Accountable Advice_July-August-2014_1stNat_B

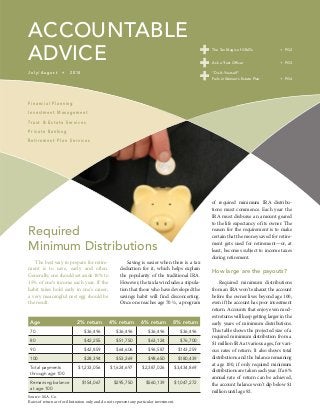

- 1. ACCOUNTABLE ADVICE J u l y / A u g u s t + 2 0 1 4 The Tax Magic of GRATs + PG2 “Do-It-Yourself” Fails in Woman’s Estate Plan + PG4 F i n a n c i a l P l a n n i n g I n v e s t m e n t M a n a g e m e n t Tr u s t & E s t a t e S e r v i c e s P r i v a t e B a n k i n g R e t i re m e n t P l a n S e r v i c e s Required Minimum Distributions The best way to prepare for retire- ment is to save, early and often. Generally, one should set aside 10% to 15% of one’s income each year. If the habit takes hold early in one’s career, a very meaningful nest egg should be the result. Saving is easier when there is a tax deduction for it, which helps explain the popularity of the traditional IRA. However, the tax law includes a stipula- tion that those who have developed the savings habit will find disconcerting. Once one reaches age 70 ½, a program of required minimum IRA distribu- tions must commence. Each year the IRA must disburse an amount geared to the life expectancy of its owner. The reason for the requirement is to make certain that the money saved for retire- ment gets used for retirement—or, at least, becomes subject to income taxes during retirement. How large are the payouts? Required minimum distributions from an IRA won’t exhaust the account before the owner lives beyond age 100, even if the account has poor investment return. Accounts that enjoy even mod- est returns will keep getting larger in the early years of minimum distributions. This table shows the projected size of a required minimum distribution from a $1 million IRA at various ages, for vari- ous rates of return. It also shows total distributions and the balance remaining at age 100, if only required minimum distributions are taken each year. If a 6% annual rate of return can be achieved, the account balance won’t dip below $1 million until age 92. Ask a Trust Officer + PG3 Age 2% return 4% return 6% return 8% return 70 $36,496 $36,496 $36,496 $36,496 80 $42,255 $51,750 $63,124 $76,700 90 $42,859 $64,606 $96,587 $143,259 100 $28,394 $53,269 $98,650 $180,439 Total payments through age 100 $1,233,056 $1,624,697 $2,387,026 $3,434,869 Remaining balance at age 100 $154,067 $295,750 $560,139 $1,047,272 Source: M.A. Co. Rates of return are for illustration only and do not represent any particular investment.

- 2. What do Facebook’s Mark Zuckerberg, casino magnate Sheldon Adelson, and Lloyd Blankfein, the CEO of Goldman Sachs, have in common? They, along with hundreds of other highly compensated executives, have employed a Grantor Retained Annuity Trust, or GRAT to estate planners, to move wealth within the family at little or no gift tax cost. According to a report from Bloomberg, Adelson may have passed some $7.9 billion through 30 different trusts to his heirs, saving about $2.8 billion in gift taxes. An estimated $100 billion in gift taxes has been legally avoided since 2000. How can the reporters know all this? Aren’t IRS filings and trust documents private? Yes, they are, but the SEC requires many disclosures from the major owners of publicly traded companies. It is from the SEC filings that the report- ers gleaned this information. How does it work? The idea is that the grantor places an asset in a trust for a term of years, receiving income from the trust during its existence. At the end of the term, the trust terminates, and the remaining assets pass to the heirs. When the trust is created, there is a gift tax due on what the heirs will receive, discounted to reflect the value that the grantor retained for himself or herself. The Tax Magic of GRATs One of the Walton heirs pushed this strategy farther. A GRAT was set up to last for just two years, funded with Walmart stock. The annuity was set so high that essentially the entire value of the transfer had to be returned to the donor, so the value of the gift was “zeroed out,” and no gift tax would be due. What’s the point? If the stock transferred to such a trust zooms in value during the two years, the excess appreciation passes to heirs entirely free of gift taxes, and the asset has been remove from the estate of the donor. Bloomberg reported that in 2009 Adelson placed about $30.9 million worth of his Las Vegas Sands stock in a GRAT for two years. In 2011, the trust terminated and distributed $31.1 million, to him—the initial contribution plus interest. During those two years, the price of the stock soared from $2.58 per share to $46.87. The final result was that $518.8 million passed to Adelson’s heirs with no gift tax. That same amount has been removed from his estate, and will be free of estate taxes as well. (June 2014) © 2014 M.A. Co. All rights reserved. 2

- 3. A S K A T R U S T O F F I C E R : S T A T E O F T H E E C O N O M Y , P A R T 2 revenue bump in late 2012 and early 2013, as wealthy taxpay- ers sought to lock in their gains before the big tax increases took effect. That phenomenon is over now. Even though stock prices have continued to rise, the incentive to realize taxable gains has been reduced. The contrary leading indicator is the stock market itself, which has been powering to new highs this year. The S&P 500 grew 3% through May, following its 30% run-up last year. The fact that the economy contracted in the first quarter suggests that the Fed is unlikely to move toward higher inter- est rates in the near term. I’m afraid that your CD rates are not likely to improve. Do you have a question concerning wealth management or trusts? Send your inquiry to wealthmanagement@fnni.com. (June 2014) © 2014 M.A. Co. All rights reserved. 3 DEAR TRUST OFFICER: Is the economy doing better? Any chance that my CD rates will go up this year? —STILL WORRIED GRANDMA DEAR STILL WORRIED: I’m afraid there isn’t much good news to report. We had thought that the economy grew by an anemic 0.1% in the first quarter, well below expectations. At the time, some observers thought that figure might be revised upward when more data became available. The data are now in, and the growth rate was revised downward to a loss of 1%. One more quarter like that and we might be back in a recession. As a parallel indicator, state tax revenues have been fall- ing in many parts of the country, a total of 0.4% nationwide, the first such contraction since 2009. California, for example, took in 12.9% less in the first quarter of 2014 than in the similar year-earlier period. To some extent, this is just a return to normal. States that tax capital gains saw an unusual

- 4. Newsletter Opt Out: We hope that you find this information helpful as you make financial decisions. However, should you decide that you would rather not receive the newsletter, please contact us at 800.495.1293 or wealthmanagement@fnni.com. Deposit and Lending Products are: First National Wealth Management is a division of First National Bank of Omaha. “Do-It-Yourself” Fails in Woman’s Estate Plan This is, unfortunately, a true story. Anne Aldrich wrote her will on an “E-Z Legal Form” on April 5, 2004. Ms. Aldrich carefully inventoried all of her property on the preprinted form, and she left all of her posses- sions to her sister. She also provided that if the sister died before she did, “I leave all listed [property] to James Michael Aldrich,” her brother. The will was duly signed and witnessed. It was legal and unambiguous. However, it did not contain a “residuary clause” for disposing of any property not spe- cifically mentioned in the will. Ms. Aldrich may not have appreciated the importance of that omission. Had she died soon thereafter, it might not have made any difference. But as it happened, the sister died first. Ms. Aldrich inherited a considerable amount of property from the sister. The property so acquired was not, of course, mentioned in the will. Ms. Aldrich wrote an addendum to her will that acknowl- edged her sister’s death and said, “I reiterate that all my worldly possessions pass to my brother.” Alas, under local law the note could not be considered a valid will or codicil, because it lacked the signature of a witness. After Ms. Aldrich died, two nieces challenged the will. They argued that the brother’s inheritance must be limited to the items named in the first will, and that the balance of the estate must pass under the laws of intestacy (the rules that govern inheritance in the absence of a will). The Courts, with some regret, sided with the nieces, although they acknowledged that this was almost certainly not Ms. Aldrich’s intention. The Florida Supreme Court summed up the outcome with these words: “Obviously, the cost of drafting a will through the use of a pre-printed form is likely substantially lower than the cost of hiring a knowledgeable lawyer. However, as illustrated by this case, the ultimate cost of utilizing such a form to draft one’s will has the potential to far surpass the cost of hiring a lawyer at the outset.” The costs of litigation, and having the estate tied up for years, as well as the possibility of failing to have one’s intentions accurately carried out, make the investment in consulting an estate planning attorney a wise one indeed. (May 2014) © 2014 M.A. Co. All rights reserved. (July, 2014) © 2013 M.A. Co. All rights reserved. The general information in this publication is not intended to be nor should it be treated as tax, legal or accounting advice. Additional issues could exist that would affect the tax treatment of a specific transaction and, therefore, taxpayers should seek advice from an independent tax advisor based on their particular circumstances before acting on any information presented. WWW.FIRSTNATIONALWEALTH.COM Investment Products are: Not FDIC Insured • May Go Down in Value • Not a Deposit • Not Guaranteed By The Bank • Not Insured By Any Federal Government Agency