QE Index Falls 0.3% Led by Transportation, Real Estate Losses

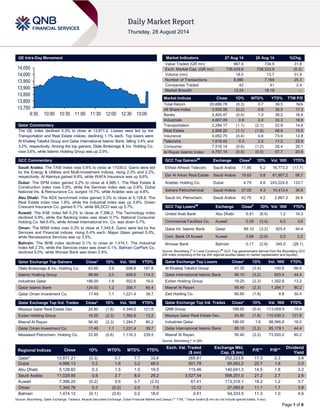

- 1. Page 1 of 6 QE Intra-Day Movement Qatar Commentary The QE index declined 0.3% to close at 13,871.2. Losses were led by the Transportation and Real Estate indices, declining 1.1% each. Top losers were Al Khaleej Takaful Group and Qatar International Islamic Bank, falling 3.4% and 3.2%, respectively. Among the top gainers, Dlala Brokerage & Inv. Holding Co. rose 3.6%, while Islamic Holding Group was up 2.0%. GCC Commentary Saudi Arabia: The TASI index rose 0.8% to close at 11030.0. Gains were led by the Energy & Utilities and Multi-Investment indices, rising 2.3% and 2.2%, respectively. Al Alamiya gained 9.9%, while WAFA Insurance was up 9.6%. Dubai: The DFM index gained 0.2% to close at 4,986.1. The Real Estate & Construction index rose 0.9%, while the Services index was up 0.6%. Dubai National Ins. & Reinsurance Co. surged 14.7%, while Arabtec was up 4.8%. Abu Dhabi: The ADX benchmark index gained 0.3% to close at 5,128.8. The Real Estate index rose 1.8%, while the Industrial index was up 0.8%. Green Crescent Insurance Co. gained 6.1%, while BILDCO was up 5.7%. Kuwait: The KSE index fell 0.2% to close at 7,396.2. The Technology index declined 0.9%, while the Banking index was down 0.7%. National Consumer Holding Co. fell 6.4%, while Amwal International Inv. Co. was down 5.7%. Oman: The MSM index rose 0.3% to close at 7,345.8. Gains were led by the Services and Financial indices, rising 0.4% each. Majan Glass gained 5.0%, while Renaissance Services was up 3.5%. Bahrain: The BHB index declined 0.1% to close at 1,474.1. The Industrial index fell 2.3%, while the Services index was down 0.1%. Bahrain CarPark Co. declined 5.0%, while Ithmaar Bank was down 2.9%. Qatar Exchange Top Gainers Close* 1D% Vol. ‘000 YTD% Dlala Brokerage & Inv. Holding Co. 63.60 3.6 698.8 187.8 Islamic Holding Group 98.60 2.0 656.5 114.3 Industries Qatar 196.00 1.6 502.6 16.0 Qatar Islamic Bank 124.50 1.2 306.7 80.4 Qatar Oman Investment Co. 17.49 1.1 1,221.4 39.7 Qatar Exchange Top Vol. Trades Close* 1D% Vol. ‘000 YTD% Mazaya Qatar Real Estate Dev. 24.80 (1.8) 4,349.0 121.8 Ezdan Holding Group 19.25 (2.3) 1,392.8 13.2 Masraf Al Rayan 56.40 (2.3) 1,284.7 80.2 Qatar Oman Investment Co. 17.49 1.1 1,221.4 39.7 Mesaieed Petrochem. Holding Co. 33.95 (0.6) 1,116.3 239.5 Market Indicators 27 Aug 14 26 Aug 14 %Chg. Value Traded (QR mn) 967.9 734.5 31.8 Exch. Market Cap. (QR mn) 736,429.6 738,333.9 (0.3) Volume (mn) 18.0 13.7 31.9 Number of Transactions 8,980 7,165 25.3 Companies Traded 42 41 2.4 Market Breadth 12:24 18:18 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 20,688.78 (0.3) 0.7 39.5 N/A All Share Index 3,505.06 (0.2) 0.8 35.5 17.2 Banks 3,400.47 (0.5) 1.0 39.2 16.6 Industrials 4,667.09 0.8 2.0 33.3 18.9 Transportation 2,284.17 (1.1) (2.1) 22.9 14.6 Real Estate 2,908.20 (1.1) (1.9) 48.9 15.5 Insurance 4,062.75 (0.4) 0.6 73.9 12.8 Telecoms 1,616.42 0.3 2.2 11.2 22.9 Consumer 7,516.14 (0.6) (1.2) 26.4 28.1 Al Rayan Islamic Index 4,787.14 (0.5) (0.0) 57.7 20.6 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Etihad Atheeb Telecom. Saudi Arabia 11.85 6.2 16,773.3 (17.7) Dar Al Arkan Real Estate Saudi Arabia 15.63 5.8 81,907.2 58.7 Arabtec Holding Co. Dubai 4.79 4.8 243,224.6 133.7 Sahara Petrochemical Saudi Arabia 27.05 4.3 10,413.4 36.6 Saudi Int. Petrochem. Saudi Arabia 42.79 4.2 2,867.3 34.6 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% United Arab Bank Abu Dhabi 6.41 (8.4) 1.2 14.3 Commercial Facilities Co. Kuwait 0.29 (3.4) 6.5 3.6 Qatar Int. Islamic Bank Qatar 89.10 (3.2) 925.4 44.4 Com. Bank Of Kuwait Kuwait 0.68 (2.9) 0.0 2.0 Ithmaar Bank Bahrain 0.17 (2.9) 345.0 (26.1) Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) Qatar Exchange Top Losers Close* 1D% Vol. ‘000 YTD% Al Khaleej Takaful Group 47.35 (3.4) 140.6 68.6 Qatar International Islamic Bank 89.10 (3.2) 925.4 44.4 Ezdan Holding Group 19.25 (2.3) 1,392.8 13.2 Masraf Al Rayan 56.40 (2.3) 1,284.7 80.2 Zad Holding Co. 90.60 (1.8) 4.8 30.4 Qatar Exchange Top Val. Trades Close* 1D% Val. ‘000 YTD% QNB Group 198.50 (0.4) 113,059.9 15.4 Mazaya Qatar Real Estate Dev. 24.80 (1.8) 110,430.3 121.8 Industries Qatar 196.00 1.6 98,566.8 16.0 Qatar International Islamic Bank 89.10 (3.2) 85,179.1 44.4 Masraf Al Rayan 56.40 (2.3) 73,520.2 80.2 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 13,871.21 (0.3) 0.7 7.7 33.6 265.81 202,223.6 17.3 2.3 3.6 Dubai 4,986.13 0.2 1.6 3.2 48.0 501.78 95,563.2 20.7 1.8 2.0 Abu Dhabi 5,128.82 0.3 1.5 1.5 19.5 115.46 140,641.3 14.5 1.8 3.2 Saudi Arabia 11,029.95 0.8 2.7 8.0 29.2 3,527.54 598,201.0 21.2 2.7 2.6 Kuwait 7,396.20 (0.2) 0.6 3.7 (2.0) 61.41 113,319.1 18.2 1.2 3.7 Oman 7,345.76 0.3 (0.2) 2.0 7.5 12.12 27,060.6 11.1 1.7 3.8 Bahrain 1,474.12 (0.1) (0.6) 0.2 18.0 0.41 54,333.5 11.3 1.0 4.6 Source: Bloomberg, Qatar Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 13,750 13,800 13,850 13,900 13,950 14,000 14,050 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QE index declined 0.3% to close at 13,871.2. The Transportation and Real Estate indices led the losses. The index fell on the back of selling pressure from Qatari shareholders despite buying support from non-Qatari shareholders. Al Khaleej Takaful Group and Qatar International Islamic Bank were the top losers, falling 3.4% and 3.2%, respectively. Among the top gainers, Dlala Brokerage & Inv. Holding Co. rose 3.6%, while Islamic Holding Group was up 2.0%. Volume of shares traded on Wednesday rose by 31.9% to 18.0mn from 13.7mn on Tuesday. Further, as compared to the 30-day moving average of 17.4mn, volume for the day was 3.5% higher. Mazaya Qatar Real Estate Dev. and Ezdan Holding Group were the most active stocks, contributing 24.1% and 7.7% to the total volume respectively. Source: Qatar Exchange (* as a % of traded value) Global Economic Data Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 08/27 US MBA MBA Mortgage Applications 22-August 2.80% – 1.40% 08/27 France INSEE Production Outlook Indicator August -20.0 – -19.0 08/27 France INSEE Manufacturing Confidence August 96.0 96.0 97.0 08/27 France INSEE Business Confidence August 91.0 93.0 93.0 08/27 France French Labor Office Total Jobseekers July 3,424.4k 3,412.5k 3,398.3k 08/27 France French Labor Office Jobseekers Net Change July 26.1 14.5 9.4 08/27 Germany Destatis Import Price Index MoM July -0.40% -0.10% 0.20% 08/27 Germany Destatis Import Price Index YoY July -1.70% -1.40% -1.20% 08/27 Germany GfK AG GfK Consumer Confidence September 8.6 8.9 8.9 08/27 UK London Gold Market Fix. London Gold Market PM Fix 27-August 1,282.8 – 1,286.0 08/27 Spain INE Total Mortgage Lending YoY June 13.20% – -9.20% 08/27 Spain INE House Mortgage Approvals YoY June 19.00% – -3.40% 08/27 Italy ISTAT Consumer Confidence Index August 101.9 104.0 104.4 08/27 Italy Banca D'Italia 6M Bill Allotment 27-August 7.500B – 7.000B 08/27 Italy Banca D'Italia 6M Bill Average Yield 27-August 0.14% – 0.24% 08/27 Italy Banca D'Italia 6M Bill Bid/Cover Ratio 27-August 1.63% – 1.75% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar New Port set to be operational by 2016-end – The first phase of the QR27bn worth new port project is set to be operational by 2016-end with an initial capacity to accommodate 2mn containers. The port would accommodate 4mn containers in 2018 and 6mn containers when completed in 2020. HE the Prime Minister and Interior Minister Sheikh Abdullah bin Nasser bin Khalifa Al-Thani attended a ceremony marking the final step of building the wall of the new port’s basin in northern Mesaieed’s industrial zone. Officials briefed the Premier on the progress of construction work of the 26 square kilometer project. The new port has divisions like the economic zone, the commercial port and the naval base. The port’s first phase is set to be completed by the end of December 2016. The Prime Minister while expressing his happiness over the work progressing as per the timeframe set by the government voiced his optimism that the project would conclude ahead of schedule. HE the Minister of Transport Jassim Seif Ahmed Al Sulaiti said that the project was progressing ahead of schedule and that the port’s full operation was pushed forward by 10 years from 2030 to 2020. (Gulf-Times.com) Ashghal set to open Al Markhiya, Dahl Al Hamam intersections – The Public Works Authority (Ashghal) will open Al Markhiya and Dahl Al Hamam intersections that have been converted from roundabouts into signalized intersection, starting from August 31, 2014. Ashghal also announced that the final layer of asphalt will be laid on Al Markhiya intersection on August 29 and 30. Therefore, the Al Markhiya intersection and accesses to roads leading to it will be closed during these two days so that the intersection can be opened for traffic on Sunday morning (August 31). (Bloomberg, Qatar Peninsula) 70% of Al Shamal project done – 70% of the work on flyovers and underpasses in Al Shamal has been completed. Construction companies said that the flyovers and the project will be finished by the middle of 2015. (Peninsula Qatar) QA set to get new Airbus plane – Qatar Airways (QA) – the launch customer of the Airbus A350 Xtra Wide Body (XWB) aircraft – is set to receive its first delivery before the end of 2014. The airline has ordered 80 of the wide-body A350 XWB, which will be deployed on a wide variety of routes. The A350 MSN005 development aircraft recently concluded a world tour, touching down in 14 cities, demonstrating its readiness for airline operations on a global scale. (Peninsula Qatar) Overall Activity Buy %* Sell %* Net (QR) Qatari 60.55% 67.02% (62,556,103.98) Non-Qatari 39.44% 32.98% 62,556,103.98

- 3. Page 3 of 6 International CBO: US budget gap narrows to smallest since 2007 – According to the Congressional Budget Office, the US budget deficit will narrow less than forecast this year even as it falls to the lowest level since 2007 as a share of the economy. The non- partisan CBO said in a report that the projected shortfall will be $506bn in the 12 months ending September 30 as compared to an April prediction for $492bn and a $680bn gap posted last year. The budget deficit is projected to shrink for a sixth straight year in 2015 to $469bn, capping the longest stretch of fiscal improvement since 2000, near the end of an era of surpluses. According to CBO data, a declining jobless rate that is lifting the individual and corporate tax revenue will help narrow the gap next year to about a third of the record $1.4tn deficit reached in 2009. The report shows a fiscal picture that is improving in the near-term before starting to deteriorate, with deficits swelling again starting in 2018. The CBO said that the deficit will be 2.9% of GDP this year and 2.6% next year. In 2007, it was 1.1% of GDP. (Bloomberg) Lagarde to explain her role in French legal case to IMF board – The International Monetary Fund’s board will meet as early as this week to hear Managing Director Christine Lagarde explain her involvement in a French court decision that threatens to tarnish the lender’s reputation. The fund’s 24 directors are awaiting details from Lagarde as she returns from Paris, where she was placed under formal investigation for “negligence” in a 2008 decision she made as French finance minister. Lagarde has denied any wrongdoing. She received public support from the board in previous steps of the legal process. The board’s meeting is tentatively planned for Thursday, according to two board officials who asked not to be named because the information is not public. IMF spokeswoman Conny Lotze declined to comment. (Bloomberg) BCC: UK to enjoy fastest growth since 2007 – Britain's economy looks set to grow at its fastest rate since 2007 this year, but the rapid pace is unlikely to be sustained, the British Chambers of Commerce (BCC) said after nudging up its growth forecasts for this year and next. The BCC said it expected Britain's economy to grow by 3.2% this year and by 2.8% in 2015, up from forecasts of 3.1% and 2.7% three months earlier and a little above economists' average forecast in a Reuters poll. Britain's upturn contrasts with a stagnant Eurozone. However, this strong growth comes from higher consumer spending on the back of faster-than-expected recent falls in unemployment, and the BCC said it was halving its forecast for exports growth this year to just 0.8%. The BCC's forecast for trade is much more downbeat than one made by the Bank of England earlier this month, which predicted an export growth of 2.25% this year. (Reuters) PBOC resolve tested as $6tn shadow banking industry sours – Rising stress in China’s $6tn shadow banking industry is testing central bank Governor Zhou Xiaochuan’s resolve to limit monetary easing as risks to the government’s growth target rise. At least 10 trusts backed by assets spanning coal mines in Shanxi to forests in Fujian have struggled to meet payments over the past three months, sparking protests by investors outside banks that distributed their products. A slump in new credit in July underscored strains on the industry that funded as much as half of China’s recent growth, presenting Zhou with a choice: ease policy to avert a slowdown, or hold the line. At stake is Li Keqiang’s economic expansion target of about 7.5% this year. That is already threatened by a slowdown in industrial production and investment growth, a slumping property market, and a pullback in manufacturing. While the People’s Bank of China (PBOC) has not changed its benchmark lending and deposit rates for the past two years, local media reported last month that it had extended a 1tn Yuan ($163bn), three-year loan to a state development bank to support the funding of government-backed housing projects. The PBOC said it recently granted a 20bn Yuan relending quota to some regional bank branches to support agriculture. (Bloomberg) China's industrial profits grow 13.5% YoY in July – China's industrial profits grew 13.5% in July as compared to a year-ago period, slowing from June's 17.9% annual rise. Between January and July, profits rose 11.7% as compared to the same period last year. China's economy has had a rough ride this year as unsteady foreign and domestic demand dragged on exports, factory output and domestic investment. A surprisingly sharp slowdown in the housing market has also further dampened activity. (Reuters) Regional IDB approves $987mn for funding development projects – Islamic Development Bank (IDB) has approved $987mn in funds for supporting economic and social development projects in its member countries. This is in addition to grants for Muslim communities among non-member countries. The funds approved by the IDB's Board of Executive Directors at a recent meeting include $176mn for Oman, $100 mn for Uzbekistan, $179.3mn for Cameroon, $26.7mn for Lebanon, $20mn for Yemen and $10mn for Uganda. (GulfBase.com) CPC acquires Sphinx Glass from Qalaa – Saudi-based Construction Products Holding Company (CPC) has signed an agreement on August 26, 2014 with Qalaa Holdings for the purchase of Egypt-based Sphinx Glass for a consideration of EGP1.3bn. The transaction enables CPC to expand its international activities in Egypt, while the divestment will allow Qalaa Holdings to abandon non-core projects, enabling it to focus on strategic sectors. (GulfBase.com) OBG: Kingdom’s economic reforms generate interest of investors – According to “The Report: Saudi Arabia 2014” released by Oxford Business Group (OBG), Saudi Arabia’s drive to create a more open business environment and broaden its economic base has generated a new group of investors interested in the Kingdom. The report analyzes the reforms that are being rolled out in a bid to boost foreign investment, including a landmark decision to liberalize the Kingdom’s capital markets. It also covers the Kingdom’s efforts to increase natural gas output. Further, the report analyzes the role that legislation is expected to play in offering homebuyers more flexibility and explores the potential for further growth and diversification in the Islamic financial services segment. (GulfBase.com) NCB: Saudi hydrocarbon sector outlook dim – According to the “Saudi Arabia Business Optimism Index – Q3 2014” report published by the National Commercial Bank (NCB), the outlook for Saudi Arabia’s hydrocarbon sector has turned bleak in 3Q2014. The Composite BOI for the hydrocarbon sector shrank from 49 in 2Q2014 to 25 in 3Q2014, reaching the lowest level since 4Q2012 as all constituent parameters reflected a downward trend. The composite index for the non-hydrocarbon sector registered a 14 points slide, partly due to the seasonal downturn during summer and partly on the back of expectations skewed toward a trend of stability. The country’s SME segment holds a slightly stronger outlook with a Composite BOI of 38 as compared to large companies’ BOI at 34. (Gulf-Base.com) Zad National to produce Turkish products at KAEC – Zad National Ltd recently signed an agreement with King Abdullah Economic City (KAEC) for purchasing 22,000 square meters of land in KAEC’s Industrial Valley-Phase 1 to build a

- 4. Page 4 of 6 manufacturing facility for the production of sweets. The contract was signed by Prince Abdullah bin Saud bin Mohammed bin Abdulaziz, Chairman of the Board of Al-Ahlam Holding Group and ZAD National, and Rayan Qutub, COO of the Industrial Valley in KAEC. (Gulf-Base.com) SPC completes maintenance in affiliate plant – Sahara Petrochemicals Company (SPC) announced that the necessary maintenance works at its Al Waha Petrochemicals Company plant have been completed. The company has also initiated the necessary steps to restart the operation and production units after the maintenance, which lasted 10 days. Earlier, SPC said that the plant faced technical failure which affected the utilities unit and resulted in the shutdown of the production units. (Tadawul) Tecom Investments: UAE freehold property market witnesses exponential growth – The UAE freehold property market, especially in Dubai, continues to witness exponential growth with the Real Estate Regulatory Agency bringing about stability in the industry and rebuilding investor confidence. Badr Al Gargawi, CEO, Development & Planning Division, Tecom Investments, while launching Villa Lantana, a freehold villa community, noted that the realty industry in the Emirate has been booming at a fast pace. The government with its various regulatory bodies has gone an extra mile to bring about stability by controlling supply and nipping problems that had been experienced in the past. These timely steps have totally restored the health of the realty estate, which has become more vibrant than pre-recession days, Gargawi added. (GulfBase.com) Etihad to start A380, Dreamliner operations in December 2014 – Etihad Airways is all set to launch its Airbus A380 and Boeing 787-9 Dreamliner operations in December 2014, with an extensive pilot training program now under way. During its first year of operations, the Airbus A380 will be deployed on Etihad’s three daily flights between Abu Dhabi and London, along with selected flights to Sydney. Between December 2014 and June 2015, the Boeing 787-9 will be introduced on six routes, including Dusseldorf, Doha, Washington DC, Mumbai, Brisbane and Moscow. (Bloomberg) Gulftainer records 14% YoY growth in SCT container volumes – Gulftainer recorded a 14% YoY growth in container volumes during 1H2014 at its Sharjah Container Terminal (SCT). The growth in volume was driven in part by the robust UAE-East Africa trade route and new projects in Sharjah. SCT signed more than 20 new consignees and grew its market share during the first half of the year, putting it on track to exceed its targeted throughput by the end of the year. (Gulf-Base.com) GFH signs $105mn Murabaha deal with KFH-Bahrain – Gulf Finance House (GFH) has entered into an agreement for a $105mn credit facility from Kuwait Finance House – Bahrain (KFH-Bahrain). The five-year facility, which will be extended to GFH on an amortized basis and with an 18-month moratorium, will be utilized by the bank to redeem two existing debt facilities with 27 syndicate participants and allows the release of major assets for GFH. Under the agreement terms, which is subject to regulatory approvals, KFH-Bahrain will have the option to convert its outstanding debts into shares in GFH. (DFM) Nakheel awards AED75mn contract – Nakheel has awarded AED75mn contract to UAE-based Trojan General Contracting for the construction of a residential complex with 130 apartments on Dubai’s Palm Jumeirah. Construction is expected to begin before December 2014, while completion is likely to be in mid- 2016. (Bloomberg) Forbes: Dubai world’s seventh most influential city – According to a list published by Forbes magazine, Dubai has been ranked as the seventh most influential city in the world, ranking above global cities such as Los Angeles, Beijing and Sydney. The list ranks the global cities based on eight factors including the amount of foreign direct investment they have attracted; the concentration of corporate headquarters; the business niches they dominate; air connectivity; strength of producer services; financial services; technology and media power; and cultural diversity. The report also stated that the UAE capital Abu Dhabi, which ranked 20th, could move up in the future. (GulfBase.com) Phidar: Dubai villa prices decline 4% – According to Phidar’s House Price Index (PHI), the residential prices in Dubai witnessed a drop in the first six weeks of 3Q2014 with rates falling 4% for villas and 0.6% for apartments, as compared to 2Q2014. The apartment and single family home (SFH) prices are still up 28.8% and 14.5% YoY. For apartments in The Greens, prices increased by 0.26%, but Uptown Motor City decreased by 0.94%. For SFHs, Jumeirah Islands declined 8.4%, but The Lakes increased 6.4%. Nominal average apartment lease and SFH rates are up 14.9% and 0.9% in 1H2014 as compared to 3Q2013. (GulfBase.com) TDA: Ras Al Khaimah welcomes 330,048 visitors in 1H2014 – According to the Ras Al Khaimah Tourism Development Authority (TDA), Ras Al Khaimah witnessed 330,048 visitors during 1H2014, generating $118.7mn in revenue. In the city, hotel occupancy reached 64.11%, while the average daily rate (ADR) stood at $69.85, generating a total revenue of $14.9mn. Luxury & upscale hotels in the Emirate had an ADR of $140.83, while beach hotels & resorts had an ADR of $168.58, generating a total revenue of $103.8mn. (Bloomberg) Dubai Customs: Dubai foreign trade drops to AED654bn in 1H2014 – According to a report by Dubai Customs, foreign trade in Dubai during 1H2014 amounted to AED654bn, down by 3.7% as compared to AED679bn during 1H2013. Dubai’s total foreign trade for entire 2013 stood at AED1.392tn. Imports during 1H2014 had a share of AED408bn, while exports had a share of AED59bn and re-exports AED187bn. China was Dubai’s top foreign trade partner during 1H2014, with a value of AED80.5bn, followed by India with AED53bn, the US with AED41bn, and Saudi Arabia with AED27bn. Phones and PCs accounted for 17% of Dubai’s total foreign trade in 1H2014. (Bloomberg) NBK Capital: Kuwait earnings flat despite strong bank results – According to NBK Capital, aggregate profits of all listed companies in Kuwait were unimpressive during 1H2014, despite the strong bottom-line growth by banks. A solid performance by banks during 1H2014, on the back of an improving operational environment and reduced provisioning, boosted the overall earnings and offset the weakness in other sectors. Most of the weakness came from the real estate and non-banking financial services sectors, following several years of strong recovery in both. Despite flat reported earnings, stock prices reacted positively as the outlook remains favorable. The reported earnings of 165 listed Kuwaiti companies were down 1.3% YoY in 1H2014 to KD810mn. The aggregates conceal more mixed results, with over 70 companies reporting declines in profits as compared to a year ago, while 94 companies reported healthy growth. This year was the first time since 2010 that total reported losses did not shrink; instead they doubled to KD42mn, though the number of loss-making companies was stable at 27. Banks continued to ride the economic upturn, benefitting from reduced provisions and a healthier appetite for credit. As a result, bank profits experienced their best half in four years, growing by 16% YoY to KD315mn. At 39%, banks

- 5. Page 5 of 6 accounted for the lion’s share of total reported earnings. Their contribution increased by seven percentage points as compared to a year ago at the expense of the real estate and financial services companies, as these saw their shares shrink to 10% and 8%, respectively. (GulfBase.com) KHCB signs home finance deal with Eskan Bank – Khaleeji Commercial Bank (KHCB) has entered into an agreement with Eskan Bank to join the social housing finance program, which was launched by the Ministry of Housing in October 2013. The program aims at increasing the private sector’s participation, including banks in provide housing solutions in Bahrain. (Bahrain Bourse) Bapco achieves reliability milestone – Bapco has reported a key performance achievement in its reliability standards. For the first time since the introduction of the Refinery Reliability Clock (RRC), the company has achieved 360 continuous days without a clock reset. Not only has the refinery operated without a single RRC reset for one full year, two of its operating sections (South Process and North Process) have now surpassed two years without a reset. (GulfBase.com)

- 6. Contacts Saugata Sarkar Abdullah Amin, CFA Shahan Keushgerian Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6509 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa Sahbi Kasraoui Ahmed Al-Khoudary QNB Financial Services SPC Manager – HNWI Head of Sales Trading – Institutional Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6544 Tel: (+974) 4476 6548 PO Box 24025 sahbi.alkasraoui@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg 80.0 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 170.0 180.0 190.0 200.0 210.0 Jul-10 Jul-11 Jul-12 Jul-13 Jul-14 QE Index S&P Pan Arab S&P GCC 0.8% (0.3%) (0.2%) (0.1%) 0.3% 0.3% 0.2% (0.6%) 0.0% 0.6% 1.2% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D% WTD% YTD% Gold/Ounce 1,282.60 0.1 0.2 6.4 DJ Industrial 17,122.01 0.1 0.7 3.3 Silver/Ounce 19.46 0.5 0.2 (0.0) S&P 500 2,000.12 0.0 0.6 8.2 Crude Oil (Brent)/Barrel (FM Future) 102.72 0.2 0.4 (7.3) NASDAQ 100 4,569.62 (0.0) 0.7 9.4 Natural Gas (Henry Hub)/MMBtu 3.99 1.2 3.4 (8.2) STOXX 600 343.33 0.1 2.0 4.6 LPG Propane (Arab Gulf)/Ton 101.75 0.2 0.0 (19.6) DAX 9,569.71 (0.2) 2.5 0.2 LPG Butane (Arab Gulf)/Ton 120.00 0.9 0.5 (11.6) FTSE 100 6,830.66 0.1 0.8 1.2 Euro 1.32 0.2 (0.4) (4.0) CAC 40 4,395.26 0.0 3.3 2.3 Yen 103.88 (0.2) (0.1) (1.4) Nikkei 15,534.82 0.1 (0.0) (4.6) GBP 1.66 0.2 0.0 0.1 MSCI EM 1,093.74 0.5 1.0 9.1 CHF 1.09 0.3 (0.1) (2.4) SHANGHAI SE Composite 2,209.47 0.1 (1.4) 4.4 AUD 0.93 0.3 0.2 4.7 HANG SENG 24,918.75 (0.6) (0.8) 6.9 USD Index 82.43 (0.3) 0.1 3.0 BSE SENSEX 26,560.15 0.4 0.5 25.5 RUB 36.17 (0.0) 0.2 10.0 Bovespa 60,950.57 1.9 4.4 18.3 BRL 0.44 0.1 0.8 4.6 RTS 1,260.72 0.1 0.1 (12.6) 199.3 168.2 150.6