CalSTRS SocialSecurityInfo2

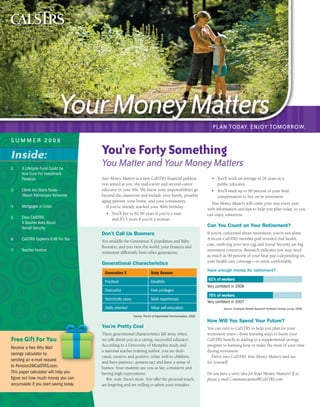

- 1. white ©iStockphoto.com/fotoVoyager.com Your Money Matters PLAN TODAY. ENJOY TOMORROW. SUMMER 2008 Inside: You’re Forty Something 2 A Lifecycle Fund Could be You Matter and Your Money Matters Your Cure For Investment Paralysis Your Money Matters is a new CalSTRS financial publica- • You’ll work an average of 26 years as a tion aimed at you, the mid-career and second-career public educator. 3 Climb the Stairs Today— educator in your 40s. We know your responsibilities go • You’ll need up to 90 percent of your final Mount Kilimanjaro Tomorrow beyond the classroom and include your family, possibly compensation to live on in retirement. aging parents, your home, and your community. Your Money Matters will come your way every year 4 Mortgages in Crisis If you’ve already reached your 40th birthday: with information and tips to help you plan today, so you • You’ll live to 82.96 years if you’re a man can enjoy tomorrow. 5 Dear CalSTRS: and 83.5 years if you’re a woman. A Teacher Asks About Social Security Can You Count on Your Retirement? Don’t Call Us Boomers If you’re concerned about retirement, you’re not alone. 6 CalSTRS Explains It All For You A recent CalSTRS member poll revealed that health You straddle the Generation X population and Baby care, outliving your nest egg and Social Security are big Boomers, and you view the world, your finances and 7 Teacher Feature retirement differently from other generations. retirement concerns. Research indicates you may need as much as 90 percent of your final pay—depending on your health care coverage—to retire comfortably. Generational Characteristics Have enough money for retirement? Generation X Baby Boomer 61% of workers Practical Idealistic Very confident in 2008 Distrustful Feel privileged 70% of workers Technically savvy Seek experiences Very confident in 2007 Skills oriented Value self-education Source: Employee Benefit Research Institute’s annual survey, 2008 Source: The Art of Experiential Communication, 2006 How Will You Spend Your Future? You’re Pretty Cool You can turn to CalSTRS to help you plan for your These generational characteristics fall away when retirement years—from learning ways to boost your Free Gift For You we talk about you as a caring, successful educator. CalSTRS benefit to adding to a supplemental savings According to a University of Memphis study and program to learning how to make the most of your time Receive a free Why Wait a national teacher training author, you are dedi- during retirement. savings calculator by cated, creative and positive, relate well to children, Delve into CalSTRS Your Money Matters and see sending an e-mail request and have patience, possess tact and have a sense of for yourself. to Pension2@CalSTRS.com. humor. Your students see you as fair, consistent and This paper calculator will help you having high expectations. Do you have a story idea for Your Money Matters? If so, figure out how much money you can But, wait, there’s more. You offer the personal touch, please e-mail Communications@CalSTRS.com. accumulate if you start saving today. are forgiving and are willing to admit your mistakes.

- 2. A Lifecycle Fund Could Be Your Cure for Investment Paralysis Set it and Forget it The ABCs of Investment Choices Information to Consider When Choosing a Lifecycle Fund Investing for retirement can be a Lifecycle funds generally consist of individual mutual funds within the same perplexing mix of choices: IRAs, fund family that invest in different assets, such as bonds, U.S. stocks and 403(b)s, 457s, annuities, mutual international stocks. funds and money markets. • Different mutual fund families invest their funds differently, even for the When you add in concerns about same retirement date. One asset allocation isn’t better than another; Social Security and health care, there’s however, more stocks usually means more volatility. no wonder many suffer from invest- • Costs vary. Funds can charge from $21 for every $10,000 to $78 per ment paralysis. $10,000 invested. A lifecycle fund, which is a special type of mutual fund, can help you • Some funds charge other fees, such as a front-end commission, which shake off inertia and take action. immediately reduces the amount of money available for investing. • The lifecycle fund manager allocates the most appropriate mix for your Lifecycle Funds Are target date. Be aware that investing in a lifecycle and in outside funds Easy and Effective may increase your level of risk more than your fund manager intended. Lifecycle funds, also known as target • Although lifecycle funds may be more diversified than any single mutual date funds, are designed to follow fund, the diversity may vary among fund families, affecting volatility. you throughout your working life and change as you approach retirement. They frequently start out with aggres- sive investments and automatically grow increasingly conservative. You can set it and forget it. CalSTRS offers a lifecycle portfolio 40s: mid-career through the Pension2® Easy Choice Rebalance allocations Portfolio at www.CalSTRS.com/ Pension2. CalSTRS Mission: 20s: starting out 60s: retirement age Securing the financial future How They Work Heavy with stocks Switch to more bonds and sustaining the trust of California’s educators Once you select your target retirement Teachers’ Retirement Board date and risk tolerance, a professional Dana Dillon, Chair Jerilyn Harris, Vice-Chair money manager takes over, calculating Kathy Brugger the initial allocation and periodically John Chiang Michael Genest rebalancing that allocation as your Harry Keiley retirement date nears. Watch Out for Fees plan keeps your costs low with Roger Kozberg Bill Lockyer While in your 20s, lifecycle funds The flip side to the ease and conve- reduced fees and expenses and by Jack O’Connell Peter Reinke are heavy with stocks—generally a nience of a lifecycle fund is the fee selecting funds that are no-load and Beth Rogers more risky but higher yielding invest- structure. Keep your eye on the costs, no-commission. You never have to Carolyn Widener ment. As you approach your 50s and which frequently are hard to find. guess about our fee structure because Jack Ehnes Chief Executive Officer eventually retirement, the lifecycle Costs are key because in long-term we tell you up-front what the fees are. Christopher J. Ailman fund’s level of risk is gradually and investments such as these, higher Chief Investment Officer automatically reduced because it costs can have a substantial impact on The Next Generation Lynette Blumhardt switches to more conservative your retirement nest egg. From CalSTRS Editor Statements in this publication bond investments. CalSTRS Pension2 personal wealth The CalSTRS Pension2 Easy Choice are general and the Teachers’ lifecycle portfolio merges time Retirement Law is complex and specific. If a conflict arises between Benefits of horizon with risk tolerance and information contained in this publication and the law, any decisions Compounding Value at age 65 if investing starts . . . includes various mutual fund fami- will be based on the law. lies. These features offer greater Monthly diversification than most lifecycle Your Money Matters is published once Current age Today In 3 years In 10 years a year for active CalSTRS members contribution and Cash Balance participants. Send funds. The funds are chosen and your comments or suggestions to: 40 $100 $78,747 $61,014 $31,286 monitored by CalSTRS investment Editor, Communications, M.S. 34 45 $100 $51,014 $38,397 $17,202 pros—the same people who invest P Box 15275 .O. Sacramento, CA 95851 50 $100 $31,286 $22,272 $7,160 your Defined Benefit portfolio. Source: Why Wait savings calculator, 2007, available free from CalSTRS. See offer on the front page of this newsletter. printed on recycled paper Note: This hypothetical illustration uses an assumed yield of 7 percent. 2 www.CalSTRS.com

- 3. It’s An Adventure Within travel, adventure travel is a growing trend. If you want to climb Mount Kilimanjaro or bike through the wine country, regular exercise now will help you get there. By The Numbers Climb the Stairs Today— • One-half of U.S. adults, or 98 million people, have taken an adventure trip Mount Kilimanjaro Tomorrow in the past five years. • This includes 31 million adults who engaged in hard adventure activities like whitewater rafting, scuba diving 30 Quick Minutes It’ll Make You Feel Good and mountain biking. How much exercise do you need now to get healthy The physical benefits range from lookin’ good to • A full 52 percent of adventure and stay healthy into your later years? lowering the risk of some illnesses, such as: travelers are women. • 30 minutes of moderate exercise each day. • Heart disease, • 41- to 60-year olds make up the highest participating age group. • Three 10-minute intervals provide the same • Cancer and • Highest year-to-year, increased benefits. • Diabetes. consumer regional interest is Moderate exercise includes activities that make you The mental health benefits include reduction of: South America. out of breath but not sweaty like gardening, brisk — • Stress and Source: the Adventure Travel Report, 2008 walking or cycling. • Depression. Source: American College of Sports Medicine and the Centers for Disease Control and Prevention And Prevent Mental Decline The Web site, adventurelogue.com Another study found that regular exercise in midlife defines adventure travel as: A Northern Arizona University study reduces the possibility of dementia by 50 percent and intentionally going beyond your Alzheimer’s by 60 percent. Specifically, the researchers normal known area, seeking out concludes that 10 minutes of exercise suggest that exercising as little as twice a week will experiences which are unfamiliar. can lift your mood. provide positive results. One analyst believes that the study makes the case for beginning good health habits early. Keep Your Security Information Safe • Get a summary of medical benefits • Sign up for the national Do Not Call unsolicited e-mail or other type of paid in your name each year. Registry at www.donotcall.gov. electronic communication. • Keep copies of medical records. • Sign up for the Direct Marketing • When you use the CalSTRS • For more information, go to Association’s Mail Preference Service Web site, you agree to our terms www.worldprivacyforum.org. at www.dmaconsumers.org to reduce and conditions available at junk mail and junk spam. www.CalSTRS.com/help/privacy. Medical Identity Theft Stop Unwanted Solicitations • Delete spam. – Use of our Web site is anonymous, An estimated 250,000 Americans You can slow the onslaught of unwanted • Visit www.junkbusters.com/fax.html unless otherwise specified. have their medical ID stolen each year, phone, e-mail, fax and mail solicitations, to find out how to reduce junk faxes. • CalSTRS securely transmits your according to the World Privacy Forum. advises the California Department of warrant for direct deposit. Thieves may use your medical information Consumer Affairs, by exercising these Protect Your CalSTRS Information to receive health care or sell prescription consumer tips: CalSTRS uses your personal information drugs. Protect yourself: • Stay off marketing lists. only to conduct CalSTRS-related business. • Give health insurance info – Don’t fill out consumer surveys, • CalSTRS will never ask for your to trusted providers. sweepstakes or warranty personal information in an registration cards. SUMMER 2008 www.CalSTRS.com Your Money Matters 3

- 4. Mortgages in Crisis If you own a home, you may be worried about its value, or you may find yourself struggling with a high or adjustable interest rate. If you want to purchase a home, you may wonder if the market will ever settle down. Here’s what two financial experts have to say: “I’m not minimizing the risks in the housing market because they’re very real in many locations. Nor am I predicting any sort of miraculous turnaround in the next six months, since I doubt that we’ll see that happen. But I’m still a believer in the long-term viability of housing as a solid investment if you buy at the right price.” l Suze Orman, March 2008 od kin x Slob ck photo.c om/Ale “Residential real estate cannot be counted out as a smart invest- ©iSto ment or maybe even as the smartest one you’ll make. Patience remains the watch word when buying real estate. If You’re Concerned About Foreclosure Even if you buy at the peak, if you wait long enough, you will generally make out well … If you expect to turn it over quickly and consistently for a profit, you are taking a risk. On the other Resources hand, the present real estate situation presents a rare and envi- able long-term opportunity.” Many borrowers who obtained subprime mortgages are now at great risk of foreclosure l Ben Stein, June 2008 and the loss of their home. We can’t give you advice, but we can provide resources: Hang in there. Homeownership Preservation Foundation: www.995hope.org Tips for Avoiding Foreclosure: www.hud.gov/foreclosure/index.cfm CalSTRS Offers Home Loans to Members California Government Web site: www.yourhome.ca.gov/ The CalSTRS Home Loan Program offers a number of home loan options to members, including loans to purchase a home, Avoid Foreclosure as well as refinances of existing mortgages. We have agreements with several lenders who provide 15- and 30-year fixed rate 1. Don’t ignore the problem. loans, as well as a down payment assistance mortgage program, 2. Contact your lender as soon as you realize you have a problem. for the purchase of single and various multi-family dwellings. 3. Open and respond to all mail from your lender. Rates are set daily by CalSTRS. 4. Know your mortgage rights. Qualified CalSTRS members can borrow up to $417,000 or 5. Understand foreclosure prevention options. $650,000, depending on the program. 6. Prioritize your spending. To qualify to apply for a home loan, you must be a CalSTRS 7. Use your assets. member or an employee of a public school and the loan must 8. Avoid fee-based foreclosure prevention companies be for your primary residence within California. 9. Don’t lose your house to foreclosure recovery scams. Go to www.CalSTRS.com/homeloanprogram for details. Source: the U.S. Department of Housing and Urban Development, 2008 The Subprime Mortgage Collapse Has Foreclosure Q & A Had Little Affect on Your Retirement Fund What is Foreclosure? Your CalSTRS retirement fund’s exposure to losses arising Foreclosure is a legal action used by a mortgage company to recover any money from the subprime market has been minimal. You can’t get an from a customer when the customer does not pay his or her debt in accordance with adjustable-rate or subprime mortgage loan from the CalSTRS the mortgage agreement. In other words, it’s the legal remedy used by a mortgage Home Loan Program because we simply don’t offer them and company to assume ownership of a property when the required loan payments are never have. not made. Foreclosure obliterates otherwise good credit. What’s Mortgage Insurance? How Does Foreclosure Happen? Mortgage insurance is a policy that protects lenders against Although the actual process varies from state to state, a foreclosure is initiated due to some or most of the losses that can occur when a borrower a borrower’s inability to keep up with monthly mortgage payments over a period of defaults on a mortgage loan. Mortgage insurance is required four to six months. The farther behind the homeowner gets with monthly mortgage primarily for borrowers with a down payment of less than payments, the closer to foreclosure the homeowner becomes. 20 percent of the home’s purchase price. Source: U.S. Department of Housing and Urban Development, 2008 Is Anyone Exempt From Foreclosure? No. Everyone with a mortgage is subject to foreclosure if they fail to make their monthly payment on an ongoing basis. Source: Homeownership Preservation Foundation, 2008 4 www.CalSTRS.com

- 5. dear CalSTRS your Social Security—but not your CalSTRS check— Teacher Asks About Social Security could be reduced or eliminated altogether. From what you’ve told me, it sounds like your Short Answer: If You Don’t Pay in, friend didn’t earn Social Security from non-CalSTRS You’re Not Eligible work and may not be eligible through her husband. For information on your specific case, please go to www.socialsecurity.gov. What you can do now Dear CalSTRS: can take the 6.2 percent they don’t have deducted One suggestion is to take advantage of the 10 work from their paycheck for Social Security and put it in I’m a classroom teacher in southern California. A years you have ahead of you to open a supplemental their own savings program, like a 403(b) or IRA. friend of mine who taught at my school just retired in savings plan, such as a 403(b) or IRA. Sock some June. She spent her entire career in the classroom and money away for your future. loved it. But she was surprised to find out she didn’t Other work or your spouse’s work More info is available at www.CalSTRS.com/ get any Social Security for herself when she retired. You could be eligible for Social Security from other Pension2. This scares me because I’ve got about 10 good nonteaching jobs you’ve held or from a spouse. If years before I retire. I always counted on Social Secu- you qualify because of work you’ve done, your Social Do you have a question to be answered in the Dear rity for my teaching, along with my teacher pension. Security check—but not your CalSTRS check—could CalSTRS feature? If so, please e-mail your question to The friend who just retired is married and her be reduced, or offset, but it will not be eliminated. If Communications@CalSTRS.com. If you have a general husband is a retired grocery store manager. Does his you qualify through a spouse’s Social Security benefit, question or one about your personal account, please go to Social Security check have some affect on her? www.CalSTRS.com/contact. Signed— CalSTRS Differs from Social Security Not Secure in SoCal CalSTRS pension Social Security Dear SoCal: Beneficiaries are California public educators who earn Beneficiaries include all private and some public There’s a lot of misunderstanding among public creditable service workers who pay into Social Security educators about Social Security. Retired California public school teachers receive no Social Security A pre-funded system enhanced by investment earnings A pay-as-you-go system with no investment earnings benefits for their income from CalSTRS-covered teaching. Here’s how it works: Lifetime benefit based on a specific formula Benefit based on a complex three-tiered formula Public educator work A California defined benefit earned by virtue of A federal insurance program that represents a promise employment with the specific entity that agrees to provide from the federal government to provide a basic benefit As a full-time public school teacher in California, you benefits in exchange for the services of the employee in retirement don’t pay in to Social Security, so you don’t get Social Security benefits from teaching when you retire. Worker contributes 8 percent of salary Worker contributes 6.2 percent of salary California’s public educators made the decision in 1955 to stay out of the program, primarily because Minimum retirement age is 50 with 30 years of service Minimum retirement age is 62 for a reduced benefit CalSTRS benefits were better. Theoretically, teachers or 55 with 5 years of service Full retirement age is 65-67 for a maximum benefit Source: CalSTRS is Teachers’ Sole Retirement, 2007 Forty-Somethings’ Advise: Invest and Save Sooner Which retirement issue would you advise a younger colleague to follow? CalSTRS conducted an online poll Choices Responses Percentage between December 17, 2007, and Investing, sooner than later 347 39% March 10, 2008, and posed this Rising health care costs 126 14% question: “As an active educator Paying down debt 113 13% between the ages of 40 and 49, Working after retirement 61 7% which one of the following retire- ment issues and concerns would you Financial education 56 6% advise a younger colleague to give Effects of inflation 54 6% primary attention to when planning Long-term care 43 5% for retirement?” Downsizing lifestyle 26 3% Other 59 7% (Percentages are rounded.) SUMMER 2008 www.CalSTRS.com Your Money Matters 5 photos this page © 2008 Jupiterimages Corporation

- 6. CalSTRS Explains It All For You CalSTRS Pension2® Personal Wealth Plan: What’s a 403(b) What’s Tax Deferred? Your First Step to a Brighter Financial Future and 457(b)? Tax-Deferral Delays Your Tax Liability GeT STARTeD HeRe Under a tax-deferred retirement plan, you don’t A 403(b) Offers Special Tax Benefits Planning for the future isn’t complicated. pay taxes on your contributions or investment Start saving today. A 403(b) is a tax-deferred investment plan that earnings, but delay any possible tax liability until public schools offer to their employees. It’s named you retire or withdraw from your account. Paying Your first step is to get the information you need about the after the 403(b) section of the Internal Revenue the tax later when your income is smaller could new CalSTRS Pension2 personal wealth plan. Read more at Code. The CalSTRS Pension2 is a 403(b). Your result in a reduced tax bill. www.CalSTRS.com/members/pension2. contribution is deducted from your pay check Yes, it is just that easy before it is taxed so you see a savings right away. E-mail: Pension2@CalSTRS.com Fax: Phone: 916-229-4202 888-394-2060 457(b) is Similar to a 403(b) What’s a Defined Benefit? A 457(b), often called a deferred compensation Mail to: CalSTRS, P Box 15275, M.S. 44 .O. plan, is similar to a 403(b), but with different CalSTRS Defined Benefit Is Guaranteed Sacramento, CA 95851-0275 rules. It is named after the 457(b) section of Your CalSTRS pension is a guaranteed monthly the Internal Revenue Code. benefit based on a formula, not the amount of money you have in your account. CalSTRS Pension2 Your first pension is your CalSTRS Defined Benefit. Pension2 is a CalSTRS-administered supplemental savings plan. ment i r e How Much Can You Live On? r Re t You cannot outlive your CalSTRS monthly late You S? benefit. However, the average career teacher’s CalSTR ve from pension replaces only about 60 to 65 percent of Calcu recei t you’ll ch ret iremen final pay. We have found that you should have ow mu 90 percent of your final pay, depending on your sa bout h Curiou elf lculato rs blicatio ns. health care coverage, to retire comfortably. ate I t Yours lSTRS.com/ca STRS.com/pu And consider this: You don’t earn Social Secu- Calcul at ww w.Ca t www. Cal • Online Hand book a rity for your public school employment, and ember get In M you can many retired educators have to pay for their own • and older, ent health care costs. Statem ent ears old nnual statem Your emb er 45 y atest a Check ctive m iewing your l ’re an a v port. The Question • If yo u e by re gress Re estimat irem ent Pro a quick the Ret Most educators need more income to make up within found r the gap between their CalSTRS benefit and their unselo e. Fro m a Co 53 to schedul in retirement needs. What to do? Get It 28 -54 nt alance l 800-2 l Re tireme ot the b nt benefit • Cal cessfu formu la, n ireme Supplemental Savings Is One Answer la fo r a Suc is bas ed on a a monthly ret ormu ent ben efit uarante ed Your F If you want to retire with more, one way is to retirem ted, you are g alSTRS nce ves start a supplemental savings plan. Get started at Your C O count. www.CalSTRS.com/members/pension2. your ac tired life. r re for you ula: Here’s the basic form tion = Member-Only Bene fit Se rvice Credit X Age Factor X Final Compensa rk Stay om/Ma photo.c ©iStock 6 www.CalSTRS.com

- 7. Money Can’t Next year I plan to use our great new science and social studies adoptions to meet state Buy You language arts standards. It’s a great way to make these curricular areas a bigger priority Love, But throughout our school day. ©iStockphoto.com/Murat Koc It Can Buy — Wendy Weller, elementary teacher, Elk Grove Service Credit Service Credit Is Important Service credit is the number of years you earn while you work as a teacher or school administrator in public schools and contribute to CalSTRS before retirement. The more service credit you have, the greater your retirement benefit. Three teachers were asked: Your retirement benefit is figured on this formula: I will focus on being a better What will you do differently communicator to the students Your service credit x Your age at retirement x and my colleagues. The individual next year as an educator? Your final compensation = Your Retirement Benefit who has the ability to communicate clearly and An increase in any of these factors, including service credit, may effectively will create a increase your benefit. cohesive environment Incentives to retire with as much service credit as possible and enhance the include: learning opportunities • 25 or more years of service credit gives you the one-year and experiences of final compensation calculation. Otherwise, the three-year everyone. calculation applies. — Eric Anson, elementary • 30 or more years of service credit gives you a career factor teacher, Rancho Cordova boost of up to 0.2 percent. • 30 years or more of service credit may give you a longevity bonus of up to $400 per month if you earn 30 years of service credit by January 1, 2011. I had an absolutely outstanding school year; therefore, there is little I plan to change. I will How to Get More Service Credit continue to introduce new poems, literature and writing prompts and will learn along with my • Work more years. students. I’ll attend workshops because the way • Within certain restrictions, make these kinds of service to stay excited about teaching is to be excited credit purchases: about learning. – Permissive credit for nonCalSTRS activities, such as — Margaret Karl, secondary teacher, Elk Grove substitute teaching or active military service – Nonqualified service credit, or “air time” ~ Nonqualified service credit doesn’t qualify you for the career factor, longevity bonus or the 25-year Funny About Money threshold final compensation – Redeposit previously withdrawn CalSTRS contributions. The Cost of Service Credit Costs to purchase service credit differ depending on the kind of service credit you want to buy. It will cost less if you purchase service credit early in your career. In general, the sooner you buy service credit, the better. Calculate the Cost Calculate the cost of purchasing service credit at www.CalSTRS.com/calculators. Schedule to attend a CalSTRS workshop or a benefits counseling session at 800-228-5453. Sample calculations are available in Purchase Additional Service Credit at www.CalSTRS.com/publications. Steve Kelley Editorial Cartoon © 2008 Steve Kelley. Used with the permission of Steve Kelley and Creators Syndicate. All rights reserved. SUMMER 2008 www.CalSTRS.com Your Money Matters 7

- 8. PRSRT STD U.S. POSTAGE M 79 Y84 PAID PERMIT NO. 25 SACRAMENTO, CA CalSTRS Resources Web sites www.CalSTRS.com Click Contact Us to e-mail black www.403bCompare.com Call 800-228-5453 7 a.m. to 6 p.m. Monday through Friday TTY 916-229-3541 866-384-4457 Home Loan Program white 888-394-2060 Pension2® Write CalSTRS P Box 15275 .O. Sacramento, CA 95851-0275 Fax 916-229-3879 myCalSTRS: Your Personal Information Quick, Current and Paper-free “Logging onto myCalSTRS was easy. I found myself with tremendous access to all sorts of valuable information about retirement and planning for my future.” —Alan Sitomer, high school teacher and 2007 California Teacher of Year How easy is it to register for myCalSTRS? Free Gift MyCalSTRS gives you access to secure information about your CalSTRS For You account anytime, day or night. Receive a free Why Wait savings • Review your benefit choices calculator by sending an e-mail • Update your mailing address and telephone number request to Pension2@CalSTRS.com. (Level II access) This paper calculator will help you • Ask questions about your account and receive figure out how much money you can prompt, confidential answers. accumulate if you start saving today. You check your bank statement online. Why not do the same with your CalSTRS account? To register, go to www.CalSTRS.com and follow the step-by-step directions. If you’re already registered, you can log on right away.