Listed Equity REITs and Stocks: Income and Capital Appreciation

•Descargar como PPTX, PDF•

2 recomendaciones•351 vistas

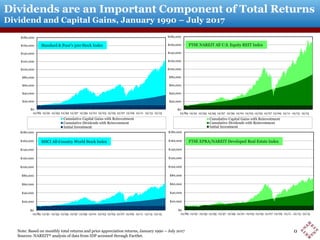

Cumulative income (cash dividends) and capital appreciation (share price growth) of listed equity REITs and stocks in the U.S. from December 31, 1991 through July 31, 2017. Equity REIT returns are from the FTSE NAREIT All U.S. Equity REIT Index; stock returns are from the S&P 500 Index. REITs have provided substantially stronger total returns during the "modern REIT era." This chart is updated monthly. Questions? Contact me at bcase@nareit.com.

Denunciar

Compartir

Denunciar

Compartir

Recomendados

This bibliography of published research comparing the performance of investments in private equity real estate and public real estate (REITs) shows that empirical data from the late 1970s to the present has never, ever, even once, suggested that institutional investments in private equity real estate have outperformed public real estate.Empirical Research on Performance of Private and Public Real Estate Investments

Empirical Research on Performance of Private and Public Real Estate InvestmentsBrad Case, PhD, CFA, CAIA

Más contenido relacionado

Similar a Listed Equity REITs and Stocks: Income and Capital Appreciation

Similar a Listed Equity REITs and Stocks: Income and Capital Appreciation (20)

2016 Q4 Investment Webinar - The San Diego Foundation

2016 Q4 Investment Webinar - The San Diego Foundation

Quarterly Investment Update: First Quarter 2014 Dimensional Fund Advisors

Quarterly Investment Update: First Quarter 2014 Dimensional Fund Advisors

Mother of All FinTech IPO Infographics by FT Partners

Mother of All FinTech IPO Infographics by FT Partners

Greater Baton Rouge Home Sales December 2017 Update provided by GBRAR.

Greater Baton Rouge Home Sales December 2017 Update provided by GBRAR.

From Good to Great: How to Ace Your Marketplace Fundraise

From Good to Great: How to Ace Your Marketplace Fundraise

Más de Brad Case, PhD, CFA, CAIA

This bibliography of published research comparing the performance of investments in private equity real estate and public real estate (REITs) shows that empirical data from the late 1970s to the present has never, ever, even once, suggested that institutional investments in private equity real estate have outperformed public real estate.Empirical Research on Performance of Private and Public Real Estate Investments

Empirical Research on Performance of Private and Public Real Estate InvestmentsBrad Case, PhD, CFA, CAIA

This document summarizes 61 independent academic studies of private equity investment performance, with at least one key quotation from each study, plus a web link to each one.

Most of the empirical evidence suggests that private equity investments perform relatively poorly, but some reach the opposite conclusion--generally those that do not take into account leverage or illiquidity risk.

Several of the studies investigate the ill effects of poor alignment of interests between investment managers and their investors. Some find evidence that investment managers manipulate their reported returns while they are raising capital for a follow-on fund; others find evidence that investment managers make poor investments to deploy unused capital. One shows that the way returns to private equity funds are measured makes it possible to achieve no better than average results for decades but to report spectacular performance.

Questions? Contact me at bcase@nareit.com.Updated Summary of Academic Research on Performance of Private Equity Investm...

Updated Summary of Academic Research on Performance of Private Equity Investm...Brad Case, PhD, CFA, CAIA

Más de Brad Case, PhD, CFA, CAIA (11)

Empirical Research on Performance of Private and Public Real Estate Investments

Empirical Research on Performance of Private and Public Real Estate Investments

Volatility Comparison, Public & Private Real Estate

Volatility Comparison, Public & Private Real Estate

Updated Summary of Academic Research on Performance of Private Equity Investm...

Updated Summary of Academic Research on Performance of Private Equity Investm...

Are Listed Equity REITs the Same as Unlisted Real Estate? Bibliography

Are Listed Equity REITs the Same as Unlisted Real Estate? Bibliography

Temporal Diversification in Real Estate Portfolios

Temporal Diversification in Real Estate Portfolios

Asset Class Correlations & Volatilities: End of July 2017

Asset Class Correlations & Volatilities: End of July 2017

REIT Returns and Interest Rates: Correcting an "Urban Legend"

REIT Returns and Interest Rates: Correcting an "Urban Legend"

REITs and Small Cap Value Stocks: Correlation, Volatility, Beta, and Alpha

REITs and Small Cap Value Stocks: Correlation, Volatility, Beta, and Alpha

Correlation and Beta: Listed Equity REITs and Stocks

Correlation and Beta: Listed Equity REITs and Stocks

Listed Equity REITs and Stocks: Income and Capital Appreciation

- 1. $0 $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 $180,000 12/89 12/91 12/93 12/95 12/97 12/99 12/01 12/03 12/05 12/07 12/09 12/11 12/13 12/15 $0 $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 $180,000 12/89 12/91 12/93 12/95 12/97 12/99 12/01 12/03 12/05 12/07 12/09 12/11 12/13 12/15 MSCI All-Country World Stock Index FTSE EPRA/NAREIT Developed Real Estate Index Price Return Note: Based on monthly total returns and price appreciation returns, January 1990 – July 2017 Sources: NAREIT® analysis of data from IDP accessed through FactSet. Dividends are an Important Component of Total Returns Dividend and Capital Gains, January 1990 – July 2017 $0 $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 $180,000 12/89 12/91 12/93 12/95 12/97 12/99 12/01 12/03 12/05 12/07 12/09 12/11 12/13 12/15 Cumulative Capital Gains with Reinvestment Cumulative Dividends with Reinvestment Initial Investment $0 $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 $180,000 12/89 12/91 12/93 12/95 12/97 12/99 12/01 12/03 12/05 12/07 12/09 12/11 12/13 12/15 Cumulative Capital Gains with Reinvestment Cumulative Dividends with Reinvestment Initial Investment Standard & Poor’s 500 Stock Index FTSE NAREIT All U.S. Equity REIT Index 0