First insights cairn india ltd

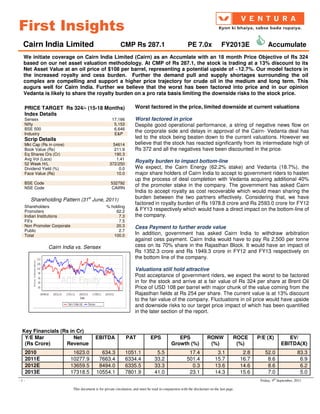

- 1. First Insights Cairn India Limited CMP Rs 287.1 PE 7.0x FY2013E Accumulate We initiate coverage on Cairn India Limited (Cairn) as an Accumlate with an 18 month Price Objective of Rs 324 based on our net asset valuation methodology. At CMP of Rs 287.1, the stock is trading at a 13% discount to its Net Asset Value at an oil price of $108 per barrel, representing a potential upside of ~12.7%. Our model factors in the increased royalty and cess burden. Further the demand pull and supply shortages surrounding the oil complex are compelling and support a higher price trajectory for crude oil in the medium and long term. This augurs well for Cairn India. Further we believe that the worst has been factored into price and in our opinion Vedanta is likely to share the royalty burden on a pro rata basis limiting the downside risks to the stock price. PRICE TARGET Rs 324/- (15-18 Months) Worst factored in the price, limited downside at current valuations Index Details Sensex 17,166 Worst factored in price Nifty 5,153 Despite good operational performance, a string of negative news flow on BSE 500 6,646 Industry E&P the corporate side and delays in approval of the Cairn- Vedanta deal has Scrip Details led to the stock being beaten down to the current valuations. However we Mkt Cap (Rs in crore) 54614 believe that the stock has reacted significantly from its intermediate high of Book Value (Rs) 211.9 Rs 372 and all the negatives have been discounted in the price. Eq Shares O/s (Cr) 190.3 Avg Vol (Lacs) 1.41 52 Week H/L 372/250 Royalty burden to impact bottom-line Dividend Yield (%) 0.0 We expect, the Cairn Energy (62.2% stake) and Vedanta (18.7%), the Face Value (Rs) 10.0 major share holders of Cairn India to accept to government riders to hasten up the process of deal completion with Vedanta acquiring additional 40% BSE Code 532792 NSE Code CAIRN of the promoter stake in the company. The government has asked Cairn India to accept royalty as cost recoverable which would mean sharing the Shareholding Pattern (31st June, 2011) burden between the two partners effectively. Considering that, we have factored in royalty burden of Rs 1978.8 crore and Rs 2593.0 crore for FY12 Shareholders % holding Promoters 62.2 & FY13 respectively which would have a direct impact on the bottom-line of Indian Institutions 7.3 the company. FII’s 7.5 Non Promoter Corporate 20.3 Cess Payment to further erode value Public 2.7 Total 100.0 In addition, government has asked Cairn India to withdraw arbitration against cess payment. Cairn India would have to pay Rs 2,500 per tonne Cairn India vs. Sensex cess on its 70% share in the Rajasthan Block. It would have an impact of Rs 1352.3 crore and Rs 1949.3 crore in FY12 and FY13 respectively on the bottom line of the company. Valuations still hold attractive Post acceptance of government riders, we expect the worst to be factored in for the stock and arrive at a fair value of Rs 324 per share at Brent Oil Price of USD 108 per barrel with major chunk of the value coming from the Rajasthan fields at Rs 254 per share. The current value is at 13% discount to the fair value of the company. Fluctuations in oil price would have upside and downside risks to our target price impact of which has been quantified in the later section of the report. Key Financials (Rs in Cr) Y/E Mar Net EBITDA PAT EPS EPS RONW ROCE P/E (X) EV/ (Rs Crore) Revenue Growth (%) (%) (%) EBITDA(X) 2010 1623.0 634.3 1051.1 5.5 17.4 3.1 2.8 52.0 83.3 2011E 10277.9 7663.4 6334.4 33.2 501.4 15.7 16.7 8.6 6.9 2012E 13659.5 8494.0 6335.5 33.3 0.3 13.6 14.6 8.6 6.2 2013E 17318.5 10554.1 7801.9 41.0 23.1 14.3 15.6 7.0 5.0 -1- Friday, 9th September, 2011 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 2. First Insights Oil Fundamentals remain intact With most of the large oil wells in decline state and no news flow on any major discoveries being announced we expected the supply side to remain curtailed. Coupled with the ever increasing demand for energy from the populated developing countries we expect demand for energy to continue to grow further straining the depleting supplies. This should ensure that oil prices will remain elevated for the foreseeable future. World Oil Supply and Demand Source: Industry Sources and Ventura estimates Major Oil producing countries production profile in a declining phase Country Year Peak Production (bn bbl) 2010 Production (bn bbl) Decline Rate US 1970 4.1 2.7 -1.0% Mexico 2004 1.4 1.1 -0.6% Argentina 1998 0.3 0.2 -0.6% Colombia 1999 0.3 0.3 -0.1% Venezuela 1998 1.4 0.9 -1.1% Norway 2001 1.2 0.8 -1.1% United Kingdom 1999 1.1 0.5 -2.0% Uzbekistan 1998 0.1 0.0 -2.8% Nigeria 2005 0.9 0.9 -0.1% Australia 2000 0.3 0.2 -0.9% Indonesia 1991 0.6 0.4 -1.3% Egypt 1993 0.3 0.3 -0.3% Libya 1970 1.2 0.6 -1.7% Oman 2000 0.4 0.3 -0.6% Syria 1995 0.2 0.1 -0.9% Trinidad & Tabago 1978 0.1 0.1 -1.6% Total 13.9 9.4 Source: BP Statistical Review of World Energy, 2011 This is extremely positive for Cairn and we estimate that for every $10 rise in the price of oil to contribute Rs 32.6 to the NPV per share. -2- Friday, 9th September, 2011 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 3. First Insights Sensitivity of NPV to oil price fluctuations 500 Our Best Case 450 Scenario Fair price in Rs per share 400 350 300 250 200 150 100 50 0 80 90 100 108 110 120 130 140 150 Oil Price at $ per barrel Fair Price Incremental Source: Ventura estimates Rajasthan Block- Key to future growth Rajasthan Block- Key Producing asset Currently Cairn is producing 1,25,000 bpd of crude from the Mangala fields and post approval from its minority partner ONGC and DGH (Director General of Hydrocarbon), it is expected to scale up to its production to 1,50,000 bpd. In addition to the Mangala field, the Bhagyam and Aishwarya fields are also expected to come on-stream and achieve stable production levels of 40,000 bpd and 10,000 bpd in Q4FY12 and H2FY13 respectively. Cumulatively the three fields are expected to produce 2,00,000 bpd of production which should cater to 20% of India’s total oil output. With Cairn all committed to meet its production targets, approval from the minority partner ONGC and DGH holds the key. We foresee no further impediments to the smooth passage of the deal as Cairn Energy and Vedanta are very likely to accept government riders for the approval of the Cairn- Vedanta deal. Gross Production Profile of MBA Asset 250.0 200.0 150.0 100.0 50.0 0.0 Gross prod. - MBA (000' bpd) Gross Prod MBA EOR ('000 bpd) Source: Cairn & Ventura estimates -3- Friday, 9th September, 2011 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 4. First Insights Cairn’s Rajasthan fields have significant 2P resources The total Proven and Probable (2P) reserves of the MBA fields is estimated to be ~ 649 mn boe while 300 mnboe or more is recoverable through EOR activity. Apart from the MBA fields, 22 other fields (including the Barmer Hill Formation) have been estimated to hold approximately 1.9 bn boe of resources, out of which, the 2P recoverable resources is estimated at 140 mnboe. Cumulatively Cairn’s exploration resource potential is of 2.5 bn boe. We expect the company to reach a production level of 190,000 bpd by FY13. On the back of enhanced production, we expect the Rajasthan field to contribute Rs 14,053.7 crore and Rs 20,258.1 crore to the revenue by FY12 and FY13 respectively. Matured Assets- Ravva & Cambay Fields have limited growth opportunities and drilling to commence on Sri Lankan Block Cairn Energy’s other assets; Ravva block (in KG Basin) and Cambay basin are matured assets with its production pegged at 34,800 /31,400 bpd and 11,400 / 10,100 bpd of oil and oil equivalent in FY12 / FY13 respectively. With production from these fields on a decline path, the assets have a production life of 7-8 years and hence present truncated growth opportunities. Cairn Lanka with 100% Working Interest in the NOC block in Sri Lanka has commenced its drilling plan in August 2011 and plans to dig 3 wells. Any hydrocarbon discoveries from this block would provide further upside to the stock. However we have not factored this in our valuations. Asset Profile for Cairn Energy Source: Cairn & Ventura Research estimates -4- Friday, 9th September, 2011 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 5. First Insights Train- 4 and Extended Pipeline to enhance operational performance and open export opportunities To ease the transportation of crude oil from the Rajasthan Block to other public and private refineries in India, Cairn energy has developed a transportation system consisting of four trains and a pipeline. At present the total operational capacity of the three operational trains is 30,000 bpd, 50,000 bpd and 50,000 bpd respectively. Train 4 with a capacity of 75,000 bpd is expected to be commissioned in H2CY11 and enhance total capacity to 2,05,000 bpd. In addition to the implementation of Train 4, Cairn is also undertaking extension of the MPT Salaya pipeline to Bhogat which is expected to be concluded in H2CY12 and will not only expand domestic reach to multiple refineries but would also open up the possibilities for export. Both these expansions are expected enhance sales while reducing operational expenses significantly. Key Concerns • Further delays in the approval for ramp up of production in the Rajasthan Fields from the minority partner ONGC and DGH would lower the value of the stock. • Volatility in Crude Oil Prices would have upside and downside risks to our valuations. -5- Friday, 9th September, 2011 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 6. First Insights Exhibit 01: Financials and Projections Profit & Loss Statement Key Ratios Y/E March, Fig in Rs. Cr FY2010 FY2011 FY2012e FY2013e Y/E March, Fig in Rs. Cr FY2010 FY2011 FY2012e FY2013e Net Sales 1623.0 10277.9 13659.5 17318.5 Per Share Data (Rs) % Chg. 13.0 533.3 32.9 26.8 EPS 5.5 33.2 33.3 41.0 Total Expenditure 988.7 2614.5 5165.5 6764.3 Cash EPS 5.6 36.5 41.1 52.1 % Chg. 0.0 164.4 97.6 31.0 DPS EBIDTA 634.3 7663.4 8494.0 10554.1 Book Value 178.5 211.9 245.1 286.1 EBIDTA Margin % 39.1 74.6 62.2 60.9 Capital, Liquidity, Returns Ratio Other Income 407.7 128.8 186.5 264.6 Debt / Equity (x) 0.1 0.1 0.1 0.0 PBIDT 1042.0 7792.2 8680.5 10818.7 Current Ratio (x) 1.5 2.7 3.9 4.5 Depreciation 10.9 611.3 1487.7 2107.1 ROE (%) 3.1 15.7 13.6 14.3 Interest 14.8 290.9 380.4 322.6 ROCE (%) 2.8 16.7 14.6 15.6 PBT 1016.3 6890.0 6812.4 8389.1 Dividend Yield (%) 0.0 0.0 0.0 0.0 Tax Provisions -34.8 555.6 476.9 587.2 Valuation Ratio (x) Profit After Tax 1051.1 6334.4 6335.5 7801.9 P/E 52.0 8.6 8.6 7.0 Exceptional Items P/BV 1.6 1.4 1.2 1.0 Reported PAT 1051.1 6334.4 6335.5 7801.9 EV/Sales 32.5 5.1 3.9 3.0 PAT Margin (%) 64.8 61.6 46.4 45.0 EV/EBIDTA 83.3 6.9 6.2 5.0 Operational Exp / Sales (%) 26.2 14.8 30.0 31.3 Efficiency Ratio (x) Employee Exp / Sales (%) 6.8 1.1 1.2 1.1 Inventory (days) 65.4 11.6 10.5 9.5 Other Mfr. Exp / Sales (%) 28.0 9.6 6.6 6.6 Debtors (days) 69.0 52.7 55.0 55.0 Tax Rate (%) -3.4 8.1 7.0 7.0 Creditors (days) 194.6 37.3 36.5 36.5 Balance Sheet Cash Flow Statement Y/E March, Fig in Rs. Cr FY2010 FY2011 FY2012e FY2013e Y/E March, Fig in Rs. Cr FY2010 FY2011 FY2012e FY2013e Share Capital 1897.0 1901.9 1902.5 1902.5 Profit After Tax 1051.1 6334.4 6335.5 7801.9 Stock options outstanding 46.4 55.5 55.5 55.5 Depreciation 10.9 611.3 1487.7 2107.1 Reserves & Surplus 31925.0 38335.8 44671.4 52473.2 Working Capital Changes -660.5 -761.4 -719.1 -292.5 Total Loans 3400.7 2678.2 2709.0 1562.4 Others -264.5 305.7 0.0 0.0 Net Deferred Tax Liability 445.3 561.2 561.2 561.2 Operating Cash Flow 137.0 6490.0 7104.1 9616.4 Total Liabilities 37714.4 43532.6 49899.6 56554.8 Capital Expenditure -3238.1 -2835.1 -2015.4 -3128.3 Gross Block 222.8 6653.9 7319.3 8197.7 Change in Investment -1541.1 618.0 -109.4 -120.4 Less: Acc. Depreciation 95.8 730.4 2218.1 4325.1 Cash Flow from Investing -4779.3 -2217.1 -2124.8 -3248.7 Net Block 127.0 5923.6 5101.3 3872.5 Proceeds from equity issue 0.3 4.9 0.6 0.0 Capital Work in Progress 9662.9 6066.8 7416.8 9666.8 Inc/(Dec) in Debt -955.7 -722.5 30.8 -1146.7 Goodwill 25319.3 25319.3 25319.3 25319.3 Dividend Paid Investments 1712.4 1094.4 1203.9 1324.3 Cash Flow from Financing -955.4 -717.6 31.4 -1146.7 Net Current Assets 717.6 5034.3 10764.0 16277.6 Net Change in Cash -5597.6 3555.3 5010.7 5221.0 Miscellaneous Exp. 175.2 94.3 94.3 94.3 Opening Cash Balance 6527.1 929.4 4484.7 9495.4 Total Assets 37714.4 43532.6 49899.6 56554.8 Closing Cash Balance 929.4 4484.7 9495.4 14716.4 Ventura Securities Limited Corporate Office: C-112/116, Bldg No. 1, Kailash Industrial Complex, Park Site, Vikhroli (W), Mumbai – 400079 This report is neither an offer nor a solicitation to purchase or sell securities. The information and views expressed herein are believed to be reliable, but no responsibility (or liability) is accepted for errors of fact or opinion. Writers and contributors may be trading in or have positions in the securities mentioned in their articles. Neither Ventura Securities Limited nor any of the contributors accepts any liability arising out of the above information/articles. Reproduction in whole or in part without written permission is prohibited. This report is for private circulation. -6- Friday, 9th September, 2011 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.