24 July Daily market report

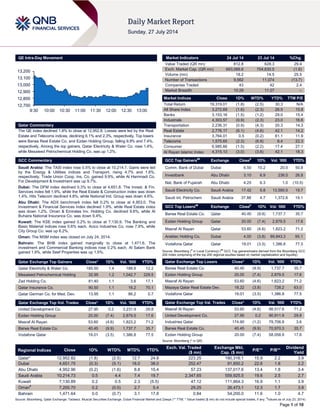

- 1. Page 1 of 10 QE Intra-Day Movement Qatar Commentary The QE index declined 1.8% to close at 12,952.8. Losses were led by the Real Estate and Telecoms indices, declining 6.1% and 2.3%, respectively. Top losers were Barwa Real Estate Co. and Ezdan Holding Group, falling 9.9% and 7.4%, respectively. Among the top gainers, Qatar Electricity & Water Co. rose 1.4%, while Mesaieed Petrochemical Holding Co. was up 1.2%. GCC Commentary Saudi Arabia: The TASI index rose 0.5% to close at 10,214.7. Gains were led by the Energy & Utilities indices and Transport, rising 4.7% and 1.6%, respectively. Trade Union Coop. Ins. Co. gained 9.9%, while Al Hammadi Co. For Development & Investment was up 9.7%. Dubai: The DFM index declined 0.3% to close at 4,651.8. The Invest. & Fin. Services index fell 1.9%, while the Real Estate & Construction index was down 1.4%. Hits Telecom declined 4.8%, while National Ind. Group was down 4.6%. Abu Dhabi: The ADX benchmark index fell 0.2% to close at 4,953.0. The Investment & Financial Services index declined 1.9%, while Real Estate index was down 1.2%. Oman & Emirates Inv. Holding Co. declined 9.6%, while Al Buhaira National Insurance Co. was down 9.4%. Kuwait: The KSE index gained 0.2% to close at 7,130.9. The Banking and Basic Material indices rose 0.6% each. Acico Industries Co. rose 7.9%, while City Group Co. was up 6.2%. Oman: The MSM index was closed on July 24, 2014. Bahrain: The BHB index gained marginally to close at 1,471.6. The investment and Commercial Banking indices rose 0.2% each. Al Salam Bank gained 1.9%, while Seef Properties was up 1.5%. Qatar Exchange Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Electricity & Water Co. 185.50 1.4 188.9 12.2 Mesaieed Petrochemical Holding 32.95 1.2 1,042.7 229.5 Zad Holding Co. 81.40 1.1 3.6 17.1 Qatar Insurance Co. 90.50 1.1 16.2 70.1 Qatar German Co. for Med. Dev. 13.95 1.1 86.2 0.7 Qatar Exchange Top Vol. Trades Close* 1D% Vol. ‘000 YTD% United Development Co. 27.95 0.2 3,231.9 29.8 Ezdan Holding Group 20.00 (7.4) 2,879.5 17.6 Masraf Al Rayan 53.60 (4.6) 1,823.2 71.2 Barwa Real Estate Co. 40.45 (9.9) 1,737.7 35.7 Vodafone Qatar 19.01 (3.5) 1,386.8 77.5 Market Indicators 24 Jul 14 23 Jul 14 %Chg. Value Traded (QR mn) 812.8 628.3 29.4 Exch. Market Cap. (QR mn) 693,066.6 704,630.5 (1.6) Volume (mn) 18.2 14.5 25.5 Number of Transactions 9,562 11,074 (13.7) Companies Traded 43 42 2.4 Market Breadth 10:29 11:27 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 19,319.01 (1.8) (2.5) 30.3 N/A All Share Index 3,272.69 (1.6) (2.3) 26.5 15.8 Banks 3,153.16 (1.5) (1.2) 29.0 15.4 Industrials 4,303.57 (0.9) (2.3) 23.0 16.6 Transportation 2,236.31 (0.9) (4.3) 20.3 14.3 Real Estate 2,776.17 (6.1) (4.6) 42.1 14.2 Insurance 3,764.01 0.5 (0.2) 61.1 11.9 Telecoms 1,575.65 (2.3) (6.9) 8.4 22.3 Consumer 6,985.66 (1.5) (2.2) 17.4 27.1 Al Rayan Islamic Index 4,315.13 (3.0) (3.6) 42.1 18.3 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Comm. Bank of Dubai Dubai 6.50 10.2 20.0 50.8 Investbank Abu Dhabi 3.10 6.9 236.0 26.8 Nat. Bank of Fujairah Abu Dhabi 4.25 6.3 1.0 (10.5) Saudi Electricity Co. Saudi Arabia 17.42 5.8 13,590.5 19.7 Saudi Int. Petrochem Saudi Arabia 37.88 4.7 1,372.6 19.1 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Barwa Real Estate Co. Qatar 40.45 (9.9) 1,737.7 35.7 Ezdan Holding Group Qatar 20.00 (7.4) 2,879.5 17.6 Masraf Al Rayan Qatar 53.60 (4.6) 1,823.2 71.2 Arabtec Holding Co. Dubai 4.00 (3.8) 89,843.3 95.1 Vodafone Qatar Qatar 19.01 (3.5) 1,386.8 77.5 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) Qatar Exchange Top Losers Close* 1D% Vol. ‘000 YTD% Barwa Real Estate Co. 40.45 (9.9) 1,737.7 35.7 Ezdan Holding Group 20.00 (7.4) 2,879.5 17.6 Masraf Al Rayan 53.60 (4.6) 1,823.2 71.2 Mazaya Qatar Real Estate Dev. 18.22 (3.8) 728.2 63.0 Vodafone Qatar 19.01 (3.5) 1,386.8 77.5 Qatar Exchange Top Val. Trades Close* 1D% Val. ‘000 YTD% Masraf Al Rayan 53.60 (4.6) 98,517.6 71.2 United Development Co. 27.95 0.2 90,911.9 29.8 Industries Qatar 174.90 (1.2) 79,706.9 3.6 Barwa Real Estate Co. 40.45 (9.9) 70,970.3 35.7 Ezdan Holding Group 20.00 (7.4) 58,058.9 17.6 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 12,952.82 (1.8) (2.5) 12.7 24.8 223.25 190,316.1 15.9 2.2 3.9 Dubai 4,651.75 (0.3) (5.1) 18.0 38.0 252.47 91,850.2 22.6 1.8 2.2 Abu Dhabi 4,952.96 (0.2) (1.6) 8.8 15.4 57.23 137,017.6 13.4 1.8 3.4 Saudi Arabia 10,214.73 0.5 4.4 7.4 19.7 2,347.65 559,925.5 19.6 2.5 2.7 Kuwait 7,130.89 0.2 0.5 2.3 (5.5) 47.12 111,864.3 16.9 1.1 3.9 Oman# 7,200.70 0.2 (0.0) 2.7 5.4 29.25 26,473.1 12.3 1.7 3.9 Bahrain 1,471.64 0.0 (0.7) 3.1 17.8 0.84 54,200.0 11.6 1.0 4.7 Source: Bloomberg, Qatar Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any; # Values as of July 23, 2014) 12,700 12,800 12,900 13,000 13,100 13,200 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 10 Qatar Market Commentary The QE index declined 1.8% to close at 12,952.8. The Real Estate and Telecoms indices led the losses. The index fell on the back of selling pressure from non-Qatari shareholders despite buying support from Qatari shareholders. Barwa Real Estate Co. and Ezdan Holding Group were the top losers, falling 9.9% and 7.4%, respectively. Among the top gainers, Qatar Electricity & Water Co. rose 1.4%, while Mesaieed Petrochemical Holding Co. was up 1.2%. Volume of shares traded on Thursday rose by 25.5% to 18.2mn from 14.5mn on Wednesday. Further, as compared to the 30-day moving average of 14.2mn, volume for the day was 27.4% higher. United Development Co. and Ezdan Holding Group were the most active stocks, contributing 17.8% and 15.9% to the total volume respectively. Source: Qatar Exchange (* as a % of traded value) Ratings, Earnings and Global Economic Data Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Qatar Real Estate Investment Company((Alaqaria) Fitch Qatar LT IDR/ST IDR/SUR BBB+/F2/BBB+ BBB+/F2/BBB+ – Stable – Mubadala Development Company Fitch Abu Dhabi LT IDR/ST IDR/SUR/GMTN/ECP AA/F1+/AA/AA/ F1+ AA/F1+/AA/AA/ F1+ – Stable – Boubyan Bank CI Kuwait FSR/LT FCR/ST FCR/SR BBB/BBB+/A2/ 2 Stable - Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Currency Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, SUR – Senior Unsecured Rating, GMTN – Global Medium-Term Note, ECP – Euro Commercial Paper) Earnings Releases Company Market Currency Revenue (mn)2Q2014 % Change YoY Operating Profit (mn) 2Q2014 % Change YoY Net Profit (mn) 2Q2014 % Change YoY Aramex Dubai AED 917.0 8.8% – – 80.8 11.8% National General Insurance Co. (NGI)* Dubai AED 276.6 0.6% 8.7 -61.2% 40.2 -39.0% National Central Cooling Co. (Tabreed) Dubai AED 299.1 7.3% 100.2 4.7% 90.4 13.8% Orient Insurance Co. Dubai AED 501.9 10.2% 53.3 27.7% 58.5 6.9% Dubai Insurance Co. (DIC) Dubai AED 85.5 16.8% 3.1 7.4% 7.3 35.5% Union Properties (UP)* Dubai AED 1,288.5 40.3% – – 707.1 423.2% Emirates Integrated Telecommunications Co. (Du) Dubai AED 3,023.7 13.7% 966.2 21.2% 547.7 15.6% Agthia Group Abu Dhabi AED 432.5 7.4% 54.9 12.4% 55.8 12.7% Arkan Building Materials Co.* Abu Dhabi AED 366.6 89.1% 37.0 NA 30.1 72.7% Abu Dhabi National Takaful Co. (ADNTC) Abu Dhabi AED 30.6 34.7% 10.8 -32.3% 4.7 -52.8% Foodco Holding* Abu Dhabi AED 77.5 40.0% – – 31.0 81.8% Al Wathba National Insurance Co. (AWNIC) Abu Dhabi AED 55.0 -9.9% 1.4 -84.3% 47.3 55.2% Finance House (FH) Abu Dhabi AED 33.8 13.8% – – 23.8 -16.9% Ras Al Khaimah Properties (RAK Properties)* Abu Dhabi AED 149.4 1.2% – – 51.6 1.0% Jazeera Airways Kuwait KD 15.5 NA 3.6 NA 2.8 NA Wataniya Telecom (Ooredoo)* Kuwait KD 379.4 2.5% – – 48.4 -7.3% Oman Qatari Telecommunications Co. (NAWRAS)* Oman OMR 108.2 10.0% – – 18.7 23.0% Bahrain National Holding Company (BNH) Bahrain BHD 3.4 -7.9% 0.2 1292.9% 0.7 5.6% Seef Properties Bahrain BHD 2.9 -2.3% 2.8 1.4% 1.9 1.8% Bahrain Telecommunication Co. (Batelco)* Bahrain BHD 194.6 14.0% – – 24.9 -1.6% Aluminium Bahrain (Alba) Bahrain BHD 193.6 -1.0% – – 15.2 -26.6% Source: Company data, DFM, ADX, MSM (*1H2014 results) Overall Activity Buy %* Sell %* Net (QR) Qatari 66.72% 65.59% 9,168,693.53 Non-Qatari 33.28% 34.41% (9,168,693.53)

- 3. Page 3 of 10 Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 07/24 US Department of Labor Initial Jobless Claims 19 July 284K 307K 303K 07/24 US Markit Markit US Manufacturing PMI July 56.3 57.5 57.3 07/24 US Bloomberg Bloomberg Consumer Comfort 20 July 37.6 – 37.5 07/24 US US Census Bureau New Home Sales June 406K 475K 442K 07/24 US US Census Bureau New Home Sales MoM June -8.10% -5.80% 8.30% 07/24 EU Markit Markit Eurozone Manufacturing PMI July 51.9 51.7 51.8 07/24 EU Markit Markit Eurozone Services PMI July 54.4 52.7 52.8 07/24 EU Markit Markit Eurozone Composite PMI July 54.0 52.8 52.8 07/25 EU European Central Bank M3 Money Supply YoY June 1.50% 1.20% 1.00% 07/25 EU European Central Bank M3 3-month average June 1.10% 1.00% 0.90% 07/24 France Markit Markit France Composite PMI July 49.4 48.3 48.1 07/24 France Markit Markit France Manufacturing PMI July 47.6 48.0 48.2 07/24 France Markit Markit France Services PMI July 50.4 48.2 48.2 07/25 France French Labor Office Total Jobseekers June 3398.3k 3399.5k 3388.9k 07/25 France French Labor Office Jobseekers Net Change June 9.4 10.5 24.8 07/24 Germany Markit Markit/BME Germany Manu. PMI July 52.9 51.9 52.0 07/24 Germany Markit Markit Germany Services PMI July 56.6 54.5 54.6 07/24 Germany Markit Markit/BME Germany Composite PMI July 55.9 53.8 54.0 07/25 Germany GfK AG GfK Consumer Confidence August 9.0 8.9 8.9 07/25 Germany IFO Institute IFO Business Climate July 108 109.4 109.7 07/25 Germany IFO Institute IFO Current Assessment July 112.9 114.5 114.8 07/25 Germany IFO Institute IFO Expectations July 103.4 104.4 104.8 07/25 UK Hometrack Hometrack Housing Survey MoM July 0.10% – 0.30% 07/25 UK Hometrack Hometrack Housing Survey YoY July 5.80% – 6.00% 07/25 UK ONS GDP QoQ 2Q2014 0.80% 0.80% 0.80% 07/25 UK ONS GDP YoY 2Q2014 3.10% 3.10% 3.00% 07/25 UK ONS Index of Services MoM May 0.30% 0.20% 0.30% 07/25 UK ONS Index of Services 3M/3M May 1.00% 1.00% 0.90% 07/24 SP INE Unemployment Rate 2Q2014 24.47% 24.90% 25.93% 07/25 SP INE PPI MoM June 0.90% – 0.90% 07/25 SP INE PPI YoY June 0.40% – -0.40% 07/24 IT ISTAT Consumer Confidence Index July 104.6 105.2 105.6 07/24 CH Markit HSBC China Manufacturing PMI July 52.0 51.0 50.7 07/24 JN Markit Markit/JMMA Japan Manufacturing PMI July 50.8 – 51.5 07/25 JN MIC Natl CPI YoY June 3.60% 3.50% 3.70% 07/25 JN Bank of Japan PPI Services YoY June 3.60% 3.60% 3.60% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar MPHC reports net profit of QR899.4mn in 1H2014 – Mesaieed Petrochemical Holding Company (MPHC) – a subsidiary of Qatar Petroleum (QP) – reported a net profit of QR899.4mn in 1H2014, reflecting the group’s enhanced cash position. Cash from operations across all group companies stood at QR 894.8mn for 1H2014. The group maintained strong EBITDA margins for 1H2014 which was aided by resilient key product prices, supply of competitively priced ethane feedstock and fuel gas under long-term supply agreements with QP and the recognition of a tax refund from the Public Revenues and Tax Department. MPHC’ EPS amounted to QR0.72 in 1H2014. On a segmental level, the revenue from its business unit Q- Chem/Q-Chem II amounted to QR1.8bn for 1H2014 with Polyolefins constituting 71% of revenue, alpha-olefins 26% with the remainder attributable to other minor products. Q-Chem/Q- Chem II’s combined EBITDA for 1H2014 was QR1.1bn, with EBITDA margin of 63.3%. Net profit for the period 1H2014 was QR 836.4mn. Meanwhile, QVC’s revenue amounted to QR 348.3mn for 1H2014 from the sale of its chlor-alkali products. For 1H2014, net profit stood at QR18.3mn with a net profit margin of 5.3%, while EBITDA was QR59.2mn and EBITDA margin of 17.0%. (QE) AHCS posts QR159mn net profit in 1H2014 – Aamal Company (AHCS) reported a net profit of QR159mn in 1H2014, indicating an increase of 18.9% on a YoY basis, supported by robust performance of all of its divisions (Industrial Manufacturing QR25.8mn in 1H2014 as compared to QR0.4mn in 1H2013, Trading & Distribution QR51mn as compared to QR42.8mn in 1H2013). The Company’s EPS stood at QR0.27 in 1H2014 versus QR0.22 in 1H2013. AHCS’ revenue increased by 14% YoY to reach QR1.1bn. The company’s net investment in capital expenditure stood at QR38.7mn in 1H2014 as compared to QR81.9mn in 1H2013, the majority of which was driven by Advanced Pipes & Casts Company and Aamal Readymix’s upgrade of its fleet. (Company Press release) NLCS reports net profit of QR30.7mn in 1H2014 – Alijarah Holding Company (NLCS) reported a net profit of QR30.7mn in 1H2014 while EPS amounted to QR0.62. The company’s total revenue stood at QR130.6mn in 1H2014, achieved from multiple

- 4. Page 4 of 10 business lines, including Taxi & Limousine services, Material transportation & Earth moving equipment, Leasing and Infrastructure & Property development. In the area of Equipment, some contracts were completed while others are into force & new contracts yet to commence during 2014. In the field of real estate NLCS has completed a deal of purchasing a property in Al Aziziya area of QR120mn to be developed into shops and administrative offices in the coming period, leading the company to promote investments in the real estate field. Considering taxi services, the fleet consisted of 650 taxi cabs in 2013. A new 150 taxi cars were added during the 1Q2014 reaching 800 cars. Under the franchise agreement with Karwa, Mowasalat, the fleet is meant to reach 1000 car before the end- 2014, which also leads to an increment in the operational & consumable expenses. (QE) QGMD reports net loss of QR6.46mn in 1H2014 – Qatar German for Medical Devices Company (QGMD) revealed a net loss of QR6.46mn in 1H2014 as compared to a net loss of QR3.18mn in 1H2013. The Loss per Share (LPS) amounted to QR0.55 in 1H2014 versus loss per share (LPS) of QR0.27 in 1H2013. (QE) SIIS posts QR43.8mn net profit in 1H2014 – Salam International Investment (SIIL) reported a rise in its net profit to QR43.8mn in 1H2014 in comparison to QR14.5mn in 1H2013. The Company’s EPS reached QR0.38 in 1H2014 as of June 30, 2014 versus QR0.13 in 1H2013. (QE) Barwa Bank 1H2014 profit rises by 35% to QR411mn – Barwa Bank reported net profit of QR411mn in 1H2014, reflecting an increase of 35% on a YoY basis. Total assets grew by 28% to QR35.6bn as compared to 2Q2013 while financing assets increased 35% to exceed QAR22bn. Customer deposits increased by 35% to QR22.4bn. EPS amounted to QR1.38 verses QR1.01 in 1H2013. Barwa bank strengthened its profitability in 1H2014 by increasing revenue by 11% while reducing expenses by 5%. Non-performing assets reduced to less than 1.5% of the total financing assets as compared to 2% at the end of 2013. (Zawya, Peninsula Qatar) QNBK, ZyFin forge ties to tap India’s sovereign debt market – QNB Group (QNBK) has partnered with ZyFin Capital, an investment advisory firm, to open the QNB ZyFin India Sovereign Bond Fund for private subscription. This open-ended fund is the first dedicated fund to invest fully in the Indian sovereign debt market. It is also the first fund to benchmark itself against the S&P BSE India 10-year Sovereign Bond Index. The QNB ZyFin Sovereign Bond Fund will provide global investors a cost-efficient access to one of the most promising bond markets in Asia, whose debt markets have traditionally been difficult to access. The fund has been designed by ZyFin Capital in partnership with QNB Group. The fund is licensed by the Qatar Central Bank and once the private subscription period is finalized, approval from the Qatar Financial Market Authority (QFMA) will also be sought to list its units on the Qatar Exchange. (Gulf-times.com) ERES: Qatar real estate records 30.5% growth in June – Ezdan Holding Group (ERES) has reported that Qatar’s real estate sector recorded a robust growth of 30.5% in June in terms of number of transactions, despite the summer season slowdown. In mid-June this year, ERES reported that transactions rose to 141 deals worth QR1.31bn (daily average of QR262mn), as compared to 108 deals from the previous week. The report also noted that despite the 29.7% decline in the value of transactions from QR1.9bn in the previous week to QR1.3bn, revenues were still above the weekly average recorded since the beginning of 2014. The Al Mirqab area secured the highest deal at QR250mn, while Doha topped the transactions for the week with 28 deals worth QR921.2mn. The ERES report predicted a rise in property transactions over the coming weeks, especially in the land lots segment. (Gulf-Times.com) CI affirms Qatar’s sovereign ratings – Capital Intelligence (CI) has affirmed Qatar’s long-term foreign and local currency ratings of ‘AA-’, along with its short-term foreign and local currency ratings at ‘A1+’. The outlook for these ratings remains stable. Qatar’s ratings primarily reflect its substantial economic wealth and sound macroeconomic management. The country’s strong public and external finances are underpinned by the sheer scale of hydrocarbon production relative to the small size of the population and supported by favorable trends in international energy prices. (Bloomberg) KCBK signs Closir to offer investors platform – Al Khalij Commercial Bank (KCBK) has signed a partnership deal with London-based technology company Closir to enhance its shareholder engagement efforts with the leading investor relations platform for listed companies and global institutional investors. KCBK has sought Closir’s solutions to leverage the best practice disclosure and facilitate connection with its institutional investors. The new relationship comes after Qatar, the third largest equity market in the GCC, was upgraded to the MSCI Emerging Market Index from the MSCI Frontier Markets in May 2014. The new classification is expected to result in additional inflows of an estimated $500mn, as funds that track the index take positions in the Qatari market. Dr Joe Maalouf, Head of Investor Relations, KCBK, said that effective stakeholder engagement is recognized across the wider public sector as a vital aspect of ensuring business delivery. (Gulf- Times.com) Qatargas awards vibration engineering contract to Xodus Group – Qatargas has selected Xodus Group to deliver vibration engineering services for its onshore and offshore facilities. Xodus is collaborating with Chiyoda Almana Engineering for the contract. The two companies seek to develop a long-term piping integrity management program to assess, reduce or eliminate vibration in all of Qatargas’ facilities. The $1mn per year contract has been signed for a Technical Services Vibration Program at Qatargas’ QG1, QG2 and QG3&4 LNG Facilities, Ras Laffan refinery and associated offshore assets, with the option of an extension for a further two years. (Bloomberg) Nexans wins cabling contract on Laffan refinery – Nexans has been awarded a contract to provide power and instrumentation cabling for the construction of Laffan Refinery 2 in Doha. The contract has been awarded by CCJV – a joint venture between Chiyoda and CTCI – which is the main contractor on the project. Nexans will provide over 1,000 km of cables that suit the requirements of the oil & gas industry, including low and medium-voltage and flame retardant cables. Construction of the refinery began in December 2013, and is expected to be completed by 3Q2016. (Bloomberg) SEC, QLC sign deal for leadership program – The Supreme Education Council (SEC) has signed a MoU with Qatar Leadership Centre (QLC) to develop and strengthen capacity building among the SEC's leadership. According to the MoU, QLC will organize a specialized leadership training program to upgrade the skills of council’s officials in order to achieve the SEC's objectives that are in line with the Qatar National Vision 2030. (Qatar Tribune) QF awards construction for Sidra facilities – The Qatar Foundation for Education, Science & Community Development (QF) has awarded the contract to complete the construction of

- 5. Page 5 of 10 Sidra Medical and Research Center, located inside the Education City, to a joint venture of Midmac and Consolidated Contractors Group SAL. The two companies are expected to begin work at the site immediately. (Peninsula Qatar) Qatar willing to hire 180,000 Nepali workers this year – According to sources, Qatar is willing to take as many as 180,000 Nepali workers this year, though there has been a demand for diversifying the source of expatriate workforce in the country. Kathmandu-based E-Kantipur.com, quoting the Nepali embassy in Doha, said the Qatari government has allocated 180,000 jobs for Nepali workers this year amid pressures from local recruitment companies to prioritize on workers from other countries. Qatari companies have reportedly been pressing the government to seek alternatives to hiring Nepali workers due to the lengthy and tough process involved. (Gulf-Times.com) QE announces Eid Al- Fitr holidays – As per the circular from the Qatar Central Bank (QCB) and the instructions of the Qatar Financial Markets’ Authority (QFMA), the Qatar Exchange (QE) has announced that holidays for Eid Al- Fitr will be four working days, starting on July 28, 2014 till July 31, 2014. The QE’s official work will resume on August 3, 2014. (QE) MRDS to announce results on August 14 – Mazaya Qatar Real Estate Development (MRDS) will disclose its financial reports for the period ending June 30, 2014, on August 14, 2014. (QE) International US business spending data gives mixed signals on growth – A mixed reading on the health of business investment in the US suggested the country’s economy may not have rebounded as strongly in 2Q2014 as previously believed, but it offered hope for the rest of 2014. The Commerce Department said non- defense capital goods orders excluding aircraft, rebounded 1.4% after declining by a downwardly revised 1.2% on the prior month. However, shipments of these so-called core capital goods fell 1.0%. It was the third month of decline in shipments, prompting some economists to temper their second-quarter growth estimates. TD Securities said that the weak performance in core capital goods shipments during the quarter suggests that this segment is unlikely to contribute much to economic activity. Morgan Stanley trimmed its second-quarter growth estimate by one-tenth of percentage point to a 3.2% annual rate, while JPMorgan lowered its forecast to 2.6% from 2.7%. Meanwhile, the US economy contracted 2.9% in the first three months of the year, with business spending on equipment falling at a 2.8% rate. (Reuters) ONS: UK overcomes record slump with 0.8% quarterly growth – The UK has completely recovered its output that was lost during the financial crisis and is now on track to be the best- performing Group of Seven economy in 2014. The Office for National Statistics (ONS) said GDP expanded 0.8% in 2Q2014, pushing output above its previous peak in 1Q2008. The rise was the same as in the first quarter and in line with the median estimate in a Bloomberg News survey. These figures may provide a boost for Prime Minister David Cameron as he seeks re-election in less than a year, and maintain pressure on the Bank of England to begin raising interest rates. Meanwhile, the International Monetary Fund raised its UK growth forecast to 3.2%, putting Britain on course to expand at almost twice the pace of the US in 2014. GDP between April and June stood at 0.2% above its pre-crisis level after six consecutive quarters of expansion. Output was 3.1% higher than a year earlier, the fastest annual pace since the final three months of 2007. (Bloomberg) Slower Japan inflation highlights BoJ’s reflation task – Japan’s inflation slowed in June, highlighting the tough task faced by the Bank of Japan Governor Haruhiko Kuroda in reaching the bank’s target. The official statistics bureau said that consumer prices excluding fresh food rose 3.3% from a year earlier after a 3.4% gain in May. The increase matched the projection in a Bloomberg News survey of 32 economists. Kuroda said inflation will ease in coming months before accelerating later in 2014 toward the BoJ’s 2% goal, which strips out the effects of a sales-tax increase in April. As the impact of the Japanese yen’s slide on prices fades, some economists say the central bank may add stimulus if price gains drop below 1. (Bloomberg) Brazil to pump 45bn Reais in credit into ailing economy – Brazil's central bank announced measures to inject as much as 45bn Reais in credit into the country's ailing economy, which is weighed down by the highest borrowing costs. The bank said it was freeing up an estimated 30bn Reais in the financial system by making changes to banks' reserve requirements and an additional 15bn Reais may be unlocked over time by easing minimum capital requirements in credit operations. The bank said this move aims at improving the distribution of liquidity in the economy, given the recent slowdown in credit and relatively low levels of loan defaults. After years of slow growth, the Brazilian economy is now on the verge of a recession as manufacturing shrinks and industry workers lose their jobs. Inflation, however, is running at 6.5%, the ceiling of a government target, leaving policymakers in a difficult position. (Reuters) PMIs show global economy starts 2H2014 on solid footing – China's factory activity expanded at its fastest pace in 18 months in July 2014, while the Eurozone's private sector also perked up, but the pace of US manufacturing expansion slowed. While China is relying on increased government stimulus to steer its economy away from reliance on exports and toward consumer spending, Europe has taken the opposite approach, combining fiscal austerity with near-zero interest rates. The latest HSBC/Markit Flash China Manufacturing Purchasing Managers' Index rose to 52 in July from 50.7, the highest reading since January 2013. Similarly, the private sector activity in the Eurozone also rose more than expected, to 54.0 from 52.8, with inflation remaining lows. Deutsche Bank’s European economist Mark Wall said that the strength of the data from China and the Eurozone offers some encouragement about the momentum building for the global economy at the start of 3Q2014. However, as per Markit, the pace of expansion in the US manufacturing sector eased in July with new orders and employment also growing more slowly. The preliminary US Manufacturing Purchasing Managers Index stood at 56.3 in July, down from the June reading of 57.3 and below analyst expectations for a reading of 57.5. (Reuters) China jobless rate at around 4.1-5.1% in June – China released two measures of unemployment that had a divergence of almost 1% point, underscoring a lack of clarity in the job market in the world’s second-largest economy. While the first Friday of the month in the US typically sees investors, policy makers and members of the public eagerly awaiting the American employment report, no such equivalent exists for China. Chinese ministry said the registered urban jobless rate was 4.08% at the end of June, two days after another agency said the urban jobless rate was 5.05%, based on a 31-city survey. (Bloomberg) Russia raises rates to prepare for Western sanctions – The Russian central bank unexpectedly raised its interest rates, apparently preparing for possible Western sanctions over

- 6. Page 6 of 10 Ukraine that could speed up capital flight from Moscow's already battered markets. The 28-nation EU has warned it may curb Russia’s access to capital markets, arms and energy technologies in response to last week's downing of a Malaysian airliner in an area of eastern Ukraine held by Russian-backed separatists. The central bank said the 50-basis points rate hike was governed by concerns about high inflation and geopolitical tensions – an apparent reference to Ukraine. The central bank said inflation risk has increased due to a combination of factors, including, inter alia, the aggravation of geopolitical tensions and its potential impact on the Russian rouble’s exchange rate dynamics. (Reuters) India threatens to derail WTO deal, prompts angry US rebuke – India threatened to block a worldwide reform of custom rules, which some estimates say could add $1tn to the global economy and create 21mn jobs, prompting a US warning that its demands could kill global trade reform efforts. Diplomats from the 160 World Trade Organization member countries meeting in Geneva had been meant to rubber stamp a deal on "trade facilitation" that was agreed at talks in Bali last December in the WTO's first ever global trade agreement. But India, in an 11th-hour intervention, demanded a halt to the trade facilitation timetable until the end of the year and said a permanent WTO deal on food stockpiling must be in place at the same time, well ahead of an agreed 2017 target date. (Reuters) Regional Tadawul opening to direct foreign investments boosts MENA – The Saudi Cabinet’s approval to open the Saudi stock market for direct foreign investments after the issuance of guidelines from the country’s Capital Market Authority (CMA) drew positive reactions. The actual opening of the market is expected to happen in 1H2015. Deutsche Bank’s Research Analyst Aleksandar Stojanovski said that the opening of the Saudi stock market would be a major positive for the MENA region, with a total market capitalization of $1.2tn, where Saudi Arabia alone accounts for 45%. With over 160 listed securities, Saudi equities are currently accessible only via synthetic products for foreign investors and have less than 1% foreign ownership versus regional peers, where direct investments are available, with foreign ownership accounting for around 8%. Stojanovski said after the opening of the Saudi market and assuming foreign ownership reaches a similar level to the regional equity markets, around $35bn worth of incremental foreign inflow is expected as compared to the around $4bn that foreigners have accumulated since 2009, when indirect ownership first became available. (Gulf-Base.com) Serenity Villa project gets good response in Turkey – A new UAE-Turkish entrepreneurial company, Deal Sapanca, announced that its iconic FCC Serenity Villa project located in the picturesque Sapanca Lake region in Turkey has received good response from Gulf nationals. The company, mandated to market projects by Turkish-based FCC Construction & Development Company, also pointed out that the FCC Serenity Villa project is almost 60% complete and is scheduled to be handed over in the beginning of 2015. The FCC Serenity Villa project is being built on 55,000 square meters land in Sapanca one of the best vacation destinations in Turkey. (GulfBase.com) GPCA: Saudi fertilizer industry set for diversification era – According to the Gulf Petrochemicals & Chemicals Association (GPCA), the Saudi fertilizer industry leads regional production and is set to usher in a period of strong growth and diversification. According to the GPCA’s 2013 GCC Fertilizer Industry Indicators, Saudi Arabia dominates the GCC fertilizer industry with a capacity of 17.1mn tons, holding 40% of the region’s total capacity. In 2013, fertilizer capacity in the GCC reached 42.7mn tons, a 4% increase from the previous year. The global fertilizer industry, meanwhile, grew by just 1.7% in the same period. Nitrogen-based fertilizers like ammonia and urea dominate Saudi’s production capacity, but infrastructural developments in the Kingdom are geared toward product diversification. Projects like the $7bn Maaden’s Waad Al-Shamal city, expected to begin production at the end of 2016, will tap into Saudi Arabia’s large phosphate rock reserves to produce up to 2.3mn tons of diammonium phosphate fertilizers. (Bloomberg) Saudi PIF plans housing firms – Saudi Finance Minister Ibrahim Al-Assaf said that Saudi Arabia's Public Investment Fund (PIF) aims to establish companies in various areas including housing, petrochemicals and technology, as it expands its investments locally and overseas. According to the Sovereign Wealth Fund Institute, the PIF was established in 1971 to help finance strategic economic projects and has assets under management worth about $5.3bn. The cabinet authorized the PIF to establish companies inside and outside the Kingdom in partnership with other institutions from the public or private sectors. (Gulf-Base.com) SEDCO’s Riyali partners with Khawater 10 – The Saudi Economic & Development Company’s (SEDCO Holding Group) Riyali Financial Literacy Program (Riyali) has entered into a partnership with the popular ‘Khawater 10’ program hosted by Ahmad AlShugairi on satellite TV channel MBC 1. The collaboration comes in line with Riyali’s CSR initiative to instill human values in the community and sustain growth for a collective end, and in conformity with the issues raised over Khawater’s program. (GulfBase.com) KSA boosts renewable energy investments – The Kingdom has confirmed its commitment to allocate over $109bn of investment to develop a strong renewable energy sector by 2032. The Kingdom’s strategy targets renewable energy to contribute 20-23% of its energy needs, with the world’s most valuable company, the Saudi Aramco, taking the lead in the country’s solar energy development. The ambitious plan is fast progressing as Saudi Aramco is already setting up a 300 MW plant. The government has also mandated Saudi investments funds to use their substantial liquidity to partner with international renewable energy providers to cater for this rapidly growing sector. (GulfBase.com) DHHC signs SR955.5mn Islamic financing deal with SABB – Dallah Healthcare Holding Company (DHHC) has signed an Islamic financing agreement worth SR955.5mn with Saudi British Bank (SABB) for a term of six and half years. The amount is to be paid after a grace period of 37 months. The company intends to use these facilities to finance the construction of its new medical facilities and hospitals. The financing facilities were granted against a promissory note from the company to the benefit of SABB with the total facilities granted of SR1bn. The granted facilities from SABB included Tawarruq Metal Murabaha, L/Gs, bridge financing, and structured hedging. (Tadawul) Saudi Oger owned Cell C restructures debt – South Africa- based mobile operator Cell C – majority owned by Saudi construction & telecom group Saudi Oger – said that it would look to restructure €77.4mn worth of senior debt, a move that could help improve its cash management. The company said it would ask bondholders for permission to extend by three years the maturity of senior secured notes due July 2015. The two tranches of euro-dominated notes have a coupon of 8.625%. Cell C also said it would buy back in cash any of the notes for

- 7. Page 7 of 10 their principal amount from bondholders who would rather sell than extend the debt. (Reuters) SEC to receive SR1.5bn claim settlement from Saudi Aramco – The Saudi Electricity Company (SEC) is to receive SR1.5bn payment from oil giant Saudi Aramco toward claims settlement for using its electricity transmission systems. The settlement includes payments due between 2007 and 2013 and will affect cash flow and reduce consumer receivables in 3Q2014. (Bloomberg) EIU: UAE economy to grow 4.4% from 2014-18 – According to the Economist Intelligence Unit, the UAE economy is expected to register an annual growth of 4.4% between 2014 and 2018.The report said although the economic growth of the UAE would depend on oil production, the huge accumulative reserves of foreign assets would contribute in maintaining a balanced economic growth. The report added that the efforts to expand the economic growth base would play a clearer role during the second half of the forecast period, so that the growth of non-oil segments would constitute an additional support that would protect the economy from the fluctuating oil prices. Meanwhile, the IMF said UAE’s economic recovery has been solid, supported by the country’s real estate, tourism and hospitality sectors. The Fund observed that the macroeconomic outlook is positive. (Gulf-Base.com) EIB’s profit jumps 104% to AED226.46mn in 1H2014 – Emirates Islamic Bank (EIB) reported a net profit of AED226.46mn for 1H2014, up 104% as compared to AED111.02mn for 1H2013. In 2Q2014, the bank’s net profits were up 70.3% at AED132.49mn compared to AED77.78mn in 2Q2013. For 1H2014, the bank’s total assets were up 4.27% at AED41.46bn as compared to AED39.77bn at the end of December 2013. Bank’s total income for 1H2014 surged to AED1bn from AED929.64mn compared to 1H2013, while income from financing activities was up 17.24% at AED661.97mn in 1H2014 compared to 1H2013. EPS for 1H2014 amounted to AED0.058 as compared to AED0.034 in 1H2013. (DFM) Emirates NBD reports AED1,308mn net profit for 2Q2014 – Emirates NBD reported a net profit of AED1,308mn for 2Q2014, improved 35% YoY and 25% QoQ. The bank’s net interest income rose 22% YoY, helped by an improved asset mix due to retail and Islamic growth, CASA growth leading to lower cost of funds and a 5% contribution from Egypt. Non-interest income improved 37% YoY, boosted by increases in trade finance income, asset management fees, gains from legacy property sales and a contribution of 3% from Egypt. Cost to income ratio improved 4.6% YoY. Egypt contributed 6% of the increase. Provisions of AED1,345mn boosted the coverage ratio by 4% in Q2 to 64.7%. Advances-to-deposit ratio of 95.6% was within the 90-100% management range. The bank’s 2Q2014 net interest income improved to 2.78% due to improving asset and deposit mix. Total assets grew by 2% to AED348.3bn in 1H2014. Customer loans increased by 1% to AED241.8bn. Customer deposits also increased by 6% to AED252.9bn over the same period. The bank’s NPL ratio improved further to 13.5% whilst the Tier 1 ratio strengthened to 15.6%. (DFM) DIB net profit up 59.6% in 2Q2014 – Dubai Islamic Bank (DIB) posted a 59.6% jump in 2Q2014 net profit, aided by higher fee and investment income. The bank made profit of AED667.5mn in 2Q2014, up from AED418.2mn in 2Q2013. Net profit for 1H2014 increased to AED1,337mn from AED739mn during 1H2013, an increase by 81%. Total revenue for 1H2014 increased to AED3,056mn from AED2,714mn in 1H2013, an increase of 12.6%. The result continues a positive earnings reporting season for banks in the UAE, whose profits have jumped in recent quarters because of a growing domestic economy and improved asset quality. DIB's earnings were boosted by a 34.5% increase in income from commissions, fees and foreign exchange, as well as hikes in revenue generated from property and other investments. Net financing assets grew to AED66.1bn at June 30, 2014 from AED56.1bn at December 31, 2013, an increase of 18%. Customer deposits stood at AED94.8bn at the end of June, up 20% on the end of 2013, while total loans were 18% higher over the same timeframe at AED66.1bn. (DFM) Marka to list on DFM in September – Marka said that its shares would list on the Dubai Financial Market (DFM) in September 2014, more than four months after the subscription period for its offering closed. In April 2014, Marka’s IPO, which targeted a market capitalization of AED500mn, was 36.5 times oversubscribed, attracting AED10bn in subscriptions. Marka said that it would list its shares in the second week of September after having obtained the preliminary approval from the Securities & Commodities Authority (SCA). Marka’s plan is to use the IPO money to build a presence in the retail, luxury and restaurant business in the Arabian Gulf region. (GulfBase.com) Dubai Trade, Imdaad sign agreement – Imdaad has entered into an agreement with Dubai Trade to utilize the trade facilitator’s ‘Rosoom’ online payment gateway. Under the terms of agreement, Imdaad’s client base of around 2900 customers may now use Imdaad’s portal powered by Dubai Trade’s e- Payment gateway ‘Rosoom’ to process the company’s payment for services rendered through multiple payment options including major credit cards, direct debit by linking to the online internet banking portals of major banks, and pre-paid instruments such as e-Dirham. ‘Rosoom’ is compliant with the latest 3-D secure requirements, which aim to reduce the fraudulent transactions and therefore give greater protection to the business entities connected to it. (GulfBase.com) Sheffield reports over 80% of Marina 101 project completed – Sheffield Holdings Limited has announced that over 80% of its Marina 101 project has been completed. The tower, which stands at 425 meters, is poised to be the tallest tower in Dubai Marina and the second tallest tower in the UAE. The expected handover of the Hotel is anticipated to be in early 2015. Following the approvals and the certification of its completion, handover of the hotel apartments and residential units will begin accordingly. Upon completion, the tower will house a total of 420 hotel and hotel apartments, 60 three bedroom residential units, eight duplexes and a five-star hotel. The tower will be fully equipped with health clubs and swimming pools on different levels, along with other leisure facilities. (GulfBase.com) Tamweel becomes private joint stock company – Tamweel Properties & Investments announced that the company has been converted into a private joint stock company from public joint stock company in accordance with the ministerial resolution. (DFM) Ajman Bank reports AED10.8mn net profit in 2Q2014 – Ajman Bank reported net profit of AED10.8mn in 2Q2014 as compared to AED960,000 in 2Q2013. The bank made net profit of AED24.5mn in 1H2014 as compared to AED13.27mn in 1H2013. Net operating income for 2Q2014 was AED81.86mn as compared to AED56.64mn in 2Q2013. Total assets as of June 30, 2014 stood at AED8.8bn as compared to AED7.1bn as of December 31, 2013. Customer deposits increased to AED6.2bn as compared to AED5.5bn as of December 31, 2013. EPS for

- 8. Page 8 of 10 1H2014 amounted to AED0.0245 as compared to AED0.0133 in 1H2013. (DFM) Tabreed’s share capital increased to AED738mn through bond conversion – National Central Cooling Co. (Tabreed) has approved the increase of share capital to AED738,489,649 (AED1 per share) pursuant to the conversion of bonds into 79,426,202 additional shares at a conversion price of AED1.6856 per share issued by Tabreed to General Investments FZE. As a result of this conversion, General Investments FZE's shareholding has increased to 19.88% of Tabreed's share capital. General Investments FZE is wholly- owned by Mubadala Development Company. Therefore, Mubadala Development Company's shareholding has increased to 33% of Tabreed's share capital. (DFM) Former Arabtec CEO sells stake worth AED14.6mn – According to the exchange data, Arabtec's former CEO, Hasan Ismaik, has sold about AED14.6mn worth of shares in the group in the week ended July 24, 2014, cutting his stake slightly. Ismaik cut his stake to 28.77% from 28.85%, the website of the Dubai Financial Market (DFM) showed. The data showed 3.52mn shares were sold, worth AED14.6mn. (Reuters) Dubai airport traffic cut by runway work in June – Dubai Airports said that passenger traffic through Dubai International Airport dropped 8.5% YoY to 5.07mn people, as construction temporarily reduced its capacity. The airport cut back flights by about 26% for an 80-day period that ended on July 21, 2014, as first one runway and then the other was closed for resurfacing and other work. In 1H2014, passenger traffic expanded 6.2% to 34.68mn people. Cargo volumes in June dropped 14.3% to 180,025 tons. 1H2014 volumes edged down 1.8% to 1.18mn tons. (Reuters) TAQA pulls out of $1.6bn India power deal – Abu Dhabi National Energy Company (TAQA) is pulling out of a $1.6bn deal to buy two Indian hydroelectric power plants because of a change in strategy. In March 2014, TAQA said a consortium led by it had agreed to buy the two power plants from Jaiprakash Power Ventures. The consortium was to spend $616mn on equity in the plants, and in addition take over their non-recourse project debt, bringing the total enterprise value to around $1.6bn. State-run TAQA, with 51% of the consortium, was to control the operations and management of both plants. TAQA’s withdrawal from the deal made it liable to the payment of a break fee, Jaiprakash Power said in the filing. (GulfBase.com) RAKBank in talks to acquire majority stake at RAK Insurance – The National Bank of Ras Al Khaimah (RAKBank) said that it intends to acquire a majority stake in Ras Al Khaimah National Insurance (RAK Insurance) amid a consolidation of the insurance industry in the UAE. The bank said in a statement to the stock exchange that it is in the process of negotiating the details with the regulators, including the Securities & Commodities Authority and the Abu Dhabi Securities Exchange. The government of Ras Al Khaimah owns stakes of slightly less than 50% in both RAKBank and Rak Insurance. (GulfBase.com) Bidding open for Abu Dhabi’s onshore oilfields – Bids have been placed by major global energy players for stakes in Abu Dhabi’s onshore oil fields, capable of producing 1.6mn bpd. Based on previous partnerships, Royal Dutch Shell, BP and Total have already submitted bids to gain a stake, which will be reviewed by the Abu Dhabi Company for Onshore Oil Operations (ADCO). However, US-based petroleum giants ExxonMobil have reportedly decided against renewing their share in the onshore oil initiative. Abu Dhabi is currently undergoing an expansion regarding oil production, with aims to increase output from 2.7mn bpd, across both onshore and offshore facilities, to a record 3.5mn bpd by 2017. According to sources, China’s National Petroleum Corporation (CNPC), Japan’s Inpex and Korea National Oil Corp are all said to have made fresh bids, with Russia’s Rosneft expected to follow suit. (GulfBase.com) Bank of Sharjah reports AED152mn net profit in 1H2014 – Bank of Sharjah reported a net profit of AED152mn in 1H2014, indicating an increase of 6% YoY. As of June 30, 2014, loans and advances reached AED13,947mn, 8% above the corresponding 2013 figure of AED12,895mn, and 6% more than the December 31, 2013, balance of AED13,135mn. Total assets reached AED23,805mn in 1H2014, an increase of 5% as compared to AED22,673mn in 1H2013. When compared to the December 31, 2013 figure, total assets declined slightly by 5% from AED24,973mn. This was mainly driven by a 6% decline in customer deposits from AED18,374mn in December 31, 2013, to AED17,217mn as of June 30, 2014. The main reason for the decline in deposits was due to the unwinding of expensive and unstable deposits. Total operating income for 1H2014 declined by 18% as compared to 1H2013, mainly due to the decline in both net interest income and non-interest income. The decline in net interest income was mostly driven by the overall decline in market interest rates, and the fact that the high liquidity held by the bank is placed in money market instruments generating negligible yields. (Gulf-Base.com) Etisalat announces entitlement date for dividend distribution – Emirates Telecommunications Corporation’s (Etisalat) has announced that the entitlement date for the distribution of interim dividend of 35 fils per share for 1H2014 will be August 3, 2014 instead of July 30, 2014 due to the Eid Al Fitr holidays. However, the start date of the dividend payouts scheduled on August 13, 2014 will remain unchanged. (ADX) Alitalia investors approve cash call to buy time for Etihad deal – Italian carrier Alitalia’s shareholders have approved a share issue of up to €250mn to keep the Italian flag carrier flying as it seeks to finalize a life-saving tie-up with Abu Dhabi-based Etihad Airways. Etihad Airways plans to buy a 49% stake in the Italian carrier. (Reuters) IBM rejects Globalfoundries’ offer for chip unit – According to sources, International Business Machines Corporation’s (IBM) talks to sell its money-losing chip-manufacturing operations to Abu Dhabi-state owned Globalfoundries Inc. have ended after the two companies failed to agree on terms. Globalfoundries made an offer that was rejected by IBM as too low. (Bloomberg) Goldman, ADIA to join Gavea in Fleury deal – Private-equity arm of Goldman Sachs Group Inc. and Abu Dhabi Investment Authority (ADIA) are considering joining Gavea Investimentos Ltd., in a bid for Brazilian medical-services company Fleury SA. In joining Gavea, the two investors would be wading into a bid for a company that has been on the market for more than six months. Fleury, which has a market value of about 2.6bn Brazilian Reais ($1.2bn), said in March 2014 that it was in exclusive talks with Gavea. (Bloomberg) NBAD asset management MD & CFO steps down – The Managing Director and Chief Financial Officer of the asset management division of the National Bank of Abu Dhabi (NBAD), Mark Watts, has stepped down. Watts joined the business in May 2010 as head of fixed income for NBAD’s asset management group. (Bloomberg) KBR wins key Abu Dhabi oil filed contract – Kellogg, Brown & Root Inc. (KBR) has been awarded a contract by Hyundai Heavy Industries to perform engineering design services for the Abu Dhabi Marine Operating Company's (ADMA-OPCO) Al-

- 9. Page 9 of 10 Nasr full field development project, located offshore Abu Dhabi. Under the terms of the contract, KBR will provide engineering design and support services for the entire Al-Nasr Package 2 scope with the services provided by KBR’s office in Singapore and supported by other KBR offices. However, the contract value was not disclosed. The Al-Nasr Package 2 facilities consist of a multi-platform super complex that includes central processing facilities, accommodation, utilities, flares, bridges and power distribution. When completed, the super complex will produce an annual average production of 65,000 barrels of crude oil per day. ADMA-OPCO's other stakeholders in the Al- Nasr project are BP, Total and Japan Oil Development Company. (Bloomberg) Kuwait invests KD4.6bn in green fuel project – According to sources, Kuwait is investing KD4.6bn to develop oil refineries, as part of the “environmental fuel” project to be launched in 2018. The project aims at developing Mina Al-Ahmadi and Mina Abdullah refineries, providing them with new units to increase their refinement abilities. (Gulf-Base.com) Kuwait’s sovereign ratings affirmed at ‘AA-’ – Capital Intelligence (CI) has affirmed Kuwait’s long-term foreign currency and local currency ratings of ‘AA-’, and its short-term foreign and local currency ratings of ‘A1+’. The outlook for Kuwait’s ratings remains stable. Kuwait’s ratings are underpinned by strong macroeconomic fundamentals and a large net external creditor position, which in turn reflects the government’s prudent management of the country’s substantial oil wealth. The ratings are also supported by the comparatively high level of GDP per capita of around $48,000 in 2013. (Bloomberg) Bank Sohar’s profit jumps by 35.1% in 2Q2014 – Bank Sohar reported a net profit of OMR16.15mn in 2Q2014 as compared to QR11.95mn in 2Q2013, reflecting an increase of 35.1%. The net interest income witnessed an improvement of 13.1%, increasing from OMR21.04mn for the period ended June 30, 2013 to OMR23.79mn for the period ended June 30, 2014. The operating income increased by 26.88% to OMR35.27mn in 2Q2014 as compared to OMR27.80mn in 2Q2013. The bank’s total assets grew from OMR1.7bn in 2013 to OMR1.9bn in the same period in 2014, a growth of 8.89%. Gross loans have increased by 16.18% from OMR1.21bn on June 30, 2013 to OMR1.40bn as of June 30, 2014. Net loans & advances grew by 16.47% to OMR1.37bn in comparison to OMR1.18bn in 2013. The bank’s deposits which stood at OMR1.35bn by the end of June 2014 witnessing a growth of 8.17% over 2013. (GulfBase.com) CBO issues CDs worth OMR582mn – The Central Bank of Oman (CBO) has issued certificates of deposit (CDs) worth OMR582mn for issue no. 877. The average interest rate of these certificates was 0.13% whilst the maximum accepted interest rate was 0.13%. The tenure of these certificates is 28 days. The maturity date is August 20, 2014. The certificates of deposit issued to licensed banks by the CBO as a monetary policy instrument is aimed at absorbing excess liquidity at the banking sector in particular, and maintaining stability of the interest rate and the money market in general. (Bloomberg) AFS launches three new products – Arab Financial Services (AFS) has announced the formal launch of three new products that will be offered to all the member banks. These products will improve the current value proposition that the member banks can offer their customers. The first product is the new ‘Instant Issuance’ service where the member bank can issue on-the-spot EMV payment cards to their customers at their branches. The second product is the new online ‘Loyalty Redemption’ service with an ecosystem of partners like airlines, hotels, car-rentals, retailers, sporting events etc. The customers can redeem their reward points online through the bank’s web portal and the entire redemption process will be hassle free and this will delight the customers. The third product is the mobile base iEPP ‘Interactive Equated Payment Plan’ service where a cardholder can opt to convert his high value retail transactions to an easy installment plan. (GulfBase.com) ABC Islamic Bank reports profit of $7.5mn in 1H2014 – ABC Islamic Bank reported net profit of $7.5mn for 1H2014, 25% higher than the profit of $6.0mn in 1H2013. Total operating income rose to $10.7mn, compared to $8.3mn for 1H2013. Operating expenses increased to $3.1mn compared to $2.2mn for 1H2013. Net profit for 2Q2014 was $4.0mn, 43% higher than 2Q2013 and also represents a 14% increase over 1Q2014. Operating expenses were $1.5mn compared to $1.3mn in 2Q2013. Bank’s total assets stood at $1.277bn at the end of 1H2014 compared to $1.002bn at 2013 year-end. (AMEInfo) BIBF, BBK sign contract for management training & development program – Bahrain Institute of Banking & Finance (BIBF) and BBK have signed a contract to deliver a management training and development program for new recruits in the areas of Banking, Accounting, IT, Marketing and Management. A capstone project will be presented to senior management of BBK at completion. The four-month intensive program is set to start on September 1, 2014. (AMEInfo) Sico 1H2014 profit jumps 166% to BHD5.1mn – Bahrain- based conventional wholesale bank, Securities & Investment Company (Sico), reported a 166% increase in 1H2014 net profit to BHD5.1mn, compared to BHD1.9mn during 1H2013. Operating income grew by 87% to BHD8.2mn as compared to BHD4.4mn in 1H2013. Basic earnings per share rose from 4.5 fils to 11.8 fils. For 2Q2014, net profit increased to BHD2.5mn as compared to BHD901,000 in 2Q2013; while operating income rose by 86% to BHD4.0mn. Basic earnings per share rose from 2.1 fils for 2Q2013 to 5.8 fils for 2Q2014. Total assets under management increased to a record $955mn, surpassing the highs recorded before the financial crisis of 2008 by 57%. (Bloomberg)

- 10. Contacts Saugata Sarkar Abdullah Amin, CFA Shahan Keushgerian Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6509 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa Sahbi Kasraoui Ahmed Al-Khoudary QNB Financial Services SPC Manager – HNWI Head of Sales Trading – Institutional Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6544 Tel: (+974) 4476 6548 PO Box 24025 sahbi.alkasraoui@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 10 of 10 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg (# Data as of 23 July 2014) Source: Bloomberg Source: Bloomberg 80.0 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 170.0 180.0 190.0 200.0 210.0 Jul-10 Jul-11 Jul-12 Jul-13 Jul-14 QE Index S&P Pan Arab S&P GCC 0.5% (1.8%) 0.2% 0.0% 0.2% (0.2%) (0.3%) (2.4%) (1.6%) (0.8%) 0.0% 0.8% SaudiArabia Qatar Kuwait Bahrain Oman# AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D% WTD% YTD% Gold/Ounce 1,307.15 1.0 (0.3) 8.4 DJ Industrial 16,960.57 (0.7) (0.8) 2.3 Silver/Ounce 20.74 1.8 (0.6) 6.5 S&P 500 1,978.34 (0.5) 0.0 7.0 Crude Oil (Brent)/Barrel (FM Future) 108.39 1.2 1.1 (2.2) NASDAQ 100 4,449.56 (0.5) 0.4 6.5 Natural Gas (Henry Hub)/MMBtu 3.79 (0.3) (3.1) (12.9) STOXX 600 341.95 (0.7) 0.7 4.2 LPG Propane (Arab Gulf)/Ton 104.50 0.8 1.0 (17.2) DAX 9,644.01 (1.5) (0.8) 1.0 LPG Butane (Arab Gulf)/Ton 120.00 0.6 (0.2) (12.1) FTSE 100 6,791.55 (0.4) 0.6 0.6 Euro 1.34 (0.3) (0.7) (2.3) CAC 40 4,330.55 (1.8) (0.1) 0.8 Yen 101.84 0.0 0.5 (3.3) Nikkei 15,457.87 1.1 1.6 (5.1) GBP 1.70 (0.1) (0.7) 2.5 MSCI EM 1,078.69 (0.2) 1.5 7.6 CHF 1.11 (0.2) (0.7) (1.3) SHANGHAI SE Composite 2,126.61 1.0 3.3 0.5 AUD 0.94 (0.2) 0.1 5.4 HANG SENG 24,216.01 0.3 3.2 3.9 USD Index 81.03 0.2 0.6 1.2 BSE SENSEX 26,126.75 (0.6) 1.9 23.4 RUB 35.14 0.5 0.0 6.9 Bovespa 57,821.08 (0.3) 1.4 12.3 BRL 0.45 (0.4) (0.1) 6.0 RTS 1,246.25 (1.6) (2.4) (13.6) 186.1 157.7 142.1