The Estonian Economy, No 5, September 27, 2011

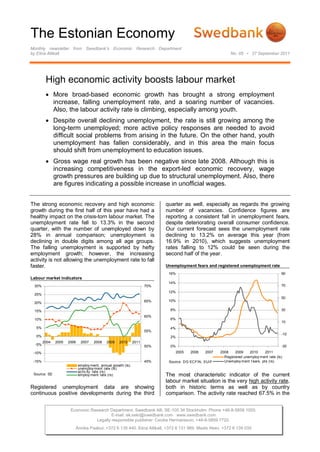

- 1. The Estonian Economy Monthly newsletter from Swedbank’s Economic Research Department by Elina Allikalt No. 05 • 27 September 2011 High economic activity boosts labour market More broad-based economic growth has brought a strong employment increase, falling unemployment rate, and a soaring number of vacancies. Also, the labour activity rate is climbing, especially among youth. Despite overall declining unemployment, the rate is still growing among the long-term unemployed; more active policy responses are needed to avoid difficult social problems from arising in the future. On the other hand, youth unemployment has fallen considerably, and in this area the main focus should shift from unemployment to education issues. Gross wage real growth has been negative since late 2008. Although this is increasing competitiveness in the export-led economic recovery, wage growth pressures are building up due to structural unemployment. Also, there are figures indicating a possible increase in unofficial wages. The strong economic recovery and high economic quarter as well, especially as regards the growing growth during the first half of this year have had a number of vacancies. Confidence figures are healthy impact on the crisis-torn labour market. The reporting a consistent fall in unemployment fears, unemployment rate fell to 13.3% in the second despite deteriorating overall consumer confidence. quarter, with the number of unemployed down by Our current forecast sees the unemployment rate 28% in annual comparison; unemployment is declining to 13.2% on average this year (from declining in double digits among all age groups. 16.9% in 2010), which suggests unemployment The falling unemployment is supported by hefty rates falling to 12% could be seen during the employment growth; however, the increasing second half of the year. activity is not allowing the unemployment rate to fall faster. Unemployment fears and registered unemployment rate 16% 90 Labour market indicators 14% 30% 70% 70 12% 25% 50 65% 10% 20% 15% 8% 30 60% 10% 6% 10 5% 4% 55% -10 0% 2% 2004 2005 2006 2007 2008 2009 2010 2011 -5% 50% 0% -30 -10% 2005 2006 2007 2008 2009 2010 2011 Registered unemploy ment rate (ls) -15% 45% Source: DG ECFIN, EUIF Unemploy ment f ears, pts (rs) employ ment, annual growth (ls) unemploy ment rate (ls) activ ity rate (rs) Source: SE employ ment rate (rs) The most characteristic indicator of the current labour market situation is the very high activity rate, Registered unemployment data are showing both in historic terms as well as by country continuous positive developments during the third comparison. The activity rate reached 67.5% in the Economic Research Department. Swedbank AB. SE-105 34 Stockholm. Phone +46-8-5859 1000. E-mail: ek.sekr@swedbank.com www.swedbank.com Legally responsible publisher: Cecilia Hermansson, +46-8-5859 7720. Annika Paabut, +372 6 135 440. Elina Allikalt, +372 6 131 989. Madis Aben, +372 6 139 035

- 2. The Estonian Economy Monthly newsletter from Swedbank’s Economic Research Department, continued Nr 05 • 27 September 2011 second quarter, up from 66.3% a year before and We expect employment growth to slow, but to close to the levels seen at the end of 2008, when remain stable and balanced among sectors. The the recession deepened; most of this increase was biggest unknown is perhaps connected with the founded on the youth age group (i.e. <24 year-olds; construction sector, which, although gaining from which can indicate that part of it is seasonal), as high investment activity (including in the public well as among 50-69 year-olds (partially connected sector), is already suffering from a lack of skilled with the age increase in women’s pensions). Labour workers (see last page). activity in Estonia is among the highest in the EU, only falling short to mostly Nordic countries. Vacancies at high level with structure shifting We expect the activity rate to go down somewhat Together with high economic activity and during the second half of the year, supported by a employment growth, the number of vacancies has pickup in nonactivity among youth due to their also been soaring. After a regular seasonal pickup return to studies; however, there are risks regarding this assumption. We estimate labour activity to in vacancies during the spring, vacancies have remain at rather high levels for a longer period, thus continued to grow during the third quarter as well. not allowing unemployment rates to decline faster. The number of vacancies during the first half of this year was registered at an amount comparable to Employment continued to grow at a rapid pace in those seen during the boom years of 2006-2007 the second quarter, with 7.9% more people (see chart). However, just as employment growth is reported employed than a year ago, up from 6.8% showing a structural shift in the labour market, so in the first quarter. While employment growth in the are the vacancies. For example, growing economic first quarter was still mainly led by the effectiveness (including technology related) and a manufacturing sector (60% of total increase), it bigger contribution from the tradable sector have became more broad based in the second quarter, considerably decreased the need for low-skilled and with construction and the retail-wholesale sector less educated workers – compared to 2007, contributing at a similar strength; employment vacancies have declined the most for elementary continues to fall in the public services sector. occupations and craft and related sales workers. At Despite hefty employment developments during the the same time, vacancies for professionals and first half of this year, total employment is still technicians are more than twice as high. roughly 10% lower than the highest levels seen in 2007-2008, including 20% lower in the recovery- Number of vacancies by occupation leading manufacturing sector. However, the boom (thousands) year levels should not be set as a target because 30 Other they were unsustainable in the long run and the labour force is declining; indeed, the size of actual 25 Elementary emigration as well as future immigration policies occupations can changes these estimates. 20 Plant & machine operators Employment, annual change (thousands) 15 Craf t and related trades 45 Other 10 Serv ice and sales 30 Public serv ices 5 Technicians, assoc. 15 ICT prof essionals 0 0 Prof essionals Transport 2005 2006 2007 2008 2009 2010 2011 1H 2007 1H 2009 1H 2011 , storage -15 1H Source: EUIF Retail, wholesale -30 Constru- Labour supply, on the other hand, has responded -45 ction less flexibly to changes, resulting in structural Manuf a- unemployment problems. Training and education is cturing -60 still the main key for the solution – lots of means Total and resources have been channeled to tackle this -75 Source: SE issue, including from EU structural funds. However, there are difficulties in forecasting, especially in the long run, which occupations are needed and in 2 (5)

- 3. The Estonian Economy Monthly newsletter from Swedbank’s Economic Research Department, continued Nr 05 • 27 September 2011 which sectors; this is because data are scarce and can be created for the companies to hire long-term curricula take time to be prepared. Also, in many unemployed. In addition, measures to popularise fields, the private sectors could be more integrated, part-time job creation (which is currently twice as e.g., in work practice and coaching activities. In low as the EU average) can also be beneficial. addition, legislators should consider lifting the Another major negative outcome for the labour special benefit tax on work-related education and markets across the developed economies from the training. recent recession has been sharply increasing youth Long-term unemployment up, youth unemployment. In Estonia, this unemployment rate unemployment down spiked from less than 10% before the crisis to 40% in the beginning of 2010. Since then, however, The biggest trouble area behind the overall positive youth unemployment has halved, coming down to developments in the labour market is high long-term around EU average levels. Also, one of the most unemployment. The number of short-term closely followed indicators among youth – NEET unemployed (i.e., less than 12 months) fell by 46% (the number of those not in employment, education, during the first half-year, but only by a mere 2% for or training) – has fallen to near pre-crisis levels (see long-term unemployed, including a 47% increase in chart). the number of very-long-term unemployed (i.e., more than 24 months). The share of long-term Youth unemployment rate, s.a. unemployed in total unemployment rose above 50% (percent) during this period (see chart); a similar share was 45 seen, for example, in 2007. However, the total number in absolute terms has now more than 40 tripled compared with that period. In addition to the 35 long-term unemployment numbers, the number of discouraged persons was up by 35%, although the 30 number of inactive persons fell by 3% during the 25 same period. 20 Unemployment rate by duration 15 14% 70% 10 12% 60% 5 10% 2006 2007 2008 2009 2010 2011 EU27 Estonia Latv ia 50% Source: Eurostat Lithuania Sweden 8% 6% 40% Most of this sharp decline in youth unemployment 4% can be attributed to strong employment growth, 30% which was up by 25% on average during the first 2% half of this year, including 28% in the second 0% 20% quarter; seasonal factors definitely play a role in 2004 2005 2006 2007 2008 2009 2010 2011 this, as many temporary and part-time jobs have share of long-term unemploy ment (rs) been created in different services and sales Source: SE long-term activities. However, the number of students has short-term remained at a low level for several years now, indicating an increasing number of youth working Long-term unemployment poses problems because during their studies or choosing, instead, to work the longer somebody stays out of work, the less altogether. In the long run, this cannot be likely it is they will manage to find work, as skills considered sustainable as it imposes the risk of and work habits erode; this, in turn, will burden the increasing the share of uneducated in the work social system and affect negatively the declining force. labour force. Also, many of the long-term unemployed used to work in areas where demand In order for activity among youth to decline and the for labour has now fallen sharply; this situation number of students to increase, more social and pointing to struggles with structural unemployment. financial safety nets need to be put in place for In addition to effective education and training youth to allow them to fully concentrate on their measures, more incentives, including tax benefits, studies. Currently, many students feel as if they are forced to work during their studies because of 3 (5)

- 4. The Estonian Economy Monthly newsletter from Swedbank’s Economic Research Department, continued Nr 05 • 27 September 2011 financial problems; this, in turn, affects their on average since the start of last year. However, academic record and increases the risk to this pattern cannot survive in the long run, even eventually drop out. While more flexibility is needed, more so because production has been climbing on including better part-time work possibilities, the the value-added ladder and will continue to do so. currently planned policy changes in the parliament, The tightening of the labour supply will also put unfortunately, seem to be doing the opposite – pressures on wage growth in manufacturing, as the making the rules for higher-education students biggest employment sector in the economy. stricter and thus education more elitist. Average monthly gross wage real growth Youth labour market indicators (annual growth) (thousands) 25% Total Manuf acturing 140 Construction 20% Retail Storage, transport 120 Public serv ices 15% 100 10% 80 5% 60 0% 40 2007 2008 2009 2010 2011 -5% 20 0 -10% 2004 2005 2006 2007 2008 2009 2010 2011 -15% Employ ed Unemploy ed Source: SE Source: SE Students NEET* * not in employ ment, education or training Lack of qualified workers as the main reason for restraining Real wage growth still negative business activity (share of all respondents) What surprised us negatively about the second 80 quarter labour market data was the slower-than- expected growth of average gross wages and, in 70 turn--due to the high inflation--also the continuously 60 negative real wage growth of – +4.2% and -1%, respectively. Growth fluctuated strongly across 50 sectors, from -7% in education to +6% in real estate 40 activities (in real annual terms). Looking at current developments, especially accelerating inflation, the 30 outcome in the second half of this year will probably 20 be weaker than we previously expected as well, although overall wage pressures in the economy 10 are strengthening. There are growing risks that 0 structural unemployment will push up wages in the 2005 2006 2007 2008 2009 2010 2011 most supply-squeezed sectors; this, in turn, can industry serv ices construction spill over to other sectors in the economy. The Source: EKI current public sector wage policy, which is entirely concentrated on effectiveness gains, will not be A bit confusing are the wage growth numbers in the sustainable in the long run either. construction sector. On the one hand, this sector reported the strongest growth in employment (26%) Real wage growth in the manufacturing sector has in the second quarter; also, the lack of qualified been hovering around zero for a year now, labour is considered to be the biggest problem, in reporting just +0.2% in the second quarter. This the face of increasing investment and construction cost advantage edge points to growing activity, as many of those who lost their work during competitiveness in the global markets as most of the recession went to Finland, where construction the production in manufacturing is exported. As a sector started recovering sooner and wage levels result, productivity growth in manufacturing has are much more attractive. On the other hand, been many times higher than in the whole economy wages in the construction sector were up by just 4 (5)

- 5. The Estonian Economy Monthly newsletter from Swedbank’s Economic Research Department, continued Nr 05 • 27 September 2011 3.1% in nominal terms and declined by 2% in real also, the need to attract workers probably adds to terms. At the same time, construction price growth their incentives to increase unofficial payments. is accelerating, based on the price of labour – e.g., This notion is supported by confidence figures, construction prices were up by 3.2% in the second according to which the share of respondents in the quarter, including by 7% of labour. Even more, data construction sector claiming the lack of qualified show that during the first half of this year wages in labour to be the main reason for restraining their the construction sector in Finland outpaced those in business activity has shot up to levels last seen in Estonia (8.2% vs. 3%, respectively). late 2007 (see chart). This conflict in figures can no longer be explained by just structural shifts, and thus the share of unofficial pay is most likely increasing as well. Elina Allikalt Despite the increase in construction activity, many construction companies are still financially troubled; Swedbank Economic Research Department Swedbank’s monthly newsletter The Estonian Economy is published as a service to our SE-105 34 Stockholm customers. We believe that we have used reliable sources and methods in the preparation Phone +46-8-5859 1028 of the analyses reported in this publication. However, we cannot guarantee the accuracy or ek.sekr@swedbank.com www.swedbank.com completeness of the report and cannot be held responsible for any error or omission in the underlying material or its use. Readers are encouraged to base any (investment) decisions Legally responsible publisher on other material as well. Neither Swedbank nor its employees may be held responsible for Cecilia Hermansson, +46-8-5859 7720 losses or damages, direct or indirect, owing to any errors or omissions in Swedbank’s Annika Paabut +372 6 135 440 monthly newsletter The Estonian Economy. Elina Allikalt +372 6 131 989 Madis Aben +372 6 139 035 5 (5)