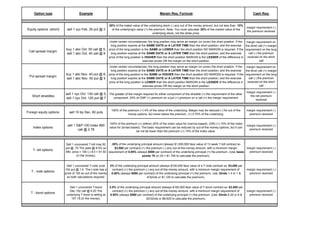

Options Margin

- 1. Option type Example Margin Req. Formula Cash Req: 20% of the maket value of the underlying stock (-) any out of the money amount, but not less than 10% margin requirement (-) Equity options: (short) sell 1 xyz Feb. 35 put @ 3 of the underlying's value (+) the premium. Note: You must calculate 20% of the market value of the the premium received underlying stock, not the strike price. Under certain circumstances, the long position may serve as margin (or cover) the short position. If the margin requirement on long position expires at the SAME DATE or A LATER TIME than the short position; and the exercise the short call (+) margin buy 1 abc Oct. 50 call @ 5, price of the long position is the SAME or LOWER than the short position NO MARGIN is required. If the requirement on the long Call spread margin: sell 1 abc Oct. 40 call @ 8 long position expires at the SAME DATE or A LATER TIME than the short position; and the exercise call (-) the premium price of the long position is HIGHER than the short position MARGIN is the LESSER of the difference in received on the short exercise prices OR the margin on the short position. call Under certain circumstances, the long position may serve as margin (or cover) the short position. If the margin requirement on long position expires at the SAME DATE or A LATER TIME than the short position; and the exercise the short call (+) margin buy 1 abc Nov. 40 put @ 8, price of the long position is the SAME or HIGHER than the short position NO MARGIN is required. If the requirement on the long Put spread margin: sell 1 abc Nov. 50 put @ 5 long position expires at the SAME DATE or A LATER TIME than the short position; and the exercise call (-) the premium price of the long position is LOWER than the short position MARGIN is the LESSER of the difference in received on the short exercise prices OR the margin on the short position. call margin requirement (-) sell 1 xyz Oct. 130 call @ 5, The greater of the margin required for either component of the straddle (+) the requirement of the other Short straddles the net premium sell 1 xyz Oct. 120 put @ 7 component. 20% of CMP (+) premium on a put (+) premium on a call (=) the margin requirement received 100% of the premium (+) 4% of the value of the underlying. Margin may be reduced (-) for out of the margin requirement (-) Foreign equity options: sell 10 bp Dec. 60 puts money options, but never below the premium (+) 0.75% of the underlying. premium received 100% of the premium (+) (either) 20% of the index value for (narrow-based). (OR) (+) 15% of the index sell 1 S&P-100 Index 860 margin requirement (-) Index options: value for (broad-based). The basic requirement can be reduced by out-of-the-money options, but it can call @ 2.78 premium received be not be lower than the premuim (+) 10% of the index value. Sell 1 uncovered T-bill may 92 .35% of the underlying principal amount (always $1,000,000 face value of 13 week T-bill contract so put @ .70 The yield @ 8.5% so $3,500 per contract) (+) the premium (-) any out-of-the-money amount, with a minimum margin margin requirement (-) T- bill options: Mkt. price = 100 (-) 8.5 = 91.50 requirement of 0.05% (always $500 per contract) of the underlying principal (+) the premium. (Use basis premium received (in the money). points 70 (x) 25 = $1,750 to calculate the premium). Sell 1 uncovered T-note June 3% of the underlying principal amount (always $100,000 face value of a T-note contract so $3,000 per 104 put @ 1.4. The t-note has a contract) (+) the premium (-) any out-of-the-money amount, with a minimum margin requirement of margin requirement (-) T - note options: price of 103 so out of the money 0.50% (always $500 per contract) of the underlying principal (+) the premium. Use 32nds 1.4 or 1 & premium received so both calculations required. 4/32nds or $1,125 to calculate the premium). Sell 1 uncovered T-bond 3.5% of the underlying principal amount (always $100,000 face value of T-bond contract so $3,500 per Dec.102 call @ 6.20 The contract) (+) the premium (-) any out-of-the-money amount, with a minimum margin requirement of margin requirement (-) T - bond options: underlying T-bond is selling at 0.50% (always $500 per contract) of the underlying principal (+) the premium. (Use 32nds 6.20 or 6 & premium received 107.18.(in the money). 20/32nds or $6,625 to calculate the premium).