Más contenido relacionado Similar a Education Investor Insight 230592 (20) 1. InvestorInsight

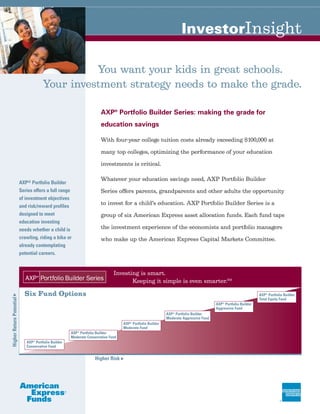

You want your kids in great schools.

Your investment strategy needs to make the grade.

AXP® Portfolio Builder Series: making the grade for

education savings

With four-year college tuition costs already exceeding $100,000 at

many top colleges, optimizing the performance of your education

investments is critical.

Whatever your education savings need, AXP Portfolio Builder

AXP® Portfolio Builder

Series offers a full range Series offers parents, grandparents and other adults the opportunity

of investment objectives

and risk/reward profiles

to invest for a child’s education. AXP Portfolio Builder Series is a

designed to meet group of six American Express asset allocation funds. Each fund taps

education investing

needs whether a child is the investment experience of the economists and portfolio managers

crawling, riding a bike or who make up the American Express Capital Markets Committee.

already contemplating

potential careers.

Investing is smart.

Keeping it simple is even smarter.SM

▲ Six Fund Options AXP® Portfolio Builder

Higher Return Potential

Total Equity Fund

AXP® Portfolio Builder

Aggressive Fund

AXP® Portfolio Builder

Moderate Aggressive Fund

AXP® Portfolio Builder

Moderate Fund

AXP® Portfolio Builder

Moderate Conservative Fund

AXP® Portfolio Builder

Conservative Fund

Higher Risk

▲

2. InvestorInsight

Simplify your education investment program with

AXP Portfolio Builder Series

■ With six funds, you can exchange to a more conservative portfolio as your child’s

college years draw near.

■ Streamline the process of fund selection, letting you and your advisor focus on

long-term goals and risk tolerance.

■ Obtain immediate diversification for any investment amount.

■ Put asset allocation decisions in the hands of experienced investment professionals.

Take the next step to help secure a child’s future. Contact your financial advisor and

learn more about AXP Portfolio Builder Series. Once you’ve done your homework,

you’ll see that AXP Portfolio Builder Series makes the grade.

5%

10%

20%

35%

20% 35% 50% 100%

50%

70% 60%

65% 80%

AXP® Portfolio Builder AXP® Portfolio Builder AXP® Portfolio Builder AXP® Portfolio Builder AXP® Portfolio Builder AXP® Portfolio Builder

Conservative Fund Moderate Moderate Fund Moderate Aggressive Fund Total Equity Fund

Conservative Fund Aggressive Fund

■ Stock Funds 20% ■ Stock Funds 35% ■ Stock Funds 50% ■ Stock Funds 65% ■ Stock Funds 80% ■ Stock Funds 100%

Large-, mid- and Large-, mid- and Large-, mid- and Large-, mid- and Large-, mid- and Large-, mid- and

small-cap small-cap small-cap small-cap small-cap small-cap

Growth and value Growth and value Growth and value Growth and value Growth and value Growth and value

International developed International International International International International

markets Emerging markets Emerging markets Emerging markets Emerging markets Emerging markets

■ Bond Funds 70% ■ Bond Funds 60% ■ Bond Funds 50% ■ Bond Funds 35% ■ Bond Funds 20%

Government Government Government Government Government

Investment grade Investment grade Investment grade Investment grade Investment grade

corporate corporate corporate corporate corporate

Multi-sector High yield corporate High yield corporate High yield corporate High yield corporate

■ Cash 10% Global Global Global Global

Multi-sector Multi-sector Multi-sector Multi-sector

■ Cash 5%

Diversification helps you spread risk throughout your portfolio, so investments that do poorly may be balanced by others that do relatively better. Diversification is not

a guarantee of overall portfolio profit.

AXP Portfolio Builder funds will invest in the types of stock and bond funds listed above. These stock and bond funds may invest in asset classes not specifically listed

here. Pie charts represent neutral allocation for each fund. Actual asset allocation will vary over time depending on market conditions.

There are special risk considerations associated with international investing related to market, currency, economic, political and other factors. Stocks of small

companies generally may be subject to abrupt or erratic price movements more so than stocks of larger companies. Some of these companies also have fewer

financial resources. Higher yield corporate bond prices may fluctuate more broadly than prices of higher quality bonds. Risk of principal and income is also greater

than with higher quality securities.

American Express Funds Products offered are not federally or FDIC-insured, are not deposits or

70100 AXP Financial Center obligations of, or guaranteed by any financial institution and involve

Minneapolis, MN 55474 investment risks including possible loss of principal and fluctuation in value.

americanexpress.com You should consider the investment objectives, risks, charges and expenses of

each AXP Portfolio Builder fund carefully before investing. For a free copy of

© 2004 American Express Financial Corporation the prospectus, which contains this and other information, call (800) 297-3863,

All rights reserved. TTY: (800) 846-4852. Read the prospectus carefully before you invest.

American Express Financial Advisors Inc. Member NASD.

American Express Company is separate from American Express Financial

Advisors Inc. and is not a broker-dealer. 230592 A (2/04)