Hong Kong - A City of Contrasts

- 1. HONG KONG This is an independent publication by Archimedia London MONDAY, SEPTEMBER 12, 2011 A City of Contrasts

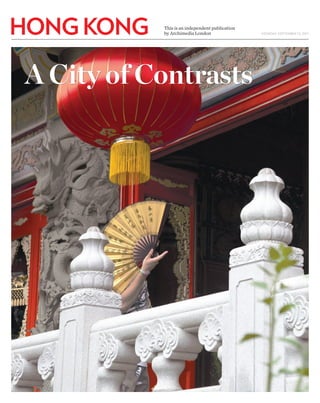

- 2. A DV E RT I S I N G S U P P L E M E N T A DV E RT I S I N G S U P P L E M E N T 2 HONG KONG HONG KONG 3 GROWTH PROSPECTS ARE BRIGHT INSIDE THIS REPORT ECONOMY Hong Kong’s growth is founded other emerging markets to list on solid economic fundamen- in Hong Kong. What advan- tals. What is your assessment tages does it offer? of the medium-term economic I believe this is good for stabil- outlook? ity. Any multinational will have Hong Kong is China’s biggest 4 If you try to analyse why Hong Kong has become so strong, what have been the ingredients of our to find the way to raise capital and put their anchor somewhere, and they have been putting their trading partner and helps fuel success, and then you look at the anchors in Wall Street and in the the mainland’s growth durability of these ingredients, then City of London. Multination- one would come to the conclusion als want their assets traded on a CURRENCY that Hong Kong will remain pretty 24-hour basis. With Hong Kong’s 6 INTERVIEW prosperous in the medium term, if not in the long term. Our strength is derived first position in East Asia, we continue to trade while London and New York are sleeping. DONALD TSANG from our geographic location, And the liquidity pool in Hong being at the centre of East Asia, Kong is huge; it is huge, safe and HONG KONG the focal point of all economic free. Money can move in and HONG KONG’S CHIEF activities in the coming decades, out at the press of a button, so it Used increasingly for trade EXECUTIVE TALKS and in particular we are a part of provides safety as well. We [also] settlement, China’s yuan is on TO PETER DRENNAN fast-growing China. The second have a low-tax regime, they will the road to full convertibility The plans, aspirations and objec- ingredient is the infrastructural based on common law, as distinct be taxed a lot less than if they’re AND THE RISE OF ASIA strength of Hong Kong. This in- from the mainland. This is a very tives enshrined in that chapter in New York or London for that C R E AT I V E I N D U S T R I E S cludes a critical mass of profes- important point. are Hong Kong’s own. We believe matter. As far as the supervision China’s sustained 11 sionals, particularly financial- economic boom that we are able to contribute to issue is concerned, the Hong services professionals. We have Is the ‘China factor’ Hong has been a boon national growth by being a global Kong standard is well known. most of the world’s largest banks Kong’s greatest competitive to Hong Kong. financial centre; a global centre We are not second to anybody in located in Hong Kong. We have a advantage? There are now some for trade, for finance, for shipping, terms of our regulatory regime, 800 mainland huge number of multinationals, This is perhaps the most impor- for aviation. And our strengths particularly if they want to trade As the centre of gravity in the global economy shifts to Asia, Hong Kong-based multinational more than 6,000. These are not tant factor in the coming decade firms established in the city. also lie in the new industries that with the mainland, and that is and China in particular, AAA-rated Hong Kong is right at the Jardine Matheson. “But we must transient, this happened over a as China continues to grow at we are nurturing or the communi- quite an important aspect. In The city is fast becoming a hub never surrender our position as long period. If you understand a more or less breakneck pace, ties we are nurturing, including the past, bilateral trade was for product design, fashion, heart of the region. By Alejandro Reyes an international centre with a the strengths of London – it is not nearly double-digit every year. our education services, health mostly denominated, or wholly GETTY IMAGES filmmaking, music and television tremendous platform for doing in the eurozone but it is still the We are part of the nation and services, testing and certification, denominated, in US dollars. Now, A business in Asia and the world.” focal point of euro transactions in our prosperity is seen by our Chi- and innovation and technology. because of the strength of the E X P LO R E t a June reception ing on the China market. This tide ber, Standard & Poor’s accorded Benjamin Hung, executive di- Europe – then you would come to nese leaders as a significant part Those things are really part and renminbi, some of it is denomi- for new or expanded of arrivals has made Hong Kong the SAR what might be the most rector and CEO of Standard Char- the conclusion that it is because of the national growth, because parcel of Hong Kong’s plans, but nated in that currency. Remark- 14 foreign companies, the chief executive of Hong Kong raised a toast to thank the third largest recipient of FDI in 2010, behind the US and mainland China. All the more remarkable prized accolade any financial centre can receive when for the first time the agency gave it a top tered Bank, agrees. “Through the crisis, Asia has been a strong leg [in the global economy], with Greater of the critical mass of financial experts who live in London. Here in Asia, they live in Hong Kong. we are able to do things which the nation itself cannot do, and the services we provide cannot now they are being incorporated into our national plan because it is not only good for Hong Kong, ably, of all the trade conducted in renminbi by China last year, more than 90% was settled and cleared some 350 executives for having is that this surge is happening AAA sovereign credit rating, citing China the locomotive. This region Then there’s another part of be delivered by any other city in it is good for the nation if these in Hong Kong. confidence in the city. In 2010, against the backdrop of the worst its economic flexibility and strong is fundamentally very strong, with the infrastructure, this includes the country. For instance, as an strengths continue to grow stron- There are now about 800 Donald Tsang noted, foreign direct global economic crisis since the fiscal position. metrics that many countries covet. our networking throughout offshore centre for renminbi, ger over time. mainland firms established in investment (FDI) in the special ad- Great Depression. The nine months since the Here there is zero debt, a huge the world and our networking the provision of a common-law Hong Kong, many of them as re- It’s hard to match this city’s ministrative region (SAR) of China Noteworthy, too, is that just 14 upgrade have proven just how surplus, strong foreign currency in mainland China. We are the jurisdiction and the use of a You have invited more com- gional headquarters. On the Hong mix of ancient traditions and reached US$68.9 billion, 32% years ago Britain returned Hong resilient and robust Hong Kong’s reserves, high capital ratios and number one investor there. We are convertible currency, which is far panies from the mainland and Kong Stock Exchange there are 21st century lifestyle more than in 2009. In the first half Kong to China, raising among economy is. Its recovery from the banks that are not overleveraged.” the number one investor in each more important in a well-trusted several hundred. Mainland firms of this year, nearly 200 overseas the city’s people and the inter- global recession has been stellar. The growth of intra-Asian trade and every province in China. So, economy. Hong Kong provides all listed in Hong Kong have a total and mainland Chinese enterprises national community fears for its GDP growth in the first quarter and the rise of domestic consump- if people want to do business in of these things. OF ALL THE TRADE CONDUCTED capitalization of nearly 12 trillion set up or expanded their opera- future. Soon after the handover, of 2011 was a remarkable 7.5%, tion in China are going to drive China, the location from where to Hong Kong dollars, that’s about This supplement has been produced by Archimedia London Limited. tions in Hong Kong. “We want Hong Kong’s economy went into although in the second quarter significant new growth in the Hong enjoy the greatest experience will China’s latest five-year plan de- IN RENMINBI BY CHINA LAST £1 trillion. Over the years they It did not involve the reporting or you to stay and grow and prosper a tailspin as Asia suffered its own the pace of expansion moderated Kong economy, Mr Hung reckons. be Hong Kong. Another part of the infrastruc- votes a chapter to Hong Kong, what are the most significant YEAR MORE THAN 90% WAS have raised about HK$3 trillion in Hong Kong, this is what we can do editorial staff of The Times and no with us,” Mr Tsang told his guests. financial crisis. to 5.1%. The outlook for the short Yet Hong Kong and its leaders endorsement is implied. “Your success is our success.” Yet the future turned out and medium terms is good, despite are not simply sitting back and ture is our legal system which is aspects outlined in the plan? SETTLED AND CLEARED HERE. for them. Among those Mr Tsang wel- far better than even the most concerns about the direction of waiting for the rise of Asia and comed was Bob Guard, who just a optimistic of Hong Kong’s fortune the global economy. China to give it a boost. In addition week earlier had opened the new tellers predicted. Last Decem- China and its own fast-growing to deepening its integration with For information about working Hong Kong office of Wm Morrison, economy have, of course, been the mainland, Hong Kong is imple- with Archimedia, to discuss future publications, or to offer feedback on the UK’s fourth-largest supermar- the major factor in Hong Kong’s menting wide-ranging initiatives this Hong Kong report, please contact: ket chain making its first foray into healthy rebound. But it is not just such as education reform and in- hello@archimedia.uk.com or call Asia. The company chose Hong about the mainland. frastructure projects, including the Peter Drennan on 020 8442 8202, Kong because of its location at Chi- “Hong Kong is at the centre of development of a district devoted peter@archimedia.uk.com na’s doorstep, within easy flying the global market, with economic to arts and culture. Editor: Peter Drennan distance from all the main cities gravity shifting east towards “There is still quite a distinct Feature Directors: Caroline Steiner, in the region. “The availability of emerging Asia,” says Gregory So, difference between what we have Nicole Howarth diverse and high-calibre talent is Hong Kong’s secretary for com- achieved and stand for and our Reporter: John Maratheftis also an attraction,” said Mr Guard merce and economic develop- competitors around this region,” Photography: All original at the launch. “The ease of setting ment. “Mainland China will be the says Chief Executive Tsang. “Hong photography by Zoltan Vogronics up a company in a legal system key growth driver for the global Kong’s strengths are there. We www.zoltanvogronics.com very similar to the UK is another economy. Hong Kong is in the best have very resilient people who are (unless otherwise credited). important factor.” position to reap the benefits from totally free spirited and work very Design: Paul Lussier Location, talent pool, rule of the vibrant growth of Asia.” hard. They make a lot of demands www.paullussier.com law – these are among the three The China factor “is Hong on every aspect of city life, includ- factors most often cited by inves- Kong’s single most competitive ing the way in which the govern- Cover photo: The Po Lin Monastery tors who have flocked to Hong advantage,” says Anthony Night- ment is run,” he says. “There is a on Hong Kong’s Lantau Island Kong, mainly as a platform for tak- ingale, managing director of the continued search for excellence.”

- 3. A DV E RT I S I N G S U P P L E M E N T A DV E RT I S I N G S U P P L E M E N T 4 HONG KONG HONG KONG 5 we don’t want to forget about the rest capital and people.” multinationals based in Hong Kong of Asia. If you look at Indonesia for Hong Kong, traditionally associ- and while FDI is at record levels, example, they have over 260 million ated with the financial services and InvestHK’s Mr Galpin says there are people so you’re talking about big logistics sectors, is now focusing on a still some challenges. PROPERTY BOOM markets there too. First timers from range of new areas to attract foreign Perhaps the biggest of these is Europe and the US going into these investment including public health, to convince smaller, high-growth DEFIES TRENDS markets need to find a base and a green and renewable energy, creative companies from overseas that Hong reliable partner to help mitigate the industries such as graphic and prod- Kong is a suitable base. “Some smaller risks and better understand what it is uct design, and education – the public companies assume that Hong Kong is all about. In Hong Kong we practice school Harrow will open Hong Kong’s only for big multinationals, but in fact M common law, we have open and first international boarding school it is very easy to set up here and we any residential property markets around the transparent regulatory systems and next year. are beginning to get a lot of UK SMEs world are stagnating or seeing falling values, but we have a free flow of information, There are currently over 6,000 setting up offices”. one is showing that price recovery can take on spectacular dimensions – Hong Kong. Average house prices rose nine-fold in the 20 years before the Asian financial crisis of the late 1990s. They then fell back sharply, losing four-fifths of their value in three years (1999- 2001) and were buffeted further by the trauma of 9/11 and the THE ‘CHINA FACTOR’ outbreak of the SARS respiratory disease. But for the past seven years average prices have risen again, with increasing steepness, so that today they are only slightly below their 1998 peak. Estate agency Knight Frank calculates that luxury home prices in July reached HK$21,600 (£1,698) IS A KEY COMPETITIVE REALISING ITS ADVANTAGE per square foot, some 14% higher than just one year earlier. Rents for similar top-end homes reached HK$49 per square foot in July, about 12% more than in 2010. GATEWAY POTENTIAL Four factors underpin Hong Kong’s residential sector INVESTMENT Global survey shows the sentiment boom. Firstly, interest rates are at a historical low – base rate is just 0.5% – encouraging borrowers wishing to buy. Secondly, and related, investment sentiment about the HK of major corporations. By Helen Jones economy is optimistic. W H A third factor is that established demand for homes has ECONOMY Hong Kong is China’s biggest trading hile Hong Kong’s econ- been boosted by more mainland Chinese buyers than ever ong Kong’s status within most importantly, its location. omy is surging thanks to seen before. They now account for some 30% of all sales, and the global economy is “Hong Kong is at the centre of China’s rise in the global partner and helps fuel the mainland’s growth via a two- this is expected to rise further in the near term. reflected in its record high East Asia. If you want to access op- marketplace, the main- “Expats prefer traditional areas such as Mid-levels and ranking as the third largest portunities elsewhere in the region land’s fast growth is in large measure way investment channel. By Alejandro Reyes Southside. Investors like traditional areas for yield returns and recipient of global FDI flows.” then no other city can cover so many fuelled by investment coming from or newly emerging areas for capital growth - Kowloon Station or Simon Galpin, director-general of In- business centres –Shanghai, Beijing, through Hong Kong. Central. Mainlanders are attracted by luxury developments, vestHK, Hong Kong’s department of Singapore or Kuala Lumpur – so eas- On a visit to Hong Kong in August, the city’s confidence after having weath- not to depend too much on reaping the mostly Kowloon. They often buy trophy assets for occasional foreign direct investment, has much ily from one location.” Chinese Vice Premier Li Keqiang an- ered the global economic crisis well. In benefits of the two-way flow of business use,” explains Simon Smith of estate agency Savills. to feel good about. Last year, for the But perhaps Hong Kong’s great- nounced a slew of measures meant to response to the crisis, Beijing made it even and investment. Just as Hong Kong’s A fourth factor is that there is a limited supply of homes first time, Hong Kong trailed only the est advantage is the “China factor,” bolster the city’s economy and deepen its easier for mainland residents to travel to manufacturing sector hollowed out in being built annually compared to the number of buyers; the US and China as a recipient of FDI. its unrivalled relationship with the integration with the mainland. Among Hong Kong, sped up cross-border infra- the 1980s after the mainland opened its Hong Kong Housing Authority says new housing supply is According to the United Nations Con- mainland. them: plans to strengthen Hong Kong’s structure projects, and fast-tracked the doors and promoted economic zones forecast to be 13,000 units a year until 2016, with demand at ference on Trade and Development “We have been trading with the role as the main offshore renminbi growth of offshore renminbi business. along its coast, the SAR’s service indus- least 20% above. World Investment Report 2011, FDI rest of the world for over 100 years, centre and make it easier for companies By the end of July, 616 mainland tries could follow suit, unless it works This demand-supply imbalance is key, explains Denise hit a record HK$537 billion (US$68.9 but at the same time we were the first registered in the Special Administrative enterprises were listed on the Hong Kong to maintain its competitive advantages, Yam of Morgan Stanley’s Greater China economics team. She billion) up 31.5% from 2009. to go into mainland China the mo- Region (SAR), including the local units of Stock Exchange, accounting for 42% of focuses on developing cutting-edge busi- says: “The government responded to the Asian financial crisis “With Hong Kong positioned at ment it opened in 1979 which means foreign enterprises, to expand their busi- all listed companies in the SAR and 55% nesses and climbs up the value chain. and asset market correction in the late 1990s with a massive the heart of Asia and as the gateway to that we are the only place with over ness in the mainland. of the total market capitalization. The To this end, in 2009, Hong Kong shrinkage in housing supply. This supply has not been revived China, it is clearly benefiting from the 30 years’ experience in dealing with With Hong Kong’s GDP growth hum- mainland is Hong Kong’s biggest trading Chief Executive Donald Tsang identified again in reaction to the recovery in the Hong Kong economy, shift in economic interest to the east,” the mainland,” says Margaret Fong, ming along at more than 5% this year, partner, with two-way trade exceeding six industries as potential growth en- the improvement in investment sentiment, and the increased Mr Galpin adds. deputy executive director of the Hong the package of initiatives was widely $230 billion in 2010. Half of China’s out- gines: education, medical services, green southward flow of consumption and investment.” Businesses seem to think so. Kong Trade Development Council. viewed not as any sort of urgent rescue ward direct investment either originated industries, innovation and technology, So is Hong Kong’s current residential market boom In a survey commissioned this This, she says, gives Hong Kong a programme but as solid evidence of in Hong Kong or went through Hong cultural and creative industries and test- just a bubble, likely to burst soon? No, according to Colin year by the global property consul- unique perspective: “For someone Beijing’s support for the SAR’s role as Kong to other parts of the world. ing and certification. The latter alone Fitzgerald, managing director of Knight Frank’s Greater tancy CB Richard Ellis, Hong Kong from a different culture it would be an international financial, shipping and “It is very important that the contributed $653 million to the Hong China team. “The possibility of a significant drop is slim, ranks as the most popular location difficult even to know where to start, trading centre and the central govern- world understands that Hong Kong is Kong economy in 2009, up from $577 although sales volumes are likely to for global business with 68.2% of the who to talk to and what you are ment’s intention to strengthen coop- international, that we serve not just the million the year before. be lower in the short term amid cur- world’s major companies having a looking for. This is the Hong Kong eration, in particular by helping Hong mainland market but very much the “Even in a financial tsunami, we rent stock market volatility and the presence in the city as a regional hub. advantage; we understand both Skyscrapers Kong’s emerging industries extend their Asian market and, for the mainland, we experienced growth in that industry,” dominate the limited government’s determination to curb “Hong Kong is attractive to markets and we have the talent business in the mainland. serve the world,” Ms Fong says. notes Gregory So, Hong Kong’s secretary land for building. the property price surge.” international businesses due to its already trained in both.” “The China factor certainly is Hong Hong Kong’s critical challenge is for commerce and economic develop- location, lack of foreign ownership Among the companies to have Kong’s competitive advantage be- ment. “This industry assures overseas restrictions and its international and benefited from Hong Kong’s exper- cause the whole world is looking at the buyers of the quality and safety of prod- highly skilled workforce. It is the key tise, Ms Fong says, is L’Occitane, the mainland,” says Margaret Fong, deputy ucts sourced in the region.” city for accessing China and is set to French skincare brand which started executive director of the Hong Kong Mr So believes that as China adopts benefit most from the gradual liber- with a handful of shops in Hong Trade Development Council. “What is testing and certification standards and alisation of the Chinese financial-ser- Kong – it now has 22 there and 71 in less well known is that while Hong Kong requires systems to enforce them, Hong vices market,” says CBRE’s director of mainland China as of July. “Some 22.7 has benefited enormously from having Kong professionals can be at the fore- research, Edward Farrelly. million mainland tourists visit us and mainland China as our hinterland market, front of providing them. Hong Kong’s success, Mr Galpin they see quality goods here. Once a the mainland has also been the major des- By promoting these emerging indus- adds, is founded on its long-estab- brand is successful here, they go to tination for our investment for 30 years.” tries and strengthening its advantages in lished reputation as a global ship- the mainland and it takes off. This Hong Kong is the number one inves- education and infrastructure, Hong Kong ping, trade and financial centre, its applies to all lifestyle brands.” tor in the mainland – over US$492 can maintain its competitiveness not just infrastructure, its transport links, its But Ms Fong says that Hong billion by the end of June, or 44% of as a gateway for China but as the thriv- ability to attract talented individuals Kong’s appeal goes beyond its rela- China’s total foreign direct investment. ing service economy it already is, with from around the world, its entre- tionship with China. That mutual benefit is fuelling Hong capabilities beyond its tried and tested preneurial spirit and its legal system “We want to think of Hong Kong Kong’s economic surge and is renewing competencies in financial services. based on common law, but perhaps as Asia’s international business hub,

- 4. A DV E RT I S I N G S U P P L E M E N T A DV E RT I S I N G S U P P L E M E N T 6 HONG KONG HONG KONG 7 A GLOBAL LEADER FOR RAISING CAPITAL CURRENCY Used increasingly for trade settlement, China’s yuan is on the road to full convertibility. ROBUST RENMINBI IPOS City emerges as a major player in the highly Prof. Chan points to other reasons There is also the size and depth of And Chinese companies are likely why Hong Kong will continue to at- the Hong Kong market which, largely to continue seeking a Hong Kong IPO competitive market for fundraising by international tract international IPOs: its role as the because of the number of Chinese as a stepping stone to expanding into GAINS WORLD’S companies, writes Jonathan Gregson premier financial centre for Asia and for China, confidence in its financial companies that have launched IPOs and are listed there, means that global markets, especially now that the “China Gap” – the difference between I regulation, a legal tradition based on capital markets – including the stock Hong Kong and the mainland in terms ACCEPTANCE n recent years Hong Kong’s stock less, big names like the Italian luxury English common law and widespread market – are many times larger than of the pricing of the renminbi, corpo- exchange has become a global goods group Prada, US luggage-maker use of English. These are, he says, “the would be needed for the size of the rate governance, transparency and leader for companies seeking to Samsonite and Rusal – the world’s larg- fundamental strengths of Hong Kong.” local economy. accounting standards – is narrowing. raise new capital through initial est aluminium producer and the first A public offerings, or IPOs. Much of this Russian company to choose Hong Kong t an April summit on the middle of 2010 has been new business has traditionally come – all launched their IPOs. the Chinese island remarkable. In the first quarter from mainland Chinese enterprises The rationale for choosing a Hong of Hainan, the lead- of 2011, China’s cross-border seeking a Hong Kong listing, yet over Kong listing varies from one company ers of the informal trade settlement amounted to the past 18 months more internation- to the next, but most cite their interest group of countries known as RMB360 billion (£35.1 billion), al companies, including global brands in raising their corporate profile in key the BRICS – Brazil, Russia, or 7% of the total, up from 5% in such as Prada and Samsonite, have markets (namely China), along with India, China and South Africa – the previous quarter. Banking chosen Hong Kong over local bourses. confidence in Hong Kong’s regulation agreed to conduct more of their giant HSBC expects more than “We have had more IPOs than any and financial infrastructure, its open- trade in their own currencies. half of China’s total trade with other market for two years in a row,” ness to free markets, and the potential While this accord may have emerging markets to be settled says Prof. K.C. Chan, Hong Kong’s Sec- price premium for their shares com- REUTERS been more symbolic than sub- in renminbi within the next retary for Financial Services and the pared with the other main IPO markets. stantive, it is likely to promote two to four years. By the end Treasury, adding that the total market Prada shares were priced at 28 the growing use of the Chinese of August, RMB88 billion in is “quite instrumental” to developed to such a stage that expected to reach RMB1 trillion value of companies listed on the times forecast earnings – a premium to with a RMB6 billion issue. renminbi in trade settlement, bonds had been issued in Hong China’s strategy of allowing its the internationalisation of its by the end of this year. This exchange is nearly 10 times larger than their peer group – raising US$2.6 bil- China’s plans to establish especially by countries with Kong this year, data gathered by enterprises [to] go global as a currency is an inevitable event,” rapid growth has opened the Hong Kong’s gross domestic product. lion (£1.6 billion), though most went to Shanghai as an international which China is the biggest trad- Thomson Reuters indicate. way for them to become more explains He Guangbei, vice way for the introduction of an Last year saw a record 114 compa- institutional investors as local take-up financial centre by 2020 suggest ing partner or in which it is the According to Charley competitive at home, especially chairman and chief executive increasing range of renminbi- nies raising HK$445 billion (£35.2 was lukewarm. Samsonite’s US$1.25 that Beijing aims to achieve largest investor. Song Lin, chairman of China as the Chinese economy opens of Bank of China (Hong Kong). denominated investment ve- billion) on the HKSE, according billion IPO was launched in a market full convertibility of the yuan The expansion of offshore Resources (Holdings) Co., further to foreign participation. “Without it, development of hicles in Hong Kong, including to accountancy group Pricewater- that was 5% off over the month and, by then. For that to happen, renminbi business since internationalising the RMB “The Chinese economy has the Chinese economy may an increasing number of debt houseCoopers, which predicted that although priced at the lower end of the “the internationalisation of the be confined.” More and more issues, now widely referred to Hong Kong would be among the top anticipated range on a price/earnings renminbi is a must because you Chinese businesspeople will use as “dim sum” bonds. IPO rankings again in 2011, although ratio of 18, still fell sharply on the first would need to have internation- renminbi when they go abroad Hong Kong “can act as a test overall volumes would be down as part day of trading. Similarly, Glencore’s al recognition before it could to invest, Mr He predicts. “This ground for internationalisation of the current global trend. secondary listing in Hong Kong has become the third reserve cur- provides us with a lot more busi- of the renminbi,” because it is But it is the emergence of Hong been trading below its debut price. rency,” says Peter Wong, chair- ness opportunities.” an established international Kong as a major player in the intense- But then the same has been true man of HSBC Bank (China) Expanding the use of the financial centre and has the ly competitive market for fundraising of recent IPOs launched in London Co. Global financial conditions renminbi for trade settle- necessary infrastructure, Bank by global corporations – where it and New York. As Norman Chan, CEO indicate that the time is right ment and foreign investment of China’s Mr He says. has been winning market share from of the Hong Kong Monetary Author- for this logical step. “Because is essential to driving the Adds Benjamin Hung, more established centres like London ity, notes, the pricing depends on the of the depreciation of the US global liquidity of the currency executive director and CEO and New York – that is focusing the “prevailing sentiment of the time,” dollar and the financial issues that is needed to support full of Standard Chartered Bank: attention of both CEOs and the in- while he is proud that “there were no that Europe is facing, suddenly convertibility, a long-term goal “Hong Kong serves as both vestment banks that advise them. In hiccups” because the market infra- it looks like China is coming up,” of China. For the renminbi to experimental ground and a the first half of this year, capital raised structure was there. “The payment Mr Wong notes. be fully convertible, it has to firewall. We run trials, and if by foreign companies on the HKSE system, the cheque clearing, electronic Renminbi deposits in Hong be widely traded around the the outcomes are less than reached HK$105.5 billion, equivalent subscription, everything worked ac- Kong shot up from less than world, used by Chinese to make ideal, we change. Hong Kong to more than half of the total proceeds cording to plan,” – even with a totally RMB50 billion at the end of investments overseas and by has a unique role that no other raised on the exchange. new product such as the first IPO 2009 to over RMB400 billion foreign investors inside China, geography can take on.” But the extreme volatility of global denominated in China’s renminbi. at the end of 2010. They are and held as a reserve currency markets over the summer has forced by central banks. some international companies, like The size and depth of the Hong Hong Kong is playing a cen- US accessory group Coach or fash- Kong market has been greatly tral role in the RMB’s interna- THINK ASIA, ion house Jimmy Choo, to postpone boosted by the number of Chinese tionalisation. Seven years ago, Hong Kong THINK HONG KONG plans for Hong Kong IPOs. Nonethe- companies that have listed there. monetary authorities began The Hong Kong Trade Development Council is or- allowing individuals to hold ganising a major Hong Kong promotion – “Think renminbi bank deposits. About 18 months later, corporations Asia, Think Hong Kong” – in London, Leeds and were allowed to do so. In July Edinburgh this week. More than 40 Hong Kong 2007, with the green light from partners and British organisations will take part in the Chinese Central Bank, the week-long event, the focal point of which is a China Development Bank is- symposium and series of seminars bringing togeth- sued the first renminbi-denom- er business leaders to discuss trends and business inated bonds in Hong Kong, opportunities across Asia. In addition, HKTDC will totalling RMB5 billion. The run a separate forum in Cambridge for Hong Kong Bank of China and other main- and British businesses in the technology sphere. land commercial banks fol- The Hong Kong Tourism Board too will host a lowed. Two years later, HSBC street carnival and a food and wine promotion and issued RMB1 billion in bonds to institutions, while the Bank of will be working with the Hong Kong Film Develop- East Asia sold bonds retail. In ment Council and the British Film Institute to October 2009, China’s Finance showcase Hong Kong cinema in London. Ministry launched its first sale To find out more about ‘Think Asia, Think Hong of sovereign renminbi bonds Kong’ visit www.thinkasiathinkhk.com