QE Index Rises 0.5% Led by Telecom, Banking Gains

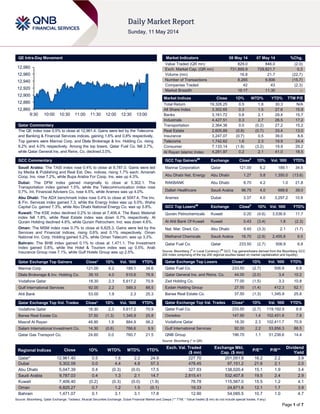

- 1. Page 1 of 7 QE Intra-Day Movement Qatar Commentary The QE index rose 0.5% to close at 12,961.4. Gains were led by the Telecoms and Banking & Financial Services indices, gaining 1.6% and 0.8% respectively. Top gainers were Mannai Corp. and Dlala Brokerage & Inv. Holding Co. rising 6.2% and 4.0% respectively. Among the top losers, Qatar Fuel Co. fell 2.7%, while Qatar General Ins. and Reins. Co. declined 2.0%. GCC Commentary Saudi Arabia: The TASI index rose 0.4% to close at 9,787.0. Gains were led by Media & Publishing and Real Est. Dev. indices, rising 1.7% each. Amanah Coop. Ins. rose 7.2%, while Bupa Arabia For Coop. Ins. was up 4.3%. Dubai: The DFM index gained marginally to close at 5,302.1. The Transportation index gained 1.5%, while the Telecommunication index rose 0.7%. Int. Financial Advisers Co. rose 4.5%, while Aramex was up 4.0%. Abu Dhabi: The ADX benchmark index rose 0.4% to close at 5047.4. The Inv. & Fin. Services index gained 7.3, while the Energy Index was up 5.0%. Waha Capital Co. gained 7.3%, while Abu Dhabi National Energy Co. was up 5.8%. Kuwait: The KSE index declined 0.2% to close at 7,406.4. The Basic Material index fell 1.8%, while Real Estate index was down 0.7% respectively. Al Qurain Holding declined 4.8%, while Qurain Petrochem. Ind. was down 4.6%. Oman: The MSM index rose 0.7% to close at 6,825.3. Gains were led by the Services and Financial indices, rising 0.6% and 0.1% respectively. Oman National Inv. Corp. Holding gained 5.2%, while Oman Telecom. was up 3.3%. Bahrain: The BHB index gained 0.1% to close at 1,471.1. The Investment Index gained 0.8%, while the Hotel & Tourism index was up 0.5%. Arab Insurance Group rose 7.1%, while Gulf Hotels Group was up 2.5%. Qatar Exchange Top Gainers Close* 1D% Vol. ‘000 YTD% Mannai Corp. 121.00 6.2 189.1 34.6 Dlala Brokerage & Inv. Holding Co. 39.10 4.0 610.6 76.9 Vodafone Qatar 18.30 2.3 5,617.2 70.9 Gulf International Services 92.00 2.2 589.3 88.5 Ahli Bank 53.00 1.9 2.3 25.3 Qatar Exchange Top Vol. Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 18.30 2.3 5,617.2 70.9 Barwa Real Estate Co. 37.50 (1.3) 1,345.9 25.8 Masraf Al Rayan 48.90 1.9 884.9 56.2 Salam International Investment Co. 14.30 (0.6) 766.6 9.9 Qatar Gas Transport Co. 24.60 0.0 760.7 21.5 Market Indicators 08 May 14 07 May 14 %Chg. Value Traded (QR mn) 829.0 846.0 (2.0) Exch. Market Cap. (QR mn) 731,895.9 729,821.7 0.3 Volume (mn) 16.8 21.7 (22.7) Number of Transactions 8,265 9,806 (15.7) Companies Traded 42 43 (2.3) Market Breadth 16:17 11.30 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 19,328.25 0.5 1.8 30.3 N/A All Share Index 3,302.65 0.3 1.5 27.6 15.9 Banks 3,161.72 0.8 2.1 29.4 15.7 Industrials 4,427.51 0.3 2.7 26.5 17.2 Transportation 2,364.36 0.0 (0.2) 27.2 15.2 Real Estate 2,605.89 (0.8) (0.7) 33.4 13.0 Insurance 3,247.07 (0.7) 0.5 39.0 8.6 Telecoms 1,742.62 1.6 2.3 19.9 24.4 Consumer 7,133.14 (1.8) (3.2) 19.9 29.2 Al Rayan Islamic Index 4,281.97 0.2 2.1 41.0 18.5 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Mannai Corporation Qatar 121.00 6.2 189.1 34.6 Abu Dhabi Nat. Energy Abu Dhabi 1.27 5.8 1,350.0 (13.6) RAKBANK Abu Dhabi 8.70 4.2 1.0 21.8 Dallah Healthcare Saudi Arabia 96.75 4.0 688.6 39.0 Aramex Dubai 3.37 4.0 3,297.2 10.9 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Qurain Petrochemicals Kuwait 0.25 (4.6) 3,538.9 11.7 Al Ahli Bank Of Kuwait Kuwait 0.43 (3.4) 1.8 (2.3) Nat. Mar. Dred. Co. Abu Dhabi 8.45 (3.3) 2.1 (1.7) Methanol Chemicals Saudi Arabia 16.70 (2.9) 2,455.8 9.5 Qatar Fuel Co. Qatar 233.50 (2.7) 506.9 6.8 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) Qatar Exchange Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Fuel Co. 233.50 (2.7) 506.9 6.8 Qatar General Ins. and Reins. Co. 44.00 (2.0) 3.4 10.2 Zad Holding Co. 77.00 (1.5) 3.3 10.8 Ezdan Holding Group 27.55 (1.4) 412.3 62.1 Barwa Real Estate Co. 37.50 (1.3) 1,345.9 25.8 Qatar Exchange Top Val. Trades Close* 1D% Val. ‘000 YTD% Qatar Fuel Co. 233.50 (2.7) 119,192.9 6.8 Ooredoo 147.90 1.4 102,451.6 7.8 Vodafone Qatar 18.30 2.3 102,411.7 70.9 Gulf International Services 92.00 2.2 53,856.3 88.5 QNB Group 196.70 1.1 51,238.6 14.4 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 12,961.40 0.5 1.8 2.2 24.9 227.70 201,051.8 16.2 2.2 3.9 Dubai 5,302.09 0.0 4.4 4.8 57.3 478.45 97,151.2 21.6 2.1 2.0 Abu Dhabi 5,047.39 0.4 (0.3) (0.0) 17.5 327.93 138,020.4 15.1 1.9 3.4 Saudi Arabia 9,787.03 0.4 1.3 2.1 14.7 2,815.41 532,407.8 19.5 2.4 2.9 Kuwait 7,406.40 (0.2) (0.3) (0.0) (1.9) 76.78 115,567.0 15.5 1.2 4.1 Oman 6,825.27 0.7 1.2 1.5 (0.1) 19.33 24,671.6 12.1 1.7 3.9 Bahrain 1,471.07 0.1 3.1 3.1 17.8 12.90 54,085.5 10.7 1.0 4.7 Source: Bloomberg, Qatar Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 12,860 12,880 12,900 12,920 12,940 12,960 12,980 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QE index rose 0.5% to close at 12,961.4. The Telecoms and Banking & Financial Services indices led the gains. The index rose on the back of buying support from Qatari shareholders despite selling pressure from non-Qatari shareholders. Mannai Corp. and Dlala Brokerage & Inv. Holding Co. were the top gainers, rising 6.2% and 4.0% respectively. Among the top losers, Qatar Fuel Co. fell 2.7%, while Qatar General Ins. and Reins. Co. declined 2.0%. Volume of shares traded on Thursday fell by 22.7% to 16.8mn from 21.7mn on Wednesday. Further, as compared to the 30-day moving average of 30.4mn, volume for the day was 44.9% lower. Vodafone Qatar and Barwa Real Estate Co. were the most active stocks, contributing 33.5% and 8.0% to the total volume respectively. Source: Qatar Exchange (* as a % of traded value) Ratings, Earnings and Global Economic Data Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Emirates NBD (ENBD) Moody’s Dubai LT DR/ ST DR/FSR Baa1/Prime- 2/D Baa1/Prime- 2/D – Stable Gulf Investment Corporation (GIC) Moody’s Kuwait LT IDR/ ST IDR/ Senior Unsecured MTN –/–/(P)Baa2 A2/P-1/(P)A2 Stable – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Credit Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, DR– Deposit Rating ) Earnings Releases Company Market Currency Revenue (mn)1Q2014 % Change YoY Operating Profit (mn) 1Q2014 % Change YoY Net Profit (mn) 1Q2014 % Change YoY National General Insurance Co. (NGI) Dubai AED 73.93 -0.7% 3.3 -69.8% 44.75 41.4% Emirates Airline * Dubai AED 82,600.00 NA – – 3,300.00 43.5% Green Crescent Insurance Co. Abu Dhabi AED 17.55 67.2% 4.3 9.6% 6.31 439.1% Foodco Holding Abu Dhabi AED 35.72 8.7% – – 26.49 293.2% Gulf Pharmaceutical Industries (Julphar) Abu Dhabi AED 393.46 19.2% – – 70.62 12.5% Bahrain Duty Free Shop Complex (BDFS) Bahrain BHD 6.41 9.1% – – 1.80 11.6% Aluminium Bahrain (Alba) Bahrain BHD 182.83 -2.3% – – 15.61 -48.5% Source: Company data, DFM, ADX, MSM (* FY2013 results) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 05/08 US Federal Reserve Consumer Credit March $15.500B $12.986B $12.986B 05/08 US Department of Labor Initial Jobless Claims 3 May 325K 345K 345K 05/08 US Department of Labor Continuing Claims 26 April 2758K 2761K 2761K 05/09 US US Census Bureau Wholesale Inventories MoM March 0.50% 0.70% 0.70% 05/09 US US Census Bureau Wholesale Trade Sales MoM March 1.10% 0.90% 0.90% 05/08 EU European Central Bank ECB Announces Interest Rates 8 May 0.25% 0.25% – 05/08 EU European Central Bank ECB Marginal Lending Facility 8 May 0.75% 0.75% – 05/08 Germany Deutsche Bundesbank Industrial Production SA MoM March 0.20% 0.60% 0.60% 05/08 Germany BMWi Industrial Production WDA YoY March 4.40% 4.70% 4.70% 05/09 Germany Destatis Trade Balance March 17.4B 16.2B 16.2B 05/09 Germany Destatis Current Account Balance March 14.9B 13.8B 13.8B 05/09 Germany Deutsche Bundesbank Exports SA MoM March 1.30% -1.30% – 05/09 Germany Deutsche Bundesbank Imports SA MoM March 0.60% 0.40% – 05/08 UK Bank of England Bank of England Bank Rate 8 May 0.50% 0.50% – 05/08 UK Bank of England BOE Asset Purchase Target Mach 375B 375B – 05/09 UK ONS Trade Balance March -£2000 -£1713 -£1713 05/09 UK ONS Industrial Production MoM March -0.20% 0.80% 0.80% 05/09 UK ONS Industrial Production YoY March 2.40% 2.50% 2.50% 05/09 UK ONS Manufacturing Production MoM March 0.50% 0.30% 1.00% 05/09 UK ONS Manufacturing Production YoY March 3.30% 2.90% 3.90% Overall Activity Buy %* Sell %* Net (QR) Qatari 53.28% 51.26% 16,782,740.91 Non-Qatari 46.72% 48.74% (16,782,740.91)

- 3. Page 3 of 7 05/09 UK ONS Construction Output SA MoM March -1.00% 0.60% -2.00% 05/09 UK ONS Construction Output SA YoY March 6.40% 7.10% 3.90% 05/09 UK NIESR NIESR GDP Estimate April 1.00% – 0.80% 05/08 Spain INE Industrial Output NSA YoY March 8.10% 2.00% 2.70% 05/08 Spain INE Industrial Output SA YoY March 0.60% 1.60% 2.50% 05/09 Italy ISTAT Industrial Production MoM March -0.50% 0.30% -0.40% 05/09 Italy ISTAT Industrial Production WDA YoY March -0.40% 1.30% 0.40% 05/09 Italy ISTAT Industrial Production NSA YoY March 1.10% – 0.40% 05/08 China NBSC Exports YoY April 0.90% -3.00% -6.60% 05/08 China NBSC Imports YoY April 0.80% -2.10% -11.30% 05/09 China NBSC PPI YoY April -2.00% -1.90% -2.30% 05/09 China NBSC CPI YoY April 1.80% 2.10% 2.40% 05/09 Japan ESRI Leading Index CI March 106.5 106.7 108.7 05/09 Japan ESRI Coincident Index March 114.0 114.0 112.9 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar QGMD reports net loss of QR2.8mn in 1Q2014 – Qatar German Company for Medical Devices (QGMD) reported a net loss of QR2.8mn in 1Q2014 as compared to a net loss of QR2.7mn in 1Q2013, despite robust revenue. Revenue for 1Q2014 almost tripled to QR5.3mn on a YoY basis. As a result, the company was able to report a gross profit of QR0.5mn in 1Q2014 compared to a gross loss of QR0.1mn in 1Q2013. The company’s Loss per Share (LPS) amounted to QR0.24 in 1Q2014 vs. LPS of QR0.23 in 1Q2013. (QE) Qatari bourse plans two ETFs – The Qatar Exchange’s (QE) CEO Rashid Al Mansoori disclosed that the bourse is working toward launching two exchange-traded funds (ETFs) over the next six months. One ETF will be based on government fixed income risk from an Asian borrower, while the second product is likely to be an ETF based on a representative Qatar-country index. Last week, QE, in collaboration with QNB Financial Services and Bank of America Merrill Lynch, concluded a week- long roadshow in London and New York to enhance investor relations between international investment institutions and Qatari-listed companies. The forthcoming inclusion of Qatar in the MSCI Emerging Market Index has provided a unique opportunity for the country to showcase its market-leading listed companies. (Peninsula Qatar) QFMA approves slashing face value of listed shares to QR1 – The Qatar Financial Markets Authority (QFMA) has approved a proposal to reduce the face value of listed shares to QR1.00 from QR10.00. According to a QFMA report for 2013, this reduction will help in increasing liquidity, investor base and the share turnover ratio as well as attract a new genre of investors. The QFMA's board approving the proposal does not mean the nominal value of shares listed on the Qatar Exchange would be reduced to QR1.00 from QR10.00. However, the corporate law needs to be amended to implement the move and QFMA is required to approach the Ministry of Economy & Commerce for approval. (Peninsula Qatar) Ashghal to build flyovers in Doha – The Public Works Authority (Ashghal) has called on specialized companies to submit pre-qualification applications for designing and building pedestrian flyovers. The authority plans to build multi-layer flyovers at different locations in the country, aimed at providing pedestrians easy and safe access to schools, shopping centers and bus stops. The proposed flyovers will have escalators and covered air-conditioned passages. (Gulf-Times.com) OASIS tech lab opens at Ooredoo HQ – Ooredoo has opened the OASIS technology laboratory in Doha, which is a new facility for the development, testing and demonstration of IT and communication solutions. OASIS, which stands for ‘Ooredoo Advanced Smart Innovative Solutions’, will host advanced communication solutions and cutting-edge experimental technologies, which is the first-of-its-kind in the region. Further, the lab has been equipped with a special Business Lounge to host events and meetings and is supported by the tele-presence technology hosted at the Ooredoo HQ. The launch of the OASIS lab is the latest in a series of significant investments by the company to enhance the range of services available to businesses in Qatar. (Gulf-Times.com) PwC: Water use in Qatar over 12 times its renewable resources – According to PricewaterhouseCoopers (PwC), Qatar’s annual per capita consumption of water is more than 12 times the amount of renewable water available, but its usage is substantially lower than that in Kuwait and the UAE. The usage of desalinated seawater in Qatar constitutes 75% of the total water consumption, which is higher than that in Saudi Arabia, Oman, the UAE and Kuwait. In its report named ‘Achieving a sustainable water sector in the GCC: Managing supply and demand, building institutions’, PwC stated that the per capita water consumption in Qatar was estimated at 377 cubic meters per annum, whereas renewable resources were only 31 cubic meters, translating to 12 times higher use. Overall, the per capita consumption of water per annum in the Gulf countries is about 816 cubic meters, 65% more than the world average, thus calling for rationalization of subsidies and a pragmatic fixation of tariffs. (Gulf-Times.com) Project Qatar expo opens tomorrow – Project Qatar 2014, the 11th International Construction Technology & Building Materials Exhibition, will open its doors tomorrow under the patronage of the Prime Minister and Interior Minister, HE Sheikh Abdullah bin Nasser bin Khalifa Al Thani. Taking place at the Qatar National Convention Centre till May 15, Project Qatar 2014 will feature over 2,100 exhibitors and 24 international pavilions, along with an anticipated 45,000 professional visitors from 130 countries. (Peninsula Qatar) International Although not yet out of the woods, the Indian economy is on the mend – The IMF expects the Indian real GDP growth to recover to 5.4% this year (4.4% in 2013, the lowest in 5 years), bolstered by a rebound in agriculture and stronger exports and government reforms. However, lingering imbalances and structural impediments are still holding back a full recovery. The

- 4. Page 4 of 7 ongoing parliamentary elections mark a cross-roads to the current program of reforms needed to sustain stronger growth. Of critical importance will be how the new leadership will tackle the lack of infrastructure investment and structural reforms whilst attempting at the same time to keep the current account and fiscal deficits in check. Against the background of parliamentary elections due to be completed by mid-May and prospective global liquidity tightening, the new administration coming to power will face a number of key economic reform challenges. At the top of the agenda is addressing infrastructure investment gaps and supply-side constraints. In particular, electricity shortages and an inadequate transportation system need to be tackled in the short term. Over the medium term, further fiscal consolidation is needed, particularly tax and subsidy reforms to lower fiscal imbalances. In addition, more effective education and health spending will be critical to ensure that the demographic dividend pays off over the long run. Finally, addressing structural challenges in agriculture as well as in the pricing and allocation of natural resources will be essential to achieve faster growth and higher job creation. Overall, stronger global growth, improving export competitiveness, measures already underway to advance stalled infrastructure projects and a confidence boost from recent policy actions are likely to result in a moderate growth recovery over the medium term. However, further structural reforms in the areas of electricity and transportation, fiscal consolidation, education and health spending, and the pricing of natural resources are needed in order for India to achieve its full growth potential. (QNB Group) ONS: UK factory output grows at fastest quarterly pace since 2010 – British factory output grew at its fastest pace in nearly four years and the trade deficit narrowed during 1Q2014, adding to signs that the economy is rebalancing. The Office for National Statistics (ONS) said manufacturing output grew by 1.4% in the first three months of the year, up from 0.6% in the last three months of 2013. This was the best calendar quarter since the second quarter of 2010, as the sector recovers from a steep slump after the financial crisis. Britain's trade deficit for goods with the rest of the world also narrowed more than expected, sinking to £8.478bn, which is its lowest since December. (Reuters) Draghi, worried by strong euro, says ECB poised to act soon – The European Central Bank (ECB) is ready to take action next month to boost the Eurozone economy, if updated inflation forecasts merit it, its president said, warning outsiders not to pressurize the bank into action. Stressing that the euro's strength was a serious concern, ECB President Mario Draghi said the exchange rate would have to be addressed, adding that the bank's policymakers held a council discussion about all instruments at their meeting in Brussels. Eurozone’s inflation ticked up to 0.7% in April from March's 0.5%, but remains far below the ECB's target of just under 2%. Draghi did not specify what policy action the ECB could take beyond saying the discussion touched upon the policy instruments the central bank has mentioned earlier. These include interest rate cuts, liquidity measures and even quantitative easing. (Reuters) BoJ to set aside more reserves as balance sheet grows – The Bank of Japan (BoJ) will set aside four times the amount of reserves it normally would need to offset the risk posed by the assets it is rapidly adding to its balance sheet due to its quantitative easing. The BoJ said that it has requested permission from the Japanese finance ministry to set aside 20% of the funds left over after the central bank closes its books for fiscal year, which ended in March. The finance ministry is likely to approve. Currently, the BoJ is required to set aside only 5% of excess funds. The BOJ will announce its results for FY2015 sometime in late May. Since April last year, the BoJ has rapidly increased its purchases of government debt and riskier assets such as real estate investment trusts and exchange-traded funds, as part of its quantitative easing aimed at ending 15 years of deflation. As a result, the central bank’s balance sheet has expanded to 246tn yen at the end of April from 164tn yen at the end of March last year. This has pushed the central bank's capital adequacy ratio below its desired level of 8%, so it judged that it was necessary to increase the reserves it would set aside. (Reuters) China’s inflation slows down to 1.8% in April – Consumer inflation in China moderated to an 18-month low and the decline in its factory-gate prices persisted, giving the government more scope to loosen policies if a growth slowdown deepens. The National Bureau of Statistics said the consumer price index rose 1.8% from a year earlier in April 2014. That compares with the median estimate of 2.1% in a Bloomberg News survey and a 2.4% gain in March. The producer-price index fell 2%, the 26th straight decline, after recording a 2.3% drop the previous month. Recent data adds to signs that domestic demand remains muted, with falling commodity prices exacerbating overcapacity in industries including steel and cement. The lack of inflationary pressure will allow the People’s Bank of China to relax its monetary policy to support the economy, if Chinese Premier Li Keqiang’s full-year goal of about 7.5% growth is threatened. (Bloomberg) Regional Etihad Rail signs MoU with SAR – Etihad Rail and the Saudi Railway Company (SAR) have signed a MoU that will enhance collaboration and coordination for the rail industry among GCC members. The MoU seeks to introduce common solutions, leverage best practices and allow for the free exchange of ideas to improve the safety, efficiency, and economy of railway networks in both the countries. (Bloomberg) HMH adds new hotel property in Riyadh – Hospitality Management Holdings (HMH) has signed a franchise agreement for a new property in Riyadh to add Coral Riyadh Al Dhabab Hotel to its portfolio. The hotel with 114 rooms and suites is in the final stages of development and is expected to open in 3Q2014. This agreement enables HMH to expand its portfolio of hotels and strengthen its position in Saudi hospitality market. (GulfBase.com) Nesma & Partners awards contract for Saudi hospital projects – Nesma & Partners Contracting Company has awarded Jacobs Engineering Group a contract for program management services for the Saudi Arabian National Guard Hospital Program. The contract duration is for up to three years including option periods. Under the terms, Jacobs will support Nesma & Partners in managing a program that involves building five hospitals on four sites in Saudi Arabia. They include a 300- bed maternity hospital in Riyadh, two 300-bed National Guard hospitals in Qassim and Taif, and a 346-bed children’s hospital and 176-bed neurological hospital on an existing hospital site in Jeddah. (GulfBase.com) Saudi Aramco awards $4bn EPC contracts to Saipem – Saudi Aramco has awarded three EPC contracts worth around $4bn to Italy-based Saipem for onshore engineering and

- 5. Page 5 of 7 construction activities in Saudi Arabia. Two EPC contracts relevant to the Jazan Integrated Gasification Combined Cycle project are located near the city of Jazan. The Package 1 contract comprises the gasification unit, the soot/ash removal unit, the acid gas removal and the hydrogen recovery units. Package 2 contract includes six sulfur recovery unit trains and relevant storage facilities. Saudi Aramco has also awarded an EPC contract to Saipem for the Loops 4 & 5 of the Shedgum- Yanbu Gas Pipeline, linking Shedgum to Yanbu. (GulfBase.com) Saudi crude output rises to 9.66mn bpd in April – According to sources, Saudi Arabia produced 9.66mn bpd of crude oil in April 2014, up from 9.566mn bpd in March 2014. KSA supplied 9.65mn bpd in April to the market, up from 9.533mn bpd in March. (GulfBase.com) OBG: Saudi retail sector to reach SR267bn – According to a report by Oxford Business Group (OBG), the retail sector in Saudi Arabia is projected to grow to an estimated value of SR267bn by the end of 2014 as compared to SR250bn in 2012. The growth is driven by many factors such as high rates of consumption, growing population and expanding incomes. Manufactured items for direct use captured 38.5% of the market share, followed by electronic devices (27.3% share), textiles & clothes (23.3%), sanitary items and cosmetics (17.9%). Meanwhile, the per capita spending in retail markets is expected to increase to SR15,200 by 2015, or 50% higher as compared to 2010. (GulfBase.com) Mobily enters into multiple IT partnerships – Etihad Etisalat Company (Mobily) has entered into multiple partnerships with major IT companies such as IBM, Cisco and Virtustream to give world-class services to its clients. Meanwhile, the Saudi Ministry of Education has chosen Mobily and IBM to enhance information security throughout its organization. IBM’s Security Operations Center will provide management and security services to the ministry, which will be hosted in Mobily’s Tier IV-Design and Construction Certified Data Center. Mobily and IBM will utilize data security services to provide a comprehensive expert assessment of the current data protection capabilities of the ministry. (GulfBase.com) UAE MoE to launch center for national patents – The UAE’s Ministry of Economy (MoE), in collaboration with Korean Intellectual Property Office (KIPO), is set to launch the first national center for examining and issuing patents in the UAE. The agreement outlines the framework, mechanism and procedures required for the development of a patent system in the country. It also specifies the procedures that need to be set in place for reviewing patent applications received within the UAE. (GulfBase.com) UAE bank lending up at AED1.293tn – The Central Bank of the UAE stated that lending by various UAE-based banks and financial institutions rose 0.6% YoY to AED1.293tn in February 2014. Total bank deposits increased by 0.6% as well, due to an increase in resident deposits by AED10.3bn and a decrease in non-resident deposits by AED2bn, reaching AED1.299tn. Total bank assets increased by 1% at the end of February 2014. The central bank announced that the money supply aggregate M0 increased by 1.1%, from AED63.5bn in January 2014 to AED64.2bn in February 2014. The money supply aggregate M1, increased by 1.9%, from AED389.2bn in January to AED396.6bn in 2014. Similarly, the money supply aggregate M2 rose by 1.3% in February. The money supply aggregate M3 expanded by 0.9% from AED1.23tn in January to AED1.243tn in February. (Bloomberg) DAMAC’s unit launches Dubai’s 1st Shari’ah-compliant hotel apartments – DAMAC Hotels, the hospitality arm of DAMAC Properties, has launched the first fully certified Shari’ah-compliant serviced hotel apartments in Dubai. Constella is a luxury tower under construction in the thriving community of Jumeirah Village. The complete management of the project will be carried out on Shari’ah principles and result in the issuing of a Shari’ah certification by ‘Dar Al Sharia’. The company said, although there are projects in Dubai that are alcohol-free and claim to be Shari’ah-compliant, Constella will also have separate swimming pools for men and women, separate gymnasiums and saunas. The restaurant will also have a single section for men and separate family section. There will also be dedicated floors provided for ladies that will be served by female only staff. (Gulf-Times.com) Ajman Bank reports AED13.7mn net profit in 1Q2014 – Ajman Bank has reported a net profit of AED13.7mn for 1Q2014 as compared to AED12.3mn for 1Q2013. EPS amounted to AED0.0137 at the end of 1Q2014 as against AED0.0123 at the end of 1Q2013. Total assets stood at AED7.71bn as of March 31, 2014 as compared to AED7.09bn as of March 31, 2013. Customer deposits stood at AED6bn at the end March 31, 2014 as against AED5.48bn at the end of December 31, 2013. (DFM) Dubai SME, Oasis 500 sign MoU – Dubai SME, an agency of the Department for Economic Development (DED) has signed a MoU with Amman-based Oasis 500 to identify and foster SMEs capable of driving innovation and enhancing Dubai’s profile ahead of the World Expo 2020. Oasis 500, the entrepreneurial and investment projects company of Jordan, focuses on investments and acceleration programs for technology-based start-ups in the MENA region, by providing them with training, coaching and mentorship. The MoU will see Dubai SME and Oasis 500 combining their respective resources to invest in 500 companies by 2018 with additional capital, mentoring and incubation provided for the next 24 months leading to the World Expo 2020. (GulfBase.com) Jumeirah plans AED8bn global expansion in 11 countries – Jumeirah Group is planning expand globally and add 4,300 hotel rooms to its portfolio over the next three years. The group has endorsed an expansion project worth AED8bn in 11 countries, which will enable it to double its revenue over the next few years and expand its portfolio to more than 40 hotels and 10,000 hotel rooms by 2017. (GulfBase.com) Ramee Group plans five-star hotels in UAE – Dubai-based Ramee Group of Hotels is planning to open 2 five-star hotels in the UAE over the next three years with an investment of around AED700mn. The hospitality group has a portfolio of 40 properties, including hotels, hotel apartments and resorts across the UAE, Bahrain, Oman and India. (GulfBase.com) Emaar exempted from IPO rules on DFM – According to sources, the Securities & Commodities Authority has given Emaar Properties approval to float shares of its malls business on the Dubai Financial Market (DFM), and has exempted it from restrictions that would normally apply to a local-market IPO. Emaar is likely to abandon plans for simultaneous listings on the Emirate’s international market, Nasdaq Dubai, and the London Stock Exchange. The exemption allows the company to reduce the amount of equity it has to sell from 55% to about 25%, it will be able to use book-building to determine the price rather than to issue shares at par value and shareholders will be allowed to realize cash in the IPO rather than put all proceeds back in the company. Investment Corporation of Dubai, with a 30% stake in Emaar, will be a big beneficiary of the IPO. The IPO would be valued at AED9bn and is expected to be completed by June 30, 2014. (GulfBase.com)

- 6. Page 6 of 7 RTA awards AED384mn Dubai Water Canal Project contract – The Roads & Transport Authority (RTA) has awarded the contract for Phase II of the Dubai Water Canal Project to China State Corporation. The Phase II contract comprises the construction of bridges across the Canal on Al Wasl and Jumeirah Roads at a cost of AED384mn, which is expected to be completed in 4Q2016. (Bloomberg) RAKBank increases foreign ownership to 40% – The National Bank of Ras Al-Khaimah’s (RAKBank) EGM has approved the proposal to increase the maximum foreign ownership in the bank’s equity to 40%. (ADX) Dar Al Takaful increases capital to AED150mn – Dar Al Takaful’s EGM has decided to increase the company’s paid-up share capital from AED100mn to AED150mn by offering a rights issue. The rights shares will be offered to those shareholders who own shares at the close of trading on May 14, 2014. (ADX) Etisalat expects to complete Vivendi acquisition on May 14 – Emirates Telecommunications Corporation (Etisalat) is expecting to complete the acquisition of Vivendi's 53% shareholding in Itissalat Al Maghrib (Maroc Telecom) on May 14, 2014. (ADX) ADCM to build business hotel in Montenegro – Abu Dhabi Capital Management (ADCM) has signed an agreement to invest in building a business hotel in Montenegro. The hotel will form part of the Atlas Capital Center, located in the central business district of Podgorica, the capital city of Montenegro. The six-storey hotel is expected to be completed by the end of 2015. (GulfBase.com) Etihad acquires ADAT from Mubadala – Etihad Airways and Mubadala Development Company have signed an agreement in which Etihad will acquire Abu Dhabi Aircraft Technologies (ADAT) from Mubadala. The deal will see Mubadala retain ADAT’s engine focused maintenance, repair and overhaul (MRO) business, which will be the catalyst for the growth of its dynamic engine business through the establishment of a new engine company. The transaction includes maintenance and engineering teams, hangars, component workshops, and paint facilities in Abu Dhabi, which will enhance Etihad’s capability to undertake airframe and component maintenance on its growing fleet of modern aircraft, including the new Airbus A380 and Boeing B787, which will join the fleet in 4Q2014. (GulfBase.com) GMS plans $400mn capex – Gulf Marine Services (GMS) is planning to expand into South-East Asia and West Africa in 2015 to tap strong demand for its vessels. GMS currently has a fleet of nine vessels, and is expecting to add another six by 2016 as part of its new build program with capital spending of around $400mn. (Reuters) OPWP invites bids for new Salalah power project – The Oman Power & Water Procurement Company (OPWP) has issued a request for proposals (RfP) to six prominent international utilities, inviting them to participate in a competitive process for building a new independent power project (IPP) in Salalah. The new gas-fired plant in Raysut, dubbed Salalah2 IPP, will have an installed capacity of around 300-400 MW. RfPs have been sent out to six major developers that have been prequalified by OPWP, which include EDF International, Mitsui & Co, Marubeni Corporation and Sojitz Corporation, Korea Electric and the International Company for Power & Water. The successful bidder will secure a 20-year license to develop, construct, operate and maintain the gas-fired power station at Raysut. (GulfBase.com) CBO plans short-term Islamic instruments – The Central Bank of Oman (CBO) is planning to issue short-term Islamic finance instruments to help Islamic institutions to park their excess funds within the country. The apex bank is expected to float a tender seeking advisory service from consultancy agencies for choosing the type of instruments suitable for the market. This transaction will boost the profitability of Omani Islamic banks, which have so far mainly relied on Wakala – the Shari’ah-compliant agency agreements – to manage their short- term funding needs. (GulfBase.com) NCSI: Oman’s oil production rose marginally – According to a report by the National Centre for Statistics & Information (NCSI), oil production in Oman has witnessed a 1% YoY growth during 1Q2014, rising to 85.3mn barrels compared with 84.5mn barrels in 1Q2013. The growth is attributed to the increase in crude oil production by 3.5%, which recorded 77.6mn barrels in 1Q2014 as compared to 74.9mn barrels in 1Q2013. In addition, condensate production rose to 7.7mn barrels for 1Q2014, compared with 9.5mn barrels during 1Q2013, reflecting an increase of 18.3%. (GulfBase.com) NBO appoints new CEO – The National Bank of Oman (NBO) has appointed Ahmed Al Musalmi as its new Chief Executive Officer. Earlier, Al Musalmi had served as NBO's Deputy CEO since 2011, and had worked to transform the bank. Al Musalmi will continue to drive forward the NBO's long-term strategy for sustained growth. (Bloomberg) NBB, Gulf Air enters into joint promotion agreement – National Bank of Bahrain (NBB) and Gulf Air have entered into a major joint promotion agreement to offer customers a 10% discount on purchase of Gulf Air tickets online, using their NBB debit cards or credit cards. This offer is applicable on both the national carrier's business and economy class fares and is valid for all tickets purchased from the official Gulf Air website. In addition, all NBB credit card holders are eligible for a special discount to access the Gulf Air Falcon Gold Lounge in Bahrain International Airport when travelling with the national carrier. The joint promotion is valid until March 31, 2015. (GulfBase.com)

- 7. Contacts Saugata Sarkar Keith Whitney Sahbi Kasraoui Head of Research Head of Sales Manager - HNWI Tel: (+974) 4476 6534 Tel: (+974) 4476 6533 Tel: (+974) 4476 6544 saugata.sarkar@qnbfs.com.qa keith.whitney@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*Market closed on May 09, 2014) 80.0 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 170.0 180.0 190.0 200.0 Jun-10 Jan-11 Aug-11 Mar-12 Oct-12 May-13 Dec-13 QE Index S&P Pan Arab S&P GCC 0.4% 0.5% (0.2%) 0.1% 0.7% 0.4% 0.0% (0.4%) (0.2%) 0.0% 0.2% 0.4% 0.6% 0.8% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D% WTD% YTD% Gold/Ounce 1,288.79 (0.0) (0.8) 6.9 DJ Industrial 16,583.34 0.2 0.4 0.0 Silver/Ounce 19.16 (0.1) (1.7) (1.6) S&P 500 1,878.48 0.2 (0.1) 1.6 Crude Oil (Brent)/Barrel (FM Future) 107.89 (0.1) (0.6) (2.6) NASDAQ 100 4,071.87 0.5 (1.3) (2.5) Natural Gas (Henry Hub)/MMBtu 4.57 (3.5) (3.0) 5.3 STOXX 600 338.54 (0.3) 0.2 3.1 LPG Propane (Arab Gulf)/Ton 103.75 (0.7) (3.0) (17.8) DAX 9,581.45 (0.3) 0.3 0.3 LPG Butane (Arab Gulf)/Ton 116.50 (0.6) (3.2) (14.7) FTSE 100 6,814.57 (0.4) (0.1) 1.0 Euro 1.38 (0.6) (0.8) 0.1 CAC 40 4,477.28 (0.7) 0.4 4.2 Yen 101.86 0.2 (0.3) (3.3) Nikkei 14,199.59 0.3 (1.8) (12.8) GBP 1.69 (0.5) (0.1) 1.8 MSCI EM 1,006.95 (0.2) 0.4 0.4 CHF 1.13 (0.7) (0.9) 0.8 SHANGHAI SE Composite 2,011.14 (0.2) (0.8) (5.0) AUD 0.94 (0.1) 0.9 5.0 HANG SENG 21,862.99 0.1 (1.8) (6.2) USD Index 79.90 0.7 0.5 (0.2) BSE SENSEX 22,994.23 2.9 2.6 8.6 RUB 35.23 0.6 (1.7) 7.2 Bovespa 53,100.34 (0.6) 0.2 3.1 BRL 0.45 0.0 0.4 6.8 RTS* 1,232.78 0.0 7.3 (14.6) 186.2 154.8 140.8