield of roughly 2.9%. Compare that to a 10-year Treasury bond with a yield of 1.7%, and inflation of 1.5%, and that seems Chart E: Individual Dividend Yields of S&P 500 Components (5-1-13) (Source: Janney ISG) 6 8 10 12 Dividend Yield 0 2 4 D Constituents of the S&P 500 ordered by Yield (lowest to highest) 1.63 287 of S&P 500 Stocks Yield More than 10-Year Treasury 127 of S&P 500 Stocks Yield More than 30-Year Treasury 2.83

- 7. 5W W W. J A N N E Y. C O M Go Global The exercise above was merely intended to bring alive the “increasing income-paying stocks story” in order to demonstrate the way by which one can achieve—and what is meant by—“purchasing power.” Investors do not need to limit their selection process to just four companies. In fact, we believe strongly in a globally diversified portfolio because the merits of international investments demand it. Generally speaking, incorporating non-U.S. stocks in a portfolio may enhance results as global equity markets are not perfectly correlated. This allows investors to spot great companies; often times counterparts to a U.S.- based firm that are in similar industries, where the dividend or growth potential is more appealing. In Chart G, we show the yields offered by the stock markets of a sample of developed countries. Obviously, the yields are mostly greater than that of the U.S. stock market—the exception being Japan—demonstrating that the search for the solution to purchasing power should not be confined to the selection of U.S. equities because it may not fully exploit the outcome sought. Concluding Thoughts Purchasing power is simply the ability to maintain capital growth that matches or exceeds that of rising costs. That is a widely adaptable objective for individuals and institutions alike. It applies to investors in need of current income, and for those that seek growth where income is considered a contributing factor to total return. Choices to satisfy the objective of purchasing power parity mostly do not include government and high quality non-government bonds and cash, simply because the yields currently available on these instruments are close to or are negative on a real basis. Dividend-paying stocks, domestic and foreign, offer the most attractive opportunity set for building or completing a portfolio designed for purchasing power. Further scrutiny should be applied to tease out those companies with sturdy cash flows to support the current dividend, as well as those best poised to increase it. Establishing a portfolio crafted to meet the investor’s unique objectives is always paramount, and is what drives the asset allocation decision. This process should involve fashioning a solution that maintains purchasing power today, as well as into the future—a goal common to virtually all investors. Chart G: Foreign Stock Yield (Source: Janney ISG, Bloomberg) 5 4 3 2 1 0 Percent United States Australia France UK Germany Switzerland Canada Japan International investments currently hold particular appeal because of valuation disparity when compared with the U.S. There is also an academic case whereby holding both U.S. and international stocks in combination helps to optimize a portfolio because of the different correlations between countries, currencies, and risks associated with various markets. The literature tends to be shaped depending upon the time period in review, but it consistently respects a notion that promotes international diversity.

- 8. JANNEY MONTGOMERY SCOTT LLC www.janney.com The Highest Standard of Success in Financial Relationships © 2013, Janney Montgomery Scott LLC Member: NYSE, FINRA, SIPC 1304469 IMPORTANT DISCLOSURES “Investors Need Purchasing Power” is being provided solely for informational and illustrative purposes, is not an offer to sell or a solicitation of an offer to buy any securities that may be listed in this material, and does not constitute investment advice by Janney Montgomery Scott LLC or its affiliates. Decisions to buy or sell a stock should be based on an investor’s investment objectives and risk tolerance and this material should not be relied upon in substitution of independent judgment. This material does not take into account individual client circumstances, objectives or needs and is not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The information provided has been obtained or derived from sources believed by Janney Montgomery Scott LLC to be reliable. Janney Montgomery Scott LLC, however, does not represent that this information is accurate or complete. Any opinions or estimates contained in this report represent the judgment of the Investment Strategy Group of Janney Montgomery Scott LLC at this time and are subject to change without notice. The opinions and estimates do not necessarily represent the viewpoint of Janney Montgomery Scott LLC, its Research Department or any other group or employee associated with Janney Montgomery Scott LLC or its affiliates, and may differ from opinions or estimates of Janney Montgomery Scott LLC, including its Research Department, and its affiliates. Janney Montgomery Scott LLC or its affiliates may have issued, and may in the future issue, other communications that are inconsistent with, and reach different conclusions from, the information presented in this material. Janney Montgomery Scott LLC, its officers, directors, employees, or members of their families may have positions in the securities mentioned and may make purchases or sales of such securities from time to time in the open market or otherwise and may sell to or buy from customers such securities on a principal basis. Dividend information is as of May 1, 2013. “Dividend Yield” refers to the trailing 12 month dividend per share divided by share price. Past performance is no guarantee of future performance and future returns are not guaranteed. There are risks associated with investing in stocks such as a loss of original capital or a decrease in the value of your investment. A company may also decide to decrease or cancel a dividend payment at any time without notice. For additional information or questions, please consult with your Financial Advisor.