PGSI's shares offer a unique risk/reward scenario

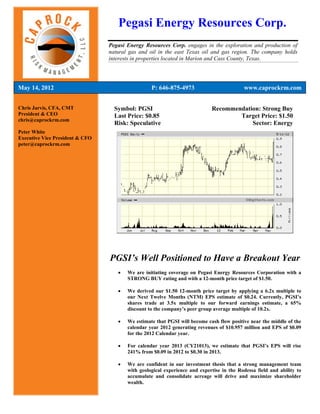

- 1. Pegasi Energy Resources Corp. Pegasi Energy Resources Corp. engages in the exploration and production of natural gas and oil in the east Texas oil and gas region. The company holds interests in properties located in Marion and Cass County, Texas. May 14, 2012 P: 646-875-4973 www.caprockrm.com Chris Jarvis, CFA, CMT Symbol: PGSI Recommendation: Strong Buy President & CEO Last Price: $0.85 Target Price: $1.50 chris@caprockrm.com Risk: Speculative Sector: Energy Peter White Executive Vice President & CFO peter@caprockrm.com PGSI’s Well Positioned to Have a Breakout Year We are initiating coverage on Pegasi Energy Resources Corporation with a STRONG BUY rating and with a 12-month price target of $1.50. We derived our $1.50 12-month price target by applying a 6.2x multiple to our Next Twelve Months (NTM) EPS estimate of $0.24. Currently, PGSI’s shares trade at 3.5x multiple to our forward earnings estimate, a 65% discount to the company’s peer group average multiple of 10.2x. We estimate that PGSI will become cash flow positive near the middle of the calendar year 2012 generating revenues of $10.957 million and EPS of $0.09 for the 2012 Calendar year. For calendar year 2013 (CY21013), we estimate that PGSI’s EPS will rise 241% from $0.09 in 2012 to $0.30 in 2013. We are confident in our investment thesis that a strong management team with geological experience and expertise in the Rodessa field and ability to accumulate and consolidate acreage will drive and maximize shareholder wealth.

- 2. Caprock Risk Management, LLC 5/14/2012 Investment Summary We are initiating coverage on Pegasi Energy Resources Corporation with a STRONG BUY rating and with a 12-month price target of $1.50. We believe PGSI’s shares offer investors a unique and favorable risk/reward profile for the following three reasons: “Initiating coverage with a 1) PGSI’s management team has a long track record of success operating in STRONG BUY East Texas, specifically the Rodessa field, dating back to the early 1980’s. In rating, 12- addition, PGSI’s management has been focused extensively on the “Corner month price target of $1.50” Stone” project for over a decade now and long before PGSI became a public entity. We believe the years of experience and intimate knowledge that management brings to the table is on the cusp of bearing fruits for PGSI investors, which starts with the company’s first horizontal well that is expected to be completed by June. 2) In the Rodessa field of East Texas, where PGSI operates, ownership of mineral leases is highly fragmented. As a result, major E&P companies have avoided the area given the difficultly of acquiring acreage. This creates high barriers of entry for PGSI’s competitors and with PGSI the leading E&P in the Rodessa field in terms of acreage by a decent margin, we believe the company will continue to increase its leading acreage position, consolidating difficult leaseholds into one package. As PGSI unlocks this value through consolidation, we believe the company’s acreage portfolio alone will become “PGSI’s of significant value for a major E&P in the near future. In short, PGSI is in fundamentals the sweet spot of the Rodessa field; not too big that the highly fragmented and current leases are non-material to the company’s business model and big enough to valuation offers be the leading acreage acquirer. investors a unique and 3) PGSI’s shares are currently trading at a deep discount to its peer group favorable average valuation as the company has flown under the radar for most risk/reward institutional and individual investors. However, we believe the successful scenario” completion of the company’s first horizontal well in the coming weeks with three similar projects behind it slated to roll out over the next 12-to-18 months provides investors seeking exposure to the energy space a favorable risk/reward scenario. In summary, we are confident in our investment thesis that a strong management team with geological experience and expertise in the Rodessa field and ability to accumulate and consolidate acreage will drive and maximize shareholder wealth. We believe at current levels, PGSI’s shares are attractive, underpinning our STRONG BUY rating. Risks Geopolitical Risks. In our opinion, geopolitical risks remain elevated, especially with events out of the Middle East and North Africa. The “Arab Spring” has brought wide scale upheaval in the region. We believe these pressures coupled with Iran’s quest to become nuclear will intensify as we head into the second half of the year, which should 2

- 3. Caprock Risk Management, LLC 5/14/2012 drive volatility in the energy markets. Given the fact that PGSI’s operations are domestic, any potential impact of international instability should be mitigated. Volatility. Although PGSI has roughly 54 million shares outstanding, the shares 3-month average trading volume per day is 37k. The relatively low level of liquidity could “Geographical increase share price volatility. focus mitigates much of the Correlation to Energy Prices. PGSI’s operating results are correlated to U.S. energy global prices. Given the elevated geopolitical risks and global macroeconomic cross currents in geopolitical 2012, energy prices are expected to be volatile. The company does not have a risk risk” management program in place but following the completion of the Morse #1 well, we believe management will institute a hedge program when appropriate. Common Stock is subject to the “Penny Stock” rules and quotations are based on the “Pink Sheets”. Currently, the Company’s common stock is subject to the “Penny Stock” rules of the SEC, and the trading market is limited. Common stock is currently traded based upon quotations over the counter and the bid and ask prices for the Company’s stock could have wide fluctuations. Valuation We derived our $1.50 12-month price target by applying a 6.2x multiple to our Next Twelve Months (NTM) EPS estimate of $0.24. Currently, PGSI’s shares “We believe our trade at 3.5x multiple to our forward earnings estimate, a 65% discount to the multiple is company’s peer group average multiple of 10.2x (peer group below). In our conservative opinion, the NTM EPS estimate is the appropriate metric to use considering the and as completion of the Morse #1 well in the coming months as well as the completion management of a second horizontal well before the end of the calendar year. Given this, using executes PGSI’s NTM will capture the company’s true earnings power going forward. growth strategy over the next PGSI’s Peer Group: 12-24 months, multiple expansion is S/O Market Cap likely, or closer Symbol Symbol Last (000's) EPS PE (mil) to the PGSI’s Spindletop O&G SPND $2.00 7,661 $0.23 8.70x $15.3 peer group Pyramid Oil C o PDO $4.45 4,684 $0.23 19.35x $20.8 multiple of C KX Lands, Inc C KX $12.01 1,942 $0.49 24.51x $23.3 Earthstone Energy ESTE $20.00 1,707 $1.73 11.56x $34.1 10.2x” PostRock Energy C orp PSTR $2.30 12,269 $2.29 1.00x $28.2 Mesa energy MSEH $0.17 80,874 $0.06 2.75x $13.3 C allon Petroleum C o C PE $5.11 39,444 $2.75 1.86x $201.4 Trans Energy TENG $2.30 12,980 $0.70 3.29x $29.9 Texas Vanguard Oil TVOC $11.75 1,417 $0.82 14.33x $16.6 Energy Partners, LTD EPL $15.25 39,233 $1.06 14.39x $598.3 Peer Group Average 10.17x NTM Pegasi Energy Resources Corp $0.85 54,200 $0.24 3.54x $46,070.00 Prem/(Disc) -65% Source: Thomson First Call, CRM Estimates 3

- 4. Caprock Risk Management, LLC 5/14/2012 We derived our 6.2 price-to-earnings multiple by applying a high growth firm multi-stage P/E model using the following assumptions: Assumptions: 5-year growth rate: 20% Post 5-year growth rate: 8% Assigned Beta 1.8 (High beta reflects drilling execution risk) Dividend payout first 5-years: 0% Dividend payout post 5-years: 15% “We expect Discount rate: 11.76% (equivalent to PV-10 discount rate) PGSI to turn cash flow = Price-to-earnings multiple: 6.2x. positive by the middle of the year with Oil Revenue driving Earnings Outlook growth and We estimate that PGSI will become cash flow positive near the middle of the earnings over calendar year 2012 generating revenues of $10.957 million and EPS of $0.09 for the next 12-to- the 2012 Calendar year (CY2012). Our estimates for CY2012 are based on the 18 months.” company’s existing production and the completion of Morse #1 well within the next 60-days and successful drilling and completion of Morse #2 well in the 3Q2012. For calendar year 2013 (CY21013), we estimate that PGSI’s EPS will rise 241% from $0.09 in 2012 to $0.30 in 2013. Our CY2013 estimates are based on the company drilling an additional 2 horizontal wells during the 2013 calendar year. Given managements aggressive growth strategy, we believe our estimates will likely be conservative if PGSI’s management is successful in raising additional capital to accelerate the company’s drilling and production goals over the next 24-months. 4

- 5. Earnings Model Pegasi 100 100 100 100 100 100 100 100 100 100 100 100 100 100 100 100 100 Earnings Model 2.50 2.30 2.15 2.32 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.50 2.75 2.42 2.18 31 29 31 30 30 31 30 30 31 31 30 31 31 30 31 31 365 De scription Jan-12 Fe b-12 Mar-12 1Q 2012E Apr-12 May 2012 Jun-12 2Q 2012E Jul-12 Aug-12 Se p-12 3Q 2012E O ct-12 Nov-12 De c-12 4Q 2012E 2012E Revenues T otal Oil Revenues $ 34,100 $ 31,727 $ 33,731 $ 99,558 $ 32,466 $ 33,366 $ 1,074,614 $ 1,140,446 $ 1,031,061 $ 957,509 $ 1,903,164 $ 3,891,734 $ 1,824,251 $ 1,637,760 $ 1,570,137 $ 5,032,147 $ 10,163,885 T otal Gas Revenues 24,878 20,875 20,338 66,091 17,851 17,985 37,850 73,686 37,087 35,190 53,184 125,461 51,705 58,878 63,036 173,619 438,858 Condensate & Skim Oil 4,500 4,500 4,500 13,500 4,500 4,500 4,500 13,500 4,500 4,500 4,500 13,500 4,500 4,500 4,500 13,500 54,000 T ransportation & Gathering 25,000 25,000 25,000 75,000 25,000 25,000 25,000 75,000 25,000 25,000 25,000 75,000 25,000 25,000 25,000 75,000 300,000 Total Re ve nue s 88,478 82,102 83,569 254,149 79,817 80,851 1,141,964 1,302,632 1,097,648 1,022,199 1,985,848 4,105,695 1,905,456 1,726,138 1,662,673 5,294,267 10,956,743 COGS 28,240 26,487 26,891 81,618 25,859 26,143 317,949 369,951 305,762 285,014 550,017 1,140,793 527,909 478,597 461,144 1,467,650 3,060,012 Gross Profit Margin 60,237 55,615 56,679 172,531 53,958 54,708 824,015 932,681 791,885 737,185 1,435,831 2,964,902 1,377,546 1,247,541 1,201,529 3,826,616 7,896,730 Operating Expenses General & Administrative 170,833 170,833 170,833 512,500 170,833 170,833 170,833 512,500 170,833 170,833 170,833 512,500 170,833 170,833 170,833 512,500 2,050,000 Sales & Marketing 10,000 10,000 10,000 30,000 10,000 10,000 10,000 30,000 10,000 10,000 10,000 30,000 10,000 10,000 10,000 30,000 120,000 Miscellaneous 2,500 2,500 2,500 7,500 2,500 2,500 2,500 7,500 2,500 2,500 2,500 7,500 2,500 2,500 2,500 7,500 30,000 Total O pe rating Expe nse s 183,333 183,333 183,333 550,000 183,333 183,333 183,333 550,000 183,333 183,333 183,333 550,000 183,333 183,333 183,333 550,000 2,200,000 EBITDA (123,096) (127,718) (126,655) (377,469) (129,375) (128,625) 640,682 382,681 608,552 553,852 1,252,497 2,414,902 1,194,213 1,064,208 1,018,195 3,276,616 5,696,730 He dging & O the r De rivative s - - - - - - - - - - - - - - - - - - Inte re st Expe nse 55,000 55,000 55,000 165,000 55,000 55,000 55,000 165,000 55,000 55,000 55,000 165,000 55,000 55,000 55,000 165,000 660,000 De pre ciation & Amortiz ation 25,000 25,000 25,000 75,000 25,000 25,000 25,000 75,000 25,000 25,000 25,000 75,000 25,000 25,000 25,000 75,000 300,000 Ne t Income Be fore Taxe s (203,096) (207,718) (206,655) (617,469) (209,375) (208,625) 560,682 142,681 528,552 473,852 1,172,497 2,174,902 1,114,213 984,208 938,195 3,036,616 4,736,730 Tax Expe nse (2012 tax rate 0%) - - - - - - - - - - - - - - - - - Ne t Income (203,096) (207,718) (206,655) (617,469) (209,375) (208,625) 560,682 142,681 528,552 473,852 1,172,497 2,174,902 1,114,213 984,208 938,195 3,036,616 4,736,730 Earnings Pe r Share ($) (0.00) (0.00) (0.00) (0.01) (0.00) (0.00) 0.01 0.00 0.01 0.01 0.02 0.04 0.02 0.02 0.02 0.06 0.09 Share s O utstanding (in 000's) 54,220 54,220 54,220 54,220 54,220 54,220 54,220 54,220 54,220 54,220 54,220 54,220 54,220 54,220 54,220 54,220 54,220 % of Total Revenue Revenues Total Oil Revenues 39% 39% 40% 39% 41% 41% 94% 88% 94% 94% 96% 95% 96% 95% 94% 95% 93% Total Gas Revenues 28% 25% 24% 26% 22% 22% 3% 6% 3% 3% 3% 3% 3% 3% 4% 3% 4% Condensate & Skim Oil 5% 5% 5% 5% 6% 6% 0% 1% 0% 0% 0% 0% 0% 0% 0% 0% 0% Transportation & Gathering 28% 30% 30% 30% 31% 31% 2% 6% 2% 2% 1% 2% 1% 1% 2% 1% 3% Total Revenues 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% COGS 32% 32% 32% 32% 32% 32% 28% 28% 28% 28% 28% 28% 28% 28% 28% 28% 28% Gross Profit Margin 68% 68% 68% 68% 68% 68% 72% 72% 72% 72% 72% 72% 72% 72% 72% 72% 72% Operating Expenses General & Administrative 193% 208% 204% 202% 214% 211% 15% 39% 16% 17% 9% 12% 9% 10% 10% 10% 19% Sales & Marketing 11% 12% 12% 12% 13% 12% 1% 2% 1% 1% 1% 1% 1% 1% 1% 1% 1% Miscellaneous 3% 3% 3% 3% 3% 3% 0% 1% 0% 0% 0% 0% 0% 0% 0% 0% 0% Total Operating Expenses 207% 223% 219% 216% 230% 227% 16% 42% 17% 18% 9% 13% 10% 11% 11% 10% 20% EBITDA -‐1 39% -‐1 56% -‐1 52% -‐1 49% -‐1 62% -‐1 59% 56% 29% 55% 54% 63% 59% 63% 62% 61% 62% 52% Hedging & Other Derivatives Interest Expense 62% 67% 66% 65% 69% 68% 5% 13% 5% 5% 3% 4% 3% 3% 3% 3% 6% Depreciation & Amortization 28% 30% 30% 30% 31% 31% 2% 6% 2% 2% 1% 2% 1% 1% 2% 1% 3% Net Income Before Taxes -‐2 30% -‐2 53% -‐2 47% -‐2 43% -‐2 62% -‐2 58% 49% 11% 48% 46% 59% 53% 58% 57% 56% 57% 43% Tax Expense (2012 tax rate 0 %) 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% Net Income -‐2 30% -‐2 53% -‐2 47% -‐2 43% -‐2 62% -‐2 58% 49% 11% 48% 46% 59% 53% 58% 57% 56% 57% 43% Source: Company Data, CRM Estimates

- 6. Caprock Risk Management, LLC 5/14/2012 Company Overview Pegasi Energy Resources Corporation (“PGSI”) is a Nevada corporation that is headquartered in Tyler Texas with operations in Jefferson and properties in Cass and Marion counties (see PGSI’s Acreage & Operations Map below). The Rodessa oilfield extends from western Louisiana across the southeastern corner of Cass County and into the northeastern corner of Marion County both Cass and Marion counties are part of the Rodessa oil field. “PGSI’s The company’s strategy is to maximize shareholder wealth by focusing on low-risk management (geological) profile production by targeting crude and natural gas exploration and team has a long production (E&P) adjacent to existing or indicated producing areas within the Rodessa oil and successful field. Pegasi’s management team refers to this strategy as the “Cornerstone Project” and track record in has a deep understanding of the Rodessa oil field as well as a long operating history of East Texas, success dating back to 1980. Furthermore, and dating back to the early 1930’s, the specifically the Rodessa oil field has been operated by small independent companies given the fact that Rodessa field.” acreage is highly fragmented, which has created high barriers to enter for major oil companies looking to acquire large blocks of acreage. We believe Pegasi’s successful operating track record in the Rodessa oil field since 1980 coupled with the company’s ability to acquire and consolidate acreage through a strong communal footprint in Cass and Marion counties provides investors seeking exposure to domestic onshore exploration and production of crude oil and natural gas with a unique opportunity. Pegasi’s Acreage and Operations Map Source: EIA, Company Data 6

- 7. Caprock Risk Management, LLC 5/14/2012 East Texas History Operating History (2000-2007): PGSI’s management team began operations in early 2000 by acquiring leases in the Rodessa field in East Texas. Management’s first leasehold purchase was roughly 1,500 gross acres (PGSI currently holds roughly 30,000 gross acres to date, representing management’s successful track record for consolidating acreage in a geographical location that is highly fragmented). “PGSI’s current growth In December 2002, management formed First Southern Crown, Ltd, a Texas limited strategy, the liability partnership, to be a holding company for several operating entities. Management Cornerstone rolled up their personal investment of $3.5 million for data harvesting and acreage Project, began acquisition for the Cornerstone Program into First Southern Crown. over 10-years ago and is ready PGSI’s History (2007-Current): In December 2007 while operating under a company to bear fruit for named Maple Mountain Explorations, a Nevada corporation, Maple Mountain entered PGSI into a share agreement with Pegasi Energy Resources Corporation to acquire all of shareholders.” PGSI’s outstanding shares. This transaction would also include the folding in of First Southern Crown’s subsidiaries into Pegasi. From 2000-to-date, the company has successfully drilled 12 productive wells, of which 8 remain producing. Historically, the company’s exploration and production has been predominantly for natural gas. However, PGSI recently completed drilling the Morse Unit #1-H horizontal well that will transform and diversify the company’s existing production profile from natural gas to oil, a significant new direction for the company. This well is scheduled to be completed in June Company Management We believe PGSI’s founders and principals have a long and successful track record operating in East Texas, specifically the Rodessa oil field that dates back over 30 years. PGSI’s Mike Neufeld, CEO, and Bill Sudderth, Executive Vice President, have been partners since the early 1980’s. Mike Neufeld is a geologist with over 40 years of experience exploring and developing natural gas and oil in East Texas. Bill Sudderth is a well-seasoned land man with over three decades of experience in East Texas. Collectively, both have worked together to drill over 300 wells in Texas and Louisiana, mainly in East Texas. In our opinion, PGSI shares, underpinned by a strong management and operating team, provides a unique investment for investors seeking exposure to domestic onshore exploration and production of natural gas and oil. Below, we have highlight PGSI’s management biographies: Michael H. Neufeld Insider Ownership (Shares) President, CEO and Director 22,970,253 Mr. Neufeld worked for Pennzoil Company from 1972 to 1976 as Development Geologist, Exploration Geologist and Senior Geologist working in Pennzoil's Gulf Coast 7

- 8. Caprock Risk Management, LLC 5/14/2012 Division. He then joined American Resources Company from 1976 to 1977 as Senior Geologist. In 1977 he joined Hunt Oil Company as Sr. Geologist working in the Texas and Gulf Coast regions. From 1978 to 1981, Mr. Neufeld worked for Croftwood Corporation as Senior Exploration Geologist and Vice-President of Exploration working in the Gulf Coast of Louisiana and Texas. In 1983 Mr. Neufeld co-founded SMK Energy, where exploration efforts were concentrated in East Texas, Gulf Coast Louisiana and the Rocky Mountains. He graduated from Louisiana State University in 1971 with a B.S. Degree in Geology. Bill L. Sudderth Insider Ownership (Shares) Executive Vice President 22,895,252 Mr. Sudderth began his career at Lone Star Producing Company in 1970 where he worked through 1971. In late 1971 he joined Midwest Oil Corporation and worked there until 1974, at which point he became an independent landman working the entire continental United States. In 1981 Mr. Sudderth became a Certified Professional Landman. In 1983 Mr. Sudderth co-founded SMK Energy Corporation, along with Mr. Neufeld, which later merged with Windsor Energy in 1997. Mr. Sudderth received his B.B.A. Degree from Sam Houston State University in 1970. Billy Denman Insider Ownership (Shares) Land Manager - Mr. Denman has over 25 years of industry expertise and currently serves as Pegasi “The Energy Resources Corp's Land Manager. Mr. Denman became a certified professional Cornerstone Landman in 1992, and previously worked with Mr. Neufeld and Mr. Sudderth at SMK Project is Energy. Mr. Denman received his B.A. Degree from Texas Tech University. diversifying the PGSI’s assets Cornerstone Project into Oil as well as becoming the company’s PGSI’s Cornerstone Project targets resources in and adjacent to existing/indicated revenue and producing regions of the Rodessa field and slightly north of the Rodessa fault located in earnings growth Cass and Marion counties. The Rodessa field was discovered on August 3, 1930 with the driver.” first discovery oil well completed on July 7, 1935. The Rodessa field’s peak production was in 1936 when over 19 million barrels of oil were produced. Since the original discovery and production efforts, the Rodessa field has produced over 400 million barrels of oil and 2.3 trillion cubic feet of natural gas. Geographically, the Rodessa field is very large extending from the northwest corner of Louisiana up northward into Miller County, Arkansas and southwestward into Cass and Marion counties Texas (PGSI’s targeted exploration and production zones). PGSI has zoned in on proved and producing reservoirs with the Bossier and Cotton Valley (CV) Lime formations (see formation maps below) that are contained within a 225,000 acre closure against the Rodessa fault known as the “Cornerstone Area”, thus the name of PGSI’s strategy named the Cornerstone Project. The Bossier and Cotton Valley reservoirs have produced over 5 million barrels of high quality light sweet crude in the last 50 years. 8

- 9. Caprock Risk Management, LLC 5/14/2012 Bossier/Cotton Valley Formations “PGSI is the leading acreage holder in the Source: Company Data Rodessa field… The Rodessa field has historically been predominately explored and produced by small …high barriers independent operators and is not a legacy field for any major oil company since to enter will inception. As a result, mineral rights are highly fragmented creating high barriers to likely keep PGSI entry for major exploration and production (“E&P’s) companies seeking to acquire at the top of the acreage in the Rodessa field. Several major E&P’s have attempted to acquire large acreage list.” acreage positions, however, the highly fragment leases that require an intensive time investment as well as expertise necessary to consolidate the acreage necessary for major E&P’s have led these companies to focus elsewhere geographically. For PGSI, this creates a competitive advantage in the Rodessa field as management has a long track record of operating and acquiring acreage through cultivating existing communal relationships in Cass and Marion counties. In our opinion, PGSI’s ability to consolidate acreage in the Rodessa field as well as being the largest acreage holder in the 225,000 acres of the Bossier/Cotton Valley formation unlocks significant value for shares of PGSI. PGSI’s Competitive Advantages: Process Driven PGSI’s 3 step process for identifying, acquiring, and producing acreage in the Rodessa field is highly unique and specific to PGSI. The process is fortified with years of expertise/ experience targeting high valued acreage in addition to the company’s ability to consolidate key acreage by leveraging PGSI’s landmens’ deep rooted community relationships with mineral owners. Overlaying PGSI’s experience/expertise and 9

- 10. Caprock Risk Management, LLC 5/14/2012 communal ties is PGSI’s cutting edge technology platform that enables the company to move more swiftly and efficiently relative to other E&Ps operating in the Rodessa field. Below, we have provided a schematic overview of the company’s process: PGSI’s 3 Step E&P Process: #1) Mike Neufeld If #3 is not feasible, Geology Identifies restart the process. Attractive Acreage. #2) Bill #2) If acreage Sudderth and acquisition is PGSI’s Technology Platform Billy Denman feasible, go to (Right of Way Land Services, LLC) call up PGSI’s step 3, if not “PGSI’s has repeat 1. mapping three system. competitive advantages in the Rodessa #3) If acreage identified field that will can be acquired, PGSI’s PGSI’s 25 Staffed Landmen Team drive and landmen make contact (Right of Way Land Services, LLC) maximize with leaseholders shareholder wealth.” Source: Company Data, CRM estimates April 2012 Site Visit During our site visit in early April to the company’s headquarters in Tyler Texas and land operations in Jefferson, our expectations were exceeded by PGSI’s E&P process, information systems, and landmens’ long standing relationships with the community. Clearly looking at Mike Neufeld’s and Bill Sudderth’s successful track record in East Texas, PGSI’s geological efforts are certainly a major strength for the company. With that said, our site visit also provided us with a unique insight that is difficult to attain from an annual report or other financial information available to the investment community. In our opinion, the insight and information (we go into more detail on the following page) that we gathered during our site visit accentuates PGSI’s multiple competitive advantages that enhances and optimizes PGSI’s business model, which we believe will drive shareholder wealth for the foreseeable future and is currently being undervalued by the market today. 10

- 11. Caprock Risk Management, LLC 5/14/2012 Right Of Way Land Services, LLC Jim Gallant is the founder and CEO of Right Of Way Land Services and has a long and solid relationship with PGSI’s management team of Mike Neufeld, Bill Sudderth, and Bill Denman. Mr. Gallant, with the help of Mr. Denman, conceptualized and formed Right of Way Land Services in the early 2000’s. Since then, Jim Gallant and his team have built a mapping technology around PGSI management’s needs, customizing the program and fine tuning the platform to its current day form. In addition, Right Of Way Land Services provides PGSI with a staff of 25 professional landmen that are deeply rooted in the Cass and Marion county communities, enabling PGSI to consolidate acreage that in the past, has been difficult to acquire by outside E&Ps. In short, Right Of Way provides PGSI with a cutting edge technology platform as well as boots on the ground in the Rodessa field that is well respected in the community. Technology: “ROWLS PGSI uses a cutting edge front-end system that was designed specifically for the provides cutting company by Right Of Way Land Services, LLC (company based in Fort Worth Texas) to edge technology and boots on target new acreage as well as to manage existing acreage in real-time. The front-end the ground for interface is a web based program (screen shot on the following page) that provides PGSI PGSI, a vital with 1) real-time mapping information for prospective and current acreage, 2) easy access part to our for management, and 3) very user-friendly interface that promotes efficient and timely investment use of information. In our opinion, PGSI is effectively using this high-end technology thesis and platform that many of the major E&P’s would likely be envious of. PGSI’s attractiveness.” PGSI’s Land Management Front-End System: Cutting Edge Technology for PGSI Source: Right of Way Land Services, LLC In summary, PGSI has three very distinctive competitive advantages: 1) Management’s geological experience and expertise for East Texas, specifically the Rodessa field, 2) experienced landmen that are utilizing a cutting edge proprietary mapping platform, and 3) using local landmen to consolidate leases in a highly fragment market. We believe 11

- 12. Caprock Risk Management, LLC 5/14/2012 these competitive advantages individually, and collectively, enable PGSI to acquire and produce acreage in a swift, cost effective manner that is very difficult to replicate by another competitor, which gives PGSI a leading position in the Rodessa field. Acreage As of December 31, 2011, PGSI had 26,868 gross acres, 18,017 net acres with 11,998 net acres with working interest. We estimate that the company has acquired a significant amount of more acreage since the beginning of the year, or north of 30,000 gross acres and 14,000 new acres with working interest. Overall, of the 225,000 gross acres of Bossier and Cotton Valley formations, we estimate that PGSI now holds roughly 13% of this total gross acreage while PGSI’s total competitors’ positions (please see “PGSI Cornerstone Project, Rodessa Field” illustration for competitors) are roughly 8,000 gross acres collectively, or just under 4%, making PGSI the biggest operator in the region. “PGSI currently holds about PGSI Acreage 13% of the total acreage in the Rodessa field… …next biggest competitor’s position is 8,000 gross acres or 4% of Rodessa’s total acreage.” Source: Company Data, CRM Estimates As of December 31, 2011, PGSI has 5,116 developed gross acres and 4,648 developed net acres while for undeveloped acreage the company had 21,752 gross acres and 7,350 net acres. PGSI Developed/Undeveloped Acreage Source: Company Data, CRM Estimates 12

- 13. Caprock Risk Management, LLC 5/14/2012 PGSI Cornerstone Project, Rodessa Field With Competitors “Acreage and position in the Rodessa field a Source: Company Data, CRM Estimates puts PGSI pole position in Marion and Cass counties.” Leases Per Acreage The company has roughly 1,200 leases for Cass and Marion Counties, which averages out to be about 22 gross acres per lease, 15 net acres per lease, or 10 net acres with working interest per lease (see chart below). Clearly acreage mineral ownership is highly fragmented and difficult to consolidate making the Rodessa field unattractive to larger E&P’s. However, as PGSI continues to consolidate these leases into one package, we believe a major E&P will begin to take notice as PGSI reaches critical mass required by the majors. Number of Acres Per Lease On Average Source: Company Data, CRM Estimates 13

- 14. Caprock Risk Management, LLC 5/14/2012 Acreage Comparisons Based on PGSI’s enterprise value (see chart below), we estimate that the company is being value at roughly $2,400 per acre. Compared to recent transactions in Eagle Ford and Bakken over the past few years in which we have calculated the average cost per acre to be $14,000 (Eagle Ford) and $8,300 (Bakken) respectively, PGSI shares are trading a significant discount on a per acreage basis. We believe the discount largely reflects the fact that the major E&P’s are not in the Rodessa field given the fact that mineral leases are so fragmented and difficult to consolidate. As PGSI accumulates the Rodessa acreage, we believe these efforts will bear fruit for PGSI shares as management unlocks the value of this acreage through consolidation. Cost Per Acre Comparisons “On a per acre basis, PGSI’s shares are trading at a discount to recent transactions in the Eagle Ford and Bakken.” Source: Company Data, CRM Estimates *PGSI Enterprise Value is Market Cap + LT Debt Equals $54.3 Million PGSI Growth & Diversification Strategy “Morse #1 Well Over the next 12-24 months, PGSI is targeting 8 horizontal wells in each of the five a major target zones for total wells of 40. The wells will be predominantly oil and represents a milestone for significant new direction for the company. Not only will this strategy switch the PGSI… company’s portfolio from predominantly natural gas to predominantly oil, we estimate the new production will have a significant impact on PGSI economics (see our estimates … Will on the following page). PGSI just completed the first of these 8 horizontal wells called transform and the Morse #1. In addition, the company expects to drill a second horizontal well in the diversify the summer called Morse #2 with roughly the same economics as Morse #1. PGSI expects to company’s complete this well within in the next 60 days. PGSI raised capital in July 2011 with total assets as well costs for drilling and completion of $6 million, representing a significant capital as drive investment for the company. growth” Going forward, the company will likely use the cash flow from Morse #1 as well as raising capital or debt financing, or combination of all three, to drill Morse #2. We 14

- 15. Caprock Risk Management, LLC 5/14/2012 believe the success of Morse #1 will enable the company to be in a strong position to finance the company’s growth strategy and ability to raise addition capital. Production 2009 2010 2011 2012E Net oil production (Bbls) 5,719 4,346 4,063 101,639 Net gas production (Mcf) 64,003 61,678 117,461 200,387 Average sales price per Bbl of oil $56.62 $76.11 $93.63 $100.00 Average sales price per Mcf of gas $3.25 $3.91 $3.85 $2.18 Year-Over-Year Growth 2009 2010 2011 2012E Net oil production (Bbls) -24.0% -6.5% 2401.6% Net gas production (Mcf) -3.6% 90.4% 70.6% “Morse #1 Well Average sales price per Bbl of oil 34.4% 23.0% 6.8% scheduled to be Average sales price per Mcf of gas 20.3% -1.5% -43.3% completed by June and a Crude Production: Morse #1 & 2 Will Have a Material Impact on PGSI second horizontal well slated to be drilled and completed by the 3Q should push PGSI’s oil production over 100k barrels in 2012.” Source: Company Data, CRM Estimates For 2012, we estimate the company will generate revenues of $10.956 million with oil revenue accounting for nearly 93%, or $10.163 million (please see our revenue per category on the following page). We estimate PGSI will generate $0.438 million for natural gas revenues. Although we forecast a significant increase for the company’s natural gas production, we have modeled in an average price per MMBtu of $2.18, which makes our natural gas estimates conservative. A strong rebound in natural gas prices would prompt us to raise our estimates, a scenario that we believe is likely given our 2012 forecast (see our macroeconomic section on page 21 for our price forecast). All of our estimates have been based on the successful completion of Morse #1 in the coming months and Morse #2 this summer. 15

- 16. Caprock Risk Management, LLC 5/14/2012 CRM’s 2012 Revenue Estimates Per Category “PGIS’s Horizontal well will push PGSI revenue mix heavily towards oil… …however, PGSI’s natural gas assets are robust and any Source: Company Data, CRM Estimates rebound in NG prices will CRM’s 2012 Quarterly Revenue & Gross Margin Estimates create a second source of significant revenue” Source: Company Data, CRM Estimates By the end of 2012, we believe that PGSI’s annual run rate for revenues should be around $20 million with oil revenue from the Morse #1 and Morse #2 accounting for the bulk of the revenue. If the company is successful in raising addition capital to drill 2 to 3 more horizontal wells heading into 2013, we believe PGSI would be on solid footing to drive and maintain a rapid growth rate over the next 12-24 months. 16

- 17. Caprock Risk Management, LLC 5/14/2012 3rd Party Engineering Report PGSI’s latest engineering report, dated 1/31/2012, generated by James E. Smith & Associates estimates Total Proved (P1) to be $23.8 million with Probable of $11.1 million and Possible of $111.3 million. Total Proved and Probable (P2) is $34.874 million. We believe with the successful completion of Morse #1 and Morse #2 in the summer, the company’s PV-10 will likely be significantly high this time next year. James E. Smith &B Associates, Inc. 1/31/2012 Engineering Report PGSI PV-‐10 P1 P2 P3 rd “3 Party $23,763.569 $34,874.753 $146,192.042 Proved Engineering Proved Proved Non-‐ Behind Proved Total shows Income Entities Unit Producing Producing Pipe Undeveloped Proved Probable Possible significant Gross Oil Production (MBBLS) 18.990 71.070 468.989 205.428 764.477 205.428 15,667.015 Proven Behind Gross Natural Gas Production (MMCF) 1,070.717 678.711 13,968.628 11,477.167 27,195.223 11,474.746 72,487.320 Net Oil Production (MBBLS) 9.473 42.612 280.896 115.173 448.154 108.280 6,663.315 Pipe and PV-10 Net Gas Production (MMCF) 352.819 411.191 8,357.710 5,744.294 14,866.014 5,461.298 35,620.441 should Net Oil Price ($/BBL) $92.100 $92.100 $92.100 $92.100 $92.100 $92.100 $92.100 significantly Net Gas price ($/MCF) $3.620 $3.620 $3.620 $3.620 $3.620 $3.620 $3.620 increase Net Oil Sales (MS) $872.463 $3,924.565 $25,870.522 $10,607.433 $41,274.983 $9,972.588 $613,691.312 Net Gas Sales (MS) $1,277.205 $1,488.511 $30,254.910 $20,794.344 $53,814.971 $19,769.899 $128,945.996 following PUD Total Net Sales (MS) $2,149.668 $5,413.077 $56,125.432 $31,401.778 $95,089.954 $29,742.487 $742,637.308 to PDP with the Ad V alorem Tax (MS) $81.461 $207.466 $2,106.536 $1,174.122 $3,569.585 $1,111.997 $28,186.760 Morse 1 and 2 Production Tax (MS) $113.173 $226.383 $3,462.006 $2,048.683 $5,850.245 $1,942.579 $37,968.254 wells coming in Direct Operating Expense (MS) $955.183 $1,057.251 $11,113.015 $2,235.012 $15,360.461 $2,112.854 $132,277.812 Equity Investment (MS) $0.000 $640.000 $4,400.000 $8,195.000 $13,235.000 $7,832.000 $311,244.469 line in 2012.” Future Net Cash Flow (MS) $999.851 $3,281.977 $35,043.875 $17,748.961 $57,074.663 $16,743.057 $232,960.013 Cum. Disc. (10%) Cash Flow (MS) $863.789 $1,914.899 $8,595.262 $12,389.619 $23,763.569 $11,111.184 $111,317.289 Life (YRS) 8.7 26.8 42.6 10.3 42.6 10.8 44.7 Source: James E. Smith & Associates and Company Data PGSI Total Proved (P1) Per Segment (000’s): PV-10 Source: James E. Smith & Associates and Company Data 17

- 18. Caprock Risk Management, LLC 5/14/2012 PGSI Total Proved, Probable, and Possible (000’s): PV-10 Source: James E. Smith & Associates and Company Data PGSI Total P1, P2, and P3 (000’s): PV-10 Source: James E. Smith & Associates and Company Data 18

- 19. Caprock Risk Management, LLC 5/14/2012 Financial Review In 2011, Pegasi finished the year off on a strong note both operational and financially. Pegasi’s production rose in 2011 while production costs fell simultaneously, which we highlighted below: Operating Highlights: Description 2010 2011 Y-O-Y %^ Net Oil Production (Bbls) 4,346 4,063 -6.5% Net Gas Production (Mcf) 61,678 117,461 90.4% “Cratering Total Production (MBoe) 14,626 23,640 61.6% natural gas Average sales price per Bbls of oil $76.11 $93.63 23.0% prices more than offset an Average sales price per Mcf of gas $3.91 $3.85 -1.5% increase in gas Average production cost per Boe $14.07 $10.87 -22.7% production of over 90% in Source: Company Data, CRM Estimates 2011 over the previous year… Income Statement Review: … a rebound in For the Year Ending December, 31 gas prices would provide Results of Operations ( 000's) 2010 2011 PGSI investors Revenues with another Gas Revenues 248 458 significant Oil Revenues 331 380 increase in Other Revenues 309 350 revenue streams” Total Revenues 888 1,188 Operating Expenses 645 681 General and Administrative 2,083 2,175 Depletion and Depreciation 187 277 Total Operating Expenses 2,915 3,133 Operating Loss (2,027) (1,945) Other Expenses (4,267) (3,409) Miscellaneous Income ( Loss) (197) 785 Net Loss (6,491) (4,569) Source: Company Data, CRM Estimates Total Revenues jumped 34% in 2011 year-over-year versus 2010. Gas revenues increased 85% for the same time period, primarily from the Norbord well that came online in December 2010 while Oil revenues increased 15%, mainly due to higher oil prices. 19

- 20. Caprock Risk Management, LLC 5/14/2012 Total Operating Expenses were 7% higher, driven by an increase in depletion and depreciation. Pegasi continues to closely manage General and Administration expenses as well as SG&A expenses as both fell as a percentage of total revenues in 2011. We believe that Pegasi is on track to generate net income and cash flow from operations in 2012, given the company’s drilling program that should continue to bolster PGSI’s balance sheet. Balance Sheet Review: Financial Condition ( 000's) At December 31 2010 2011 Assets Cash $250 $6,749 Other Current Assets 775 674 Total Current Assets 1,025 7,423 Net Property and Equipment 20,689 22,188 Other Assets 1,266 210 Total Assets $22,980 $29,821 Liabilities Current Liabilities $11,204 $7,827 LT Debt and Other Liabilities 5,147 8,657 Total Liabilities 16,351 16,484 Total Equity 6,629 13,337 Total Liabilities and Equity $22,980 $29,821 Source: Company Data, CRM Estimates In 2011, Pegasi significantly improved its financial condition when it raised $5,200,000 of equity. As a result, cash increased to $6,749,000 while negative working capital decreased to $404,000 and debt to equity ratio improved to 1.2 to 1. 20

- 21. Caprock Risk Management, LLC 5/14/2012 Macro Economic: 2012 Energy Markets Outlook For 2012, we believe there is a significant amount of uncertainty for the energy “Geopolitical markets that could drive major price swings in either direction from current levels Risks will making this the most difficult year in recent memory for our year-ahead preview. dominate The two major issues overhanging the global markets are no strangers to the energy headlines in 2012 with complex: 1) European debt issue and 2) Geopolitical risks. However, we believe as Europe concerns Europe kicks the can down the road over the systemic debt issues overhanging sovereign taking a back nations, the risk of the Euro breaking up in some format will be elevated in 2012 while seat” geopolitical risks, which are a constant, are not appropriately discounted the heightened level of turmoil in the Middle East and beyond. In fact, we believe geopolitical risks in 2012 will dominate the headlines, especially as we head into the second half of the year. In short, 2012 could be one for the books as we expect volatility to be elevated relative to historic levels. 2012 Price Targets At the beginning of the year, we raised our WTI price target from $100 to $125 a barrel for 2012. We believe the average price for the year will be $110. Incorporating geopolitical risk such as a successful oil embargo on Iran, we believe prices can rise between $125 and $150 a barrel in relatively short order. A direct military conflict with Iran would push prices $150+ depending on the length and severity of the campaign. “Crude oil prices Our 2012 price target for natural gas is $2.50 MMBtu, which we adjusted down are likely to from our original 2012 price target of $3.75 MMBtu. We have revised down our price remain elevated target given the fact that we had one of the warmest winters on record, which lead to the given weakest withdrawal season in over 20-years. Although prices have recently broken the geopolitical $2.00 MMBtu level, we do believe price spikes lower will likely be short lived. At risks and an current levels, or $2.34 MMBtu, we wouldn’t be surprised to see a retest of the recent improving global lows set in April, especially as we head into the peak injection season which occurs in economy… late May. However, we do believe fundamentals have to improve based on structural issues alone. Maximum storage capacity for the U.S. is 4.1 TCF. Once the injection …natural gas season comes to an end in late October, we will likely reach capacity at 4.1 TCF, which is prices will put in only about 250 BCF over the all-time high set last year (3.852 TCF), or 6.4% higher than a secular bottom the previous high and much lower than our current surplus of 58% over the 5-year in 2012” average. Furthermore, the extreme price moves lower have caused forced shut-ins as well as natural gas rigs counts hitting a 20+ year low. If the 2012/2013 winter is colder than the national averages, we believe the withdrawal season could be one of the strongest considering declining production levels. In short, we expect a silver lining for the natural gas producers once this year’s injection season comes to an end in the fall. 21

- 22. Caprock Risk Management, LLC 5/14/2012 Disclosures and Certification: Independent Fee-Based Research • CRM only accepts cash compensation for our work and do not accept any compensation contingent on the content or conclusions of the research or the resulting impact on share price. • Report Discloser: - CRM received a 12-month contract for $4,116 a month starting March 15, 2012 to launch and maintain independent fee-based research on Pegasi Energy Resource Corporation shares. - CRM and/or our staff have no personal, professional, or financial relationship with Pegasi or its subsidiaries, agents, or trading entities. - CRM analyst credentials, including professional designations and experience: Chris Jarvis is Chairman, Chief Executive Officer, and President of Caprock. He has served as Senior Commodities Strategist for vFinance Investments, a unit of National Holdings Corporation of New York, New York. Prior to working at National, Mr. Jarvis was a senior energy and commodities strategist with Merrill Lynch and Advest. He holds a BA from University of Massachusetts and a MBA from University of Connecticut. Christopher has earned the right to use the Chartered Financial Analyst (CFA) designation. He is a member of the CFA Institute. Lastly, Christopher has also earned the right to use the Chartered Market Technician (CMT) designation and is a member of Market Technicians Association (MTA). CRM will provide continuing coverage on Pegasi. Interested parties can either visit www.caprockrm.com or email Chris Jarvis at Chris@caprockrm.com or Peter@caprockrm.com for future updates. CRM is not aware of any matters that could reasonably be expected to impair our objectivity in drafting the report. There is no history of recommendations for the subject-company and number and distribution of recommendations for all companies we cover. I, Christopher C. Jarvis, hereby certify that the analysis or recommendations contained in the report, if any, represent the true opinions of the author or authors. CRM refrains from engaging in, or receiving compensation from, any investment banking or corporate finance-related activities with the issuer. 22

- 23. Caprock Risk Management, LLC 5/14/2012 CRM’s analyst(s) do not share information about the subject company or the timing of the release of a research report with any person who could have the ability to trade in advance of (“front run”) the release of a report. CRM and affiliates refrain from trading in the shares of the subject company in advance of the release of a report or update. CRM refrains from trading in a manner that is contrary to, or inconsistent with, the employees’ or the firm’s most recent published recommendations or ratings, except in circumstances of unanticipated extreme financial hardship. CRM abides by all laws, rules, and regulations that apply to registered or regulated analysts. About Caprock Chris Jarvis, CFA, CMT founded Caprock Risk Management, LLC (“CRM” or “Caprock”) in 2006. Caprock’s mission is to add value for our clients by providing superior market intelligence and advisory services for energy risk management. Management and Employees Chris Jarvis is Chairman, Chief Executive Officer, and President of Caprock. He has served as Senior Commodities Strategist for vFinance Investments, a unit of National Holdings Corporation of New York, New York. Prior to working at National, Mr. Jarvis was a senior energy and commodities strategist with Merrill Lynch and Advest. He holds a BA from University of Massachusetts and a MBA from University of Connecticut. Christopher has earned the right to use the Chartered Financial Analyst (CFA) designation. He is a member of the CFA Institute. Lastly, Christopher has also earned the right to use the Chartered Market Technician (CMT) designation and is a member of Market Technicians Association (MTA). Peter White is Executive Vice President and Chief Financial Officer. Mr. White is an innovative and proficient executive with over 30 years of experience with private and publicly traded companies in the financial and investment sectors. A CPA, Mr. White has a MBA from New York University and an MAB from Bowdoin College. 23

- 24. Caprock Risk Management, LLC 5/14/2012 Disclaimer This publication is intended for informational purposes only and the opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade Equities, futures and/or options. All opinions and information contained in this document constitute Caprock Risk Management (CRM) judgment as of the date of this document and are subject to change without notice. CRM, persons connected with it, members of the CRM, subsidiaries and affiliates ("Affiliated Companies") and their respective directors and employees may, directly or indirectly, effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of an Affiliated Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Affiliated Company accepts any liability whatsoever for any direct, indirect or consequential loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed, or published in electronic, paper, or other form for any purpose without the prior written consent of CRM. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. 24