Hasbro Report

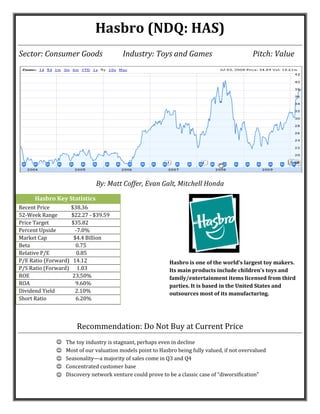

- 1. Hasbro (NDQ: HAS) Sector: Consumer Goods Industry: Toys and Games Pitch: Value By: Matt Coffer, Evan Galt, Mitchell Honda Hasbro Key Statistics Recent Price $38.36 52-Week Range $22.27 - $39.59 Price Target $35.82 Percent Upside -7.0% Market Cap $4.4 Billion Beta 0.75 Relative P/E 0.85 P/E Ratio (Forward) 14.12 P/S Ratio (Forward) 1.03 ROE 23.50% ROA 9.60% Dividend Yield 2.10% Short Ratio 6.20% Hasbro is one of the world’s largest toy makers. Its main products include children’s toys and family/entertainment items licensed from third parties. It is based in the United States and outsources most of its manufacturing. Recommendation: Do Not Buy at Current Price The toy industry is stagnant, perhaps even in decline Most of our valuation models point to Hasbro being fully valued, if not overvalued Seasonality—a majority of sales come in Q3 and Q4 Concentrated customer base Discovery network venture could prove to be a classic case of “diworsification”

- 2. 2 Table of Contents Part I: Qualitative Company Profile 3 Product Segments 3 Customers 4 Key Developments 4 Analysis of Strategy 5 Management 6 Investor Relations 8 Interview with CEO Brian Goldner 8 Competitors 10 SWOT 11 Part II: Macro Analysis Macroeconomic Trends 13 Industry Analysis 14 Porter’s Five Forces 15 Part III Quantitative Analysis Price Performance 16 Financial Ratio Analysis 17 Z-Score Model 19 Pro Forma Income Statement 20 Pro Forma Income Statement Explanation 20 Price Multiples Comparison 23 Discounted Cash Flow Analysis 24 Stylized Models 25 Valuation Summary 26 Conclusion 26 Appendix 27

- 3. 3 PART I QUALITATIVE Company Profile1 Hasbro is a worldwide leader in children's and family leisure time entertainment products and services, including the design, manufacture and marketing of games and toys ranging from traditional to hi-tech. Founded in 1923 by Henry and Helal Hassenfeld, the company grew from its first popular toy (Mr. Potato Head) to making G.I. Joe, My Little Pony, and the many other products that followed. The company’s name was shortened to “Hasbro” in 1968. Hasbro built its toys and games business through the following major acquisitions: 1984 – Milton Bradley Company (a producer of games and jigsaw puzzles) including its subsidiary Playskool (which produced toys for infants and pre-school children) 1991 – Tonka Corporation, Kenner Toys and Parker Brothers Games The company's product range encompasses both games and toys. In the games sector it markets traditional board games, card games, handheld electronic games, trading card games, role-playing games, and computer games based on both plug-and-play devices and DVDs. In the toys sector, Hasbro markets boys' action figures, vehicles and play-sets, girls' toys, electronic toys, plush toys, toys for pre-school children and infants, children's consumer electronics, electronic interactive products and toys that encourage creative play. Product Segments2 Boys’ Toys: These include brands such as the Transformers and G.I. Joe toys, NERF sports/action toys, Star Wars, and Marvel toys and accessories. Most popular in this category have been the merchandise relating to the recent movies that have come out such as Ironman, G.I. Joe: The Rise of Cobra and Transformers: Revenge of the Fallen. Other products in this category include Tonka and Supersoaker. Girls’ Toys: Covers traditional and play sets, such brands in this category are Little Pet Shop, My Little Pony, Furreal Friends, Baby Alive, and Strawberry Shortcake . My Little Pony will be expanded when Hasbro begins its collaboration with Discovery in the premiere of “The Hub” in Fall 2010. Preschool Toys: Most of these toys are marketed under the Playskool trademark, and include Mr. Potato Head, Weebles, Sit ‘n Spin, and Gloworm. Infant toys are also included here, as well as Play-Doh, and Tonka toys for toddlers. Most recently Hasbro acquired rights to produce Sesame Street toys covering character such as Elmo and Big Bird starting in 2011. Games and Puzzles:3 Include Milton Bradley, Parker Brothers, Trivial Pursuit, Cranium, Avalon Hill and Wizards of the Coast. These brand portfolios consist of a broad assortment of games for children, tweens, families and adults. 1 Hasbro 2009 10-K 2 Hasbro 2009 10-K 3 Hasbro 2009 10-K

- 4. 4 Core game brands include Monopoly, Battleship, Life, Scrabble, Chutes and Ladders, Candy Land, Trouble, Mousetrap, Operation, Hungry Hungry Hippos, Connect Four , Twister, Yahtzee, Cranium, Jenga, Simon, Clue, Sorry!, Risk, Boggle, Trivial Pursuit, Guess Who? and Bop It!, as well as a line of puzzles for children and adults, including the Big Ben and Croxely lines of puzzles. Wizards of the Coast offers trading card and role- playing games, including Magic: The Gathering, Duel Masters and Dungeons and Dragons. We seek to keep our game brands relevant through sustained marketing programs, such as Family Game Night, as well as by offering consumers new ways to experience these brands. *For further analysis of brands, please refer to the Revenue Breakdown section of the Appendix. Customers4 Hasbro’s products mainly are concerned with the younger age groups who like to play with action figures, toy guns, etc. Additionally the company markets itself to the family unit with its board games and DVD entertainment products. Additionally Hasbro sells its products to stores such as Target, Wal-Mart, Toys R Us, and countless other stores (toy, convenience, discount, etc). The table below takes sales from Hasbro’s three largest customers and puts it into a percent of total revenue basis. In 2009 Hasbro’s largest customer accounts for 25% of total revenue, while its three largest customers aggregated together account for 49% of total revenue. While investors would like to see a decrease in the concentration of the revenues, the figures are in-line with the characteristics of the toy-industry at large. in Mil. 2009 2008 2007 2006 2005 2004 Wal-Mart 25% 25% 24% 24% 24% 21% Target 13% 12% 12% 13% 12% 10% Toys "R" Us 11% 10% 11% 11% 12% 15% Total % of Rev. 49% 47% 47% 48% 48% 46% Net Revenues (in $'s) $2,010 2,009 2,008 2,007 2,006 2,005 % ∆ in Rev. 1.2% 4.8% 21.8% 2.1% 3.0% - Key Developments5 Hasbro issued a complaint against Atari for breaches for fraud and five separate breaches of their licensing for the Dungeons and Dragons brand (owned by the Hasbro subsidiary Wizards of the Coast). Atari apparently was seeking to work with Namco Bandai to obtain digital rights for the Dungeons and Dragons. Hasbro, Inc. is seeking compensatory damages for economic losses suffered as well as a termination of the licensing agreement.” – Dec 16, 2009 “The Associated Press reported that Hasbro, Inc. said it will make and market toys and games based on well- known Sesame Street characters, such as Elmo, Big Bird and Cookie Monster. The deal takes the license away from Hasbro rival Mattel Inc., which makes Sesame Street toys under its Fisher-Price brand under a deal lasting until 2010. Hasbro will start making the products in 2011. “ – Dec 7, 2009 4 Respective Hasbro 10-k’s 5 All articles from http://www.reuters.com/finance/stocks/keyDevelopments?symbol=HAS.N

- 5. 5 “Reuters reported that Hasbro, Inc. opened a representative office in Russia in order to improve brand awareness and distribution in its market in Eastern Europe.” - September 23, 2009 “Lightning Gaming, Inc. announced that it has entered into a long-term licensing agreement with Hasbro, Inc. The agreement grants exclusive rights to Lighting Gaming, Inc. to develop and produce gaming machines based on Hasbro's SCRABBLE brand in the United States and Canada. The first gaming devices to be developed are expected to debut later this year.” – September 21, 2009 “Hasbro, Inc. and Discovery Communications announced an agreement to form a 50:50 joint venture, including a television network and website. At the closing of the transaction, Hasbro will purchase a 50% stake in the venture, which will hold the assets related to Discovery Kids Network in the U.S., for which Discovery Communications will receive $300 million. The joint venture`s rebranded network is expected to debut in late 2010 reaching approximately 60 million Nielsen households in the U.S. with programming geared to boys and girls 14 years of age and under. The joint venture also will participate in merchandising opportunities associated with on-air content.” – April 30, 2009 “Hasbro, Inc., Marvel Entertainment, Inc. and Spider-Man Merchandising L.P. announced that Hasbro will retain rights through 2017 to make toys and games based on new Marvel and Columbia Pictures theatrical releases and on Marvel's globally popular portfolio of Super Hero brands, including franchises such as Spider-Man, Iron Man, the Avengers, X-Men, Thor and Captain America. As part of the new agreement.” – Feb 17, 2009 Analysis of Strategy6 Hasbro’s current operating strategy is comprised of four main avenues: 1) Growing core owned and controlled brands. The company continues to grow its core brands by expanding its business into countries previously untouched. In recent years, the company has expanded into China, Brazil, Russia, Korea, Romania, and the Czech Republic. In addition, the company continues to grow its controlled brands by means of acquisition. The most recent acquisitions include Cranium, in 2008, and Trivial Pursuit, from which they have long-term license agreements. The company also recognizes the growing importance of the digital world, and in 2007 entered into agreement with Electronic Arts (EA) to create digital games for all platforms. This line of business will become increasingly important for the business if it wishes to remain competitive. 2) Developing new and innovative products that respond to market insights. One method of addressing this point is by entering into licensing agreements with other companies that own a certain brand, but lack the capabilities or expertise to make products complementing the brand. Hasbro has avoided over-reliance upon this form of business because of the inherent riskiness and lack of leverage within the relationship. Currently, the company has agreements with Marvel Characters, Lucas Licensing (Star Wars), and most recently the Sesame Workshop. In 2010, Iron Man 2, part of the Marvel Character brands, will debut; Hasbro owns the rights to produce toys for this franchise. 6 Respective Hasbro 10k’s. The “Diworsification” concept is from Peter Lynch.

- 6. 6 3) Offering immersive entertainment experiences that allow consumers to experience the Company’s brands across different forms and formats. The company generally licenses out the rights to create movies based off of their core brands; most recently G.I. Joe and Transformers have been remade as motion pictures. This strategy has revitalized the brands. The company also notes that it has formed a strategic alliance with Universal Pictures to produce a minimum of three movies based on their core brands, with the option of two additional films. The first film is due to be released in 2012. In addition to traditional alliances, the company has entered into a 50% stake venture with Discovery Communications to create the television network, “The Hub”. Programming will include content from Hasbro, Discovery, and from third parties. A major aspect of this venture is the possibility of reigniting a recently stagnant girls’ toys segment by producing new television shows such as My Little Pony, which is to begin airing in 2010. Hasbro’s programming will be overseen by a group formed by the company and an estimated 60 million homes are expected to be reached at debut in late fall of 2010. This venture can potentially increase the visibility of HAS brands. However, this extension of Hasbro’s business reaches beyond its traditional scope of expertise. “Diworsification” comes to mind. *For additional information about the network venture, please refer to the appendix. 4) Optimizing efficiencies within the Company to reduce costs, increase operating profits and maintain a strong balance sheet. Hasbro 2009 2008 2007 2006 2005 2004 2003 2002 Gross Margin 58.8% 57.9% 58.9% 58.6% 58.3% 58.2% 59.0% 61.0% Operating Margin 14.5% 12.3% 13.5% 11.9% 10.1% 9.8% 11.0% 7.8% NI Margin 9.2% 7.6% 8.7% 7.3% 6.9% 9.8% 5.0% -6.1% As the above table indicates Gross Margin has remained relatively flat while there has been a persistent, increasing trend in HAS’ Operating Margin. The NI margin does not follow the Operating Margin trend and could be indicative of poor debt management. Management7 Position Name Age Salary Total Compensation Years spent at current position Total years spent at Company Hasbro Chairman Alfred J. Verrecchia 67 $1,200,000 $15,018,011 2 45 President, CEO, and Director Brian Goldner 46 920,769 6,321,241 2 10 COO David D.R. Hargreaves 57 660,384 5,177,460 2 28 CFO Deborah Thomas 45 - - 1 12 Global Chief Development Officer Duncan Billing 51 403,846 1,350,481 2 8 Global Chief Marketing Officer Jonathan Frascotti 49 400,480 890,727 2 2 7 Reuters, Hoovers, 10-K

- 7. 7 Why bother analyzing management? The decisions made by the “C-suite” can make or break a company. While it is difficult for an outsider to fully judge the integrity and abilities of the C-suite, given the power this group holds, it still seems prudent to examine the group with what little data is available. Hasbro’s Management team: As an outsider, a good sign to look for is a management team that promotes within and gives thought to successors. Judging from this rudimentary data, Hasbro’s management team looks great. Overall, the team has spent a multitude of years at Hasbro, and the different ages indicate a tendency to recruit and train future replacements. Two years ago the ex-CEO, now Chairman, retired from his position and, in effect, everyone was promoted one level up. This explains the minimal years spent at each position and indicates that the company likes to promote within, when possible. Position Name Age Salary Total Compensation Years spent at current position Total years spent at Company Mattel Chairman and CEO Robert A. Eckert 54 $1,250,000 $6,999,051 10 10 CFO Kevin M. Farr 52 725,000 1,713,182 10 18 President - Mattel Brands Neil. B. Friedman 62 1,000,000 3,240,346 5 15 President - International Bryan Stockton 55 750,000 2,447,421 3 10 EVP Worldwide Operations Thomas A. Debrowski 59 710,000 2,078,420 10 10 EVP Mattel an President, American Girl Ellen L. Brothers 54 - - 10 10 How Hasbro’s Management team compares to competitors: The data on Hasbro’s management team become even more useful when a comparison to similar companies is possible. Looking at Mattel’s c-suite, one can note a stark contrast to Hasbro’s. The ages are relatively the same and a majority of the executives have only spent 10 years at the company, with the most at 18 years. Before working at Mattel many of the executives worked at Kraft Foods, a different business altogether, and 10 years ago there was a mass migration to Mattel. Succession plans and promoting within both seem weaker in comparison to Hasbro. This could hurt morale within Mattel and possibly affect long-term outlooks as well. A successful businessman once said to pay employees more than they deserve. Many of these executives have talent and can walk at any time. Thus, paying a generous, but not excessive, amount helps to retain the talent. Hasbro seems to have a hierarchical compensation while Mattel has a flatter dispersion. If this is any indication of compensation within the respective companies, Hasbro’s compensation method could possibly prove problematic in retaining talent in the lower echelons of the company. *See Appendix for an analysis of Hasbro’s Board of Governors.

- 8. 8 Investor Relations Interview8 What would you describe as Hasbro’s Competitive Advantage? What we focus on, our approach, is delivering innovative products that not only encompass the traditional categories of toys such as board games and action figures, but also in electronic entertainment and our most recent trend of making toys for recent movies such as Ironman and Transformers. The emphasis on licensing toys from popular movies is helpful most in the idea that it will help offset the drop in sales after Christmas is over. What do you expect with your recent stake in the Discovery Communications? We see this as a chance to work with a successful television company and make a channel (Discovery Kids) that will get the word out about our products and further increase sales in the future. (New programming will be based on brands such as Romper Room, Trivial Pursuit, Scrabble, Cranium, My Little Pony, G.I Joe, Life, Tonka and Transformers, among many others.)9 The Discovery Kids cable channel “The Hub” will show in 60 million households nationwide. What do you see happening with your revenue in the future years? We see our trend of growth of 5% still something that is maintainable over these coming years (as opposed to the Toy industry’s average of 1%). Currently we are looking to expand our offices in Brazil, Russia, and China. Interview with CEO Brian Goldner10 The following is an interview conducted by Wall Street Journal’s Willa Plank that appeared in his article “Cable-TV Shows and Hollywood Guide Hasbro's Toy Development” on December 22, 2009. It provides valuable information about the direction in which Hasbro is aiming to move for 2010. Some of Goldner’s descriptions of company strategy also played a role in estimating growth rates for product segments in our pro forma income statement analysis. WSJ: Tells us about the joint venture with Discovery. Mr. Goldner: A lot of other kids networks seem to be focused on teenagers. We think there is a great opportunity to focus on the six- to 12-year-old and their parents. And we have a lot of brands that we'll use. It's not just all Hasbro programming. Certainly you will see My Little Pony and Tonka as some of the shows, but really at least a significant portion will be new ideas. The network will launch in the fall of 2010. Bob Orci and Alex Kurtzman, who wrote the "Transformers" movies, a "Star Trek" movie, and the TV show "Fringe," are working on a show for us. Lauren Faust created the "Powerpuff Girls" and "Foster's Home for Imaginary Friends." She's doing a show for us—the "My Little Pony" show. We are working with Overbrook, which is Will Smith's and James Lassiter's company on two TV pilots. WSJ: How has the recession affected Hasbro? Mr. Goldner: The average purchase has shifted down from $30 retail to between $25 and $20. Part of that was self- created because we are offering products at lower price points. 8 Matt Coffer spoke with Debbie Hancock, Investor Relations Director for Hasbro on April 1, 2010 at 11:00 AM. 9 http://www.hasbro.com/corporate/media/press-releases/hasbro-discovery-joint-venture.cfm 10 http://online.wsj.com/article/SB10001424052748704869304574596150227117662.html

- 9. 9 I think you can see that consumers are very promotional oriented, even more so than prior years. We are focused on that. We work with all of our retailers on major promotions this holiday season. WSJ: So no $100 products this year? Mr. Goldner: Maybe one. The [Transformer] Devastator is about $100. Most of our products are still a great value, mostly $30, $20 and under. In fact 80% are $20 and under. WSJ: What have you done that you would have done differently? Mr. Goldner: Not everything works.... You can point to an item here or there that worked or didn't work: You should have done fewer Butterscotches [plush ponies] or less Kotas [toy dinosaurs] or things along those lines. But those are very small in comparison to the $4 billion in business that we did, and the thousands of items we put in the marketplace or the entertainment initiatives we've begun. WSJ: How has your management strategy changed? Mr. Goldner: We had to rewire our organization. We actually reorganized the company to focus on our brand. Before we were in the toys business, games business and international business. It was a much more manufacturing-centered approach to the world. Now we've become more consumer-centric. WSJ: What lessons did you take from the recession? Mr. Goldner: We didn't take a decision that other companies took, which was to lay off employees. We didn't have wholesale layoffs. Instead we asked everyone to take a pay freeze....We set a goal and objective to cut back on travel and entertainment expenses....But at the same time, we haven't stopped opening key offices in Brazil, in Russia, Czech Republic, Poland and China because that's where the future markets are. WSJ: What opportunities are you pursuing in emerging markets? Mr. Goldner: Brazil. It's a very young population and a population that is already predisposed to liking toys and games. Our nearest competitors were marching ahead of us in Latin America—and they are hundreds of millions of dollars ahead of us. We think we can catch up really quickly there. So there's an opportunity for us to put several hundreds of millions of dollars of growth just by getting our fair market share in those territories. The Czech Republic, Poland, Russia are all significant opportunities for growth for us, places where there are already established toys and games markets. Transformers has been a tremendous growth business for us in China and has been a great calling card for the company as we also launch other brands. A challenging financial time for the company in 1999/2000 had us putting the pause button in international growth at that time. WSJ: What do you see for the year ahead? Mr. Goldner: We still believe that we can grow our business for the long-term, over the next several years, and over a strategic plan we set for ourselves. And yet we have to be a little more conservative and careful about our expectations for growth.

- 10. 10 Competitors11 The traditional scope of the Toy Industry has changed dramatically over the years. What once were narrow definitions of toys have now become greatly blurred with the proliferation of the internet, video games, and other electronics. The phenomenon described by Hasbro of “children getting older younger”12 is a direct result from the blurring of what children consider to be toys. Hasbro must not only compete with their traditional competitors, but also face intensifying pressures from companies that are responsible for this trend. Toys do still sell, but children getting older younger is an issue that could continue to haunt Hasbro in the future. In terms of chief competitors, since the majority of Hasbro’s revenue comes from toys in the traditional sense, the following is an analysis of global competitors that derive most of their revenue from these traditional toys or have a large share of the traditional toy industry: *For a complete list of segments and brands, please refer to appendix. Mattel: The largest toy maker in the world and is pursuing strategies very similar to Hasbro’s. Mattel has a range of established brands under its name including Barbie, Hot Wheels, UNO, and the Fisher-Price brands. The company engages in strategic partnerships as well, notably WWE Wrestling, Disney/Pixar studios for Toy Story 3 & CARS, and DC Comics (Batman). Unlike Hasbro, Mattel oversees a majority of its manufacturing abroad, with plants located in China, Indonesia, Thailand, Malaysia, and Mexico. While ties with film industries are present, no notable strategic alliance with a gaming company, such as EA games, could be found. In addition, the company leverages its brand via animated T.V. series (Barbie & Hot Wheels), but it has not had any recent major motion pictures based off its brands. It also has not partaken in any ventures with any cable television networks. In recent years, a string of bad news has struck Mattel. In 2007 the spur recalls from Chinese based products hit the company especially hard, forcing Mattel to mass recall products on three separate occasions; major brands include Dora the Explorer, Elmo, and Big Bird. The company also had an exclusive licensing with Sesame Street, but lost the contract to Hasbro in 2009. On a positive note, Mattel finally won the legal battle over claims to the Bratz brand, ending by receiving $100 Million in damage and the right to launch its own Bratz product line. Namco Bandai Holdings: Based in Japan, the company was created in 2005 with the acquisition of Namco by Bandai. The company makes toys and computer games, including Digimon, Gundam, Power Rangers, Tekken, and Ridge Racer. In 2009, sales were $258.9 million with Net Income at $120.3 million. The company plans to expand its global presence (currently 20% of total sales), which means it will start to compete with Hasbro more competitively for market share. Namco Bandai does not trade on an American exchange through ADR’s. Lego: The Lego company is privately owned and based originally out of Denmark. The company not only makes the Lego play-sets, but also engages in strategic licensing agreements to create videogames, movies, television shows, and computer games. Major company ties include NHL, NBA, Nike, Warner Bros. Home Entertainment Group, Miramax Film Corp, Scholastic, and Mega Brands. The Bionicle brands and recent licensing agreements including Harry Potter & Star Wars, have allowed the company to grow. This has amounted to sales in 2008 at $1,804 million with $256.1 million in Net Income. Although Lego is not at Hasbro/Mattel levels in terms of sales, the fact that this 11 Respective Hasbro 10-k’s, Hoovers, Reuters 12 This describes the recent phenomenon that children cease playing with dolls, cars, etc. and instead turn to more adult forms of entertainment (i.e. videogames) at younger and younger ages.

- 11. 11 company understands the trends of the industry, continues to form licensing agreements, and is trying to branch off the traditional toy sector makes it an increasingly dangerous competitor. Geobra Brandstätter: Started in 1876, the company’s biggest brand is the Playmobil set, invented in 1974. Its primary business is molding plastic into different products. The company is privately owned and is headquartered in Germany with 2009 sales at $567.4 Million. While not as popular within the U.S., Geobra Brandstätter maintains a large presence within Europe. This could prove particularly challenging for Hasbro as it tries to penetrate new European markets. The company also operates theme parks and does not trade on U.S. Stock exchanges. Tomy: One of the largest toy producers in Japan, Tomy generates 90% of its revenue from Asia. The company primarily makes toys, games, video games, and apparel for children. Net sales in 2009 were $865.1 million with a net income of $15.6 million. It has a small presence in Europe and the U.S., and will likely continue to put pressure on Hasbro by increasing its presence worldwide. Particularly attractive markets for Tomy include India and China. Walt Disney Toys: While no data for traditional toys could be separated out, Disney is one company to watch out for in the future. The company is well positioned for the changing toy industry trend, for it owns television networks (ABC Family, Disney Channel, ESPN), film studios (Walt Disney Pictures, Touchstone, Pixar), and an incredible brand reputation. Children worldwide recognize the Disney brand, and perhaps more importantly, parents feel comfortable letting their children become immersed in the Disney experience. This is particularly troubling for Hasbro because it does not have the universal rapport with parents that Disney does. Some parents feel Hasbro products induce violence and shield their children from them. Overall: While many more competitors exist, it is evident that the traditional toy industry is highly competitive even without the inclusion of the electronics industries. It is also apparent within the traditional toy industry that there is a wide dispersion between the big players and the small. Hasbro and Mattel do dominate but should be very watchful of the smaller players, and the 300 pound gorilla (or in this case, mouse), as these competitors continue their expansion into Hasbro/Mattel waters. Within the big players one should also note the incredible similarities between Hasbro and Mattel. Both giants are pursuing the same strategies, implying head-to-head competition, as can be seen with the rivalry over the Sesame Street licensing. A head-to-head competition of this magnitude could be especially problematic, as this generally tends to promote thinking in short-term results. SWOT13 Strengths Hasbro owns several iconic properties in the toys and games market, such as Monopoly, Scrabble, Transformers, Playskool, Tonka and My Little Pony. Its alliance with major studios in Hollywood means that it has secured rights to key brands associated with movie franchises that are unlikely to disappoint at the box office. Hasbro maintains a strong capital position, which means it is well placed to conduct expansion into emerging markets, mergers and acquisitions where desired, and to develop more innovatively— such as incorporating technology and online elements into its products. 13 Euromonitor Database

- 12. 12 Weaknesses The company is reliant upon a few major distributors for the majority of its revenue. Although these distributors are market leaders, the company is clearly eager to develop its online presence to counter the vulnerability this presents. Given current economic conditions, the narrow supply chain leaves Hasbro particularly at risk if there is any change in the purchasing powers of its customers. Hasbro is, to some extent, constantly speculating on the preferences of a youth market that can be fickle in its choices. There is no guarantee that a particular brand will retain its popularity in spite of past performance. Innovation is, therefore, constantly necessary; but, especially in the case of the increased trend towards electronic games, innovation can cost more and take longer to develop. This may expose the company to the risks of lower profit margins and potentially appearing outdated in the market. Hasbro is also dependent on third party manufacturers abroad, meaning if there is any complication in terms of production or supply, the company is likely to be affected instantly and adversely. This applies to the manufacturing companies and also to more general economic concerns such as currency fluctuations, legislative changes, and importation costs. Opportunities Hasbro has been quick to identify that its brands benefit from exposure across different media. In the past, this has meant that the company has developed close ties with film studios, and these will continue with big releases slated for 2011 that will doubtless bolster the company's performance. The company has also been quick to seize the initiative in terms of technological integration, singing an exclusive license with Electronic Arts. This will allow the software company to develop electronic formats of Hasbro brands across all platforms, ranging from the market-leading electronic games consoles (Xbox, Playstation and Wii) to mobile phones and portable games consoles. In addition to the increased interaction with technology, Hasbro is also developing online versions of its games and has been working, again with Electronic Arts, on using the social networking site Facebook to promote and develop some of its key brands such as Monopoly. Threats The principal threat to Hasbro's economic performance in the coming year is the global recession currently affecting all major areas of the world economy. As detailed above, the company is at higher risk as it is a leisure company and it operates through only a few major distributors. As so many of its games brands are so iconic, replacement cycles can be long and customers may be drawn elsewhere to newer brands. The company is also heavily dependent on holiday sales with 66% of its sales coming in the second half of the year in 2007. Increased dependence on technology is more expensive to pursue and develop and this is going to slim down profit margins somewhat. Hasbro has already moved a great deal of manufacturing out to China meaning that its room for maneuver to counter this is restricted.

- 13. 13 PART II MACRO ANALYSIS MACROECONOMIC TRENDS:14 Real GDP: Economic downturns that negatively impact the retail and credit markets, or that otherwise damage the financial health of retail customers and consumers, can harm Hasbro’s business and financial performance. Retail sales for companies such as HAS are driven by consumer spending, which is likewise driven by overall economic health. Forecasts for real GDP growth provide important data for Hasbro. After declining 6.4% in Q1 2009, real GDP is expected to return to a positive growth rate in 2010. GDP growth is estimated at 5.7% for Q4 2009. Some preliminary estimates place the growth between 2-3% for fiscal year 2010. Disposable Personal Income: Consumption is the largest component of expenditure, but is forecasted to decrease relative to other components as U.S. consumers switch to saving their money. Growth in DPI indicates consumer ability to purchase nonessential goods. Hasbro’s sales grow as the income of its consumers grows. DPI increased 4.8% in Q4 2009, a sharp rise from its 1.2% increase in Q3 of the same year. This indicates a likely upturn in the willingness of consumers to purchase discretionary retail goods such as board games and toys, two staples of Hasbro’s product lines. Consumer Confidence: A relatively high consumer confidence level indicates that consumers feel good about earnings potential in the upcoming year and the overall state of the economy. In turn, high confidence breeds increased borrowing and spending, specifically in the specialty retail sector. Consumer confidence was measured to be 68.4 in February, down from 70.1 in January but substantially higher than the 50.5 it recorded in January of 2009. Retail Sales Indicator: This indicator tracks the dollar value of merchandise sold within the retail trade by taking a sampling of companies, such as Hasbro, that sell “end products” to consumers. Between January and February 2010, total sales volume increased 2.1%. Furthermore, YOY retail sales increased 3.5% in February. The growth was encapsulated entirely in non-food stores, which grew 8.4% in contrast to -0.5% growth for food-stores. This uptick in retail sales is encouraging for Hasbro shareholders, as the economy continues its momentum out of the recession. So What? Overall economic indicators are bullish for Hasbro’s stock appreciation potential. As the economy rebounds, retail sales should increase accordingly. Hasbro’s stockholders should continue to watch these four macroeconomic indicators; as long as they indicate improvement in overall economic health, both domestically and internationally, Hasbro’s downside risk is limited. 14 Standard & Poor’s Net Advantage Industry Survey

- 14. 14 INDUSTRY ANALYSIS:15 The Bad News? Hasbro has traditionally been a toy maker with much of its consumer purchases located in the U.S. market. Many of its brands, including Monopoly, Clue, Risk, Candy Land, G.I. Joe, etc. developed strong reputations, contributing to a large moat around Hasbro’s business, even with rival Mattel in constant competition. But the domestic toy making industry has been a loser in recent years, especially to the relatively new electronic games industry. Retail sales in the U.S. toy industry decreased 3.1% from 2007 to 2008, from $22.32 to $21.64 billion. This trend continued in 2009, decreasing from $21.64 to $21.47 billion, a decline of 0.8%. In comparison, 2004 sales in the U.S. toy industry were $22.1 billion. The Good News? Not all hope is lost for Hasbro and the toy industry. While the market appears to be mature, Hasbro can continue to steal market share from competitors through its high quality brands. Although U.S. toy industry sales declined 3.1% in 2008, Hasbro’s sales rose 4.8% in 2008. Preliminary numbers for 2009 depict a 1.2% increase for HAS sales and a 0.8% decrease for the industry. This indicates an outperformance of the industry of 7.9% and 2.0%, respectively. Furthermore, year to date through March 12, the S&P Leisure Products Index advanced 16.8% compared to a 3.7% rise for the S&P 1500 Index (note that this is not the same as the SMF benchmark, the S&P 500). To combat pressure from the electronic gaming industry, the company signed a "long-term strategic licensing alliance" with Electronic Arts, Inc. providing EA with the exclusive worldwide rights to develop digital games for all platforms based on Hasbro's intellectual properties. While it remains to be seen how successful Hasbro’s brands can be in the world of videogames, this appears to be a sensible step in diversification, rather than expansion into a market in which Hasbro is destined to fail. Along these lines, Hasbro is committed to developing presence in emerging markets, and to that end has recently opened offices in Brazil, Russia and China. So What? It is true that Hasbro’s retail business has been highly seasonal and focused on toy making in the past. Were Hasbro to fail to recognize the maturation of the toy market in the U.S. and pursue alternative entertainment segments, the company’s business model would likely be destined for bankruptcy. However, CEO Brian Goldner has transformed the focus of the company. Since 2008, the company’s multimedia strategy has been investing in Hollywood—namely the releases of movies Transformers, Iron Man 2, and G.I. Joe. It also recently purchased a 50% stake in Discovery Communications for the creation of a website and a children’s cable network that airs programming featuring Hasbro’s brands. Admittedly, the venture with Discovery contains substantial risk because of the unknown territory into which Hasbro is treading. However, the potential upside of opening up this market could provide a substantial return. In sum, Hasbro’s new business model is potentially worrisome for risk-averse investors, but long-run stockholders could see above-average appreciation as it develops its hold in these emerging markets. If Hasbro fails to adapt and obtain market share outside the toy industry, shareholders could witness a slow-but-steady decline in share value in the foreseeable future. 15 Standard & Poor’s Net Advantage Industry Survey

- 15. 15 PORTER’S FIVE FORCES:16 Barriers to Entry: Low. New participants with a popular product idea or entertainment property can gain access to consumers and become a significant source of competition for Hasbro’s products. In some cases, competitors’ products may achieve greater market acceptance than Hasbro’s products, even with Hasbro’s strong brand recognition. Supplier Power: Medium. 25% of Hasbro’s product sales are to Wal-Mart, 13% are to Target, and 11% are to Toys R Us. With approximately 50% of sales to three different suppliers, Hasbro has little room to navigate should one of the companies become displeased with the quality of Hasbro’s products. Threat of Substitutes: High. Hasbro competes directly with Mattel on a variety of specific products, including boys’ action toys, girls’ toys, and games. Furthermore, Hasbro is increasingly competing with products from video game suppliers, consumer electronics companies and other businesses outside of the traditional toy and game industry. Buyer Power: High. Hasbro faces volatile, ever-evolving consumer preferences. This makes it difficult to maintain and build upon the success of existing products and product lines or introduce successful new products. Additionally, Hasbro management cites the financial health of its customers as one of its greatest threats in its 10-K report, as economic downturns can negatively impact discretionary income. This indicates Hasbro retains little power to affect buyer preferences for its products other than lowering prices and cutting into its profit margins. Rivalry: Medium. Hasbro traditionally competed head-to-head with fellow toy-maker Mattel, but in recent years has attempted to diversify into such segments as television, movies, and electronic games. With a more differentiated product base, Hasbro has opened itself to new competition from companies in these sectors, but its established brand allows it a competitive edge over less well known rivals. So What? Porter’s 5 Forces paint a fairly grim picture for the industry in which Hasbro competes. Low barriers to entry, a high threat of substitutes, and substantial buyer power restrict Hasbro’s operating margins and reveal consistent opportunity for competitors to steal market share from HAS. Furthermore, HAS must continually strengthen its brand against its main rival, Mattel, and venture into new markets without diworsifying. Nevertheless, it is encouraging for shareholders that Hasbro has continued to maintain strong sales in this difficult environment, increasing 5.8% versus a 3.1% decline in the toy industry in 2008. 16 Standard & Poor’s Net Advantage Industry Survey, 2009 Hasbro 10-k

- 16. 16 PART III QUANTITATIVE ANALYSIS PRICE PERFORMANCE17 Trailing 5-year Period, HAS vs. S&P 500 The above graph depicts a comparison of HAS to the S&P 500 over the last five years. HAS appreciated 88.3 % over the period, compared to -0.3% growth for the S&P. The stock closely mirrored the S&P 500 from 2005 to the beginning of the housing collapse at the end of ‘07. Hasbro withstood much of the recessionary pressure of ’07-’09, dipping only slightly in price and even gaining ground briefly during 2008. While this is somewhat unsurprising given the nature of Hasbro’s products (the demand for board games, cheap action figures, etc. is relatively inelastic), it should be noted that HAS’s stock price has continued its outperformance of the S&P 500 even during the expansion, maintaining a wide margin of appreciation. 17 Yahoo! Finance

- 17. FINANCIAL RATIO ANALYSIS18,19,20 Liquidity: The story is mixed between Hasbro and Mattel for liquidity ratios. Hasbro has consistently (albeit slightly) outperformed Mattel in recent years in terms of current ratio and quick ratio. The two companies hold similar amounts of cash to fund investment opportunities, although most of their funding for ventures comes in the form of debt holdings. The Discovery venture for Hasbro is being financed almost entirely by debt. Profitability: Hasbro has consistently improved its net income and operating margins. However, gross margins have remained relatively flat. This can be explained by the stagnant growth of the toy industry over the last five years. Hasbro has increasingly earned a better rate of return on its assets and equity, increasing its ROA by 50% over the period and nearly doubling its ROE. Mattel has likewise made improvements in its NI and OM, but not to the extent that Hasbro’s management has. Part of the reason Mattel currently has a higher NI margin than Hasbro is because of Mattel’s lower tax rate. Overall, in terms of profitability, the story is slightly in Hasbro’s favor. Despite Mattel’s strong performance early in the period, it has failed to keep pace with Hasbro’s managerial changes, and may soon fall behind if Hasbro maintains its cost-cutting effectiveness. The 5-year peer averages for profitability ratios reiterate why a head-to-head comparison of Hasbro to Mattel was more appropriate. 18 All numbers derived from respective 10-k’s of Hasbro and Mattel. 19 FCFF was calculated as EBIT- (1-T) + Dep. + Amort. - ∆NWC – CapEx (PP&E). 20 The financial ratio analysis only compares Hasbro to Mattel. An analysis of JAAKS Pacific and LeapFrog Enterprises was done in lieu of available data and comparability of the other direct competitors. Unfortunately when JAAKS and LeapFrog are included within the peer averages (as noted within the 5 yr. peer average), they distort the numbers to such an extent that it makes Hasbro seem better than they really are. For a better analysis Hasbro was compared to Mattel not only because the numbers reveal a more accurate picture of current financial health, but also because of the overlap in their stories and strategies. 17 HAS MAT 5 yr. Peer Financial Analysis 2009 2008 2007 2006 2005 2009 2008 2007 2006 2005 5 Yr. AVG 5 yr. AVG Average Liquidity Current Ratio 2.51 2.14 2.13 1.90 2.01 2.41 1.89 1.71 1.80 1.65 2.14 1.89 2.74 Quick Ratio ((C+A/R)/C.L) 2.05 1.55 1.61 1.40 1.61 1.76 1.18 1.20 1.36 1.20 1.65 1.56 2.07 Cash (in Millions) 636$ 630$ 774$ 715$ 942$ 1,117$ 618$ 901$ 1,206$ 998$ 740$ 760$ 357$ Cash as a % of C.A. 31.1% 36.8% 41.0% 41.6% 51.5% 43.7% 25.9% 34.8% 42.3% 41.4% 40.4% 42.3% 38.9% Cash as % of F.A. 16.3% 19.9% 23.9% 23.1% 28.5% 23.4% 13.2% 18.8% 24.3% 22.8% 22.4% 23.6% 42.5% NWC (in Millions) 1,229$ 914$ 1,001$ 812$ 919$ 1,494$ 1,127$ 1,023$ 1,268$ 949$ NWC less Cash 593$ 284$ 226$ 97$ (23)$ 377$ 509$ 121$ 62$ (48)$ Profitability NI Margin 9.2% 7.6% 8.7% 7.3% 6.9% 9.7% 6.4% 10.0% 10.5% 8.1% 7.9% 7.7% -2.4% Operating Margin 14.5% 12.3% 13.5% 11.9% 10.1% 13.5% 9.2% 12.2% 12.9% 12.8% 12.5% 12.1% -0.7% Gross Margin 58.8% 57.9% 58.9% 58.6% 58.3% 50.0% 45.4% 46.5% 46.2% 45.8% 58.5% 58.5% 44.2% ROA 9.6% 9.7% 10.3% 7.4% 6.4% 11.1% 8.1% 12.5% 12.0% 9.5% 8.7% 8.5% -2.7% ROE 23.5% 22.1% 24.0% 15.0% 12.3% 20.9% 17.9% 26.0% 24.4% 19.8% 19.4% 18.5% -5.6% Tax Rate 29.2% 30.4% 28.0% 32.6% 31.8% 19.9% 22.2% 14.7% 13.3% 36.0% 30.4% 30.7% Hasbro (HAS) Mattel (MAT)

- 18. 18 Asset Management: The story here paints an almost identical picture for Hasbro against Mattel, especially when one observes the five year averages. Hasbro has lost some ground to Mattel in this area, decreasing the rate at which the company collects payments from its customers and increasing its rate of payment to suppliers. Both of these trends negatively impact financials for Hasbro, and may be explained by the moderate leverage that suppliers Wal-Mart, Target, etc. have over the company’s products. This explanation can be countered by the observation that Mattel has resisted these trends. Total asset, fixed asset, and current asset turnover ratios are nearly the same for the two rivals. Nevertheless, it seems that Hasbro has again been improving slowly over the last five years, while Mattel has stagnated. Debt Management: Hasbro’s management has increased its reliance on debt as a form of financing over the last five years. This could be a result of recessionary pressures and refinancing opportunities, which allowed Hasbro to take advantage of lower interest rates. From 2008-2009, the majority of the increase in long term debt can be explained by the requirements of financing the Discovery venture. Mattel has also increased its holdings of long term debt over the period, but not as aggressively as has Hasbro. Hasbro’s shareholders may be disconcerted by the level of debt that HAS currently holds, but, as will be indicated using the Z-score Model in the next section, the company is in no real imminent danger of defaulting on its obligations. Risk-averse investors would be wise, however, to observe how effectively Hasbro manages to pay off its debt in the near future. Should the Discovery venture fail to provide adequate returns over the next couple of years, Hasbro could begin to scramble for corporate restructuring, refinancing, or begin to default on portions of its debt. Du-Pont ROE: The Du-Pont ROE provides a snapshot of perhaps the most important parts of the ratio analysis that have been discussed thus far. It demonstrates that Hasbro has been more effective than Mattel in improving its profit margins, total asset turnover, equity multiplier, and return on equity on a percentage growth basis. Meanwhile, Mattel has decreased or remained stagnant in each of these categories. Overall, the last five years have seen the previously dominant Mattel lose ground to Hasbro—a trend that could allow Hasbro to obtain the number one position in the toy industry in the near future. HAS MAT 5 yr. Peer Financial Analysis 2009 2008 2007 2006 2005 2009 2008 2007 2006 2005 5 Yr. AVG 5 yr. AVG Average Asset Management ACP (days) 92 55 61 64 61 50 53 60 60 53 67 61 79 Days Sales in Inv 45 64 59 56 50 47 54 48 45 48 55 57 64 APP (days) 37 39 43 44 43 46 39 50 45 34 41 42 50 TATO 1.04 1.27 1.19 1.02 0.94 1.14 1.27 1.24 1.14 1.18 1.09 1.10 1.09 FATO 2.20 2.76 2.85 2.29 2.10 2.44 2.59 2.70 2.68 2.64 2.44 2.49 4.21 CATO 1.99 2.35 2.03 1.83 1.69 2.13 2.48 2.30 1.98 2.15 1.98 1.98 1.71 Debt Management LTD (in Millions) 1,132$ 710$ 710$ 495$ 496$ 700$ 750$ 550$ 636$ 525$ 708$ 624$ 360$ LTD as a % of Total Liabilities 49.2% 39.9% 38.3% 31.7% 31.4% 31.1% 29.3% 22.0% 25.2% 23.1% 38.1% 35.9% 36.0% LT Debt-to-Assets 29.0% 22.4% 21.9% 16.0% 15.0% 14.6% 16.0% 11.4% 12.8% 12.0% 20.9% 19.2% 15.4% Total Liabilites-to-Equity 1.44 1.28 1.34 1.01 0.92 0.89 1.21 1.08 1.04 1.08 1.20 1.15 0.69 Total Liabilities-to-Assets 59.1% 56.1% 57.2% 50.3% 47.8% 47.1% 54.7% 52.0% 50.9% 51.9% 54.1% 53.1% 39.2% TIE 9.55 10.49 15.00 13.68 10.17 10.18 6.61 10.29 9.13 8.69 11.78 12.22 14.27 Du-Pont ROE PM 9.2% 7.6% 8.7% 7.3% 6.9% 9.7% 6.4% 10.0% 10.5% 8.1% 7.9% 7.7% -2.4% TATO 1.04 1.27 1.19 1.02 0.94 1.14 1.27 1.24 1.14 1.18 1.09 1.10 1.09 EM 2.44 2.28 2.34 2.01 1.92 1.89 2.21 2.08 2.04 2.08 2.20 2.15 1.70 ROE 23.5% 22.1% 24.0% 15.0% 12.3% 20.9% 17.9% 26.0% 24.4% 19.8% 19.4% 18.5% -5.5% Hasbro (HAS) Mattel (MAT)

- 19. Z-SCORE MODEL21 Hasbro maintains long term debt of $1.13 billion. With a market cap of just over $4 billion, this highly leveraged position is potentially worrisome to risk-averse investors who imagine a double-dip in the global recession. The Z-Score model is a financial analysis tool used to predict the probability that a firm will go bankrupt in the next two years. The model weights five variables and then sums them to arrive at the ”probability” of bankruptcy. We find the formula to be a more useful indicator of a firm’s near term financial soundness than a simple comparison of cash holdings to total long term debt. The formula is as follows (figures in millions of dollars): Z = 1.2T1 + 1.4T2 + 3.3T3 + 0.6T4 + 0.999T5 Where: T1= Working Capital/Total Assets22 = 1,229/3,897 = 0.315 T2= Retained Earnings/Total Assets = 2,721/3,897 = 0.698 T3= Earnings Before Interest and Taxes/Total Assets = 588,598/3,896,892 = 0.151 T4= Market Value of Equity/Book Value of Total Liabilities = 4,400/2,302 = 1.911 T5= Sales/Total Assets = 4,068/ 3,897 = 1.044 Therefore, Z = 1.2(0.315) + 1.4(0.698) + 3.3(0.151) + 0.6(1.911) + 0.999(1.044) Z = 4.043 Generally, the distribution of z-scores is divided into three zones: “safe,” “grey,” and “distress.” Companies in the safe zone have a Z-score greater than 2.99. Companies with a score between 1.8 and 2.99 are in the grey zone. Finally, a score below 1.8 indicates imminent financial distress. Indeed, since its development in 1968, the model has been 80-90% accurate in predicting bankruptcy one year prior to the company’s insolvency. Because Hasbro maintains a score of over 4, we are confident that downward pressures—both economic and industrial—pose little threat to the company’s ability to meet its debt obligations, despite its somewhat highly leveraged position. 21 Edward Altman, 1968 22 All figures are year-end 2009 data, and in 000’s of $US. 19

- 20. 20 HASBRO PRO FORMA INCOME STATEMENT 2011 2010 2009 2008 2007 Revenue Net revenues $ 4,515,000 4,182,000 4,067,947 4,021,520 3,837,557 Cost of sales 1,851,150 1,714,620 1,676,336 1,692,728 1,576,621 Gross profit 2,663,850 2,467,380 2,391,611 2,328,792 2,260,936 Expenses Amortization 49,000 49,000 85,029 78,265 67,716 Royalties 361,200 334,560 330,651 312,986 316,807 Research and product development 203,175 188,190 181,195 191,424 167,194 Advertising 496,650 460,020 412,580 454,612 434,742 Selling, distribution and administration 889,455 823,854 793,558 797,209 755,127 Total expenses 1,999,480 1,855,624 1,803,013 1,834,496 1,741,586 Operating profit 664,370 611,756 588,598 494,296 519,350 Nonoperating (income) expense Interest expense 54,180 50,184 61,603 47,143 34,618 Interest income 0 0 -2,858 -17,654 -29,973 Other (income) expense, net 0 0 156 23,752 52,323 Total nonoperating expense (net) 54,180 50,184 58,901 53,241 56,968 EBT 610,190 561,572 529,697 441,055 462,382 Income taxes 183,057 168,472 154,767 134,289 129,379 Net earnings $ 427,133 393,100 374,930 306,766 333,003 Shares Outstanding 136,000,000 138,000,000 139,379,182 140,718,349 156,339,437 Earnings Per Share Basic $ 3.14 2.85 2.69 2.18 2.13 Diluted $ 2.89 2.62 2.48 2.00 1.97 Cash dividends declared $ 0.80 0.80 0.80 0.80 0.64 PRO FORMA INCOME STATEMENT EXPLANATION23 The process by which we projected 2010 and 2011 sales revenue for Hasbro first required breaking down its various product segments. A growth rate for each segment was obtained and then applied to that segment’s 2009 revenues to obtain total sales revenue for 2010. Subsequently, we projected growth rates for each segment in 2011 and applied these separate growth rates to our 2010 estimates to arrive at total sales revenue for 2011. The following indicates our reasoning behind each growth rate. *For a complete breakdown of Revenue and further notes on the pro-forma, please refer to the Appendix. 23 The 50/50 joint venture with Discovery is supposed to launch in fall of 2010. We can calculate sales growth projections for Hasbro without considering the merits of this venture, at least for 2010, because its programming will not begin airing until the fourth quarter of the fiscal year.

- 21. 21 Sales revenue growth rates breakdown 2010: Games and Puzzles: 1% Weighted average growth rate of 1.0% (40% weight for 2009, 30% for 2008, 20% for 2007, and 5% for 2006 and 2005 revenues for this division). Scrabble and Lightning Game, Inc. teamed up to develop and produce gaming devices which are to be released in 2010. The assumption of a 1% growth rate appears to be reasonable given the flat sales projection of the industry. Boys’ Action Toys: 5% Releases for 2010 include a multitude of possible outlets for selling boys’ action figures. Among these are Iron Man 2 and TV Shows Super Hero Squad, Star Wars-based Clone Wars, and Beyblade. We anticipate similar sales growth to 2008 (5.8%) in this segment. In that year, Hasbro’s releases included the original Iron Man, Incredible Hulk, Star Wars: Clone Wars, and other hits. We also expect residual earnings from the 2009 sales of Transformers and G.I. Joe to positively affect Hasbro’s top line in this area. Girls’ Toys: 2% This segment is likely to mirror the flat-line sales of the toy industry throughout 2009. “Girls’ toys” seems to be a fairly resilient segment regardless of economic conditions or new releases. We do expect slight positive growth, however, with the development of the new animated TV show My Little Pony. Preschool: 2.6% Sales for the “preschool” division of Hasbro’s products were projected at 2.6% based on a weighted average growth rate for 2005-2009, similar to the projections for “games and puzzles.” Sales for this division account for only 11% of the revenue for HAS, so a miscalculation in this area will be unlikely to materially affect Hasbro’s top line. Tweens Toys: N/A. Hasbro recently broke up the “tweens toys” division of its product line and distributed its assets to the other product segments. Other: 0.0% Because we have limited information about this division of Hasbro’s sales, and because it accounts for < 1% of total revenue, we left the growth rate of this segment at 0%. There appears to be little justification for significantly altering this, either positively or negatively. Projected Total Sales Revenue Growth for 2010: 2.8%, to $4,182,00024 Sales revenue breakdown 2011: Games and Puzzles: 2% We anticipate this division again following a trend of flat sales for the toy industry. However, with the production of the movie Battleship, we forecast a slight increase in growth as sales of games, specifically the game after which the movie is named, edge higher. 24 This growth rate was weighted by each segment’s total revenue.

- 22. 22 Boys’ Action Toys: 15% With such blockbusters as Transformers 3, Spiderman, Thor, Captain America, Stretch Armstrong, and Battleship all scheduled to be released in 2011, we anticipate robust growth in this division of Hasbro’s product line. In 2005, the release of Star Wars Episode III: Revenge of the Sith propelled growth in this division 22%. We are tempering our projections with the weighted average calculation of growth rates in this division from 2005-2009, and with the trend of decreasing sales in the toys industry over the last five years. Girls’ Toys: 4% The launch of “The Hub” programming network in Q4 of 2010 should boost sales for this division, at least in the short term. Even if the venture ultimately fails, we anticipate increased interest in Hasbro’s product lines with this additional avenue for advertisement. Preschool: 9% Sales in this segment were forecasted on the basis of the release of Sesame Street toys in 2011. Hasbro took over rights to the franchise, including all Sesame Street characters, after it was owned by rival Mattel. We justify this growth rate because of the decades of success retained by the Sesame Street brand in the preschool age group. Tweens Toys: N/A Other: 0% Again, with little information about this division, we are hesitant to project either an uptick in revenue or a downturn. In any case, the total revenue for this segment is immaterial for our total sales projections for 2011. Projected Total Sales Revenue Growth for 2011: 8.0%, to $4,515,000 While this figure may seem a little high, as recently as 2007 Hasbro experienced 21.8% growth in sales revenue. Because we are confident in our analysis of each of the components of total sales revenue, we think 8% growth for 2011 is both reasonable and probable. Other than sales revenue, all items were projected on a percentage of sales basis as a compound annual growth rate over the 2007-2009 period. We recognize that a majority of acquisitions negatively impact companies’ bottom lines, and that this decrease in net income should be accounted for in the pro forma evaluation. However, preliminary revenue from the project will not begin cash flow to Hasbro until fall of 2010. Thus, we have limited data on which we can base a solid estimate of profit or loss this early in the life of the Discovery venture. We neglected to include either a non- operating income or expense based on this acquisition because of this. The possibility that this venture will fail has, nevertheless, been incorporated into conservative estimates of sales revenue growth for each of Hasbro’s product segments, as well as a decision to maintain constant operating margins despite Hasbro’s continued trend towards improving its bottom line.

- 23. 23 PRICE MULTIPLES COMPARISON25 The above table depicts a valuation of Hasbro’s stock based on five metrics. We computed straight and weighted averages26 for 2005-2009 for each metric and then multiplied the result by our projections from the pro forma income statement to derive the “value according to projections.” The margin of safety column compares this value to the most recent stock price (at the time of writing) of $38.36. We computed margins of safety for Hasbro, Hasbro and Mattel combined, and the entire peer group to observe how Hasbro was performing relative to its industry. So What? Notably, the largest margin of safety resulting from this analysis is a mere 3.13% using projections of Hasbro’s P/E ratio in 2010. A majority of the margins are negative, implying that Hasbro’s stock price may currently be overvalued. While relative valuation is perhaps not as financially convincing as intrinsic methods of stock price analysis, the fact that all five measures provided weak margins of safety is a red flag moving forward. 25 All numbers from respective 10-ks. 26 Weights were 40% for 2009, 30% for 2008, 20% for 2007, and 5% for 2006/2005. Multiples projected Simple Weighted Simple Weighted Simple Weighted for 2010 5 yr. AVG 5 yr. AVG 5 yr. AVG 5 yr. AVG 5 yr. AVG 5 yr. AVG P/E Just HAS 15.10 14.12 39.56 36.98 3.13% -3.59% (Has + MAT) 14.94 14.39 39.14 37.69 2.04% -1.75% All Peer 12.47 11.37 32.67 29.79 -14.83% -22.34% S&P 500 P/E (12/31/09) 20.21 P/S Just HAS 1.08 1.03 33.29 31.68 13.21% -17.41% (Has + MAT) 1.18 1.10 36.30 33.90 -5.37% -11.64% All Peer 1.05 0.95 32.40 29.14 -15.54% -24.02% P/BV Just HAS 2.60 2.72 30.44 31.86 -20.64% -16.95% (Has + MAT) 2.87 2.80 33.70 32.88 -12.15% -14.29% All Peer 2.25 2.13 26.43 24.98 -31.11% -34.89% EV/EBITDA Just HAS 7.55 7.45 5,718 5,642 0.08% -1.24% (Has + MAT) 7.81 7.58 5,915 5,737 3.54% 0.42% All Peer 5.33 4.71 4,037 3,565 -29.34% -37.60% EV/Revenue Just HAS 1.28 1.30 5,373 5,455 -5.94% -4.51% (Has + MAT) 1.25 1.22 5,231 5,088 -8.43% -10.93% All Peer 1.00 0.92 4,185 3,846 -26.74% -32.68% Multiples Target Price Margin of Safety

- 24. Discounted Cash Flow Analysis27 in Mil. $'s. 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 Sales Growth 3.0% 3.0% 3.0% 8.0% 2.8% 1.2% 4.8% 21.8% 2.1% 3.0% Sales $4,934 4,790 4,650 4,515 4,182 4,068 4,022 3,838 3,151 3,088 2,998 EBIT $731 708 683 664 612 589 494 519 376 311 293 (1-T) 70.0% 70.0% 70.0% 70.0% 70.0% 70.8% 69.6% 72.0% 67.40% 68.20% 75.40% Depr of PP&E $113 110 107 104 96 96 88 89 68 78 76 Amortization. $49 50 52 49 49 85 78 68 79 102 71 Cap Ex - PP&E $(276) (268) (260) (253) (234) (104) (117) (92) (82) (71) (79) ∆ NWC $37 36 35 85 (159) 315 (86) 188 (107) 350 (9) FCFF $361 352 342 280 498 179 479 251 425 (29) 297 Terminal Value $5,779 Projected Implied Value Value WACC 9.43% 9.43% 9.43% 9.43% 9.43% Net Debt (496) (496) PV of CF $3,913 245 261 233 455 Sum of the PVCF's 5,107 5,713 Total Value of firm 4,611 5,217 # of Shares 136 136 Price Per Share $33.91 $38.36 *For accompanying notes to DCF please refer to Appendix. Based on the respective variables, the intrinsic value per share was calculated to be $33.91 a share. The current price (as of close April 2, 2010) is $38.36, which is above the calculated price and suggests the stock to be overvalued. As a point of reference one can work backwards from the current $38.36 per share price to figure out how much difference there is in Market Capitalization (Implied Value). The current price suggests a Market capitalization of $5,217 million, with the projected intrinsic value at $5,107million, resulting in $606 million unaccounted for. 27 Historical numbers were based off respective Hasbro 10-k’s. 24

- 25. Stylized Models:28 In the preceding sections, the different models (pro-forma, multiples, and the spreadsheet DCF) used conservative assumptions and pointed to the firm being fully-valued, if not over-valued. Instead of simply regurgitating the same findings, the following stylized models attempt to provide a different perspective by taking an optimistic stance and relaxing the conservative assumptions made with the other models. For example, the stylized models assume that the network venture, movies, and licensing agreements work out spectacularly for Hasbro and translate over into higher growth rates. H-Model: Equation: V = [FCFF x (1 + Gl) / (WACC - Gl) ] + [ FCFF x H x (Gs-Gl) / ( WACC – Gl ) ] Assumptions Analysis FCFF $267 V $5,193 WACC 9.43% Net Debt (496) H 1.5 # of shares 136 Gs 17.70% Price/share $34.53 Gl 3.00% *Please refer to the appendix for definitions & explanation of the respective variables. Three-Stage FCFF valuation model with declining growth in stage 2: Year: 1 2 3 4 4 Growth Rate 17.70% 17.70% 8.20% 8.20% 3% FCFF $314 370 400 433 TV $6,937 PV at 9.43% $287 309 305 302 4,837 Assumptions: Analysis: FCFF $267 Value (V) $6,041 WACC 9.43% Net Debt (496) g1 17.70% # of shares 136 g2 8.20% Price per share $ 40.77 g3 3% *Please refer to the appendix for definitions & explanation of the respective variables. 28 Figures in millions of Dollars. 25

- 26. 26 Analysis: One should bear in mind the growth rates apply to growth in FCFF and not sales. With the liberal assumptions made the H-model results in an intrinsic value of $34.53 per share, while the 3-stage model calculates a $40.77 per share. With the current price at $38.36 per share (as of close April 2, 2010), this translates into a margin of Safety of -9.98% and 6.28% respectively. While one of the models results in a positive value, even with the liberal assumptions this does not surpass the minimum margin of safety threshold. Valuation Summary29 Metrics: Values P/E $38.34 P/S 35.45 P/BV 33.79 EV/EBITDA 33.13 EV/Revenue 32.22 DCF 38.36 H-Model 34.53 3-Stage Model 40.77 Value $35.82 The current price (as of 4/2/10) is $38.36. At an implied value of $35.82, this indicates Hasbro is overvalued by 7.0% (a margin of safety of -7.0%). Our recommendation thus must be to not buy the stock at its current value. However, should the stock decline to a price of $28.66 without significant negative change in Hasbro’s fundamentals, the economic outlook, and other variables analyzed in this report, this price would provide a margin of safety of 25% according to our valuation. Under these circumstances, we would be confident in issuing a buy recommendation for Hasbro. Conclusion The Good: Sesame Street brand ownership Well balanced portfolio of assets Exclusive licensing agreements with EA, Marvel, and production studios Expanding into untapped markets (Brazil, India, Eastern Europe, etc) Company promotes from within Outsources most of its manufacturing so it can focus on its core business Slated to release a number of movies and animated T.V. shows leveraging core brands in 2011 29 The multiple values were derived by averaging the 5 year simple average for Has, the 5 year weighted average for Has, the 5 year simple average for (Has + Mat), and the 5 year weighted average for (Has + Mat). In addition, the final value was derived by averaging all of the different metrics.

- 27. 27 The Bad: Seasonality—a majority of sales come in Q3 and Q4 Concentrated customer base Discovery network venture could prove to be a classic case of “diworsification” The trend of kids becoming “older younger” The Ugly: The toy industry is stagnant, perhaps even in decline Most of our valuation models point to Hasbro being fully valued, if not overvalued Appendix Network Venture Article:30 Overcrowding A Problem For Kids Children's TV marketplace expected to be flat despite new entrants By Claire Atkinson -- Broadcasting & Cable, 3/1/2010 12:16:52 PM The smackdown for the attention of young viewers will get some new heavyweights in 2010. Discovery Communications' “The Hub”-its rebrand for Discovery Kids-and SyFy will look to crack open a piece of the billion-dollar-plus market. But as the kids upfront pitches get started on March 11 with Nickelodeon's presentation in New York, the emergence of new players doesn't necessarily mean there's any more money to go around. While the scatter market is running as much as 30% above upfront levels in other sectors, in the kids marketplace scatter is just a tick above upfront rates. The 2009 kids upfront was pegged at $850 million, according to industry estimates, and few see that-or the total ad spend figure-increasing. "I would say 2010 is going to be down versus 2009 as far as calendar-year spending," says Francois Lee, VP and activation director at MediaVest USA. Lee does note that major toy companies reported decent fourth-quarter earnings, and the annual New York toy fair has generated some buzz. Kantar Media figures puts the overall children's cable TV market at $1.175 billion in 2009, down from $1.281 billion in 2008. The company tracks Nickelodeon, Nick Tunes, Cartoon Network and Walt Disney Co.'s Disney Tunes/XD, but not Discovery Kids. Discovery has said little as yet about its rebranded kids entrant. A year ago, the factual giant sold a half- share in Discovery Kids to toy retailer Hasbro, and will turn the channel into “The Hub” this fall under the 30 http://www.broadcastingcable.com/article/449399-Overcrowding_A_Problem_For_Kids.php

- 28. 28 aegis of former Fox Kids Network chief Margaret Loesch. Hasbro paid $300 million for its share of the channel, but it's unclear whether the company, which owns properties such as G.I. Joe and My Little Pony, will continue to spend as widely with other services as a result of its big media investment. How visible Hasbro's own brands will be on the new channel is of keen interest to TV buyers. "We have to see what programming they put on and how directly or indirectly they support it," Lee says. "I'm sure they'll maintain a presence on other networks. If there's preferential treatment, I think it would create issues for other advertisers." Also joining the fray will be NBC Universal's SyFy. "As of fourth quarter, 13 million 2-11-year-olds were watching, with 25 million adults living with a child of those ages," says Alan Seiffert, senior VP of SyFy Ventures. "The kids side in many ways has not been well served, and we're in a unique place because our channel is very special." SyFy is looking to break out of its tight niche as a service for science-fiction aficionados and aims to embrace the wider theme of imagination. "What better audience to grow that with than children," Seiffert adds. Kids programming will launch first online and then is likely to appear on the channel in the next six months. Not all players in the space are linear networks. Comcast, an owner of PBS Sprout, is also out selling advertisers on its growing video-on-demand catalog, which has gained notable traction in the sector. Diana Kerekes, VP of video content at Comcast Cable, reports that customers ordered up a monthly average of 25 million hours of kids-themed content in 2009. In terms of usage, customers viewed kids content 70 million times over the same period. "On Demand is huge for kids; it is our most-viewed area within the On Demand system," Kerekes says. Between 2005 and 2010, Comcast says it has experienced a 370% increase in views of kids shows. Board of Governors:31 Why bother analyzing the Board of Governors? A strong board can prove to be an invaluable asset, while a weak board can materially hurt the company. It thus seems prudent to examine the board for any glaring negative points. In general, one would like a strong board to have a range of backgrounds in regard to experience, age, and sex. It is also important for the board to be vested in the company’s future, in equities, and to have a good number of people from the company itself. Too many other board affiliations are generally a negative sign, as this has a tendency to distract focus on the company. 31Hoovers (HAS, MAT), http://phx.corporate-ir.net/phoenix.zhtml?c=68329&p=irol-govboard, http://corporate.mattel.com/about-us/bios.aspx

- 29. 29 Hasbro Name Age Sex Number of other board affiliations Previously work experience Alfred j. Verrechia 67 M 1 Hasbro Basil L. Anderson 63 M 5 Staples; Campbell, etc Alan R. Batkin 63 M 3 Eton Park Capital Management; Kissinger Associates Frank J. Biondi, Jr 63 M 4 WaterView Advisors Kenneth A. Bronfin 48 M 0 Hearst Interactive Media Jack M. Connors 65 M 1 Hill, Holliday, Connors Cosmopulos Inc Michael W.O. Garrett 65 M 4 Nestle E. Gordon Gee 64 M 3 Ohio State University Brian Goldner 46 M 0 Hasbro Jack M. Greenberg 65 M 4 Western Union Company; McDonald's Alan G. Hassenfeld 59 M 0 Hasbro Tracy Leinbach 48 F 2 Ryder Edward M. Philip 42 M 0 Highland Consumer Fund Paula Stern 63 F 1 Stern Group Mattel Robert A. Eckert 54 M 1 Mattel, Kraft Dominic Ng 51 M 1 East West Bancorp Vasant M. Prabhu 50 M 1 Starwood Hotels and Resorts Worldwide Andrea L. Rich 65 F 2 Log Angeles County Museum of Art Ronald L. Sargent 53 M 2 Staples, Corporate Express NV Dean A. Scarborough 54 M 0 Avery Dennison Corporation Christopher A. Sinclair 58 M 2 Scandent Holdings; Cambridge Solutions G. Craig Sullivan 70 M 2 Clorox Company Kathy Brittain White 58 F 1 Horizon Institue of Technology; Rural Sourcing Desired Size Current Board # Retirement Age Term Limits Company ownership by Directors Limitations to serving on other Boards Hasbro 12-15 14 72 None Mandatory None Mattel 10-12 9 72 None Mandatory None Analysis: The facts reveal a wide range of backgrounds in both companies. If there is any weakness apparent from the data, it would have to be Mattel’s lack of directors who are ex-Mattel employees. It is important to have a good number of people from inside the company, for they have a tendency to better understand the company and can offer insider-perspectives. Takeover Defenses: No current information on takeover defense could be found for either company. In 1989, Hasbro enacted shareholder defenses, including a poison pill and staggered board, which may or may not be still in effect.

- 30. Financial Ratios for JAAKS and LeapFrog. 30 JAKK LF JAKK LF Finacial Analysis 2009 2008 2007 2006 2005 2009 2008 2007 2006 2005 MRY MRY 5 yr. AVG 5 yr. AVG Liquidity Current Ratio 3.26 3.17 3.09 2.64 3.43 2.51 2.40 2.78 3.97 4.41 1.89 1.71 3.12 3.22 Quick Ratio ((C+A/R)/C.L) 2.47 2.12 2.45 1.98 2.64 2.13 1.69 2.11 2.97 2.74 1.18 1.20 2.33 2.33 Cash (in Millions) 255$ 170$ 241$ 185$ 240$ 62$ 79$ 105$ 148$ 72$ 618$ 901$ 218$ 93$ Cash as a % of C.A. 50.2% 35.7% 45.8% 40.9% 56.5% 25.0% 33.0% 32.9% 38.2% 13.6% 25.9% 34.8% 45.8% 28.5% Cash as % of F.A. 202.4% 30.7% 52.7% 43.0% 72.9% 20.1% 25.8% 27.5% 32.9% 11.9% 13.2% 18.8% 80.4% 23.6% NWC (in Millions) 352$ 325$ 356$ 281$ 301$ 148$ 140$ 203$ 290$ 411$ 1,127$ 1,023$ NWC less Cash 97$ 155$ 115$ 96$ 61$ 87$ 61$ 99$ 142$ 339$ 509$ 121$ Profitability NI Margin -48.0% 8.4% 10.4% 9.5% 9.6% -0.7% -14.9% -22.9% -28.9% 2.7% 6.4% 10.0% -2.0% -12.9% Operating Margin -56.3% 7.9% 12.5% 12.0% 13.3% -2.2% -13.1% -22.9% -24.8% 3.2% 9.2% 12.2% -2.1% -12.0% Gross Margin 25.2% 35.5% 37.8% 38.6% 40.3% 41.6% 39.5% 39.2% 29.3% 43.0% 45.4% 46.5% 35.5% 38.5% ROA -37.5% 7.4% 9.1% 8.2% 8.4% -0.9% -22.3% -26.7% -32.2% 2.9% 8.1% 12.5% -0.9% -15.8% ROE -103.8% 10.2% 12.9% 11.9% 12.1% -1.4% -38.0% -41.6% -43.4% 3.8% 17.9% 26.0% -11.3% -24.1% Tax Rate credit 14.4% 31.5% 32.1% 34.2% credit credit credit credit credit 22.2% 14.7% Asset Management ACP (days) 58 59 74 72 47 140 71 112 102 143 53 60 62 113 Days Sales in Inv 21 54 51 59 61 45 74 70 74 164 54 48 49 85 APP (days) 23 35 36 50 46 94 71 63 48 72 39 50 38 70 TATO 1.27 0.88 0.87 0.87 0.88 1.24 1.50 1.16 1.12 1.07 1.27 1.24 0.95 1.22 FATO 6.38 1.63 1.88 1.78 2.01 6.44 6.95 7.02 7.97 8.67 2.59 2.70 2.74 7.41 CATO 1.58 1.90 1.63 1.69 1.56 1.54 1.91 1.39 1.30 1.22 2.48 2.30 1.67 1.47 Debt Management LTD (in Millions) 87$ 98$ 98$ 98$ 98$ - - - - - 750$ 550$ 96$ - LTD as a % of Total Liabilities 33.2% 34.9% 33.6% 35.9% 42.8% - - - - - 29.3% 22.0% 36.1% - LT Debt-to-Assets 13.7% 9.5% 10.0% 11.1% 13.0% - - - - - 16.0% 11.4% 11.5% - Total Liabilites-to-Equity 0.70 0.38 0.42 0.45 0.44 0.51 0.56 0.56 0.35 0.30 1.21 1.08 0.48 0.46 Total Liabilities-to-Assets 41.3% 27.3% 29.7% 31.0% 30.4% 36.9% 41.2% 35.8% 25.8% 23.1% 54.7% 52.0% 31.9% 32.6% TIE (50.33) 29.21 19.45 20.36 62.86 - - - - - 6.61 10.29 16.31 Du-Pont ROE PM -48.0% 8.4% 10.4% 9.5% 9.6% -0.7% -14.9% -22.9% -28.9% 2.7% 6.4% 10.0% -2.0% -12.9% TATO 1.27 0.88 0.87 0.87 0.88 1.24 1.50 1.16 1.12 1.07 1.27 1.24 0.95 1.22 EM 1.70 1.38 1.42 1.45 1.44 1.51 1.59 1.56 1.35 1.30 2.21 2.08 1.48 1.46 ROE -103.7% 10.2% 12.9% 11.9% 12.1% -1.3% -35.4% -41.6% -43.5% 3.8% 17.9% 26.0% -11.3% -23.6% JAKKS Pacific (JAKK) LeapFrog Enterpsies (LF) Financial Analysis

- 31. Notes to Pro-Forma Income Statement Explanation: Revenue Breakdown: This segment attempts to comprehensively breakdown revenue, so as to better understand the company trends. Furthermore, the revenue breakdown aid in the interpretation of the valuation section, most notably the Pro- Forma Income Statement. From year 2006 through 2010 (proj.) From year 2005 through 2009 Simple 5 year Weighted 35 Simple 5 year Weighted 36 Sales by Operations 5 yr. AVG CAGR 5 yr. AVG 5 yr. AVG CAGR 5 yr. AVG Games and Puzzles 1.68% 1.67% 1.16% 0.4% 0.4% 1.0% Boys 20.84% 16.44% 16.77% 24.2% 20.0% 31.7% Girls 13.08% 12.54% 5.98% 17.0% 16.5% 12.0% Preschool 7.09% 6.71% 2.74% 4.1% 3.4% 2.6% Tweens Toys excluded excluded Other -10.08% -27.25% -26.70% -4.7% -23.7% -27.6% Analysis: The above tables aided our calculations of projected total sales revenue for the pro forma income statement analysis. We computed compound annual growth rates for each product segment between the years 2004-2009 32 The bolded 2010 and 2011 numbers are projections. 33 Due to the decision in 2009 (footnote below), the girls toys sale figure is skewed and one would have probably seen a decline in sales with the raw number. 34 In 2009 the Tween Toys segment was dissolved and the brands were re-categorized under the different segments. 35 Weighed average calculated as [(2009x40%) + (2008x30%) + (2007x20%) + (2006x5%) + (2005x5%)] 36 Weighed average calculated as [(2010x40%) + (2009x30%) + (2008x20%) + (2007x5%) + (2006x5%)] 31 Sales by Operations 2011 2010 32 2009 2008 2007 2006 2005 2004 In Mil. $'s Games and Puzzles 1,381 1,354 1,341 1,315 1,324 1,294 1,246 1,316 Boys 1,776 1,545 1,471 1,083 1,024 576 722 592 Girls 839 807 791 33 791 697 540 447 368 Preschool 505 463 451 481 435 407 335 381 Tweens Toys 34 - - - 270 252 267 270 287 Other 14 14 14 81 106 68 68 54 Net Revenues 4,515 4,182 4,068 4,022 3,838 3,151 3,088 2,998 1 yr. Games and Puzzles 2.0% 1.0% 1.9% -0.6% 2.3% 3.8% -5.3% - Growth Boys 15.0% 5.0% 35.8% 5.8% 77.8% -20.2% 22.0% - Girls 4.0% 2.0% 0.0% 13.4% 29.1% 20.9% 21.5% - Preschool 9.0% 2.6% -6.1% 10.5% 6.9% 21.5% -12.2% - Tweens Toys - - 0.0% 7.2% -5.5% -1.1% -6.0% - Other 0.0% 0.0% -83.0% -22.9% 56.0% -0.5% 26.7% - Net Revenues 8.0% 2.8% 1.2% 4.8% 21.8% 2.1% 3.0% -