Expe earnings 4 q10

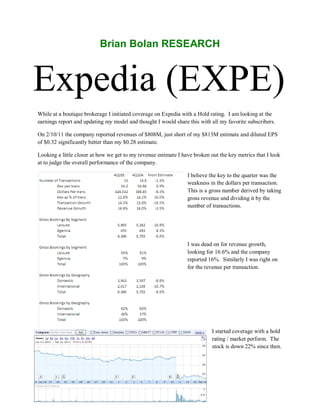

- 1. Brian Bolan RESEARCH Expedia (EXPE) While at a boutique brokerage I initiated coverage on Expedia with a Hold rating. I am looking at the earnings report and updating my model and thought I would share this with all my favorite subscribers. On 2/10/11 the company reported revenues of $808M, just short of my $813M estimate and diluted EPS of $0.32 significantly better than my $0.28 estimate. Looking a little closer at how we get to my revenue estimate I have broken out the key metrics that I look at to judge the overall performance of the company. I believe the key to the quarter was the weakness in the dollars per transaction. This is a gross number derived by taking gross revenue and dividing it by the number of transactions. I was dead on for revenue growth, looking for 16.6% and the company reported 16%. Similarly I was right on for the revenue per transaction. I started coverage with a hold rating / market perform. The stock is down 22% since then.

- 4. Portfolio of Brands Expedia provides a wide selection of travel products and services, from simple, discounted travel to more complex, luxury travel. Offerings primarily consist of airline flights, hotel stays, car rentals, destination services, cruises and package travel. The company also offers travel and non-travel advertisers access to a potential source of traffic and transactions through its various media and advertising offerings on both the TripAdvisor Media Network and other transaction-based websites. Expedia.com. The Expedia-branded websites make a large variety of travel products and services available directly to travelers through, www.expedia.com, as well as through localized versions of the Expedia website in several countries. Expedia-branded websites offer a consumer content on travel and the capability to book travel products and services on the site, including airline tickets, lodging, car rentals, and cruises from a large number of suppliers, on both a stand- alone and package basis. Hotels.com. The hotels.com website provides a broad selection of hotel properties to travelers, who can plan, shop for and book lodging accommodations, from traditional hotels to vacation rentals. Hotels.com provides travelers with premium content. Hotwire.com The discount travel website, hotwire.com, makes available airline tickets, hotel rooms, rental cars, cruises and vacation packages. Hotwire.com’s approach matches flexible, price-sensitive travelers with suppliers who have excess seats, rooms and cars they wish to fill without affecting the public’s perception of their brands. Hotwire.com travelers may enjoy significant discounts by electing to book travel services “opaquely,” without knowing certain itinerary details such as brand, time of departure and exact hotel location, while suppliers create value from excess availability without diluting their core brand-loyal traveler base. Venere.com The Venere-branded websites make approximately 30,000 hotel properties available to European consumers, through the website venere.com, and provide hoteliers with geographically diverse sources of demand. The TripAdvisor Media Network. TripAdvisor, a comprehensive online travel search engine and directory, aggregates traveler opinions and unbiased articles about cities, hotels, restaurants and activities in a variety of destinations. TripAdvisor also operates in China under the brand daodao.com. In addition to travel-related information, TripAdvisor’s destination-specific search results provide links to the websites of TripAdvisor’s travel partners (travel providers and marketers) through which travelers can make related travel arrangements. TripAdvisor has also acquired and now operates a number of travel media content properties within the TripAdvisor Media Network. Expedia Affiliate Network. A private label and co-brand program makes travel products and services available to travelers through third-party company-branded websites. Classic Vacations. Classic Vacations offers individually-tailored vacations, primarily through a national network of third-party retail travel agents.

- 5. Expedia CruiseShipCenters. Majority-owned by Expedia, CruiseShipCenters is one of North America’s leading sellers of cruise vacations. CruiseShipCenters has over 107 retail locations, a team of 2,000 professionally-trained cruise consultants, and a searchable online database of more than 10,000 cruise vacations. Egencia. Egencia is a full-service travel management company offers travel products and services to corporations and corporate travelers through points of sale in 15 countries across North America, Europe and Asia Pacific. Egencia charges its corporate clients account management fees, as well as transactional fees for making or changing bookings. In addition, Egencia provides on-site agents to some corporate clients to more fully support the account. Egencia has also begun offering consulting and meeting management services. eLong. Majority-owned by Expedia, eLong is an online hotel and air travel service company, based in Beijing specializing in travel products and services in China. eLong provides consumers with the ability to make hotel reservations at more than 10,000 hotels in over 450 cities across China and more than 100 countries worldwide Management Barry Diller, Chairman & Senior Exec - Expedia, Inc. Barry Diller is the Chairman and Chief Executive Officer of IAC/InterActiveCorp, and Chairman of Expedia, Inc. Since December 1992, beginning with QVC, Mr. Diller has served as chief executive for a number of predecessor companies engaged in media and interactivity prior to the formation of IAC. From October 1984 to April 1992, Mr. Diller served as Chairman and Chief Executive Officer of Fox, Inc. and was responsible for the creation of Fox Broadcasting Company in addition to Fox's motion picture operations. Dara Khosrowshahi, President & CEO - Expedia, Inc. Dara Khosrowshahi became CEO of Expedia, Inc. when it spun off from IAC/InterActiveCorp in August 2005. Prior to that, he was acting CEO of the travel portfolio within IAC from December 2004. Previously, Khosrowshahi had served as executive vice president and chief financial officer of IAC/InterActiveCorp since January 2002. In this capacity, he oversaw all financial matters of IAC, served in IAC's Office of the Chairman, and was directly involved in the expansion of IAC’s travel portfolio through various acquisitions. Michael Adler, CFO - Expedia, Inc. As Chief Financial Officer, Michael Adler oversees the planning and analysis of the global finance and accounting functions for Expedia, Inc. Prior to joining Expedia, Adler most recently served as senior vice president of financial planning and analysis for IAC/InterActiveCorp, He held a number of financial and operational roles during his five-year tenure at IAC.

- 6. Investment Thesis The online travel agent (OTA) industry has four major players that compete for the business of a highly fragmented hotel industry as and, to a lesser extent, the airline industry and rental car industry. Airlines sales provide large gross dollar bookings, but contribute little to the bottom line. The rental car industry, while possibly constrained by supply, has the exact opposite problem the airlines have in that their gross bookings are very small. The savior of the sector is the hotel industry, which is highly fragmented and the biggest contributor to net income of the three major suppliers. We believe that hotel bookings will continue to drive the OTA industry due to the consolidation in the airline industry (United and Continental) and in the rental car business (Hertz plans to acquire Dollar Thrifty, although Avis may show up as a late bidder). The hotel industry is coming off of a consolidation boom which saw both strategic (hotel buying hotel) and financial (private equity buying hotel) buyers bidding up a market that had severe capacity concerns in 2005-2007. Another chronic problem for the hotel industry has been its ill timed expansions that seem to coincide with economic downturns. With occupancy rates around 60%, hotels are lowering average daily rates (ADR) to stimulate demand, and continue to look to OTA’s to find customers. There are several concerns that the OTA’s face in both the short and near terms. One of the biggest is the economic concerns of Europe. Priceline.com, in particular, generates a majority of its revenues from the hotel business in Europe, which, given the economic uncertainty, may not be a destination of choice for foreign travelers. The situation could be compounded should a second volcano from Iceland erupt and possibly disrupt travel on an even larger scale that than the Eyjafjallajokull eruption in April 2010. Longer term, the implications of contract re-negotiations with several airlines loom on the horizon for 2012. Crude oil prices, which continue to dramatically affect the airline industry, and which also affect the hotel and rental car industries, could move higher and again strangle the leisure travel market as they did in the summer of 2008. Our view of the industry is that there will be several players for some time to come. Competition, whether via metasearch players like Kayak.com or other OTA’s, tends to benefit the consumer and stimulate travel. We view Expedia.com as having the deepest breadth throughout the categories of services provided and Orbitz the weakest in that category. Priceline.com is our top pick in the space due to its clean balance sheet, brand recognition and retention and market perception of being a leader in the space. Expedia is also attractive, but its brand is diluted across several properties and its financial structure may worry some. Orbitz, founded by five airlines, has shifted its focus to hotels and continues to try to build its brand, but its debt structure may impede future third party investment. Industry Discussion As we look at the online travel industry, we want to highlight a few key areas to better understand the industry as a whole. First, we will discuss the primary components of the online travel agent, the suppliers of travel services. Then we will look into the fees and metasearch and, finally, we will touch on traffic.

- 7. Airline Segment The airline industry has been plagued by overcapacity, financial losses and volatility in oil prices. Consolidation continues in the space, with the most recent tie-up of United Airlines and Continental showing that even the biggest airlines need to find ways to save on costs. From the consumer perspective, bigger isn’t necessarily better, as less competition ultimately drives prices higher. The same is true for OTA’s in that fewer suppliers could lead to lower revenues sources and thus potential decreases in future sales. Although an airline ticket does a lot to boost gross bookings, it is generally a very small contribution to net income. The recent moves by bother American Airlines and Delta point to further consolidation and cost cutting in the airline industry. We expect other airlines to look the potential of squeezing the OTA’s for better pricing or face a 100% elimination of supply. Positioning in front of negotiations is one move that Expedia has employed and it resulted in the airline suggesting consumers use Priceline.com. The eventual consumer decision has traditionally been one that has included competitor information unless a purchase comes solely from brand loyalty or brand “dislike”. Rental Car Segment The proposed consolidation of two major players in the rental car industry supports some recent anecdotal stories of very low supply of rental cars in select markets. The inventory issues of rental cars companies is a problem that can be solved quite quickly and with minimal impact to the OTA’s. The health of the business appears to be relatively stable with a small majority of rental cars coming from corporate travelers as opposed to leisure. Avis notes its mix is a 60/40 split of corporate and leisure customers respectively. Currently, the rental car sector is a small focus of the OTA’s. Hotel Segment With a highly fragmented ecosystem, the hotel industry appears as though it will always need the OTA’s to inform potential consumers and provide an easy transaction for those wishing to be customers. Large national chains serve as good proxies for the entire industry, but there are many smaller entities that will require OTA’s to maintain acceptable occupancy rates. The hotel sector has historically been out of touch with the supply and demand of the broader market over the last few decades. When times were good, supply was constrained and new construction was initiated. As the broader economy cooled, many new properties came on line just as demand was close to or had bottomed. More recently, the pattern has repeated itself as supply grew in the face of economic recession. Hotel News Resources has estimated that there are 1.1 million new hotel rooms under construction as of April 2010, suggesting that the trend will continue. While lower occupancies have historically increased the availability of discounted hotel rooms, and a lower rate of ADR growth can positively impact underlying room night growth, lower ADRs also decrease Expedia revenue per room night as their payment varies proportionally with the room price. Revenue per room night in 2009 declined 17%, primarily due to the downward movement in ADRs as well as adverse movements in foreign exchange rates and lower fees. Key leisure markets like Las Vegas and Hawaii have seen dramatic declines in ADR’s.

- 8. Fees and Metasearch The OTA’s are coming off the anniversary of a reduction in fees that occurred in 1Q09. This reduction in fees was spurred on by the success of the metasearch companies such as Kayak.com. Metasearch is simply an aggregator of all of the data from several sites presented to the consumer in a usable format to help locate the lowest price or best outcome from multiple service provider locations. Other metasearch companies in the past would “scrape” data off sites, sometimes with permission, mostly without. Kayak.com employs a different model, one where the OTA’s pay them for placement. This aggregation of prices ended up prompting a price war that saw the end of most fees by the OTA’s. This led to lower revenue and earnings for OTA’s and lower prices for consumers. The advertising expense that the OTA’s pay Kayak.com and the other metasearch sites is likely to be the focus of other technology companies, particularly Google which has purchased ITA Software. Yahoo! has a travel site that has transactions powered by Travelocity, whereas Google is not likely to partner for a transaction but instead deliver consumers to advertisers. This means that Google is a threat to the metasearch companies more than the OTA’s, and Yahoo!’s partnership with Travelocity potentially limiting the amount of advertising the other OTA’s are willing to spend on Yahoo!. The graph below from Compete.com shows that Expedia holds an edge over the other OTA’s in terms of unique users per month over the last year. Expedia’s depth of portfolio is the likely reason for the sizeable advantage it enjoys over its rival OTA’s. Macro Concerns for OTA’s The OTA’s are facing a challenging 2011. The weakening of the Euro may become a material problem for the entire industry as US-based travelers, who would normally take leisure trips to Europe when the exchange rate is so favorable, may not travel abroad due to the economic concerns in multiple countries. Those same concerns cast doubt on the amount of intra-European leisure travel as well, in effect causing a double hit to demand. Asian travel is also coming under pressure as civil unrest in Thailand will undoubtedly curtail a percentage of travel to the region. Australia and Canada have lowered the threat level to its citizens that have planned travel but still advise that people use caution and reconsider their travel plans.

- 9. The volcano in Iceland that disrupted air travel in Europe in April 2010 due to the massive ash cloud may see its larger neighbor erupt in the near term as well. Mid-May earthquakes around the site of the larger Katla volcano were thought to signal an eruption in near future. Although the near term in geological time could be several decades, it could also mean in the next several months or quarters. Should this volcano erupt, we would believe that shares of OTA companies will face severe pressure as European travel would like halt entirely. Finally, domestic concerns over the oil spill in the Gulf of Mexico have derailed travel in several Gulf states, particularly in the tourist-heavy Florida Gulf coast. The struggles of the Gulf Coast have been well documented and there is limited proof of any full scale tourism increase. This may benefit other domestic travel destinations, but concerns of a double dip recession may keep the leisure traveler spending less than average again this year. Comparable Companies OTA’s compete directly with one another (Priceline.com, Expedia, Orbitz (and Travelocity) as well as many other firms. The OTA’s offer transaction services that separate them from the metasearch players such as Kayal.com and the Fly.com division of TravelZoo. Priceline.com Expedia and Orbitz compete for advertising revenue with large internet portal sites, such as America Online and MSN who offer listing or other advertising opportunities for travel-related companies. The companies also compete with search engines like Google, Bing and Yahoo! Search that offer pay-per-click advertising services. Priceline.com (NASDAQ: PCLN) - Priceline.com Incorporated enables consumers to use the Internet to save money on a variety of products and services. The Company's product allows customers to name their own price on products or services and communicates that demand directly to participating sellers or to their private databases. Participants include domestic and international airlines, and hotel chains. Expedia (NASDAQ: EXPE) - Expedia, Inc. provides branded online travel services for leisure and small business travelers. The Company offers a wide range of travel shopping and reservation services, providing real-time access to schedule, pricing and availability information for airlines, hotels, and car rental companies.. Orbitz. (NYSE: OWW -,) - Orbitz Worldwide, Inc. offers travel services over the Internet. The Company's website offers air, hotel, vacation package, car rental, cruise, travel insurance, ground transportation, event ticket, and tour bookings. Travelzoo (NASDAQ: TZOO) - Travelzoo Inc. provides online marketing solutions to the travel industry. Through the Company's Web site, its newsletter, and by using its listing management software, travel companies can inform Internet users about their specials. Travelzoo serves companies such as Alamo Rent-A-Car, Delta Airlines, Expedia, and Hilton Hotels.

- 10. Universal Travel Group (NYSE: UTA ) - Universal Travel Group provides travel services. The Company's core services include booking services for air tickets, hotels, restaurants as well as tour routing for customers. Ctrip.com (NYSE: CTRP,) - Ctrip.com International, Ltd. is a consolidator of hotel accommodations and airline tickets in China. Sabre Holdings (Privately Held) - Sabre Holdings, owner of Travelocity, is a world leader in the travel marketplace, Sabre Holdings merchandises and retails travel products and provides distribution and technology solutions for the travel industry. Sabre Holdings supports travelers, travel agents, corporations and travel suppliers around the world.