Deduction of rs.2000 under 87 a

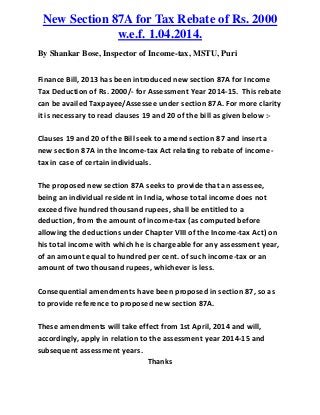

- 1. New Section 87A for Tax Rebate of Rs. 2000 w.e.f. 1.04.2014. By Shankar Bose, Inspector of Income-tax, MSTU, Puri Finance Bill, 2013 has been introduced new section 87A for Income Tax Deduction of Rs. 2000/- for Assessment Year 2014-15. This rebate can be availed Taxpayee/Assessee under section 87A. For more clarity it is necessary to read clauses 19 and 20 of the bill as given below :- Clauses 19 and 20 of the Bill seek to amend section 87 and insert a new section 87A in the Income-tax Act relating to rebate of income- tax in case of certain individuals. The proposed new section 87A seeks to provide that an assessee, being an individual resident in India, whose total income does not exceed five hundred thousand rupees, shall be entitled to a deduction, from the amount of income-tax (as computed before allowing the deductions under Chapter VIII of the Income-tax Act) on his total income with which he is chargeable for any assessment year, of an amount equal to hundred per cent. of such income-tax or an amount of two thousand rupees, whichever is less. Consequential amendments have been proposed in section 87, so as to provide reference to proposed new section 87A. These amendments will take effect from 1st April, 2014 and will, accordingly, apply in relation to the assessment year 2014-15 and subsequent assessment years. Thanks