OCL India Poised for Growth

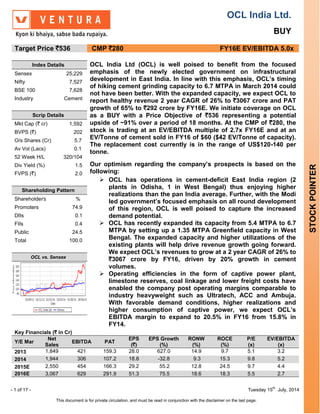

- 1. OCL India Ltd. BUY - 1 of 17 - Tuesday 15 th July, 2014 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page. STOCKPOINTER Target Price `536 CMP `280 FY16E EV/EBITDA 5.0x Index Details OCL India Ltd (OCL) is well poised to benefit from the focused emphasis of the newly elected government on infrastructural development in East India. In line with this emphasis, OCL’s timing of hiking cement grinding capacity to 6.7 MTPA in March 2014 could not have been better. With the expanded capacity, we expect OCL to report healthy revenue 2 year CAGR of 26% to `3067 crore and PAT growth of 65% to `292 crore by FY16E. We initiate coverage on OCL as a BUY with a Price Objective of `536 representing a potential upside of ~91% over a period of 18 months. At the CMP of `280, the stock is trading at an EV/EBITDA multiple of 2.7x FY16E and at an EV/Tonne of cement sold in FY16 of $60 ($42 EV/Tonne of capacity). The replacement cost currently is in the range of US$120-140 per tonne. Our optimism regarding the company’s prospects is based on the following: OCL has operations in cement-deficit East India region (2 plants in Odisha, 1 in West Bengal) thus enjoying higher realizations than the pan India average. Further, with the Modi led government’s focused emphasis on all round development of this region, OCL is well poised to capture the increased demand potential. OCL has recently expanded its capacity from 5.4 MTPA to 6.7 MTPA by setting up a 1.35 MTPA Greenfield capacity in West Bengal. The expanded capacity and higher utilizations of the existing plants will help drive revenue growth going forward. We expect OCL’s revenues to grow at a 2 year CAGR of 26% to `3067 crore by FY16, driven by 20% growth in cement volumes. Operating efficiencies in the form of captive power plant, limestone reserves, coal linkage and lower freight costs have enabled the company post operating margins comparable to industry heavyweight such as Ultratech, ACC and Ambuja. With favorable demand conditions, higher realizations and higher consumption of captive power, we expect OCL’s EBITDA margin to expand to 20.5% in FY16 from 15.8% in FY14. Sensex 25,229 Nifty 7,527 BSE 100 7,628 Industry Cement Scrip Details Mkt Cap (` cr) 1,592 BVPS (`) 202 O/s Shares (Cr) 5.7 Av Vol (Lacs) 0.1 52 Week H/L 320/104 Div Yield (%) 1.5 FVPS (`) 2.0 Shareholding Pattern Shareholders % Promoters 74.9 DIIs 0.1 FIIs 0.4 Public 24.5 Total 100.0 OCL vs. Sensex Key Financials (` in Cr) Y/E Mar Net Sales EBITDA PAT EPS (`) EPS Growth (%) RONW (%) ROCE (%) P/E (x) EV/EBITDA (x) 2013 1,849 421 159.3 28.0 627.0 14.9 9.7 5.1 3.2 2014 1,944 306 107.2 18.8 -32.8 9.3 15.3 9.8 5.2 2015E 2,550 454 166.3 29.2 55.2 12.8 24.5 9.7 4.4 2016E 3,067 629 291.9 51.3 75.5 18.6 18.3 5.5 2.7

- 2. - 2 of 17- Tuesday 15 th July, 2014 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page. Higher than expected ramp-up in utilization of the new capacity in West Bengal and/or in its existing facilities and higher than expected expansion in EBITDA margins owing to demand uptick are upside triggers to our Price Objective. Advantageous location in cement deficit East India Historically, East India has been a cement and limestone deficit region with the deficit demand being met from the South and the Central cement clusters. Hence, the utilizations and realizations in the region have been higher than the historical pan-India average. With the Modi led government’s focused emphasis on all round development of the East and North East India, these clusters will continue to be attractive markets for cement manufacturers. With its recently expanded capacity, OCL is well poised to benefit from the potential demand boost from this region. Capacity expansion and operating efficiencies to propel growth OCL, in March 2014, has commissioned a 1.35 MTPA Greenfield capacity in West Bengal at an investment of ` 525 crore, funded at a debt-equity ratio of 2:1. With the expansion, the total grinding capacity of OCL stands at 6.7 MTPA with a clinker capacity of 2.9 MTPA. The expanded capacity will help OCL achieve a healthy revenue growth in FY15-16E. We expect volumes to increase at a two year CAGR of 20% and realizations to grow at 6% during the same period. OCL enjoys operating efficiencies through captive limestone reserves, coal linkages and a 54 MW captive power plant. We expect OCL’s PAT to grow at a 2 year CAGR of 65% to ` 292 crore in FY16 led by healthy revenue growth and expansion in EBITDA margins. PAT margin is expected to expand to 9.5% in FY16 from 5.5% in FY14. We expect EPS to more than double to ` 51.3 in FY16 from ` 18.8 in FY14. Valuation We initiate coverage on OCL as a BUY with a Price Objective of `536 representing a potential upside of ~91% over a period of 18 months. At the CMP of `280, the stock is trading at an EV/EBITDA multiple of 2.7x FY16E and at an EV/Tonne of cement sold in FY16 at $60 ($42 EV/Tonne of cement capacity). The Price Objective is derived by applying a EV/EBITDA multiple of 5x on FY16E EBITDA of `629 crore. The replacement cost currently is in the range of US$120-140 per tonne. Higher than expected ramp-up in utilization of the new capacity in West Bengal and/or in its existing facilities and expansion in EBITDA margin with demand uptick are upside triggers to our price objective.

- 3. - 3 of 17- Tuesday 15 th July, 2014 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page. Company Background OCL India Ltd, earlier known as Orissa Cement Ltd, is a leading cement manufacturer in Eastern India. OCL, incorporated in 1950-51, has grown from a 500 TPD capacity to a ~18500 TPD capacity in 2014. The grinding capacity of 6.7 MTPA is backed by a 2.9 MTPA clinker capacity and a 54 MW captive power plant. Major end-markets are Odisha, Bihar and West Bengal, with around half of cement revenues stemming from Odisha. Cement sales (sold under the brand, ‘Konark’) constituted 86% of the revenues, while sales from the refractory division accounted for the remaining. OCL India is promoted by the Dalmia group; Dalmia Cement (Bharat) has a 48% stake in OCL India. Dalmia Bharat Group Structure 85%15% 100% 74%26% Adhunik Cements (100%) Calcom CementIndia (76%) Dalmia CementBharatLtd. OCL India (48%) FY14:Rs 1943 Cr Bokaro Cement (74%) Cement FY14:Rs 1,686Cr Primarily,Portland Slag Cement(PSC) Key markets: Odisha Biharand West Bengal Refractory FY14:Rs 257 Cr Primarily,Silica and Castables;major end-usein the steel industry Domestic and exportpresence Dalmia PowerLtd. Dalmia Bharat Ltd. (Holding Co; listed) DCB PowerVentures Kohlberg Kravis Roberts' Source: OCL , Ventura Research

- 4. - 4 of 17- Tuesday 15 th July, 2014 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page. Key Investment Highlights Advantageous location in cement deficit East India OCL derives around half of its sales from Odisha. Historically, East India has been a cement and limestone deficit region with the deficit demand being met from the south and the central cement clusters. Hence, the utilizations and the realizations in the region have been higher than the historical pan-India average. For instance, prices in East are currently hovering around ` 340 per bag, as compared to pan India average of ` 295 per bag. The eastern region (Bihar, West Bengal and Chhattisgarh) is expected to witness an addition of around 12 mn tones of capacities in FY15. However, we believe, with the Modi led government’s focused emphasis on all round development of the East and North East India, these clusters will continue to be attractive markets for cement manufacturers. OCL, with a capacity share of 14% in FY14, is well poised to benefit from the potential demand boost from this region. OCL Facilities Kapilas, Orissa 1.4 MTPA Cement Grinding Capacity Rajgangpur, Odisha 4 MPTA Cement Grinding Capacity and 54 MW Power plant Medinipur, West Bengal, 1.4 MTPA cement grinding capacity Lanjiberna Limestone and Dolomite Mine Source: OCL , Ventura Research

- 5. - 5 of 17- Tuesday 15 th July, 2014 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page. OCL earns majority of its revenues from Odisha 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% FY09 FY10 FY11 FY12 FY13 FY14 Bihar Odisha West Bengal Others Source: OCL, Ventura Research

- 6. - 6 of 17- Tuesday 15 th July, 2014 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page. Cement Industry prospects to improve Pan India utilizations expected to improve Cement prices increase in May-June 2014 60% 62% 64% 66% 68% 70% 72% 74% 76% 78% 80% 0 50 100 150 200 250 300 350 400 450 FY11 FY12 FY13F FY14F FY15E FY16E In MTPA Capacity Production Consumption Utilisation 190 240 290 340 390 Jun-13 Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 May-14 June2014 North Central East West South All India Source: OCL, Ventura Research Source: OCL, Ventura Research Utilisations to remain stable in North India Surplus capacities to restrict utilizations to 60- 65% in the South 70% 72% 74% 76% 78% 80% 82% 84% 86% 0 10 20 30 40 50 60 70 80 FY11 FY12 FY13P FY14F FY15E FY16E In MTPA Capacity Production Consumption Capacity Utilisation (RHS) 0% 10% 20% 30% 40% 50% 60% 70% 80% 0 50 100 150 200 250 FY11 FY12 FY13P FY14F FY15E FY16E In MTPA Capacity Production Consumption Capacity Utilisation (RHS) Source: OCL, Ventura Research Source: OCL, Ventura Research

- 7. - 7 of 17- Tuesday 15 th July, 2014 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page. Capacity expansion to propel revenue growth OCL had expanded its capacity from 2 MTPA to 5.35 MTPA in FY09. While there is no expansion planned at its existing facilities in Odisha, it has commissioned a 1.35 MTPA Greenfield capacity in West Bengal at an investment of ` 525 crore, funded at a debt-equity ratio of 2:1. With the expansion, the total grinding capacity of OCL stands at 6.7 MTPA with a clinker capacity of 2.9 MTPA. The expanded capacity will help OCL achieve a healthy revenue growth in FY15-16E. A typical Greenfield capacity in a new market takes ~ 3 years to achieve a utilization Utilizations to remain stable in cement deficit Central India Utilizations could pick up in the deficit Eastern Region 82% 83% 84% 85% 86% 87% 88% 0 10 20 30 40 50 60 FY11 FY12 FY13P FY14F FY15E FY16E In MTPA Capacity Production Consumption Capacity Utilisation (RHS) 72% 74% 76% 78% 80% 82% 84% 86% 88% 90% 0 10 20 30 40 50 60 70 FY11 FY12 FY13P FY14F FY15E FY16E In MTPA Capacity Production Consumption Capacity Utilisation (RHS) Source: OCL, Ventura Research Source: OCL, Ventura Research Utilisations to show marginal improvement in West 71% 72% 73% 74% 75% 76% 77% 78% 79% 80% 0 10 20 30 40 50 60 70 FY11 FY12 FY13P FY14F FY15E FY16E In MTPA Capacity Production Consumption Capacity Utilisation (RHS) Source: OCL, Ventura Research

- 8. - 8 of 17- Tuesday 15 th July, 2014 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page. rate of 65% depending on the market conditions. However, given the fact that West Bengal is already one of the key markets constituting around 20% of revenues, the ramp-up of utilization in OCL’s plant is likely to be faster. We have assumed conservative utilization levels of 40% in FY15 and 60% in FY16 in the recently commissioned West Bengal plant. We expect utilization levels in the existing plants to increase to 70%-75% in FY15-16 from an average of 65% in the past two years with the anticipated demand growth in East and North East India. Consequently, we expect volumes to increase at a two year CAGR of 20% and realizations to grow at 6% during the same period. Captive power plant, limestone reserves and coal linkages provide operating efficiencies OCL enjoys operating efficiencies through captive limestone reserves, coal linkages and a 54 MW captive power plant. Captive limestone reserves are adequate for the foreseeable future: Approximately 1.3 tonnes of limestone is required in the manufacturing of 1 tonne of cement. However, OCL manufactures the Portland Slag Cement (~90% of sales) variety which is a blended cement with a composition of 45%-55% slag. Hence, the limestone requirement for OCL comes down to 0.7-0.8 tones per tonne of PSC. OCL’s current limestone requirements are met entirely by its Lanjiberna Limestone and Dolomite mine having a reserve life of 27 years. With annual approved mining quantity of 4 MTPA, the reserves are sufficient to meet the requirements of the existing and expanded capacity. For the West Bengal plant, clinker will be transported from the existing unit in Odisha. Captive Power Plants and coal linkages: OCL has set up a 54 MW thermal based power plant for captive consumption. The first phase of 27 MW turned operational in September 2011, while the second phase of 27 MW was commissioned in April 2012. The power plant was set up at an investment of ~ ` 270 crore. The company has 40% coal linkage from Mahanadi Coal Fields, 20% is purchased at e-auction rates and the remaining requirement is imported. The OCL Sales and Realisations trend Cement FY11 FY12 FY13 FY14 FY15E FY16E Volumes ( in MTPA) 3.3 3.2 3.3 3.3 4.2 4.8 % growth -5.1% 5.0% 0.1% 27.3% 12.6% Average Realisation per tonne 4054.2 4133.5 5056.3 5056.3 5290.1 5715.4 % growth 2.0% 22.3% 0.0% 4.6% 8.0% Revenues ( in Rs Crore) 1354.1 1310.3 1683.7 1685.7 2245.3 2731.4 % growth -3.2% 28.5% 0.1% 33.2% 21.6% Source: OCL , Ventura Research

- 9. - 9 of 17- Tuesday 15 th July, 2014 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page. power plant is operating at optimum PLFs and meets OCL’s power requirements. The power plant is located at the Rajgangpur plant which meets 100% of its power requirements. From the Rajgangpur plant, power is transported to OCL’s plant in Kapilas, Odisha, which fulfills ~80% of the power requirements of the plant. Power for the West Bengal plant will be purchased from the grid. Freight Costs: With captive limestone quarry situated within 10-20 kms from the kiln and the end markets at a distance of 350 kms from the plant (industry average of 450-500 kms), the company’s freight cost as a proportion of revenues is lower compared to peers. Together, the benefits of captive limestone mines, power plant, coal linkages and lower freight costs have resulted in similar operating margins as compared to the large-sized peers. RM high due to higher limestone cost in East Coal linkages enable savings in fuel costs 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% FY11 FY12 FY13 FY14 OCL Dalmia Bharat ACC Ambuja Ultratech 10% 15% 20% 25% 30% 35% FY11 FY12 FY13 FY14 OCL Dalmia Bharat ACC Ambuja Ultratech Source: OCL, Ventura Research Source: OCL, Ventura Research Lower lead distance reduce freight costs EBITDA margin comparable to larger peers 5.0% 7.0% 9.0% 11.0% 13.0% 15.0% 17.0% 19.0% 21.0% 23.0% FY11 FY12 FY13 FY14 OCL Dalmia Bharat ACC Ambuja Ultratech 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% FY11 FY12 FY13 FY14 OCL Dalmia Bharat ACC Ambuja Ultratech Source: OCL, Ventura Research Source: OCL, Ventura Research

- 10. - 10 of 17- Tuesday 15 th July, 2014 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page. Key Risks Geographic concentration: OCL’s revenues are concentrated in East India and hence it faces the risk of any unforeseen events, both economic and natural, in the region. Further, given the over-capacity situation in South India, many players have been pushing volumes into the Eastern market, resulting in increased price competition for OCL. Further, if the demand does not pick up as anticipated, coupled with the fact that 12 mn tones of capacity is expected to be added in Central and East India in the next two years, OCL could face severe margin pressure. Coal costs: OCL imports 40% of its coal requirements. Any adverse movement in coal prices will hurt the company’s profitability.

- 11. - 11 of 17- Tuesday 15 th July, 2014 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page. Financial Performance OCL’s Q4FY14 revenues expanded 10.8% Y-o-Y to ` 538.6 crore led by pick-up in volumes. It reported an EBITDA of ` 91.84 crore in Q4FY14; EBITDA margin declined 100 bps to 17.1% in Q4FY14 owing to higher power and fuel costs and selling expenses. However, higher other income led to a PAT growth of 31% Y-o-Y to ` 41.6 crore in Q4FY14. PAT margin expanded 100 bps to 7.7% in Q4FY14. Q4FY14 EPS stood at ` 7.32. Financial Outlook We expect OCL’s revenues to grow at a 2 year CAGR of 26% to ` 3067 crore driven by 20% growth in cement volumes and 6% realization growth. The volume growth is due to a) ramp up in utilization levels in the 1.35 MTPA West Bengal Greenfield capacity which commenced production in March 2104. b) Increase in utilizations in the existing plants in Odisha as we expect significant infrastructural development in East India. We expect the refractory division to grow at a steady 10% CAGR to ` 335 crore in FY16 (12-13% of total revenues). Quarterly Financial Performance (` in crore) Particulars Q4FY14 Q4FY13 FY14 FY13 Net Sales 538.6 486.04 1855.5 1817.3 Growth % 10.8 2.1 Total Expenditure 446.78 396.93 1564.5 1400.7 EBIDTA 91.84 89.11 291.0 416.6 EBDITA Margin % 17.1 18.3 15.7 22.9 Depreciation 32.0 34.9 126.4 138.4 EBIT (EX OI) 59.8 54.3 164.6 278.2 Other Income 16.1 8.6 36.6 25.3 EBIT 75.9 62.8 201.2 303.5 Margin % 14.1 12.9 10.8 16.7 Interest 21.9 17.53 68.1 77.0 Exceptional items 0.0 0.0 0.0 0.0 PBT 54.0 45.3 133.1 226.4 Margin % 10.0 9.3 7.2 12.5 Provision for Tax 12.36 13.53 35.2 70.1 PAT 41.6 31.8 97.9 156.4 PAT Margin (%) 7.7 6.5 5.3 8.6 Source: OCL, Ventura Research

- 12. - 12 of 17- Tuesday 15 th July, 2014 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page. OCL’s EBITDA margin dropped ~900 bps to 15.8% in FY14. The overall economic slowdown resulted in flat volumes and realizations, while input costs continued to rise resulting in a steep drop in EBITDA margins. As the demand outlook looks bright, we expect margins to revert to 10 year historical mean of 20.5% in FY16E. There is scope for further margin expansion given that in the previous up-cycle, OCL reported a peak EBITDA margin of 28.3% in FY10. We expect OCL’s PAT to grow at a 2 year CAGR of 65% to ` 292 crore in FY16 led by healthy revenue growth and expansion in EBITDA margins. PAT margin is expected to expand to 9.5% in FY16 from 5.5% in FY14. We expect EPS to more than double to ` 51.3 in FY16 from ` 18.8 in FY14. 10 year historical EBITDA margin trend Revenues to grow; Margins to improve 10.0% 14.0% 18.0% 22.0% 26.0% 30.0% FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15E FY16E Mean - (1) std dev EBITDA Mean Mean + (1) std dev 0% 5% 10% 15% 20% 25% 0 500 1000 1500 2000 2500 3000 3500 FY12 FY13 FY14 FY15E FY16E Rs.Crore Revenues EBITDA margin (RHS) PAT margin (RHS) Source: OCL, Ventura Research Source: OCL, Ventura Research EPS and Return ratios to improve Leverage to reduce 0% 5% 10% 15% 20% 25% 30% 0 10 20 30 40 50 60 FY12 FY13 FY14 FY15E FY16E in Rs EPS RoE (RHS) RoCE (RHS) 0 2 4 6 8 10 12 FY12 FY13 FY14 FY15E FY16E in (x) D/E Interest Coverage Source: OCL, Ventura Research Source: OCL, Ventura Research

- 13. - 13 of 17- Tuesday 15 th July, 2014 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page. Valuation We initiate coverage on OCL as a BUY with a Price Objective of `536 representing a potential upside of ~91% over a period of 18 months. At the CMP of `280, the stock is trading at an EV/EBITDA multiple of 2.7x FY16E and at an EV/Tonne of cement sold in FY16 at $60. The Price Objective is derived by applying a EV/EBITDA multiple of 5x on FY16E EBITDA of `629 crore. The replacement cost currently is in the range of US$120-140 per tonne. Also, in our opinion, margins have bottomed out in FY13-14 and an improvement in profitability is imminent given the lucrative markets serviced by OCL thus presenting a great opportunity to enter the stock. Triggers to our Price Objective Higher than expected ramp-up in utilization of the new capacity in West Bengal and/or in its existing facilities Higher than anticipated realization growth Significant margin expansion with demand uptick Valuation Methodology Valuation Target EV/EBITDA (x) 5.0 FY16 EBITDA ( Rs crs) 629.3 EV ( Rs crs) 3146.4 Debt ( Rs crs) 229.7 Cash ( Rs crs) 131.0 Market Cap (Rs crs) 3047.7 No. of Shares ( in Crs) 5.7 Target price 536 CMP 280.0 % upside 91% Source: OCL, Ventura Research OCL attractively valued OCL Ltd Ultratech Cement ACC Ambuja Cements Dalmia Bharat India Cements Shree Cement Heidelberg Cement 4.0 8.0 12.0 16.0 20.0 0.5 50.5 100.5 150.5 200.5 ROE16E(%) EV/tonne of Cement Capacity (in$ FY16E) Source: OCL, Ventura Research

- 14. - 14 of 17- Tuesday 15 th July, 2014 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page. Peer Comparison – Ev/Tonne FY13 FY14 FY15 FY16 FY13 FY14 FY15 FY16 OCL Ltd 42.2 49.3 48.7 41.7 68.4 79.9 78.1 59.4 Ultratech Cement Ltd. 175.8 149.9 181.3 179.7 205.6 208.1 263.1 263.2 ACC Ltd. 120.3 117.1 117.8 120.0 143.9 136.3 164.2 152.2 Ambuja Cements Ltd. 173.0 173.1 174.2 152.0 219.1 210.5 222.3 211.8 Dalmia Bharat Enterprises 41.9 46.3 61.4 60.4 77.2 86.0 119.9 91.9 India Cements Ltd. 69.2 68.4 62.3 71.0 96.7 92.2 83.2 88.7 Heidelberg Cement India Ltd 54.4 70.4 79.0 58.0 112.1 103.6 99.7 66.8 Name EV/Tonne of cement capacity ( in $) EV/Tonne of Cement Sales ( in $) Source: OCL, Ventura Research Peer Comparison –Financial and Valuation Parameters Y/E Mar Net Revenue EBITDA PAT EPS EPS (%) RONW (%) P/E (x) EV/EBITDA (x) OCL India 2014 1943.5 306.1 107.2 18.8 -32.8 9.3 9.8 5.2 2015E 2550.0 454.0 166.3 29.2 37.7 12.8 9.6 4.4 2016E 3066.8 629.3 291.9 51.3 77.1 18.6 5.5 2.7 ACC 2014 11528.4 2216.8 1386.1 74.2 27.2 18.5 19.4 15.7 2015E 11168.7 1647.8 1019.6 53.9 -27.4 13.1 26.7 15.0 2016E 12051.0 1732.2 1100.4 58.6 8.8 15.9 24.6 11.6 Ambuja Cement 2014 10110.4 2599.6 1658.0 8.3 -1.4 19.4 20.8 12.1 2015E 9303.2 1701.2 1222.9 7.7 -28.8 12.0 29.1 18.9 2016E 19533.6 3499.5 1751.4 9.6 23.9 13.3 23.5 9.2 Ultratech Cement 2014 21731.3 4000.4 2148.2 78.3 -22.9 13.0 32.1 18.3 2015E 25082.0 5023.5 2614.7 95.4 21.9 16.8 26.3 14.3 2016E 28813.4 6260.9 3429.0 125.0 31.0 16.9 20.1 11.3 India Cement 2014 5106.9 711.7 21.8 0.8 -91.5 0.7 143.3 8.7 2015E 5496.9 813.6 111.0 3.6 362.3 6.3 31.0 7.6 2016E 6168.6 1010.4 236.7 7.7 112.4 8.2 14.6 5.8 Heidelberg Cement 2014 1389.6 123.7 -39.1 -1.7 -168.6 -3.3 28.9 19.8 2015E 1656.7 233.9 33.2 1.0 -159.9 3.2 60.6 9.6 2016E 1932.0 318.7 81.2 3.5 244.5 8.3 17.6 4.5 Source: OCL, Ventura Research

- 15. - 15 of 17- Tuesday 15 th July, 2014 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page. P/E 0 50 100 150 200 250 300 350 400 Mar-05 Mar-07 Mar-09 Mar-11 Mar-13 Mar-15 CMP 4X 6X 8X 10X 12X Source: OCL, Ventura Research P/BV 0 50 100 150 200 250 300 350 400 450 Mar-05 Mar-07 Mar-09 Mar-11 Mar-13 Mar-15 CMP 0.75X 1.03X 1.3X 1.58X 1.86X Source: OCL, Ventura Research EV/EBITDA 0 500 1000 1500 2000 2500 3000 3500 Mar-05 Mar-07 Mar-09 Mar-11 Mar-13 Mar-15 EV 3X 4X 5X 6X 7X Source: OCL , Ventura Research

- 16. - 16 of 17- Tuesday 15 th July, 2014 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page. Financials and Projections Y/E Mar, Fig in ` Cr FY 2013 FY 2014 FY 2015E FY 2016E Y/E Mar, Fig in Rs. Cr FY 2013 FY 2014 FY 2015E FY 2016E Profit & Loss Statement Per Share Data (Rs) Net Sales 1848.6 1943.5 2550.0 3066.8 EPS 28.0 18.8 29.2 51.3 % Chg. 25.7 5.1 31.2 20.3 Cash EPS 70.7 70.6 74.0 98.3 Total Expenditure 1427.4 1637.4 2096.0 2437.5 DPS 4.0 4.0 4.0 4.0 % Chg. 13.0 14.7 28.0 16.3 Book Value 187.8 202.0 227.9 275.9 EBITDA 421.3 306.1 454.0 629.3 Capital, Liquidity, Returns Ratio EBITDA Margin % 22.8 15.8 17.8 20.5 Debt / Equity (x) 0.7 0.6 0.4 0.1 Other Income 25.4 39.4 36.5 35.5 Current Ratio (x) 1.5 1.5 1.7 1.9 Exceptional items 0.0 0.0 0.0 0.0 ROE (%) 14.9 9.3 12.8 18.6 PBDIT 446.6 345.5 490.5 664.8 ROCE (%) 6.7 2.4 3.9 7.9 Depreciation 139.5 131.3 177.5 188.2 Dividend Yield (%) 2.8 2.2 1.4 1.4 Interest 77.7 71.1 63.5 38.8 Valuation Ratio (x) PBT 229.5 143.1 249.5 437.9 P/E (x) 5.1 9.8 9.6 5.5 Tax Provisions 70.1 35.6 82.3 144.5 P/BV (x) 0.8 0.9 1.2 1.0 Reported PAT 159.5 107.5 167.2 293.4 EV/Sales (x) 0.7 0.8 0.8 0.6 Minority Interest 0.1 0.4 0.8 1.5 EV/EBIDTA (x) 3.2 5.2 4.4 2.7 PAT 159.3 107.2 166.3 291.9 Efficiency Ratio (x) PAT Margin (%) 8.6 5.5 6.5 9.5 Inventory (days) 174.4 161.4 160.0 160.0 Power & Fuel as a % of sales 17.2 14.8 15.2 14.4 Debtors (days) 45.5 50.9 50.0 50.0 Freight cost as a % of sales 11.1 13.9 14.1 13.7 Creditors (days) 129.3 166.6 150.0 150.0 Balance Sheet Cash Flow statement Share Capital 11.4 11.4 11.4 11.4 Profit Before Tax 226.4 143.1 249.5 437.9 Reserves & Surplus 1057.3 1138.0 1285.5 1558.5 Depreciation & Amortisation 161.6 131.3 177.5 188.2 Minority Interest 3.3 3.5 4.3 5.8 Working Capital Changes -47.6 95.6 -33.0 -69.8 Long-Term Provisions 0.0 0.0 0.0 0.0 Direct Taxes Paid and Others -4.9 -3.9 -55.3 -141.2 Long-Term Borrowings 446.1 539.2 489.2 304.2 Operating Cash Flow 335.5 366.2 338.7 415.0 Other Long-Term Liabilities 31.8 32.8 35.0 35.0 Capital Expenditure -170.8 -333.3 -91.2 -100.0 Total Liabilities 1550 1725 1825 1915 Dividend Received 13.5 39.4 36.5 35.5 Gross Block 2083.7 2400.0 2628.0 2735.0 Others -136.6 7.2 0.0 0.0 Less: Acc. Depreciation 960.8 1092.2 1269.7 1457.8 Cash Flow from Investing -293.9 -286.7 -54.7 -64.5 Net Block 1122.9 1307.8 1358.3 1277.2 Increase/(Decrease) in Loan Fund 65.2 -55.0 -135.0 -280.0 Capital Work in Progress 141.8 158.8 50.0 50.0 Others -26.5 -26.6 -26.6 -26.6 Non-Current Investments 3.9 3.9 3.9 3.9 Interest Paid -73.0 -71.1 -63.5 -38.8 Net Current Assets 370.2 377.8 523.7 688.5 Cash Flow from Financing -34.3 -152.7 -225.1 -345.4 Deferred Tax Assets -130.1 -136.4 -136.4 -136.4 Net Change in Cash 7.3 -73.2 58.9 5.1 Other Non-Current Assets 40.3 12.9 25.8 31.0 Opening Cash Balance 132.8 140.2 67.0 125.9 Total Assets 1550 1725 1825 1915 Closing Cash Balance 140.2 67.0 125.9 131.0 Ventura Securities Limited Corporate Office: C-112/116, Bldg No. 1, Kailash Industrial Complex, Park Site, Vikhroli (W), Mumbai – 400079 This report is neither an offer nor a solicitation to purchase or sell securities. The information and views expressed herein are believed to be reliable, but no responsibility (or liability) is accepted for errors of fact or opinion. Writers and contributors may be trading in or have positions in the securities mentioned in their articles. Neither Ventura Securities Limited nor any of the contributors accepts any liability arising out of the above information/articles. Reproduction in whole or in part without written permission is prohibited. This report is for private circulation.