New Green Reit Prospectus 2014

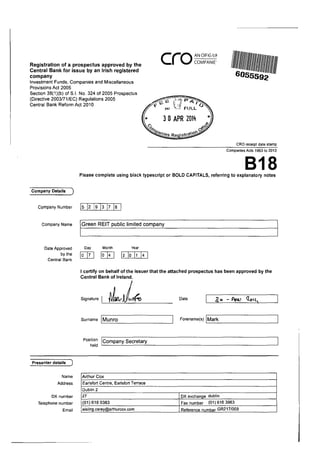

- 1. Registration of a prospectus approved by the Central Bank for issue by an Irish registered company Investment Funds, Companies and Miscellaneous Provisions Act 2005 Section 38(1)(b) of S.l. No. 324 of 2005 Prospectus (Directive 2003171/EC) Regulations 2005 Central Bank Reform Act 2010 C(ioAN OIFIG ll~ COMPANIE' CRO receipt date stamp Companies Acts 1963 to 2013 818Please complete using black typescript or BOLD CAPITALS, referring to explanatory notes Company Details ) Company Number Company Name Date Approved by the Central Bank Presenter details ) Name Address OX number Telephone number Email !Green REIT public limited company Day Month Year rn rn l2 lo It 14 I I certify on behalf of the issuer that the attached prospectus has been approved by the Central Bank of Ireland. ''"~'·I d"',,J,f(:. Surname LlM=u:..:n:..:ro:.__________j Position ICompany Secretary held · Arthur Cox Earlsfort Centre, Earlsfort Terrace Dublin 2 27 (01) 618 0383 aisling.carey@arthurcox.com Date Forename(s) LIM_a_r_k___________j OX exchange dublin Fax number (01) 616 3963 Reference number GR217/009

- 2. Further information ) CRO address Payment When you have completed and signed the form, please file with the CRO. The Public Office is at 14 Parnell Square, Dublin 1. The OX address for the CRO is 145001. If submitting by post, please send with the prescribed fee to the Registrar of Companies at: Companies Registration Office, O'Brien Road, Carlow, County Carlow If paying by cheque, postal order or bank draft, please make the fee payable to the Companies Registration Office. Cheques or bankdrafts must be drawn on a bank in the Republic of Ireland. A Form B18 that is not completed correctly or is not accompanied by the correct documents or fee is liable to be rejected and returned to the presenter by the CRO FURTHER INFORMATION ON COMPLETION OF FORM B18, INCLUDING THE PRESCRIBED FEE, IS AVAILABLE FROM www.cro.ie OR BY EMAIL info@cro.ie

- 3. IMPORTANT NOTICE THIS DOCUMENT IS AVAILABLE ONLY TO INVESTORS WHO ARE (1) BOTH QUALIFIED INSTITUTIONAL BUYERS ("QIBS") AS DEFINED IN RULE 144A UNDER THE US SECURITIES ACT OF 1933, AS AMENDED (THE "US SECURITIES ACT") AS WELL AS QUALIFIED PURCHASERS ("QPS") WITHIN THE MEANING OF SECTION 2(A)(51) OF THE US INVESTMENT COMPANY ACT OF 1940 (THE "US INVESTMENT COMPANY ACT") OR (2) OUTSIDE THE UNITED STATES IN COMPLIANCE WITH REGULATIONS UNDER THE US SECURITIES ACT ("REGULATION S") WHO ARE NOT US PERSONS AS DEFINED IN REGULATIONS. IMPORTANT: You must read the following before continuing. The following applies to the document following this page (the ''Document"'), and you are therefore advised to read this carefully before reading, accessing or making any other use of the Document. In accessing the Document, you agree to be bound by the following terms and conditions, including any modifications to them any time you receive any infomtation from Green REIT pic (the ''Company"), Green Property REIT Ventures Limited (acting as the Investment Manager to the Company), J.P. Morgan Securities pic ("JPM") or J&E Davy ("Davy") (JPM and Davy each a bank and together, the "Banks") as a result of such access. IF YOU ARE NOT THE INTENDED RECIPIENT OF THIS MESSAGE, PLEASE DO NOT DISTRIBUTE OR COPY THE INFORMATION CONTAINED IN THIS ELECTRONIC TRANSMISSION, BUT INSTEAD DELETE AND DESTROY ALL COPIES OF THIS ELECTRONIC TRANSMISSION. NOTHING IN THIS ELECTRONIC TRANSMISSION CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN ANY JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. THE SECURITIES HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE US SECURITIES ACT, OR THE SECURITIES LAWS OF ANY STATE OR OTHER JURISDICTION OF THE UNITED STATES AND THE SECURITIES MAY NOT BE OFFERED OR SOLD DIRECTLY OR INDIRECTLY IN, INTO OR WITHIN THE UNITED STATES, OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, US PERSONS, EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE US SECURITIES ACT AND APPLICABLE STATE SECURITIES LAWS AND UNDER CIRCUMSTANCES THAT WILL NOT REQUIRE THE COMPANY TO REGISTER UNDER THE US INVESTMENT COMPANY ACT. THE COMPANY HAS NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE US INVESTMENT COMPANY ACT AND INVESTORS WILL NOT BE ENTITLED TO THE BENEFITS OF THAT ACT. THERE WILL BE NO PUBLIC OFFERING OF THE SECURITIES IN THE UNITED STATES. THE FOLLOWING DOCUMENT IS BEING FURNISHED TO YOU SOLELY FOR YOUR INFORMATION AND YOU ARE NOT AUTHORISED TO, AND YOU MAY NOT, FORWARD OR DELIVER THE DOCUMENT, ELECTRONICALLY OR OTHERWISE, TO ANY PERSON OR REPRODUCE THE DOCUMENT IN ANY MANNER WHATSOEVER. ANY FORWARDING, DISTRIBUTION OR REPRODUCTION OF THIS DOCUMENT IN WHOLE OR IN PART IS UNAUTHORISED. FAILURE TO COMPLY WITH THIS DIRECTIVE MAY RESULT IN A VIOLATION OF THE US SECURITIES ACT OR THE APPLICABLE LAWS OF OTHER JURISDICTIONS. IF YOU HAVE GAINED ACCESS TO THIS TRANSMISSION CONTRARY TO ANY OF THE FOREGOING RESTRICTIONS, YOU ARE NOT AUTHORISED AND WILL NOT BE ABLE TO PURCHASE ANY OF THE SECURITIES DESCRIBED THEREIN. THE ATTACHED DOCUMENT IS ADDRESSED TO AND DIRECTED AT PERSONS IN MEMBER STATES OF THE EUROPEAN ECONOMIC AREA ("MEMBER STATES") WHO ARE "QUALIFIED INVESTORS" WITHIN THE MEANING OF ARTICLE 2(l)(E) OF THE PROSPECTUS DIRECTIVE (DIRECTIVE 2003/71/EC AS AMENDED (INCLUDING AMENDMENTS BY DIRECTIVE 2010/73/EU TO THE EXTENT IMPLEMENTED IN THE RELEVANT MEMBER STATE)) ("QUALIFIED INVESTORS").

- 4. In addition, this electronic transmission and the Document is only directed at, and being distributed: (A) in the United Kingdom, to persons (i) who have professional experience in matters relating to investments and who fall within the definition of "investment professionals" in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended) (the "Order") or who fall within Article 49 of the Order, and (ii) are "qualified investors" as defined in section 86 of the Financial Services and Markets Act 2000, as amended; (R) in Ireland, to Qualified Investors who are "professional clients" as defined in Schedule 2 of the European Communities (Markets in Financial Instruments) Regulations (Nos I to 3) 2007 of Ireland; and (C) any other persons to whom it may otherwise be lawfully communicated (together all such persons being referred to as "relevant persons"). This document must not be acted on or relied on (a) in the United Kingdom and Ireland, by persons who are not relevant persons, and (b) in any Member State other than the United Kingdom and Ireland, by persons who are not Qualified Investors. Any investment or investment activity to which this docnment relates is available only to (I) in the United Kingdom and Ireland, relevant persons and (2) in any member state of the European Economic Area other than the United Kingdom and Ireland, Qualified Investors and other persons who are permitted to subscribe for the Ordinary Shares pursuant to an exemption from the Prospectus Directive and other applicable legislation, and will only be engaged in with such persons. Confirmation of your Representation: In order to be eligible to view the Document or make an investment decision with respect to the securities, investors (I) must be either (a) both QIBs and QPs or (b) non- US persons outside the United States transacting in an offshore transaction (in accordance with Regulation S under the US Securities Act), (2) if located in the United Kingdom and Ireland, must be relevant persons and (3) if located in any member state of the European Economic Area other than the United Kingdom and Ireland, must be Qualified Investors. By accepting the e-mail and accessing the Document, you shall be deemed to have represented to the Company, the Investment Manager and each of the Banks that ( l) you have understood and agree to the terms set out herein, (2) you and any customers you represent are (a) both QlBs and QPs or (b) outside the United States and are not US persons and the electronic mail address to which this e-mail and the Document has been delivered is not located in the United States, (3) if you are located in the United Kingdom or Ireland, you and any customers you represent are relevant persons, (4) if you are located in any member state of the European Economic Area other than the United Kingdom or Ireland, you and any customers you represent are Qualified Investors, (5) you consent to delivery of the Document and any amendments or supplements thereto by electronic transmission and (6) you acknowledge that this electronic transmission and the Document is confidential and intended only for you and you will not transmit the Document (or any copy of it or part thereof) or disclose, whether orally or in writing, any of its contents to any other person. You are reminded that the Document has been delivered to you or accessed by you on the basis that you are a person into whose possession it may be lawfully delivered in accordance with the laws of the jurisdiction in which you are located and you may not. nor are you authorised to, deliver or disclose the contents of the Document to any other person. The materials relating to the offering do not constitute, and may not be used in connection with, an offer or solicitation in any place where offers or solicitations are not permitted by law. No action has heen or will be taken in any jurisdiction by the Company or the Investment Manager or any of the Banks that would, or is intended to, permit a public offering of the securities, or possession or disuibution of a Prospectus (in preliminary, proof or final form) or any other offering or publicity material relating to the securities, in any country or jurisdiction where action for that purpose is required. If a jurisdiction requires that the offering be made by a licensed broker or dealer and the Banks or any affiliate of the Banks is a licensed broker or dealer in that jurisdiction, the offering shall be deemed to be made by the Banks or such affiliate on behalf of the Company or the Investment Manager in such jurisdiction. The Document has been sent to you or accessed by you in an electronic form. You are reminded that documents transmitted via this medium may be altered or changed during the process of electronic transmission and consequently, none of the Company, the Investment Manager, any Bank and their respective affiliates, directors. officers, employees. representatives and agents or any other person controlling the Company. the Investment Manager, any Bank or any of their respective affiliates accepts any liability or

- 5. responsibility whatsoever. whether arising in tort, contract or otherwise which they might have in respect of this electronic transmission. the Document or the contents thereof. or in respect of any difference between the document distributed to you in electronic fom1at and the hard copy version available to you on request from the Company, the lnvesunent Manager or any Bank. Please ensure that your copy is complete. If you receive the Document by e-mail, you should not reply to the e-mail. Any reply e-mail communications. including those you generate by using the "Reply" function on your e-mail software. will be ignored or rejected. If you receive this Document by e-mail. your use of this e-mail is at your own risk and it is your responsibility to take precautions to ensure that it is free from vimses and other items of a desouction nature.

- 6. THIS PROSPECTUS AND A~'Y ACCOMPANYING DOCUMENTS ARE IMPORTANT AND REQUIRE YOUR niMEDIATE ATTENTION. If you are in any doubt as to what action you should take, or the contents of this Prospectus, you are reconmtended to consult immediately ycmr stockbroker, bank manager, solicitor, fund manager or other independent financial ad~or (being in the case of Shareholders in Ireland, an organisation or finn authorised or exempted pursuant to the European Communities (Markets in Financial Instruments) Regulations (Sos. I to 3) 2007 or the lm'eslment lntermediari~ Act 1995 (as amended) and, in the case of Shareholders resident in the United Kin~dom, a finn authori..ed under lhe Financial Services and 1fark{'ts Act 2000 las amended) ("FSMA") or otherwise from an appropriately authorised independent financial adisor if you are in a territory out<ride Ireland or the United Kingdom. 1f you M"ll or h;we sold or have otherwise transferred all of your Existing Ordinary Shares before 8.00 a.m. (Dublin time) on 7 April 2014 plea.<;e :>end any documents issued hy the Company in connection with the Cupital Raise. if and when received. at once to the purchaser or transferee or to the bank, stockbroker or other agent through whom the sale or transfer was effect.ed for delivery to the purchaser or transferee e-.;cept that ~uch document.s should not he sent to any jurisdiction where to do so might constitute a violation of local securities laws or regulations. including but not limit.ed to the United Stales and the Excluded Territories, or to US Perr-ons. If you have sold or otherv:ise transferred pan nf your holding of E.--.:isting Ordinary Shares prior to such date, please consuh the stockbroker, bank or other agent through whnm the sale or transfer was effectrd and refer to the insuuctions regarding split applications set out in the Application Fonn. u· your regi~tered holding(s) of Existing Ordinary Shares which were sold or transferred wae held in uncertificated fonn and were sold or transferred before 6.00 p.m. on 3 April 2014. a claim u-ansaction v.ill automatically· be generated by CREST which, on settlement, will transfer the appropriate number of Open Offer Entitlemenl<; to the purchaser or transferee. Instruction~ regarding split application~ are r-et out in the Application Fonn. This document conMitutcs a prospectus for the purposes of Allicle 3 of the Prospe<.:tus Directive relating to the Company (the "Prospectus") and has been prepared in accordan.::e with Pmt 5 of the Invesunent Funds, Companies and :Miscellaneous Provisions A't 2005. Part 5 of the Prospectus Regulations, and the EU Prospectus Regulation. This Prospectus has hl!cn approved by the C..::ntral Bank. as competent authority under the Prospectus Directive. The Central Bank only apprO'CS this Prospccrus as meeting the requirements imposed under Irish and EU law pursuant to the Pro~pecms Directive. Such approval relates only to the ~ew Ordinary Shares which are w be admitted to tradinJ:! on the regulated market of the Irish Stock Exchange or other regula(C{I markets for the purposes of Directive :!004/39/F..C or which are to be offered to the public in any member state of the European Economic Area. This Prospectus has heen made a'ailable to the public in Ireland and the United Kingdom in accordance with Part 8 of the Prospectus Re-gulations by the 5.atnc hcing made available. free of charge. in electronic fonn on the Company's wcbsite (www.grccnpropcrtyrcit.com). The Company has rcquc.<.ted that the Central Hank provide a ccnificate of approval and a copy of this Prospectus to the FCA in the United Kingdom for the purposes of tl1e Prospecru~ Directive. The Company and the Directors, whose names and functions are set out in Part V (Directors, Company S(•cretary, R~gist..>rd Office, lm·e.1tment Manager and Adl'isors) of this Prospenu~. accept re~ron~ibility for the infonnation contained in this Prospectus. To the best of the knowledge and belief of the Company and the Directors (who have taken all rea~onabk care to ensure that such is the case). the information contained in this Pros~tus is in accordance with the facl~ and the Prospectus makes no omission likely to affect its import. The distribution of this Prospectus and any documents issued by thr Company in connection with the Capital Raise into any jurisdictions outside Ireland and the United Kingdom may be restricted by law and therefore person~ into whose possessiun this Prospectus and/or any accompanying documents comes should inform themselves .about and observe !.Uch restrictions. Any failure to comply with any such restrictions may constitute a violation of the securities laws or regulations of such jurisdictions. In particular, subject to certain exceptions, this Prospectus and any documents issued by the Company in C{lnnect.ion with the Capital Raise should not be distributed, forwarded to or transmitted in the United Slates or any of the Excluded Territories or to US Persons. All Overseas Shareholders and any person {including, without limitation, agents, custodians, nominees or trustees) who has a contractual or other legal obligation to rorward any documents i.'>!.ued by the Company in connection with the Capital Raise, if and when received, to a jurisdiction outside Ireland and the United Kingdom should read paragraph 8 of Part XVI (Terms and Conditions ofthe Open Offer) of this Prosp«tus. The Exi<;ting Ordinary Share.; are li~ted on the Official Lists and are traded on the regulated markel~ fm listed securities of the lri~h Stock Exchange and the London Stock Exchange. Application will be made to (iJ the Irish Stock Exchange for the New Ordinary Shart~ to be admitted h' listing on the primary listing segment of the Official List of the Irish Stock Exchange (the '"Irish Official List"): (ii) the UK Listing Authority for the New Ordinary Shares to he admitted to listing on the premium li~ting segment of the Official List of the UK Listing Authority (the ""UK Official List"' and together with the Irish Official List. the '"Official Lists"); (iii) the Irish Stock Exchange Limited for t11e New Ordinary Shares to be admitted to trudiug on it~ regulated market for listed securities: and tiv) to the London Stock Exchange for tl1e New Ordinary Shares to he admiued to trading on il~ main market for listed securities. Admissinn to the Official Lisl<;, together with admission to trading on the rt"gulated market ol tl1e Irish Stock Exchange and the main market of the London Stock Ex~;hange. respectively, for listed securities constitutes admission to official listing on a stnck exchange (the ·'Admission..). Subject to certain conditions being satislied. as ~t out in Part XVI (7i.•nns and Conditions of tile Open Offer), it h expe.cted that Admissinn wi11 become effecti,·e and that dealings will commenn>: in the New Ordinary Shares al8.00 a.m. on 2 May 2014. GREEN REIT PLC (Incorporated and registered in Ireland under the Irish Companies Acts with registered number 529378) PROSPECTUS Proposed Firm Placing and Placing and Open Offer of in aggregate 356,969,696 New Ordinary Shares at €1.12 per New Ordinary Share to raise approximately €399.8 million Davy J.P. Morgan Cazenove Joint Bookrunner. Joint UK Sponsor and Irish Sponsor Joillt Bookrunner and Joint UK Sponsor Your attention is drnwn to thl' letter from the Chairman of thl' Company which is set out in Part VII (Utter from th~ Chairman) of tbis Prospe-ctus. You should read the whole of thb I•rospcctus. Qualifying Shan.-holders and .any other persons contemplating a purchase of New Ordinary Shares should review Ute risk factors set out in l'art II (Risk Factors) of this Prospt-ctus for a discussion of certain factors that should be considered when deciding on what action to take in relation to the Firm l'lacing and l'lacing and Open Offer and deciding "hdher or not to purchase New Ordinary Shares. A cir('ular is also being issued to Shareholders today in connection with the EG:1 of the Company con••ened to he held for the purpose of l"onsidering and, if thought fit... approving the Resolutions in connection with the Capital Raise. The EGM is convened to be hdd at 10.00 a.m. on I May 2014 at the Conrad Dublin Hotel, Dublin 2.Ireland.

- 7. The Capital Raise is conditional, inter alia. on (i) die passing ofall of dle Resolutions at die EGM: (ii) Admission ofthe New Ordinary Shares becoming effective hy not later than 8.00 a.m. on 2 May 2014 (or such later time and date as the Company and Joint Bookrunners may agree not being later than 8.00 a.m. on 30 May 2014); and (iii) on the Placing and Open Offer Agreement becoming unconditional in all respects and not having been terminated in accordance with its tem1s. The New Ordinary Share:. will, on Admission, rank in full for all di,•idends and other distributions declared, made or paid on the Existing Ordinary Shares after Admission and will 01herwi~e rank pari passu in all material respects with the f_-.;i~ting Ordinary Shares in is~uc at the date of this Prospectus. Qualifying ~on-CREST Shareholders (other than. suhject to certain exceptions, Qualifying Nl)n-CREST Shareholders with registered addresses in the United States or any oflhe Exduded Territories) will be sent an Application Fonn on 7 April :!014. Qualifying CREST Shareholders (other than, subject to certain e-.:ceptions, Qualifying CREST Shareholders with registered addresses in !he United States ot any ofthe Excluded Territories), none of whom will receive an Application Form, will receive a credit to their appropriate stock account~ in CREST in respect of the Open Offer Emillemenb which will be enahled for settlement at 8.00 a.m. on 8 April :!014. Qualifying CREST Shareholders who are CREST sponsored members should refer to their CREST sponsors Tt'garding action to ~ taken in connection with !his Prospectus and the Capital Raise. Applications under the Open Offer may only be made by Qualifying Shwholders originally entitled or by a person entitled by ·inue of a b(lnafuie market claim arising out of a sale or tran~fer of Existing Ordinary Shares prior to !he date on which the Exi::ting Ordinary Shares were marked "ex" the entitlement by the Irish Stock Exchange and the London Stock Exchange. The lat~t time and date for acctptance and payment in fuU under the Open Offer is 11.00 a.m. on 30April2014. The procedu~s for acceptance and payment are set out in Part XVI tT~rms and CondUions ofthe Open Offer) of this Prospectus and, where rele,·ant, in the Application Form. Holdings of Existing Ordinary Shares in certificated and uncertiticated fonn will be treated as separate holdings for the purpose of calculating entitlement~ under the Open Offer. Fractional entitlement~ will not he alloued to Qualifying Shareholders and, where applicable, fractional entitlement~ will he rounded down to the nearest whole number of Open Offer Shares. D:~.vy (which is authorised and regulated in Ireland by !he Central Bank) is acting exclusively fur the Company. a.-; joint bookrunner. Irish sponsor and joint UK sponsor in relation to the Finn Placing and Placing and Open Offer, and no one else (including the recipients of this Prospectus) in connection with th..: arrangement~ described in this Prospectus and will not be respon~ible to anyone other than the Company fur providing the p101ectiuns afforded to its customer!Jdients for !he contents of thi~ Prospectus or for advising any other person in connection with the Finn Placing :~.nd Placing and Open OtTer (to the extent required or any other mauers referred to in this Prospectus. Apart from the responsibilities and liabilities, if any, l<hich may be imposed on Davy by the Central Bank or by FSM- or the regulatory regime e~tablished thereunder. Davy, or any per1>on affiliated with it. makes no representation or wananty, express or implit>d. with re~pect to the accuracy, ·eriiication or completeneJ.s of any information contained in the Prospectus and accepts no responsibility wh:tboever for, nor doe~ it authori~e. the content~ of the Prospectus or it.!. publication, including without limit.:Ition under Section 41 of !he Investment Funds, Companie1:o and Miscdlaneous Provbion~ Act 2005, or Regulation 31 of dle Irish Prospectus R..:gulations or any other st:ttement made or purponed to be made by !he Company, or on itl> behalf. in connection with !he ammgement<. described in this Prtlspectus, and nothing in thh Prospectus, is or ~hall be read a~. a promise or rcpre~ntation in this re~pcct., whether as to the past or future. Davy accordingly di.sclairus to the fullest extent permitted by law all and any li:tbility whatsoever whether 3rising out of ton. contr.tct or otherwise (save as referred to above) which it might otherv.•iJ.e have to any person other than the Company in respect of thi:o. Prospectus or any olhc-r :o.tatcment. J.P. Morgan Ca1.enove (which is aulhorised in the United Kingdom hy the PRA and regulate.d in the United Kingdom by the FCA and PRA) is acting exclusively for the Company, as joint hookrunner and joint UK spon~or in relation to the Finn Placing and Placing and Open Offer, and no one else (including. the recipients of this Prospectus) in connection with the arrangement-; described in this Prospectus and w11l not be responsible to lnyone other than the Company for providing the protectkms afforded to "1L~ cusiOmer~/clienL~ for the contents of this Pm-;pectus or for advising any other person in connection with the Fim1 Placing and Placing and Open Offer (to the extent required) or any other matters referred to in thi" Prospectu". Apart from the responsibilities and liahilities, if any, which may be impo~ed on J.P. ~-forgan Ca1enove hy t11e PRA and/or FCA or by FSM:A or the regulatory regime established thereunder. J.P. ;vtorgan Ca7enove, or any person affiliatt'd with it., makes no represent.ation or warranty. e-..::prcss or implied, w11h respect to the accuracy, verification or completeness of any information contained in the Prospectus and accepts no responsibility whaL~oever for, nor doe~ it authorise. the contents of the Prospectus or it~ publication, including without limitation under Section 41 of the lnvesunent Funds. Companies and Miscellaneous Provisions Act 2005. or Regulation 31 of !he lrio;h Prospectus Regulations or any other statement made or purported to be made by the Company, or on its behalf, in connection with tlle arra.ngement~ described in this Pro~pectus, and nothing in this Prospectus i<. or shall he read as a promise or repre.o;;.entation in this r~sp~cl. whl:"iht".r ~s to the past or future. J.P. Morgan Cazenove accordingly disclaim<; w the fullest exttlll permitted by law all and any liability whaL<.oever whether arising out of ton, contract or otlterv.'ise which it might otherwise (save as referred to ahove) h&xe to any person other dlan the Company in respect of this Prospectus or any other statement. Neither this Prospectul> nor !he Application foiTTI con~titutcs or forms part of any offer or invitation to sell or i~sue, or any solicitation of any offer tn acquire, the New Ordinary Shares offered to any person with a registered addre1:os, or who is rc~ident or located, in the US or any of the Excluded Teniwries, ~ubject to certain exceptions, or to any per~on in any jurisdiction in which such an offer or solicilation is unlawful. The New Ordinary Shares have not been and will not be registered under the applicable securities laws of Australia. Canada. Japan. Switzerland or tl1c Republic of Somh Africa. Accordingly. subject to certain exceptions, the New Ordinary Shares may not he offered or sold in Australia. Canada, Japan, Switzerland or Sl•uth Africa or to, or for the account or benefit of. any resident of Australia, Canada, Japan, Switzerland or South Africd. All Overseas Shareholders and any person (including, without limitation, a custodian. norrrinee, agent or tru~tee) who is holding Existing Ordinary Shares for the benefit of such pt'r;,ons or who has a contr.tctual or legal obligation to forward this Prospectu~ or any Application FoiTTI. if and when received, or other doeumt'nt to a juri~ktion out-;ide Ireland or tl1e linited Kingdom, ;,hould rea.d paragr.tph 8 of Pan XVI (Tenns and Condition.f nftht> Opm Ojfu) of this Pro~pectus entitlt'd "Overseas Shareholder;,". Suhj~X:t to certain c.-.:ceptions. this Prospectus and !he Application Fonn should not be distributed, forv.'arded to or transmitted in or into tlle United .States or the Excluded Tenitories, to US Persons or in or into any jurisdiction or to any person~ (including US persons) where the extension or availability of the Capital Raise would brea.ch any applic:J.hle law. Sotice to US lm·e.~tors The New Ordinary Shares and th..: Open Offer Entitlements have nut been approved or disapproved by !he United St:~.tes Securities and Exch<mge Commission, any state securities commil>J.ion in the US or any US regulatory authority, nor have any of the foregoing authorities passed upon or endorsed the merits of the otTeling of the New Ordinary Shares or t.he accuracy or adequacy of tl1is Prospectu~. Any representation to the wntrary is a criminal offence. The Nt'w Ordinary Shares and the Open Offer Entitlements have not been, and will not be, registered under the US Securities Act of 1933. as amendc.-d (the "US Securities Acf'), or under the securities Jaws of any state or other jurisdiction of the United States and, subject lo certain exceptions, may not he offered or sold, directly or indirectly, within the United States or to, or for !he account or benefit of, US Persons (as defined in RegulationS under the US Securities Act ("RegulationS")). There will he no public offer of the New Ordinary Shares or Open Offer Entitlements in the United State~. The Company has not he<:n, and will not he, registered undt'r the CS Investment Company Act of 1940. as amended (the '·US Investment Company Act"). and investors will not be entitkd to the benefits of that Act. Tht' New Ordinary Shares madt' availaf:>k under the Finn Placing and Placing and Open Offer art' heing offered and sold (i) in the United States only to persons rt"a..~onably believed to be qualified imtirutional buyer;, (each a "QIB'") as detined in Rule 144A under the US Securities Act (..Rule 144A") that are also qualified purcha.<:ers ("QPs'") a.~ defined in se-ction 2(:1)(51) of the US Invc~unt'nt Comp:my Act :md the related rule~ thereunder in reli:mce 2

- 8. on Rule l44A or pursuam 10 anolher exemption from, or in a lransaction not subject w, lhe registration requirements of the US Securities Act; and (ii) outside of the United States 10 persons who are nm US Persons (as defined in Rcgul:llion S) in offshore tram.actions in reliance on Regulation S. Pro-,pective purchase~ are her.:by notitied that sellers of the New Ordinary Shares may be relying on !he exemption from the provhions of sectionS of the US SecuriliesAct provided by Rule 144A. For a description ofthesc and certain funher restrictions on offers, sales and tramfcrs ofthe New Ordinary Shares and the distribution of this Prospectus, sec paragraph S of Part XVI (Tnms and Gmditions ofthe Open O.ffer). Until the expiry of 40 days afkr the commencemem of the Firm Placing and Placing and Open Offer, an offer or "ale of rew Ordinary Shares within the United States by a dealer (whether or not it is participating in the Finn Plru•ing or Placing and Open Offer) may violate the registration requirements of the US Securities Act if such offer or ~e is made otherwi~e than in accordance with an applicable exemption from registration under the US Securities Act. The New Ordinary Share~ are ~ubject to selling and tran~fer restrictiom in cenain jurisdic1ions. Prospective purchasers should read the restrictions dc!.Cribcd in paragraph S of Pan XVI (Ji:mzs and Conditions f'f the Open Offer). Each purch:u.cr of the ~ew Ordin:rry Shares will be deemed to have made the relevant represent.ations described therein and in Part XVI (Tmns and Conditions ofthe Open Offer). SOTICE TO 1T.W HAMPSHIRE RF.SIDESTS NEITHER THE FACf THAT A REGISTRATION STATEMENT OR Al."l APPLICATION FOR A LICENSE HAS BEEN FilED UNDER CHAPTER 421-B OF THE NEW HAMPSHIRE REVISED STATUTES ANNOTATED. 1955, AS AME~DED ("RSA") WITH THE STATE OF KEW HA~1PSHIRE :-.lOR THE FACT THAT A SECURITY IS EFFEcnVELY REGISTERED OR A PERSON IS LICENSED IN THE STATE OF NEW HA~1PSHIRE CONSTITIJTES A FINDIKG BY THE SECRETARY OF STATE OF NEW HAMPSHIRE THAT ANY DOCUMENT FILED UNDER RSA 421-B IS TRUE, COMPLETE AKD NOT MISLEADING. NEITHER ANY SUCH FAC..'T NOR TilE FACT THAT /u' EXE.U'TION OR EXCEPTION IS AVAILABLE FOR A SECURITY OR A TRANSACTION MEANS THAT THE SECRETARY OF STATE HAS PASSED IN ANY WAY UPON THE MERITS OR QUALIFICATIONS OF. OR RECOMMENDED OR GIVEN APPROVAL TO, ANY PERSON, SECURITY OR TRANSAC..'TION. IT IS UNLAWFUL TO MAKE, OR CAUSE TO BE MADE. TO ANY PROSPECTIVE PURCHASER. CUSTOMER OR CLIENT ANY REPRESF..:~TATION INCONSISTEJ'T WITH THE PROVISIONS OF 11-IIS PARAGRAPH. NOTICE TO PROSPECTIVE 1~'"'F.STORS IN AUSTRALIA Thi<. Pro~pectu~ ha<. been prepared under the !au: and operating rules of a foreign market. namely Ireland and the United Kingdom. This Pro~pectus does not constitute a di.<,cJosure document under Pan tlD.2 or a product di~losure document under Chapter 7 of the Corporations Act 2001 of the C{1mmonwealth of Australia (the ·'Au.~traUan Corporations Act") and has not been. and will not be. lodged with the Auslralian Securitir-s and Investment~ Commission. At:cordingly, this Prospecms does not wntain all of the inlonnation a prospective investor in Australia would expe1.:1 to be contained in a disclo~ure document in Australia or which he/she may require to properly evaluate and consider making an investmem dedsion. The Company is not. and will not be, subject to lhe continuous disclosure requirement~ of the Aul.ttalian Corporations Act. The offer of New Ordinary Shares under this Prospectus to investors in Australia will only he m:ldc to the extent that such offe~ do nO! need di~closurc to investors under Pan 6D.2 or Chapu:r 7 of the Australian Corporations Act. In particular. any person who receives an offer of New Ordinary Shares under this Prospectus in Australia rcpre..ents and warran!S 10 the Company and the Joint Hookrunncrs that they are a per!.Dn who falls within an exemption from disclosure to investors provided by thcAustmli:m Corporations Act, including a ·'sophisticatc.d inve~tor" within the meaning of section 708(8) of the Corporations Act, a ''professional in'eswr" within the meaning of section 708( I I) of the Australi:m Corporations Act or a •·wholesale cliem"' within the meaning of section 761G of the Corporations Act. Any otTer of New Ordinary Shares received in Australia is void to the extent that it needs disclosure to investors under the Australian Corporatil.}ns Act. Any person to whom New Ordinary Shares are issued or .~old pursu3nt to an exemption fmm the disclosure requirement<> under the Australian Corpormions Act must not, within 12 months after the issue. l1ffer those New Ordinary Shares for sale in Auslralia unles..; that offer is itself made pur.;uam to a disclosure document under Pan 60.2 or Chapter 7 of the Au.;tralian Corporations Act or is it~elf made in reliance on an exemption from the disclosure requirement~ provided by the Au~>tralian Corpor::nions Act. General !'iotice Subject to ccnain exceptions, no document issued by the Company in connection wilh the Capital Raise h or constitutes an invitation or offer of ~ccuritics for l.Ubscription, sale or purchase to any person with a registered addres~. or who is resident or located, in the United States or the Excluded Territories or to, or for the account or bencfi1 of, :my US Person. Each of the Joint Bookrunners and any l)f their respective affiliates may, acting as im•e.~tor~ for their own acwum. in accordance with applicable legal and regulatory provisions, and subject to the provisions of the Placing and Open Offer Agreement, may retain, purcha:.e, sell, offer to sell or otheiWise deal for their 011 account(s) in relation to the New Ordinary Shares and/or related instrumenL~ in connection with the Capital Raise or otheiWise. Ac.:ordingly. references in this Prospec1us to Finn Placing and Placing and Open Offer Shares heing is~ued, offered, subscribed, acquired, placed or otherv.·i~e dealt in should be read as including any issue or offer to, or subscription, acquisition. pladng or dealing by. the Joint Booknmners and any of their affiliates acting as investors for their own act·ounL Except as required hy applicahle Jaw or regulation, the Joint B(){)krunner~ do not propose to make any puhlic di~do~ure in •elation to such tran~actions. In addilion the Joim Bookrunners or their affiliates may enter into financing arrangement~ (including ~waps or eontracL~ for difference) with investors in connection with which the Joint Bookrum1er~ (or their affiliates) may from time to time acquire, hold or dispose of Ordinary Share!.. In making an invcsuneot decision, each investor must rely on their own examination. analysis and .:nquiry of the Company and the terms of the Capital Raise, including the merits and risks invoh·ed. Each investor acknowledges that it has not relied on the Joint Bookrunncr~ or any person affiliated with the Joint Bookrunncrs in connection with any investigation of the accuracy of any infonuation contained in this Prospertus or it~ investmcm decision. No pen.on has been authorised to give any information or make any representations other than those contained in this Prospectus and, if given or made. such information or representation must not be rdied upon as having been :.o authorised by the Company or the Joint Boukrunners. Neither the delivery of this Prosl)l!ctus nor any subscription or sa1e made hereunder shall. under any circumstances, create any implication thar th.:rc has been no change in the affairs of the Company since the date of this Prospecrus or that the information in this Prospectus is correct as at any time subsequent to its dare. The Company will comply with its ohliga1ion to putllil.h a ~upplememary prospectus containing funher updated information if :.o required by law or by any regulatory :1mhority but assumes. no further obligation to publish additional information. The content<, of this Pro~rcctu~ should not be construed as legal, tinancial. hu~ine~s. investment, tax or other professional advic~. Each prospective inve~tor should consult his, her or it~ legal adviser, independent financial adviser or tax advi<.er for legal, financial, husiness, inve.~tment or t.ax advice. Pro<,pec!ive iovestor<. must inform them~dvcs a.~ to: (a) the legal requirement~ within the1rown countries fnr the purchase, holding, tramfer, redemption or other disposal of the New Ordinary Shares; (b) a.ny foreign exchange restrictions applicahle to the purchase. holding, transkr. redemption or other disposal of the New Ordinary Shares which they might enclmnter: and (c) the income and other tax con~uences which m3y apply in their own countrie~ as a result ofthe purchase, holding. transf~r. redemption mother dispmall)fthe New Ordinary Share~. This Prospectus i:. for your information only and nothing in this Prospectus is intended to endorse or recommend a panicular enurse of action. Ccn:lin tcm1s used in thi~ Pro~pectus, including ccnain technical and other iteffi!>. are explained and defined in Part XXI (Glossary ofTI'clmical TemiS) and Part XX (Defillitions), :u. the ca~e may be. 3

- 9. Past Performance is not a Reliable Indication for Future Perfonnance llistorica1 facts, infonnation gained from historic experience, present facts. circum~tance~ and infonnation, and assumptions from aU or any of these are not a guide to fumre pertonnance. Aim.:;, target~. plans and intentions referred to herein are no more than that and do not imply forecast.<>. The contents of the website~ of the Group do not form pan of this Prospectus. This Prospectus include.s statements that arc, or may be deemed to he, "forward.Jooking statement<;''. These forwa.rd·lo.oking ~tatemcnts can b.! idcmificd by the use offorward·looking tenninology. including the tenn~ "bdieves", "estimates", ''plans", "anticipates". "targets'', "aims", "continues", "expects". "intends", "may", ·'will", ··would" or ··should" or, in each case, their negatives or other variations or comparable terminology. These for.vard·looking statements include all matters that are not historical facts. They appear in a number of places throughout this Prospecrus and include statements regarding the Group intentions, beliefs or current expe<"tations concerning. among other things, the Group's result~ of operations. financial condition. liquidity. prospects. growth strategies and the markets in which the Group operates. By tht>ir nature, forward·looking statements invoh·e risk and uncertainty hecau<,(' they relate to future event~ and circumstam•es. A number of factors could cause acrual re;.ull<> and developments to differ materially from those expressed or implied by the forward·looking statements, including, u•ithout limitation: conditions in the markets, the market position ofthe Group. earnings, financial position, ca~h flrows, return on capital, anticipated investment." and capital expenditure~. changing business or other market conditiom and general economic conditions. These and other factor~ could adversely affect the outcome and financial effects of the event~ described herein on the Company and the Group. Fnrward.Jooking statements contained in this Prospecru~ based on these trends or activities should not be taken a~ a representation that such trends or activities will continue in the future. Except as may be required b} the ProspeL:tus Regulations, the Prospectus Rules, the Transparency Rules. the Market Abuse Rules, the UK Disclosure and Transparency Rules. the Listing Rules or by any other rules of any applicable rcgulawry OOdy or hy law. the Company disclaims any obligations or undcnal.ing to release publicly updates or revisions to any forward·looklng slatemcnts contained herein to rcflcl'l any changes in the Company's expeo:tations with regard thereto or any change in events, conditions or cin::umswnces on which any such statemem is based. 4

- 10. CONTENTS Page(s) PART 1: SUMMARY 6 PART II: RISK FACTORS 27 PART III: EXPECTED TIMETABLE 51 PART IV: CAPITAL RAISE STATISTICS 53 PARTY: DIRECTORS, COMPANY SECRETARY, REGISTERED OFFICE, INVESTMENT MANAGER AND ADVISORS 54 PART VI: IMPORTANT INFORMATION 56 PART VII: LETTER FROM THE CHAIRMAN 59 PART VIII: INFORMATION ON THE GROUP 67 PART IX: GREEN PROPERTY REIT VENTURES AND THE INVESTMENT MANAGER AGREEMENT 79 PART X: DIRECTORS AND CORPORATE GOVERNANCE 89 PART XI: OPERATING AND RNANCIAL REVIEW 96 PART XII: HISTORICAL RNANCIAL INFORMATION 107 PART XIII: UNAUDITED PRO FORMA FINANCIAL INFORMATION 129 PART XIV: PROPERTY PORTFOLIO 133 PART XV: PROPERTY VALUATION REPORTS 143 PART XVI: TERMS AND CONDITIONS OF THE OPEN OFFER I66 PART XVII: IRISH REIT REGIME AND TAXATION INFORMATION 192 PART XVIII: ALTERNATIVE INVESTMENT FUND MANAGERS DIRECTIVE 206 PART XIX: ADDITIONAL INFORMATION 208 PART XX: DEFINITIONS 248 PART XXI: GLOSSARY OF TECHNICAL TERMS 265 5

- 11. PART I SUMMARY Summaries are made up of disclosure requirements known as ·Elements'. These elements are numbered in Sections A-E (A.l-E.7). This summary contains all the Elements required to be included in a summary for this type of securities and Issuer. Because some Elements are not required to be addressed, there may be gaps in the numbering sequence of the Elements. Even though an Element may be required to be inserted in the summary because of the type of securities and Issuer, it is possible that no relevant information can be given regarding the Element. In this case a short description of the Element is included in the summary with the mention of 'not applicable'. Paragraph A - Introduction and warnings A.! Introduction and warning THIS SUMMARY SHOULD BE READ AS AN to prospective investors: INTRODUCTION TO THIS PROSPECTUS. ANY DECISION TO INVEST IN THE NEW ORDINARY SHARES SHOULD BE BASED ON CONSIDERATION OF THE PROSPECTUS AS A WHOLE BY THE INVESTOR, INCLUDING IN PARTICULAR THE RISK FACTORS. Where a claim relating to the information contained in this Prospectus is brought before a conrt, the plaintiff investor might, under the national legislation of the member states of the European Union, have to bear the costs of translating this Prospectus before the legal proceedings are initiated. Civil liability attaches only to those persons who have tabled the summary including any translation thereof, but only if the summary is misleading, inaccurate or inconsistent when read together with the other parts of the Prospectus or it docs not provide. when read together with other parts of the Prospectus, key infonnation in order to aid investors when considering whether to invest in such securities. A.2 Subsequent resale of Not applicable. The Company is not engaging any financial securities or final intermediruies for any resale of securities or final placement of placement of securities securities requiring a prospectus after publication of this through financial document. intermediaries: Paragraph B - Lo;suer B. I The legal and commercial The legal and commercial name of the issuer is Green REIT pic. name of the issuer: B.2 Domicile/legal form/ The Company is incorporated in Ireland with registered number legislation/country of 529378 as a public lintited company under the Irish Companies incorporation: Acts and is domiciled in Ireland. 6

- 12. B.3 Key factors relating to the nature of the issuer's current operations and its principal activities: B.4a Significant recent trends affecting the Group and the industries in which it operate.<: Green REIT is an Irish incorporated propeny investment company and has Irish REIT status under the TCA. The Group is focused on investing in commercial real estate, including office, industrial and retail assets in Ireland. In addition, the Company may consider investing in residential or multi-family assets together with commercial propeny as pan of a mixed use ponfolio. The Management Team, who advise the Group through the Investment Manager. focuses on properties which require active management and which fit with the Group's strategy of creating a real estate investment ponfolio capable of paying dividends in line with requirements of the Irish REIT Regime. The Property Portfolio comprises 16 investment properties all of which are located in Ireland and the majority are located in the Dublin region. The latest data from the IPD Commercial Property Index for the fourth quarter of 2013 supports the Management Team's belief in a continued improvement in perfonnance of the commercial property market with total returns increasing by 5.7% during the quarter (comprising capital growth of 3.6% and income returns of 2.0%) and a strong year-on-year total return for 2013 of 12.7%. (Source: IPD Commercial Property Index). Investment in Irish commercial real estate increased significantly in 2013. The aggregate value of transactions for 2013 was approximately €1.93 billion, over 3 times higher than aggregate values for 2012 of €557 ntillion and a further increase on 201 I which witnessed only €186 million of aggregate transaction value. The growing liquidity in the Irish commercial real estate market was demonstrated by deal activity in the fourth quarter of 2013, with transaction values reaching €804 million across 46 deals. Prime city centre offices continue to be the core focus for the majority of investors. which is driven by an expectation of rental growth in the short to medium-term. In terms of total volumes for 2013. offices accounted for 42%, followed by ntixed use (34%), industrial and other (16%) and retail (8%) (Source: Jones Lang LaSalle Research 2014). There have also been signs of continued improvements in cet1ain pans of the occupier markets. Within the core Dublin central business district there are signs of an increase in demand from potential tenants and a strengthening of prime Dublin office equivalent yields by I00 basis points during 2013. contracting from 6.75% at the end of 2012 to 5.75% by the end of 2013 (Source: CBRE Research 2014). There was a continued decline in the overall office vacancy rate in Dublin over the course of 2013. The overall availability rate has decreased from 20.25% in the first qua11er of 2012 to 15.33% in the final quarter of 2013 (Source: CBRE Research 2014). This was supported to some extent by a lack of new development with almost no speculative office development being completed during 2013 in Dublin. More than 170,000 m' of lettings and sales activity was achieved in the Dublin office market in 2013, an increase of 25% over 2012 activity. Office rents stabilised in the first quarter of 2013 following an average decline in rents of approximately 56% from a peak in 2007 with prime headline rents in the Dublin office 7

- 13. 8.5 Group Structure: 8.6 Major shareholders: 8.7 Selected historical key financial information: market increasing during the quarter and through the rest of the year. Prime office rents increased to €377 per m2 in the fourth quarter of 2013, giving rise to a total increase in prime headline quoting rents of approximately 25% during 2013 (Source: CBRE Research 2014). The Company is the holding company of the Group. The Company's various real estate assets are held through a number of subsidiaries. The Company's principal subsidiaries are Green REIT (ROI) Limited, Green REIT (BR) Limited, Green REIT Arena Limited, Green REIT Horizon Limited, Green REIT Mount Street Limited, Green REIT (Molesworth Street) Limited and Green REIT (Central Park) Limited. Insofar as the Directors arc aware, immediately prior to, and following, the Last Practicable Date, the name of each person who. directly or indirectly. is interested in 3% or more of the Company's capital. and the amount of such person's interest, will be as follows: Number '!f Number of Percentage of Ordinary Percenta.r:e nf Exirtillg Existing Share:'i EnlaT{~ed Ordinary J.uued S/Ulre following the Issued Share Name Shares CapitalCapiwl Raisem Capira/(11 Franklin Templeton Companies LLC -13,560,800 14.05% 88,203,657 13.22% Paulson & Co Inc. 40,000,000 12.90% 40,000,000 6.00% Blackrock Advisers Inc. 31,76:!,113 10.25% 31,762.113 4.76% LV$ U 30,969,000 9.99% 30.969.000 4.64% MarketfielJ Asset Managemem 30,174,000 9.73% 64,919,818 9.73% Inveslec Asset Management Limited JO.t 17,974 9.72% 30.117,974 4.52% Thrcadneedle Asset Management Limilcd ~1.612,708 6.97% 45,549,~93 6.83% Zurich Life Assurance plc 10,000.000 3.23% 31,4~8.571 4.711Jt GP Holdings(11 10.000,000 3.23% 10,000,000 1.50% !'>.'"oles: (I) GP Holdings is majority owned and controlled hy members of 1he Original Managemelll Team (other than Mr. Pat Gumte) and each member of the Original Management Team is also a diret.1or of GP Holdings. (::!) Assuming no take up under the Open Offer. The above listed Shareholders do not have different voting rights. The Company is not aware of any persons who. directly or indirectly, jointly or severally, exercise or could exercise control over the Company as at, or immediately following, Admission. Under the Irish REIT Regime. the Company will become subject to an additional tax charge if it pays a dividend to, or in respect of. a Substantial Shareholder unless it has taken "reasonable steps'' to avoid paying dividends to such a shareholder. The Articles contain provisions designed to avoid the situation where dividends may become payable to Substantial Shareholders. The tables below set out the Group's summary financial infmmation for the periods indicated. The financial information for the period from incorporation (being 24 June 2013) and ended on 31 December 2013 has been extracted without material adjustment from the audited conso1idated financial information of the Group for the period 24 June 2013 to 31 December 2013. 8

- 14. Group statement of comprehensive income For the periodfrom incorporation 01124 June 2013 to 31 December 2013 €'000 Revenue - rental income 1,708 Propeny outgoings (266) Net rental income 1,442 Net deficit on revaluation of investment propenies (44) Investment manager fee (854) Administrative expenses (467) Operating profit 77 Finance income 44 Profit before tax 121 Tax expense - Profit for the period 121 Other comprehensive income - Total comprehensive income for the period 121 Basic and diluted earnings per share (cents) 0.04 Group statement of financial position As at31 December 2013 €'000 Assets Non-current assets Investment propenies 192,140 Total non-current assets 192,140 Current asset' Trade and other receivables 3,738 Cash and cash equivalents 109.835 Total current assets 113,573 Total assets 305,713 Equity Share capital 31,000 Share premium 268,618 Retained earnings 121 Equity attributable to owners of the Company 299,739 Liabilities Current liabilities Amounts due to investment manager 480 Trade and other payables 5,494 Total current liabilities 5,974 Total liabilities 5,974 Total equity and liabilities 305,713 Net assets value per share (cents) 96.69 EPRA net assets per share (cents) 96.69 9

- 15. B.8 Selected key pro forma financial information: Selected Group cash flow information For tile period from incorporation 24 June 2013 to 31 December 2013 Cash inflow from operating activities Net cash used in investing activities Net cash inflows from financing activities 2,867 (192,650) 299,618 Save for: (i) the acquisition of the Danske 2 P01tfolio and (ii) the acquisition of the Central Park Portfolio there has been no significant change in the financial condition or operating results of the Company or the Group during or. as at the date of this document, subsequent to the periods covered by the selected historical key financial information set out in the table above. Set out below is the unaudited pro forma statement of net assets of the Group as at 31 December 2013. The unaudited pro fonna net asset statement has been prepared for the purpose of illustrating the effect of the Capital Raise, the acquisition of the Central Park Portfolio and the acquisition of the Danske 2 Portfolio on the Group's net assets as if those transactions had taken place on 31 December 2013. The unaudited pro forma net asset statement has been prepared for illustrative purposes only and, because by its nature it addresses a hypothetical situation it does not reflect the Group's actual financial position or results. The unaudited pro forma statement of net assets has been compiled on the basis set out in the notes below and has been prepared in a manner consistent with the accounting policies used by the Group in preparing the consolidated financial information for the period ended 31 December 2013 and in accordance with the requirements of paragraph 20.2 of Annex I of the Prospectus Directive Regulation and items I to 6 of Annex II of the Prospectus Rules. The pro forma financial information is presented as at 31 December 2013 which has been chosen as the most recent date for which financial information is disclosed in this document. 10

- 16. Unaudited pro forma statement of net assets as at 31 December 2013 Adjustments Historical Proforma lll'tasuts Acquisition nn assns as at Net prncerds C'jCmtra/ Acquisition as at 31 Decemher fromtM Park ofDansb! 31 Dectmhn :!OU C.npital Rairt Portfolio 1 Portfolio :!()13 Notts 5 ln €'()()() NC>tt 1 Nme2 Note3 Nott 4 and6 ~on-<:uiTCnt a.<;sets Jnv~~tment propcrtk'i 192,.140 - 114.750 22,129 329,019 Current a......et~ Trad~ and other receivahle5 3.738 - - {2.200) 1.538 Ca!.h and ca~h equivalents 109.835 384,784 (45.3:!0) {20.639) 428.660 --- --- --- --- Tntal current as.~et 113.573 384,784 (45.320) {22.839) 430.198 --- --- --- --- Tntal assets .305.713 384,784 09.430 (710) 759.217 --- --- --- --- --- Equity Share capital )IJIOO 35,697 - - 66.697 Share premium 268.618 349,0!S7 - - 617.705 Retained earnings 121 - {5,158) (710) t5.7·m --- --- --- --- --- Equity attributable to owners of the Company 299.739 384,734 {5.158) (710) 678,655 --- --- --- --- --- Current liabilities Amoun~ due to Ilm."stmt"nt Managt"r 480 - - - 480 Tradr and other payables 5.494 - - - 5,494 Loans and borrowing~ - - 74,588 - 7.J.,588 --- --- --- --- --- Total current liabilitits 5,974 - 74,588 - 80,562 --- --- --- --- --- Total liabilities 5.974 - 74.588 - 80.562 --- --- --- --- --- :-itt assets ::!99.739 384,784 (5.158) (710) 678.655 --- --- --- --- --- !'Ootes: I. The net >ISSt:L'- of th~ Group have been extracted, whiwut material adjustment, from the bi~tori.:al financial iniom~.;~tion of the Gruup. 2. The adju~tment retle.:ts the receipt ol the net proceed-. olthe Capital Rahe oi €384.8 million receh•ablc by th~ Company. This rrpre~ent» gro;~ prorttd~ oi ~99.8 million less e~timated tran)action co~~ and J.%ociated uxe~ ol€15.0 million. 3. TI1i~ adjusunent rtpre<;enL the Group's 50'X inve~tment in the Central Park Portfolio. On 2R ~larch 2014 The Central Park Limit...u P..umo:r~hip aC<)uired, through an entity OY.."Ded by it. the Central Parl PonfCIIIO. Th~ ('umpany holds 11 50% intcre~t in The Central Park Limited Partnership throu&h (i) it~ 50'l shareh(llding in Central P:u-k GP Co Limited u;hich is the general p:utner (If The Central Parl.: Limited Partncr~ip and {iil iL~ ~ubsidiary Gre<.'Il Ccntr.il Park LP which is a limited partner of The Central P..nk Limited ParuiCThip. The LVS Group hold!: :.1 504 intere-t in The Central P;u:k Limited Partner~h.ip through (i) the holdin~ by the LVS Central Park Shareholder of a 50<;r ~har.:holding in Central Park GP Co Limited which is the general partner of Th~ Central Parl;: Limited Partncn.htp and (1i) LVS CcnrraJ Park LP which i~ a hm1t~d partner of The Central Park l..Jmit~d Parlllership. The Central Park Limit~d P:utner&hip, through an .:ntity owned by 11. :tequircd the Central Park Pottlolio tm· ~~9.5 million, of which th~ Group·~ ~hare w~ 014.8 million. The C~mml Park Re~idential Portfolio wdS aetjuirtd by KW Re.J Estate pic. The Group's share nf the in·e~unent in the Centnl Purl Portfolio wa~ accounted for a>. follow~: .1 The apprcnimat~ !Jir value of the Group's 50% interest in the Cenual Pari.: Portfolio as .111 20 F.:hruary 2014 u;as €114.R milhon. 3.~ Debt tinancing fmm the Bravo Lender to The Central Patk Limited P.JfUlct>bip in the amount of €74.6 million (which rclleCL~ the Company's 50% interest in the Central P..u:lr.Limitcd Panner,hip). 3.3 A cash pa~ment to d1e seller satisfied from the Group·~ existing o:a:.h re~rves m tho:: amount of €40.2 million. ]A The Cnoup'~ ~hare ofthe e<;tirm.ted costs {including stamp duty lind mher acquisition related co.~t~) wa:. appro-.:imatcly €5.:! million. Investment property is initially mea~ur~d at co.1 and ~ul><;equently at fair value. Any ~;hanges ;u:e recognised in the ~latemem ot .:omprehensive income. 3.5 It L ..:xpectcd thlt th..: debt facihty provided by the Bravo Lender (~>.hich has a term uf ~h montlL) will be replac.:d by a tenn loan from one or more third party lending insutution~. Tho:: U.."illl~ and conditiom. of this tenn loan have not yet l:lct:n n~gotiatcd. 11

- 17. B.9 Profit forecasts: B.IO Report on the historical financial information - qualifications: B.ll Working capital - qualifications: 8.34 Investment policy: 4. Thi~ adjumncm reprc~enL~ the completiun of the Group'~ JOO'} ii.C!.juhitiun of !he Dan~ke ~ Ponfolio. The Dan~kl.' 2 Ponfolio was acqutred by the Group lollld cost, in aggregate. €:?.2.8 million, repre:-.en~d hy: 4.1 The paymeot of a depo~il by a .holly ow~d Group company un ~3 December ::!013 totalling fl.J million in respect of 30-33 ~iole~worth Suect, Dublin 2. 4.::! The pa)•ment of a deposit hy "'wholly oY.'Iled Group company on 23 De~mber 2013 totalling f0.9 million in respect of the Onnond Building. Dublin 7. 4.3 Payment of the balance of the com.ideration dlll.' on the Danske 2 Portfolio in the amount of €19.9 million on 5 March 2014. bcing the dme of completion. 4.4 The crJn,iderathm paid i~ equivalent to (a) the e..~tima~ market value at 31 Decemher :!013 of 30-33 Molesworth, Dublin ! of f3.0 miHon {Which appnrdmate~ the fair value) and ibl the c.<.timated market ·alue .il 31 December 2013 of Ormond Building. Dublin 7 off9.1 mil!ion (whkh approximate~ the fair value). 4.5 E~timaterl costs (including slaiilp duly aud other acquisidon related cos~) in lhe amount ui €0.7 million were inwm~J. lnvesunent property is initiillly meal'urcd at co~t and sub..equemly at fair value. Any change~ are recognised in the statement of comprehensive income. 4.6 The con~idcr.tt.ion p<~yablc wa.~ s.llti~ficd from the Group'~ c.xi~t.ing c11.<h re~ervc~. 5. No adju~uuents have been made to reflect any trading or 01.!Je.r transactions since 31 December 2013. 6. Thi~ unaudltct.! pro fonna statement of net a..,sct.~ doe>; not con.dtlne financial statements within the m.:amng of the Irish Companic~ Acts. Not applicahle. The Group has not made any profit forecasts which remain outstanding as at the date of this document nor docs this Prospectus contain any profit forecasts or estimates. Not applicable; KPMG·s report in respect of the historical financial infonnation included in this Prospectus was unqualified. Not applicable. In the optmon of the Company. taking into consideration the existing cash balances and the Net Proceeds to be received by the Company from the Capital Raise, the working capital available to the Group is sufficient for the Group's present requirements and. in pmticular, is sufficient for at least the next 12 months from the date of this Prospectus. The Group's investment focus is on freehold and long leasehold properties in Ireland, principally in Duhlin although investments in other urhan centres within Ireland. including Cork, Galway and Limerick. may also he considered. The Group is focused on investing in commercial real estate, including office. industrial and retail assets. In addition. the Group may consider investing in residential or multi-family assets together with commercial propet1y as part of a mixed use portfolio. The Management Team. who advise the Group through the Investment Manager. focuses on propetties which require active management and which fit with the Group's strategy of creating a real estale investment portfolio capahle of paying dividends in line with requiremenLs of the Irish REIT Regime. The Management Tean1 focuses on creating both sustainable income and strong capital returns for the Company with a target Total Shareholder Return of I0% to 15% per annum (pre taxation) both when the Original Net Proceeds are fully invested and when the Net Proceeds are fully invested.1 1. These arc target'> only and not profit forecasts. There can be no as,.urance that these targets can or w111 be met and they should not be seen as an indication of the Group's expected or actual results or returns. Accordingly im·estors should not place any reliance on these targets in deciding whether to invest in the New Ordinary Shares. In addition. prior to making any investment decision prospective investors !>hould carefully consider the risk factors de!icribcd in Part n (Risk Factor.~) of the Prospectus. 12

- 18. The Management Team may also consider propeny development or redevelopment opponunities but currently expects that this will fonn a limited component of the overall ponfolio bearing in ntind the principal focus of the Group on cash flow and dividend distribution. At any point in time, the aggregate development costs incurred in respect of assets under development at that time will not exceed 15% of the Company's most recently published NAY. The Group also intends to refrain from disposing of any asset within the period of three years from completion of development of that asset where development costs exceed 30% of the market value of that asset at the date of commencement of the development, as to do so may cause the Company to incur a tax charge under the Irish REIT Regime. This tax liability becomes due on the profits received from any such disposal. The Group has the ability to enter into a variety of investment structures, including joint ventures, acquisitions of controlling interests or acquisitions of minority interests within the parameters stipulated in the Irish REIT Regime. There is no limit imposed on the proponion of dte Group's ponfolio that may be held through joint ventures. although the Board's current expectation is that no more than 50% of the Company's net equity investment would be in the form ofjoint venture investments. Gearing The Group will seek to use gearing to enhance Shareholder returns over the long term. The level of gearing is monitored carefully by the Board in light of the cost of borrowing and the Group will seek to use hedging where considered appropriate to mitigate interest rate risk. The Board currently intends that gearing, represented by the Group's aggregate borrowings as a percentage of the market value of the Group·s total assets, will not exceed 35%. However the Board may modify the Group's gearing policy (including the level of gearing) from time to time in light of the then current econontic conditions, relative costs of debt and equity capital. fair value of the Company's assets, growth and acquisition opponunities or other factors the Board deems appropriate. In any event, under the Irish REIT Regime. the Group is restricted to a REIT LTV ratio which does not exceed 50%. Restrictim1s Pursuant to the Irish REIT Regime, the Group is required, among other things, to conduct a Property Rental Business consisting of at least three propenies, with the market value of any one property being no more than 40% of the total market value of the propenies in the Company's Property Rental Business. The Company has a three year grace period from the date of becoming an Irish REIT by the end of which it must comply with these requirements. Once fully invested, the Company will have a greater degree of diversification within the portfolio than the minimum required under the Irish REIT Regime, and the Group's ponfolio will continue to consist of a minimum of five properties with no one propcny investment exceeding 30% of the Group's total assets (including cash) at Lhe time of acquisition. Further. at least 75% of 13

- 19. B.36 Regulatory status: 8.37 Typical investors: 8.38 Investment of 20% or more of its gross assets in a single underlying issuer or investment company: R.39 Investment of 40% or more of its gross assets in another collective investment undertaking: the Group's annual Aggregate Income must be derived from its Property Rental Business and at least 75% of the market value of its assets must relate to its Property Rental Business. The Company is incorporated and operates under the Irish Companies Acts and the regulations made thereunder. The Company is curTently not subject to regulation by the Central Bank as a variable capital investment company pursuant to Part XIII of the I990 Act, a unit trust pursuant to the Unit Trusts Act I990 or as another form of regulated fund pursuant to any other collective investment scheme legislation in force in Ireland. Based on the provisions ofAIFMD and the AIFMD Regulations it is considered by the Directors that the Company may be an AIF within the scope of AIFMD and the AIFMD Regulations. If the Company is determined to be an AIF it may be categorised as an unregulated AIF or it may be brought within the scope of Irish collective investment scheme legislation as a regulated AIF. The Company elected to be an Irish REIT on 18 July 2013. The Group is a Group REIT and for the purposes of the Irish REIT Regime, the Company is the Principal Company. The Company and the Group will need to comply with certain on-going conditions and requirements in order to maintain Group REIT status (including minimum distribution requirements). The typical investors in the Company are expected to be institutional and sophisticated investors, and/or all types of private investors acting on the advice of their stockbroker or financial advisor, who are looking to allocate part of their investment portfolio to the Irish commercial real estate market, as well as specialised international real estate investors. An invesunent in the Company is suitable only for investors who are capable of evaluating the risks and merits of such investment, who understand the potential risk of capital loss and that there may be limited liquidity in the underlying investments of the Company and in the New Ordinary Shares, for whom an investment in the New Ordinary Shares constitutes pan of a diversified investment portfolio, who fully understand and are willing to assume the risks involved in investing in the Company and who have sufficient resources to bear any loss (which may be equal to the whole amount invested) which might result from such investment. Investors may wish to consult their stockbroker, bank manager, solicitor, accountant or other independent financial advisor before making an investment in the Company. Not applicable. The Group will not invest 20% or more of its gross assets in a single underlying issuer or investment company. and 20% or more of its gross assets will not be exposed to the creditworthiness or solvency of any one counterpany. Not applicable. The Group will not invest 40% or more of its gross assets in another collective investment undertaking. 14

- 20. 8.40 Applicant's service providers: lnvestmeni management arrangements The Investment Manager Agreement has been entered into between the Company and the Investment Manager pursuant to which the Investment Manager has been appointed on an exclusive basis to acquire properties on behalf of the Company, to manage the Company's assets and properties on behalf of the Company, to provide or procure the provision of various accounting. administrative, registration, reporting, record keeping and other services to the Company and to act as the Company's agent in the performance of the services under, and the conduct of material contractual dealings pursuant to, and in accordance with, the Investment Manager Agreement (subject to certain reserved matters), The Investment Manager Agreement provides that the Investment Manager shall be entitled to the Base Fee and the Performance Fee during the tem1 of the Investment Manager Agreement. The Investment Manager shall also be entitled to additional fees to be agreed with the Company in respect of the provision of any additional agreed services. Cash Manager Agreement The Company has appointed the Cash Manager as discretionary investment manager of some or all cash not yet invested by the Group in property assets or otherwise applied in respect of the Group's operating expenses t:ntrusted from time to time by the Group for management by the Cash Manager pursuant to the temts and conditions of the Cash Manager Agreement with the aim of preserving the capital value of such assets. Subject to the Company providing the Cash Manager with reasonable notice when it requires the liquidation and/or transfer of a part of the entrusted assets in order to pursue the Group's investment policy, the Company has given the Cash Manager full discretionary authmity to invest in vatious types of financial instruments including cash deposits, temt deposits, depositmy bonds, fixed rate depository bonds, commercial paper, treasuries, bonds with short tenn to maturity and government securities as well as floating rate notes and other money market instruments. For the services provided under the Cash Manager Agreement, the Company shall pay the Cash Manager an annual fcc not exceeding 20 basis points of the cash value of the assets, determined in accordance with acceptable industty practice, entrusted to the Cash Manager, charged and payable quarterly in arrears, The Company shall bear any costs or expenses properly incurred by the Cash Manager or any of its affiliates or delegates under the Cash Manager Agreement. Registry sen•ices Pursuant to the Registrar Agreement, the Registrar has been appointed to act as the Company's registrar. The Registrar was entitled to a one off management fee of €1 ,000 in relation to its services in connection with the Initial Issue and the creation of the share register. The Registrar is also entitled to a 15

- 21. B.41 Regulatory status of investment manager: 8.42 Calculation of Net Asset Value: fee of €2.25 per entry on the register per annum. subject to a minimum fee per annum of €4,000. and to additional fees for processing transfers, assisting at the Company's annual general meetings and other services. There is no maximum amount payable under the Registrar Agreement. The Registrar will also be entitled to certain out of pocket expenses. Treasury Advisor Pursuant to a retainer arrangement, JCRA (authorised and regulated by the FCA) provides advice to the Company and the Investment Manager in relation to treasury risk management issues. JCRA is entitled to a retainer fcc of €12,500 per quarter payable by the Company. The fees charged by JCRA will depend on Lhe services provided. There is therefore no maximum amount payable under the retainer arrangement. Audit services KPMG provides audit services to the Company. The annual report and accounts will be prepared in accordance with !FRS as adopted by the EU. The fees charged by KPMG will depend on the services provided, computed, among other things, on the time spent by the auditor on the affairs of the Company. There is therefore no maximum amount payable under KPMG's engagement letter. Investment Manager Green Property REIT Ventures was incorporated in Ireland on 24 June 2013 under the Irish Companies Acts (registered number 529378). It is currently not authorised or regulated. If the Company is an AIF (whether a regulated or unregulated AJF). the Investment Manager. as the Company's external manager, will be required to be authorised by the Central Bank as an AJFM under AlFMD. On the basis that the Company is likely to be considered to be an AIF. the Investment Manager has filed an application with the Central Bank to be authmised as an AJFM. At the date of the Prospectus, the Company has not appointed a depositary. Should the Investment Manager be authorised as the AIFM of the Company and/or required to do so by the Central Bank, it will be required to procure that the Company appoints a depositary in Ireland upon its authorisation as the AlFM of the Company. The NAY atnibutable to the Ordinary Shares will be published at the time of publication of the Company's interim and annual financial results through a Regulatory lnfonnation Service. The NAY will be based on the Company's real estate assets most recent valuations, as at 30 June and 31 December in each year, and calculated in accordance with !FRS as adopted by the EU. Valuations of the Company's real estate assets are made in accordance with the appropriate paragraphs of the RICS Red Book at the date of valuation. This is an internationally accepted basis of real estate valuation. The valuations will be undertaken by a suitably qualified independent valuation fim1 or firms. 16

- 22. 8.43 Cross liability: 8.44 Key financial information: 8.45 Portfolio: 8.46 Net asset value: C.l Description of type and class of securities being offered: C.2 Currency of the securities issue: C.3 Number of Ordinary Shares issued and par value: C.4 Rights attaching to Ordinary Shares: C.S Restrictions on transfer: Not applicable; the Company is not an umbrella collective investment undertaking and as such there is no cross liability between classes or investment in another collective investment undertaking. Green REIT has commenced operations and historical financial infonnation is included within this Prospectus. See element B. 7 of this Part 1 (Summary) for selected histmical key financial info1mation The Property Portfolio comprises of 16 investment properties all of which are located in Ireland and primarily Dublin. The Property Portfolio has been independently valued at €329.02 million as at 31 December 2013 (save for the Central Park Portfolio which was valued as at 20 February 2014). The Propet1y Portfolio comptises office (70.4% of the total gross value), retail (15.8% of the total gross value), industrial (2.7% of the total gross value) and other real estate assets (5.1% of the total gross value) and development land (located adjacent to the investment properties) (6.0% of the total gross value), all of which are located in Ireland. The Net Asset Value per Existing Ordinary Share at 31 December 2013 was 96.7 euro cents (calculated in accordance with EPRA guidelines). Paragraph C -Securities The Open Offer is being made to all Qualifying Shareholders. Pursuant to the Open Offer, the Company is proposing to offer in aggregate 267.727.272 New Ordinary Shares to Qualifying Shareholders at €1.12 per New Ordinary Share. When admitted to trading, the !SIN number of the New Ordinary Shares will be the same as that of the Existing Ordinary Shares. being IEOOBBR67J55. The !SIN number for the Open Offer Entitlements is IEOOBKGRCJ78. The New Ordinary Shares will be denominated in euro. On Admission, the Company will have in issue 356.969,696 fully paid New Ordinary Shares and 310,000,000 Existing Ordinary Shares each with a nominal value of €0.10 each, all of which will be issued fully paid. The New Ordinary Shares issued under the Placing and Open OtTer, when issued and fully paid. will be identical to and rank pari passu with the Existing Ordinary Shares, including the right to receive all dividends or other distributions made, paid or declared after Admission. Pursuant to the Anicles, the Directors may, on the allotment and issue of any shares, impose restrictions on the transfer or disposal of such shares comprised in a par1icular allotment as may be considered by the directors to be in the best interests of the shareholders as a whole. 17