MBA Dissertation 2007 Coventry University, United Kingdom.

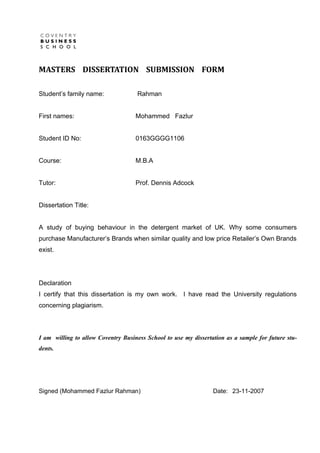

- 1. MASTERS DISSERTATION SUBMISSION FORM Student’s family name: Rahman First names: Mohammed Fazlur Student ID No: 0163GGGG1106 Course: M.B.A Tutor: Prof. Dennis Adcock Dissertation Title: A study of buying behaviour in the detergent market of UK. Why some consumers purchase Manufacturer’s Brands when similar quality and low price Retailer’s Own Brands exist. Declaration I certify that this dissertation is my own work. I have read the University regulations concerning plagiarism. I am willing to allow Coventry Business School to use my dissertation as a sample for future stu- dents. Signed (Mohammed Fazlur Rahman) Date: 23-11-2007

- 2. Acknowledgement Author would like to express his sincere gratitude, appreciation and a message of thanks to the Dissertation Supervisor Prof. Dennis Adcock for providing valuable guidance, su- pervision, mentoring as well as encouragement for carrying out research for the topic “A study of buying behaviour in the detergent market of UK. Why some consumers pur- chase Manufacturer’s Brand (MB) when similar quality and low price Retailer’s Own Brand (ROB) exist”. Author wishes to thank Dr. Rajendra Kumar and Dr. Peter McGee for providing valuable comments, support and guidance through out the course and research. Special thanks to the staff and management of London School of Commerce for providing an opportunity to enhance my career with MBA and establishing this research. A message of thanks is also conveyed to Coventry University for the opportunity provided, to conduct research, by accepting the research proposal and providing Athens login, a data base of literature which played a significant part in gathering secondary data for the research. Author conveys sincere thanks to his family and friends for their life-long support. Author specially owes his life to Allah (swt), parents and wife, for the strength and motivation through out his life. The contributions of all the above have been very crucial in carrying out this research.

- 3. Contents Page No. List of Tables and Figures i Executive Summary iii Chapter 1: Background and Objectives 1 Topic of Research, Research Objectives, Problem Statement: 2 Chapter 2: Literature Review 3 Introduction, Brand, Brand loyalty, Brand Equity, Advertising, 4 Consumer Buying Behaviour, 9 Environmental Influences, Culture, Social Class, Groups/Family, 10 Situational factors, Marketing efforts, Individual Influences, 12 Psychological factors, Demographics, Life style and Economic situation, 13 Decision Making Process, Problem or Need recognition, 14 Information Search, Evaluation of Alternatives, 15 Purchase decision, Post purchase behaviour, 16 Marketing Mix: 7 P’s, 1) Product, 2) Price, 3) Place, 4) Promotion, 17 5) People, 6) Physical evidence, 7) Process. 19 Chapter 3: An overview of detergent market. 21 Detergents, Retailer’s Own Brand (R.O.B), Why retailers display MB(s), 22 ROB Growth in UK, Tesco, Sainsbury’s, Asda, 23 Five Forces model of ROB, Competitive Rivalry within a market, 27 Barriers to entry, Threat of substitutes, 28 Bargaining power of Suppliers and Bargaining power of Buyers. 29 SWOT Analysis of ROB(s) 30 Strengths, Weakness, Opportunities, Threats 31 Manufactured Brand (MB) 32 Procter and Gamble (P&G), Unilever, Brand share. 35 Five Forces model of Manufactured Brands 38 Competitive Rivalry within a market, Barriers to entry, Threat of substitutes, 38 Bargaining power of Suppliers, Bargaining power of Buyers. 39 SWOT Analysis of ROB(s) 40 Strengths, Global Expertise, Financial Resources, Weakness, Price, 40 Research on Animals, Opportunities, Brand Leverage, 41 Sponsorship and Co-branding , Threats. 42 Chapter 4: Research Plan 43

- 4. Introduction, Research Design, Data collection methods, Secondary data, 44 Sampling, Primary data, Questionnaire, Validity, Reliability, Pilot study, 45 Research Ethics, Limitations of Research, Research Time Table. 48 Research GANTT Chart. 49 Chapter 5: Data Analysis. 50 Questionnaire Analysis: Frequency of detergent purchases, pack size, Reason for purchase, 50 Choice of product (Brand), feelings about the product, 51 experience of switch, sources of information, 53 Factors influencing consumer behaviour: 54 brand, Price, Quantity, Quality, Packaging, Promotion offers, 55 Price discounts, Coupons. 57 Influence of media advertising: 58 Television, Radio, Newspaper, Magazine, Internet, Sign Boards, 59 In store promotions. 61 Importance of store environment: 62 Location, Design, Atmosphere, Cleanliness, Shelf Display, 63 Searchable in store. 65 Demography: Gender, Age group, Education, Work, Family status. 66 Chapter 6: Conclusions 68 Recommendations, and Personal Reflection 69 Chapter 7: References: 72 Appendix 1: Questionnaire (1-3)

- 5. i List of Tables and Figures. Page Fig. 1.2.1 Price comparisons of Detergents in U.K. 2 Table 1.22 UK House hold detergent expenses. 2 Fig.2.2.1 Diffusion of Innovation model. 9 Fig.2.2.2 A frame work of Consumer Buyer Behaviour 10 Figure 2.2.51 Maslow’s hierarchy of needs 14 Fig 2.2.52 Buyer Decision Process 14 Table 2.2.5.21 Ariel product benefits 15 Fig 2.31 The 7 P’s of Marketing Mix 17 Figure 3.2.21 Segmented market share of clothes washing detergents in UK 23 Fig. 3.2.22 ROB growth in UK. 23 Fig. 3.2.23: Source of Own Label Growth 24 Fig. 3.2.24: Retailer concentration of the most developed ROB Markets 24 Fig 3.2.25 UK Differentiation % Sales in ROB. 25 Fig. 3.2.41 Porter’s Five forces model. 27 Fig 3.30 Washing up liquids 33 Figure 3.31 Market size of Detergents in UK 34 Figure 3.32 Market shares of Clothes washing detergents in UK 34 Figure 3.41 P&G share of Clothes washing detergents in UK 35 Figure 3.51 Unilever shares of Clothes washing detergents in UK 36 Figure 3.61 Brand shares of Clothes washing detergents in UK 37 Fig. 3.70 Porter’s Five forces model (MB). 38 Fig 4.1 The Research Process 43 Table 4.2 Survey Route. 45 Research GANTT Chart 49 Fig 5.1 Frequency of detergent purchase 50 Fig 5.2 Pack size purchased. 50 Fig 5.3 Reason for purchase. 51 Fig. 5.4.1 Choice of the product or brand. 51 Fig 5.4.2 Consumer’s choice between MB and ROB. 52 Fig.5.5 Consumer response about the product in use. 52 Fig. 5.6 Switch between brands and the experience of the same. 53 Fig. 5.7 Sources of Information 53 Fig 5.8 (a) Importance of Brand. 54

- 6. ii Fig: 5.8 (b) Importance of Price. 54 Fig: 5.8 (c) Importance of Quantity. 55 Fig: 5.8 (d) Importance of Quality. 55 Fig: 5.8 (e) Importance of Packaging. 56 Fig: 5.8 (f) Importance of Promotion offers. 56 Fig: 5.8 (g) Importance of Price Discount. 57 Fig: 5.8 (h) Importance of Coupons. 57 Fig 5.9 (a) Influence of Television advertising. 58 Fig 5.9 (b) Influence of Radio advertising. 58 Fig 5.9 (c) Influence of News paper advertising. 59 Fig 5.9 (4) Influence of Magazine advertising. 59 Fig 5.9 (e) Influence of Internet advertising. 60 Fig 5.9 (f) Influence of Internet sign boards. 61 Fig 5.9 (g) Influence of In-store promotions. 61 Fig 5.10 (a) Store Location. 62 Fig 5.10 (b) Store Design. 63 Fig 5.10 (c) Store Atmosphere. 63 Fig 5.10 (d) Store Cleanliness. 64 Fig 5.10 (e) Shelf displays. 64 Fig 5.10 (f) Searchable in store. 65 Fig 5.11 Gender. 66 Fig 5.12 Age. 66 Fig 5.13 Education. 66 Fig 5.14 Work pattern. 67 Fig 5.15 Family status. 67

- 7. iii Executive Summary The report is about consumer buying behaviour, factors that influence consumers towards MB(s) when less price and similar quality ROB(s) exist. The author has used two specific terminologies during the report, Retailer’s Own Brand (ROB) the private brand or own label of a retailer, usually not manufactured by retailer, for example ‘Tesco washing powder’ is sourced, not manufactured by Tesco. Manufactured Brand (MB) refers to brands which are supplied by manufacturers directly, for example ‘Ariel’ detergent is manufactured, owned as well as supplied by Procter and Gamble (P&G). The report starts with background and objectives where author explains the reasons for topic selection and objectives of the research. The topic reflects an assumption that consumers choose MB(s) against ROB(s), whether it is correct or otherwise requires research, further what factors influence consumers towards such decisions also need investigation. Hence through literature review author presents arguments based on different authors, academics and researchers on the relevance of these focus questions. Consumers perceptions influencing purchase of MB(s) against ROB(s) like ‘high price_ high quality’ and ‘low price-low quality’, market share statistics were used to highlight the dom- ination of the market by MB(s), importance of brand and brand loyalty, creation of brand equity through advertising and other promotional tools have been discussed. Consumer buying behaviour model is described to explain key factors like Individual(personal) factors and External factors (family, friends and society) as well as their significance in influencing decision making process. Maslow’s hierarchy of needs and buyer decision process model presents a better understanding of consumer influences. The importance of 7 P’s of marketing and how significantly it is used to influence consumer perceptions and decisions, helps in further understanding the area of study.

- 8. iv The overview of detergent market in UK empowers the reader about relevant information regarding the total market share, brand share, market growth and strategies of some of the major ROB(s) (Tesco) and MB(s) (P&G and Unilever). The study of ROB market share and growth reflects the current standing (Market share) as well as the indicative growth trends. The ROB(s) market share against MB(s) present the statistics required to understand the current consumer preferences, while the growth trends reflect the future prospects and hence future consumer preferences. It is quiet possible that consumers change their preferences between MB(s) and ROB(s) in the future leading a change in market share structure, the previous growth of both of these segments can give a likely indication about the same. In order to grow what strategies are applied by ROB(s), the reasons why they display MB(s) instead of only ROB(s). The analyses of ROB market is further highlighted through 5 forces model, i.e. the forces influencing ROB market. SWOT analyses present the internal capabilities of ROB(s) against external influences. These notes present a crucial understanding of consumers perceptions about ROB(s), areas ROB(s) are lacking behind MB(s) and how ROB(s) are increasing their market share. The study of MB(s) with respect to market share, market growth explains the current market situation regarding MB(s). The report presents relevant areas of interest about prominent MB(s) like P&G and Unilever, the strategies they have adopted to offset threats of low price ROB(s), why consumer preference is high for MB(s) against ROB(s) are the key areas discussed in this topic. The analysis of MB market is further highlighted through 5 forces model, i.e. the forces in- fluencing MB market. SWOT analyses present the internal capabilities of MB(s) against external influences. This chapter highlights the utilization of factors like global expertise, fi- nancial resources, sponsorship and co-branding strategies by MB(s) to influence consumer perceptions and behaviour towards MB(s). The topic on research methodology presents the methods utilized for conducting the research as well as research design. Sampling explains in detail about the methods used to select the sample for survey, why it was done so as well as the hurdles faced during the surveys.

- 9. v Questionnaire design presents the key focus areas like, what factors were considered during questionnaire design, pilot test, the precautions taken about accuracy, reliability and research ethics. In the end of this chapter the limitations of this research were also discussed. Data analyses presents the questionnaire analyses of all the 15 main as well as other sub questions. With the aid of pie diagrams, tables and conclusions about each factor, focus was drawn towards the significance of each question on consumer influences. The conclusions and recommendations chapter presents the final conclusions about the research. The main factors that influence consumers towards MB(s) against ROB(s) were concluded in detail. Apart from that conclusion also presents the likely future trends based on previous year’s growth, and the indicative future trends about the competition between MB(s) and ROB(s). The recommendations focus on how ROB(s) can increase their market share, penetration and growth. How ROB(s) can over come their weakness to compete with MB(s) and some of the strategies that ROB(s) can adopt are also discussed. The personal reflections chapter is based on author’s personal reflections observed through out the research, the lessons learnt and how this information will be applied by author for his future endeavors. In the end there is a list of references in alphabetical order and appendix contains the questionnaire format used for survey.

- 10. Chapter 1: Background and Objectives. 1 Topic of Research: The research topic was chosen by the author according to the interest on the relevant subject i.e. consumer buying behaviour. Author held various sales positions in different organizations during past 12 years, in 5 different countries. The study of consumer perceptions regarding MB and ROB empowers the author for future endeavors. The purpose of this research is based on consumer perceptions about brands in the UK market. Different aspects of consumer behaviour including the reasons for choosing certain detergents and consumer response to stimuli. This research also considers different cat- egories of consumers, e.g. male and female, working and not working, adults and ama- teurs, and their perceptions about detergents available in the UK market, hence the re- search tends to present a clear understanding of clothes washing detergents in UK from con- sumer’s perspective. Research Objectives: The objectives of research are to study the consumer perceptions about brands. The following areas will also be considered, Consumer behaviour about ROB compared to MB. Variations in perceptions about ROB and MB. Relate other theories, models and analysis, how they impact on the market. Recommendations for MB(s) and ROB(s). These were determined and focussed on the relevance of the topic rather than studying wider areas i.e. to study what factors of buying behaviour influence consumers towards selection between MB(s) and ROB(s), discuss existing theories, published literature and findings of researchers. This leads to an investigation about current market share between MB(s) and ROB(s), the reasons behind market domination by MB(s), growth trends and speculations about future indicative market growth. Problem Statement: The total market size of UK detergents was valued at £2 billion in 2006, clothes washing detergents are valued at £1.19 billion. There are 2 major MB(s) in the detergents market of UK, Procter & Gamble or P&G (47%), Unilever (30%), together they control more than 3/4 th market share. ROB(s) are estimated to be around 17% and the rest 6% by other companies. (Mintel 2007)

- 11. 2 Photo Image Tesco Sainsbury's Asda Morrisons Description price price price price ARIEL Bio Washing Pow- £5.98 £5.98 £5.98 £5.98 der 2.85 Kg. BOLD Automatic Washing £5.99 £5.99 £5.98 £5.99 Powder 2.85 Kg. PERSIL Automatic Washing £5.00 £5.98 £5.98 £5.98 Powder 3 Kg. ROB Budget Washing £1.41 £1.41 £1.41 £1.41 Powder 3 Kg. Fig. 1.2.1 Price comparisons of Detergents in U.K (Tesco 2007 & Sainsbury’s 2007) (The prices stated above were checked at “Tesco Price Check at www.tesco.com” on 23-10-2007 and11-06-2007, during this period of 4 months, prices remained constant.) As shown in figure 1.2.1, the table shows price comparison of 3 brands (Ariel & Bold belongs to P&G and Persil is with Unilever in UK) against Retailer’s Own Brands, while MB costs in the range of £1.67- £2.10 per kilogram (Avg. £1.88/Kg), ROB costs £0.47/Kg. The total number of households in 2006 were around 25 million in UK, With the average household purchasing 1 Kg of detergent in a week, the following conclusions can be drawn (National Household Statistics 2006) Description Detergent / Week Detergent / month Detergent / Year MB £1.88 £8.14 £97.76 ROB £0.47 £2.03 £24.44 Savings £1.41 £6.11 £73.32 Table 1.22 UK House hold detergent expenses. A single house hold can save £73.32 per year (£6.11/month) by switching to ROB and in total the whole of UK can save around £2 billion. Chapter 2: Literature Review: 3

- 12. Literature review avails the opportunity to explore the published research material about relevant area of interest, critical analysis in terms of debate and arguments about the merits as well as de-merits of the published records and establish relations between this secondary information with primary data collection. Literature review enables the researcher to explore all important variables, including those having repeated impact as well as influence over the problem. There is a need to know what work has already been done, critical analysis of the previous findings as well as scope to do further research. Finally relate the primary data collected with the previous secondary research. (Saunders et al 2003). The purpose of this research is to study buying behaviour in the UK market for detergents, why consumers choose Manufacturer’s Brands (MB) even when Retailer’s Own Brands (ROB) exists at a low price and similar quality. In the global environment we live today, there are different choices for a consumer to adapt. Every company influences customers towards ‘pull’ effect in order to achieve ‘push’ effect. Through marketing tools, companies create a ‘pull’ effect, i.e. pulling customers towards its products as well as encouraging customers to pull the product off shelf. Thus creates a ‘push’ effect for its products. In short, pull customers towards purchase of the product which in turn pushes the product off shelf. The consumer perception about Retailer’s Own Brands (ROB) is similar but not equal to the quality standards of Manufactured Brands (MB), hence consumers still perceive it risky to switch over to ROB. The likely effect of a bad purchase and the resulting ill effects on the clothes could also add up for this perception. More over the habitual purchases, familiarity and high level of confidence in manufactured brands, retention of stimuli about the company, brand, sub-brands particularly benefits and attributes, the bad experience about ROB in detergents as well as other categories, natural tendency ‘resistance to change’ are some of the reasons why consumers choose MB over ROB. Consumers perceive MB as superior to ROB in terms of various factors like quality standards (ingredients and final product), reliability, and fragrance and hence the final outcome. ROB lack behind due to less price (low price-low quality perception), lack in strong brand recognition, negligible or non existent advertising at the national level and lack a distinct identification with a particular manufacturer. Hence MB enjoys a level of brand image and brand equity along with quality standards that is difficult to offset by low price ROB. (Mieres et al 2006) 4 Consumers generally are not confident to make judgments on the basis of product attributes

- 13. to determine the best available alternative, hence depend on brand name and price to gauge the product quality. MB is higher in price and from a well known manufacturer hence preferred to ROB. (Sethuraman & Cole 1997, DelVecchio 2001, retrieved from Mieres et al 2006). Due to the low cost strategy of own brands, retailers spend less on advertising, though it is ef- fective in offering low costs but at the same time lacks promotion of the ROB, while MB(s) have reached market leader status with a focus on high quality production, rigorous advertising and promotion strategies (investments) for their brands, which in turn is viewed as a sense of quality, performance standards, reliability and low risk by the consumers. (Aaker 1996 retrieved from Mieres et al 2006) However Uncles (& Ellis 1989 sited in Davies & Brito 2004) contradicts these views and argues that consumers perceive ROB(s) as similar to MB(s). Consumer perceptions about ROB(s) are influenced by different factors apart from price, like specific behaviours (Baltus, 1997 sited in Davies & Brito 2004), demographics(Hoch 1996 sited in Davies & Brito 2004) and the risks involved(Batra and Indrajit 2000 sited in Davies & Brito 2004), these perceptions are common to any product irrespective whether it is ROB or MB. In response to quality con- cerns ROB(s) have developed internal quality control systems (Senker 1987 sited in Davies & Brito 2004) and have developed premium ROB(s)(Quelch and Harding, 1996 sited in Davies & Brito 2004) to place them on par with MB(s). (Davies & Brito 2004) One of the important focus areas in the debate about consumer choice between MB and ROB is the availability, MB(s) have a degree of advantage over ROB, for example an ‘Ariel’ customer will find it at any grocery, corner shop or retailer and hence finds it convenient to stick or be brand loyal, while a ‘Tesco washing powder’ customer may not find the same even in Tesco shops (metros) apart from other retailers, grocers or corner shops, instead of launching a search to the next available Tesco store where it is available, customer will find it practically inconvenient to be brand loyal for ROB. MB(s) ensure availability in retail stores as well as grocers, while ROB are just another own la- bel product which are subject to availability, in short the focus and attention MB(s) pay towards availability is rarely seen with ROB, this leads to a situation where in times of need, consumers find MB easily accessible compared to ROB.

- 14. 5 As per 2006 statistics (UK clothes detergent market share), more than 80% of market share is with MB leaving less than 20% for ROB. (Mintel 2007). According to author’s primary data collection, ROB stands at 10% while MB shares 90% of the market share. (Fig. 5.4.2, Pg :75) The UK clothes detergent market from 2004 (£1.178 billion) to 2006 (£1.190 billion) reflects a growth of + 0.01% for the total 3 year period. MB(s) reflect a growth of - 0.01% (from £0.95 bil- lion in 2004 to £0.94 billion in 2006) while ROB(s) have grown by +12% (from £0.179 billion to £0.201 billion) (Mintel 2007). Analyses of the above statements reflect market share in favour of MB whereas ROB has a very little effect and way behind MB. However with reference to market growth, the total market has grown by a slow progress (0.01%), MB(s) have shown de-growth (-0.01%) while ROB(s) have shown higher growth (+12%) despite slow growth of the total market. Even though at present market share is heavily dominated by MB(s) if the same growth rates con- tinue for all the 3 segments (Total market, MB and ROB), future looks favourable for ROB(s), higher growth rate of ROB(s) and de-growth of MB(s) will lead to a situation where market share of MB(s) will be captured by ROB(s). According to a research commissioned by Somerfield supermarket UK (published in Private label magazine), it is estimated that consumers through out UK save around £336 million per week with ROB which amounts to a weekly saving of £7.15 per adult and amounts to a saving of £371 per person annually. (Knothe 2007) Brand and advertising study enables the reader to understand what a brand is and why it is important to build a brand. Consumer buying behavior brings the focus to the key area of research i.e. why consumers buy and the factors that influence the buyer. 2.1 Brand: Brand is a very important factor for detergent markets (for both MB and ROB), with the variety of global as well as regional brands available for consumers at competitive prices, quality, packing, etc. There is a stiff competition for detergents to compete for business as well as survival. Retaining as well as increasing sales or market share depends on the influence of brand on consumer buying behaviour, ultimately the intended revenues targeted depend mainly on consumer choice.

- 15. 6 “As to valuing brands, fashions in business models may come and go – but cash flow remains a trusty and constant yardstick. The allegiance that a consumer feels towards a favourite brand – the predisposition to purchase that is built on a better product and a more useful bundle of benefits – is a capital asset. It is a reservoir, if you like, of future cash flow.” (Niall FitzGerald, chief executive, Unilever, as stated in CIM 2003). According to FitzGerald as quoted above, brand ensures secured income or cash flow, which can be achieved only by building a brand that is perceived by the consumers, as a symbol of high quality backed by product benefits and attributes. Brand empowers (a product/service) to demand and retain a better price from consumers as well as to project itself as a value for their money, this leads to long term profitability as well as growth which is the main purpose of brand. It is important to note that while all detergents are placed in the same shelf next to one another, it is the brand choice of the consumer which leads to sales of a particular brand, otherwise there is no much a difference in terms of results, as all detergents serve the purpose of cleaning. Chartered Institute of Marketing states that the brands originate from planning documents and end up in the hearts as well as minds of customers. (CIM 2003) CIM explanation points towards the actual process, it takes years of planning as well as “trial and error” methods in terms of R&D costs to establish a brand which is again a subjective matter. According to Temporal, brand image or brand building over a period of time, is essential for the long term growth of the brand. This process involves constant monitoring of attributes like values, positioning as well as perception by customers, every time a customer comes in contact with the brand combined with tracking of competitor activity. (Temporal 2002) The explanation given by Temporal highlights the time factor. Temporal emphasizes the importance of building brands over a period of time through monitoring customer perception as well as competitor activity. With the aid of packaging and promotion, brands have reached a stage where it sells for a price that exceeds well beyond the cost of its ingredients, i.e. what makes it so important to create a “consistent” brand (De Chernatony & McDonald 2003)

- 16. 7 In 1999, David D’Aessandro (President of John Hancock Mutual Life Insurance, USA) speaking on the importance of brand said, “It can take 100 years to build up a good brand and 30 days to knock it down”, this statement reflects the importance of not only building a brand but also maintaining the brand. (Klien 2000) 2.1.1 Brand loyalty: Brand loyalty is an important aspect of brand, one of the main aims of brand creation is to cre- ate brand loyalty. According to Giddens, brand loyalty is the commitment of a customer to continue purchasing the product as well as recommending to others. There is emphasis on ar- eas like the need for higher sales volumes with respect to gaining new customers as well as loosing old ones. Brands can charge premium prices where as consumers are less sensitive in terms of pricing for preferred brands, this also incurs less costs on brand marketing as well as advertising. (Giddens & Hofmann 2002) According to Rowley (1997), Brand loyal customers can be classified into 4 main groups, • Hard core consumers who will always prefer to buy a single brand. • Soft core consumers exhibit loyalty between 2 to 3 brands. • Shifting Consumers change brands very often. • Switchers keep switching between brands. (Rowley 1997), 2.1.2 Brand Equity: The measure of customer confidence or the value(s) perceived by customers in a brand is called brand equity. Firms having high brand equity gain a competitive advantage in terms of successful line extensions, high barriers to competitor entry and exit and resilience against competitor promotional activities (Farquhar, 1989, sited in Lassar et al 1995). “An indication of the importance of well-known brands is the premium asset valuation that they obtain. For example, 90% of the total price of $220 million paid by Cad- bury-Schweppes for the “Hires” and “Crush” product lines of Procter & Gamble is attributed to brand assets” ( Kamakura and Russell, 1991; Schlossberg, 1990 sited in Lassar et al 1995) Brand equity consists of two main components, brand strength (“brand associations held by customers”) and brand value (“brand values are the gains that accrue when brand strength is leveraged to obtain superior current and future profits”). (Srivastava and Shocker, 1991). (Sit- ed in Lassar et al 1995).

- 17. 8 Brand equity is created with the aid of different tools like Advertising as well as in house promotions. Advertising can be local, regional as well as international. Brand in short is a representation in terms of a product or a service, enabling the customer to identify as well as differentiate in terms of requirements, expectations, performance, etc. Since the customer has to make the ultimate choice, firms need to differentiate their product from competitors as well as identify the product with certain parameters of performance in accordance with customer expectations. Most of the MB’s (Ariel, Tide, and Persil) comes from companies which are around 100 years old, their experience, knowledge, R&D and resources have enabled them with the opportunity to build brands worth millions of dollars. ROB companies (Tesco, Sainsbury) are also around a century old, however their experience of own brands is a couple of decades old, hence are of no match when comes to expertise and experience. 2.1.3 Advertising: Advertising is an important factor to convey the message about brands. Every day consumer stimuli receives attention from advertising of brands through print as well as electronic media. Print media includes printed material like newspapers, magazines, product catalogues as well as brochures. Expert opinion, write ups as well as critical analysis of brands are also part of print media. Electronic media is gaining more importance due to the increased usage of internet on a daily basis by vast majority of consumers for information as well as shopping. Electronic sources used for advertising are search engines (Google, yahoo, msn), online trading sites (eBay), on- line news papers, e-journals, online articles, online reviews, solicited as well as unsolicited emails (spam). Kotler explains the importance of advertising in terms of establishing a strong brand po- sition or in short, advertising is an important tool for branding. Advertising aids branding in dif- ferent ways like building brand awareness, efficiency in reminding consumers, generation of leads, legitimization as well as reassurance, this leads to encouraging as well as creating competitive advantages (Kotler 2006).

- 18. 9 In house promotions consist of tools like, POS posters, POS stands, pack on pack offers, discounts, rebates, coupons as well as persons promoting the product as promoters distributing leaflets, samples as well as educating consumers at the retail stores. From this chapter the importance of brand and advertising has been highlighted as a way of differentiating the product from competition in order to achieve long term growth, however the choice still lies with the consumer as brands can be measured on the success scale depending mainly on consumer choices, hence the next chapter will present this important area of study i.e. consumer buying behaviour or simply the study of the factors influencing consumers towards making purchases. 2.2 Consumer Buying Behaviour: Consumer Buying Behaviour enables the readers to understand the most important area of this research i.e. “why consumers buy”. The study of consumer behaviour consists of the factors that influence the consumers towards purchases, these can be classified as Internal, External influences as well as traditional and additional elements of marketing mix. It is important to note that “There is no shortcut to success”, hence theoretically strategies could be planned but practical implications are much more complex than that. Firms have to work as leverage between consumer needs, influences and decision making process on the one hand and on the other, match it with product/service features and benefits; this will help in creating “Tailor made” solutions for consumer needs as well as long term profitability for the sellers. According to Rowley (1997) “Purchasing will also be influenced by individuals’ attitudes to risk and innovation. The following summarizes a widely accepted model of the roles of customers in the diffusion of innovation”: Innovators (2.5%) • Innovators 2.5 per cent; Early • Early adopters 13.5 per cent; adoptors (13.5%) • Early majority 34 per cent; Early m ajority • Late majority 34 per cent; (34%) • Laggards 16 per cent. “(Rowley 1997)” Late m ajority (34%) Laggards (16%) Fig.2.2.1 Diffusion of Innovation model.

- 19. 10 Environmental Influence Individual Influence Culture Psychological aspects Social Class Demographics Groups / Family Lifestyle Situational factors Economic situation Marketing efforts Memory Decision Making Process Feed back Motivation Search Evaluation Purchase choice Purchase outcomes Fig 2.2.2 “A frame work of Consumer Buyer Behaviour” (Lancaster et al 2002, Pg: 75) With the aid of “A frame work of Consumer Buyer Behaviour” as in fig.2.2.2, the various influences on consumer buy behaviour leading to the ultimate purchase outcomes have been explained in detail. These influences can be classified as Environmental (external) influences and Individual (internal/personal) influences. (Lancaster et al 2002) 2.2.3 Environmental Influences: These are external or environmental influences, mainly outside influences on one’s personality, these are as follows. 2.2.3.1 Culture: Culture is a broad spectrum consisting of various aspects or sub cultures like nationality groups (US/UK/Indian/Polish), Racial groups (White/Black/Asian/Hispanics), and Religious groups (Christian/Muslim/Jew/Buddhist/Hindus). These sub cultural groups are influenced by the different media they are exposed to, choice of outlets, product contents, etc. While Jews

- 20. avoid “non kosher” food and alcohol, Muslims avoid “non halal” food and alcohol, Hindus and Buddhists keep them selves on vegetarian diets. 11 According to author’s experience, most consumers, when asked about their purchase choice, indicated “habitual” decision making which exhibits a strong indication of cultural influence, passed from generation to generation, in short, what parents follow, off springs tend to follow the same. In case of ‘habitual purchases’ Manufactured Brands have a degree of advantage compared to ROB, for instance the major detergent brands (Persil, Tide, Ariel) are almost half a century old i.e. being used or at least known to 2 generations where as ROB (Tesco & Sainsbury own labels) are known only to the current generation and hence could also be one of the reasons in favour of MB. 2.2.3.2 Social Class: This class exhibits the various income levels of the individuals. This can be classified into 3 main groups, Low income group (income support and unemployment benefits), Middle class (working class paying taxes) and Elite (high incomes). (Lancaster et al 2002) Low income groups may have very less income levels; hence they are not regular buyers and tend to buy the lowest or cheapest goods irrespective of quality or brand concerns. Elite buy premium products and are not bothered about the price. Middle class are usually the target group of marketers for two obvious reasons, first they have income to dispose of on pur- chases and second they constitute a majority among the social classes. Middle class individu- als are also conscious about factors like price, brand, quality, ethics, environment, etc. 2.2.3.3 Groups/Family: These are classified into Primary groups and Secondary groups. Primary groups consist of family, friends, peers, colleagues and neighbours. Secondary groups consist of celebrities from various fields like sports, entertainment and fashion industry. Both of these groups have a major impact on consumer decision making process due to the choice of products used and recommended. Marketers are using this information in terms of “Celebrity brand endorsements” and “Brand Ambassador”, “Beckhem” brand endorsements are not only popular in UK or Europe but also globally. Manufactured Brands extensively afford to use “Brand endorsements” as it reaches larger audiences in terms or investments and return on investments, the same cannot be achieved by ROB as their target customers are far less than the MB and hence cannot justify huge investments. (Lancaster et al 2002)

- 21. 12 2.2.3.4 Situational factors: The choice of purchase or consumption can change according to convenience. During primary data collection, author realised the fact that consumers rated “convenience” as on of the top priorities for decision making. The availability of the product at the store near to the place of residence or work, price variations in terms of discounts and offers, availability of time and waiting periods at tills are some of the important situational factors. (Lancaster et al 2002) While “Tesco detergent” is exclusively available in Tesco outlets whereas “Ariel” is available at corner shops, local groceries as well as retailers like Tesco, hence in terms of convenience also MB has a degree of advantage over ROB. 2.2.3.5 Marketing efforts: The marketing information gathering (data collection) about consumer choices with respect to a firm’s own products as well as competitor activities, results in firms launching marketing campaigns through various sources like, electronic and print media as well as in store promotions. These actions also influence decision making process in terms of creating “Pull & Push” effects. (Lancaster et al 2002) Since the target customers as well as availability of MB covers vast geographical areas, they invest millions of dollars on marketing efforts like, market research, advertising, promotions, etc, whereas ROB are either local players or with limited geographical coverage and hence cannot match MB in terms of marketing resources and expenditure. For instance, P&G and Unilever advertise and promote not just their respective companies but also individual detergent brands (Ariel, Bold, Fairy, Persil, Surf) through TV commercials and soap operas, where as Tesco and Sainsbury concentrate there marketing efforts on just the ‘company’ not individual product. 2.2.4 Individual Influences (personal or internal Influences): 2.2.4.1 Psychological factors: This is a broad spectrum of consumer’s personal behaviours like perception, stimuli retention, attitude, motivation, personality, etc.

- 22. 13 The interpretation of stimuli, exposure and comprehension results in a specific attitude towards a brand, if positive then firms benefits otherwise negative attitudes have to be dealt with changing the brand itself. (Lancaster et al 2002) The way consumers interpret or even translate advertisements are important. “One airlines advertising campaign designed to promote its push leather seats urged customers to ‘fly on leather’ translated for its Latin American and Hispanic customers, ends up with the meaning ‘fly naked’”(Ghauri & Cateora, 2006, pg: 87) Ariel ‘Febreze’ and ‘Turn to 30 degree’ attracts the consumer stimuli as it conveys the message that in spite of laundry cleaning there are other benefits too, like fragrance with ‘Febreze’ and reducing CO2 with ‘Turn to 30 degree’, comparatively ‘Tesco Price check’ reflects more focus on price than other areas. 2.2.4.2 Demographics: Factors like age, sex, location, education, occupation have a specific influence on individual choices about wants, shopping and partying habits, etc. While a teenager may prefer fashion, latest trends and celebrity endorsements, a middle age person would prefer quality, competitive prices and previous experience. 2.2.4.3 Life style and Economic situation: The term “purchasing power” of consumers is a matter of primary concern for marketers specially in terms of pricing. These include income levels, spending attitudes, credit status of the consumers, which determine the nature of spending as well as amount available for the same. (Lancaster et al 2002) Life style conscious customers tend to choose branded detergents since they offer other interesting benefits apart from cleaning, like fragrance, environmental concerns and to some extent even supporting charitable causes worldwide. 2.2.5 Decision Making Process: The various environmental and individual influences over the consumers and the retention of stimuli (memory), motivates consumers towards making a decision about purchases by matching the features and benefits of products on one hand and wants, requirements and ne- cessities on the other. Once the purchase is executed, consumer’s expectations come into fo- cus. If the product is up to the accepted levels of the consumer, it leads to “habitual” purchases or even “Brand loyalty” which is not easy to break in, by new products, this area it

- 23. seems is mostly dominated by MB(s).Another similar explanation about buy behaviour is provided by Maslow’s hierarchy of needs. 14 Self actualisation needs (Self development & realisation) Esteem needs (Self esteem, recognition, status) Social needs (Love, sense of belonging) Safety needs (Security, Protection) Physiological needs (Hunger, Thirst) Figure 2.2.51 “Maslow’s hierarchy of needs” “Lancaster et al 2002, Pg: 80” The buyer decision making process explained (by Kotler & Armstrong 2006) is similar to the Maslow’s hierarchy of needs with a detailed explanation. Need Information Purchase Post Evaluation of Recognition Search decision purchase Alternatives behaviour Fig 2.2.52 “Buyer Decision Process” (Kotler & Armstrong 2006:155) 2.2.5.1 Problem or Need recognition: It is human nature to act only in times of need. A person’s internal influences like hunger, thirst, shelter, protection, security, cleanliness, etc or external influences like family, friends, society, advertisements, either of the two or a combination of both can trigger a need. Experts have always emphasised the need for marketers to examine the needs that influence consumers towards purchase decisions. This argument seems very important as it helps not only to understand consumer needs but also to place the product as a “tailor made” offer for those needs. (Czinkota & Kotabe 2001) Personal hygiene cleanliness and personality are the needs that trigger a consumer towards purchase of detergents. This lands the consumer in front of the shelf where detergent products are available however which product to choose is next step that again depends on other factors as discussed in this chapter. 2.2.5.2 Information Search: Once the consumers fully recognize the need, they will tend to search the best available product to match their needs. There are several sources a consumer can explore to search for information, the more visibility of the product benefits and reviews present in these sources,

- 24. more are the chances of consumer inclination towards that particular product. The following are the some of such sources. 15 • Personal knowledge. • Suggestions from friends, family and colleagues. • Mass media (advertisements and communication) • Product ratings (www.nextag.com) • Critical analysis and views • Expert advice (CIAO Shopping Intelligence, www.ciao.co.uk) • Product catalogues and websites. (Ariel.co.uk, Tide.com, Persil.com,Tesco.com) • Price comparison sites (Tesco price check) As per Ariel website, this detergent offers various benefits apart from contributions in reducing effects of global warming by using Ariel at 30 degrees mode of the washing machine. Ariel product Benefits Biological Brilliant cleaning, stain removal, clothes remain fresh and look new, whites remain whiter. Febreze great cleaning, fragrance and clothes retain just washed freshness all the day. Colour & Style With no bleaching agents used, garments retain colour and hence looks vibrant in addition to the expected levels of cleaning. Sensitive Recommended for sensitive skin apart from expected levels of cleaning. Table 2.2.5.21 Ariel product benefits (Ariel 2006) As shown in table 2.44, Ariel is not just a cleaning solution provider, it highlights various be- nefits like stain removal, colour protection, freshness, fragrance, sensitive skin, etc these are some of the features which have considerable influence on the buying process. In case of ROB, such detailed information about individual detergent store brands is not yet available, for example Tesco (Tesco.com) gives information about Tesco marketing efforts, fair price practises and environmental efforts of Tesco, however there is no such benefits or detailed information regarding ‘Tesco washing powder’, more over consumers are aware of

- 25. the fact that Tesco does not have manufacturing facilities and its own label products are sourced from different manufacturers. 16 2.2.5.3 Evaluation of Alternatives: The information gathering process ends up with alternatives being evaluated by the consumers in terms of various factors like benefits, brand, quality, price, etc. It is a very broad and complex spectrum of factors used by consumers during evaluation process; at times it could be impulse or some times due to intuition. Some consumers tend to make decision at the POS also however such chances are limited to special offers and well organised marketing campaigns of own brands. (Boone & Kurtz 2005) 2.2.5.4 Purchase decision: Usually purchase decisions are taken after a care full study of alternatives but some times time restrains could force quick decision making. A range of factors can influence purchase decision like, • Personal experiences • Experiences of friends and family • Price wars between brands • Special offers (pack on pack offers like buy one get one free) • Unstable economy (Eg. Zimbabwe, prices change many times in a day) • Fluctuating forex values (price variations in global and non local brands) 2.2.5.5 Post purchase behaviour: This area can make or brake brand loyalty. If the consumer is satisfied with the product, it will result in 2 ways, first the consumer is retained and ends up brand loyal and second, the person will recommend the product to friends, family and colleagues through word of mouth, in short it enhances sustainable growth and brand building efforts. However a dissatisfied customer can cause harm in terms of a “double edged sword”, first the consumer is lost and second, will promote “negative marketing” about the product to others. 2.3 Marketing Mix: 7 P’s. Another important area of study in order to understand consumer buy behaviour are the ele- ments of marketing mix. Consumers are influenced to a greater extent by elements of market- ing mix. The traditional 4 P’s of marketing have been extended to include 3 additional P’s of People, Physical evidence and Process. Hence 7 P’s of marketing can be explained as fol- lows.

- 26. 17 1) Product 5) People 2) Price Consumers 6) Physical Evidence 3) Place 4) Promotion 7) Process Fig 2.31 The 7 P’s of Marketing Mix (Lancaster et al 2002 & Kotler and Armstrong 2006) The 7 P’s of marketing mix acts like (air pressure) forces acting in all directions inwards, resulting in encouragement as well as motivation of consumers towards decision making, hence marketers need to pay high attention to these elements. 1) Product: The combination of different components, parts and services involved in delivery of the final product/ service to the consumer. In case of detergents, it is the various chemical compositions, fragrances in producing the detergent as well as quality control, variety and brand name associated with the product delivery process. (Kotler & Armstrong 2006) A product from P&G or Unilever is perceived to be both higher in quality and standards com- pared to the same from Tesco or Sainsbury by the consumers due to reasons like, • Established brands of companies with 100 of years of experience and expertise. • R&D, marketing efforts and advertising reaching global audiences apart from national and local consumers, which are limited with own brands. • Habitual purchases from generation to generation. 2) Price: The final price paid by the consumer for the end result, includes a variety of costs incurred from raw materials, production, storage, transportation, retailer margins, offers, list prices, discounts, coupons, advertising costs, etc. In short all these costs are recovered from con- sumers. Manufactured brands charge higher prices compared to own brands, through there are savings with own brands limited consumers choose the same as own brands are still perceived to be low price low standards compared to high price, high standard perception of MB. Hence consumers are still willing to pay a premium for their perception of high results.

- 27. However own brands are improving the brand and marketing efforts to reach more consumers but still remains behind MB. 18 3) Place: Place includes not just point of sale but also supply chain management (logistics, trans- port, inventory management) and channels (supplier-producer-agent-distributor-wholesaler-re- tailer). The effective management of these elements leads to on time delivery schedules. MB does not have their own franchises or wholly owned departmental stores and hence are dependent on groceries and other departmental stores for retail distribution, it is not practical for MB(s) to limit the supply of their brands to retailers even with ‘own brand’ stores like Tesco or Sainsbury as this will limit their sales in the short term and in long term there are threats from other MB competitors as well as own brands. ROB(s) also have a similar situation to face, though they can restrict MB presence in their stores and decide to display only own labels, the risk here is that consumers may switch to other stores which offer both and hence may loose out to competitors. 4) Promotion: The various “Pull & Push” strategies involved in marketing as well as sales activities. Ad- vertising through media (print & electronic), in store promotions, sponsorship of TV soap oper- as, music, fashion and sports live events, etc. (Kotler & Armstrong 2006) The promotion efforts of MB(s) like P&G and Unilever in terms of advertising and marketing in- vestments are to the tune of millions of dollars. They have developed several key brands (Areil, Tide, and Persil) for detergents and again each key brand includes sub brands (Ariel biological, Ariel Febreeze, etc). These huge investments are perceived by the consumers as a sign of higher standards and higher results. It can be understood from an example of how credit card is issued, Credit card companies look at the credit history of the applicant, particularly the earnings reflected in the bank statement of the applicant for the past 3-6 months, the more an applicant earns in a month, the higher credit limit is given as it reflects the higher capacity to pay back, similarly the more MB(s) spend on promotion, consumers rate them to be of higher value com- pared to ROB which spend less. 5) People:

- 28. All people either directly or indirectly involved in the delivery of end result, work like a sequential chain in terms of adding value to the process. An excellent explanation of which was termed by Porter as “Value Chain”. (Sutherland & Canwell 2004) 19 Raw material suppliers, production work force, personnel involved in storage and supplies as well as customer service and sales force, etc. There are well co-ordinated departments specially in R&D and Marketing to gather maximum information on improving the quality and services provided to the end user, the result is product benefits are highlighted in a user friendly way and more sub categories are introduced as per consumer demands with separate departments being setup to monitor consumer complaints (like toll free numbers), these efforts end in up in constantly improving the results as desired by consumers. Comparatively own brands are not as organised as MB and hence lag behind. 6) Physical evidence: The features and benefits offered in terms of quality, commitment, promises, warranty, guarantee, concerns addressed by marketers regarding environment, health care, hygiene, etc as well as the experiences during consumption. Recommendation of experts, critical views also encourages consumers to perceive the high standards of quality. In short both tangible and non tangible elements are involved. The availability of MB through out the retail sector, product from companies with high brand values, strong penetration into the consumer base, appeal to the maximum end users, long standing credibility of the manufacturers along with product features, recommendations on the pack from fabric and washing machine manufacturers act as a form of physical evidence that the product offers results as per expectations and hence consumers stick to these brands. In case of ROB ‘low price’, sourced from ‘different manufacturers’ and availability only in particular stores are a few of the limitations when comes to physical evidence. 7) Process: The efficient process management is ultimately responsible for sustainable growth in sales revenues. Availability of inventory through out the retailer network, accessibility in terms of convenience, has to be ensured by manufacture-retailer network.

- 29. 20 In short, the product should be made available to the consumer as per consumer needs and convenience; otherwise competitors can exploit this situation to capture the market share. (Lancaster et al 2002) As discussed the penetration of MB is much higher compared to ROB and the various departments MB(s) use for product development, in short the effective utilization of the pro- cess is the key to success. In the global environment we live today, there are different choices for a consumer to adapt. As discussed in the Marketing Efforts of Consumer Buying Behaviour model, every company influences customers towards ‘pull’ effect in order to achieve ‘push’ effect. Through marketing tools, companies create a ‘pull’ effect, i.e. pulling customers towards its products as well as encouraging customers to pull the product off shelf. Thus creates a ‘push’ effect for its products. In short, pulls customers towards purchase of the product which in turn pushes the product off shelf.

- 30. Chapter 3: An overview of detergent market. 21 3.1 Detergents: Detergent can be explained as a substance which when dissolved increases the capacity of water to clean or rinse the fabric or cloth. Detergents consist of a variety of products but the two main bifurcations are 1) Laundry or Clothes washing detergents. 2) Dish washing detergents. For the purpose of study, the focus will be on clothes washing detergents or laundry detergents, available in various forms like powder, tablets and gel. Records show that Europe was producing soaps in 7th century and English during 12th cen- tury. French are believed to have developed detergents before the middle of 19 th cen- tury, however the shortage of soap fats in first world war lead to its further development by Germans during 1916. However detergents were developed for commercial use only by 1950. (The Columbia Encyclopedia 2007) The following chapter relates to detergents market in detail. Leading detergent manufacturers, strategies adopted by them to succeed. The positions of Manufactured Brands like P&G and Unilever as well as Retailer Own Brands in the UK market are discussed. Detergents can be classified mainly into 2 main groups ROB(s) and MB(s). 3.2 Retailer’s Own Brand (R.O.B): These are also known as Private labels or Store brands, retail giants in UK like, Tesco, Sainsbury’s, Morrison’s, Asda and Marks and Spenser have developed their private labels or ROB(s) for most of the consumer products. Due to legal protection like Trademarks, copy rights and patents, MB demand a high price from consumers and offer minimal margins to retailers. Retailers explored a better way to deal with such scenarios by creating their own private brands with the aid of different manufacturers. These manufacturers are either certain ‘brand’ manufacturers willing to generate incremental revenues from excessive manufacturing capabilities or ‘non brand’ man- ufacturers exclusively producing for retailers.

- 31. 22 According to Datamoniter, MB(s) are facing intensive competition from ROB(s) (Dunne & Narasimhan, 1999, cited in Davies & Brito 2004). By 1990, ROB accounted for one-quarter of retail sales in countries like Britain, Germany and Switzerland and more than 15% in other nations like USA, France, Denmark, Belgium and Holland (The Economist, 1995, cited in Davies & Brito 2004). It is estimated that ROB growth rate stands at 11% of the total product lines sold in Europe (Corstjens & Corstjens 1995 cited in Davies & Brito 2004). 3.2.1 Why retailers display MB(s). Retailers do not refuse to list MB(s) in their stores due to the following factors. i) Due to legal restrictions it is difficult to refuse brands. ii) Competition: If retailer decides to display only ROB instead of MB or provide maximum area for ROB compared to MB, they will lose sales on MB(s) and risk competition. Consumers may switch to other stores due to unavailability of their choice. iii) Retailers earn more on MB(s) compared to ROB due to margins combined with vol- ume of sales, listing fees, shelf rentals, special charges for promotions, etc. Mar- gins are less with MB(s) but the volume is high, in total the net result is high rev- enues however with ROB(s) margins are high but with low volume, the result is less revenues compared to MB(s). iv) ROB requires direct investments however there are no direct investments on MB, further MB(s) are profitable from day one while for ROB(s) there are risks involved with respect to time, investments and are subjective to success. 3.2.2 ROB Growth in UK: Ac- cording to a research commissioned by Somerfield supermarket (published in Private label magazine), it is estimated that consumers through out UK save around £336 million per week with private label products which amounts to a weekly saving of £7.15 per adult and equivalent to a saving of £371 per person annually. During this survey, majority of the respon- dents (62%) expressed their preference for ROB for weekly purchases, while more than half (59%) respondents preferred buy-one-get-one-free style offers at least once in a week. Majority (63%) expressed price comparison as the main factor in shopping and almost all of them (97%) compare prices in search of the best deal. The findings of this report also indicat- ed that the household cleaning products featured twice within the Top 10 ratings of ROB pur-

- 32. chased at UK supermarkets with washing up liquid rated at 8th position and cleaning products rated at 9th position. (Knothe 2007) 23 According to Mintel, the estimated value of clothes washing detergent market in UK is £1.19 billion, mainly dominated by 3 segments MB, ROB and Others (Acdoco, Ecover, PLP, SC Johnson, and Dylon International). Segment Year 2006 % Market (value in Share £ billions) Manufacturer’s 0.919 77 % Brands (MB) MB (77%) Retailer’s Own 0.201 17% ROB (17%) Brands (ROB) Others (6%) Others 0.070 6% Total 1.19 100% Figure 3.2.21 Segmented market share of clothes washing detergents in UK (Mintel 2007) While 77% of market being controlled MB and 6% by others only 17% market share lies with ROB, this reflects the situation that market is dominated by MB leaving very little scope for ROB. However own brands detergents are worth £200 million, though there is a slow growth in ROB detergents however the total ROB market is growing as per the estimates (in fig.3.2.22 & fig.3.2.23) and according to experts there are chances of this situation improving further. Key note is predicting a growth of 39% by the end of 2007 for the ROB in UK, specially in the grocery segment. (Key note April 2003). The estimated value of ROB in UK in 1998 was £30- billion (Key note Jan 2000) increased in 2000 to £57.4billion compared to 1996 it exhibits a growth rate of 18.6%.(Key note Jan 2001). The same figures were £61.1billion in 2003, com- pared to 1998 this reflects a growth by 15.1%(Key note June 2003). Year 1998 Estimated Value (£) billions 100 ( £ 30 billion) 80 1998 30.0 2000 60 ( £ 57.4 billlion) 2000 57.4 40 2003 2003 61.1 ( £ 61.1 billion) 20 2007 85.0 (expected) 0 2007 ROB Grow th in UK ( £ 85 billion expected) Fig. 3.2.22 ROB growth in UK.

- 33. 24 If the predicted growth rate of 39% by 2007 is taken into account, by end of 2007 ROB(s) will cross the £85 billion in estimated value, from 1998 till 2007, in a span of 9 years, the es - timated value will increase by £55 billion or 283%, yearly avg. growth of 31% or £6 billion. Source of Own Label Growth - UK 100% 90% 34.2 31.8 80% 70% Brand Leader 60% 15.3 13.7 No 2Brand 50% 15.6 Brands over 2% 40% 19.4 Brands under 2% 8.8 30% Own Label 14.7 20% 30.0 10% 16.4 0% 1975 1997 Fig. 3.2.23: “Source of Own Label Growth – UK”. (Oxford 2005) According to Oxford University journal (figure 3.2.23 above) ROB has grown from 16.4 % in 1975 to 30.0% in 1997, i.e. and increase of 13.6% in a span of 22 years or 0.6% annually. If this trend continues, at this rate there will be a 6% rise leading to 36% market share of own la- bels by the end of 2007. Fig. 3.2.24: “Retailer concentration of the most developed ROB Markets”(Perrin 2005:11) Market research firm A C Nielsen conducted a survey on ROB. According to this report, “Across the 38 countries and 80 categories included in this study Private Label sales ac-

- 34. counted for 17% of the value sales over the 12 months ending the first quarter of 2005. In comparison to year ago, Private Label sales grew by 5%”. UK was ranked among the top 5 EU nations along with Switzerland, Germany, Spain and Belgium in the list of EU countries with highest ROB shares. UK ROB share is 28% against retailer concentration of 65% in the EU. UK consumers choose ROB for most (82%) of their purchases. Low income households and large families prefer ROB(s) for savings. (Perrin 2005) 25 There are various reasons for the growth of ROB. According to Oxford university journal, the following are the main reasons fuelling an up ward trend, • Vertical integration of UK retailers, particularly grocery segment. • Highly effective and coordinated Supply Chain Management (SCM) of the retail gi- ants both internally (within the company) as well as externally (with the suppliers). • Opportunities for retailers to earn higher margins on ROB as well as MB. • Retailers list both ROB and MB in their stores. • The brand plans of MB(s) are being updated to the retailer, empowering retailers to initiate brand plans for ROB(s). • Convenience in planning competitive strategies for ROB(s) against the innovations launched by MB(s). Brand management and inventory controls. (Oxford 2005) According to Key note ROB market is dominated by four major players in UK, Tesco, Sainsbury's, Asda and Safeway together they accounted for a total estimated value of 67.5% of grocery sales in 1999, an increase of 1.2% compared to 1996 statistics. (Key note Jan 2000) 100 80 Tesco (51%) Sainsbury (54%) 60 Asda (54%) 40 Safeway (47%) Somerfield (36%) 20 National Average (45%) 0

- 35. Fig 3.2.25 UK Differentiation % Sales in ROB. (Oxford 2005) 3.2.3 Tesco: Tesco was founded by Jack Cohen in 1919 but the brand ‘Tesco’ appeared in 1924. The word ‘Tesco’ came into existence when Cohen used 2 alphabets from his name ‘CO’ and 3 alphabets ‘TES’ from T. E. Stockwell (from whom he bought a tea shipment). The retail giant Tesco plc is a UK based company in the market segments like grocery and general merchandising. 26 Tesco stands at a 3rd position globally (after Wal-Mart, USA and Carrefour, France) and at 1st position in UK. Almost a third (30%) of the total UK grocery market share is with Tesco (al- most equal to the combined strength of its two main rivals Asda and Sainsbury’s). Tesco declared a profit of £2.55 billion in 2007 and employs 273,028 employees and operates 2,291stores world wide. Tesco is present in 11 different countries globally, it has started its operation in India in 2007. Tesco serves around 15 million customers globally. (Wikipedia Tesco 2007 & Tesco corporate 2007) According to A C Nielsen, some of the main Tesco ROB segments are as follows, • Tesco Organics the organic range of foods from cookies to sausages and 150 products in the free range, free from gluten, wheat or dairy. • Tesco Healthy Living constitutes a range of over 500 products having reduced fat, sug- ar and sodium for ‘diet’ conscious consumers. • Tesco Carb Control has been specifically developed to guide consumers for a low carb eating program. • Tesco Fair Trade includes a range of products procured from small suppliers of third world countries, guaranteed to receive fair price for their produce due to fair trade certification. • Tesco brand equity also includes personal finance, insurance and telecom portfolio. (Perrin J. 2005:20) Sainsbury’s: Sainsbury’s have ROB segments like Free From, Way to Live, Blue Parrot Café as well as val- ue and premium range. The competition from Tesco, encouraged Sainsbury’s to pene- trate non food segments with (ROB(s) like) Perform+Protect and Active:Naturals. ROB(s) ac- count for more than a third (38%) of Sainsbury’s total revenue. ‘Taste the Difference’ premium range ROB is valued between £200m and £300m. (tutor2u 2007)

- 36. Asda: Asda’s clothing range of ROB ‘George’ is valued at £1billion, incrementing Asda to be the leading cloth retailer in UK. (tutor2u 2007) 3.2.4 Five Forces model of ROB: 27 Barriers to Entry Bargaining Power of Buyers Competitive Bargaining power of Suppliers Rivalry within a Market. Threat of Substitutes Fig. 3.2.41 Porter’s Five forces model. (Source: Porter 1980 /amazon.com) 3.2.4.1 Competitive Rivalry within a market. According to Keynote, UK ROB market is dominated by four major players, Tesco, Sainsbury's, Asda and Safeway together they accounted for a total estimated value of 67.5% of grocery sales in 1999. (Key note Jan 2000) According to Tutor2u.net, in 2006 in UK, Tesco dominates the ROB market share (31.4%) with a neck to neck race between Asda (16.5%) and Sainsbury’s (16%) followed by Morrisons (11.3 %) and other retailers (24.8%).(Tutor2u 2007)

- 37. Analysis of the above statistics conclude an intense as well as competitive rivalry among them (Tesco, Sainsbury’s, Asda and Morrisons) along with other small players. While there is a cut throat competition between Asda and Sainsbury with a difference of 0.5% market share, Tesco is far ahead with almost equal to their combined strength. The estimated value of ROB in UK in 1998 was £30billion (Key note Jan 2000) increased in 2000 to £57.4billion compared to 1996 it exhibits a growth rate of 18.6%.(Key note Jan 2001). The same figures were £61.1billion in 2003, compared to 1998 this reflects a growth by 15.1% (Key note June 2003). 28 With an upper trend in ROB growth, the major retailers are in stiff competition and with pro- jected growth in ROB market share, this competitive rivalry while increase its intensity further with years to come. 3.2.4.2 Barriers to entry. There are certain legal barriers to entry for new players in terms of minimum distance between retail stores and the number of stores that can be opened up in a borough or county, however given the competitive advantages the major retailers like Tesco have in terms of market share, penetration, presence and financial resources is highly unlikely to get affected by new players, in case of threats form new players these companies can offer ‘price-cuts’ apart from attractive offers to the consumers, in addition to that they can increase advertising and marketing investments. For new players it is very difficult to sustain price wars or price cuts against these market leaders, hence there is a very little scope for new entrants given the low margins they have to settle for along with high cost of exit and hence on practical grounds there are strong barriers to entry. 3.2.4.3 Threat of substitutes. Given the mass penetration of these major retailers in most parts of UK and considering the growth of retail market and legal regulations governing the location of retail stores in a particular area, there is less number of threats from substitutes. However if MB increase their advertising and marketing expenditure combined by attractive offers for consumers, it can affect ROB(s) in the long run. The external factors like legal reg- ulations to control retail growth (concerns about monopolistic rise of Tesco in the UK retail segment), environmental concerns, fair price issues, child labour ,health issues and animal testing (from manufacturer sources) are some of the issues which may effect ROB(s). Overall there are no immediate threats from substitutes, however unlikely events in the future can

- 38. affect them. With the growth of the total ROB market, future threat perceptions exist with less effect immediately. 3.2.4.4 Bargaining power of Suppliers. Retailers like Tesco source ROB products from different sources or manufacturers in order to extract maximum benefits with respect to costs, quality control, and supply chain management in order to achieve a competitive advantage over other retailers and MB(s). In particular this helps in keeping costs low and passing on the same to the consumer. In case of these retail giants, instead of suppliers, ROB(s) have the bargaining power. 29 Since ROB(s) have the purchasing power in terms of volumes, suppliers are dependent on them more than vice versa, moreover there is no direct link between suppliers and consumers, consumer interests lie in the final product and not basic ingredients. However external influences like environment, legal and political situations may affect the suppliers, which is again a subjective matter. Finally there seem to be no immediate or direct threat from bargaining power of suppliers. 3.2.4.5 Bargaining power of Buyers. The legalities with respect to how many retail stores can be opened in an area, particularly in UK, restricts the number of retail stores. Consumers give high priority to convenience for retail shopping, this creates a favourable scenario for retailers. Consumers face problems like time, convenience and emotional distress in case they want to travel to another store in search of their choice. Retailers highlight the best discounts to attract consumers and earn on other products not on the discount list, as consumers shop for a variety of products while present in a retail stores, however increasing number of consumers search for best bargains for maximum products they shop, through various sources like Internet, Flyers, catalogues, news papers, magazines, etc this leads to increased savings for consumers. Most ROB consumers represent price conscious segments of the market, within one store only that particular store ROB is available while MB(s) cost more which is again in favour of retailers. The numbers of buyers are more for one single retailer in that particular area considering factors like time and convenience, buyers have limited bargaining power compared to retailers.

- 39. Final conclusion on 5 forces model of ROB(s). High competitive rivalry. High barriers to entry and exit. Limited threat of substitutes. Negligible bargaining power of suppliers. Limited bargaining power of buyers. 3.2.5 SWOT Analysis of ROB(s): 30 Strengths, Weakness, Opportunities and Threats, combined are known as SWOT. Mintzberg has discussed the SWOT analysis in the book ‘Strategy safari’ it forms the basis for designing any business strategy. (Mintzberg et.al 1998). SWOT analysis is an important field of information to know the internal capabilities (Strengths and Weakness) in order to exploit external influences (Opportunities and threats). 3.2.5.1 Strengths: The ROB market share in 2004 was 15% (£179 million) and in 2005 it was 16% (£186 million) these figures have shown a consistent growth of 1% annually, increasing to 17% (£201 million) in 2006. (Mintel 2007) The market for ROB in general is growing at an estimated rate of 31% annually or £6 billion per annum since 1998. ( Fig. 3.2.22, Pg:23. ROB growth in UK). ROB market share for the consecutive 3 years (2004-05-06) have shown an upward trend reflecting strong potential, growth trends and exhibits the strength of the ROB market. Consumer strength has also shown growth trends. It is important to note that with the ROB fo- cus on quality along with price, it is highly likely that ‘Brand’ conscious customers will tend to switch towards ROB(s), while a ‘Price’ conscious ROB customer is unlikely to switch over to MB(s) with prices higher than ROB(s), hence the situation favors ROB(s). ROB(s) have their own stores giving them the leverage to offset any strong competition from MB(s) and other ROB(s), while MB(s) do not have retail infrastructure and hence they are dependent on retail- ers. 3.2.5.2 Weakness:

- 40. Consumer perception about ‘Low cost-Low quality’ ROB(s) still exist and a limited number of consumers tends to switch to ROB(s) from MB(s). ROB(s) still lag behind MB(s) in terms of advertising and promotional strategies, In general ROB(s) are confined to the geographical regions, local areas and stores in terms of reaching the consumers, while MB(s) have national and global out reach. The availability of ROB(s) is confined to certain stores of that particular retailer, for example, ‘Tesco detergent’ is available only in large Tesco stores(Tesco super, Tesco metro and Tesco extra) not in small stores (Tesco express, home plus and one stop). Apart from this ‘Tesco detergent’ is not available in retail stores like Sainsbury’s, Asda, Morrisons, Sommerfield, local groceries or corner shop. (Wikipedia / Tesco 2007) 31 The limited availability of ROB(s) can force customers to switch to either competitor ROB(s) or even MB(s) when influenced by factors like time and convenience. 3.2.5.2 Opportunities: Retailers like Tesco have taken over other retail chains to increase their market size, market share, penetration and consumer reach. (May 1987 Hillards chain of 40 stores in the North of England and 1994, Scottish supermarket chain William Low). (Wikipedia / Tesco 2007) Major ROB(s) (Tesco, Sainsbury’s, Asda and Morrisons) have introduced ‘Loyalty Cards’ a rewards program for loyal customers. This helps retailers to keep track of ‘Sale demographics’ empowering them with information like age,area of residence, purchases to plan their strategies in accordance with consumer trends, needs and demands. (Wikipedia / Tesco 2007) Expansion through opening new stores (subject to legal conditions), acquiring other smaller retail chains are some of the local and national opportunities available. In the global market, venturing into new avenues through strategic partnerships with local firms as well as direct foreign ownership are some of the methods used by ROB(s). Tesco operates in 11 different countries of the world and has started its operation in India in 2007. (Wikipedia / Tesco 2007) International operations not only provide opportunities to increase revenues through sales but also provide opportunities to source ROB products at competitive rates in terms of price, quality and supply chain management.

- 41. 3.2.5.3 Threats: In Nov.2007, London borough of Marylebone received media attention with the resident and Liberal democrat activist Martin Thompson called for rebranding Westminster as “Tescoland” when the opposition organised by him failed to stop the 10th ‘Tesco’ store from coming into existence, in the area. (Prynn 2007:18) The concerns regarding ‘monopolistic’ dominance of ROB(s) like Tesco can create public attention leading to new legal frame work governing restrictions on increasing market share, acquiring other retail networks and opening new stores, this can affect growth. 32 Increased focus on advertising and promotional strategies of MB(s) and attractive offers to off- set ‘price’ factor competence of ROB(s), ‘Quality at low prices’ marketing strategies of other ROB(s) are some of threats existing in the market. Hostile takeover bids, increasing dominance through ‘stock invest’ by rival ROB(s) in the business of major retailers like Tesco, concerns with suppliers like environmental issues (CO2 emissions), fair price issues, child labour, health issues and animal testing. Unforeseen circumstances like war, natural disasters, economic downturn, increase in unemployment, high interest rates are some of the threats existing in the market. Threats existing in the market are subjective not certain and could affect in the long term while in the short term they are limited. 3.3 Manufactured Brands (M.B.): Manufacturers invest a lot of capital and resources on their products over a period of time, aiding it with legal tools like patents, copyrights and trademarks, in order to develop a brand. This is a very complex and lengthy procedure; however it is one of the best methods available. Competitors find it difficult to copy or replicate such products; hence it provides long term profitability for the manufacturers. In the current global scenario, MB(s) are facing lot of challenges from competitors like ROB. MB have to pay on listings, shelf rentals and promotions to retail outlets as well as compete specially on price ROB, in order to compete, they are investing highly on advertising and direct brand marketing to retail consumer or brand loyalty. The prices of manufactured brands are almost 3 times higher than retailer’s own brands because of the various costs involved like,