Stock Research Report for BKS as of 9/8/11 - Chaikin Power Tools

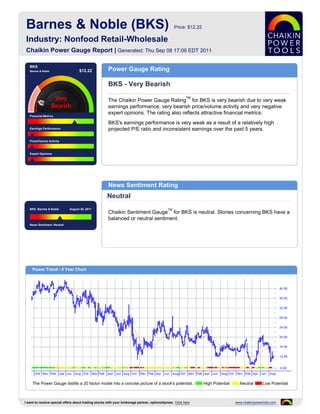

- 1. Barnes & Noble (BKS) Price: $12.22 Industry: Nonfood Retail-Wholesale Chaikin Power Gauge Report | Generated: Thu Sep 08 17:09 EDT 2011 BKS Barnes & Noble $12.22 Power Gauge Rating BKS - Very Bearish TM The Chaikin Power Gauge Rating for BKS is very bearish due to very weak earnings performance, very bearish price/volume activity and very negative expert opinions. The rating also reflects attractive financial metrics. Financial Metrics BKS's earnings performance is very weak as a result of a relatively high Earnings Performance projected P/E ratio and inconsistent earnings over the past 5 years. Price/Volume Activity Expert Opinions News Sentiment Rating Neutral BKS Barnes & Noble August 30, 2011 TM Chaikin Sentiment Gauge for BKS is neutral. Stories concerning BKS have a balanced or neutral sentiment. News Sentiment :Neutral Power Trend - 5 Year Chart The Power Gauge distills a 20 factor model into a concise picture of a stock's potential. High Potential Neutral Low Potential I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here www.chaikinpowertools.com

- 2. Financials & Earnings Financial Metrics Financial Metrics Rating LT Debt/Equity Ratio Bullish Price to Book Value BKS's financial metrics are very good. The company may be undervalued and has high revenue per share. Return on Equity The rank is based on a high long term debt to equity ratio, low price to book value, low return on equity and low price to sales ratio. Price to Sales Ratio Business Value Assets and Liabilities Valuation Returns Ratio TTM Ratio TTM Ratio TTM Current Ratio 1.09 Price/Book 0.96 Return on Invest -5.4% LT Debt/Equity 0.38 Price/Sales 0.11 Return on Equity -7.9% Earnings Performance Earnings Performance Rating Earnings Growth Very Bearish Earnings Surprise BKS's earnings performance has been very weak. The company is priced relatively high compared to next year's projected EPS and has an erratic 5 year earnings trend. Earnings Trend The rank is based on worse than expected earnings in recent quarters, a Projected P/E Ratio relatively high projected P/E ratio and inconsistent earnings over the past 5 years. Earnings Consistency 5 Year Revenue and Earnings Growth EPS Estimates 04/07 04/08 04/09 04/10 04/11 Factor Actual EPS Prev EST EPS Current Change Revenue(M) 5,261.25 5,410.83 5,121.80 5,810.56 6,998.56 Quarterly EPS $-0.22 $0.05 +0.27 Rev % Growth 3.10% 2.84% -5.34% 13.45% 20.45% Yearly EPS $-1.31 $-0.22 +1.09 EPS $2.31 $2.13 $1.38 $0.64 $-1.31 Factor Actual EPS Growth Est EPS Growth Change EPS % Growth 6.45% -7.79% -35.21% -53.62% -304.69% 3-5 year EPS 6.90% 0.00% -6.90 EPS Surprise EPS Quarterly Results Estimate Actual Difference % Difference FY Qtr 1 Qtr 2 Qtr 3 Qtr 4 Total Latest Qtr $-0.94 $-0.94 $0.00 0.00 04/09 $0.22 $-0.43 $1.40 $-0.58 $0.61 1 Qtr Ago $-0.97 $-1.04 $-0.07 -7.22 04/10 $-1.12 $-0.22 $1.01 $-1.04 $-1.37 2 Qtr Ago $1.13 $1.00 $-0.13 -11.50 04/11 $-0.99 - - - - 3 Qtr Ago $-0.07 $-0.22 $-0.15 -214.29 Fiscal Year End Month is April. I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here www.chaikinpowertools.com

- 3. Price Trend & Expert Opinions Price/Volume Activity Price/Volume Activity Rating Relative Strength vs Market Very Bearish Chaikin Money Flow Price and volume activity for BKS is very bearish. BKS is trading on lower volume than its 90 day average volume and is experiencing sustained selling. Price Trend The rank for BKS is based on its price strength versus the market, negative Price Trend ROC Chaikin money flow, a negative Chaikin price trend ROC and a decreasing volume trend. Volume Trend Relative Strength vs S&P500 Index Chaikin Money Flow Chart shows whether BKS is performing better or worse than the market. Chaikin Money Flow analyzes supply and demand for a company's stock. Price Activity Price Activity Volume Activity Factor Value Factor Value Factor Value 52 Week High 20.41 % Change Price - 4 Weeks -19.17% Average Volume 20 Days 1,186,310 52 Week Low 8.77 % Change Price - 24 Weeks 34.40% Average Volume 90 Days 1,463,646 % Change YTD Rel S&P 500 -11.35% % Change Price - 4 Wks Rel to S&P -24.42% Chaikin Money Flow Persistency 39% % Change Price - 24 Wks Rel to S&P 45.49% Expert Opinions Expert Opinions Earnings Estimate Revisions Very Bearish Short Interest Expert opinions about BKS are very negative. Analysts are lowering their EPS estimates for BKS and short interest in BKS is high. Insider Activity The rank for BKS is based on analysts revising earnings estimates downward, a high short interest ratio, insiders purchasing stock, optimistic analyst opinions and Analyst Opinions relative weakness of the stock versus the Nonfood Retail-Wholesale industry group. Relative Strength vs Industry Earnings Estimate Revisions Analyst Recommendations EPS Estimates Revision Summary Current 7 Days Ago % Change Factor Value Last Week Last 4 Weeks Current Qtr 0.05 0.05 0.00% Mean this Week Hold Up Down Up Down Next Qtr 1.47 1.47 0.00% Mean Last Week Hold Curr Qtr 0 0 2 1 Curr Yr 0 0 1 2 Current 30 Days Ago % Change Change 0.00 Next Qtr 0 0 1 2 Current FY -0.22 -0.13 -0.09 Mean 5 Weeks Ago Hold Next Yr 0 0 0 2 I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here www.chaikinpowertools.com

- 4. The Company & Its Competitors BKS's Competitors in Nonfood Retail-Wholesale News Headlines for BKS Company Power Historic EPS Projected EPS Profit Margin PEG PE Revenue(M) Judge OKs Books-A-Million, Borders deal - Aug Gauge growth growth 30, 2011 BKS 6.90% - -0.97% - - 6,999 Judge OKs Books-A-Million, Borders deal - Aug BBBY 8.63% 13.62% 9.33% 1.16 17.75 8,758 30, 2011 Liberty Media Buys $204 Million Stake in Barnes DKS 13.39% 16.34% 4.30% 1.07 19.06 4,871 & Noble - Aug 19, 2011 PETM 8.68% 15.10% 4.55% 1.13 18.28 5,694 Liberty Media Buys $204 Million Stake in Barnes & Noble - Aug 19, 2011 SPLS 9.01% 13.50% 3.76% 0.76 11.01 24,545 DealBook: Liberty Buys a Stake in Barnes & OMX -4.68% 10.00% 0.60% 0.86 9.71 7,150 Noble for $204 Million - Aug 18, 2011 ODP -3.70% 10.00% -0.09% - 43.50 11,633 Company Details Company Profile BARNES & NOBLE Barnes & Noble, Inc. is engaged in the retail sale of trade books (generally hardcover and 122 FIFTH AVE paperback consumer titles, excluding educational textbooks and specialized religious NEW YORK, NY 10011 titles), mass market paperbacks (such as mystery, romance, science fiction and other USA popular fiction), children's books, off-price bargain books and magazines. These Phone: 2126333300 collectively account for substantially all of the company's bookstore sales. Bestsellers Fax: 212-352-3660 represent only a small portion of the Barnes & Noble store sales. Website: http://http://www.barnesandnobleinc .com Full Time Employees: 30,000 Sector: Retail/Wholesale Power Gauge Ratings are created using a relative ranking system that assigns a rank of 0 to 100 (100 being the highest) to each stock in the universe. Rank is calculated by evaluating each of the stocks factors and combining them into a single number using a weighting formula. A stock's rank ranges from 100-0, where 100 is the strongest, and a rank of 95 indicates the stock is better than 95% of the stocks in the universe. Chaikin Stock Research(CSR) is not registered as a securities broker dealer or investment advisor with either the U.S. Securities and Exchange Commission or with any state securities regulatory authority. CSR is not responsible for trades executed by users of this research report, our web site or mobile app based on the information included herein. The information presented in this report does not represent a recommendation to buy or sell stocks or any financial instrument nor is it intended as an endorsement of any security or investment. The information in this report is generic by nature and is not personalized to the specific financial situation of any individual. The user bears complete responsibility for their own investment research and should seek the advice of a qualified investment professional before making any investment decisions. Copyright (c) 1978-(Present) by ZACKS Investment Research, Inc ("ZACKS"). The information, data, analyses and opinions contained herein (1) includes the confidential and proprietary information of ZACKS, (2) may not be copied or redistributed, for any purpose, (3) does not constitute investment advice offered by ZACKS, (4) are provided solely for informational purposes, and (5) are not warranted or represented to be correct, complete, accurate or timely. ZACKS shall not be responsible for investment decisions, damages or other losses resulting from, or related to, use of this information, data, analyses or opinions. Past performance is no guarantee of future performance. ZACKS is not affiliated with Chaikin Power Tools. This report from Chaikin Power Tools is for informational purposes only and is not a recommendation to buy or sell securities. LM 2.3 DS 3.0 LS 2.1 Data Provided by ZACKS Investment Research, Inc., www.zacks.com Special offers to trade stocks from optionsXpress: www.chaikinpowertools.com