Q2 2013 Houston Medical Office Market Research Report

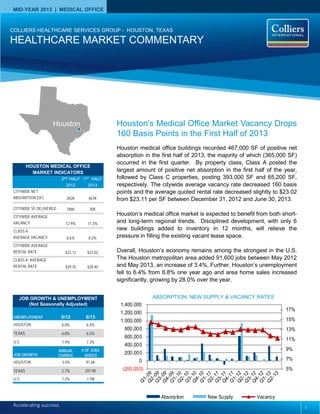

- 1. COLLIERS INTERNATIONAL | HOUSTON MEDICAL OFFICE | 2ND QUARTER 2010 MID-YEAR 2013 | MEDICAL OFFICE Accelerating success. HOUSTON MEDICAL OFFICE MARKET INDICATORS 2ND HALF 2012 1ST HALF 2013 CITYWIDE NET ABSORPTION (SF) 202K 467K CITYWIDE SF DELIVERED 186K 30K CITYWIDE AVERAGE VACANCY 12.9% 11.3% CLASS A AVERAGE VACANCY 8.6% 8.2% CITYWIDE AVERAGE RENTAL RATE $23.12 $23.02 CLASS A AVERAGE RENTAL RATE $29.35 $28.40 COLLIERS HEALTHCARE SERVICES GROUP - HOUSTON, TEXAS HEALTHCARE MARKET COMMENTARY Houston’s Medical Office Market Vacancy Drops 160 Basis Points in the First Half of 2013 Houston medical office buildings recorded 467,000 SF of positive net absorption in the first half of 2013, the majority of which (365,000 SF) occurred in the first quarter. By property class, Class A posted the largest amount of positive net absorption in the first half of the year, followed by Class C properties, posting 393,000 SF and 65,200 SF, respectively. The citywide average vacancy rate decreased 160 basis points and the average quoted rental rate decreased slightly to $23.02 from $23.11 per SF between December 31, 2012 and June 30, 2013. Houston’s medical office market is expected to benefit from both short- and long-term regional trends. Disciplined development, with only 6 new buildings added to inventory in 12 months, will relieve the pressure in filling the existing vacant lease space. Overall, Houston’s economy remains among the strongest in the U.S. The Houston metropolitan area added 91,600 jobs between May 2012 and May 2013, an increase of 3.4%, Further, Houston’s unemployment fell to 6.4% from 6.8% one year ago and area home sales increased significantly, growing by 28.0% over the year. 5% 7% 9% 11% 13% 15% 17% (200,000) 0 200,000 400,000 600,000 800,000 1,000,000 1,200,000 1,400,000 Absorption New Supply Vacancy ABSORPTION, NEW SUPPLY & VACANCY RATES Houston 1 UNEMPLOYMENT 5/12 5/13 HOUSTON 6.8% 6.4% TEXAS 6.8% 6.5% U.S. 7.9% 7.3% JOB GROWTH ANNUAL CHANGE # OF JOBS ADDED HOUSTON 3.4% 91.6K TEXAS 2.7% 297.9K U.S. 1.2% 1.7M JOB GROWTH & UNEMPLOYMENT (Not Seasonally Adjusted)

- 2. HEALTHCARE MARKET COMMENTARY | MID-YEAR 2013 | COLLIERS INTERNATIONAL HOUSTON COLLIERS INTERNATIONAL | P. Vacancy & Availability Houston’s medical office market occupancy increased during the first half of 2013 with the citywide average vacancy rate decreasing by 160 basis points to 11.3% from 12.9%. By property class, Class A vacancy rates posted the largest decrease during the first half of 2013, 530 basis points to 8.5% from 13.8% in 4Q 2012. Class C vacancy rates decreased 130 bps to 11.2% from 12.5%, while Class B vacancy rates increased 20 basis points to 12.8% from 12.6%. Sublease space has not had a significant impact on current vacancy rates, remaining below 0.5% of total vacant space over five years. Of the 3.0M SF of vacant space on the market at mid-year 2013, only 50,700 SF was sublease space. Disciplined medical office development activity has helped prevent major upheavals in current occupancy levels. There were only eight (8) new buildings (1.2M SF) added to the market during 2012 and just one (1) building (30,000 SF) delivered in the first half of 2013. The largest project completed within the past two years was the University of Texas MD Anderson Cancer Center Administration Building located at 7007 Bertner Avenue in the Texas Medical Center (895,600 SF owner occupied). Currently, the medical office construction pipeline is empty. Absorption & Demand Houston’s medical office market recorded 467,400 SF of positive net absorption in the first half of 2013. By property class, Class A posted the largest amount of positive net absorption in the first half of 2013, with 393,176 SF, followed by Class C properties posting 65,237 SF of positive net absorption. Class C posted only 8,986 SF of positive net absorption in the same period. Most of the Class A absorption occurred in Q1 2013 when MD Anderson moved in it’s new building on Bertner Avenue in the South Main/Medical Center submarket. Rental Rates Quoted full-service rental rates for all medical office property classes averaged $23.02 per SF at mid-year 2013, a decrease from $23.13 per SF recorded year-end 2012. Medical office building landlords continued to offer lease concessions including free rent to credit worthy tenants, but have decreased the amount of tenant improvement packages. By property class, on a bi-annual basis, the average Class A rental rate of $28.40 per SF decreased from $29.35 per SF, Class B increased to $22.91 from $22.77 per SF, and the average Class C rate increased from $17.21 to $17.83 per SF. MEDICAL OFFICE CLASS A & B VACANCY VS. RENTS $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 4% 6% 8% 10% 12% 14% 16% Q3-10 Q4-10 Q1-11 Q2-11 Q3-11 Q4-11 Q1-12 Q2-12 Q3-12 Q4-12 Q1-13 Q2-13 Class A Vacancy Class B Vacancy Class A Rents Class B Rents Class A 7,340,192 27.5% Class B 14,239,726 54.9% Class C 4,997,698 18.7% Class A Class B Class C (100,000) 0 100,000 200,000 300,000 400,000 500,000 600,000 700,000 Q3-10 Q4-10 Q1-11 Q2-11 Q3-11 Q4-11 Q1-12 Q2-12 Q3-12 Q4-12 Q1-13 Q2-13 Class A Class B Class C MEDICAL OFFICE NET ABSORPTION BY CLASS MEDICAL OFFICE EXISTING INVENTORY BY CLASS 2

- 3. HEALTHCARE MARKET COMMENTARY | MID-YEAR 2013 | COLLIERS INTERNATIONAL HOUSTON COLLIERS INTERNATIONAL | P. Sales Activity Transaction activity remained slowed slightly between year-end 2012 and mid-year 2013, with 30 properties changing hands compared to 57. According to CoStar Comps, Houston medical building sales transactions in the first half of 2013 had a total dollar volume of $46.3M, averaging $297 per SF with a 6.5% capitalization rate. Many of the transactions were multi-property portfolio sales, however, there were several single property transactions that occurred. The 46,380 SF 290 Medical/Office Plaza in the FM 1960/Hwy 249 submarket was purchased by the Bronner Family Trust in January for $9.6M. The 30,000 SF Memorial Hermann Covenant Care Building in the Northeast Near submarket was purchased by American Realty Capital Healthcare Trust, Inc. for $13.3M. There are currently 116 properties listed for sale and 4 pending transactions. Leasing Activity Houston’s medical office leasing activity reached 330,419 SF in the first half of 2013. By property class, Class B product led the market with 254,972 SF leased, followed by Class C at 48,600 SF, then Class A at 26,847 SF. Although the majority of new leases signed in the first half of the year were in the 1,000 - 5,000 SF range, there were a few larger lease transactions. St. Joseph Physician Services leased 13,500 SF at 2000 Crawford St in the Midtown submarket. St. Joseph Medical Center leased 5,200 SF at Heights Tower in the North Loop West submarket. Additional transactions under 5,000 SF include: Orion’s lease of 4,900 SF at Bayshore Medical Building in the Gulf Freeway/ Pasadena submarket and Legacy Community Health’s lease of 4,700 SF at the Bellaire Medical Professional Building in the Bellaire submarket. RBA: 46,380 SF Built: 2008 Buyer: Bronner Family Trust Seller: FM 1960 Medical Village Physicians, L.P. Sale Date: Jan 2013 Sale Price: $9.6M RBA: 30,000 SF Built: 2012 Buyer: American Realty Capital Healthcare Trust, Inc. Seller: Lasco Development Sale Date: Jun 2013 Sale Price: $13.3M Cap Rate: 6.75% 290 Medical/Office Plaza FM 1960/Hwy 249 Submarket SALES TRANSACTIONS Memorial Hermann Covenant Care Building Northeast Near Submarket 3 RBA: 7,194 SF Built: 2012 Buyer: TBD Seller: Fmc Houston Partners Lp Sale Date: Under Contract List Price: $1.7M Cap Rate: 7.25% Fresenius Medical Care Northeast Outlier Submarket Source: Costar Group; Real Capital Analytics

- 4. HEALTHCARE MARKET COMMENTARY | MID-YEAR 2013 | COLLIERS INTERNATIONAL HOUSTON COLLIERS INTERNATIONAL | P. The Texas Medical Center (TMC) – the world’s largest medical center – represents one of Houston’s major economic drivers and core industries with an estimated regional annual economic impact of $15 billion. TMC is also one of Houston’s largest employers with 106,000 employees, including physicians, scientists, researchers and other advanced degree professionals in the life sciences. The internationally-renowned, 1,345-acre TMC is the world’s largest medical complex with 54 member institutions, including leading medical, academic and research institutions, all of which are non-profit and dedicated to the highest standards of research, education and patient and preventive care. Over 70,000 students – including more than 20,000 international students – are affiliated with TMC, including high school, college and health profession graduate programs. More than 7.2 million patients visited in 2012, including approximately 16,000 international patient visits. In addition to the medical facilities and institutions of higher learning, TMC is also home to more than 290 professional buildings. Overall, the complex covers over 18 miles of public and private streets and roadways, with 45.8M SF of existing patient, education, and research space. TMC has continued to grow and expand over the past several decades with the majority of growth occurring in the past ten years. The Center is located in the 110-acre University of Texas Research Park, a joint effort between the University of Texas Health Science Center, M.D. Anderson and General Electric Healthcare. TMC spent $7.1 billion in building and infrastructure investments between 2008 and 2012, and spent over $3.4 billion on research and over $960 million on charity care in 2012. TMC Patient Care Institutions DePelchin Children’s Center The Menninger Clinic The University of Texas M.D. Anderson Cancer Center Texas Children’s Hospital Memorial Hermann Hospital System The Methodist Hospital St. Luke’s Episcopal Hospital Lyndon B. Johnson General Hospital Quentin Mease Community Hospital Ben Taub General Hospital The Institute for Rehabilitation and Research The Hospice at the Texas Medical Center Texas Heart Institute Shriners Hospitals for Children – Houston Veterans Affairs Medical Center in Houston TMC Academic and Research Institutions Sabin Vaccine Institute The University of Houston – Victoria School of Nursing Texas Children’s Hospital Neurological Research Institute Baylor College of Medicine The University of Texas Health Science Center at Houston The University of Texas M.D. Anderson Cancer Center University of Houston College of Pharmacy Rice University Texas A&M University Health Science Center Prairie View A&M University College of Nursing Texas Woman’s University Institute of Health Sciences Texas Southern University College of Pharmacy and Health Sciences Harris County Psychiatric Center Houston Academy of Medicine TEXAS MEDICAL CENTER The University of Texas M.D. Anderson Cancer Center in the Texas Medical Center, ranked #1 in U.S. News & World Reports “Americas Best Hospitals 2013” for cancer care. 4

- 5. HEALTHCARE MARKET COMMENTARY | MID-YEAR 2013 | COLLIERS INTERNATIONAL HOUSTON COLLIERS INTERNATIONAL | P. HOUSTON AREA HOSPITAL LOCATIONS 5 TEXAS MEDICAL CENTER

- 6. HEALTHCARE MARKET COMMENTARY | MID-YEAR 2013 | COLLIERS INTERNATIONAL HOUSTON COLLIERS INTERNATIONAL | P. Accelerating success. COLLIERS INTERNATIONAL 1223 W. Loop South Suite 900 Houston, Texas 77027 Main +1 713 222 2111 LISA R. BRIDGES Director of Market Research | Houston Direct +1 713 830 2125 Fax +1 713 830 2118 lisa.bridges@colliers.com The Colliers Advantage Enterprising Culture Colliers International is a leader in global real estate services, defined by our spirit of enterprise. Through a culture of service excellence and a shared sense of initiative, we integrate the resources of real estate specialists worldwide to accelerate the success of our partners. When you choose to work with Colliers, you choose to work with the best. In addition to being highly skilled experts in their field, our people are passionate about what they do. And they know we are invested in their success just as much as we are in our clients’ success. This is evident throughout our platform—from Colliers University, our proprietary education and professional development platform, to our client engagement strategy that encourages cross-functional service integration, to our culture of caring. We connect through a shared set of values that shape a collaborative environment throughout our organization that is unsurpassed in the industry. That’s why we attract top recruits and have one of the highest retention rates in the industry. Colliers International has also been recognized as one of the “best places to work” by top business organizations in many of our markets across the globe. Colliers International offers a comprehensive portfolio of real estate services to occupiers, owners and investors on a local, regional, national and international basis. 6