19 November Daily market report

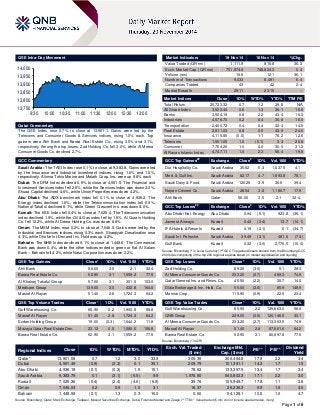

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 0.7% to close at 13,901.1. Gains were led by the Telecoms and Consumer Goods & Services indices, rising 1.0% each. Top gainers were Ahli Bank and Barwa Real Estate Co., rising 3.5% and 3.1%, respectively. Among the top losers, Zad Holding Co. fell 3.0%, while Al Meera Consumer Goods Co. declined 2.7%. GCC Commentary Saudi Arabia: The TASI Index rose 0.1% to close at 9,383.8. Gains were led by the Insurance and Industrial Investment indices, rising 1.6% and 1.0%, respectively. Alinma Tokio Marine and Malath Coop. Ins. were up 9.8% each. Dubai: The DFM Index declined 0.9% to close at 4,551.5. The Financial and Investment Services index fell 2.6%, while the Services index was down 2.0%. Shuaa Capital declined 4.6%, while Union Properties was down 4.2%. Abu Dhabi: The ADX benchmark index fell 0.1% to close at 4,936.2. The Energy index declined 1.6%, while the Telecommunication index fell 0.9%. National Takaful declined 8.1%, while Green Crescent Ins. was down 8.0%. Kuwait: The KSE Index fell 0.4% to close at 7,025.4. The Telecommunication index declined 1.9%, while the Oil & Gas index fell by 1.5%. Al Qurain Holding Co. fell 12.2%, while Al-Deera Holding Co. was down 8.6%. Oman: The MSM Index rose 0.2% to close at 7,046.0. Gains were led by the Industrial and Services indices, rising 0.3% each. Sharqiyah Desalination rose 4.3%, while Dhofar Int.Dev.and Inv. Hold was up 4.2%. Bahrain: The BHB Index declined 0.1% to close at 1,448.6. The Commercial Bank was down 0.4%, while the other indices ended in green or flat. Al Salam Bank – Bahrain fell 4.2%, while Nass Corporation was down 2.2%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Ahli Bank 56.00 3.5 2.1 32.4 Barwa Real Estate Co. 52.90 3.1 1,559.2 77.5 Al Khaleej Takaful Group 57.00 3.1 301.5 103.0 Medicare Group 139.00 3.0 432.8 164.8 Masraf Al Rayan 51.40 2.8 1,724.3 64.2 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Gulf Warehousing Co. 65.90 2.2 1,900.8 58.8 Masraf Al Rayan 51.40 2.8 1,724.3 64.2 Ezdan Holding Group 19.00 (0.3) 1,644.2 11.8 Mazaya Qatar Real Estate Dev. 23.12 0.5 1,580.0 106.8 Barwa Real Estate Co. 52.90 3.1 1,559.2 77.5 Market Indicators 19 Nov 14 18 Nov 14 %Chg. Value Traded (QR mn) 1,111.9 815.8 36.3 Exch. Market Cap. (QR mn) 751,874.6 748,824.3 0.4 Volume (mn) 16.5 12.1 36.1 Number of Transactions 9,033 8,491 6.4 Companies Traded 43 42 2.4 Market Breadth 29:11 23:15 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 20,733.32 0.7 1.2 39.8 N/A All Share Index 3,522.44 0.6 1.3 36.1 16.8 Banks 3,504.19 0.8 2.2 43.4 16.3 Industrials 4,576.70 0.2 0.4 30.8 16.0 Transportation 2,460.72 0.4 0.4 32.4 14.5 Real Estate 2,811.03 0.8 0.5 43.9 24.6 Insurance 4,115.85 (0.0) 1.1 76.2 12.6 Telecoms 1,501.05 1.0 (0.1) 3.3 20.8 Consumer 7,764.26 1.0 4.0 30.5 31.2 Al Rayan Islamic Index 4,747.11 1.0 2.3 56.4 19.8 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Dur Hospitality Co. Saudi Arabia 35.82 5.3 1,037.5 4.1 Med. & Gulf Ins. Saudi Arabia 62.17 4.7 1,893.8 78.1 Saudi Dairy & Food. Saudi Arabia 120.25 3.9 36.6 39.4 Najran Cement Co. Saudi Arabia 28.54 3.8 1,180.7 17.9 Ahli Bank Qatar 56.00 3.5 2.1 32.4 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Abu Dhabi Nat. Energy Abu Dhabi 0.94 (5.1) 923.8 (36.1) Jazeera Airways Kuwait 0.43 (3.4) 13.7 (14.1) IFA Hotels & Resorts Kuwait 0.19 (3.1) 0.1 (34.7) Saudi Int. Petroche. Saudi Arabia 29.49 (3.1) 481.6 (7.3) Gulf Bank Kuwait 0.32 (3.0) 2,776.5 (10.4) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Zad Holding Co. 89.20 (3.0) 5.1 28.3 Al Meera Consumer Goods Co. 233.20 (2.7) 489.3 74.9 Qatar General Ins. and Reins. Co. 45.50 (2.2) 30.7 14.0 Dlala Brokerage & Inv. Hold. Co. 55.00 (2.0) 85.9 148.9 Mannai Corp. 110.90 (0.9) 22.5 23.4 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Gulf Warehousing Co. 65.90 2.2 125,863.0 58.8 QNB Group 229.00 (0.5) 120,146.0 33.1 Al Meera Consumer Goods Co. 233.20 (2.7) 113,363.5 74.9 Masraf Al Rayan 51.40 2.8 87,681.6 64.2 Barwa Real Estate Co. 52.90 3.1 80,897.8 77.5 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 13,901.08 0.7 1.2 3.0 33.9 305.35 206,464.8 17.9 2.2 3.4 Dubai 4,551.49 (0.9) (2.3) 0.1 35.1 209.79 101,391.1 14.2 1.7 1.9 Abu Dhabi 4,936.18 (0.1) (0.3) 1.5 15.1 78.62 133,397.5 13.4 1.7 3.4 Saudi Arabia 9,383.79 0.1 (3.1) (6.5) 9.9 1,976.80 540,802.3 17.1 2.2 3.0 Kuwait 7,025.36 (0.4) (2.4) (4.6) (6.9) 39.76 105,949.7 17.8 1.1 3.8 Oman 7,046.04 0.2 0.5 1.0 3.1 16.37 26,236.3 9.9 1.5 4.0 Bahrain 1,448.59 (0.1) 1.3 0.3 16.0 0.60 54,128.1 10.5 1.0 4.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 13,75013,80013,85013,90013,95014,0009:3010:0010:3011:0011:3012:0012:3013:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index rose 0.7% to close at 13,901.1. Telecoms and Consumer Goods & Services indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari shareholders. Ahli Bank and Barwa Real Estate Co. were the top gainers, rising 3.5% and 3.1%, respectively. Among the top losers, Zad Holding Co. fell 3.0%, while Al Meera Consumer Goods Co. declined 2.7%. Volume of shares traded on Wednesday rose by 36.1% to 16.5mn from 12.1mn on Tuesday. Further, as compared to the 30-day moving average of 13.3mn, volume for the day was 24.2% higher. Gulf Warehousing Co. and Masraf Al Rayan were the most active stocks, contributing 11.5% and 10.5% to the total volume respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings and Global Economic Data Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Bahrain Kuwait Insurance Co. AM Best Bahrain FSR/ICR A-/A- A-/A- – Stable – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Currency Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, ICR – Issuer Credit Rating) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 11/19 US US Treasury Net Long-term TIC Flows September $164.3B – $52.1B 11/19 US US Treasury Total Net TIC Flows September -$55.6B – $44.8B 11/19 US Mortgage Bankers Asso. MBA Mortgage Applications 14-November 4.90% – -0.90% 11/19 US US Census Bureau Housing Starts MoM October -2.80% 0.80% 7.80% 11/19 US US Census Bureau Building Permits MoM October 4.80% 0.90% 2.80% 11/19 EU European Central Bank ECB Current Account SA September 30.0B – 22.8B 11/19 EU European Central Bank Current Account NSA September 31.0B – 17.4B 11/19 EU Eurostat Construction Output MoM September -1.80% – 0.70% 11/19 EU Eurostat Construction Output YoY September -1.70% – 1.50% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar Monthly banking sector update – The loan book decreased by 2.0% MoM (up 7.9% YTD) while deposits declined by 0.3% MoM (+8.0% YTD) in the month of October 2014. Public sector (down 5.7% MoM in October) was the primary driver of the overall decline in the loan book (public sector loans were up 3.9% MoM in September). Moreover, deposits also fell slightly by 0.3% MoM (deposits increased by 1.9% MoM in September). Thus, the LDR declined to 105% vs. 107% in September. Going forward, we expect increased activity in the sector. We continue to expect improvement in the public sector, in addition to large corporate loan growth followed by the SMEs and consumer lending to be the primary drivers of the overall loan book in 2014 and 2015. Our view is based on the expected uptick in project mobilizations in the coming months. The public sector deposits decreased by 3.3% MoM (+6.3% YTD 2014) for the month of October 2014. Delving into segment details, the government institutions’ segment (represents ~57% of public sector deposits) improved by 0.5% MoM (+11.4% YTD 2014). Moreover, the semi-government institutions’ segment posted a growth of 10.1% MoM (up 0.1% YTD 2014). However, the government segment decreased by 15.4% MoM (+0.3% YTD). On the other hand, private sector deposits increased by 1.0% MoM (+9.1% YTD 2014). On the private sector front, the companies & institutions’ segment increased by 1.0% MoM (+8.1% YTD 2014) while the consumer segment posted a growth of 1.1% MoM (up 10.1% YTD). The overall loan book declined by 2.0% MoM vs. a 4.0% growth MoM in September 2014. Total domestic public sector loans decreased by 5.7% MoM (also down 5.7% YTD). The government segment’s loan book went down by 16.8% MoM (up 1.6% YTD 2014). Moreover, the government institutions’ segment (represents ~59% of public sector loans) declined by 1.5% MoM and is down 11.8% YTD. Furthermore, the semi-government institutions’ segment declined by 0.5% MoM (+11.4% YTD). Hence, all the three public sector segments pulled the overall loan book down for the month of October 2014. Private sector loans gained by 0.3% MoM and are up 13.8% YTD. Consumption & Others (contributes ~30% to private sector loans) increased by 0.9% MoM (+16.9% YTD). Furthermore, the Real Estate segment (contributes ~27% to private sector loans) grew by 2.1% MoM (+5.7% YTD). However, the Services segment posted a decline of 7.2% MoM but is still up 11.8% in the first ten months of 2014. Overall, the segments representing General Trade (+27.1% YTD) and Contractors (+23.0% YTD) are the best performing segments in the private sector YTD. On the other hand, the Industry segment is flat YTD. (QNBFS Research, QCB) DHBK CEO: Surge in loan growth boosts GCC banking industry – Doha Bank Group’s (DHBK) CEO Dr. R. Overall Activity Buy %* Sell %* Net (QR) Qatari 63.13% 68.08% (55,185,297.37) Non-Qatari 36.88% 31.91% 55,185,297.37

- 3. Page 3 of 6 Seetharaman stated while the GCC banking sector has got regulated in line with the global financial architecture after the financial crisis, infrastructural development and capital market reforms are going to provide immense opportunities for the sector. Seetharaman said banks in the UAE have been the prime beneficiaries of a revival in which the country’s economy grew around 4%. Loan growth in the UAE is set to jump at least by 8% by 2014-end. Similarly, private sector lending in Saudi Arabia has grown by more than 11% till September 2014, while public sector lending went up by nearly 9%. In Oman credit off- take was close to 9%, while bank lending to the private sector in Kuwait grew close to 4%. Qatar has seen a massive lending growth of more than 10% till September 2014. Retail, contract and services sectors are the main contributors to growth in Qatar during 2014. Seetharaman said projects worth more than $529bn are underway in the GCC region during 2014, which contribute to the surge in contract financing and project financing. (Zawya) ABQK deploys SunGard risk solutions for strategic risk management – Ahli Bank (ABQK) has deployed SunGard’s risk solutions to enhance its regulatory capital calculations. These solutions will provide ABQK with an integrated platform to automate its calculations and reporting. This move also helps the bank to refocus its resources on more strategic risk activities, as well as support its move from Basel II to Basel III compliance. (GulfBase.com) International Gradual US housing recovery on track as single-family starts rise – Starts for US single-family homes rose for the second straight month in October and building permits neared a 6-1/2-year high, indicating that the housing market was still on a recovery path. The Commerce Department said groundbreaking for single-family homes, which account for more than two-thirds of the market, increased 4.2% to a seasonally adjusted 696,000- unit annual pace, the highest level recorded since last November. At the same time, permits for single and multi-family housing jumped 4.8% to a 1.08mn-unit pace, the highest level recorded since June 2008. It also was the second straight monthly gain. A 15.4% plunge in starts for the volatile multi- family homes portion of the market, however, caused overall groundbreaking to fall 2.8% to a 1.009mn-unit pace. Housing remains constrained by sluggish wage growth and still-stringent lending practices, but the housing starts data bolstered views that home building would contribute to economic growth in 4Q2014 after being neutral in 3Q2014. (Reuters) Central Bank: Spain 2014 deficit targets achievable, 2015 more difficult – The Bank of Spain Governor Luis Maria Linde said the country’s deficit target of 5.5% of gross domestic product is achievable, but next year's target of 4.2% of GDP will be more difficult. Spain registered a public shortfall of 6.3% of GDP in 2013, one of the highest in the Eurozone. (Reuters) Japan’s exports rise most in 8 months in recovery sign – Exports in Japan rose the most in eight months in October, supporting an economy that slipped into recession in 3Q2014. The finance ministry said overseas shipments rose 9.6% YoY to the highest level since October 2008, as compared with the median estimate for a 4.5% increase in a Bloomberg survey. Imports grew 2.7%, leaving a trade deficit of 710bn yen. Rising exports will support the economy after April’s sales tax increase triggered two straight quarters of economic contraction. The nation has posted 28 straight monthly trade deficits as energy import costs surged after all nuclear power plants were shut down in the wake of the Fukushima disaster. The GDP in 3Q2014 shrank an annualized 1.6%, putting the world’s third- biggest economy in its fourth recession since 2008 and pushing Prime Minister Shinzo Abe to delay a further sales tax increase. (Bloomberg) China factory gauge falls to six-month low as economy slows –Chinese manufacturing gauge fell to a six-month low in November, suggesting the world’s second-largest economy is slowing further in 4Q2014. The preliminary Purchasing Managers’ Index from HSBC Holdings Plc and Markit Economics was at 50.0, below the median estimate of 50.2 in a Bloomberg survey and lower than last month’s 50.4. China’s economy, burdened by overcapacity and weak domestic demand, is headed for the slowest full-year growth in more than two decades. The central bank has added liquidity while refraining from broad-based interest rate or reserve requirement ratio cuts as it seeks to avoid a fresh surge in debt. Meanwhile, the Head of the National Development and Reform Commission (NDRC), Xu Shaoshi said China's economy faces increasing downward pressure in 2015 while the country pushes forward reforms to keep economic growth stable. (Bloomberg, Reuters) OECD ups India growth outlook, urges structural reforms – The Organization for Economic Cooperation and Development (OECD) said India's economy will accelerate in 2015-16, but will fail to attain the heady growth rates of the past decade without sweeping structural reforms. In a country survey, the Paris- based think tank forecasted that Asia's third-largest economy would grow by 6.6% in 2015-16, up from its last forecast of 5.7% growth in May. The growth would edge higher to 6.8% in 2016- 17. In its latest forecast, the OECD said it expected inflation to fall to 5.4% in 2015-16 and nudge higher to 5.6% the following fiscal year, after 6.9% in 2014-15. In May, it forecasted that inflation would remain above 6% over the next few years. (Reuters) Regional MEA to post world’s highest cloud traffic growth rate by 2018 – According to the fourth annual Cisco Global Cloud Index (2013-2018), the Middle East & Africa (MEA) region will post the world’s highest cloud traffic growth rate, rising more than 8-fold from 2013-2018. Worldwide, Cisco forecasts continued strong growth for cloud computing traffic, cloud workloads and cloud storage with private cloud significantly larger than public cloud. The global data center traffic will nearly triple, with cloud representing 76% of the total data center traffic. Half of the world's population will have residential internet access and more than half of those users' (53%) content will be supported by personal cloud storage services by 2018. The MEA region, which has the world’s highest mobile devices per user, will see its cloud traffic grow from 31 Exabytes in 2013 to 262 Exabytes in 2018, at a CAGR of 54%. The region will also rank second in the world to the Asia Pacific region in terms of growth rates of the total data center workloads (24% CAGR), cloud data center workloads (39% CAGR), and traditional data center workloads (5% CAGR) during 2013-2018. (GulfBase.com) Ventures ME: Completed GCC construction projects to register 7.7% increase – According to Ventures ME, the GCC building construction market is showing a positive uptrend in 2014 (+7.7% from 2013) with $72bn worth of projects forecasted to be completed by end of 2014. This trend has translated into increased opportunities for both the interiors and fit-out markets, with investment estimated to reach $7.84bn by 2014-end. The residential and commercial building segments remain the sectors that attract the most investment, with $30bn and $11.8bn worth of ongoing construction projects. They are followed by educational, hospitality and medical building segments, which surged by 30% over 2013. Saudi Arabia

- 4. Page 4 of 6 ($33.82bn) and the UAE ($21.28bn) continue to command the largest market shares in terms of ongoing projects during 2014, followed by Qatar ($9.06bn), Kuwait ($3.79bn), Oman ($3.02bn) and Bahrain ($1.05bn). (GulfBase.com) Reuters: Gulf airlines close financing deals for 16 aircraft – Gulf-based airlines have closed financing agreements for a total of 16 Boeing and Airbus aircraft. Boeing has forecast the region's airlines are expected to take delivery of 2,610 aircraft by 2033, valued at $550bn. Emirates Airlines has signed a AED1.1bn financing deal with a group of banks led by First Gulf Bank for the purchase of two Boeing 777-300ER aircraft. Separately, Dubai Islamic Bank and Air Arabia have signed a $230mn Islamic financing deal to cover the purchase of six new Airbus A320 aircraft in 2015 by the budget airline. The airline has already received 29 of the 44 A320s it ordered from Airbus in 2007. These deals follow Qatar Airways closing a leaseback transaction with Standard Chartered for three 777-300ER and five 787-8 aircraft. In July, Emirates finalized a $56bn to buy 150 Boeing 777X jets, while QA ordered 50 of these jets. (Reuters) Mobily inks CIT services deal with Al-Rajhi Bank – Etihad Etisalat Company (Mobily) has signed a communications & IT (CIT) services agreement with Al-Rajhi Bank. Under the agreement terms, Mobily will provide SMS and data services, and will connect all the branches of Al-Rajhi Bank via fiber optic network. The agreement is a continuation of the ongoing cooperation between Mobily and Al-Rajhi Bank, after both parties earlier launched a cash deposit system for companies. (GulfBase.com) Saudi Aramco expects 900bn barrels of oil resources by 2025 – The Saudi Arabian Oil Company’s (Saudi Aramco) Development Director, Jamal al-Khonaifer said that the company is expecting to have 900bn barrels of oil resources by 2025, up from the current 790bn barrels. The company’s current recoverable crude oil and condensate reserves stand at around 260.2bn barrels. (GulfBase.com) NWC plans $1.1bn of Saudi Infrastructure – Saudi-based National Water Company (NWC) is planning SR4bn worth of infrastructure projects in the Kingdom for early 2015. These projects aim to increase operational efficiency among heavily populated areas to keep up with the rising demand for water services. The company recently completed the biggest water- treatment plant in Saudi Arabia, which will produce 400,000 cubic meters of treated water to serve a population that has quadrupled to 30mn in four decades. (Bloomberg) Jadwa Investment to invest in domestic real estate market – Jadwa Investment is planning to invest in domestic real estate as it expands into new asset classes, hoping to cash in on the booming demand for new homes. Supply of housing in Saudi Arabia lags behind strong demand, which is the result of a rapid population growth and slow progress in government building programs designed to ease the shortage. The company would partner with real estate developers to execute projects on behalf of clients. Funds would be set up as projects were selected and the size of the investment would be determined on a case-by- case basis. (GulfBase.com) Petromin partners with Houghton International – Petromin Corporation will be exclusively representing US-based Houghton International for lubricant services in Saudi Arabia. This agreement is in line with Petromin’s vision to serve all major areas of application in terms of providing lubricant services in Saudi Arabia. Petromin is a Saudi-based producer and supplier of lubricants, while Houghton International is a provider of both high-tech metalworking and hydraulic fluid products, as well as fluid management services. (GulfBase.com) Al-Khodari Sons wins SR40.6mn landfill operations contract – The Ministry of Municipal & Rural Affairs (Eastern Province Municipality) has awarded a contract worth SR40.6mn to Abdullah A. M. Al-Khodari Sons Company (Al-Khodari Sons) for the operation & maintenance of landfill operations in Dammam and neighboring cities. The contract needs to be completed in three years from the date of site handing and its financial impact is already visible from 2Q2014. (Tadawul) Emirates NBD opens another branch in Sharjah – Emirates NBD has opened a new banking branch in Al Nasseriya in Sharjah. The newly opened branch is in line with the bank’s closer to customer strategy. The opening of the Al Nasseriya branch brings Emirates NBD’s branch network in Sharjah to eight and 99 across the UAE. (Bloomberg) DIB signs $230mn aircraft financing deal with Air Arabia – Dubai Islamic Bank (DIB) and Sharjah-based low cost carrier Air Arabia have signed an aircraft financing deal to facilitate the delivery of six new Airbus A320 aircraft in 2015. The $230mn Ijara facility will finance the delivery of a new aircraft every two months starting January 2015, and the program will culminate with the final unit being handed over by 2014-end. (DFM) FlyDubai raises $500mn from debut bond sale – FlyDubai has raised $500mn from its debut bond sale. The five-year Sukuk will be priced to yield 200 basis points above the benchmark midswap rate. The price was cut from a guidance of about 225 basis points above midswaps. Various banks Credit Agricole CIB, Dubai Islamic Bank, Emirates NBD Capital, HSBC Holdings, National Bank of Abu Dhabi, Noor Bank, Standard Chartered arranged FlyDubai’s bond sale. (Bloomberg) MGEC sells debut bond under GMTN program – Mubadala GE Capital (MGEC) has successfully priced its inaugural 144A bond under its newly established Global Medium Term Note (GMTN) program. The $500mn tranche has tenure of five years and a coupon rate of 3%. Interest from investors was strong and the issue was oversubscribed, with orders in excess of $1.3bn. This bond issue is consistent with MGEC’s long-term business strategy and funding plans, which will enable profitable business growth. Barclays Bank, Citigroup Global Markets, First Gulf Bank, HSBC Bank and Natixis Securities Americas have acted as joint lead managers on the issue, while Barclays Bank, Citigroup Global Markets were the global coordinators. (GulfBase.com) Kufpec signs $1bn loan – Kuwait Foreign Petroleum Exploration Company (Kufpec), a wholly-owned subsidiary of Kuwait Petroleum Corporation, has signed a $1bn loan. Bank of Tokyo-Mitsubishi-UFJ, HSBC, JP Morgan, National Bank of Kuwait and Royal Bank of Scotland acted as underwriters, joint bookrunners and initial mandated lead arrangers for the loan. JP Morgan and NBK also acted as joint coordinators. (Reuters) KIB: Kuwait real estate sector posts 33% growth – According to a report by Kuwait International Bank (KIB), the Kuwaiti real estate market maintained the same growth level in October 2014 as seen in last month. The total real estate deals value indicator dropped by 3.8%, achieving an annual growth of 33% as compared to October 2013. The total value of real estate deals reached KD383.9mn, which was achieved despite the total number of working days in October were only 17 days due to Eid Al-Adha holiday. However, the total number of deals fell by 20% on a monthly basis to reach 650 deals, which is less by 5% YoY. (Bloomberg) OSC takes delivery of new LNG carrier from HHI – Oman Shipping Company (OSC) has taken delivery of one of the world's most advanced fuel efficient LNG carriers, the ‘Adam

- 5. Page 5 of 6 LNG’. The 162,000 cubic meters capacity vessel was built by Hyundai Heavy Industries (HHI) in Ulsan, South Korea. The vessel will operate across the world with 25 crew managing it. (GulfBase.com) GFH completes capital reduction plan, cuts losses – Bahrain-based Gulf Finance House (GFH) has completed a capital reduction plan, a move that helps the Islamic investment firm to cut its accumulated losses. GFH received approval from the Bahraini authorities for the step, which reduces the nominal value of its shares by 13.8% to $0.265 per share from $0.3075. As a result, paid-up capital has been reduced to $837.9mn from $972.3mn. Similarly, accumulated losses on GFH's balance sheet have been brought down by $134.4mn. The reduction does not involve any cash transfer nor does it impact shareholder positions as the bank's net equity remains unchanged. (Reuters)

- 6. Contacts Saugata Sarkar Abdullah Amin, CFA Shahan Keushgerian Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6509 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa Sahbi Kasraoui Ahmed Al-Khoudary QNB Financial Services SPC Manager – HNWI Head of Sales Trading – Institutional Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6544 Tel: (+974) 4476 6548 PO Box 24025 sahbi.alkasraoui@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg, *$ adjusted returns. 80.0 100.0 120.0 140.0 160.0 180.0 200.0 220.0 Oct-10 Oct-11 Oct-12 Oct-13 Oct-14 QSE Index S&P Pan Arab S&P GCC 0.1% 0.7% (0.4%) (0.1%) 0.2% (0.1%) (0.9%) (1.2%) (0.8%) (0.4%) 0.0% 0.4% 0.8% Saudi Arabia Qatar Kuwait Bahrain Oman Abu Dhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,182.72 (1.2) (0.5) (1.9) DJ Industrial 17,685.73 (0.0) 0.3 6.7 Silver/Ounce 16.17 (0.2) (0.9) (17.0) S&P 500 2,048.72 (0.2) 0.4 10.8 Crude Oil (Brent)/Barrel (FM Future) 78.10 (0.5) (1.6) (29.5) NASDAQ 100 4,675.71 (0.6) (0.3) 12.0 Natural Gas (Henry Hub)/MMBtu 4.39 1.7 8.7 1.1 STOXX 600 339.15 0.1 1.3 (6.0) LPG Propane (Arab Gulf)/Ton 72.00 (5.9) (10.8) (43.1) DAX 9,472.80 0.3 2.7 (9.8) LPG Butane (Arab Gulf)/Ton 100.63 (3.2) (7.6) (25.9) FTSE 100 6,696.60 0.0 0.8 (6.1) Euro 1.26 0.1 0.2 (8.7) CAC 40 4,266.19 0.2 1.8 (9.6) Yen 117.97 0.9 1.4 12.0 Nikkei 17,288.75 (1.1) (2.3) (5.3) GBP 1.57 0.3 0.1 (5.3) MSCI EM 989.91 0.1 (0.1) (1.3) CHF 1.04 0.1 0.2 (6.7) SHANGHAI SE Composite 2,450.99 (0.2) (0.9) 14.6 AUD 0.86 (1.2) (1.5) (3.4) HANG SENG 23,373.31 (0.7) (3.0) 0.3 USD Index 87.65 0.1 0.1 9.5 BSE SENSEX 28,032.85 (0.8) (0.6) 32.1 RUB 46.73 (0.3) (1.2) 42.2 Bovespa 53,402.81 3.0 3.9 (5.1) BRL 0.39 0.5 1.1 (8.1) RTS 1,021.17 0.0 2.1 (29.2) 199.8 148.5 135.0