Thai bond market outlook and inflation-linked bond issuance

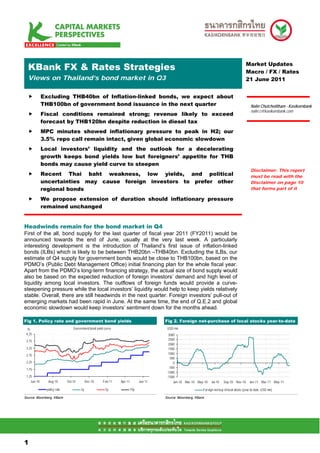

- 1. .Mean S FX & Rates Strategies KBank Market Updates Macro / FX / Rates Views on Thailand’s bond market in Q3 21 June 2011 Excluding THB40bn of Inflation-linked bonds, we expect about THB100bn of government bond issuance in the next quarter Nalin Chutchotitham - Kasikornbank nalin.c@kasikornbank.com Fiscal conditions remained strong; revenue likely to exceed forecast by THB120bn despite reduction in diesel tax MPC minutes showed inflationary pressure to peak in H2; our 3.5% repo call remain intact, given global economic slowdown Local investors’ liquidity and the outlook for a decelerating growth keeps bond yields low but foreigners’ appetite for THB bonds may cause yield curve to steepen Disclaimer: This report Recent Thai baht weakness, low yields, and political must be read with the uncertainties may cause foreign investors to prefer other Disclaimer on page 10 regional bonds that forms part of it We propose extension of duration should inflationary pressure remained unchanged Headwinds remain for the bond market in Q4 First of the all, bond supply for the last quarter of fiscal year 2011 (FY2011) would be announced towards the end of June, usually at the very last week. A particularly interesting development is the introduction of Thailand’s first issue of inflation-linked bonds (ILBs) which is likely to be between THB20bn –THB40bn. Excluding the ILBs, our estimate of Q4 supply for government bonds would be close to THB100bn, based on the PDMO’s (Public Debt Management Office) initial financing plan for the whole fiscal year. Apart from the PDMO’s long-term financing strategy, the actual size of bond supply would also be based on the expected reduction of foreign investors’ demand and high level of liquidity among local investors. The outflows of foreign funds would provide a curve- steepening pressure while the local investors’ liquidity would help to keep yields relatively stable. Overall, there are still headwinds in the next quarter. Foreign investors’ pull-out of emerging markets had been rapid in June. At the same time, the end of Q.E.2 and global economic slowdown would keep investors’ sentiment down for the months ahead. Fig 1. Policy rate and government bond yields Fig 2. Foreign net-purchase of local stocks year-to-date % Government bond yield curve USD mn 4.25 3000 3.75 2500 2000 3.25 1500 2.75 1000 500 2.25 0 -500 1.75 -1000 1.25 -1500 Jun-10 Aug-10 Oct-10 Dec-10 Feb-11 Apr-11 Jun-11 Jan-10 Mar-10 May-10 Jul-10 Sep-10 Nov-10 Jan-11 Mar-11 May-11 policy rate 2y 5y 10y Foreign net-buy of local stocks (year-to-date, USD mn) Source: Bloomberg, KBank Source: Bloomberg, KBank 11 1

- 2. Table 1. LB auction plan for FY2011 (based on PDMO documents) unit : billion baht PDMO initial tenor Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Q1 Q2 Q3 Q4 sum Budget 5Y 13 - 14 - 10 - 16 - 20 - 20 - 27 10 36 20 93 100 7Y - 12 - 10 - 10 - - 10 9 - 12 12 20 10 21 63 65 10Y - 10 - 7 - 7 - 10 - 10 - 13 10 14 10 23 57 70 12Y 8 - 8 - - - - - - - 8 - 16 0 0 8 24 40 15Y - 6 - 6 - 8 8 - 8 - 8 - 6 14 16 8 44 45 20Y - 6 - - 6 6 - 8 - 6 - 6 6 12 8 12 38 45 30Y 3 - 3 - 5 - - 5 6 - - - 6 5 11 0 22 20 50Y - - - - - 3.5 - - 4.5 - - - 0 3.5 4.5 0 8 4.5 4Y FRN - 7 - 8 - 8 - 8 - 10 - 10 7 16 8 20 51 55 CPI linked - - - - - - - - - 40 - - - - - 40 40 9 Total 24 41 25 31 21 42.5 24 31 48.5 75 36 41 90 94.5 103.5 152 440 453.5 Source: PMDO, KBank (red block denotes estimated schedule) Inflation-linked bonds in July and savings bonds in September The PDMO announced in June that it is planning on issuing the inflation-linked bonds (ILBs) during 11th-13th July. It had also mentioned that the maximum issuance would be THB40bn, given that the current need for financing is merely to convert the short-term bank loans (2-4 year maturity) into longer-term ones (ILB maturity is 10 years). The coupon rate would likely be close to 1.00% according to recent comments from the PDMO but official announcement is due on July 6th. Road-shows would be held in Hong Kong, Singapore, and London for the issue around third week of June to encourage the participation of retail and institutional investors. However, allocation among each type of investor has yet been determined. As for the savings bonds, the PDMO plans to issue those in September, mainly targeting retail investors and non-profit organizations. The issuance would not affect the secondary government bond market directly but could, in theory, affect the market indirectly should liquidity in the local markets be low. Given that liquidity is likely to remain flush even after retail investors shifted funds out of deposit accounts into savings bonds, the savings bonds would merely provide alternative investment opportunity for savers. At the same time, this could reduce the government’s financing pressure in the next fiscal year. th Note: KBank issued a report on 9 March explaining the details/calculation of returns for the ILB. Please kindly contact us for a copy. Current fiscal conditions still strong Government’s revenue collection and expenditure continued to increase following expansion of the economy, leading to higher budget deficit (cash basis) on a 12-month running-sum calculation. Nevertheless, borrowing from the market in FY2011 had been smooth-sailing, leading to sufficient treasury cash balance. The Ministry of Finance (MoF) reported its treasury cash balance at THB155bn at the end of May while the public debt to GDP ratio was at 41.3% as of end-March. For the first 8 months of the FY2011 (Oct 2010 – May 2011), the government’s gross revenue collection totaled THB1.47trn (13.1% yoy), higher than the MoF’s estimate by more than THB150bn. This was primarily due to economic expansion, as suggested by the fact that all of the MoF departments experienced an increase in revenue collection, including the Revenue Department, Excise Department, Customs Department, as well as transfers from state enterprises. There would be loss of revenue from the reduction of tax on diesel consumption (from THB 5.310/litre to THB 0.005/litre, April 21st to end- 22 2

- 3. September) and this is expected to be about THB45bn in total. Nevertheless, the MoF estimated that revenue would still exceed the initial forecast by as much as THB120bn. Fig 3. Cash-basis fiscal balance (12-month running sum) Fig 4. Public debt to GDP ratio THB bn % 200 48.0 100 46.0 0 44.0 -100 41.28 42.0 -200 40.0 -300 38.0 -400 36.0 -500 34.0 -600 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 03 04 05 06 07 08 09 10 11 12mth running rate budget balance Total Public Debt / GDP (% ) Source: CEIC, KBank Source: MOF, KBank Table 2. Government revenues growth (collection basis) FY2010 FY2011 (in millions of baht) FY2008 FY2009 FY2010 (Oct 09 - May 10) (Oct 10 - May 11) YoY (%) Gross Government Revenue 1,837,643 1,684,297 1,994,966 1,300,879 1,470,66 13.1 Revenue Dept 1,276,080 1,138,565 1,264,584 794,220 964,181 21.4 Excise Dept 278,303 291,221 405,862 272,691 291,659 7.0 Custom Dept 99,602 80,288 97,148 64,272 66,405 3.3 Other Govt Sections 77,546 83,761 131,950 104,559 68,655 -34.3 State Enterprises 101,430 86,641 91,553 62,135 76,329 22.8 Treasury Dept 4,682 3,822 3,868 3,002 3,437 14.5 Source: CEIC, KBank (data from CEIC may not be exactly the same as data according to the MOF press release due to revision at certain times. This is correct as of June 20th. The rate of change should not differ very much) More on MPC insights and views There are greater details in the MPC minutes than in the short one-page statement on June 1st and below are our thoughts on the more recent minutes. In sum, we believe that our call of 3.50% for the policy rate (overnight repurchasing rate) at year-end remains intact, given the need for hiking caution as risk to growth could heighten following global economic slowdown. Specifically, we expect hikes of 25bp each on July 13th and August 24th, in line with the Bank of Thailand’s (BoT) notes that the core inflation rate might breach the 0.50-3.00% policy band in H2/2011. 1. MPC minutes reaffirmed that the BoT remained more worried about near-term inflation than the slowdown in global economy although central bank noted several risk factors surrounding a smooth recovery passage for the global economy. 2. Admittedly, the BoT noted that core inflation rate could exceed 3.00% faster than they had predicted prior to the June 1st MPC meeting. This indicates that much of the risks lie in the second half of this year. On the positive side, the BoT noted that core inflation rate should decline to below 3.0% in 2012. 33 3

- 4. 3. There are up side risks to the BoT’s forecast of both inflationary pressure and the level of core inflation rate. For the BoT’s current forecasts, assumptions of continued interest rate normalization had been included which indicates that the policy rate used to forecast inflation rates and economic growth was based not on an unchanged rate of 2.75% for the next 8 quarters but was based on the gradual pick up of interest rate as implied by the yield curve. 4. A second source of risk is that the BoT assumed that energy prices do not see additional up-side shock. What this statement likely means is that current impact of the unrests in the MENA region, increasing energy use in emerging markets, and slowdown in advanced economies had all been factored in. However, worse outcomes in political situations in the MENA or other types of major risks remained difficult to predict. Thai version http://www.bot.or.th/Thai/MonetaryPolicy/Documents/MPC_Minute_42544.pdf English version http://www.bot.or.th/Thai/MonetaryPolicy/Documents/MPC_Minute_42011.pdf Fig 5. Implied forward curve (government bond) Fig 6. KBank’s repo forecast % % Implied bond yield curve shifts 4.25 5.5 5.0 4.5 4.00 4.0 3.5 3.75 3.0 2.5 3.50 2.0 1.5 3.25 1.0 0.5 3.00 0.0 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 01 02 03 04 05 06 07 08 09 10 11 12 13 Jun-11 Sep-11 Dec-11 Jun-12 tenor (yrs) actual model Source: Bloomberg, KBank Source: Bloomberg, KBank Outlook for interest rates for the next quarter During the third quarter of FY2011 (April-June), government bonds continued to see substantial demand from local investors, especially those investing on longer terms such as insurance companies and pension funds. Meanwhile, foreign investors’ appetite fluctuated with global factors and Thai baht’s appreciation. Recently, foreigners’ holding of Thai baht debt securities declined by about THB100bn in May and approximately THB27bn in June (as of end June 17th). Nevertheless, yields for bonds with 5-year maturity and above saw little change, reflecting the market’s ability to absorb sell-offs. Fig 7. Auction result of 5-year bonds Fig 8. Foreign holding of Thai bonds up till Jun 10th change THB bn Auction result of LB15DA 3.20 0.12 100 500 2.80 0.10 2.40 50 400 0.08 2.00 0 300 1.60 0.06 1.20 -50 200 0.04 0.80 0.02 -100 100 0.40 0.00 0.00 -150 0 27 Dec 10 15 Dec 10 09 Feb 11 27 Apr 11 15 Jun 11 Jan-10 Mar-10 May-10 Jul-10 Sep-10 Nov-10 Jan-11 Mar-11 May-11 Bid Coverage Ratio (LHS) Difference between the highest and the lowest yield (RHS Change in foreign holding (left) End period holding (right) Source: ThaiBMA, KBank Source: ThaiBMA, KBank 44 4

- 5. Government bond auctions during the current quarter (April – June) mostly saw very positive results. In total, government bonds supply for the quarter is THB103.5bn, with THB16bn left for auction on June 22nd. So far, the bid-coverage ratio (BCR) for all of the issues ranged from 1.6 to 3.8 times, suggesting substantial demand from investors which is primarily due to the high level of liquidity. The 5-year bonds auctioned with BCRs of 2.1-2.2 while 10- and 15-year bonds saw BCRs of 2.87 – 3.46. The spreads between longer-term bonds and shorter-term bonds continued to decline which is indicative of a few important situations. The most obvious one seems to be the high liquidity in the market, leading investors to demand less of liquidity premium for holding longer-term bonds. At the same time, the market may be starting to price in the end of the policy rate hike cycle by the end of the year, although we maintain caution on further policy rate hikes in the first half of the year 2012. Furthermore, Thailand’s growth rate had peaked last year, and would take a few quarters more before starting to accelerate again. All these suggest that both the government and the corporate sector should be able to enjoy low costs of borrowing for some time. The market does not seem to be pricing in higher inflation rates in recent months. Market players may be too sanguine or there is an expectation that the BoT would eventually bring inflationary pressure down. While headline inflation rate hit 4.14% in May and looks to edge higher still, we expect it to average around 4.0% this year and decline towards 3.6% in the next. Overall, we think that investors are not particularly concerned about inflation rate at the moment. Fig 10. short-term and long-term bond yield spreads and Fig 9. GDP growth %QoQ sa headline inflation % bps % 15.0 250 10 8 10.0 200 6 3.6 3.5 1.3 4 5.0 2.3 2.1 2.0 150 1.3 0.2 2 0.0 100 0 -0.4 -0.4 -0.3 -2.0 -2 -5.0 50 -5.0 -4 -10.0 0 -6 1Q08 3Q08 1Q09 3Q09 1Q10 3Q10 1Q11 Feb-01 Feb-02 Feb-03 Feb-04 Feb-05 Feb-06 Feb-07 Feb-08 Feb-09 Feb-10 Feb-11 GDP % QoQ SA GDP % YoY 2-5 IRS spread 5-10 IRS spread CPI YoY Source: CEIC, KBank Source: Thai BMA, KBank Thailand’s yields vs. regional’s – relative attractiveness Global risk appetite had shrunk during the past couple of months. Slower job gains in the U.S., weaker pace of growth in China’s economy, concerns over European debt problems, high energy prices and so forth, had all been contributing to poorer investment sentiments, especially against the emerging market assets. Thailand also saw significant capital outflows in both the bond market and the stock market, partly due to the uncertainties surrounding the July 3rd general election. Fortunately for the bond market, local liquidity remained ample and bond yields had not responded too negatively. We take a look at how Thailand’s bonds compare when they are put side by side with regional bonds. Risks and credit ratings aside, one would notice that the local yield curve is relatively flatter than the other yield curves in Asia. As such, the long-bonds seemed less attractive relative to the bonds at the front-curve for the THB bonds, as yield enhancement is deemed insufficient for investors to take increased duration risk. Of course, we have explained earlier in this paper that the low spread between short-term and long-term bonds may be reflecting low liquidity premium in the current market, given 55 5

- 6. flush liquidity. At the same time, a closer look at the credit rating ranking, THB bonds would seem less attractive than the South Korean bonds with higher credit rating and yet higher yields. At the same time, Malaysian government bonds would also provide a good alternative to THB bonds given higher credit rating and relatively similar yields. Fig 11. Thailand’s yield curve shows THB bonds may be less attractive compared to regional bonds % 8 7 6 5 4 3 2 1 Tenor (yrs) 0 0.1 0.3 0.5 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 South Korea Thailand U.S. Malaysia Indonesia Philippines Source: Bloomberg, KBank Table 3. Economic data and credit rating (based on Standard & Poor’s) as of June 17th Credit rating for Latest inflation 10-year bond 10-year bond Credit rating for Sovereign FCY (Long-term) rate yield yield – inflation LCY(Long-term) rate Thailand A- BBB+ 4.1% 3.78% -0.32% South Korea A+ A 4.1% 4.22% 0.12% Malaysia A+ A- 3.2% 3.92% 0.72% Indonesia BB+ BB+ 6.0% 7.55% 1.55% Philippines BB+ BB 4.5% 6.53% 2.03% Source: Bloomberg, KBank In general, the public debt to GDP ratios of the regional economies remained at non-risky levels. At the same time, Asian currencies continued to be in favorable light, given their strong economic growth outlook. Taking currency values from the beginning of the year 2009 (the beginning of global economic recession), Thai baht’s appreciation against the U.S. dollar would be close to that of the other regional currencies. However, recent trade showed that the baht had lost the “foreigners’ favourite” status, given near-term political uncertainties in the face of upcoming general election. USD/THB hit its recent lowest at 29.88 on April 29th before rebounding to the recent levels near 30.60. 66 6

- 7. Going forward, we expect that foreign investors would continue to invest in Thai bonds but at a reduced exposure. The global economic slowdown and concerns over Europe’s debt problems are likely to keep investors particularly selective over their universe of risky assets. Fig 12. Government debt/GDP (IMF data and forecast) Fig 13. FX movements % of GDP % 65 25 THB IDR MYR SGD 60 20 PHP KRW TWD 55 15 50 10 45 5 40 0 35 -5 30 -10 25 -15 20 -20 2006 2007 2008 2009 2010 2011 2012 2013 2014 -25 Thailand Philippines Malaysia South Korea Indonesia Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Source: Bloomberg, KBank Source: Bloomberg, KBank Fig 14. 1-month change of USD/Asia (June 21st) Fig 15. USD/THB THB -0.4% Change against USD, 1 month 34.00 PHP -0.2% 33.50 IDR -0.1% 33.00 TWD 0.0% 32.50 32.00 CNY 0.6% 31.50 INR 0.8% 31.00 MYR 1.1% 30.50 SGD 1.2% 30.00 KRW 1.8% 29.50 JPY 2.3% 1-Jan 1-Apr 1-Jul 1-Oct 1-Jan 1-Apr -0.5% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% USD/THB USD/THB 100-day moving average Source: Bloomberg, KBank Source: Bloomberg, KBank 77 7

- 8. Extend duration and expect further flattening Notice below that the spread between the policy rate and the 2-year bond yield had seldom been negative. In particular, the policy rate would exceed the 2-year yield only when the market anticipated rate cuts by the central bank during economic downturn. The bond market, responding actively to expectations and BoT’s signals, went ahead and traded the 2-year lower. At the same time, historical data on the spread showed that the 2-year yield could stay substantially above the policy rate before declining with a clear trend due to anticipation of policy rate’s decline in the future, in line with our expectation that the spread between them would shrink from the current level of 45bp towards 25bp at year-end i.e. 2-year yield is likely to continue on an upward trend towards 3.75%. Fig 16. Spread between 2Y and repo Fig 17. 2/10 spread and policy rate % bp 2/10 spread (right-axis) Policy rate (right) % 6.0 400 6 350 5.0 5 300 4.0 4 250 3.0 200 3 150 2.0 2 100 1.0 1 50 2-yr Policy rate 0.0 0 0 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Source: Bloomberg, KBank Source: Bloomberg, KBank Meanwhile, an observation of the historical spread between the 2- and 10-year bond yield showed that the minimum distance had been 5bp. This narrowing of the spread occurred during the year 2006 when the BoT hiked the policy rate to 5.00% (over the course of 1.5 years and from a low rate of 1.25% in Q3/2004) and 2-10 spread continued to narrow even after the policy rate paused for several months. The spread picked up again only when 2-year yield started to fall in anticipation of policy rate cut. This conflicts with our current forecast that the 10-year yield would trend upwards to 4.25%, given the rising inflationary pressure. We see substantial support for the current 2-10 spread to fall from the current level of 36bp to near 20bp, should investors continue to see high levels of liquidity and expect that inflation rate’s rise would be temporary. In such case, we would recommend extension of duration. Nevertheless, we maintain that the determination of 2- 10 spread or the shape of the yield curve is highly dependent on the absence of foreign large sell-offs in Thai bonds, as well as a non-accelerating inflationary pressure which could be driven by a flood of liquidity by the Federal Reserve (for the advocate of “Q.E.3”) or surging commodity prices due to natural events or disruption of oil supply among major producers. 88 8

- 9. Table 4. Monthly Key Economic Indicators Oct 10 Nov 10 Dec 10 Jan-11 Feb-11 Mar 11 Apr 11 May 11 Manufacturing index (ISIC) 188.0 189.1 189.9 192.9 188.7 187.0 180.8 % YoY 6.0 5.7 -3.4 4.1 -3.0 -6.7 -7.8 Industrial capacity utilization rate (%) (ISIC) 63.9 63.6 62.4 62.3 59.5 66.1 54.6 Retail sales (% YoY) 5.3 8.1 7.8 9.3 8.6 3.9 n.a. Total vehicle sales (units) 72,012 78,874 93,122 68,398 77,213 93,008 67,283 Motorcycle sales (units) 143,791 152,767 167,707 165,152 188,248 191,437 174,244 Unemployed labor force ('000 persons) 355 389 268 374 268 276 n.a. Unemployment rate (%) 0.9 1.0 0.7 1.0 0.7 0.7 n.a. Consumer prices (% YoY) 2.8 2.8 3.0 3.0 2.9 3.1 4.0 4.2 core 1.1 1.1 1.4 1.3 1.5 1.6 2.1 2.5 Producer prices (% YoY) 10.0 7.1 4.7 6.0 7.4 5.9 6.6 6.2 External Accounts (USD mn, unless specified otherwise) Exports 17,046.0 17,584.0 17,220.0 16,523.0 18,406.0 21,072.0 17,243.0 % YoY 16.6 28.7 18.6 21.4 29.1 31.0 24.7 Imports 14,773.0 17,094.0 15,911.0 17,111.0 16,375.0 19,180.0 17,720.0 % YoY 14.4 35.0 8.8 31.2 18.6 27.2 26.3 Trade balance 2,273.0 490.0 1,309.0 -588.0 2,031.0 1,892.0 -477.0 Tourist arrivals ('000) 1,360 1,500 1,840 1,810 1,822 1,765 1,498 % YoY 6.3 10.3 9.5 12.8 12.8 22.7 35.2 Current account balance 2,740.0 1,019.0 1,750.0 1,090.0 3,823.0 1,881.0 -165.0 Balance of payments 5,822 820 2,263 1,689 4,271 1,365 3,570 FX reserves (USD bn) 171.1 168.0 172.1 174.0 179.5 181.6 189.9 Forward position (USD bn) 12.6 15.1 19.6 19.3 17.9 21.0 21.4 Monetary conditions (THB bn, unless specified otherwise) M1 1,202.3 1,235.4 1,302.4 1,326.2 1,346.4 1,345.6 1,347.6 % YoY 11.4 10.8 10.9 15.5 13.4 13.8 14.0 M2 11,323.3 11,497.6 11,776.4 11,817.2 12,152.9 12,280.3 12,469.3 % YoY 11.2 11.1 10.9 11.5 13.7 13.1 15.1 Bank deposits 10,206.0 10,387.9 10,584.9 10,606.3 10,834.2 10,891.3 10,964.4 % YoY 8.5 8.1 8.7 8.8 10.3 9.0 9.9 Bank loans 9,580.3 9,751.1 9,947.0 10,064.5 10,209.7 10,308.2 10,375.0 % YoY 12.1 12.3 12.6 14.5 15.1 14.9 15.3 Interest rates (% month end) BOT 1 day repo (target) 1.75 1.75 2.00 2.25 2.25 2.50 2.75 2.75 Average large banks' minimum lending rate 6.00 6.00 6.12 6.37 6.37 6.62 6.75 6.75 Average large banks' 1 year deposit rate 1.11 1.11 1.32 1.51 1.51 1.67 1.86 1.86 Govt bond yield 1yr 1.98 2.11 2.38 2.54 2.68 2.83 3.00 3.15 Govt bond yield 5yr 2.83 2.98 3.26 3.40 3.48 3.41 3.38 3.50 Govt bond yield 10yr 3.18 3.59 3.77 3.85 3.89 3.75 3.70 3.79 Key FX (month end) DXY US dollar index 77.27 81.20 79.03 77.74 76.89 75.86 72.93 74.64 USD/THB 29.94 30.21 30.06 30.93 30.60 30.28 29.88 30.32 JPY/THB 37.18 36.11 37.01 37.60 37.47 36.42 36.80 37.17 EUR/THB 41.76 39.22 40.23 42.35 42.25 42.86 44.24 43.64 Source: Bloomberg 99 9

- 10. Disclaimer For private circulation only. The foregoing is for informational purposes only and not to be considered as an offer to buy or sell, or a solicitation of an offer to buy or sell any security. Although the information herein was obtained from sources we believe to be reliable, we do not guarantee its accuracy nor do we assume responsibility for any error or mistake contained herein. Further information on the securities referred to herein may be obtained upon request. 1010 10