22 July Daily market report

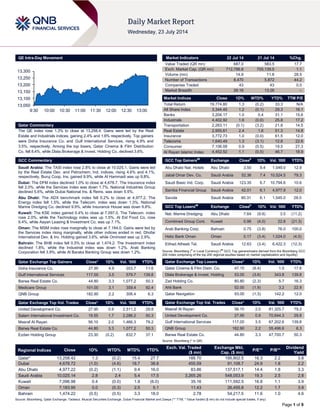

- 1. Page 1 of 9 QE Intra-Day Movement Qatar Commentary The QE index rose 1.3% to close at 13,258.4. Gains were led by the Real Estate and Industrials indices, gaining 2.4% and 1.6% respectively. Top gainers were Doha Insurance Co. and Gulf International Services, rising 4.9% and 3.5%, respectively. Among the top losers, Qatar Cinema & Film Distribution Co. fell 8.4%, while Dlala Brokerage & Invest. Holding Co. declined 3.6%. GCC Commentary Saudi Arabia: The TASI index rose 2.8% to close at 10,025.1. Gains were led by the Real Estate Dev. and Petrochem. Ind. indices, rising 4.6% and 4.1%, respectively. Buruj Coop. Ins. gained 9.9%, while Al Hammadi was up 9.8%. Dubai: The DFM index declined 1.0% to close at 4,678.7. The Insurance index fell 2.0%, while the Services index was down 1.7%. National Industries Group declined 5.6%, while Dubai National Ins. & Reins. was down 5.5%. Abu Dhabi: The ADX benchmark index fell 0.2% to close at 4,977.2. The Energy index fell 1.5%, while the Telecom. index was down 1.3%. National Marine Dredging Co. declined 9.9%, while Insurance House was down 9.8%. Kuwait: The KSE index gained 0.4% to close at 7,097.0. The Telecom. index rose 2.0%, while the Technology index was up 1.5%. Al Eid Food Co. rose 9.4%, while Aayan Leasing & Investment Co. was up 7.1%. Oman: The MSM index rose marginally to close at 7,184.0. Gains were led by the Services index rising marginally, while other indices ended in red. Dhofar International Dev. & Inv. Holding gained 3.6%, while Ominvest was up 2.9%. Bahrain: The BHB index fell 0.5% to close at 1,474.2. The Investment index declined 1.8%, while the Industrial index was down 1.2%. Arab Banking Corporation fell 3.9%, while Al Baraka Banking Group was down 1.2%. Qatar Exchange Top Gainers Close* 1D% Vol. ‘000 YTD% Doha Insurance Co. 27.90 4.9 203.7 11.6 Gulf International Services 117.00 3.5 579.7 139.8 Barwa Real Estate Co. 44.80 3.3 1,077.2 50.3 Medicare Group 101.00 3.1 359.4 92.4 QNB Group 182.90 2.2 306.4 6.3 Qatar Exchange Top Vol. Trades Close* 1D% Vol. ‘000 YTD% United Development Co. 27.95 0.9 2,511.2 29.8 Salam International Investment Co. 19.55 1.7 2,286.2 50.3 Masraf Al Rayan 56.10 2.0 1,466.3 79.2 Barwa Real Estate Co. 44.80 3.3 1,077.2 50.3 Ezdan Holding Group 23.30 (0.2) 832.7 37.1 Market Indicators 22 Jul 14 21 Jul 14 %Chg. Value Traded (QR mn) 687.0 583.5 17.7 Exch. Market Cap. (QR mn) 712,786.8 705,139.5 1.1 Volume (mn) 14.9 11.6 28.5 Number of Transactions 8,470 5,872 44.2 Companies Traded 43 43 0.0 Market Breadth 26:16 13:26 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 19,774.80 1.3 (0.2) 33.3 N/A All Share Index 3,344.45 1.2 (0.1) 29.3 16.1 Banks 3,204.17 1.0 0.4 31.1 15.6 Industrials 4,402.92 1.6 (0.0) 25.8 17.2 Transportation 2,263.11 (0.1) (3.2) 21.8 14.5 Real Estate 2,955.61 2.4 1.6 51.3 14.8 Insurance 3,772.73 1.0 (0.0) 61.5 12.0 Telecoms 1,640.49 1.3 (3.1) 12.8 22.6 Consumer 7,106.09 0.9 (0.5) 19.5 27.3 Al Rayan Islamic Index 4,452.52 1.1 (0.5) 46.7 18.9 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Abu Dhabi Nat. Hotels Abu Dhabi 3.50 9.4 1,049.0 12.9 Jabal Omar Dev. Co. Saudi Arabia 52.36 7.4 10,524.5 79.3 Saudi Basic Ind. Corp. Saudi Arabia 123.35 6.7 10,794.6 10.6 Samba Financial Group Saudi Arabia 42.01 6.1 4,977.9 12.0 Savola Saudi Arabia 80.31 6.1 1,545.0 28.0 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Nat. Marine Dredging Abu Dhabi 7.64 (9.9) 3.5 (11.2) Combined Group Cont. Kuwait 0.96 (4.0) 22.8 (21.3) Arab Banking Corp. Bahrain 0.75 (3.8) 76.0 100.0 Hsbc Bank Oman Oman 0.17 (3.4) 1,024.0 (4.5) Etihad Atheeb Tel. Saudi Arabia 12.63 (3.4) 6,422.3 (12.3) Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) Qatar Exchange Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Cinema & Film Distri. Co. 47.15 (8.4) 1.0 17.6 Dlala Brokerage & Invest. Holding 53.00 (3.6) 343.8 139.8 Zad Holding Co. 80.80 (2.3) 5.7 16.3 Ahli Bank 52.00 (1.9) 3.2 22.9 Qatar Navigation 93.00 (1.3) 142.2 12.0 Qatar Exchange Top Val. Trades Close* 1D% Val. ‘000 YTD% Masraf Al Rayan 56.10 2.0 81,325.7 79.2 United Development Co. 27.95 0.9 70,644.3 29.8 Gulf International Services 117.00 3.5 67,202.6 139.8 QNB Group 182.90 2.2 55,496.6 6.3 Barwa Real Estate Co. 44.80 3.3 47,700.7 50.3 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 13,258.42 1.3 (0.2) 15.4 27.7 188.70 195,802.5 16.3 2.2 3.8 Dubai 4,678.72 (1.0) (4.6) 18.7 38.8 455.59 91,108.7 24.9 1.8 2.2 Abu Dhabi 4,977.22 (0.2) (1.1) 9.4 16.0 83.86 137,517.1 14.4 1.8 3.3 Saudi Arabia 10,025.14 2.8 2.4 5.4 17.5 3,265.26 548,053.9 19.3 2.5 2.8 Kuwait 7,096.98 0.4 (0.0) 1.8 (6.0) 35.16 111,592.5 16.8 1.1 3.9 Oman 7,183.95 0.0 (0.3) 2.5 5.1 11.43 26,455.8 12.2 1.7 3.9 Bahrain 1,474.22 (0.5) (0.5) 3.3 18.0 2.78 54,217.5 11.6 1.0 4.6 Source: Bloomberg, Qatar Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 13,050 13,100 13,150 13,200 13,250 13,300 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 9 Qatar Market Commentary The QE index rose 1.3% to close at 13,258.4. The Real Estate and Industrials indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari shareholders. Doha Insurance Co. and Gulf International Services were the top gainers, rising 4.9% and 3.5%, respectively. Among the top losers, Qatar Cinema & Film Distribution Co. fell 8.4%, while Dlala Brokerage & Invest. Holding Co. declined 3.6%. Volume of shares traded on Tuesday rose by 28.5% to 14.9mn from 11.6mn on Monday. Further, as compared to the 30-day moving average of 14.2mn, volume for the day was 5.3% higher. United Development Co. and Salam International Investment Co. were the most active stocks, contributing 16.8% and 15.3% to the total volume respectively. Source: Qatar Exchange (* as a % of traded value) Earnings and Global Economic Data Earnings Releases Company Market Currency Revenue (mn)2Q2014 % Change YoY Operating Profit (mn) 2Q2014 % Change YoY Net Profit (mn) 2Q2014 % Change YoY Tamweel Dubai AED 110.9 -22.0% – – 28.3 8.7% Waha Capital Abu Dhabi AED 1,281.52 1158.5% – – 1,137.76 2865.7% Umm Al-Qalwaln Cement Industries Co. (QCEM) Abu Dhabi AED 3.1 -6.7% – – -3.6 NA Oman Cement Co. (OCC)* Oman OMR 25.7 -6.1% – – 9.9 4.3% Construction Materials Industries & Contracting (CMIC) Oman OMR 1.4 -17.8% – – -0.2 NA Bahrain Cinema Co. (BCC) Bahrain BHD 4.8 3.5% 1.7 -4.1% 1.9 -20.5% Source: Company data, DFM, ADX, MSM (* 1H2014 results) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 07/22 US BLS CPI MoM June 0.30% 0.30% 0.40% 07/22 US BLS CPI YoY June 2.10% 2.10% 2.10% 07/22 US BLS CPI Core Index SA June 238.083 238.227 237.78 07/22 US BLS CPI Index NSA June 238.343 238.535 237.9 07/22 US FHFA FHFA House Price Index MoM May 0.40% 0.20% 0.10% 07/22 US Richmond Fed Richmond Fed Manufact. Index July 7.0 5.0 4.0 07/22 UK ONS Public Finances (PSNCR) June 11.8B – 8.4B 07/22 UK ONS Central Government NCR June 18.1B – 12.3B 07/22 UK ONS Public Sector Net Borrowing June 9.5B 9.4B 11.9B 07/22 UK CBI CBI Business Optimism July 19.0 30.0 33.0 07/22 Japan METI All Industry Activity Index MoM May 0.60% 0.60% -4.60% 07/22 Japan ESRI Leading Index CI May 104.8 – 105.7 07/22 Japan ESRI Coincident Index May 111.3 – 111.1 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 61.44% 70.81% (64,406,307.26) Non-Qatari 38.56% 29.19% 64,406,307.26

- 3. Page 3 of 9 News Qatar VFQS posts narrower June 2014 loss on postpaid driven ARPU growth and lower than expected expenses – In 1QFY2015, Vodafone Qatar’s (VFQS) net loss narrowed by 16% on a QoQ basis and 68% on a YoY basis and stood at QR27mn. We were expecting a net loss of QR35mn. Results were helped by an increase in revenue with June quarter revenue up 6% QoQ and 27% YoY to QR585mn. Reported revenue was 3% above our estimate of QR570mn. VFQS’ mobile customer growth was modestly disappointing at 2% QoQ; subs reached 1.354mn (up 18% YoY) vs. our estimate of 1.388mn. Quarterly ARPU however exceeded our expectation, coming in at QR131 (+2% QoQ, +7% YoY) vs. our estimates of flattish sequential ARPU at QR128. ARPU growth was driven by postpaid customers that contributed 18% of total revenue (vs. 17% in March 2014). The company reported a quarterly EBITDA margin of 27.2% vs. our estimate of 28.5% and March 2014 quarter’s 27.7%. VFQS’ June 2014 quarter's EBITDA of QR159mn (+4% QoQ, +61% YoY) was 2% lower than our estimate of QR163mn. (QE, QNBFS) GISS 1H2014 net profit rises 58% YoY to QR463.7mn – Gulf International Services (GISS) posted a net profit of QR463.7mn in 1H2014, up 58% on QR170.6mn in 1H2013. The rise in earnings stemmed from growth across all its business portfolios, particularly drilling operations. GISS recorded revenue of QR1.59bn in 1H2014. Robust performance from GDI drove the QoQ and YoY growth. Several initiatives drove GDI’s growth in 2Q2014. first and foremost, GISS completed the buy-out of Japan Drilling Company Limited’s 30% shareholding in Gulf Drilling International for a total consideration of $157.7mn, resulting in GDI becoming a 100% subsidiary of GISS with effect from May 1, 2014. The buy-out contributed an additional profit of QR40.0mn for two months period ended 30 June 2014. Revenue in the Drilling segment closed the first half of 2014 at QR697.6mn, a YoY increase of QR316.5mn, or 83%. This performance was driven by a combination of factors: the acquisition with effect from May 1, 2014 of Japan Drilling Company’s 30% stake in GDI; added QR 103.9 million in revenue, the deployment of the Al-Jassra and Leshat offshore rigs in the second and fourth quarter of 2013 contributed a further QR131.3mn and revisions to three rolled-over offshore contracts during the latter part of 2013 and to four onshore contracts during the current quarter. On QoQ basis, revenue was up by QR174.4mn or 67.0%, principally due to the buy-out of JDC and the onshore contract revisions. Aviation segment revenue for the first half increased by a moderate QR11.7mn, or 3.8%, to total QR320.0mn, as an increase in the number of helicopters in the fleet (2014, H1: 45 helicopters versus 2013, H1: 43 helicopters) and the success of GHC’s proactive business development strategy which resulted in operations in a number of new territories, were partially mitigated by the end of its long-term relationship with the National Health Authority for providing a helicopter emergency medical service. Compared to the previous quarter, revenue increased by QR14.1mn or 9.2% due to an increase in business across all lines of business within the segment. The group’s insurance subsidiary registered gross insurance revenue for the period ended June 30, 2014 of QR381.1mn, a resolute QR44.3mn, or 13.2%, improvement on the same period of 2013. The main contributor to this growth was the medical line of business, as an additional 8,000 members joined the Al Koot Global Care Medical Insurance Scheme versus the first half of 2013. The medical line of business has grown by an annual average of circa 20% per year since 2009, and now contributes circa 40% of Al Koot’s annual revenue. Results in the core Energy line remained flat showing a minimal year-on-year growth of 0.3%, in line with Qatar Petroleum’s reduced capital expenditure activity. Revenue was slightly down in the first quarter of 2014, by QR2.2mn, or 1.1%. Amwaj Catering Services Limited contributed QR548.7mn to group revenue, representing the largest segment at 34% of group revenue. Compared to last year, the segment improved by QR74.3mn, or 15.7%, due to the expansion of the core industrial catering and manpower contracting services to a number of projects throughout Qatar. On a quarterly basis, Amwaj’s performance was similar to the first three months of 2014 with a positive QR4.6mn, or 1.7%, variance, mainly attributed due to winning contracts in new segments and clients (GISS Press Release) ERES 1H2014 net profit reaches QR718.1mn – Ezdan Holding Group Company (ERES) reported a strong increase in its net profit reaching to QR718.1mn in 1H2014 as compared to QR478.7mn in 1H2013. EPS amounted to QR0.27 in 1H2014 as compared to QR0.18 in 1H2013. (QE) QIGD posts net profit of QR119.5mn in 1H2014 – Qatari Investors Group (QIGD) has posted a net profit of QR119.5mn in 1H2014 as compared to QR111.3mn in 1H2013. QIGD’s EPS stood at QR0.96 in 1H2014 vs. QR0.90 for 1H2013. (QE) Woqod posts net profit of QR530mn in 1H2014 – Woqod (QFLS) posted a 12.5% YoY increase in its net profit to QR530mn in 1H2014. The company’s assets exceeded QR10.4bn in 1H2014, up 9.65% as compared to 1H2013. EPS amounted to QR6.28 for 1H2014, compared with QR5.58 for 1H2013. During 1H2014, the total volume of sales of petroleum products (diesel, gasoline and jet fuel) reached 3,446mn litres, registering an increase of 11.6% as compared to 1H2013. (Gulf- Times.com) QIMD discloses a net profit of QR80.4mn in 1H2014 – Qatar Industrial Manufacturing Company (QIMD) reported a net profit of QR80.4mn in 1H2014 as compared to QR80.7mn in 1H2013. EPS stood at QR1.69 in 1H2014 versus QR1.70 in 1H2013. The company’s total shareholders' equity amounted to QR1,487mn in 1H2014 compared to QR1,409mn for 1H2013. (QE) VFQS 1Q2015 distributable profit hits QR73mn – Vodafone Qatar (VFQS) delivered strong growth in its “distributable profit” that reached to QR73mn in 1Q2015 on the back of continued customer growth and increased revenue per user. The results showed that the company’s mobile customer base reached 1.35mn in June, registering an 18% YoY growth. VFQS reported 1Q2015 revenue of QR585mn, indicating a 27% YoY growth. Mobile average revenue per user (ARPU) increased YoY by QR8 to QR131 in 1Q2015. EBITDA reached QR159mn, registering a 61% YoY increase in 1Q2015. The company’s net loss reduced to QR27mn in 1Q2015. The loss per share stood at a negative of QR0.03 in 1Q2015 compared with a negative ofQR0.1 in 1Q2014. (Gulf-Times.com) Abank completes inaugural issuance of $250mn notes – Alternatifbank (Abank), 74.25% owned by the Commercial Bank of Qatar (CBQK), has completed the pricing and closing of its inaugural $250mn five-year senior unsecured RegS notes issue, guaranteed by CBQK. The notes, rated A by Fitch, were issued at a spread of 143 basis points over mid-swaps with a coupon of 3.125% per annum, and are listed on the Irish Stock Exchange. The issue was arranged and offered through a syndicate of joint lead managers comprising Bank of America Merrill Lynch and Commerzbank, and attracted substantial global interest with orders in excess of $1.5bn. (QE)

- 4. Page 4 of 9 Real Fitch Affirms Nakilat's Bonds at 'A+'/'A-'; Outlook Stable – Fitch Ratings has affirmed Nakilat’ (QGTL) senior and subordinated bond ratings. The $850mn series A senior secured bonds due 2033 have been affirmed at 'A+' with a Stable Outlook while $300mn series A subordinated second priority secured bonds due 2033 are affirmed at 'A-' with a Stable Outlook. The rating affirmations reflect Nakilat's stable operating and financial performance. Reported revenues of $828mn partly reflecting a pass-through of higher operating costs slightly exceeded Fitch's expectations for 2013. EBITDA remains in line with Fitch's base case. (Reuters) QF terminates contract for construction of Sidra facilities – Qatar Foundation (QF) has terminated the contract for design & construction of the Sidra facilities in Doha, which was awarded in 2008 to the OHL Internacional/Contrack (Cyprus) JV. QF said the Sidra Medical & Research Center (Sidra) is a crucial project for the people of Qatar. According to a source, the contract was terminated apparently because of the contractor’s failure to deliver the project on time. The Sidra Medical & Research Center or the Sidra hospital for women and children, as it is popularly known, is one of Qatar’s most ambitious healthcare projects. The medical and academic center, which was originally scheduled to open in 2011, has failed to meet the launch dates since then. Sidra is being built with a QF endowment of over QR28bn, one of the largest endowments ever provided to a medical and research center anywhere in the world. (Gulf- times.com) WDAM to announce results on August 10 – Widam Food Company (WDAM) will disclose its financial reports for the period ending June 30, 2014, on August 10, 2014. (QE) estate deals stood at QR1.3bn between July 13-17 – The real estate registration department at the Ministry said that the real estate transactions in Qatar between July 13 and 17 for the real estate sales contracts registered at the Ministry of justice were worth QR1.3bn. The list of properties that were traded by sale includes open plots of land, two floors villas, annexes, houses, residential buildings and compounds and Kindergartens located in the municipalities of Umm Salal, Al Khor, Al Dhakira, Doha, Al Rayyan, Al Shamal, Al Daayen and Al Wakra. (Peninsula Qatar) QIIK appoints new COO – Qatar International Islamic Bank (QIIK) has appointed Ehab Eshehawi as its new Chief Operating Officer (COO). QIIB chief executive officer Abdulbasit A al- Shaibei said the appointment of a new COO was part of the bank’s continuous efforts to strengthen its core management team with top international professionals. Al-Shaibei said Eshehawi has a proven track record with considerable years of banking experience and several high qualifications in the industry. (Gulf-times.com) International US consumer inflation rises on high gasoline prices – US consumer prices rose in June as the cost of gasoline surged, but the underlying trend remained consistent with a gradual build-up of inflationary pressures. The Labor department said that its Consumer Price Index (CPI) increased 0.3% last month, with gasoline accounting for two-thirds of the gain, after May's 0.4% rise. The CPI increased 2.1% after a similar rise in May, in the 12 months through June. Inflation is creeping up as the economy's recovery becomes more durable, a welcome development for some Federal Reserve officials who had worried that price pressures were too low. The steady increases have led some economists to predict that a separate inflation gauge watched by the Fed, currently running below the US central bank's 2% target, could breach that target by year-end as acceleration in job growth lifts wages. Fed Chairperson Janet Yellen warned last week the Fed could raise interest rates sooner than currently envisioned if the labor market continued to improve faster than anticipated by policy makers. The last month's increase in the CPI was in line with economists' expectations. Gasoline prices jumped 3.3%, the largest rise in a year, after increasing 0.7% in May. (Reuters) US housing turning the corner, inflation creeping up – US home resales hit an eight month-high in June, suggesting the housing market was gradually regaining momentum and would help the economy to stay on a higher growth path this year. The National Association of Realtors reported the third straight month of home sales gains, added to employment and retail sales data that have indicated economic growth ended the second quarter on a firmer note. A separate report showed inflation moved slightly higher. Bank of Tokyo-Mitsubishi UFJ in New York’s Chief Financial Economist said that the economy is normalizing from whatever went wrong in the first quarter and the growth is up and running. Existing home sales rose 2.6% to an annual rate of 5.04mn units last month, with the median house price touching its highest level since 2007. The housing market stumbled in the second half of 2013, raising concerns it could undermine the economy's recovery. Now, its rebound is bolstering forecasts for stronger growth. (Reuters) Eurozone debt rises in first quarter, set to peak this year – The Eurozone public debt rose to 93.9% of economic output in the first quarter of 2014, approaching the peak it is expected to reach later in 2014. The EU's statistics office Eurostat said that the government debt of the 18 countries sharing the Euro stood at €9.055tn in the first three months of 2014 as compared to €8.905tn in the last quarter of 2013. The EU's executive arm - the European Commission - expects the debt to peak at 96.0% of GDP this year and then ease to 95.4% of GDP in 2015. Nearly 80% of the bloc's debt is in bonds and treasury bills. Loans account for 17.9% of the debt. Twice bailed-out Greece was the Eurozone's most indebted country with sovereign debt of 174.1% of GDP, followed by the bloc's third-biggest economy Italy, with debt equivalent to 135.6% of GDP in the first quarter. Only two countries – Germany and Luxembourg – saw their debt fall as compared to the last quarter of 2014 and the first quarter of 2013. (Reuters) Nielsen: More than half of global consumers upbeat on job prospects – According to a survey carried out by Nielsen, more than half of global consumers expect job prospects to be good to excellent in the year ahead. That helped push global consumer confidence up in the second quarter to its highest since the first quarter of 2007. India overtook Indonesia as the most optimistic consumer market, while Portugal and Slovenia were the most pessimistic. Japan and Hong Kong saw the biggest declines in confidence from the previous quarter. According to the survey, conducted between May 12 and 30, the Nielsen Global Consumer Confidence Index rose 1 point in the second quarter to 97. The reading headed closer to the 100 mark that signals optimism among consumers. By region, consumers in the Asia Pacific were most confident about job prospects with 65% seeing favorable job opportunities for the year ahead, up from 64% in the first quarter. Globally, 56% of respondents to the survey viewed their personal finances positively, up from 55% over the past three consecutive quarters. North America reported the biggest increase, with 63% of respondents feeling secure in money matters over the next 12 months, up from 59% in the first quarter. The Nielsen survey covered more than 30,000 online consumers across 60 markets. (Reuters) Credit Suisse posts big loss after US tax settlement – Credit Suisse Group AG will quit commodities trading after chalking up

- 5. Page 5 of 9 its biggest loss since the 2008 financial crisis, the result of a 1.6bn Swiss franc fine from US authorities for helping its clients evade taxes. The Swiss bank reversed a recent vow to stick with its commodities unit, and thus joins the ranks of trading firms answering regulatory demands for more capital by significantly reducing or even shuttering their natural resource trading arms. Credit Suisse's fixed income unit outshone both its wealthy client unit and its US rivals with a 4% rise in sales and trading, flouting its own downbeat guidance in May. That compares to drops of at least 10% at American banks like Goldman Sachs and JPMorgan last week. Credit Suisse said the commodities cuts, set to save $75mn, would allow resources and funds to be reassigned to its private bank, which disappointed investors with a 39% drop in revenue & weaker margins, and swung to a loss due to the fine. (Reuters) Japan government trims economic growth estimate for 2014 – Japan's government slightly lowered its growth forecast for the current fiscal year due to sluggish exports and a drop in demand after the April sales-tax hike, but the forecasts were largely in line with the Bank of Japan's projections. Members of the government's top advisory panel did not object to the BOJ's view that consumer prices will continue to rise under its quantitative easing program, showing there is little difference between the government's and the BOJ's assessment of the economy. The convergence of views suggests the BOJ is unlikely to face pressure from the government to ease monetary policy further as the government turns its attention to compiling next fiscal year's budget. Economics Minister Akira Amari said the private sector members agreed that consumer prices can continue to rise as the output gap moves into the positive territory. The government now sees real GDP growth at 1.2% in fiscal 2014/15, versus 1.4% forecasted earlier this year. According to Cabinet Office estimates, the growth is expected to accelerate to 1.4% in the following year. The estimates are broadly in line with projections made by the Bank of Japan, which last week cut its economic growth forecasted for the current fiscal year to 1.0%. The BOJ expects growth to pick up to 1.5% the following fiscal year. The Cabinet Office estimates also showed that overall consumer prices, including those of fresh food & energy, are seen rising 1.2% YoY in fiscal 2014/15 and increasing 1.8% in the following year. The consumer price estimates exclude the effect of the sales tax hike. That is little changed from the BOJ's CPI estimates, which are 1.3% this fiscal year and 1.9% in fiscal 2015/16. (Reuters) Regional CITC: Saudi Arabia mobile subscriptions jump 165% to 50mn in 1Q2014 – According to the Communications & Information Technology Commission (CITC), the number of subscriptions in the mobile telecommunications services across Saudi Arabia reached about 50mn in 1Q2014, indicating a penetration rate of 165% of the population. The number of internet users reached about 18.1mn in 1Q2014, with a penetration rate of more than 59%. Fixed telephone lines operating in 1Q2014 reached about 4.8mn lines. (GulfBase.com) Intigral appoints two new GMs – Middle East’s leading digital media, content and services company, Intigral, has appointed Jose Valles as General Manager (GM) of Digital Product Marketing & Innovation, Digital, and J. Moreno as GM of Operations, Digital. Valles was earlier associated with Telefonica Digital in the UK and Moreno with Orange Spain. (AMEinfo) STC renews partnership with JWT Riyadh – Saudi Telecom Company (STC) has renewed its partnership with JWT Riyadh for a further 3 years. After a highly competitive pitch process for the consumer and enterprise business, JWT’s dynamic offering, coupled with its unique insights into the Saudi market and its understanding of the STC brand, helped JWT seal the deal. (AMEinfo) Saudi Arabia’s Dabbagh Group to mull IPO of Petromin – According to sources, Petromin Corporation may offer its shares to public through an IPO in 2015 after Saudi-based Dabbagh Group canceled a proposed 20% stake sale in Petromin. The offer may value Petromin at $700mn to $1bn. Petromin is fully owned by Dabbagh Group and makes more than 150 lubricant products & exports to more than 35 countries in the Middle East, Africa and Asia. (Bloomberg) India-based Rolta bags Sadara engineering contract – Sadara Chemical Company (Sadara), an alliance between Saudi Aramco and The Dow Chemical Company, has awarded India-based Rolta a contract for the implementation of a comprehensive engineering system at the Sadara complex. Rolta announced that this multi-million dollar award of additional scope is an amendment to its original contract. With a total investment of about $20bn, Sadara is now building and will own and operate an integrated chemical complex in Jubail Industrial City II in Saudi Arabia. Comprising 26 world scale manufacturing units, the Sadara complex will possess flexible cracking capabilities and will produce over 3mn metric tons of high value- added chemicals & performance plastic products. (GulfBase.com) SACC BoD recommends SR143.5mn dividend for 2Q2014; plans catering academy – Saudi Airlines Catering Company (SACC) board of directors has recommended the distribution of 17.5% dividend (SR1.75 per share) amounting to SR143.5mn for 2Q2014. Shareholders, who are registered in the registers of the Securities Depository Center (Tadawul) on August 7, 2014, will be eligible to receive the dividend. The dividend will be distributed on August 19, 2014. Meanwhile, the company’s board has approved to establish a catering academy for training in the art of cooking and hospitality services, and appointed Mr. Wajdy Ghabban as a General Manager with full authority to establish the academy and do all the needful. (Tadawul) Shaker Group receives LOA to supply air-conditioning units – Ibrahim Hussein Shaker Projects & Maintenance Company, a wholly-owned subsidiary of Al Hassan Ghazi Ibrahim Shaker Company (Shaker Group), has received a Letter of Award from Saudi Arabia’s Ministry of Education (MoE) to supply air conditioning units of LG brand as per the MoE special specifications, to a number of its associated schools located in several regions across Saudi Arabia for a value of SR38.3mn. The work has to be carried out within four months from the date of signing the contract. (Tadawul) Alkhodari announces dividend payment date – Abdullah A. M. Al-Khodari Sons Company (Alkhodari) announced the payment of SR0.50 cash dividend per ordinary share for FY2013 through National Commercial Bank by a way of SARIE transfer on July 24, 2014 to the shareholders of record at Saudi Stock Exchange. (Tadawul). (Tadawul) UACC signs Islamic financing agreement with SABB – Umm Al-Qura Cement Company (UACC) has signed an Islamic financing agreement aggregating SR618.87mn with The Saudi British Bank (SABB). The facility's duration extends from July 22, 2014 to July 22, 2017. (Tadawul) Gulf Union announces non-renewal of motor insurance policy – Gulf Union Cooperative Insurance Company (Gulf Union) announced the non-renewal of motor insurance policy

- 6. Page 6 of 9 with Aksat Global for Business Trading Company for 2015, which expires on June 30, 2014. (Tadawul) Savola Group appoints new CEO & MD – Savola Group’s CEO and Managing Director, Dr. Abdulraouf Mohammed Mannaa, has resigned from his position, due to personal reasons. On the same day, the company appointed its current board member, HE Eng. Abdullah Mohammed Noor Rehaimi, as the CEO and Managing Director for the Group with effect from January 1, 2015. Meanwhile, Dr. Mannaa will continue with his role and responsibilities until December 31, 2014. (Tadawul) MEED: Investment in wellness programs to yield healthy returns for firms – A research report conducted by MEED has revealed that investment in corporate wellness programs is one of the most effective ways to improve business performance. The results of the study suggested that companies could see as much as 300% return on investment on money spent on corporate wellness initiatives. The report was conducted as a part of the Daman Corporate Health Awards, which aim to recognize the best employers in the UAE for their successful health and wellness initiatives. The report stressed that companies must appreciate the commitment required to deliver a successful health and wellness program. (GulfBase.com) UAE’s second tallest tower 80% complete – Sheffield Holdings announced that the second tallest tower, Marina 101 in the UAE is over 80% complete. The 425-metre tower, which will trail only the 828m Burj Khalifa, is expected to be completed by early 2015. Upon completion the tower will feature 420 hotel rooms & hotel apartments, 60 three-bedroom residential units, eight duplexes, a five-star hotel, plus health clubs and swimming pools on different levels. (GulfBase.com) Egypt proposes three petrochemical projects to UAE – Egypt has proposed three petrochemical projects to the UAE for a total investment of $540mn. The proposed projects involve establishing refineries and plants across various regions, including Ain Sokhna, the North Coast, Alexandria, and Upper Egypt. The projects include establishing a factory to produce bio-ethanol from molasses, the output of which would reach 100,000 tons of molasses annually, with investment in the project totaling $250mn; a factory for the production of bio- ethanol from rice straw, with a capacity of 100,000 tons of rice straw produced per year with an investment of $240mn. The third project would increase polyvinyl chloride (PVC) production, used in making pipes, with the target implementation date as FY 2016-17. (GulfBase.com) DED: Dubai consumer confidence remains steady – A quarterly survey conducted by the Department of Economic Development (DED) showed that consumer confidence remained steady in Dubai at 143 points in 2Q2014, but job security continues to pose the biggest concern, followed by work/life balance. Positive sentiment is running deeper among consumers in Dubai with personal finances improving and more people are willing to put their spare cash into savings & holidays. The local population seems to be more optimistic about the current state of the economy and personal finance as compared to expats. According to the survey, the percentage of the consumers who believe that the economy will recover in next 12 months also slightly decreased to 74% from 77%. The DED survey revealed that rising rental & property prices and tourism boom are the causes of optimism for the next 12 months, while the lack of job opportunities and not much increase in salary levels are the main concerns. The consumer confidence index for 2Q2014 showed optimism prevailing for the fifth quarter in a row even when it remained at 143 points, the same as 1Q2014. Job security and salary levels remaining unchanged are concerns for a significant number of consumers, but 81% of the consumers rated current job prospects as excellent/good while 93% see improvements in the next 12 months. The survey showed that personal finance estimates are brighter with 81% of consumers having a positive outlook currently and 92% in the next 12 months. Apparently, more than half of the consumers are putting their spare cash into savings & holidays buoyed by the expectations of stable finances and 35% of them are likely to make such spending in the next 12 months. (GulfBase.com) DFM to close from July 28 on occasion of Eid Al Fitr – Dubai Financial Market (DFM) announced it will remain closed from July 28, 2014 till July 30, 2014 on account of Eid Al Fitr. Trading will resume after the holiday on July 31, 2014. (DFM) Arenco awards two Dubai Palm Jumeirah hotel projects to CSCEC – Dubai-based developer Arenco Real Estate has awarded two contracts to China State Construction Engineering Company (CSCEC) to build two new hotels at Palm Jumeirah. The scope of work includes all civil works, MEP, external works and finishes. The hotels, which are on adjoining plots, will be five-star resort hotels of around 100,000 square meters each. The projects will take 940 days to complete. (Bloomberg) ADIA boosts services for summer season – Abu Dhabi International Airport (ADIA) has geared up for a huge spike in passenger numbers during the summer season by providing a series of facility developments and service upgrades. The Abu Dhabi Airports company said that a range of recently completed ground improvements and new services at the capital’s main air gateway are expected to offer a smooth and enjoyable passage through the main passenger terminals at the airport. The number of travelers to the city are set to soar to record levels, and as a result, the airport will provide service developments which include setting up 20 new boarding bus gates (now fully open) to passengers and flights in Terminal 3, increasing the airport’s flight capacity by 44%, with a total of 66 boarding gates, and installing six new code E aircraft stands for wide-bodied aircrafts, which will increase the airport’s aircraft handling capability by 10%, with a total of 63 stands. Abu Dhabi Airports’ Chairman, Ali Majed Al Mansoori, expects the number of flights during the peak travel months to leap by 18% to nearly 170 every single day of the week as compared to the summer of 2013. (GulfBase.com) Aldar, Chalhoub to launch region's largest department store in Yas Mall – Aldar Properties has signed an agreement with Chalhoub Group to create the region’s largest department store experience, comprising 200,000 square feet of prime retail space within Yas Mall. The mall is now 95% committed ahead of the opening in November 2014. The remaining units will be leased-up on a selective basis to ensure that they complement the existing retail mix, while bringing new experiences to Abu Dhabi. (ADX) ADCB reports profit of AED1.058bn in 2Q2014 – Abu Dhabi Commercial Bank (ADCB) reported a net profit of AED1.058bn in 2Q2014 as compared to AED917mn in 2Q2013, reflecting an increase of 15% YoY. Net profit for 1H2014 was AED2.16bn as compared to AED1.82bn, up by 19%. The bank recorded total net interest income of AED1.41bn in 2Q2014 as compared to AED1.46bn in 2Q2013. Total assets stood at AED197.8bn as of June 30, 2014 against AED183.1bn as of December 31, 2013. Net loans & advances stood at AED134.3bn, while customer deposits stood at AED119bn as of June 30, 2014. EPS as of June 30, 2014 was AED0.36 for 1H2014 as compared to AED0.29 in 1H2013. (ADX) FGB 2Q2014 profit touches AED1.35bn – First Gulf Bank (FGB) reported net profit of AED1.35bn in 2Q2014 as compared

- 7. Page 7 of 9 to AED1.17bn in 2Q2013, reflecting an increase of 16%. The bank made net profit of AED2.68bn in 1H2014 as compared to AED2.21bn in 1H2013, up by 21%. Total net interest income for 2Q2014 was AED1.65bn as compared to AED1.47bn in 2Q2013, an increase of 12%. EPS for 2Q2014 amounted to AED0.35 as against AED0.28. FGB’s total assets as of June 30, 2014 increased by 7% YoY and 3% QoQ to touch AED198.2bn. Loans & advances increased by 6% to AED128.2bn, while customer deposits increased by 11% to AED137.5bn, as of June 30, 2014. (ADX) NBAD reports profit of AED2.83bn for 1H2014 – National Bank of Abu Dhabi (NBAD) reported net profit of AED2.83bn for 1H2014, up 7.9% over AED2.62bn in 1H2013. In 2Q 2014, net profits were up 17.5% YoY to AED1.42bn as compared to AED1.21bn in 2Q2013. Total net interest income increased by 3.7% to AED3.33bn in 1H2014, as compared to AED3.21bn in 1H2013. NBAD’s total assets grew by 7.2% to AED348.5bn as of June 30, 2014 as compared to AED325.1bn as of December 31, 2014. Net Loans and advances increased 4.8% YoY and 1.8% QoQ to AED181.7bn, while customer deposits grew 8.2% YoY and 1.0% QoQ to AED237.4bn as of June 30, 2014. EPS amounted to AED0.56 for 1H2014. (ADX) CBI profit rises by 22.27% to AED108.66mn in 1H2014 – Commercial Bank International (CBI) net profit increased by 22.27% to AED108.66mn during 1H2014 as compared to AED88.87mn in 1H2013. Total Assets increased by 12.63% to AED16.68bn as compared to AED14.81bn at the end of December 2013. EPS at the end of June 2014 amounted to AED0.066. Loans & advances increased by 11.11% to AED11.8bn as compared to AED10.62bn at the end of December 2013. Customer deposits increased by 15.62% to AED12.14bn as compared to AED10.50bn at the end of December 2013. Meanwhile, CBI’s board of directors approved calling for EGM to approve capital increase through rights issue or authorize board to execute loans for more than three years. (ADX) RAKBank reports profit of AED365.9mn in 2Q2014 – The National Bank of Ras Al-Khaimah (RAKBank) recorded a net profit of AED365.9mn in 2Q2014 as compared to AED392.1 in 2Q2013. The bank made a profit of AED700mn in 1H2014 as compared to AED760mn in 1H2013. Total net interest income grew to AED675.7mn in 2Q2014 as compared to AED605mn in 2Q2013. Total assets as of June 30, 2014 stood at AED34.5bn as compared to AED30.1bn as of December 31, 2013. EPS amounted to AED0.22 during 2Q2014 as against AED0.23 in 2Q2013. Net loans & advances stood at AED23.4bn, while customer deposits stood at AED25.5bn as of June 30, 2014. (ADX) SIB 1H2014 profit jumps 50% to AED202.1mn – Sharjah Islamic Bank (SIB) reported 50% increase in its 1H2014 net profits to AED202.1mn as compared to AED134.7mn in 1H2013. The bank’s customer deposits were up 14.8% to AED13.7bn at the end of 1H2014 as compared to December 31, 2013. Total assets grew 7.7% to reach AED23.4bn at the end of 1H2014. (GulfBase.com) Kuwait Bourse Company established as step to privatizing the Kuwait market – Kuwait Bourse Company Constituent General Assembly was convened on July 20, 2014 as the latest step by the Kuwait Capital Market Authority (Kuwait CMA) to transfer the possession of the Kuwait Stock Exchange (KSE) to the private sector. Khaled Abdelrazzaq Al-Khaled, Chairman of Bourse Company said that the privatization would be achieved in two stages. 50% of the overall capital will be sold at an auction in the first stage, while the other 50% will be sold to Kuwaiti citizens through a public offer in the second stage. The company has been capitalized at KD60mn. (Bloomberg) OOCEP aims first gas from Block 60 Abu Tubul field in 3Q2014 – Oman Oil Company’s (OOC) subsidiary, Oman Oil Company Exploration & Production (OOCEP) is targeting first gas from the gas-rich Abu Tubul tight gas field in Block 60 in central Oman during 3Q2014. Block 60, a roughly 1,500 sq kilometer concession encompassing the wilayats of Ibri & Haima, is 100% owned and operated by OOCEP. The concession was acquired by OOCEP in December 2010 after the previous operator, UK-based BG International, relinquished the block. The output from the Abu Tubul development is targeted at a peak production rate of 90mn standard cubic feet per day (mmscf/d). Condensate production is envisaged at 6,000bpd. Under a contract awarded by OOCEP in 2012, Enerflex Middle East, a subsidiary of Canadian energy services firm Enerflex Ltd, is constructing a gas processing plant at Abu Tubul at a cost of around $228mn. (GulfBase.com) OCEC appoints new executives – The Oman Convention and Exhibition Center (OCEC) has appointed Salim al Flaiti as Director of Human Resources, Ahmed al Habsi as Director of Finance & Administration and Akram al Maawali as Protocol & Liaison Manager. (GulfBase.com) alizz islamic bank reports loss of OMR2.6mn – alizz islamic bank reported loss of OMR2.6mn for the period ended June 30, 2014. Total assets as of June 30, 2014 stood at OMR101.6mn as compared to OMR99.7mn as of December 31, 2013. During the period ended June 30, 2014, the financing portfolio reached OMR27mn as compared to OMR20mn in 1Q2014. The bank’s deposits base increased to OMR5mn during the same period. (MSM) CMIC EGM approves quarry asset sale – Construction Materials Industries & Contracting’s (CMIC) EGM has approved the sale of assets used in the Quarry & Lime Plant at Quriyat, as well as other assets no longer used in production. Additionally, the company will cancel some assets that cannot be sold. (MSM) HSBC Bank Oman posts net profit of OMR5.7mn in 1H2014 – HSBC Bank Oman posted a net profit of OMR5.7mn for 1H2014, representing a decline of 38.7% over 1H2013. Net interest income was flat at OMR23.1mn, while total other operating income increased by 8.9% to OMR11mn as compared to OMR10.1mn for 1H2013. (Bloomberg) Duqm airport to be operational from July 23; Oman Air to launch flights – According to the Special Economic Zone Authority in Duqm (SEZAD), the Duqm airport will be operational from July 23, 2014. Meanwhile, Oman Air is set to start serving Duqm airport from 23rd July and will consist of four flights per week. The new flights will be operated by the carrier’s E175 aircraft. (Bloomberg) BHB extends maturity date and listing of GREF – Bahrain Bourse (BHB) announced the maturity date extension and listing of Global GCC Real Estate Fund (GREF) issued by Global Investment House. (Bahrain Bourse) BBK net profit rises 7.8% to BHD27.2mn during 1H2014 – BBK reported a growth of 7.8% in its net profit at BHD27.2mn for 1H2014, compared with BHD25.2mn for 1H2013. Bank made a profit of BHD13.2mn during 2Q2014 as compared to BHD12.1mn for 2Q2013, reflecting an increase of 8.6%. Net interest income was BHD34.8mn in 1H2014 as against BHD34.6mn in 1H2013. EPS for the period was 27 fils as against 25 fils for the same period in 2013. Net loans & advances grew by 12.3% to BHD1.74bn from BHD1.55bn a year

- 8. Page 8 of 9 earlier. Customer deposits increased by 5.1% to BHD2.39mn when compared with BHD2.28bn a year earlier. (Bahrain Bourse) NBB reports profit of BHD28.74mn for 1H2014 – National Bank of Bahrain (NBB) recorded a net profit of BHD28.74mn for 1H2014 as compared to BHD26.77mn for 1H2013, an increase of 7.4 %. For 2Q2014, the bank recorded a net profit of BHD12.12mn as compared to BHD11.94mn for 2Q2013. The net interest income for 1H2014 was BHD30.51mn as compared to BHD28.36mn for 1H2013, an increase of 7.6%. EPS for 1H2014 improved to 30.5 fils from 28.5 fils for 1H2013. Total assets as of June 30, 2014 stood at BHD2.86bn as compared to BHD2.62bn a year earlier. Loans & advances as of June 30, 2014 stood at BHD852.5mn, while customer deposits stood at BHD2.18bn. (Bahrain Bourse) Bahrain hires four banks for new US dollar bond – According to sources, the Kingdom of Bahrain has hired four banks including Citigroup, Gulf International Bank and Standard Chartered to arrange a new US dollar bond issue. Bahrain could be considering a 30-year bond deal. The timing of the transaction is still unclear. (Reuters) Bahrain’s MoST rules out plan to issue fourth mobile license – Bahrain’s Minister of State for Telecommunications (MoST), HE Sheikh Fawaz Bin Mohamed Al Khalifa has ruled out any plans to issue a fourth mobile network operator license as it would have no economic feasibility. (Bloomberg) BIBF signs MoU with Bahrain SMEs Society – Bahrain Institute of Banking and Finance (BIBF) has signed a MoU with the Bahrain SMEs Society to collaborate on training and skills development for members of both organizations. The bilateral agreement also includes the organization of conferences & seminars, as well as research & studies related to entrepreneurship and SMEs. (Bloomberg) Gulf Air receives first A330 retrofitted aircraft – Gulf Air has received its first retrofitted A330 aircraft at the Bahrain International Airport on July 22, 2014 arriving from Canada. The plane is newly configured for a total of 214 seats in a two-class configuration of 30 falcon gold class and 184 economy seats with significant enhancements across both cabins. (Bloomberg)

- 9. Contacts Saugata Sarkar Abdullah Amin, CFA Shahan Keushgerian Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6509 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa Sahbi Kasraoui Ahmed Al-Khoudary QNB Financial Services SPC Manager – HNWI Head of Sales Trading – Institutional Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6544 Tel: (+974) 4476 6548 PO Box 24025 sahbi.alkasraoui@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 9 of 9 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg 80.0 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 170.0 180.0 190.0 200.0 210.0 Jul-10 Jul-11 Jul-12 Jul-13 Jul-14 QE Index S&P Pan Arab S&P GCC 2.8% 1.3% 0.4% (0.5%) 0.0% (0.2%) (1.0%) (2.0%) 0.0% 2.0% 4.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D% WTD% YTD% Gold/Ounce 1,306.43 (0.5) (0.4) 8.4 DJ Industrial 17,113.54 0.4 0.1 3.2 Silver/Ounce 20.95 0.1 0.4 7.6 S&P 500 1,983.53 0.5 0.3 7.3 Crude Oil (Brent)/Barrel (FM Future) 107.33 (0.3) 0.1 (3.1) NASDAQ 100 4,456.02 0.7 0.5 6.7 Natural Gas (Henry Hub)/MMBtu 3.80 (1.3) (2.9) (12.6) STOXX 600 342.44 1.3 0.8 4.3 LPG Propane (Arab Gulf)/Ton 104.00 0.4 0.5 (17.8) DAX 9,734.33 1.3 0.1 1.9 LPG Butane (Arab Gulf)/Ton 122.25 0.1 0.2 (9.9) FTSE 100 6,795.34 1.0 0.7 0.7 Euro 1.35 (0.4) (0.4) (2.0) CAC 40 4,369.52 1.5 0.8 1.7 Yen 101.46 0.1 0.1 (3.7) Nikkei 15,343.28 0.8 0.8 (5.8) GBP 1.71 (0.1) (0.1) 3.1 MSCI EM 1,074.48 1.1 1.1 7.2 CHF 1.11 (0.5) (0.4) (1.1) SHANGHAI SE Composite 2,075.48 1.0 0.8 (1.9) AUD 0.94 0.2 0.0 5.3 HANG SENG 23,782.11 1.7 1.4 2.0 USD Index 80.78 0.3 0.3 0.9 BSE SENSEX 26,025.80 1.2 1.5 22.9 RUB 34.96 (0.7) (0.5) 6.4 Bovespa 57,983.32 0.6 1.7 12.6 BRL 0.45 0.4 0.6 6.8 RTS 1,266.88 2.2 (0.7) (12.2) 190.5 156.0 140.8