alltel 4q05nongaaprecon

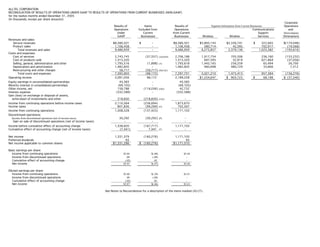

- 1. ALLTEL CORPORATION RECONCILIATION OF RESULTS OF OPERATIONS UNDER GAAP TO RESULTS OF OPERATIONS FROM CURRENT BUSINESSES (NON-GAAP) for the twelve months ended December 31, 2005 (In thousands, except per share amounts) Corporate Results of Items Results of Operations Segment Information from Current Businesses Operations Excluded from Operations Communications and Under Current from Current Support Intercompany GAAP Businesses Businesses Wireless Wireline Services Eliminations Revenues and sales: Service revenues $8,380,501 $ - $8,380,501 $5,895,143 $2,336,741 $ 322,665 $(174,048) Product sales 1,106,458 - 1,106,458 380,714 42,395 702,917 (19,568) Total revenues and sales 9,486,959 - 9,486,959 6,275,857 2,379,136 1,025,582 (193,616) Costs and expenses: Cost of services 2,743,745 (37,557) (A)(D)(H) 2,706,188 1,917,754 705,506 236,160 (153,232) Cost of products sold 1,315,320 - 1,315,320 697,593 32,919 621,864 (37,056) Selling, general, administrative and other 1,795,516 (1,898) (A) 1,793,618 1,445,165 256,259 65,494 26,700 Depreciation and amortization 1,482,605 - 1,482,605 960,698 480,729 33,866 7,312 Restructuring and other charges 58,717 (58,717) (B)(C)(E) - - - - - Total costs and expenses 7,395,903 (98,172) 7,297,731 5,021,210 1,475,413 957,384 (156,276) Operating income 2,091,056 98,172 2,189,2280 $ 1,254,647 $ 903,723 $ 68,198 $ (37,340) Equity earnings in unconsolidated partnerships 43,383 - 43,383 Minority interest in consolidated partnerships (69,105) - (69,105) Other income, net 158,788 (116,036) (D)(I) 42,752 Interest expense (332,588) - (332,588) Gain (loss) on exchange or disposal of assets, write-down of investments and other 218,830 (218,830) (F)(G) - Income from continuing operations before income taxes 2,110,364 (236,694) 1,873,670 Income taxes 801,836 (99,269) (O) 702,567 Income from continuing operations 1,308,528 (137,425) 1,171,103 Discontinued operations: 30,292 (30,292) (P) - Income from discontinued operations (net of income taxes) Gain on sale of discontinued operations (net of income taxes) - - - 0 Income before cumulative effect of accounting change 1,338,820 (167,717) 1,171,103 Cumulative effect of accounting change (net of income taxes) (7,441) 7,441 (T) - Net income 1,331,379 (160,276) 1,171,103 Preferred dividends 93 - 93 Net income applicable to common shares $ 1,331,286 $ (160,276) $ 1,171,010 Basic earnings per share: Income from continuing operations $3.84 $(.40) $3.44 Income from discontinued operations .09 (.09) - Cumulative effect of accounting change (.02) .02 - Net income $3.91 $(.47) $3.44 Diluted earnings per share: Income from continuing operations $3.80 $(.39) $3.41 Income from discontinued operations .09 (.09) - Cumulative effect of accounting change (.02) .02 - Net income $3.87 $(.46) $3.41 See Notes to Reconcilations for a description of the items marked (A)-(T).

- 2. ALLTEL CORPORATION RECONCILIATION OF RESULTS OF OPERATIONS UNDER GAAP TO RESULTS OF OPERATIONS FROM CURRENT BUSINESSES (NON-GAAP) for the three months ended September 30, 2005 (In thousands, except per share amounts) Corporate Results of Items Results of Operations Segment Information from Current Businesses Operations Excluded from Operations Communications and Under Current from Current Support Intercompany GAAP Businesses Businesses Wireless Wireline Services Eliminations Revenues and sales: Service revenues $2,229,370 $ - $2,229,370 $1,606,482 $580,561 $ 84,728 $ (42,401) Product sales 289,749 - 289,749 101,876 11,722 178,481 (2,330) Total revenues and sales 2,519,119 - 2,519,119 1,708,358 592,283 263,209 (44,731) Costs and expenses: Cost of services 719,683 (8,260) (D) 711,423 514,923 176,699 58,964 (39,163) Cost of products sold 343,718 - 343,718 179,831 10,021 158,860 (4,994) Selling, general, administrative and other 470,966 (1,898) (D) 469,068 379,806 66,154 16,710 6,398 Depreciation and amortization 388,989 - 388,989 257,853 121,026 8,340 1,770 Restructuring and other charges 18,873 (18,873) (E) - - - - - Total costs and expenses 1,942,229 (29,031) 1,913,198 1,332,413 373,900 242,874 (35,989) Operating income 576,890 29,031 605,9210 $ 375,945 $ 218,383 $ 20,335 $ (8,742) Equity earnings in unconsolidated partnerships 10,434 - 10,434 Minority interest in consolidated partnerships (20,573) - (20,573) Other income, net 27,325 (5,000) (D) 22,325 Interest expense (83,422) - (83,422) Gain (loss) on exchange or disposal of assets, write-down of investments and other 30,557 (30,557) (F) - Income from continuing operations before income taxes 541,211 (6,526) 534,685 Income taxes 206,068 (2,567) (O) 203,501 Income from continuing operations 335,143 (3,959) 331,184 Discontinued operations: 26,022 (26,022) (P) - Income from discontinued operations (net of income taxes) Gain on sale of discontinued operations (net of income taxes) - - - 0 Income before cumulative effect of accounting change 361,165 (29,981) 331,184 Cumulative effect of accounting change (net of income taxes) - - - Net income 361,165 (29,981) 331,184 Preferred dividends 24 - 24 Net income applicable to common shares $ 361,141 $ (29,981) $ 331,160 Basic earnings per share: Income from continuing operations $ .92 $(.01) $.91 Income from discontinued operations .07 (.07) - Cumulative effect of accounting change - - - Net income $.99 $(.08) $.91 Diluted earnings per share: Income from continuing operations $ .91 $(.01) $.90 Income from discontinued operations .07 (.07) - Cumulative effect of accounting change - - - Net income $.98 $(.08) $.90 See Notes to Reconcilations for a description of the items marked (A)-(T).

- 3. ALLTEL CORPORATION RECONCILIATION OF RESULTS OF OPERATIONS UNDER GAAP TO RESULTS OF OPERATIONS FROM CURRENT BUSINESSES (NON-GAAP) for the three months ended December 31, 2005 (In thousands, except per share amounts) Corporate Results of Items Results of Operations Segment Information from Current Businesses Operations Excluded from Operations Communications and Under Current from Current Support Intercompany GAAP Businesses Businesses Wireless Wireline Services Eliminations Revenues and sales: Service revenues $2,263,605 $ - $2,263,605 $1,643,195 $588,349 $ 82,323 $ (50,262) Product sales 318,146 - 318,146 116,983 9,801 194,115 (2,753) Total revenues and sales 2,581,751 - 2,581,751 1,760,178 598,150 276,438 (53,015) Costs and expenses: Cost of services 736,857 (9,506) (A) 727,351 543,352 165,116 58,077 (39,194) Cost of products sold 381,764 - 381,764 218,678 6,899 168,545 (12,358) Selling, general, administrative and other 496,549 - 496,549 411,139 63,637 16,874 4,899 Depreciation and amortization 404,079 - 404,079 286,787 106,955 8,553 1,784 Restructuring and other charges 39,844 (39,844) (B)(C) - - - - - Total costs and expenses 2,059,093 (49,350) 2,009,743 1,459,956 342,607 252,049 (44,869) Operating income 522,658 49,350 572,0080 $ 300,222 $255,543 $ 24,389 $ (8,146) Equity earnings in unconsolidated partnerships 6,992 - 6,992 Minority interest in consolidated partnerships (11,267) - (11,267) Other income, net 2,752 - 2,752 Interest expense (86,134) - (86,134) Gain (loss) on exchange or disposal of assets, write-down of investments and other - - - Income from continuing operations before income taxes 435,001 49,350 484,351 Income taxes 176,681 7,057 (O) 183,738 Income from continuing operations 258,320 42,293 300,613 Discontinued operations: 4,270 (4,270) (P) - Income from discontinued operations (net of income taxes) Gain on sale of discontinued operations (net of income taxes) - - - 0 Income before cumulative effect of accounting change 262,590 38,023 300,613 Cumulative effect of accounting change (net of income taxes) (7,441) 7,441 (T) - Net income 255,149 45,464 300,613 Preferred dividends 21 - 21 Net income applicable to common shares $ 255,128 $ 45,464 $ 300,592 Basic earnings per share: Income from continuing operations $ .67 $.11 $.78 Income from discontinued operations .01 (.01) - Cumulative effect of accounting change (.02) .02 - Net income $.66 $.12 $.78 Diluted earnings per share: Income from continuing operations $ .67 $.10 $.77 Income from discontinued operations .01 (.01) - Cumulative effect of accounting change (.02) .02 - Net income $.66 $.11 $.77 See Notes to Reconcilations for a description of the items marked (A)-(T).

- 4. ALLTEL CORPORATION RECONCILIATION OF RESULTS OF OPERATIONS UNDER GAAP TO RESULTS OF OPERATIONS FROM CURRENT BUSINESSES (NON-GAAP) for the three months ended June 30, 2005 (In thousands, except per share amounts) Corporate Results of Items Results of Operations Segment Information from Current Businesses Operations Excluded from Operations Communications and Under Current from Current Support Intercompany GAAP Businesses Businesses Wireless Wireline Services Eliminations Revenues and sales: Service revenues $1,989,264 $ - $1,989,264 $1,371,089 $584,016 $ 77,772 $ (43,613) Product sales 270,842 - 270,842 84,223 11,055 183,458 (7,894) Total revenues and sales 2,260,106 - 2,260,106 1,455,312 595,071 261,230 (51,507) Costs and expenses: Cost of services 660,945 - 660,945 453,806 182,667 62,776 (38,304) Cost of products sold 308,065 - 308,065 150,278 9,001 161,399 (12,613) Selling, general, administrative and other 420,536 - 420,536 331,743 62,662 16,982 9,149 Depreciation and amortization 348,320 - 348,320 212,560 125,445 8,501 1,814 Restructuring and other charges - - - - - - - Total costs and expenses 1,737,866 - 1,737,866 1,148,387 379,775 249,658 (39,954) Operating income 522,240 - 522,2400 $ 306,925 $ 215,296 $ 11,572 $ (11,553) Equity earnings in unconsolidated partnerships 15,214 - 15,214 Minority interest in consolidated partnerships (18,918) - (18,918) Other income, net 7,976 - 7,976 Interest expense (76,343) - (76,343) Gain (loss) on exchange or disposal of assets, write-down of investments and other 188,273 (188,273) (G) - Income from continuing operations before income taxes 638,442 (188,273) 450,169 Income taxes 236,381 (70,234) (O) 166,147 Income from continuing operations 402,061 (118,039) 284,022 Discontinued operations: - - - Income from discontinued operations (net of income taxes) Gain on sale of discontinued operations (net of income taxes) - - - 0 Income before cumulative effect of accounting change 402,061 (118,039) 284,022 Cumulative effect of accounting change (net of income taxes) - - - Net income 402,061 (118,039) 284,022 Preferred dividends 24 - 24 Net income applicable to common shares $ 402,037 $ (118,039) $ 283,998 Basic earnings per share: Income from continuing operations $1.28 $(.38) $.90 Income from discontinued operations - - - Cumulative effect of accounting change - - - Net income $1.28 $(.38) $.90 Diluted earnings per share: Income from continuing operations $1.27 $(.37) $.90 Income from discontinued operations - - - Cumulative effect of accounting change - - - Net income $1.27 $(.37) $.90 See Notes to Reconcilations for a description of the items marked (A)-(T).

- 5. ALLTEL CORPORATION RECONCILIATION OF RESULTS OF OPERATIONS UNDER GAAP TO RESULTS OF OPERATIONS FROM CURRENT BUSINESSES (NON-GAAP) for the three months ended March 31, 2005 (In thousands, except per share amounts) Corporate Results of Items Results of Operations Segment Information from Current Businesses Operations Excluded from Operations Communications and Under Current from Current Support Intercompany GAAP Businesses Businesses Wireless Wireline Services Eliminations Revenues and sales: Service revenues $1,898,262 $ - $1,898,262 $1,274,377 $583,815 $ 77,842 $ (37,772) Product sales 227,721 - 227,721 77,632 9,817 146,863 (6,591) Total revenues and sales 2,125,983 - 2,125,983 1,352,009 593,632 224,705 (44,363) Costs and expenses: Cost of services 626,260 (19,791) (H) 606,469 405,673 181,024 56,343 (36,571) Cost of products sold 281,773 - 281,773 148,806 6,998 133,060 (7,091) Selling, general, administrative and other 407,465 - 407,465 322,477 63,806 14,928 6,254 Depreciation and amortization 341,217 - 341,217 203,498 127,303 8,472 1,944 Restructuring and other charges - - - - - - - Total costs and expenses 1,656,715 (19,791) 1,636,924 1,080,454 379,131 212,803 (35,464) Operating income 469,268 19,791 489,0590 $ 271,555 $214,501 $ 11,902 $ (8,899) Equity earnings in unconsolidated partnerships 10,743 - 10,743 Minority interest in consolidated partnerships (18,347) - (18,347) Other income, net 120,735 (111,036) (I) 9,699 Interest expense (86,689) - (86,689) Gain (loss) on exchange or disposal of assets, write-down of investments and other - - - Income from continuing operations before income taxes 495,710 (91,245) 404,465 Income taxes 182,706 (33,525) (O) 149,181 Income from continuing operations 313,004 (57,720) 255,284 Discontinued operations: - - - Income from discontinued operations (net of income taxes) Gain on sale of discontinued operations (net of income taxes) - - - 0 Income before cumulative effect of accounting change 313,004 (57,720) 255,284 Cumulative effect of accounting change (net of income taxes) - - - Net income 313,004 (57,720) 255,284 Preferred dividends 24 - 24 Net income applicable to common shares $ 312,980 $ (57,720) $ 255,260 Basic earnings per share: Income from continuing operations $1.04 $(.20) $.84 Income from discontinued operations - - - Cumulative effect of accounting change - - - Net income $1.04 $(.20) $.84 Diluted earnings per share: Income from continuing operations $1.03 $(.19) $.84 Income from discontinued operations - - - Cumulative effect of accounting change - - - Net income $1.03 $(.19) $.84 See Notes to Reconcilations for a description of the items marked (A)-(T).

- 6. ALLTEL CORPORATION RECONCILIATION OF RESULTS OF OPERATIONS UNDER GAAP TO RESULTS OF OPERATIONS FROM CURRENT BUSINESSES (NON-GAAP) for the twelve months ended December 31, 2004 (In thousands, except per share amounts) Corporate Segment Information from Current Businesses Results of Items Results of Operations Operations Excluded from Operations Communications and Under Current from Current Support Intercompany GAAP Businesses Businesses Wireless Wireline Services Eliminations Revenues and sales: Service revenues $7,374,279 $ - $ 7,374,279 $4,791,235 $2,380,788 $ 346,662 $ (144,406) Product sales 871,862 - 871,862 286,852 39,021 577,193 (31,204) Total revenues and sales 8,246,141 - 8,246,141 5,078,087 2,419,809 923,855 (175,610) Costs and expenses: Cost of services 2,374,220 - 2,374,220 1,543,576 704,335 257,845 (131,536) Cost of products sold 1,075,545 - 1,075,545 573,646 28,711 514,239 (41,051) Selling, general, administrative and other 1,524,165 - 1,524,165 1,201,789 244,327 54,729 23,320 Depreciation and amortization 1,299,691 - 1,299,691 738,837 516,445 34,325 10,084 Restructuring and other charges 50,892 (50,892) (J)(K) - - - - - Total costs and expenses 6,324,513 (50,892) 6,273,621 4,057,848 1,493,818 861,138 (139,183) Operating income 1,921,628 50,892 1,972,520 $ 1,020,239 $ 925,991 $ 62,717 $ (36,427) Equity earnings in unconsolidated partnerships 68,486 - 68,486 Minority interest in consolidated partnerships (80,096) - (80,096) Other income, net 34,500 - 34,500 Interest expense (352,490) - (352,490) Gain (loss) on exchange or disposal of assets, write-down of investments and other - - - Income from continuing operations before income taxes 1,592,028 50,892 1,642,920 Income taxes 565,331 39,479 604,810 (O)(Q) Income from continuing operations 1,026,697 11,413 1,038,110 Discontinued operations: Income from discontinued operations (net of income taxes) 19,538 (19,538) (Q) - Gain on sale of discontinued operations (net of income taxes) - - - Income before cumulative effect of accounting change 1,046,235 (8,125) 1,038,110 Cumulative effect of accounting change (net of income taxes) - - - Net income 1,046,235 (8,125) 1,038,110 Preferred dividends 103 - 103 Net income applicable to common shares $ 1,046,132 $ (8,125) $ 1,038,007 Basic earnings per share: Income from continuing operations $3.34 $ .04 $3.38 Income from discontinued operations .06 (.06) - Cumulative effect of accounting change - - - Net income $3.40 $(.02) $3.38 Diluted earnings per share: Income from continuing operations $3.33 $ .04 $3.37 Income from discontinued operations .06 (.06) - Cumulative effect of accounting change - - - Net income $3.39 $(.02) $3.37 See Notes to Reconcilations for a description of the items marked (A)-(T).

- 7. ALLTEL CORPORATION RECONCILIATION OF RESULTS OF OPERATIONS UNDER GAAP TO RESULTS OF OPERATIONS FROM CURRENT BUSINESSES (NON-GAAP) for the three months ended December 31, 2004 (In thousands, except per share amounts) Corporate Segment Information from Current Businesses Results of Items Results of Operations Operations Excluded from Operations Communications and Under Current from Current Support Intercompany GAAP Businesses Businesses Wireless Wireline Services Eliminations Revenues and sales: Service revenues $1,897,402 $ - $ 1,897,402 $1,252,773 $597,315 $ 81,462 $ (34,148) Product sales 242,391 - 242,391 73,999 10,460 167,027 (9,095) Total revenues and sales 2,139,793 - 2,139,793 1,326,772 607,775 248,489 (43,243) Costs and expenses: Cost of services 604,818 - 604,818 399,114 173,146 64,297 (31,739) Cost of products sold 299,603 - 299,603 154,747 8,576 146,997 (10,717) Selling, general, administrative and other 402,489 - 402,489 318,968 62,466 14,856 6,199 Depreciation and amortization 332,520 - 332,520 193,789 127,921 8,454 2,356 Restructuring and other charges (873) 873 (J) - - - - - Total costs and expenses 1,638,557 873 1,639,430 1,066,618 372,109 234,604 (33,901) Operating income 501,236 (873) 500,363 $ 260,154 $ 235,666 $ 13,885 $ (9,342) Equity earnings in unconsolidated partnerships 14,970 - 14,970 Minority interest in consolidated partnerships (19,227) - (19,227) Other income, net 11,360 - 11,360 Interest expense (87,512) - (87,512) Gain (loss) on exchange or disposal of assets, write-down of investments and other - - - Income from continuing operations before income taxes 420,827 (873) 419,954 Income taxes 150,182 (286) (O) 149,896 Income from continuing operations 270,645 (587) 270,058 Discontinued operations: Income from discontinued operations (net of income taxes) - - - Gain on sale of discontinued operations (net of income taxes) - - - Income before cumulative effect of accounting change 270,645 (587) 270,058 Cumulative effect of accounting change (net of income taxes) - - - Net income 270,645 (587) 270,058 Preferred dividends 25 - 25 Net income applicable to common shares $ 270,620 $ (587) $ 270,033 Basic earnings per share: Income from continuing operations $.89 $- $.89 Income from discontinued operations - - - Cumulative effect of accounting change - - - Net income $.89 $- $.89 Diluted earnings per share: Income from continuing operations $.89 $- $.89 Income from discontinued operations - - - Cumulative effect of accounting change - - - Net income $.89 $- $.89 See Notes to Reconcilations for a description of the items marked (A)-(T).

- 8. ALLTEL CORPORATION RECONCILIATION OF RESULTS OF OPERATIONS UNDER GAAP TO RESULTS OF OPERATIONS FROM CURRENT BUSINESSES (NON-GAAP) for the three months ended September 30, 2004 (In thousands, except per share amounts) Corporate Segment Information from Current Businesses Results of Items Results of Operations Operations Excluded from Operations Communications and Under Current from Current Support Intercompany GAAP Businesses Businesses Wireless Wireline Services Eliminations Revenues and sales: Service revenues $1,885,405 $ - $ 1,885,405 $1,239,409 $592,373 $ 86,862 $ (33,239) Product sales 217,707 - 217,707 74,338 10,563 140,275 (7,469) Total revenues and sales 2,103,112 - 2,103,112 1,313,747 602,936 227,137 (40,708) Costs and expenses: Cost of services 624,442 - 624,442 406,660 179,719 68,910 (30,847) Cost of products sold 262,604 - 262,604 139,301 7,822 124,575 (9,094) Selling, general, administrative and other 373,624 - 373,624 294,070 60,033 13,593 5,928 Depreciation and amortization 324,678 - 324,678 186,169 127,580 8,570 2,359 Restructuring and other charges - - - - - - - Total costs and expenses 1,585,348 - 1,585,348 1,026,200 375,154 215,648 (31,654) Operating income 517,764 - 517,764 $ 287,547 $ 227,782 $ 11,489 $ (9,054) Equity earnings in unconsolidated partnerships 24,338 - 24,338 Minority interest in consolidated partnerships (23,647) - (23,647) Other income, net 15,652 - 15,652 Interest expense (86,699) - (86,699) Gain (loss) on exchange or disposal of assets, write-down of investments and other - - - Income from continuing operations before income taxes 447,408 - 447,408 Income taxes 143,727 19,656 163,383 (Q) Income from continuing operations 303,681 (19,656) 284,025 Discontinued operations: Income from discontinued operations (net of income taxes) 19,538 (19,538) (Q) - Gain on sale of discontinued operations (net of income taxes) - - - Income before cumulative effect of accounting change 323,219 (39,194) 284,025 Cumulative effect of accounting change (net of income taxes) - - - Net income 323,219 (39,194) 284,025 Preferred dividends 25 - 25 Net income applicable to common shares $ 323,194 $ (39,194) $ 284,000 Basic earnings per share: Income from continuing operations $ .99 $(.06) $.93 Income from discontinued operations .06 (.06) - Cumulative effect of accounting change - - - Net income $1.05 $(.12) $.93 Diluted earnings per share: Income from continuing operations $ .99 $(.07) $.92 Income from discontinued operations .06 (.06) - Cumulative effect of accounting change - - - Net income $1.05 $(.13) $.92 See Notes to Reconcilations for a description of the items marked (A)-(T).

- 9. ALLTEL CORPORATION RECONCILIATION OF RESULTS OF OPERATIONS UNDER GAAP TO RESULTS OF OPERATIONS FROM CURRENT BUSINESSES (NON-GAAP) for the three months ended June 30, 2004 (In thousands, except per share amounts) Corporate Segment Information from Current Businesses Results of Items Results of Operations Operations Excluded from Operations Communications and Under Current from Current Support Intercompany GAAP Businesses Businesses Wireless Wireline Services Eliminations Revenues and sales: Service revenues $1,825,894 $ - $ 1,825,894 $1,183,549 $599,567 $ 84,583 $ (41,805) Product sales 216,170 - 216,170 69,533 10,065 144,596 (8,024) Total revenues and sales 2,042,064 - 2,042,064 1,253,082 609,632 229,179 (49,829) Costs and expenses: Cost of services 584,189 - 584,189 382,060 178,599 58,679 (35,149) Cost of products sold 256,055 - 256,055 135,048 7,158 127,799 (13,950) Selling, general, administrative and other 372,859 - 372,859 293,009 60,908 13,050 5,892 Depreciation and amortization 321,151 - 321,151 181,350 128,610 8,755 2,436 Restructuring and other charges - - - - - - - Total costs and expenses 1,534,254 - 1,534,254 991,467 375,275 208,283 (40,771) Operating income 507,810 - 507,810 $ 261,615 $ 234,357 $ 20,896 $ (9,058) Equity earnings in unconsolidated partnerships 15,926 - 15,926 Minority interest in consolidated partnerships (21,651) - (21,651) Other income, net 2,875 - 2,875 Interest expense (86,543) - (86,543) Gain (loss) on exchange or disposal of assets, write-down of investments and other - - - Income from continuing operations before income taxes 418,417 - 418,417 Income taxes 155,889 - 155,889 Income from continuing operations 262,528 - 262,528 Discontinued operations: Income from discontinued operations (net of income taxes) - - - Gain on sale of discontinued operations (net of income taxes) - - - Income before cumulative effect of accounting change 262,528 - 262,528 Cumulative effect of accounting change (net of income taxes) - - - Net income 262,528 - 262,528 Preferred dividends 26 - 26 Net income applicable to common shares $ 262,502 $ - $ 262,502 Basic earnings per share: Income from continuing operations $.85 $- $.85 Income from discontinued operations - - - Cumulative effect of accounting change - - - Net income $.85 $- $.85 Diluted earnings per share: Income from continuing operations $.85 $- $.85 Income from discontinued operations - - - Cumulative effect of accounting change - - - Net income $.85 $- $.85 See Notes to Reconcilations for a description of the items marked (A)-(T).

- 10. ALLTEL CORPORATION RECONCILIATION OF RESULTS OF OPERATIONS UNDER GAAP TO RESULTS OF OPERATIONS FROM CURRENT BUSINESSES (NON-GAAP) for the three months ended March 31, 2004 (In thousands, except per share amounts) Corporate Segment Information from Current Businesses Results of Items Results of Operations Operations Excluded from Operations Communications and Under Current from Current Support Intercompany GAAP Businesses Businesses Wireless Wireline Services Eliminations Revenues and sales: Service revenues $ 1,765,578 $ - $ 1,765,578 $ 1,115,504 $ 591,533 $ 93,755 $ (35,214) Product sales 195,594 - 195,594 68,982 7,933 125,295 (6,616) Total revenues and sales 1,961,172 - 1,961,172 1,184,486 599,466 219,050 (41,830) Costs and expenses: Cost of services 560,771 - 560,771 355,742 172,871 65,959 (33,801) Cost of products sold 257,283 - 257,283 144,550 5,155 114,868 (7,290) Selling, general, administrative and other 375,193 - 375,193 295,742 60,920 13,230 5,301 Depreciation and amortization 321,342 - 321,342 177,529 132,334 8,546 2,933 Restructuring and other charges 51,765 (51,765) (K) - - - - - Total costs and expenses 1,566,354 (51,765) 1,514,589 973,563 371,280 202,603 (32,857) Operating income 394,818 51,765 446,583 $ 210,923 $ 228,186 $ 16,447 $ (8,973) Equity earnings in unconsolidated partnerships 13,252 - 13,252 Minority interest in consolidated partnerships (15,571) - (15,571) Other income, net 4,613 - 4,613 Interest expense (91,736) - (91,736) Gain (loss) on exchange or disposal of assets, write-down of investments and other - - - Income from continuing operations before income taxes 305,376 51,765 357,141 Income taxes 115,533 20,109 135,642 (O) Income from continuing operations 189,843 31,656 221,499 Discontinued operations: Income from discontinued operations (net of income taxes) - - - Gain on sale of discontinued operations (net of income taxes) - - - Income before cumulative effect of accounting change 189,843 31,656 221,499 Cumulative effect of accounting change (net of income taxes) - - - Net income 189,843 31,656 221,499 Preferred dividends 27 - 27 Net income applicable to common shares $ 189,816 $ 31,656 $ 221,472 Basic earnings per share: Income from continuing operations $.61 $.10 $.71 Income from discontinued operations - - - Cumulative effect of accounting change - - - Net income $.61 $.10 $.71 Diluted earnings per share: Income from continuing operations $.61 $.10 $.71 Income from discontinued operations - - - Cumulative effect of accounting change - - - Net income $.61 $.10 $.71 See Notes to Reconcilations for a description of the items marked (A)-(T).

- 11. ALLTEL CORPORATION RECONCILIATION OF RESULTS OF OPERATIONS UNDER GAAP TO RESULTS OF OPERATIONS FROM CURRENT BUSINESSES (NON-GAAP) for the twelve months ended December 31, 2003 (In thousands, except per share amounts) Corporate Segment Information from Current Businesses Results of Items Results of Operations Operations Excluded from Operations Communications and Under Current from Current Support Intercompany GAAP Businesses Businesses Wireless Wireline Services Eliminations Revenues and sales: Service revenues $7,156,067 $ - $ 7,156,067 $4,466,462 $2,395,625 $ 428,983 $ (135,003) Product sales 823,843 - 823,843 261,937 40,454 530,078 (8,626) Total revenues and sales 7,979,910 - 7,979,910 4,728,399 2,436,079 959,061 (143,629) Costs and expenses: Cost of services 2,273,598 - 2,273,598 1,367,812 737,161 299,006 (130,381) Cost of products sold 1,043,468 - 1,043,468 536,648 29,131 486,936 (9,247) Selling, general, administrative and other 1,498,122 - 1,498,122 1,154,961 259,406 60,511 23,244 Depreciation and amortization 1,247,748 - 1,247,748 670,978 526,508 36,191 14,071 Restructuring and other charges 18,979 (18,979) (M) - - - - - Total costs and expenses 6,081,915 (18,979) 6,062,936 3,730,399 1,552,206 882,644 (102,313) Operating income 1,897,995 18,979 1,916,974 $ 998,000 $ 883,873 $ 76,417 $ (41,316) Equity earnings in unconsolidated partnerships 64,373 - 64,373 Minority interest in consolidated partnerships (78,604) - (78,604) Other income, net 11,068 - 11,068 Interest expense (378,627) - (378,627) Gain (loss) on exchange or disposal of assets, write-down of investments and other 17,933 (17,933) (L)(N) - Income from continuing operations before income taxes 1,534,138 1,046 1,535,184 Income taxes 580,609 180 (O) 580,789 Income from continuing operations 953,529 866 954,395 Discontinued operations: Income from discontinued operations (net of income taxes) 37,072 (37,072) (R) - Gain on sale of discontinued operations (net of income taxes) 323,927 (323,927) (R) - Income before cumulative effect of accounting change 1,314,528 (360,133) 954,395 Cumulative effect of accounting change (net of income taxes) 15,591 (15,591) (S) - Net income 1,330,119 (375,724) 954,395 Preferred dividends 111 - 111 Net income applicable to common shares $ 1,330,008 $ (375,724) $ 954,284 Basic earnings per share: Income from continuing operations $3.06 $- $3.06 Income from discontinued operations 1.16 (1.16) - Cumulative effect of accounting change .05 (.05) - Net income $4.27 $(1.21) $3.06 Diluted earnings per share: Income from continuing operations $3.05 $- $3.05 Income from discontinued operations 1.15 (1.15) - Cumulative effect of accounting change .05 (.05) - Net income $4.25 $(1.20) $3.05 See Notes to Reconcilations for a description of the items marked (A)-(T).

- 12. ALLTEL CORPORATION RECONCILIATION OF RESULTS OF OPERATIONS UNDER GAAP TO RESULTS OF OPERATIONS FROM CURRENT BUSINESSES (NON-GAAP) for the three months ended December 31, 2003 (In thousands, except per share amounts) Corporate Segment Information from Current Businesses Results of Items Results of Operations Operations Excluded from Operations Communications and Under Current from Current Support Intercompany GAAP Businesses Businesses Wireless Wireline Services Eliminations Revenues and sales: Service revenues $ 1,806,026 $ - $ 1,806,026 $ 1,128,024 $ 605,665 $ 105,910 $ (33,573) Product sales 207,650 - 207,650 63,908 10,119 141,229 (7,606) Total revenues and sales 2,013,676 - 2,013,676 1,191,932 615,784 247,139 (41,179) Costs and expenses: Cost of services 567,946 - 567,946 350,603 173,751 74,876 (31,284) Cost of products sold 262,058 - 262,058 131,243 7,495 131,568 (8,248) Selling, general, administrative and other 388,290 - 388,290 303,033 65,644 13,896 5,717 Depreciation and amortization 321,330 - 321,330 175,446 132,064 9,176 4,644 Restructuring and other charges - - - - - - - Total costs and expenses 1,539,624 - 1,539,624 960,325 378,954 229,516 (29,171) Operating income 474,052 - 474,052 $ 231,607 $ 236,830 $ 17,623 $ (12,008) Equity earnings in unconsolidated partnerships 16,401 - 16,401 Minority interest in consolidated partnerships (17,093) - (17,093) Other income, net 3,596 - 3,596 Interest expense (90,881) - (90,881) Gain (loss) on exchange or disposal of assets, write-down of investments and other 30,999 (30,999) (L) - Income from continuing operations before income taxes 417,074 (30,999) 386,075 Income taxes 158,139 (12,058) (O) 146,081 Income from continuing operations 258,935 (18,941) 239,994 Discontinued operations: Income from discontinued operations (net of income taxes) - - - Gain on sale of discontinued operations (net of income taxes) - - - Income before cumulative effect of accounting change 258,935 (18,941) 239,994 Cumulative effect of accounting change (net of income taxes) - - - Net income 258,935 (18,941) 239,994 Preferred dividends 27 - 27 Net income applicable to common shares $ 258,908 $ (18,941) $ 239,967 Basic earnings per share: Income from continuing operations $.83 $(.06) $.77 Income from discontinued operations - - - Cumulative effect of accounting change - - - Net income $.83 $(.06) $.77 Diluted earnings per share: Income from continuing operations $.83 $(.06) $.77 Income from discontinued operations - - - Cumulative effect of accounting change - - - Net income $.83 $(.06) $.77 See Notes to Reconcilations for a description of the items marked (A)-(T).

- 13. ALLTEL CORPORATION RECONCILIATION OF RESULTS OF OPERATIONS UNDER GAAP TO RESULTS OF OPERATIONS FROM CURRENT BUSINESSES (NON-GAAP) for the three months ended September 30, 2003 (In thousands, except per share amounts) Corporate Segment Information from Current Businesses Results of Items Results of Operations Operations Excluded from Operations Communications and Under Current from Current Support Intercompany GAAP Businesses Businesses Wireless Wireline Services Eliminations Revenues and sales: Service revenues $ 1,836,059 $ - $ 1,836,059 $ 1,163,786 $ 595,319 $ 108,808 $ (31,854) Product sales 214,125 - 214,125 69,446 9,876 135,155 (352) Total revenues and sales 2,050,184 - 2,050,184 1,233,232 605,195 243,963 (32,206) Costs and expenses: Cost of services 602,609 - 602,609 361,107 195,747 76,820 (31,065) Cost of products sold 272,344 - 272,344 141,712 7,375 123,596 (339) Selling, general, administrative and other 376,285 - 376,285 292,999 63,410 14,361 5,515 Depreciation and amortization 312,183 - 312,183 168,999 131,234 8,843 3,107 Restructuring and other charges - - - - - - - Total costs and expenses 1,563,421 - 1,563,421 964,817 397,766 223,620 (22,782) Operating income 486,763 - 486,763 $ 268,415 $ 207,429 $ 20,343 $ (9,424) Equity earnings in unconsolidated partnerships 13,778 - 13,778 Minority interest in consolidated partnerships (22,287) - (22,287) Other income, net 3,391 - 3,391 Interest expense (91,164) - (91,164) Gain (loss) on exchange or disposal of assets, write-down of investments and other - - - Income from continuing operations before income taxes 390,481 - 390,481 Income taxes 147,718 - 147,718 Income from continuing operations 242,763 - 242,763 Discontinued operations: Income from discontinued operations (net of income taxes) - - - Gain on sale of discontinued operations (net of income taxes) - - - Income before cumulative effect of accounting change 242,763 - 242,763 Cumulative effect of accounting change (net of income taxes) - - - Net income 242,763 - 242,763 Preferred dividends 28 - 28 Net income applicable to common shares $ 242,735 $ - $ 242,735 Basic earnings per share: Income from continuing operations $.78 $- $.78 Income from discontinued operations - - - Cumulative effect of accounting change - - - Net income $.78 $- $.78 Diluted earnings per share: Income from continuing operations $.78 $- $.78 Income from discontinued operations - - - Cumulative effect of accounting change - - - Net income $.78 $- $.78 See Notes to Reconcilations for a description of the items marked (A)-(T).

- 14. ALLTEL CORPORATION RECONCILIATION OF RESULTS OF OPERATIONS UNDER GAAP TO RESULTS OF OPERATIONS FROM CURRENT BUSINESSES (NON-GAAP) for the three months ended June 30, 2003 (In thousands, except per share amounts) Corporate Segment Information from Current Businesses Results of Items Results of Operations Operations Excluded from Operations Communications and Under Current from Current Support Intercompany GAAP Businesses Businesses Wireless Wireline Services Eliminations Revenues and sales: Service revenues $ 1,797,520 $ - $ 1,797,520 $ 1,127,642 $ 597,109 $ 106,708 $ (33,939) Product sales 212,732 - 212,732 67,774 9,135 136,127 (304) Total revenues and sales 2,010,252 - 2,010,252 1,195,416 606,244 242,835 (34,243) Costs and expenses: Cost of services 565,612 565,612 339,730 185,580 73,458 (33,156) - Cost of products sold 271,354 271,354 141,246 6,319 124,088 (299) - Selling, general, administrative and other 372,458 372,458 287,085 64,143 15,682 5,548 - Depreciation and amortization 310,712 310,712 165,364 133,376 8,806 3,166 - Restructuring and other charges 18,979 (18,979) (M) - - - - - Total costs and expenses 1,539,115 (18,979) 1,520,136 933,425 389,418 222,034 (24,741) Operating income 471,137 18,979 490,116 $ 261,991 $ 216,826 $ 20,801 $ (9,502) Equity earnings in unconsolidated partnerships 16,689 16,689 - Minority interest in consolidated partnerships (21,390) (21,390) - Other income, net 3,634 3,634 - Interest expense (93,210) (93,210) - Gain (loss) on exchange or disposal of assets, write-down of investments and other (13,066) 13,066 - (N) Income from continuing operations before income taxes 363,794 32,045 395,839 Income taxes 139,585 12,238 151,823 (O) Income from continuing operations 224,209 19,807 244,016 Discontinued operations: Income from discontinued operations (net of income taxes) - - - Gain on sale of discontinued operations (net of income taxes) 323,927 (323,927) (R) - Income before cumulative effect of accounting change 548,136 (304,120) 244,016 Cumulative effect of accounting change (net of income taxes) - - - Net income 548,136 (304,120) 244,016 Preferred dividends 28 28 - Net income applicable to common shares $ 548,108 $ (304,120) $ 243,988 Basic earnings per share: Income from continuing operations $ .72 $ .06 $.78 Income from discontinued operations 1.04 (1.04) - Cumulative effect of accounting change - - - Net income $1.76 $ (.98) $.78 Diluted earnings per share: Income from continuing operations $ .72 $ .06 $.78 Income from discontinued operations 1.03 (1.03) - Cumulative effect of accounting change - - - Net income $1.75 $ (.97) $.78 See Notes to Reconcilations for a description of the items marked (A)-(T).