TKO Stock Analysis and Forecast for Telkonet Inc

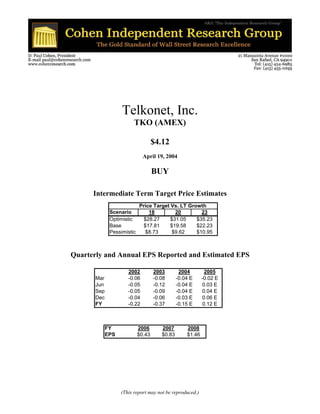

- 1. Telkonet, Inc. TKO (AMEX) $4.12 April 19, 2004 BUY Intermediate Term Target Price Estimates Price Target Vs. LT Growth Scenario 18 20 23 Optimistic $28.27 $31.05 $35.23 Base $17.81 $19.58 $22.23 Pessimistic $8.73 $9.62 $10.95 Quarterly and Annual EPS Reported and Estimated EPS 2002 2003 2004 2005 Mar -0.06 -0.08 -0.04 E -0.02 E Jun -0.05 -0.12 -0.04 E 0.03 E Sep -0.05 -0.09 -0.04 E 0.04 E Dec -0.04 -0.06 -0.03 E 0.06 E FY -0.22 -0.37 -0.15 E 0.12 E FY 2006 2007 2008 EPS $0.43 $0.83 $1.46 (This report may not be reproduced.)

- 2. Cohen Independent Research Group, Inc. VALUATION MEASURES Cash Flow Statement Market Cap (intraday): 159.44M From Operations (ttm): -5.60M Enterprise Value (18-Apr-04): 164.01M Free Cash flow (ttm): -5.73M Trailing P/E (ttm, intraday): N/A TRADING INFORMATION Forward P/E (fye 31-Dec-04): 0 Stock Price History PEG Ratio (5 yr expected)¹: N/A Beta: N/A Price/Sales (ttm): 1770.5 52-Week Change: N/A Price/Book (mrq): 55.1 52-Week Change (relative to S&P500): N/A Enterprise Value/EBITDA (ttm): N/A 52-Week High : 5.74 FINANCIAL HIGHLIGHTS 52-Week Low 1.55 Fiscal Year 50-Day Moving Average: N/A Fiscal Year Ends: 31-Dec 200-Day Moving Average: N/A Most Recent Quarter (mrq): 31-Dec-03 Share Statistics Profitability Average Volume (3 month): 450,000 Profit Margin (ttm): N/A Average Volume (10 day): 324,000 Operating Margin (ttm): N/A Shares Outstanding: (pro forma) 38.70 Management Effectiveness Float: 31.40M Return on Assets (ttm): -183.65% % Held by Insiders: 18.87% Return on Equity (ttm): -2219.71% % Held by Institutions: 0.08% Income Statement Shares Short (as of 8-Mar-04): 455.00K Revenue (ttm): 94.00K Daily Volume (as of 8-Mar-04): N/A Revenue Per Share (ttm): 0.005 Short Ratio (as of 8-Mar-04): 0.779 Revenue Growth (lfy): N/A Short % of Float (as of 8-Mar-04): 1.45% Gross Profit (ttm): -11.00K Shares Short (prior month): 101.00K EBITDA (ttm): --6.45M Dividends & Splits Net Income Avl to Common (ttm): -7.66M Annual Dividend: N/A Diluted EPS (ttm): -0.388 Dividend Yield: 0.00% Earnings Growth (lfy): N/A Dividend Date: N/A Balance Sheet Ex-Dividend Date: N/A Total Cash (pro forma): 18M Last Split Factor (new per old)²: N/A Total Cash Per Share (pro forma): 0.47 Last Split Date: N Total Debt (pro forma): 0.45M Total Debt/Total Cap (pro forma): 2.4% Current Ratio (pro forma): 28.5 Book Value Per Share (pro forma): 0.46

- 3. Cohen Independent Research Group, Inc. TABLE OF CONTENTS THE COMPANY .......................................................................................................................................3 Company History ..................................................................................................................................3 Investment Highlights............................................................................................................................3 Recent News.........................................................................................................................................4 Wed, March 31, 2004........................................................................................................................................ 4 Mon, March 29, 2004 ........................................................................................................................................ 4 Tue, March 23, 2004......................................................................................................................................... 4 Fri, March 19, 2004........................................................................................................................................... 4 Tue, March 9, 2004........................................................................................................................................... 4 Thu, March 4, 2004........................................................................................................................................... 4 Mon, Feb 23, 2004............................................................................................................................................ 4 Wed, Feb 18, 2004 ........................................................................................................................................... 4 Tue, Feb 17, 2004............................................................................................................................................. 5 Mon, Feb 9, 2004.............................................................................................................................................. 5 Wed, Feb 4, 2004 ............................................................................................................................................. 5 Mon, Jan 26, 2004 ............................................................................................................................................ 5 Wed, Jan 14, 2004............................................................................................................................................ 5 Wed, Jan 7, 2004.............................................................................................................................................. 5 Mon, Jan 5, 2004 .............................................................................................................................................. 5 Mon, Dec 15, 2003............................................................................................................................................ 5 Marketing Telkonet Products – Recent News Announcements............................................................5 Two Huge Additional Markets Propel Telkonet to another Level ..........................................................6 The Products.........................................................................................................................................6 SCHEMATIC OF THE PLUGPLUSINTERNET™ SYSTEM ....................................................................7 THREE COMPONENTS OF THE PLUGPLUSINTERNET™ SYSTEM...................................................9 Government Regulations ....................................................................................................................10 Intellectual Property ............................................................................................................................10 Business Development in a $26 Billion Market...................................................................................10 Cost of Service....................................................................................................................................11 Home versus Commercial Use ...........................................................................................................11 Competition in the Commercial Marketplace ......................................................................................12 Competing in the Commercial Marketplace - The Hospitality Industry........................ 12 History of HSIA in the Hospitality Industry ...................................................................................................... 13 Wireless in the Hospitality Industry................................................................................................................. 13 Security in the Hospitality Industry......................................................................................................14 Usage of HSIA in the Hospitality Industry....................................................................................................... 15 Support Provided to the Hospitality Industry................................................................................................... 15 Business Models for Addressing the Hospitality Industry............................................................................... 15 Marketing to the Hospitality Industry............................................................................................................... 16 Market Size of the Hospitality Industry ........................................................................................................... 16 Primary Competitors in the Hospitality Industry.............................................................................................. 17 STSN............................................................................................................................................................... 17 Wayport........................................................................................................................................................... 17 Golden Tree Communications ........................................................................................................................ 18 How Telkonet Compares to Incumbents......................................................................................................... 19 Telkonet Installation ........................................................................................................................................ 19 Telkonet’s Initial Customers................................................................................................................20 Marketing to the Hospitality Industry...................................................................................................21 Management Team.............................................................................................................................21 i

- 4. Cohen Independent Research Group, Inc. GROWTH ASSUMPTIONS ....................................................................................................................24 CASH FLOW ANALYSIS .......................................................................................................................24 LIQUIDITY AND LEVERAGE.................................................................................................................25 CAPITALIZATION...............................................................................................................................26 Capitalization – Debt....................................................................................................................................... 26 Capitalization – Equity .................................................................................................................................... 27 FORECASTS AND VALUATION ...........................................................................................................29 Bull Case.............................................................................................................................................36 Bear Case ...........................................................................................................................................36 CONCLUSION........................................................................................................................................36 ANNUAL BALANCE SHEET: TELKONET, INC. (TKO) .......................................................................39 ANNUAL BALANCE SHEET: TELKONET, INC. (TKO) .......................................................................40 QUARTERLY BALANCE SHEET ..........................................................................................................41 STATEMENT OF CHANGES IN CASH .................................................................................................42 STATEMENT OF CHANGES IN CASH .................................................................................................43 DISCLAIMER: ........................................................................................................................................43 DISCLAIMER: ........................................................................................................................................44 ii

- 5. Cohen Independent Research Group, Inc. TELKONET, INC. TKO $4.12 AMEX April 19, 2004 We have re-issued our April 10th report and increased estimated earnings per share due to positive prospects in the MDU and military markets. THE COMPANY Company History After extensive research and product testing for three years, in January 2002, the company shifted its Telkonet (TKO) has primarily been a development management emphasis from R&D to commercial stage company, but has begun the transition to a development. The company has since demonstrated revenue producing business armed with exciting the product’s robust capacity and decided to focus disruptive technology. TKO is at an inflection point on marketing the company’s initial proprietary of becoming a profitable growth company in the products. intermediate future. The company has moved into exciting giant sized market opportunities completing Investment Highlights important strategic ventures with Hughes/Direct TV - (DPV), Anteon and Leviton. TKO has developed a 1. The Company has developed a potentially system that utilizes the existing electrical wiring disruptive technology for High Speed Internet infrastructure in residential and commercial Access, using the existing electrical wiring in a buildings to deliver Internet and telephony building for Internet access. connectivity. The Company posted its initial 2. The Company’s technology can be applied to revenues in the September 2003 quarter. hotels, multiple dwelling units, commercial In 1999, Telkonet Communications, Inc, was formed buildings, ships, using either 110V or 220V and to develop applications for the emerging power line other industries. The technology can be applied carrier technologies. In July 2001, TKO announced on a worldwide, international basis. the completion of the initial product development 3. The thrust of the story is this: Telkonet has phase of its proprietary communications system. recently signed agreements with Anteon, In August 2001, the company announced the Leviton and is in the process of finalizing its performance of successful system tests in the agreement with Hughes/Direct TV. All three Washington DC area. The Telkonet PlugPlus™ companies give TKO access to enormous new Internet connectivity solutions were demonstrated in markets. Anteon provides access to the a 28 unit residential apartment building and a 5-story military and government markets. Leviton commercial office building. High-speed data provides access to the multiple dwelling unit connections were successful whether measuring the (MDU) market. Hughes/Direct TV provides basement outlets or the farthest receptacle on top access to the satellite-to-internet market floors. worldwide. Separate from the hotel industry, 3

- 6. Cohen Independent Research Group, Inc. we believe these additional markets can margins in the purchase business model will generate $40 million in real revenues going offset the initial negative margins in the lease forward. business model of the MDU and hospitality markets. 4. The hospitality industry is installing High Speed Internet Access (HSIA) for guest usage at an Recent News increasing rate. We estimate that 20,000 of a total of 45,000 hotels in the U.S. will offer HSIA Wed, March 31, 2004 to guests in five years. TKO does not charge an • Telkonet announces discussion of recent installation fee. agreements with Anteon and Leviton in webcast. 5. The Telkonet system competes very favorably Mon, March 29, 2004 on price basis. Competitors all require an • Telkonet and Leviton form strategic partnership upfront installation fee. TKO requires none. to deliver broadband internet access Competitors charge $9,000 to $23,000 for a 100 room hotel for HSIA system installation, Tue, March 23, 2004 excluding the cost of rewiring. • Telkonet and Anteon to provide power line 6. Standard installation time for the Telkonet communications solutions for the US Navy. system is typically less than a day. Fri, March 19, 2004 7. The Telkonet system competes favorably on an • Daniel L McGinnis resigns from Board of on-going cost basis. Directors of Telkonet. 8. The Telkonet system allows a hotel guest using Tue, March 9, 2004 the Internet to move a laptop to any location • Telkonet listed by Broadband Properties near an electrical outlet. Magazine as one of the ‘Companies to Watch in 2004.’ 9. In the MDU market, we forecast a conservative 1.8% market share of the 2 million buildings Thu, March 4, 2004 with over 100 units in five years. • Telkonet CEO Ronald Pickett discusses the 10. Our US government/military and satellite to Hughes VAR agreement, the AMEX listing and internet industry projections are very private stock offering. conservative. However, the company is Mon, Feb 23, 2004 currently engaged in tests with the U.S. Navy that if successful, could yield significant • Telkonet Chairman Pete Musser To Ring revenues. These two markets are forecast to AMEX Opening Bell February 24, 2004 purchase equipment rather than lease. Wed, Feb 18, 2004 11. Any improvement in the forecast for the • Telkonet, Inc. & UTEK Corporation Form government/military and satellite to internet Strategic Technology Alliance markets in the next two years will positively impact earnings and cash flows. Positive 4

- 7. Cohen Independent Research Group, Inc. • Telkonet On-Track with FCC's Broadband Over Mon, Jan 5, 2004 Power Line Initiative • Telkonet Deploys Test System Onboard U.S. Naval Research Vessel Tue, Feb 17, 2004 Mon, Jan 5 - 8:32am ET - Business Wire • Telkonet Completes Private Placement for $12.8 million. Mon, Dec 15, 2003 • Telkonet's 'Outlet to the Internet' Total Service • Telkonet Ships Next Generation Of Product Soon to Be Available Everywhere! Mon, Dec 15 - 9:00am Mon, Feb 9, 2004 Marketing Telkonet Products – Recent News Announcements • Telkonet & Anteon Team-Up On High-Speed Internet Pilot Program at Chicago Housing Telkonet is also negotiating with Value Added Authority Resellers (VAR) that will market the PlugPlus™ system and manage the installation at the local level. Wed, Feb 4, 2004 In February 2004, Telkonet announced a relationship • Telkonet Now 'TKO' on Amex with Hughes whereby Telkonet will become an authorized reseller of Hughes. Included in this • American Stock Exchange Lists Common Stock agreement is the co-marketing relationship with of Telkonet, Inc. 1000 VAR’s that are approved by Hughes. These Thu, Jan 29, 2004 VARS will be able to resell Telkonet solutions with minimal training. • Telkonet's President Makes Featured Presentation At Friedland Capital's Undervalued The scope of this agreement is global in nature and Equities Conference enables the VARS around the world to offer a HSIA • Telkonet Moving to Amex solution with a satellite connection. The global reach will primarily be in three regions, North Mon, Jan 26, 2004 America, Europe (Spain to Ukraine) and India. • Telkonet Announces Senior Noteholders Elect to Telkonet has also formed a relationship with Convert $2.5M to Equity Leviton, the largest electric component manufacturer Wed, Jan 14, 2004 in North America. The Leviton agreement provides for the future development of manufacturing • Telkonet Patents 'Power Line Telephony processes to lower the cost of the Telkonet products, Exchange and provide Telkonet with access to 7,000 licensed electrical contractors. These electrical contractors Wed, Jan 7, 2004 will be the VAR that installs and services the • Telkonet Appoints Albert Diehl as Vice Telkonet solutions. Leviton intends to manufacture President and ship Telkonet products to their network of • Wed, Jan 7 - 1:03pm ET - Business Wire electrical contractors for installation. A division of Leviton, the Leviton Integrated Networks (LIN) focuses on the multi-dwelling units (MDU) marketplace. LIN has 120 sales people who will 5

- 8. Cohen Independent Research Group, Inc. market Telkonet technology products into major with Anteon is very valuable in addressing a urban areas. potentially large market for Telkonet. The Telkonet equipment displayed its capabilities in a live setting, The relationship with Anteon for bringing HSIA to by providing a viable low-cost solution to the public housing is in its initial stages. Anteon is challenges of retrofitting a secure HSIA by using a currently working with the Chicago Housing ships existing electrical infrastructure. We Authority to install Telkonet technology in public anticipate that orders for TKO equipment on US housing structures in the Chicago area. Anteon is Navy ships are forthcoming. Aircraft carriers are also a major electronics contractor with the US floating cities of 5,000 plus personnel. Middle level Military. After testing Telkonet’s products on Navy officers and all of the lower level personnel currently vessels, Anteon has entered into an agreement to share access with many others due to wiring offer Telkonet solutions to the military. Anteon constraints onboard. Anteon will be addressing currently has a large contract to provide ongoing networking solutions for onshore facilities. support for network services for the US Navy. The agreement with Hughes opens up the Two Huge Additional Markets international marketplace by allowing internet Propel Telkonet to another Level access into a building’s electronic infrastructure via satellite access. The ProductTelkonet has developed The recent marketing agreements with Leviton, a revolutionary method for consumers and Anteon and Hughes open up large markets for businesses to access the Internet. The power line Telkonet. We believe the combination of these communications (PLC) technology utilizes the markets will add approximately $40 million in real existing electrical wiring in a building to bring revenues during the intermediate period of time. Internet access throughout the building. This patented technology is a unique system that delivers The LIN sales force will focus on the MDU market broadband Internet access without any re-wiring. for Telkonet products. This sales force has sold the The PlugPlus™ system converts every power outlet CAT5 wiring option and is knowledgeable of the in every room to an access port of a high-speed data market. In the US there are over 30 million network. It creates a transport system that allows all apartment units, of which 10 million have 100 units Internet functions including email, browsing, access or more. LIN salespeople will initially address the to company networks via the Internet and creation of large unit market place first. The Company Virtual Private Networks. The data and high-speed anticipates launching marketing efforts in two major Internet access is reliable and secure. metropolitan areas. In this market, TKO will provide the Gateway™ and Coupler™ products The Products without charge and collect a $200 per month building fee along with a monthly fee for the iBridge There are three components to Telkonet’s modems. The building or the ISP providing the PlugPlus™ system that create an Internet delivery service will only have to pay for the electricians time system. They are the PlugPlus™ Gateway, the to install the equipment in order to offer HSIA to all PlugPlus™ Coupler and the iBridge. The tenants. PlugPlus™ Gateway connects to an existing hardwire network using an embedded 10/100 The military market is very large and demands those Ethernet port and distributes the data to the who are experienced in it to succeed. The agreement 6

- 9. Cohen Independent Research Group, Inc. PlugPlus™ Coupler via the powerline carrier (PLC) The PLC communication between the Telkonet interface. The PlugPlus™ Coupler distributes the Gateway and the Telkonet iBridge is based on a set PLC signal into the electrical circuit breaker of the of proprietary protocols. The Ethernet building. The iBridge is plugged into an electrical communication protocol leading into the Gateway outlet and takes the PLC signal and converts it to an and out of the iBridge are standard communication Ethernet signal for each computer throughout the protocols. building. SCHEMATIC OF THE PLUGPLUSINTERNET™ SYSTEM The Gateway is a self-contained unit that accepts The backbone of the Gateway is a fast data from an existing network on one port and communications processor running a series of distributes it via the second port. The most proprietary applications under Linux. Other common configuration is the 10BaseT Ethernet on Gateway/Coupler configurations have a PLC to PLC one side and power line carrier PLC on the other. component where more than one coupler is required. This configuration provides bridge data around a physical block to the signal that commonly occurs 7

- 10. Cohen Independent Research Group, Inc. when an old section of a building does not share the is far less than the space required by a server and a common wiring of a new section. A third Gateway router. A coaxial cable connects the two and may be configuration is a PLC to wireless access point very long since there is virtually no attenuation on it. (WAP). This configuration provides immediate line-of-sight wireless access in an open space such The iBridge-to-Gateway architecture is encrypted as a large office or hotel lobby. for security. The default security does not allow one Internet user in the same building to see other users The PLC signal generated by the Gateway can be on the network. Communication to other users via directly coupled into low voltage wiring via the the Internet, i.e. email, is always available. A power cord of the Gateway. The PLC signal may network in a building may also be configured to also be routed to a remote injection point via a allow each user to see other users without going coaxial cable. This allows the Telkonet solution to through the Internet. This essentially creates a address the medium voltage and multi-phase virtual LAN or VLAN. There are over 1000 options environments found in commercial buildings. in configuring VLANs. This customization allows for the security required when more than one entity Large hotels or office buildings typically have exists within a building and each desires their own several electrical panels. One Coupler is required LAN. for each electrical panel, and each Gateway can drive six couplers. Recent tests indicate that one A suite of software applications on the Gateway Gateway and one Coupler were able to deliver performs communications and system management Internet access to all outlets spanning 26 stories of functions. The firmware of the Gateway and the an office building. iBridge can be remotely updated and managed. This allows for integrity of a VLAN while the The PlugPlus system is designed to operate in internal configuration of a building may change. commercial environments that experience electrical That is, as one office tenant expands and requires noise, electrical load imbalances, transformer more space, the integrity of their VLAN can be interference and unpredictable changes in maintained without additional wiring. attenuation conditions (signal strength). The PlugPlus system implements frequency division The Gateway can network with dozens of multiplexing over a spectrum of 77 communication PlugPlusInternet Modems and provides a scalable, channels. Interference and noise that could cause a robust solution for the commercial marketplace. The loss of data are continuously monitored. When PlugPlusInternet Modem is the iBridge. This interference is detected on a channel, that channel is modem has a standard 110V plug on one side and an shut down until interference is eliminated. Internet Ethernet RJ-45 connector on the other. Once the Access is continuous, reliable and seamless. Typical Gateway and Coupler are installed, a new Internet noise sources include fluorescent and halogen lamps, user needs only to plug the iBridge into an outlet and brush motors (garbage disposal) and dimmer connect the computer to the Ethernet port on the switches. Additionally, amateur band radio iBridge for an Internet connection. transmitters and switching power supplies can create electrical interference. The Gateway is The current generation of Telkonet PlugPlusInternet approximately the size of a cigar box, only thinner, system delivers data at speeds in excess of 7 mega and the Coupler is approximately 4” x 4” x 3”. The bits per second (Mbps), with burst speeds of 12.6 small size poses minimal installation difficulty, and Mbps. This compares to dial up speed of 56 Kbps, a 8

- 11. Cohen Independent Research Group, Inc. typical DSL line of 200 Kbps to 500 Kbps and a determining factor is the speed provided from the typical cable modem at 300 Kbps to 1Mbps. T1 Internet Service Provider (ISP). lines typically operate at 1.5 Mbps. The PlugPlusInternet™ system can sufficiently deliver Internet access at any required speed. The THREE COMPONENTS OF THE PLUGPLUSINTERNET™ SYSTEM 9

- 12. Cohen Independent Research Group, Inc. The incoming broadband signal (DSL, T1, Satellite hardware developed by Telkonet along with other and Cable Modem) connects to the Gateway. The associated equipment. Gateway then connects to the building’s electrical Additional patents have been applied for the past panel, and distributes access to the Internet provided several years for different product components of the by the ISP throughout the existing network of PlugPlusInternet™ system. We expect that several electrical wires within the building. Moving the additional patents will be granted to Telkonet over location of a PC, server or printer is accomplished the course of the next two years. The Coupler is by simply moving the PlugPlusInternet Modem to designated as ‘patent-pending.’ another electrical outlet. No additional wiring is required. Business Development in a $26 Government Regulations Billion Market The Federal Communications Commission (FCC) The Company’s products are designed to deliver permits the operation of unlicensed digital devices high-speed Internet connections for minimal costs in that radiate radio frequency emissions if the commercial, hospitality and multi-dwelling building manufacturer complies with certain equipment markets. Typical customers will include office authorization procedures, technical requirements buildings, hotels, schools, shopping malls, the marketing restrictions and product labeling. military, condominiums and apartment buildings. Telkonet’s Gateway PLC products have been The demand for broadband Internet access from the verified to meet FCC requirements for Class A business traveler and multi-dwelling market digital devices from an independent FCC-certified continues to grow. According to industry analysts, lab. The device may be marketed for commercial the market for home and building networks will use. Any future products will require testing. represent a $26 billion market worldwide for the next four years. The FCC has also been fielding public comments regarding allowing Internet access over the Management is initially focusing on the commercial electricity power grid. We expect more markets, targeting the hospitality and MDU markets announcements will be forthcoming this year. with a direct sales force that currently numbers twelve. Telkonet has formed relationships with a Intellectual Property select few national value added resellers (VAR) to market the PlugPlusInternet™ system. Such The company has applied for patents to cover the relationships have already extended Telkonet’s reach intellectual property embedded in the Company’s into the multi-unit dwelling, government, and products. Telkonet recently received its first patent commercial markets. that covers the ability to transmit and distribute high speed digital data and voice over existing electrical As an unknown company with a potentially power lines of the premises. This patent is very disruptive technology, Telkonet has begun an significant in that it covers the comprehensive advertising and telemarketing campaign to spread system invention. This patent utilizes PLC and awareness of its products and services. Articles Internet protocol in conjunction with Voice-Over- have appeared in certain select trade magazines Internet-Protocol (VOIP). The patent covers the covering the hospitality and MDU markets. These 10

- 13. Cohen Independent Research Group, Inc. articles describe initial users’ success with the including ongoing maintenance and support. The Telkonet system. hotel may elect to include the ISP service for an additional $200 per month. The slightly higher fees International markets are a large opportunity. for the hospitality industry are justified by the Access to the Internet is restricted in some continually changing guests that may require developing countries by the limitation of the support. The iBridge modems are priced at $173 infrastructure of the basic Public Service Telephone each or $8/month for 24 months. Network. Antiquated pricing mechanisms for per- minute usage on phone lines, creates an opportunity For a hotel, MDU or business tenant in a for Telkonet products. The end user bypasses the commercial building, there is no disruption in per-minute charge when Telkonet products are business activity during the installation process. implemented in conjunction with a 2-way satellite Implementation is quick and is far less expensive link, dedicated landline or fixed wireless access. than adding dedicated wiring or installing wireless Additional opportunities exist in Europe, South systems. America, Asia and the Pacific Rim where the Internet is available. Home vs. Commercial Use Another large market possibility for Telkonet is the A few companies offer PLC based service for the initiation to offer broadband over power lines (BPL). home. Linksys and Netgear have planned or The FCC is taking steps to allow electricity utility announced Powerline Communications products that vendors to offer BPL service. Telkonet’s proprietary are compliant with the HomePlug Alliance. The solutions can bring high speed Internet access to HomePlug Alliance was formed to form standards many users who require the “last mile” connection and develop a chipset that enables PLC products for from a high speed line. the home. Both Linksys and Netgear are focusing on products for the home and residential Cost of Service marketplace. The presence of Linksys and Netgear in the residential marketplace provides a validation The Company has experimented with different of the viability of the powerline communications revenue plans and has settled on a total solution plan market. where the customer pays nothing up front and incurs a monthly fee for a minimum of three years. Telkonet is focused on the commercial marketplace. Telkonet incurs the cost of installing the equipment. Commercial needs differ from residential in that Most standard installations can be completed in less commercial users require heightened security, the than a day. More difficult ones may take a full day ability to connect a large number of users, support or slightly more due to a difficult configuration. In for greater distances and enhanced work the MDU industry, the customer pays $195 monthly management. In the residential PLC solution, all maintenance and support fee with a minimum three nodes communicate with each other. In commercial year contract. The per modem monthly fee is $6.75 applications, software provides the isolation and in the first year, $5.75 in the second and $4.75 in the security in the network. The driver power and third year. receiver sensitivity are also improved to increase bandwidth throughput performance for commercial In the hospitality industry, the minimum three year users. contract provides for a $295 per month service fee, 11

- 14. Cohen Independent Research Group, Inc. In a commercial setting, a more powerful Gateway coverage. Wireless also is inherently less secure manages all the traffic to the Telkonet iBridges. The since other users can intercept the radio frequency PlugPlusInternet™ system is scaleable to hundreds used. Telkonet’s PlugPlusInternet™ system can of users. Proprietary software enhancements have interface with a wireless system and drive the extended the Telkonet system reach to meet the backbone of the wireless installation. needs of a broad array of building configurations. The PlugPlusInternet™ system offers a robust Competing in the Commercial solution that allows the formation and alteration of Marketplace - the Hospitality several virtual private networks (VPN) within the Industry same building. Of the several markets the Company is addressing, Competition in the Commercial we have analyzed the hospitality market for several Marketplace reasons. The hospitality industry is less fragmented than the commercial or MDU market. Secondly, The markets Telkonet is targeting, hospitality, there is data available that assist in assessing MDU, commercial and government all have Telkonet’s prospects for revenue growth. Most incumbent competitors. The competitive landscape important, industry participants are eager for high is very fragmented with numerous ISPs. Value speed Internet access (HSIA). Several companies added resellers (VAR) service the diversity of have already established themselves as the leaders in buildings that exist across the U.S. Regardless of offering HSIA to the hospitality industry. The the specific market, Telkonet’s methodology to following discussion of the hospitality industry, distribute Internet access throughout a building however, does not diminish the enormous potential competes with the incumbent separately wired of the Military, MDU, satellite and internet markets network technology. worldwide. Traditional high speed wiring, known as CAT5, is The hospitality industry is unique in that there are the coaxial cable that is a separate network within a frequent connection problems due to the constant building. It can be expensive and time consuming to turnover of users (new hotel guests daily), which install. It is certainly disruptive to the buildings creates servicing issues. Users also require secure tenants and guests. After installation, Internet access access to external corporate networks. Network is physically limited to areas served by the wall jack. configurations do not require much flexibility after Electrical outlet access to the Internet provided by installation, since VPNs will not be established Telkonet improves flexibility for furniture among guests. Hotel management functions, reconfigurations over time. however may desire a VPN. Wireless solutions also may be a competitive threat. These requirements place less demand on Telkonet’s Wireless Internet connections require a wireline product features than a commercial building with connection point to the network, which can be time tenants whose changing business demands create the consuming to install. Wireless solutions must also need to alter a VPN. Customer servicing be engineered to address the unique characteristics requirements, however, is high due to guest of the building, such as footprint and construction turnover. material. Steel and concrete demand a high concentration of access points to ensure adequate 12

- 15. Cohen Independent Research Group, Inc. History of HSIA in the Hospitality Industry all of Wayports’s customers are charging for HSIA. Wayport focuses on the high end of the hospitality The history of offering HSIA in the hospitality industry. Golden Tree Communications, which industry provides insight into user demand and focuses on both the high end and the middle level business models that have worked. Five years ago, hotels, indicates a different trend. Rein Norma, VP HSIA had been considered an amenity for hotel of Sales for Green Tree indicates that more hotels guests that would compete with entertainment overall are moving towards offering HSIA at no services such as Video on Demand (VoD) and Pay charge, while some hotels have a minimal additional per View movies (PPV). More business travelers charge. are now demanding HSIA services because HSIA provides more content and access to corporate Business travelers have been specifying they will networks. The strongest players in the VoD and only stay at hotels with HSIA since their more PPV market had the opportunity to become complex applications (CRM, PowerPoint, VPNs) dominant in offering reliable HSIA, but the focus on require high speed connections. Generally, HSIA is VoD and PPV allowed others to dominate in the becoming a free amenity in the Limited Service and HSIA market for the hospitality industry. The Extended Stay type hotels. HSIA has been built into market leaders in the HSIA market have a focus on the price of the room. The full service hotels cater to HSIA exclusive of VoD and PPV. a less price sensitive guest and HSIA is typically treated as an amenity, similar to local telephone The original players in the HSIA market within the calls. hospitality industry were Case Internet (CAIS), Sweet Technology (now STSN) and Wayport. There are three general products available to the CAIS was a Washington based ISP which resold T1 hospitality industry. Those hotels with CAT5 lines to office buildings, multiple dwelling units and (coaxial cable) wiring can offer the highest access hotels. During the dotcom era, each of these firms speeds generally available, the T1 line. All new were able to raise significant funds. The business Marriott and Hilton hotels were built with T1 models for each were similar: install the equipment capability in the past few years. Guests plug the at cost and share in the revenues. In 2001, CAIS Ethernet connector directly into the wall and turn on was bankrupt and Wayport purchased its hotel their browser. Older hotels use CAT3 wiring, the equipment. two twisted pairs for plain old telephone service (POTS). CAT3 wiring is limited to offering DSL The primary flaw in the similar business models was service. For the DSL over CAT3 wiring, a modem the long term trend for the hospitality industry to is required in each room to separate out the high offer amenities for free to attract guests. According frequency DSL from the low frequency telephone to Dwight Kling, Manager of Business Development service. The third offering is wireless. at Wayport, the largest HSIA provider offering amenities for free changes with the competitive Wireless in the Hospitality Industry structure of the hospitality industry. After 9/11/01, occupancy rates in the hospitality industry declined Many hotels are interested in wireless service. The dramatically. This heightened competitive initial impression is that wireless installation is pressures, causing HSIA offerings to be given away. inexpensive since no wires need to be installed. The With occupancy rates now back to the level of pre- reality is that many access points need to be wired. 9/11, fewer hotels are giving HSIA away. Virtually 13

- 16. Cohen Independent Research Group, Inc. A typical old hotel with much concrete and steel in wireless access points may be so large due to the its structure will require many access points. architecture, that the cost is prohibitive. The number of Wi-Fi enabled laptops is low. It is In a combination setting, wireless is available to estimated that 5% of all laptops and 15% of frequent hotel guests in the lobby and conference areas, business travelers have Wi-Fi enabled laptops. This whereas wireline is available in the guest rooms and is rapidly changing, however. Most laptops conference rooms. This mixture of services is more currently sold are Wi-Fi enabled. common in high end hotels and enables the non- guest visitor or conference attendee to have HSIA. Advertising by Intel has brought the public attention Billing for the non-guest wireless user varies by to recognizing the possibility of wireless vendor. The common theme is to have a daily connections to the Internet. Service quality is charge that can be prepaid at a discount. For hotel another matter. Just as digital cellular phones are guests, wireless access is free when the wireline less reliable than wireline phones, wireless Internet service is used in the guest room. connections can leave the user frustrated by data transmission interruptions. Nonetheless, hoteliers are Security in the Hospitality Industry interested and according to Green Tree, approximately half of new installations are wireless. Security is a primary issue in installing HSIA. Port 80% to 90% of new installations contain wireless as level security is that level of security that maintains a component. the integrity of each individual computer connected to the building’s network. This means that someone The high incident of wireless installations for Green in room 101 is secure from a hacker in room 102. Tree may be due to their business model. Green Wireless access inherently compromises this. Tree does not focus on revenue sharing, but allows Another security level occurs when a guest desires the hotel to keep all ongoing revenues from hotel access into their company’s VPN. At this level, the guests utilizing HSIA. The trade-off for the hotel is network provider needs to understand the different a higher installation cost. The installation cost for VPNs that allow secure access. For VPN access, the wireless is typically half that for a CAT3 based DSL hotel also needs to have IP addresses available. installation. The low entry cost may be very These are provided by the Internet Service Provider attractive for a hotel uncertain of usage rates. (ISP) and can be managed by the vendor managing the HSIA network in the hotel. This can be an Wireless is primarily viable in open spaces since important consideration for the hotel since the hotel building structures can limit the wireless connection. will pay the ISP for a bank of IP addresses. When a Numerous wireless receptors are required to make group of HSIA users comes to the hotel, it is all spaces accessible to Wi-Fi Internet access, and imperative that the hotel has enough IP addresses may be cost prohibitive in older buildings. Steel and available. Otherwise, guests will complain about the concrete are barriers to the wireless radio signal. HSIA that does not perform as it should. Adding Wi-Fi to public areas allows the hotel to enable Internet access to visitors attending Wireless access presents additional security issues conferences during the day at the hotel. In newer that may not be apparent to the user. The wireless buildings the cost of installing wireless is far less connection uses radio waves that are easily expensive than a CAT5 T1 speed installation. In intercepted by a hacker. Some corporate VPNs will some hotels, primarily older ones, the number of 14

- 17. Cohen Independent Research Group, Inc. not allow a user in that is using a wireless but may not be available everywhere. T1 lines are connection. typically $600 - $700 per month but may be up to $1000 per month. A fractional T1, which is close in Usage of HSIA in the Hospitality Industry speed to a DSL, can cost $500 per month. An annual software license fee may be an additional HSIA usage rates have increased dramatically in the $300 to $400 per year for the hotel regardless of past few years. In 2002, a 3% to 5% usage rate was size. typical with a peak usage up to 20% of occupied rooms. All vendors quote a 10% usage rate or Business Models for Addressing the higher. Green Tree quoted a 15%-20% usage rate in Hospitality Industry hotels that have a high concentration of business travelers. A few hotels average 30% to 40% per day There are two general business models that are and peak at 50% to 70% usage. As occupancy rates employed. The most frequently implemented model improve and the economy continues to expand, it is is a revenue share model. The vendor installs the clear that the business traveler is demanding an equipment at close to cost and participates in the HSIA connection. In the past year, surveys of revenues generated by HSIA usage. Revenue business travelers have indicated that HSIA was the sharing is negotiable but averages a 50:50 split of most preferred amenity at a hotel. Now that it is revenues between hotel and network vendor. Most becoming more widely available, the business revenue share agreements specify a range for the traveler is using the HSIA more extensively with daily HSIA charge to the guest. Cost to the guest is CRM and PowerPoint applications and to access typically $9.95 per day. their company’s VPN. Maintenance and on-going technical support is an Support Provided to the Hospitality Industry additional expense for the hotel, which can total $5 to $10 per room per month. In the revenue sharing Hoteliers are in the hospitality industry. They are model, the hotel can make a small profit while not in the Internet connection business. Technical providing a service that more guests require. If the Internet connection problems for a late arriving hotel decides not to charge the guest, the hotel is still guest needs to be addressed. Frustrating computer liable for a minimum payment to the network problems attributed to the hotel’s connection can vendor. The revenue share business model provides cause the customer to search for other hotel options incentive for the hotel to charge guests for HSIA on return visits. The top three vendors offer service. 24/7/365 service by phone for hotel guests. The top three vendors charge $3 to more than $7 per room Another business model requires higher upfront per month for this service. installation costs. The hotel pays for the equipment installation which would include a profit to the A local Value Added Reseller (VAR) is typically vendor. The hotel does not share any revenues with used for on-site hardware service. This will cost the vendor. This provides the hotel with flexibility from $100 to $300 based on the type of response the in offering amenity discounts to groups without hotel wishes to have. The cost of the ISP line can incurring an additional cost to the HSIA provider. vary. For a hypothetical 100 room hotel, this will Maintenance and support fees are required as quoted range from $250 to $1000 per month for the ISP above, combined with the monthly charge to the connection. DSL lines can cost $250 per month, ISP. The network vendor may also manage the ISP 15

- 18. Cohen Independent Research Group, Inc. vendor relationship for a fee, which transfers all Market Size of the Hospitality Industry network problem-solving to the vendor. There are approximately 45,000 hotels in the U.S. Marketing to the Hospitality Industry The vast majority of these, approximately 70%, are 120 rooms or less. The top three HSIA vendors Marketing to the hospitality industry can be a long claim a total of 2,000 hotels as customers, and it is sales cycle. For the chain hotels, the vendor must estimated that smaller players may add another 500 first receive approval from the holder of the Brand to at most 1,000 more hotels with HSIA. name. This may take some time and does not ensure Competitive forces are requiring the HSIA that any hotel will purchase the equipment. Once installation to increase dramatically. approved by the brand name parent, the franchisee is free to select from the approved list of vendors. Rein Norma of Golden Tree Communications believes that 20% of current installations are “good Most chain hotels are owned by franchisees and may to stay” with current vendors and another 20% will be managed by a separate management company. be replaced. The remaining 60% are not up for The owners and managers must agree on the vendor renewal for another year or more. Although this selected. Once approved by the brand parent, it may data is somewhat speculative, it originates from the be several months to a year before a hotel decides on V.P. of Sales of the fastest growing HSIA service a particular vendor. Long term relationships are provider who has been with two of the top three very important, and a franchisee may decide to use vendors in the industry during the past several years. the service that a competitor is using because of the Assuming that a total of 3000 hotels have HSIA vendors reputation. Cost is not always the deciding capabilities, this means that 600 hotels will most factor. Service and a good guest experience are likely change vendors in the next 18 months. vital. A lower cost service that causes some customers grief is not acceptable. Over the next two years, the market is expected to grow at a rapid pace. The technology has now been Since many hotels have tried to implement HSIA proven to be profitable for the hospitality industry service over the past several years and have had and HSIA is in demand by business travelers. Of the varying degrees of success, the hoteliers’ level of 45,000 hotels in the U.S., it is estimated that 30,000 sophistication is increasing. The initial three to five may eventually install HSIA. Some hotel chains are year contracts are going through their renewal phase mandating their owners to implement HSIA in a in the next few years. Hotel management has relatively short time frame. Competition for guests generally created a set of criteria necessary for the will cause other hotel chains and independents to next contract period. Security, guest satisfaction and install HSIA. If it takes five years for 30,000 hotels service will be more closely monitored. to install HSIA from a base of 3,000 already installed today, the industry will experience a 58.5% Most companies market with a two tier approach. compound annual growth rate. If it takes 10 years, The small direct sales force services the national HSIA adoption will grow at a 25.9% rate. Taking accounts and the indirect value added resellers into consideration the 20% of current installations (VARS) work directly with the hotels when that will be replaced, the growth rate for new HSIA installing or providing day to day assistance. installations becomes 65.7% and 28.7% over a five and ten year timeframe, respectively. We believe a 25% to 30% growth rate for HSIA adoption during 16

- 19. Cohen Independent Research Group, Inc. the next five plus years is conservative. We expect helpful in an environment where firms may hold the the growth to be much higher in the next three years. local network operator liable for significant problems. Primary Competitors in the Hospitality Industry STSN has account managers in all first tier and many second tier cities. These account managers There are three main competitors in the HSIA can train the General Managers and Sales and hospitality industry. Wayport, STSN and Green Catering staff in handling Group Event questions Tree Communications. The three are profiled as involving technology. The local Account Manager follows. is the single point of contact for the hotel, whose STSN purpose is to drive awareness of the hotel’s HSIA. Marketing materials are available for the front desk, STSN currently has 600 hotels installed and/or under the elevators and the in-guest rooms. contract, ranging from 150 rooms to 1100 room hotels. STSN has a CAT3, a CAT5 and wireless Wayport solution. STSN claims to have the best security, Wayport, Inc is currently the largest provider of best diagnostics and support. STSN can HSIA to the lodging industry, with 740 hotels troubleshoot the hotel’s switches and routers installed or under contract. Wayport is also one of remotely. the largest providers of Wi-Fi in public areas, STSN has received funding from APV Technology focusing on airports. Usage rates for HSIA are Partners, BankOne, First Media ST Holdings, Intel, increasing from 3% in mid 2002 to 10% to 12% Marriott International, Third Coast Capital, Thom recently. Vest, TransAmerica Technology Finance, Wayport is a private firm with venture capital VantagePoint Venture and Communication Partners, investments from INVESCO Private Capital, Stevin and Venture Frogs Fund. Rosen Funds, New Enterprise Associates, BA Most guests using HSIA are business travelers for Venture Partners, Lucent Venture Partners, Trellis whom security is a big issue. STSN has considerable Partners, GC Technology Fund, Sanders Morris experience working with VPN managers and Harris and Star Ventures. providing customer support. Guests find the system Wayport offers three types of HSIA systems: A easy to use. Technical support is 24/7 for both the fully digital system that requires CAT5 wires and guest and hotel staff. The network easily interfaces supplies a T1 connection, a VDSL system which with corporate Virtual Private Networks (VPN). runs over CAT3 wires and requires a modem in each Gwen Cudero explained how STSN’s experience room, and a wireless option. Wayport indicates the indicates that security is a critical issue. It is wireless Wi-Fi system receives a lot of press but is rumored that Starwood Properties had to compensate not frequently deployed in hotels. Despite being one KPMG for the impact of a virus that attacked the of the leaders in Wi-Fi, Wayport believes issues laptops of consultants and caused significant around the construction materials, billing and the downtime. STSN has had their system cost of the “Wireless Bridge” make Wi-Fi a good independently tested for hackers, viruses and other choice only for certain architectural types of hotels. security issues. The A+ grade received is very 17

- 20. Cohen Independent Research Group, Inc. Wayport uses the Revenue Share business model Golden Tree uses the investment business model where equipment installation is done at cost. where the hotel invests in the equipment and keeps Wayport collects a fee of $7 to $7.50 per room per all revenue generated from the HSIA service. An month for repair, training and technical support. average installation costs for a hypothetical 100 Maintenance is additional. The revenue share is room hotel is $23,000 without re-wiring. A wireless typically a 50:50 split with the hotel with a solution would on average cost $12,000 assuming recommended price of $9.95 per day. Installation the building configuration does not require an costs range from $90 to $180 per room or $9,000 to enormous amount of receptors. On an ongoing $18,000 for a 100 room hotel. Dwight Kling of basis, hotel operators pay for the ISP line, which is Wayport quoted that a typical hotel will have 65% standard for any business model. Green Tree will occupancy and a 10% to 12% usage rate. manage the ISP along with IP addresses for approximately $1,000 per month, which would Hotel employees who market to conferences include the cost for the ISP service. Support is typically need training to sell high speed Internet and $3/room/month and software license fee is $360 per video conferencing. Wayport trains hotel year. Contracts for support, ISP management and employees, creates marketing materials and can help software license may be separate and are 1 to 5 years hotels close deals. Wayport has been performing in length. Maintenance and support are typically one this function for its client hotels and has 30 people year contracts while ISP management is typically on staff dedicated to assisting hotel employee gain one year contracts. Green Tree offerings are a full more conference business. Wayport has service turnkey services with 24/7/365 service and onsite personnel in major cities for service. repair. Golden Tree Communications Green Tree attributes their phenomenal growth rate to how their business model makes more sense for Golden Tree Communications (GTC) has over 600 the hotel. The hotel can manage its revenue stream hotels installed with HSIA. Two years ago, GTC with more flexibility when there is no revenue share had only 50 installations. In the past two years, requirement. It may offer free HSIA to some guests, GTC has been the fastest grower of the top three or choose to make it free to all guests and raise room HSIA providers. GTC is a privately held company rate across the board to compensate for the that previously was a subsidiary of BCM Advanced additional amenity. When usage rates were in the Research, a private company that manufactures mid to low single digits, the revenue share model printed circuit boards. Golden Tree has three made more sense to hotel operators. Now that usage product offerings, T1 line speed access, DSL and rates are consistently in the 15%+ range for Green Wireless. Tree clients, hotels benefit financially by not sharing The GTC solutions are based on Cisco routers and HSIA based revenues. The risk of installing switches with GTC proprietary software interfacing equipment has decreased with the increase in usage with the router and switch software. Solutions to from guests. The payback for the investment is software problems are downloaded to all hotels. easily achieved in 14 months. This assumes a $10 Green Tree has marketing agreements with Intel and guest fee for HSIA, 65% occupancy, and a 12.3% the Centrino chip. average usage rate. The hotel will collect $29,200 in the first year for a hypothetical 100 room hotel. Expenses would be $23,000 for installation, and 18

- 21. Cohen Independent Research Group, Inc. $700 to $1100 per month for maintenance, support, The revenue share program could be more beneficial ISP service, and software license. to the hotelier if they consistently charged for the amenity. This is typically done only at the high-end Green Tree markets through 8 sales people calling hotels, where guests are willing to pay extra for on large national accounts and through many value additional amenities. In the vast majority of hotels, added resellers (VAR). The installation force of 30 where customers exhibit some price sensitivity, people works with the local VAR. A smaller hotel HSIA will most likely be offered for free due to of 100 rooms can be installed in a day. The current competitive pressures. Hotel rates may increase as a installation team can install up to 60 hotels per result. Below the high-end hotels, revenue share month. programs will most likely become less attractive to hoteliers. Green Tree’s recent strong growth How Telkonet Compares to Incumbents testifies to this general trend. Of the top three, The least expensive installation of the top three Green Tree addresses more of the middle range incumbent providers of HSIA is in the range of hotel. Telkonet’s initial targeted market segment is $9,000 to $10,000 for a 100 room hotel for a low this middle range hotel. speed DSL or minimal wireless system. The cost Of the top three incumbent competitors, Green Tree could rise to $20,000 based on a faster line speed has had the fastest growth in the past two years. and the hotel configuration. With this lower up front Green Tree charges more than the others for cost, the hotel must share revenues from HSIA with installation, but does not receive any revenue the vendor in addition to paying ongoing support sharing. Its on-going fees are among the lowest. fees. Telkonet Installation For a non-revenue share option, a 100 room hotel is required to make an upfront investment of $20,000 The no-cost installation from Telkonet for the to $25,000, which may be higher for a faster line PlugPlusInternet™ system is extremely attractive. speed or difficult hotel configurations. Most hotels will install an HSIA system for competitive or mandated reasons. No up front costs For a 100 room hotel, on-going maintenance and is a major competitive advantage whether the hotel support from the incumbents are approximately $300 charges for the service or not. to $750 per month. Lower on-going fees are typically associated with the higher installation costs The time for installation is also attractive. The top and the higher on-going fees are associated with three HSIA providers indicate a one day to one week lower installation costs and a revenue share installation timeframe. It can take up to three requirement. months to get the ISP vendor to deliver the HSIA to the hotel. Since the PlugPlusInternet™ system only For a 100 room hotel with a 65% occupancy and a requires an experienced electrician for standard 10% usage rate, the revenue share program would installation, it can be installed in less than a day, create a $975 payment to the vendor and income to typically costing the hotel less than $1,000. the hotel of $975 if all users were charged the Difficult installations that take Telkonet a full day standard $10 per day fee. However, hotels are would take several days to a week or longer for other moving away from charging for HSIA in favor of vendors. The installation time quoted does not giving it away. include time taken to rewire a building, which is 19

- 22. Cohen Independent Research Group, Inc. very time-consuming. The top HSIA providers A Telkonet PlugPlus system installed in a Newark, indicate this is rarely done. Delaware Comfort Suite hotel has been sited as the reason for a 5% - 10% increase in sales. Customer Telkonet’s ongoing fee is lower than that of satisfaction is high and people are delighted to plug Wayport, which employs the revenue sharing model, the modem in outlets that are close to the sofa, bed and slightly higher than Green Tree ($500 vs. $330). or desk. Additional modem charges for Telkonet customers will either create a nominal upfront cost or raise the A WyteStone Suite hotel in Fredericksburg, Virginia monthly cost. For a 100 room hotel, seven modems had been built in 1995 with the standard CAT-3 would cover an expected 10% usage rate at 65% wiring throughout the 85 unit hotel. Although occupancy. Purchasing seven modems at $173 each sufficient at that time for the hotels phone system, it would incur a total upfront cost of $1,211. If paid is inadequate for high-speed Internet signals. After for monthly at $8/month, seven modems would cost considering installing new wires, installing a the hotel $56/month for 24 months. As usage wireless system or a PLC system, Telkonet installed increases, the hotel would need to purchase more the PlugPlusInternet™ system. This installation modems. required five Couplers and lasted a full day. With iBridge modems in the rooms the following day, the Hotels consider three additional criteria beyond hotel was offering free Internet access. The hotel price. First, the quality of support can make or break claims the cost was one third that of a wireless a sale. TKO has a minimal track record at this time. solution. The hotel has encouraged groups that have Second, the big three offer marketing services to filled half of the hotel to challenge the Internet hotels seeking conference business that may be very system. No speed degradation has been reported. attractive to the larger hotels. Third, higher line No on-site technical assistance has been required. speed typically requires higher initial costs and may incur higher monthly costs to the vendor. For The Quality Inn in Surprise, Arizona installed a Telkonet, a higher line speed does not alter the Telkonet system using the T-1 line coming into the Telkonet fee. The higher the percentage of business property. The Helmsley in Manhattan is also a travelers at a hotel, the more the higher line speed client of Telkonet. Several hotels operated by will be required. Universal Hospitality, Inc. have installed the PlugPlus™ system through the integration of high- Telkonet’s Initial Customers quality, two-way satellite service. Since the end of FY 2002, the Company has Telkonet has a few apartment buildings using the installed the PlugPlusInternet™ system in 80 hotels, PlugPlusInternet™ system. The 154 unit Hunters and has 100+ hotels under contract in 30 states. Glen in Upper Marlboro, Maryland has installed the Currently there are 37 hotels that are waiting for an Telkonet system. Feedback from management and installation date. In December, 2002, the Company tenants using the system is very favorable. The announced the installation of a product field trial at Whitney, a 250 unit luxury apartment complex in the Marriott Residence Inn-Landfall in Wilmington, Bethesda, Maryland, has the Telkonet system. NC. The PLC system provides Internet connectivity to 90 guest rooms, meeting rooms, common areas The Chicago Housing Authority (CHA) has decided and a lobby kiosk. to deploy Telkonet’s system on a trial basis in its 20

- 23. Cohen Independent Research Group, Inc. public housing. As the CHA modernizes its 25,000 Telkonet is providing support on a 24/7/365 basis apartments, high speed Internet access is desired. for the three-year service agreement at $495 per month fee. This includes the ISP fee and the 24/7 Marketing to the Hospitality support. Recent results at the support call center Industry indicate that most problems have occurred because the hotel guest does not have an Ethernet card or the In March 2003, the Company announced a strategic Ethernet cable is not correctly attached. The alliance with Choice Hotels International (CHH). Company installs a router next to the Gateway which Choice Hotels is one of the largest hotel franchise allow software technicians to remotely determine if companies in the world with more than 4,500 hotels, a problem is associated with the ISP vendor inns, all-suite hotels and resorts in 46 countries. The franchise companies include Comfort Inn, Comfort Telkonet also offers a satellite connection to the Suites, Quality, Clarion, Sleep Inn, Roadway Inn, Internet that enables more remote hotels to offer EconoLodge and Mainstay suites. Additionally, HSIA. Six hotels currently use the there are 8,000 to 10,000 more hotels under the PlugPlusInternet™ system with a satellite hookup. Choice network. The two year agreement identifies Telkonet appears to be the only vendor offering a Telkonet as the Endorsed Vendor for the PLC satellite solution. product offerings. Telkonet and Choice will cooperatively market, advertise and promote The company has 12 direct sales people. Telkonet is Telkonet’s Internet access solution to the building momentum in the hospitality market. Once franchisees. This agreement is very significant since more traction is gained during FY04, the company CHH covers close to one third of all hotels in the will address the international hospitality market. U.S. Management Team Comfort Suites, a 400 hotel chain, has recently mandated that all hotels must have HSIA by May Warren V. “Pete” Musser Chairman of the Board and Co-CEO 31, 2004. With 80 hotels currently installed and 100+ under contract in 30 states, Telkonet has a Warren V. “Pete” Musser, 76, has served as footprint that spans the ten geographic regions Telkonet’s chairman of the board since January defined by Choice Hotels International. Advertising, 2003. Musser has taken more than 50 companies telemarketing and direct marketing is bringing name public during his distinguished and successful career recognition to members of CHH. as an entrepreneur. He is currently the managing director of The Musser Group and chairman The total solution package for the emeritus of Safeguard Scientifics, Inc. Mr. Musser's PlugPlusInternet™ system is very price competitive. distinguished affiliations also included: director of Relative to the competition discussed, Telkonet CompuCom Systems, Inc., director of Internet offers the least expensive solution. For the 70% of Capital Group, Inc., vice chairman and director of hotels in the country that have 120 rooms or less, a Nutri/System, Inc., vice chairman and director of the low cost option is very attractive. Of the top three Eastern Technology Council, chairman and director vendors to the hospitality industry, none offer a “no- of Economics PA, and vice president of cost” installation. Whether a hotel decides to charge development at Cradle of Liberty Council, Boy guests for HSIA or not, the lower ongoing cost Scouts of America. Mr. Musser received a BS structure is beneficial to the hotel. 21