Medicare: The Essentials

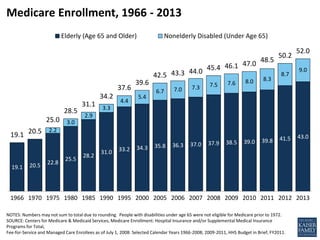

- 1. 19.1 20.5 22.8 25.5 28.2 31.0 33.2 34.3 35.8 36.3 37.0 37.9 38.8 39.6 40.5 41.9 43.3 2.2 3.0 2.9 3.3 4.4 5.4 6.7 7.0 7.3 7.5 7.8 8.0 8.4 8.5 8.7 19.1 20.5 25.0 28.5 31.1 34.2 37.6 39.6 42.5 43.3 44.3 45.4 46.5 47.7 48.8 50.4 52.0 1966 1970 1975 1980 1985 1990 1995 2000 2005 2006 2007 2008 2009 2010 2011 2012 2013 Nonelderly Disabled (Under Age 65) Elderly (Age 65 and Older) NOTES: Numbers may not sum to total due to rounding. People with disabilities under age 65 were not eligible for Medicare prior to 1972. SOURCE: Centers for Medicare & Medicaid Services, Medicare Enrollment: Hospital Insurance and/or Supplemental Medical Insurance Programs for Total, Fee-for-Service and Managed Care Enrollees as of July 1, 2011: Selected Calendar Years 1966-2011; 2012-2013, HHS Budget in Brief, FY2014. Medicare Enrollment, 1966 - 2013

- 2. SOURCE: Calculation based on Kaiser Family Foundation analysis of the CMS State/County Market Penetration file, March 2012; and 2011 population estimates from the United States Census Bureau. Medicare Beneficiaries as a Percent of State Populations, 2012 National Average, 2012 = 16% 10% - 14% 15% – 16% 17% – 18% 19% – 21% 8 states, DC 18 states 19 states 5 states DC13% 18% 18% 10% 15% 19% 13% 13% 16% 17% 19% 13% 16% 15% 15%16% 17% 16% 18% 16% 21% 14% 17%15% 17% 17% 18% 16% 14% 18% 16% 16% 16% 16% 16% 17% 17% 17% 18% 18% 17% 17% 12% 11% 19% 15% 15% 21% 15% 17% 18%

- 3. 20.4 24.9 28.4 31.1 34.3 37.6 39.7 42.6 47.7 55.6 64.3 73.5 81.5 86.5 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 2020 2025 2030 2035 SOURCE: 2013 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds. Medicare Enrollment, 1970 – 2035 Historical ProjectedIn millions:

- 4. 1.9% 3.0% 2.4% 0.9% 0.4% 39.7 47.7 64.3 81.5 88.9 92.4 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 0 10 20 30 40 50 60 70 80 90 100 2000 2010 2020 2030 2040 2050 SOURCE: 2013 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds. Projected Change in Medicare Enrollment, 2000-2050 Medicare Enrollment (in millions) Average Annual Growth in Enrollment

- 5. 50% 50% 40% 27% 23% 20% 17% 15% 13% 5% NOTE: ADL is activity of daily living. SOURCE: Urban Institute and Kaiser Family Foundation analysis, 2012; Kaiser Family Foundation analysis of the Centers for Medicare & Medicaid Services Medicare Current Beneficiary 2009 Cost and Use file. Characteristics of the Medicare Population Percent of total Medicare population: Income below $22,502 Savings below $77,482 3+ Chronic Conditions Fair/Poor Health Cognitive/Mental Impairment Dually Eligible for Medicare and Medicaid Under-65 Disabled 2+ ADL Limitations Age 85+ Long-term Care Facility Resident

- 6. $22,502 $24,797 $15,252 $13,805 $16,183 $23,809 $22,699 $17,410 $24,625 $20,920 Total White Black Hispanic Under age 65 Age 65-74 Age 75-84 Age 85 or older Male Female SOURCE: Urban Institute analysis of DYNASIM for the Kaiser Family Foundation. Median Income Among Medicare Beneficiaries, Overall and by Race/Ethnicity and Age, 2012 Race /Ethnicity Age Gender

- 7. 25% had incomes below $14,000 50% had incomes below $22,500 5% had incomes above $88,900 NOTE: Total household income for couples is split equally between husbands and wives to estimate income for married beneficiaries. SOURCE: Urban Institute analysis of DYNASIM for the Kaiser Family Foundation. Distribution of Medicare Beneficiaries by Income Level, 2012

- 8. Percent of total Medicare population: 2% 5% 9% 19% 28% 77% SOURCES: Kaiser Family Foundation analysis of the Centers for Medicare & Medicaid Services Medicare Current Beneficiary 2009 Cost and Use file. Medicare Beneficiaries’ Utilization of Selected Medical and Long-Term Care Services, 2009 Physician Office Visit Emergency Room Visit Inpatient Hospital Stay Home Health Visit Skilled Nursing Facility Stay Hospice Visits

- 9. NOTE: *Amount corresponds to the estimated catastrophic coverage limit for non-LIS enrollees ($6,734 for LIS enrollees), which corresponds to TrOOP spending of $4,750. SOURCE: Kaiser Family Foundation illustration based on CMS standard benefit parameter update for 2013. Amounts rounded to nearest dollar. Standard Medicare Prescription Drug Benefit, 2013 Deductible = $325 Initial Coverage Limit = $2,970 in Total Drug Costs Plan pays 75% Plan pays 15%; Medicare pays 80%Enrollee pays 5% Enrollee pays 25% Catastrophic Coverage Limit = $6,733.75* in Estimated Total Drug Costs Brand-name drugs Enrollee pays 47.5%; Plan pays 2.5% 50% manufacturer discount Generic drugs Enrollee pays 79%; Plan pays 21% INITIAL COVERAGE PERIOD COVERAGE GAP CATASTROPHIC COVERAGE DEDUCTIBLE

- 10. SOURCE: Kaiser Family Foundation analysis of Centers for Medicare & Medicaid Services (CMS) PDP landscape source file, 2013. Number of Medicare Part D Stand-Alone Prescription Drug Plans, by State, 2013 23 – 29 plans 30 – 31 plans 32 plans 33 – 38 plans 12 states, DC 18 states 13 states 7 states U.S. Total, 2013= 1,031 DC29 30 33 23 29 30 32 29 30 29 34 30 23 32 32 31 32 31 32 30 28 29 3032 29 31 32 32 29 28 29 30 28 30 32 33 31 30 38 31 32 33 32 32 30 31 30 38 32 30 33

- 11. Part D non-LIS enrollees 21.7 million 43% Part D LIS enrollees 11.0 million 22%Employer subsidy 4.5 million All other 13.5 million 26% SOURCE: 2012 Medicare Trustees report. NOTE: LIS is low-income subsidy. Total Part D and Medicare enrollment based on 2012 intermediate estimates. Prescription Drug Coverage Among Medicare Beneficiaries in 2012 Total Medicare Enrollment in 2012 = 50.7 million Total Part D Enrollment (excluding employer subsidy) = 32.7 million 9%

- 12. 6.9 6.8 6.2 5.6 5.3 5.3 5.6 6.8 8.4 9.7 10.5 11.1 11.9 13.1 14.4 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 NOTE: Includes MSAs, cost plans, demonstration plans, and Special Needs Plans as well as other Medicare Advantage plans. SOURCE: MPR/Kaiser Family Foundation analysis of CMS Medicare Advantage enrollment files, 2008-2013, and MPR, “Tracking Medicare Health and Prescription Drug Plans Monthly Report,” 2001-2007; enrollment numbers from March of the respective year, with the exception of 2006, which is from April. Total Medicare Private Health Plan Enrollment, 1999-2013 In millions: % of Medicare Beneficiaries 18% 17% 15% 14% 13% 13% 13% 16% 19% 22% 23% 24% 25% 27% 28%

- 13. Traditional Fee-for-service Medicare 72% HMO 65% Local PPO 22% Regional PPO 7% PFFS 3% Other 3% Medicare Advantage 28% NOTE: PFFS is Private Fee-for-Service plans, PPOs are preferred provider organizations, and HMOs are Health Maintenance Organizations. Other includes MSAs, cost plans, and demonstration plans. Includes enrollees in Special Needs Plans as well as other Medicare Advantage plans. SOURCE: MPR / KFF analysis of the Centers for Medicare and Medicaid Services (CMS) Medicare Advantage enrollment files, 2013. Distribution of Enrollment in Medicare Advantage Plans, by Plan Type, 2013 Total Medicare Advantage Enrollment, 2013 = 14.4 Million

- 14. NOTE: Includes MSAs, cost plans and demonstrations. Includes Special Needs Plans as well as other Medicare Advantage plans. SOURCE: MPR/Kaiser Family Foundation analysis of CMS State/County Market Penetration Files, 2013. Share of Medicare Beneficiaries Enrolled in Medicare Advantage Plans, by State, 2013 National Average, 2013 = 28% < 10% 10% - 19% 20% - 29% ≥30% (6 states) (14 states + DC) (15 states) (15 states) DC 10% 35% 22% 0% 38% 17% 37% 35% 23% 7% 36% 25% 46% 30% 11% 21% 14% 12% 22% 26% 17% 8% 18%49% 12% 24% 15% 12% 32% 5% 16% 29% 33% 20% 12% 37% 16% 42% 39% 20% 13% 29% 27% 33% 7% 15% 28% 21% 3% 33% 27%

- 15. SOURCE: Kaiser Family Foundation analysis of the Medicare Current Beneficiary Survey 2008, and Kaiser Commission on Medicaid and the Uninsured and Urban Institute estimates based on data from FY2008 MSIS and CMS Form-64. Dually eligible beneficiaries comprise 20% of the Medicare population and 15% of the Medicaid population, 2008 Dual Eligibles 9 million Medicare 37 million Medicaid 51 million Total Medicare beneficiaries, 2008: 46 million Total Medicaid beneficiaries, 2008: 60 million

- 16. 20% 31% 15% 39% 80% 69% 85% 61% SOURCE: Kaiser Family Foundation analysis of the CMS Medicare Current Beneficiary Survey Cost and Use File, 2008, and Kaiser Commission on Medicaid and the Uninsured and Urban Institute estimates based on data from FY2008 MSIS and CMS Form-64. Dual eligible beneficiaries as a share of Medicare and Medicaid population and spending, 2008 Total Medicare Spending, 2008: $424 Billion Total Medicare Population, 2008: 46 Million Total Medicaid Spending, 2008: $330 Billion Total Medicaid Population, 2008: 60 Million Dual Eligibles as a Share of the Medicare Population and Medicare Spending, 2008: Dual Eligibles as a Share of the Medicaid Population and Medicaid Spending, 2008:

- 17. Employer- Sponsored 31% Medicare Advantage 25% Medigap 15% Medicaid 15% Other Public/Private 1% 12% NOTE: Numbers do not sum due to rounding. SOURCE: Kaiser Family Foundation analysis of the Centers for Medicare & Medicaid Services Medicare Current Beneficiary 2009 Cost and Use file. Sources of Supplemental Coverage Among Medicare Beneficiaries, 2009 Total Number of Beneficiaries, 2009: 47.2 Million No Supplemental Coverage

- 18. 11.9% 11.8% 12.0% 12.8% 14.0% 14.9% 15.5% 15.6% 15.6% 16.2% 5.5% 5.3% 5.4% 5.5% 6.0% 6.5% 6.7% 6.9% 7.4% 8.0% 4.1% 4.2% 4.4% 4.9% 5.2% 5.5% 5.8% 5.6% 5.5% 5.4% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 NOTES: Differences between 1997 and 2006 are statistically significant for all displayed measures. Annual amounts for the components of total health care spending do not sum to total amounts because values shown are median, not mean, values. SOURCE: Kaiser Family Foundation analysis of CMS Medicare Current Beneficiary Survey Cost and Use files, 1997-2006. Median Out-of-Pocket Health Care Spending As a Percent of Income Among Medicare Beneficiaries, 1997–2006 Total health care out-of-pocket Premium out-of-pocket Nonpremium out-of-pocket

- 19. 11.9% 11.8% 12.0% 12.8% 14.0% 14.9% 15.5% 15.6% 15.6% 16.2% 23.9% 23.9% 24.9% 26.2% 27.4% 29.2% 29.9% 30.1% 29.9% 30.1% 47.5% 49.1% 50.0% 51.8% 56.3% 59.2% 58.4% 59.8% 57.9% 57.8% 0% 10% 20% 30% 40% 50% 60% 70% 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 NOTES: Differences between 1997 and 2006 are statistically significant for all displayed measures. SOURCE: Kaiser Family Foundation analysis of CMS Medicare Current Beneficiary Survey Cost and Use files, 1997-2006. Out-of-Pocket Health Care Spending As a Percent of Income Among Medicare Beneficiaries, By Spending Percentile, 1997–2006 90th percentile 75th percentile 50th percentile (median)

- 20. NOTE: SMI is Supplementary Medical Insurance. Out-of-pocket spending includes SMI (Part B and Part D) premiums and out-of- pocket cost-sharing expenses for SMI covered services. SOURCE: Kaiser Family Foundation analysis based on data from 2012 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds. Part B and Part D Out-of-Pocket Spending as a Share of Average Social Security Benefit, 1970 – 2010 Average Monthly Social Security benefit payment $604 $772 $906 $1,001 $1,151 Average monthly out-of-pocket spending on Part B and Part D $39 $53 $111 $136 $299 6% 7% 12% 14% 26% 1970 1980 1990 2000 2010

- 21. Distribution of Average Household Spending by Medicare and Non-Medicare Households, 2010 Housing $10,940 36% $4,106 13% $4,527 15% Food $4,766 15% Other $6,480 21% SOURCE: Kaiser Family Foundation analysis of the Bureau of Labor Statistics Consumer Expenditure Survey Interview and Expense Files, 2010. Non-Medicare Household SpendingMedicare Household Spending Average Household Spending = $49,641 Average Household Spending = $30,818 Health Care Transportation Housing $16,824 34% $8,188 16% $2,450 Food $7,364 15% Other $14,815 30% Health Care 5% Transportation

- 22. Other2 13% Nondefense Discretionary 17% Defense 19% Social Security 22% Medicare1 16% Medicaid 7% Net Interest 6% NOTE: FY is fiscal year. 1Amount for Medicare excludes offsetting premium receipts (premiums paid by beneficiaries, amount paid to providers and later recovered, and state contribution (clawback) payments to Medicare Part D). 2Other category includes other mandatory outlays, offsetting receipts, and negative outlays for Troubled Asset Relief Program (TARP). SOURCE: Congressional Budget Office (CBO) Medicare Baseline, May 2013. Medicare as a Share of the Federal Budget, 2012 Total Federal Spending, FY2012 = $3.5 Trillion Federal Spending on Medicare, FY 2012 = $551 Billion

- 23. $586 $597 $615 $671 $695 $722 $794 $849 $911 $1,018 $1,064 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 SOURCE: Congressional Budget Office (CBO) Medicare Baseline, May 2013. Projected Medicare Spending, 2013 – 2023 In billions:

- 24. 8.5% 12.1% 15.1% 16.9% 1990 2000 2010 2020 SOURCE: CBO Budget and Economic Outlook, January 2011 (for 1990-2010 data) and May 2013 (for 2020 data). Medicare as a share of Federal Budget Outlays, and as a share of Gross Domestic Product (GDP), 1990-2020 1.9% 2.2% 3.6% 3.7% 1990 2000 2010 2020 Medicare Spending as a Share of Federal Budget Outlays Medicare Spending as a Share of Gross Domestic Product (GDP) Total Federal Outlays (trillions) $1.3 $1.8 $3.5 $5.0 Gross Domestic Product (trillions) $5.7 $9.8 $14.5 $22.9

- 25. NOTE: Excludes administrative expenses and is net of recoveries. *Includes hospice, durable medical equipment, Part B drugs, outpatient dialysis, ambulance, lab services, and other services. SOURCE: Congressional Budget Office (CBO) Medicare Baseline, May 2013. Medicare Benefit Payments By Type of Service, 2012 Total Benefit Payments = $536 billion Hospital Inpatient Services 26% 5% Physician Payments 13% 6%4% Other Services 13% Medicare Advantage 23% Outpatient Prescription Drugs 10% Home Health Hospital Outpatient Services Skilled Nursing Facility Part A Part B Part A and B Part C Part D

- 26. 21% 44% 28% 25% 24% 24% Total Services* Home Health Care Hospital Services Prescription Drugs Physician Services Nursing Home Care NOTE: Total also includes dental care, durable medical equipment, other professional services, and other personal health care/products. SOURCE: Centers for Medicare & Medicaid Services, Office of the Actuary, 2011 National Health Expenditure. Projections 2011-2021. Medicare’s Share of National Personal Health Expenditures, by Type of Service, 2012 Expenditures in Billions Medicare $591 $34 $250 $69 $131 $38 Total $2,809 $78 $885 $277 $550 $155

- 27. 90% 43% 10% 57% NOTES: Excludes Medicare Advantage enrollees. Includes noninstitutionalized and institutionalized beneficiaries. SOURCE: Kaiser Family Foundation analysis of the CMS Medicare Current Beneficiary Survey Cost and Use File, 2009. Distribution of Traditional Medicare Beneficiaries and Medicare Spending, 2009 Total Number of Traditional Medicare Beneficiaries: 35.4 million Total Traditional Medicare Spending: $343 billion Average per capita Traditional Medicare spending: $9,702 Average per capita Traditional Medicare spending among top 10%: $55,763 Average per capita Traditional Medicare spending among bottom 90%: $4,584

- 28. 0% 5% 10% 15% 20% 25% 1970 1975 1980 1985 1990 1995 2000 2005 2010 Medicare (Average Annual Growth, 1970-2011 = 7.9%) Private Health Insurance (Average Annual Growth, 1970-2011 = 9.1%) NOTE: Comparison includes benefits commonly covered by Medicare and Private Health Insurance. These benefits are hospital services, physician and clinical services, other professional services and durable medical products. SOURCE: Centers for Medicare & Medicaid Services, Office of the Actuary, National Health Statistics Group: National Health Expenditure Historical Data, 2013. Annual Change in Per Enrollee Medicare and Private Health Insurance Spending, 1970-2011 Medicare Private Health Insurance

- 29. $536.9 billion $243.0 billion $227.0 billion $66.9 billion 4% 6% 2% 3% 8%2% 13% 13% 1% 26% 12% 38% 85% 40% 72% 75% TOTAL Part A Part B Part D General revenue Payroll taxes Beneficiary premiums State payments Taxation of Social Security benefits Interest and other SOURCE: 2013 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds. Estimated Sources of Medicare Revenue, 2012

- 30. 6.6% 6.9% 2.9% 2.5% 3.2% 5.0% 4.1% 2.1% NOTE: *Assumes no reduction in physician fees under Medicare between 2012 and 2021. SOURCES: Kaiser Family Foundation analysis of data from Boards of Trustees, Congressional Budget Office, Centers for Medicare & Medicaid Services, U.S. Census Bureau. Historical and Projected Average Annual Growth Rate in Medicare Spending Per Capita and Other Measures Actual (2000-2011) Projected (2012-2021) Medicare spending per capita Private health insurance spending per capita GDP per capita CPI Medicare spending per capita* Private health insurance spending per capita GDP per capita CPI

- 31. $- $50 $100 $150 $200 $250 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 SOURCE: 2013 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds. Medicare Part A Trust Fund Balance at Year End, 2012-2026 In billions:

- 32. 13 12 13 19 8 11 12 12 15 15 23 28 28 25 16 10 4 5 6 7 6 10 14 13 14 2 2026 2024 2024 2029 2017 2019 2019 2018 2020 2019 2026 2030 2029 2025 2015 2008 2001 2001 2001 2001 1999 2002 2005 2003 1994 1972 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1980 1970 NOTES: ‘Insolvency’ refers to the depletion of the trust fund. No insolvency projections were made for 1973-1975 and 1989. For all other years not displayed, the Hospital Insurance Trust Fund was projected to remain solvent for 17 or fewer years. SOURCE: Intermediate projections from 1970-2013 Annual Reports of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds. Solvency Projections of the Medicare Part A Trust Fund, 1970-2013 Year of Trustees’ Report Projected Number of Years to Insolvency and Projected Year of Insolvency:

Notas del editor

- 1767, 2561

- 2569

- 1790

- 1790

- 1927

- 2590/2592

- 2584

- 1795

- 1800,2585, 2951

- 1804

- 1807

- 2594, 2956

- 1812