QSE Intra-Day Movement

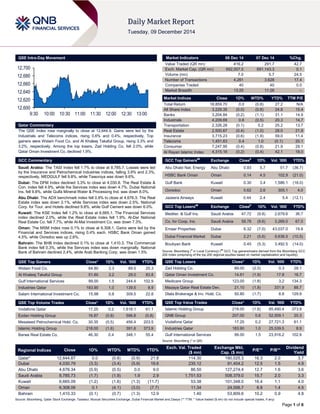

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index rose marginally to close at 12,644.9. Gains were led by the Industrials and Telecoms indices, rising 0.6% and 0.4%, respectively. Top gainers were Widam Food Co. and Al Khaleej Takaful Group, rising 3.3% and 3.2%, respectively. Among the top losers, Zad Holding Co. fell 2.0%, while Qatar Oman Investment Co. declined 1.9%. GCC Commentary Saudi Arabia: The TASI Index fell 1.7% to close at 8,785.7. Losses were led by the Insurance and Petrochemical Industries indices, falling 3.9% and 2.3%, respectively. MEDGULF fell 9.8%, while Tawuniya was down 9.6%. Dubai: The DFM Index declined 3.3% to close at 4,030.8. The Real Estate & Con. index fell 4.9%, while the Services index was down 4.7%. Dubai National Ins. fell 9.8%, while Gulfa Mineral Water & Processing Ind. was down 8.0%. Abu Dhabi: The ADX benchmark index fell 0.9% to close at 4,676.3. The Real Estate index was down 3.1%, while Services index was down 2.5%. National Corp. for Tour. and Hotels declined 9.8%, while Gulf Cement was down 6.0%. Kuwait: The KSE Index fell 1.2% to close at 6,665.1. The Financial Services index declined 2.0%, while the Real Estate index fell 1.9%. Al-Dar National Real Estate Co. fell 7.7%, while Al-Mal Investment Co. was down 7.3%. Oman: The MSM Index rose 0.1% to close at 6,308.1. Gains were led by the Financial and Services indices, rising 0.4% each. HSBC Bank Oman gained 4.5%, while Ooredoo was up 2.6%. Bahrain: The BHB Index declined 0.1% to close at 1,410.3. The Commercial Bank index fell 0.3%, while the Services index was down marginally. National Bank of Bahrain declined 2.4%, while Arab Banking Corp. was down 1.5% QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Widam Food Co. 64.80 3.3 89.5 25.3 Al Khaleej Takaful Group 51.60 3.2 29.0 83.8 Gulf International Services 99.00 1.5 244.4 102.9 Industries Qatar 183.90 1.0 139.5 8.9 Salam International Investment Co. 15.98 0.8 309.5 22.8 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 17.25 0.2 1,618.1 61.1 Ezdan Holding Group 16.87 (0.8) 596.8 (0.8) Mesaieed Petrochemical Hold. Co. 30.35 (0.5) 456.4 203.5 Islamic Holding Group 218.00 (1.6) 391.6 373.9 Barwa Real Estate Co. 46.30 0.4 348.1 55.4 Market Indicators 08 Dec 14 07 Dec 14 %Chg. Value Traded (QR mn) 416.2 291.7 42.7 Exch. Market Cap. (QR mn) 692,007.5 691,143.3 0.1 Volume (mn) 7.0 5.7 24.5 Number of Transactions 4,261 3,628 17.4 Companies Traded 40 40 0.0 Market Breadth 13:25 11:26 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,859.70 0.0 (0.8) 27.2 N/A All Share Index 3,229.35 (0.0) (0.8) 24.8 15.4 Banks 3,204.84 (0.2) (1.1) 31.1 14.9 Industrials 4,209.69 0.6 (0.5) 20.3 14.7 Transportation 2,326.28 (0.1) 0.2 25.2 13.7 Real Estate 2,500.67 (0.4) (1.0) 28.0 21.9 Insurance 3,715.23 (0.6) (1.9) 59.0 11.4 Telecoms 1,451.63 0.4 1.0 (0.1) 20.1 Consumer 7,247.95 (0.4) (0.8) 21.9 29.1 Al Rayan Islamic Index 4,315.16 (0.2) (0.4) 42.1 18.0 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Abu Dhabi Nat. Energy Abu Dhabi 0.93 5.7 51.7 (36.7) HSBC Bank Oman Oman 0.14 4.5 102.9 (21.0) Gulf Bank Kuwait 0.30 3.4 1,586.1 (16.0) Ooredoo Oman 0.62 2.6 305.1 4.0 Jazeera Airways Kuwait 0.44 2.4 5.4 (12.1) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Mediter. & Gulf Ins. Saudi Arabia 47.72 (9.8) 2,679.6 36.7 Co. for Coop. Ins. Saudi Arabia 58.78 (9.6) 3,269.0 67.0 Emaar Properties Dubai 8.32 (7.0) 43,037.0 19.8 Dubai Financial Market Dubai 2.21 (5.6) 9,638.5 (10.5) Boubyan Bank Kuwait 0.45 (5.3) 3,492.5 (14.0) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Zad Holding Co. 89.00 (2.0) 0.3 28.1 Qatar Oman Investment Co. 14.61 (1.9) 17.8 16.7 Medicare Group 123.00 (1.8) 3.2 134.3 Mazaya Qatar Real Estate Dev. 21.10 (1.8) 331.9 88.7 Dlala Brokerage & Inv. Hold. Co. 50.80 (1.7) 8.8 129.9 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Islamic Holding Group 218.00 (1.6) 85,490.4 373.9 QNB Group 207.00 0.6 52,509.1 20.3 Vodafone Qatar 17.25 0.2 27,721.3 61.1 Industries Qatar 183.90 1.0 25,539.5 8.9 Gulf International Services 99.00 1.5 23,916.2 102.9 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 12,644.87 0.0 (0.8) (0.9) 21.8 114.30 190,025.3 16.3 2.0 3.7 Dubai 4,030.79 (3.3) (3.4) (5.9) 19.6 235.12 91,404.2 12.5 1.5 4.9 Abu Dhabi 4,676.34 (0.9) (0.5) 0.0 9.0 86.50 127,274.4 12.7 1.6 3.6 Saudi Arabia 8,785.73 (1.7) (1.9) 1.9 2.9 1,751.53 508,379.0 15.7 2.0 3.3 Kuwait 6,665.09 (1.2) (1.6) (1.3) (11.7) 53.38 101,348.0 16.4 1.1 4.0 Oman 6,308.06 0.1 (4.1) (3.0) (7.7) 11.34 24,006.7 8.8 1.4 4.5 Bahrain 1,410.33 (0.1) (0.7) (1.3) 12.9 1.40 53,809.6 10.2 0.9 4.8 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 12,60012,62012,64012,66012,68012,7009:3010:0010:3011:0011:3012:0012:3013:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index rose marginally to close at 12,644.9. Industrials and Telecoms indices led the gains. The index rose on the back of buying support from Qatari shareholders despite selling pressure from non-Qatari shareholders. Widam Food Co. and Al Khaleej Takaful Group were the top gainers, rising 3.3% and 3.2%, respectively. Among the top losers, Zad Holding Co. fell 2.0%, while Qatar Oman Investment Co. declined 1.9%. Volume of shares traded on Monday rose by 24.5% to 7.0mn from 5.7mn on Sunday. However, as compared to the 30-day moving average of 13.6mn, volume for the day was 48.3% lower. Vodafone Qatar and Ezdan Holding Group were the most active stocks, contributing 23.0% and 8.5% to the total volume respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 12/08 EU Sentix Behavioral Ind. Sentix Investor Confidence December -2.5 -9.0 -11.9 12/08 France Ministry of Economy 3M T-Bill Amount Sold 8-December €3,993M – €3,990M 12/08 France Ministry of Economy 3M T-Bill Average Yield 8-December -0.01% – -0.02% 12/08 France Ministry of Economy 3M T-Bill Bid/Cover Ratio 8-December 2.8 – 3.0 12/08 France Ministry of Economy 6M T-Bill Amount Sold 8-December €1,493M – €1,890M 12/08 France Ministry of Economy 6M T-Bill Average Yield 8-December -0.01% – -0.02% 12/08 France Ministry of Economy 6M T-Bill Bid/Cover Ratio 8-December 3.4 – 3.4 12/08 France Ministry of Economy 12M T-Bill Amount Sold 8-December €1,692M – €1,497M 12/08 France Ministry of Economy 12M T-Bill Average Yield 8-December -0.01% – -0.01% 12/08 France Ministry of Economy 12M T-Bill Bid/Cover Ratio 8-December 4.1 – 4.4 12/08 Germany Deutsche Bundesbank Industrial Production SA MoM October 0.20% 0.40% 1.10% 12/08 Germany BMWi Industrial Production WDA YoY October 0.80% 0.90% 0.10% 12/08 China Nat. Bureau of Statistics Trade Balance November $54.47B $43.95B $45.41B 12/08 China Nat. Bureau of Statistics Exports YoY November 4.70% 8.00% 11.60% 12/08 China Nat. Bureau of Statistics Imports YoY November -6.70% 3.80% 4.60% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar CBQK initiates squeeze-out process to acquire shares of ABank; announces senior management changes – The Commercial Bank of Qatar (CBQK), together with Anadolu Endüstri Holding and Anadolu Motor Üretim ve Pazarlama have initiated a formal squeeze-out process to acquire additional shares of Turkish bank Alternatifbank AS, Turkey (ABank). CBQK currently holds 74.25% shares of ABank. Anadolu Endüstri Holding holds 17.21% shares of ABank and Anadolu Motor Üretim ve Pazarlama holds 7.79% shares of the bank. CBQK initiated the process on July 1, 2014 pursuant to which it will acquire further 0.75% shares of ABank from the Bourse Istanbul. The necessary application regarding the squeeze-out, and simultaneous delisting from Bourse Istanbul will be made to ABank's Board of Directors in accordance with the relevant provisions of the Communiqué. Meanwhile, the bank announced a number of changes at the senior management. Colin Macdonald has been appointed as Deputy CEO. While Fahad Badar, currently EGM, Head of Wholesale becomes EGM, Chief International Officer and Head of Private Banking, Raju Buddhiraju will join as EGM, Head of Wholesale in January 2015. Dean Proctor, currently Head of Retail, becomes EGM, Head of Retail and Enterprise. (QSE) QNB Group: Large investment spending and population surge to push Qatar inflation to 3.5% in 2015 – QNB Group (QNBK), in its “Qatar Monthly Monitor” said Qatar’s domestic inflation will mainly be driven by rising rents in response to higher land prices and the growing population, as the bank forecasts overall CPI inflation to average 3.5% in 2015. Lower international food prices are likely to keep foreign inflation low, thus partly offsetting the rise in domestic inflation. However, the bank said there was a risk that large investment spending and the growing population could lead to supply bottlenecks owing to limited domestic capacity. This could push up domestic prices more than expected in QNBK’s baseline forecasts. Rent inflation has accelerated in recent months in line with QNBK’s projections, tracking movements in the underlying price of land. According to the latest Ministry of Justice data, land prices increased by 73% YoY in October 2014. This continues to put upward pressure on rent inflation with a six-month lag. The combination of rapid population growth and higher GDP per capita are leading to a strong increase in housing demand, pushing up real estate prices. According to QNBK, Qatar’s Consumer Price Index (CPI), inflation for October 2014 moderated to 3% YoY from 3.6% YoY in September. On a MoM basis, inflation edged up 0.1% relative to September 2014. Housing and rents (the largest component of overall inflation with a 32.2% share) rose 8.2% YoY in October 2014, leading to Overall Activity Buy %* Sell %* Net (QR) Qatari 67.99% 58.72% 38,584,988.45 Non-Qatari 32.00% 41.27% (38,584,988.45)

- 3. Page 3 of 6 an acceleration of domestic inflation to 3.7%. Counterbalancing these domestic inflationary pressures, foreign inflation moderated to 1.3% in October as lower international commodity prices feed through into lower domestic price. Qatar’s population grew by 9.7% YoY in November to reach 2.27mn. The latest population figures for November are in line with QNBK’s forecast of 10.1% average population growth for 2014 – one of the world’s highest population growth rates. (Gulf-Times.com) Ashghal undertaking projects worth QR1.4bn to develop Doha Industrial Area – The Public Works Authority (Ashghal) is undertaking ambitious roads and infrastructure development projects worth QR1.4bn to change the face of Doha Industrial Area. Ashghal’s Roads Projects Department Manager, Saoud Al Tamimi said the development of roads and infrastructure is one of the major projects under the program which aims to make comprehensive improvement in the area known for high traffic and a large number of businesses. Ashghal Project Engineer Ahmed Al Obaidly said to facilitate implementation, the project has been divided into several phases. The first phase of the project commenced at the beginning of 2014 and extends over around 480 hectares. This phase consists of works related to redesigning and upgrading the existing road network and associated utilities. It also includes construction and rehabilitation of roads with a total length of over 38 kilometers, including 18 kilometers of local roads, 7 kilometers of collector roads, and 14 kilometers of arterial roads in addition to 19 intersections to organize and manage traffic, and improve the existing transportation system. (Peninsula Qatar) ORDS set to launch M2M cloud platform – Ooredoo (ORDS) is currently implementing a cloud-based Machine to Machine (M2M) platform, which will be launched in a number of its markets in 1Q2015 and will be rolled out to all countries by 2015-end. The innovative new cloud platform will enable Ooredoo to substantially reduce the time-to-market and provide a group-wide capability to build industry specific solutions across a wide range of sectors enabling all of its B2B customers to benefit from innovative solutions in the ‘Internet of things’ market place. (Bloomberg) QFLS BoD to meet on December 21 – Woqod (QFLS) announced that its board of directors will meet on December 21, 2014 to discuss the estimated budget for 2015 and other agenda items. (QSE) International US inflation expectations remain flat – According to a Federal Reserve Bank of New York survey, falling oil prices and a stronger US dollar did not dampen Americans' inflation expectations in November, which also witnessed a jump in expected earnings growth. In the survey of consumer expectations, median expectations of inflation one and three years into the future have remained steady at 3.0% since August, even while one-year-ahead gasoline price predictions fell for the fourth straight month. The internet-based survey, which started midway through last year, saw median earnings growth expectations jump to its highest recorded level at 2.7% in November. A global drop in energy prices and a stronger dollar has put pressure on overall US inflation, which remains below the central bank's 2% target. Fed policy makers are not expected to raise interest rates from near zero until about the middle of 2015. (Reuters) OECD lead indicators show European growth losing momentum – According to the Organisation for Economic Cooperation and Development (OECD), the economic growth is set to continue losing momentum in Europe while the outlook is stable for most other major economies and in the OECD countries as a whole. The Paris-based OECD's monthly Composite Leading Indicator (CLI) covering 33 member countries pointed to growth easing from relatively high levels in Britain, a loss of growth momentum in Germany and Italy, and stable growth momentum in France. The overall CLI indicator, meant to flag early signals of turning points in economic activity, was steady at 100.4, above the long-term average of 100. The CLI for Germany ticked down to 99.5 from 99.7 in November, while Italy's was 101.1 down from 101.2. The OECD said among other major economies, the CLIs continue to point to stable growth momentum in the US, Canada, China and Brazil. (Reuters) BoE looks beyond rate guidance in UK bank stress test – The Bank of England (BoE) is willing to put aside its own forward guidance to determine how well the country’s eight largest lenders would fare in a crisis. BoE Governor Mark Carney has said the rate increases from the current record-low 0.5% are likely to be gradual and the peak in rates lower than in previous cycles. Yet in its stress test of the UK’s eight largest banks, the BoE assumes an increase to 4% by the end of 2015. The BoE scenario will examine whether UK lenders could survive the interest-rate spike coupled with an economic and financial catastrophe so severe that it’s only happened once in the last 150 years. How they fare will be revealed on December 16. (Bloomberg) German industry output edges up less than forecast – Data from the Economy Ministry showed the industrial output in Germany rose less than expected in October, offering only feeble support for hopes that Europe's largest economy is returning to health after a weak 3Q2014. Production rose by 0.2% thanks to a pick-up in construction activity, although the energy output dropped. The headline figure missed the consensus forecast for a 0.3% gain. Recent figures showed industry orders are rising far more than forecasted in October, but other data on the sector has been more downbeat – a recent purchasing managers survey showed manufacturing activity shrinking in November at the fastest rate in 17 months, partly due to a decline in new business. (Reuters) ECB slows asset purchases; Greece gains two extra months to qualify for next aid tranche – The European Central Bank (ECB) slowed asset purchases, underlining the challenge for policy makers trying to expand the institution’s balance sheet. The ECB settled €233mn of asset-backed- securities purchases in the week ended December 5, after spending €368mn in the first week of the program. The Frankfurt-based central bank also bought €3.126bn of covered bonds, down from €5.078bn the previous week. ECB President Mario Draghi has held out the prospect of more stimulus measures to boost the balance sheet when policy makers review current measures early in 2015. Meanwhile, the finance ministers of Eurozone gave Greece two extra months to win the next installment of bailout money as Greek Prime Minister Antonis Samaras fights demands for more spending cuts in a bid to avoid snap elections. The current Eurozone and International Monetary Fund review of Greece’s progress in meeting budget targets will continue until as long as the end of February 2015. Greece will not get as much as €7bn in aid disbursements due under this year’s portion of the rescue unless those milestones are met. Greece’s international creditors are showing flexibility over approving the next payouts from the country’s €240bn rescue. (Bloomberg, Reuters) Japan service sector sentiment worsens in November – A Cabinet Office survey showed Japan's service sector sentiment index fell to 41.5 in November, reflecting worries over the economic outlook after the April sales tax hike hit spending. The

- 4. Page 4 of 6 survey of workers such as taxi drivers, hotel workers and restaurant staff - called "economy watchers" for their proximity to consumer and retail trends - showed their confidence about the current economic conditions declined from 44.0 in October. The Cabinet Office said the economy was showing weakness in its recovery recently and there are worries about price increases ahead. That compared with the previous view that the economy was showing signs of weakness recently, but was still likely to recover moderately as a trend. The outlook index, indicating the level of confidence in future conditions, fell to 44.0 in November from 46.6 in October. (Reuters) Regional PM Survey: Reduced optimism for GCC construction sector in 2015 – According to Pinsent Masons' (PM) Annual GCC Construction Survey, optimism in the Gulf Cooperation Council's (GCC) construction sector has been tempered down for 2015. The optimism has fallen by 13% from last year, which may partly be explained by ongoing geopolitical concerns, falling oil prices, a highly competitive market and the cost of accessible capital. However, the survey suggests that the construction industry remains optimistic in 2015 — with 77% of respondents replying yes. Transport (69%) followed by real estate (48%) and power (46%) are considered to be the sectors with most opportunities in 2015. According to the survey, Saudi Arabia (40%) followed by the UAE (33%) and Qatar (14%) are expected to be the strongest performing construction markets in the MENA region in 2015. (GulfBase.com) IEA: Long-term outlook for GCC economies remains positive – The International Energy Agency (IEA) said that the long-term outlook for GCC countries remains positive and would not be affected much by the decline in oil prices. According to IEA, even as the oil price falls, major oil producers are still maintaining high production levels. IEA estimates that global oil requirement is expected to rise to 104mn barrels per day (bpd) in 2040, as compared to the present 90mn bpd. Among the GCC countries, Saudi Arabia has almost maintained its production level, declining marginally from 9.704mn bpd in September to 9.69mn bpd in October. Furthermore, GDP growth of the GCC countries would remain intact in the coming years aided by expansion in non-oil sectors. (GulfBase.com) Honeywell: Mideast operators cut down plans for new aircraft – According to Honeywell’s 23rd Business Aviation Outlook Report, a combination of geopolitical and socio- economic influences has pushed out five-year new jet purchase plans in the Middle East at least in the short term. The report found fewer operators are planning new jet purchases in the coming few years. However, the demand is strong in the large cabin market segment, fuelled by the region’s desire for long- haul luxury travel, and there is buoyancy in the five-year used jet market segment as well. The report stated that significant business is expected across the aftermarket services, such as cockpit & cabin. (GulfBase.com) Saudi Transport Minister signs 46 contracts worth SR2bn – Saudi Arabia’s Transport Minister, Jabara Al-Seraisry signed 46 contracts worth SR2.1bn to carry out various projects related to his ministry, including maintenance, electrical work, computers, consultancy, study & designing and supervision. Al-Seraisry revealed that the ministry has previously signed contracts worth more than SR6.3bn and allocations for the contracts have been made in the national budget for 2014. (GulfBase.com) Du Telecom announces speed upgrade for broadband customers – Emirates Integrated Telecommunications Company (Du Telecom) has announced a complimentary speed upgrade for all of its broadband professional business customers. All business broadband professional customers including large companies and SMEs will receive the complimentary upgrade, which is subject to technical feasibility. The new speed will be reflected in the customers’ bill starting January 2015 onward, without any change in the charges they incur. (GulfBase.com) Dow Chemical sees big future in UAE chemical trade – According to Dow Chemical’s Finance Chief for the Middle East & Africa, Moosa Al Moosa, the company is expecting huge growth in chemical trade via Jebel Ali Free Zone (Jafza) port in the UAE, when its Sadara joint venture plant in Saudi Arabia starts up in 2015. Al Moosa said that with Sadara JV coming online, the UAE will become the regional hub for all sales from the plant, amounting $6-8bn of sales annually. This will add around 2.2% to the Emirate’s total value of trade. He added that Dow is currently in talks with DP World about the large additional space and handling it will need at Jafza. The $20bn Sadara petrochemicals plant being built at Jubail Industrial City is a JV between Dow Chemical and Saudi Aramco. (GulfBase.com) UBF: UAE banks complete pre-implementation phase of Mobile Wallet – The UAE Banks Federation (UBF) said that the banks in the UAE have completed the pre-implementation phase of the Mobile Wallet project. The project comprises the design, construction and roll-out of a purpose-designed platform that interfaces with all banks operating in the UAE. The project incorporates the facility for smart phones and other digital devices to be used for cashless purchase in retail and other outlets, as well as a means to store and transfer money. (GulfBase.com) Dubai Parks & Resorts’ AED2.5bn IPO oversubscribed – Dubai Parks & Resorts, which is building a $2.9bn amusement park complex in the Emirate, said that its AED2.5bn IPO was many times oversubscribed. The institutional tranche, which consisted 60% of the offer, was 65 times oversubscribed. Interested investors included sovereign wealth funds such as the Kuwait Investment Authority and the Qatar Investment Authority. The remaining 40% of shares were reserved for investors in the UAE, which was oversubscribed 10 times. The company will list its shares on the Dubai Financial Market on December 10, 2014. (Reuters) Stanusch signs distribution deal with SPI Group – Poland- based Stanusch Technologies has signed an agreement with Dubai-based marketing & publishing company, SPI Group to have its technologies, Virtual Advisor and Virtual Hostess, distributed in the UAE. (GulfBase.com) Knight Frank: Jafza asset valued at over $4.5bn – Global real estate consultancy, Knight Frank said that Jebel Ali Free Zone (Jafza) in Dubai represents the largest valuation ever of a single asset having a value of over $4.5bn. The valuation of the flagship construction, which encompasses 57 million square meters (sqm) of land, was undertaken as part of the planned acquisition of Economic Zones World by DP World. Jafza is set around Jebel Ali Port, extending across 57 square kilometers. The property consists of 14,000 tenancies, 32mn sqm of land, over 1,000 warehouses, 2mn square feet of office space, 9,000 rooms of worker accommodation, a hotel & convention centre and retail assets. (GulfBase.com) Dubai World optimistic on $15bn debt restructuring talks – Dubai World’s Chairman Sheikh Ahmed Al Maktoum said that he is optimistic that the conglomerate will strike a deal with its creditors for US$15bn worth of debt that is being restructured in long-running talks with 100 banks and financial institutions. Creditors at a recent meeting in Dubai, effectively rubber-

- 5. Page 5 of 6 stamped a formula agreed last week at a similar meeting in London. Under the deal terms, DW will repay early and in full a $4.5bn chunk of debt that matures in September 2015, and in return will get a four-year extension on its $10.5bn of debt due in 2018. (GulfBase.com) Emirates REIT acquires space in DIFC Index Tower – Emirates REIT is extending its footprint in Dubai’s financial hub after purchasing another chunk of the Index Tower, located in the Dubai International Financial Centre (DIFC). The real estate investment trust (REIT) paid AED17.9mn to acquire another 11,870 square feet of office space in the tower from the Egyptian investment bank, EFG Hermes. Emirates REIT now owns 17 out of the 25 office floors, 1,426 car parking spaces and the whole retail component in the tower. (GulfBase.com) Lockheed Martin opens collaboration center in Masdar City – Global security and aerospace company, Lockheed Martin opened a new state-of-the-art collaboration center, the ‘Centre for Innovation & Security Solutions’ (CISS), in Masdar City, Abu Dhabi. CISS will enable cooperation between Lockheed Martin and the UAE government for exploring innovation in advance security, and bring industry and academia together to develop solutions that address the challenges facing today’s world, from climate change to resource scarcity, and advance scientific discovery. (GulfBase.com) Cluttons: Reem Island registers biggest rent gains in Abu Dhabi – According to property consultant Cluttons, Abu Dhabi’s Reem Island recorded the biggest rent gains in the capital during 3Q2014. Rents of mid-range apartments increased on average by almost 6% in 3Q2014. However, the jump only brought average rents on the island back to the year-ago level. Overall, rents in Abu Dhabi’s freehold areas increased by just 2.7% during 9M2014 despite the removal of the rental cap last year. Cluttons also said that as in Dubai, house prices in Abu Dhabi are continuing to slow down as new mortgage caps introduced last year make it harder for buyers to get finance. The consultant said that the house prices increased by just 1.6% during 3Q2014, taking the total growth during 9M2014 to almost 19%. (GulfBase.com) ADNOC plans CO2 injections for oilfields in 2016 – Abu Dhabi National Oil Company (ADNOC) is on schedule to start injecting carbon dioxide into oilfields in 1Q2016. The proposed move helps in reducing CO2 emissions, boosting oil production through enhanced oil recovery techniques and replacing the natural gas used in oilfields. The project involves capturing and then piping 800,000 tons of CO2 emissions each year to oilfields operated by ADNOC. The CO2 will be sourced from Emirates Steel. (GulfBase.com) $10bn Ruwais refinery extension ready by early 2015 – According to state-run refiner Takreer, the $10bn extension of Ruwais refinery will be fully operational by the beginning of 2015. The expansion will support Abu Dhabi’s plans toward diversifying its economy by investing in downstream capacity. Takreer has already started commissioning the new facility, which will nearly double the refinery’s capacity from the current 415,000 barrels per day and will process Abu Dhabi’s Murban crude oil grade. (GulfBase.com) KKR, CVC Capital lead bidders for Americana – According to sources, a buyout group including KKR & Company and CVC Capital Partners Limited is the leading bidder to acquire the Middle Eastern fast-food operator Kuwait Food Company (Americana) after interest from Saudi Arabian firm Savola Group waned. The private equity firms, who submitted a joint offer for the $3.8bn KFC and Pizza Hut restaurants operator in the Middle East, are still negotiating the price with its Kuwaiti owners. (Bloomberg) Kuwait plans $7bn heavy-oil project – State-owned Kuwait Oil Company’s (KOC) CEO, Hashem Hashem said that Kuwait plans to spend around $7bn to develop heavy-oil fields even when crude oil prices are near five-year lows. The first phase of the Lower Fars heavy-oil project will cost $4.2bn, with contracts to be awarded by the end of 2014. KOC, which plans to drill 900 wells and pump 60,000 barrels per day (bpd) by 2018 in the project’s first phase, targets output of 180,000 bpd by 2025 and 270,000 bpd by 2030. (Reuters) Wärtsilä to build 120MW power project in Musandam – Oman Oil Company’s (OOC) majority-owned subsidiary, Musandam Power Company (MPC) signed the engineering, procurement & construction (EPC) contract and long term service agreement (LTSA) with Wärtsilä Muscat for building a new dual fuel power plant in Tibat-Wilayat Bukha at Musandam Governorate. Under the agreement, Wärtsilä will design, procure and manage the construction of the 120MW gas-fired power plant, as well as provide maintenance and performance monitoring during the concession period of 15 years. (GulfBase.com) Manara Developments’ housing project on track – Manara Developments announced that more than 50% of the construction in the final phase of the Wahat Al Muharraq housing project in Bahrain is completed. The developer said that the project is on track to deliver the 58 attached villas being built in the third phase by June 2015. The homes are designated as affordable housing and are meant for middle to lower income households, with prices not exceeding BHD120,000. (GulfBase.com)

- 6. Contacts Saugata Sarkar Abdullah Amin, CFA Shahan Keushgerian Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6509 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa Sahbi Kasraoui Ahmed Al-Khoudary QNB Financial Services SPC Manager – HNWI Head of Sales Trading – Institutional Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6544 Tel: (+974) 4476 6548 PO Box 24025 sahbi.alkasraoui@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 200.0 220.0 Nov-10 Nov-11 Nov-12 Nov-13 Nov-14 QSE Index S&P Pan Arab S&P GCC (1.7%) 0.0% (1.2%) (0.1%) 0.1% (0.9%) (4.0%) (3.3%) (3.4%) (2.8%) (2.2%) (1.6%) (1.0%) (0.4%) 0.2% Saudi Arabia Qatar Kuwait Bahrain Oman Abu Dhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,203.52 0.9 0.9 (0.2) MSCI World Index 1,726.47 -0.7 -0.7 3.9 Silver/Ounce 16.37 0.5 0.5 (15.9) DJ Industrial 17,852.48 -0.6 -0.6 7.7 Crude Oil (Brent)/Barrel (FM Future) 66.19 (4.2) (4.2) (40.3) S&P 500 2,060.31 -0.7 -0.7 11.5 Crude Oil (WTI)/Barrel (FM Future) 63.05 (4.2) (4.2) (35.9) NASDAQ 100 4,740.69 -0.8 -0.8 13.5 Natural Gas (Henry Hub)/MMBtu 3.50 2.0 2.0 (19.5) STOXX 600 348.61 -0.5 -0.5 -5.2 LPG Propane (Arab Gulf)/Ton 50.25 (13.0) (13.0) (60.3) DAX 10,014.99 -0.5 -0.5 -6.4 LPG Butane (Arab Gulf)/Ton 70.00 (8.5) (8.5) (48.4) FTSE 100 6,672.15 -0.7 -0.7 -6.7 Euro 1.23 0.3 0.3 (10.4) CAC 40 4,375.48 -0.8 -0.8 -9.0 Yen 120.69 (0.6) (0.6) 14.6 Nikkei 17,935.64 0.7 0.7 -4.2 GBP 1.57 0.5 0.5 (5.5) MSCI EM 976.84 -0.9 -0.9 -2.6 CHF 1.02 0.3 0.3 (8.5) SHANGHAI SE Composite 3,020.26 2.4 2.4 39.9 AUD 0.83 (0.3) (0.3) (7.0) HANG SENG 24,047.67 0.2 0.2 3.2 USD Index 89.04 (0.3) (0.3) 11.3 BSE SENSEX 28,119.40 -1.0 -1.0 32.9 RUB 53.80 1.7 1.7 63.7 Bovespa 50,274.07 -4.2 -4.2 -11.8 BRL 0.38 (0.4) (0.4) (9.1) RTS 870.37 -4.2 -4.2 -39.7 181.7 ``` 138.0 126.8