FirstBank Impact Series International Conference 2011 Brochure

- 1. VOLUME 2, SEPTEMBER 2011 AS A TOOL FOR POVERTY ERADICATION & ECONOMIC GROWTH IN NIGERIA

- 2. VOLUME 2, SEPTEMBER 2011 MICRO-FINANCING AS A TOOL FOR POVERTY ERADICATION & ECONOMIC GROWTH IN NIGERIA

- 4. Welcome to VOLUME 2, SEPTEMBER 2011 “We must drive far-reaching changes in the society” AS A TOOL FOR POVERTY ERADICATION & ECONOMIC GROWTH IN NIGERIA Bisi Onasanya Group Managing Director/CEO First Bank of Nigeria Plc. I am pleased to welcome you to the maiden edition of Chief Host FirstBank Impact Series, a policy and thought leadership His Excellency initiative of First Bank of Nigeria Plc. The series will be made Mr. Babatunde Raji Fashola (SAN) up of annual international conferences meant to facilitate The Executive Governor of Lagos State business and economic growth, drive social change, and Guest of Honour entrench outstanding values in leadership and governance in Mr. Sanusi Lamido Sanusi, CON the polity. The series is envisaged to create true impact for socio- Governor, Central Bank of Nigeria economic growth and development through insightful, Other Speakers and Panelists actionable and change-centered conferences, workshops, Dr. Dalvinder Singh seminars, strategy sessions, and policy implementation road- Professor of Law, University of Warwick, UK shows to drive far-reaching changes in the society. Stephen Olabisi Onasanya, FCA As West Africa's pioneer financial services group, the FirstBank GMD/CEO, First Bank of Nigeria Plc. group is proud of its legendary contributions to national growth Mrs. Pauline Nsa, MD/CEO and development over the past 117 years. Our role in ensuring FBN Microfinance Bank Ltd methodical and rapid economic transformation cannot be overemphasized. The truism that the citizenry requires Prof. Oyewusi Ibidapo-Obe commensurate technical progress to achieve the former is a FAS, FA Eng, OFR President, Nigerian Academy of Science matter of course for us. We will persist in initiating and implementing impactful programmes like this. Bunmi Lawson, MD/CEO, AMFB With FirstBank Impact Series, we intend to collaborate with you Tokunboh Ishmael, MD/CEO, Alitheia on a continuous basis in addressing every day challenges Conference Coordinators impeding systematic growth and development. The initiative Folake Ani-Mumuney will provide engaging platforms for evolving strategic outlook Oze K. Oze to problem-solving, especially from the capacity building and leadership perspectives. Chidinma Igbokwe Chiedozie Mbaogu This edition of the conference, with its thematic focus on “Micro- financing as a tool for poverty eradication and economic Conference Consultants growth,” appropriately addresses our bottom-up approach of Avaizon Consulting Ltd. engendering change from the grassroots. We are particularly excited to have Professor Muhammad Yunus, Nobel laureate, micro-finance icon and banker to the poor, as the distinguished This is a Publication of First Bank of Nigeria Plc. FirstBank Impact Series 03

- 5. PROGRAMME Conference Director: Folake Ani-Mumuney, Marketing & Corporate Communications, First Bank of Nigeria Plc. Date: 5th September, 2011 Venue: Shell Hall of the MUSON Center, Lagos, Nigeria Morning Session 8.00am Registration and Coffee 8.30am Moderator's Introductions Fela Durotoye, MD/CEO, Visible Impact Consulting 8.35am Welcome Address Mr. Bisi Onasanya, GMD/CEO, First Bank of Nigeria Plc. 8.45am Opening Speech by the Chief Host His Excellency, The Executive Governor of Lagos State: Mr. Babatunde Raji Fashola (SAN) 9.00am Micro-financing in Nigeria: Perspectives of the Central Bank of Nigeria (CBN) Mr. Sanusi Lamido Sanusi, CON, Governor of the CBN Panelists: Professor Oyewusi Ibidapo-Obe, The Academia Dalvinder Singh, University of Warwick Akin Akintola, Community Development Edna Ishaya, Credit Registry Pauline Nsa, FBN Microfinance Bunmi Lawson, ACCION Moderator starts conversation: Are MFBs truly lending to micro-entrepreneurs? Are we confusing SME lending with micro lending? What are the roles of micro-entrepreneurs in Nigeria's industrial growth? Is CBN creating a regulatory environment that allows MFBs empower micro- entrepreneurs? Why don't young businesses with innovative ideas spring up and survive in Nigeria? What should the government's role be in supporting micro-businesses- strategy, structure, funding, capacity development? The panel will discuss: * Are the current CBN stipulated frameworks impeding MFBs from lending to the poor? * What should be the government's role in enabling suitable frameworks for micro-financing? * Is the Nigerian model encouraging innovation and creating a supportive environment for venture start-ups? * Micro-entrepreneurs: the nail that sticks up should not be hammered down * MFBs, venture capitalists and NGOs * Q&A 10.01am The Global Need for Micro-financing and Social Business: The Dangers of Doing Nothing Professor Muhammad Yunus, Keynote Speaker Panelists: Professor Oyewusi Ibidapo-Obe, The Academia Modupe Ladipo, EFinA 04 FirstBank Impact Series

- 6. Programme Fela Durotoye, Visible Impact Consulting Pauline Nsa, FBN Microfinance Bunmi Lawson, ACCION Ndidi Nwuneli, LEAP Africa Moderator starts conversation: What roles do large corporates have to play in micro-financing and social investments? Are Nigeria's corporate giants aware of and fulfilling their roles in this regard? What incentives are being provided by the Nigerian government to encourage social investments? The panel will discuss: * What should the motive for setting-up a microfinance bank be? * Is it wrong to make profits from micro-financing? * What should be the priority: profit or social empowerment? * Are Nigerian MFBs structured with the capacity (human, funding) to engage the poor? * How can donor funding help? * How can donor funding be attracted by Nigerian MFBs? * Q&A 11.31am Micro-financing in Nigeria: Challenges and Opportunities Mrs. Pauline Nsa, MD/CEO, MFB Microfinance Bank Limited Panelists: Professor Oyewusi Ibidapo-Obe, The Academia Modupe Ladipo, EFinA Tokunboh Ishmael, Alitheia Capital Edna Ishaya, Credit Registry Ndidi Nwuneli, LEAP Africa Moderator starts conversation: How can MFBs' operations costs be reduced? Is the tax regime encouraging? How much help can MFBs get from the regulators, donors, capacity development NGOs? The panel will discuss: * How can MFBs lend to the non-skilled poor? * Is collateral over-rated? * Do Nigerian MFBs hire the right people for the job? * Where is the collaboration point for NGOs and MFBs? * Should MFBs just tend to SMEs? * Is social empowerment beyond the remits of Nigerian MFBs? * Do we need a different institution for reaching the poor? * Q&A 12.31pm Lunch Break Afternoon Session 1.16pm Moderator's Introductions 1.20pm Banking the Unbanked: What Regulatory Frameworks Exist Dr. Dalvinder Singh, Warwick University Panelists: FirstBank Impact Series 05

- 7. Programme Mr. Tokunbo Abiru, Honourable Commissioner for Finance, Lagos State Tokunboh Ishmael, Alitheia Capital Lanre Olushola, FATE Foundation Adesina Ayodele Fagbenro, DFID Edna Ishaya, Credit Registry Bunmi Lawson, ACCION Ndidi Nwuneli, LEAP Africa Moderator starts conversation: How much can we learn from the international communities where micro-financing has worked? What can we learn from those that failed? Do we require an overall policy review? Is government (at all levels- LGA, State and Federal) doing enough? What legal structure is required to enable government-provided funds disbursed through partner MFBs rather than political channels? The panel will discuss: * Lessons from abroad; what can we take onboard? * What should the motive for setting-up a microfinance bank be? * Should MFB lending rate be regulated? * What regulatory reporting/supervisory system is required for the MFBs * What is micro insurance and how does it help MFBs in Nigeria? * How do we make banking attractive to the unbanked? * Q&A 2.21pm Making a Success of Micro-financing and Social Business: Case Studies from Around the World, and the Roadmap for Nigeria Professor Muhammad Yunus, Keynote Speaker Panelists: Mr. Tokunbo Abiru, Honourable Commissioner for Finance, Lagos State Tokunboh Ishmael, Alitheia Capital Lanre Olushola, FATE Foundation Adesina Ayodele Fagbenro, DFID Dalvinder Singh, University of Warwick Akin Akintola, Community Development Edna Ishaya, Credit Registry Bunmi Lawson, ACCION Moderator starts conversation: Who is responsible for social business incubation? How should social businesses be funded? Microfinance fund; what, why and how? Where exactly do the problems lie; regulations, MF Bankers, micro-entrepreneurs, donors? The panel will discuss: * What must happen for there to be lasting change? * What has culture got to do with it? * Would micro-financing work better under an Islamic banking system? * Could women (gender) empowerment be the answer? * What are the effective ways for organizations such as NAPEP work with MFBs? * CSR and Micro-financing: could there be a strategic partnership? * Q&A 06 FirstBank Impact Series

- 8. CONTENTS Economic Growth With your active participation in this conference, we look forward to generating a visible roadmap for tackling the challenges of micro-financing and development, as we make commensurate input to: Informed Policy making Structured financial inclusion; and Impactful socio-economic transformation Bisi Onasanya, FCA Group Managing Director/CEO, First Bank of Nigeria Plc. 09 11 41 FirstBank Impact Series 07

- 9. CONTENTS Speakers 15| Prof. Muhammad Yunus Winner, Nobel Peace Prize (2006) 22| Dr. Dalvinder Singh Associate Professor of Law, University of Warwick, UK Panelists 29 15 41| Stephen Bisi Onasanya Group Managing Director/CEO, First Bank of Nigeria Plc. 42| Prof. Oyewusi Ibidapo-Obe FAS, FA Eng, OFR. President, Nigerian Academy of Science 43| Hon. Tokunboh Abiru Comm. for Finance, Lagos State 44| Mrs. Edna Ishaya COO, Credit Registry 24 42 45| Adesina Ayodel Fagbenro DFID 46| Tokunboh Ishmael 32| Managing Director, Alitheia FBN Microfinance Bank Profile 47| Modupe Ladipo Chief Executive Officer, EFInA 68| Microfinance Banks Directory 48| Bunmi Lawson Senior Operational Director, ACCION 99| Participating Organisations 49| Mr. Lanre Olusola Life & Executive Coach 50| Mr. Akinyemi Akintola CEO, Community Development Foundation Papers 51| Ndidi Okonkwo Nwuneli Founder, LEAP Microcredit and Social Business 18| for a Poverty Free World Prof. Muhammad Yunus Moderators The Role of the IMF and World Bank in 53| Fela Durotoye Computer Scientist & Economist 23| Financial Sector Reform and Compliance Dr. Dalvinder Singh 54| Ademola Ogunbanjo Strategy & Execution Management Expert 08 FirstBank Impact Series

- 10. Babatunde Raji Fashola (SAN) Chief Host FirstBank Impact Series 09

- 11. G overnor of Lagos State, Mr. improving Agriculture and Food undertaking the statutory training for Babatunde Raji Fashola (SAN) is Security among many others. Barristers and Solicitors. the recipient of the 2009 Yikzak Rabin Centre for African Development A passionate lover of children and the For the mandatory National Youth Governor of the Decade for Peace youth who represent the future of our Service Corps [NYSC] programme Award and the recipient of the 2010 continent, Governor Fashola has, in [1988-1989], he served in Benin, the Award of Excellence in Leadership of the three and a half years of his former Bendel State now Edo State. the Martin Luther King Jnr. tenure, embarked on projects aimed His flourishing private legal practice, Foundation. at improving their lives and the running into nearly fifteen years, saw opportunities open to children and him acquiring appreciable expertise He is the recipient of the 2009 Good youths in the State. They include, the and vast experience in such areas as Governance Award from the United construction of Maternal and Litigation, Intellectual Property Kingdom-based African Business Childcare Centres across the State to [registration of trademarks], Magazine. Here in Nigeria, he is The improve maternal and child health, Commercial Law, Mergers, Guardian, The Vanguard and The Sun immunization against polio and other Acquisitions, Right of Issues, newspapers' Man of The Year for child-killer diseases, the revitalization Ownership of Shares and Equity of 2009. of voluntary uniformed organizations Corporations, as well as Land in the State's public schools to build Disputes and Chieftaincy Matters. Both nationally and internationally, character and leadership qualities in he is acclaimed as one of the bright children and provide a choice away In the course of his distinguished hopes for the future of Nigeria; one of from street gangs, renovation and legal career at Sofunde, Osakwe, the very progressive Governors rehabilitation of classrooms as well as Ogundipe and Belgore; the law firm of determined to reclaim Nigeria's past the building of new structures and K.O.Tinubu & Company and as glories through competent and the provision of educational facilities Managing Partner, Lead Counsel, transparent leadership. including desks and chairs. Babatunde Raji Fashola successfully Others are the provision of free pleaded many cases at High Courts, In the past three and a half years, Mr. uniforms and textbooks to pupils and various divisions of the Court of Fashola (SAN), has demonstrated students in public schools, provision Appeal and the Supreme Court, and excellence and uncommon of summer vacation jobs for students, to cap a successful legal career, he commitment to his avowed pledge to the formation of youth clubs and was elevated to the class of Nigerian lead the change that would transform societies in schools, including Climate Elite Lawyers in August 2004 when he Lagos into Africa's model mega-city. Change Clubs and the Be Road was conferred with the rank of Senior Friendly Club designed to inculcate Advocate of Nigeria [SAN], a Some of the key projects which his environmental and road traffic leadership position of the Nigerian dynamic and proactive business- awareness respectively in children at Bar and the nation's highest legal minded skills have inspired and an early age. These have been distinction and honour for lawyers. advanced include the Eko Atlantic projected at making school more City project, the 10-lane Lagos- attractive to children; the school He was appointed Chief of Staff by the Badagry Expressway, the expansion should also become that real centre former Governor of Lagos State of the Lekki-Epe Expressway, the of a well rounded learning. [Governor Emeritus], Asiwaju Bola Lekki Free Zone, the Bus Rapid Transit Ahmed Tinubu who he later System, massive Infrastructure Born on June 28, 1963 in Lagos, Mr. succeeded in office and served from Renewal in all parts of the State, that Babatunde Raji Fashola (SAN) is a truly August 16, 2002 to November 6, 2006, has won the State honours from as far made in Nigeria product. He obtained during which time he served as as Australia for undertaking the his First School Leaving Certificate Member, State Tenders Board; fastest infrastructure renewal ever in [FSLC] from the Sunny Fields Primary Member, State Executive Council, Africa, and the establishment of the School, Adelabu Surulere, Lagos, after Member, State Treasury Board, and Security Trust Fund. which he proceeded to Birch Member, State Security Council Freeman High School, Surulere, Lagos amongst several other Ad-Hoc His other achievements include and later Igbobi College, Yaba from Committees/Panels. With the Environmental Regeneration that where he acquired the West African experiences he garnered he resigned helped reduce violent crimes by over School Certificate [WASC]. He, voluntarily to contest for the Office of 70% in (one) year; the massive thereafter, went to the University of Governor of Lagos State under the cleanup of Oshodi and other Benin, Benin City and graduated with platform of Action Congress [AC] metropolitan open sores once a Bachelor of Laws [LLB Hons] degree Party now Action Congress of Nigeria. regarded as irredeemable. Concrete in 1987. He was called to the Nigeria steps have also been taken towards Bar in November 1988 after With his victory at the April 14, 2007 10 FirstBank Impact Series

- 12. Sanusi Lamido Sanusi CON Guest of Honour FirstBank Impact Series 11

- 13. Mallam Sanusi Lamido Sanusi was appointed Governor of President Umaru Musa Yar'Adua nominated Sanusi as the Central Bank of Nigeria on 3 June 2009. He is a career Governor of the Central Bank of Nigeria on 1 June 2009 and banker and ranking Fulani nobleman, and also serves as a his appointment was confirmed by the Senate on 3 June respected Islamic scholar 2009, in the middle of a global financial crisis. Based on his past record it seemed probable that as governor of the Birth and Education central bank he would impose strict controls. Sanusi was born on July 31, 1961. His father was a Permanent Secretary in the Ministry of Foreign Affairs in the 1960s and In August 2009, Sanusi bailed out Afribank, Intercontinental his grandfather was Emir of Kano and Islamic Scholar, Alhaji Bank, Union Bank, Oceanic Bank and Finbank with 400 billion Muhammadu Sanusi. Sanusi graduated from King's College, Naira of public money, and dismissed their chief executives. Lagos in 1977 and studied at Ahmadu Bello University (ABU), He said "We had to move in to send a strong signal that such Zaria earning a BSc in Economics in 1981. He obtained an recklessness on the part of bank executives will no longer be MSc in Economics in 1983, and then taught economics at tolerated." 16 senior bank officials face charges that included ABU from 1983 to 1985. fraud, lending to fake companies, giving loans to companies they had a personal interest in and conspiring with Banking Career stockbrokers to boost share prices. In September 2009 he In 1985, Sanusi joined Icon Limited (Merchant Bankers), a said that 15 of the current 24 Nigerian banks might survive subsidiary of Morgan Guaranty Trust Bank of New York, and reform in the banking sector. Baring Brothers of London. He moved to the United Bank for Africa in 1997 in the Credit and Risk Management Division, In a wide-ranging interview with the Financial Times in rising to the position of a General Manager. In September December 2009, Sanusi defended the extensive reforms that 2005, he joined the Board of First Bank of Nigeria as an he had initiated since taking office, dubbed by some as the Executive Director in charge of Risk Management and "Sanusi tsunami". He noted that there was no choice but to Control, and was appointed Group Managing Director (CEO) attack the many powerful and interrelated vested interests in January 2009. He was also the Chairman, Kakawa Discount who were exploiting the financial system, and expressed his House and sat on the Board of FBN Bank (UK) Limited. Sanusi appreciation of support from the Presidency, the Economic is recognized in the banking industry for his contribution and Financial Crimes Commission, the Finance minister and towards developing a Risk Management culture in the others. Nigerian banking sector. First Bank is Nigeria's oldest bank and one of the biggest financial institutions in Africa. Sanusi In January 2010, Sanusi said that banks will only want to give was the first Northerner to be appointed CEO in First Bank's credit to the Nigeria's Small and Medium Enterprises (SMEs) if history of more than a century. the government gives adequate attention to the provision of infrastructure. In January 2010 Sanusi admitted that since Governor of the Central Bank 12 FirstBank Impact Series

- 14. Follow Us on:

- 15. t he ee t s a M k e r S p e 14 FirstBank Impact Series

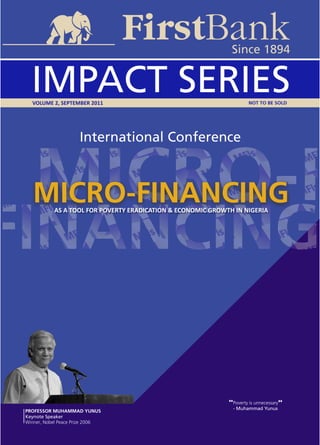

- 16. Professor Muhammad Yunus FirstBank Impact Series 15

- 17. Profile Professor Muhammad Yunus Recipient of the 2006 Nobel Peace Prize, Professor Muhammad Yunus is internationally recognized for his work in poverty alleviation and the empowerment project in 1976, Grameen Bank has grown to provide collateral-free loans to His Grameen Bank spread from village to 5 million clients in Bangladesh, 96% of village as a lender of tiny amounts of who are women. Over the last two money (microcredit), primarily to decades, Grameen Bank has loaned out I magine a bank that loans money women. Yunus heard that “all women over 5 billion dollars to the poorest of the based on a borrower's desperate can do is raise chickens, or cows or make poor, while maintaining a repayment circumstances -where, as baskets. I said, 'Don't underestimate the rate consistently above 98%. The Muhammad Yunus says, “the less talent of human beings.' ” No collateral is innovative approach to poverty you have, the higher priority you have.” required, nor paperwork—just an effort alleviation pioneered by Professor Yunus Turning banking convention on its head to make good and pay back the loan. in a small village in Bangladesh has has accomplished a world of good for Now the bank boasts 5 million inspired a global microcredit movement millions of impoverished Bangladeshis, borrowers, receiving half a billion dollars reaching out to millions of poor women as the pioneering economist Yunus has a year. It has branched out into student from rural South Africa to inner city demonstrated in the last three decades. loans, health care coverage, and into Chicago. other countries. Grameen has even What began as a modest academic created a mobile phone company to His autobiography, “Banker to the Poor: experiment has become a personal bring cell phones to Bangladeshi Micro-lending and the Battle Against crusade to end poverty. Yunus reminds villages. Yunus envisions microcredit World Poverty,” has been translated in us that for two-thirds of the world's building a society where even poor French, Italian, Spanish, English, population, “financial institutions do not people can open “the gift they have Japanese, Portuguese, Dutch, Gujarati, exist.” Yet, “we've created a world which inside of them.” Chinese, German, Turkish and Arabic. It goes around with money. If you don't was published in 1998 and it became a have the first dollar, you can't catch the Biography New York Times Best-Seller. next dollar.” It was Yunus' notion, in the Professor Yunus has successfully melded In 1957, he enrolled in the department of face of harsh skepticism, to give the capitalism with social responsibility to economics at Dhaka University and poorest of the poor their first dollar so create the Grameen Bank, a microcredit completed his BA in 1960 and MA in they could become self-supporting. institution committed to providing small 1961. Following his graduation, Yunus “We're not talking about people who amounts of working capital to the poor joined the Bureau of Economics as don't know what to do with their for self-employment. research assistant. Later he was lives….They're as good, enterprising, as appointed as a lecturer in economics in smart as anybody else.” From its origins as an action-research Chittagong College in 1961. He was 16 FirstBank Impact Series

- 18. offered a Fulbright scholarship in 1965 to study in the USA. He x Human Rights obtained his Ph.D. in economics from Vanderbilt University in x International Affairs 1969. x Entrepreneurship x Visionaries Besides Grameen Bank he has created a number of x Women's Issues companies in Bangladesh to address diverse issues of poverty x Feed the World and development. Among the companies are: x Making Poverty History Grameen Phone (A Mobile Telephone Company) Some Speech Titles Grameen Cybernet (Internet Service Provider) x Social Entrepreneurship - A Different Business Model Grameen Communications (Rural Internet Service Provider) x The Total Eradication of Poverty from the World Grameen Software Company x Global Advances in Health Care Grameen Information Technology Park x Halving Poverty by 2015 - We Can Actually Make It Grameen Fund (Social Venture Capital Company) Happen Grameen Capital Management Company Grameen Textile Company Advisor and Board Memberships Grameen Knitwear Company x International Crisis Group, Washington D.C., USA Grameen Renewable Energy Company x Patron, United Kingdom Social Investment Forum, Grameen Health Company London, UK Grameen Education Company x Board of Directors, United Nations Foundation, Grameen Agriculture Company Washington, USA Grameen Fisheries and Livestock Company x Founding Patron, C21: Tomorrow's Leaders for a Safer Grameen Business Promotion Company Planet, Oxford Research Group, Oxford,United Kingdom Professor Muhammad Yunus serves on the boards of many x Board of Directors, Schwab Foundation for Social national and international organizations. Entrepreneurship, Cologny, Geneva, Switzerland x Board of Directors, ManyOne Foundation, Canada Topics x Board of Trustees, Coexist Foundation, University of x Economy Cambridge, UK x Finance x Board of Directors, Prince Albert II of Monaco Foundation, Monaco FirstBank Impact Series 17

- 19. Microcredit and Social Business for a Poverty Free World Muhammad Yunus Lagos, Nigeria September 2011 Grameen Bank After all my efforts, over several months, It is 30 years now since we began. We I became involved in the poverty issue failed I offered to become a guarantor for keep looking at the children of our not as a policymaker or as a researcher. I the loans to the poor. When I gave the borrowers to see what has been the became involved because poverty was loans, I was stunned by the result. The impact of our work on their lives. The all around me, and I could not turn away poor paid back their loans, on time, every women who are our borrowers always from it. time! But still I kept confronting gave topmost priority to the children. difficulties in expanding the program One of the Sixteen Decisions developed In 1974, I found it difficult to teach elegant through the existing banks. That was and followed by them was to send theories of economics in the university when I decided to create a separate bank children to school. Grameen Bank classroom, in the backdrop of a terrible for the poor, I finally succeeded in doing encouraged them, and before long all famine in Bangladesh. Suddenly, I felt that in 1983. I named it Grameen Bank or the children were going to school. Many the emptiness of those theories in the Village bank. of these children made it to the top of face of crushing hunger and poverty. I their class. We wanted to celebrate that, wanted to do something immediate to Today, Grameen Bank gives loans to so we introduced scholarships for help people around me, even if it was nearly 7.00 million poor people, 97 per talented students. Grameen Bank now just one human being, to get through cent of whom are women, in 76,848 gives 30,000 scholarships every year. another day with a little more ease. That villages in Bangladesh. Grameen Bank brought me face to face with poor gives collateral-free income generating Many of the children went on to higher people's struggle to find the tiniest loans, housing loans, student loans and education to become doctors, engineers, amounts of money to support their micro-enterprise loans to the poor college teachers and other professionals. efforts to eke out a living. I was shocked families and offers a host of attractive We introduced student loans to make it to discover a woman in the village, savings, pension funds and insurance easy for Grameen students to complete borrowing less than a dollar from the products for its members. Since it higher education. Now some of them money-lender, on the condition that he introduced them in 1984, housing loans have PhD's. There are 15,754 students would have the exclusive right to buy all have been used to construct 644,965 on student loans. Over 7,000 students she produces at the price that he houses. The legal ownership of these are now added to this number decides. This, to me, was a way of houses belongs to the women annually. recruiting slave labor. themselves. We focused on women because we found giving loans to We are creating a completely new I decided to make a list of the victims of this women always brought more benefits generation that will be well equipped to money-lending n the village next door to to the family. take their families way out of the reach of our campus. poverty. We want to make a break in the In a cumulative way the bank has given historical continuation of poverty. When my list was complete, it had the out loans totaling about US $6.1 billion. names of 42 victims who borrowed a total The repayment rate is 98.28%. Grameen Free Market Economy amount of US $27. I was shocked. I offered Bank routinely makes profit. Financially, Many of the problems in the world today, US $27 from my own pocket to get these it is self-reliant and has not taken donor including poverty, persist because of a victims out of the clutches of those money since 1995. Deposits and own too narrow interpretation of capitalism. money-lenders. The excitement that was resources of Grameen Bank today created among the people by this small amount to 155 per cent of all Capitalism centers around the free action got me further involved in it. If I outstanding loans. According to market. It is claimed that the freer the could make so many people so happy Grameen Bank's internal survey, 64 per market, the better is the result of with such a tiny amount of money, why cent of our borrowers have crossed the capitalism in solving the questions of shouldn't I do more of it? poverty line. what, how, and for whom. It is also claimed that the individual search for That is what I have been trying to do ever This idea, which began in Jobra, a small personal gains brings collective optimal since. The first thing I did was to try to village in Bangladesh, has spread around result. persuade the bank located in the campus the world and there are now Grameen to lend money to the poor. But that did type programs in almost every country. The theory of capitalism assumes that not work. They didn't agree. The bank entrepreneurs are one-dimensional said that the poor were not creditworthy. Second Generation human beings, who are dedicated to one 18 FirstBank Impact Series

- 20. mission in their business lives − to new type of capital market of its own, to Bank shares with their own money, and maximize profit. This interpretation of raise capital. these shares cannot be transferred to capitalism insulates the entrepreneurs Young people all around the world, non-borrowers. A committed from all political, emotional, social, particularly in rich countries, will find the professional team does the day-to-day spiritual, environmental dimensions of concept of social business very running of the bank. their lives. Many of the world's appealing since it will give them a problems exist because of this challenge to make a difference by using Bilateral and multi-lateral donors could restriction on the players of free-market. their creative talent. easily create this type of social business. When a donor gives a loan or a grant to We have remained so impressed by the Almost all social and economic problems build a bridge in the recipient country, it success of the free-market that we never of the world will be addressed through could create instead a "bridge company" dared to express any doubt about our social businesses. The challenge is to owned by the local poor. A committed basic assumption. We worked extra hard innovate business models and apply management company could be given to transform ourselves, as closely as them to produce desired social results the responsibility of running the possible, into the one-dimensional cost-effectively and efficiently such as company. Profit of the company will go human beings as conceptualized in the healthcare for the poor could be a social to the local poor as dividend, and theory, to allow smooth functioning of business, financial services for the poor, towards building more bridges. Many free market mechanism. information technology for the poor, infrastructure projects, like roads, education and training for the poor, highways, airports, seaports, utility I have said that capitalism is a half told marketing for the poor, renewable companies could all be built in this story. By defining "entrepreneur" in a energy − these are all exciting ideas for manner. broader way we can change the social businesses. character of capitalism radically, and Grameen has created two social solve many of the unresolved social and Social business is important because it businesses of the first type. One is a economic problems within the scope of addresses very vital concerns of mankind. yogurt factory, to produce fortified the free market. Let us suppose an It can change the lives of the bottom 60 yogurt to bring nutrition to entrepreneur, instead of having a single per cent of world population and help malnourished children. It is a joint source of motivation (such as, them to get out of poverty. venture with Danone. It will continue to maximizing profit), now has two sources expand until all malnourished children of motivation, which are mutually We cannot cope with the problem of of Bangladesh are reached with fortified exclusive, but equally compelling − a) poverty within the orthodoxy of yogurt. Another is a chain of eye-care maximization of profit and b) doing capitalism preached and practiced today. hospitals. Each hospital will undertake, good to people and the world. With the failure of many Third World on an average, 10,000 cataract surgeries governments in running businesses, per year at differentiated prices to the Each type of motivation will lead to a health, education, and welfare rich and the poor. separate kind of business. Let us call the programs efficiently everyone is quick to first type of business a profit-maximizing recommend: "hand it over to the private Social Stock Market business, and the second type of sector". I endorse this recommendation To connect investors with social business as social business. whole-heartedly. But I raise a question businesses, we need to create social stock with it. Which private sector are we market where only the shares of social Social business will be a new kind of talking about? Personal profit based businesses will be traded. An investor business introduced in the market place private sector has its own clear agenda. will come to this stock-exchange with a with the objective of making a difference It comes in serious conflict with the pro- clear intention of finding a social to the world. Investors in the social poor, pro-women, pro-environment business, which has a mission of his or business could get back their agenda. Economic theory has not her liking. Anyone who wants to make investment money, but will not take any provided us with any alternative to this money will go to the existing stock- dividend from the company. Profit familiar private sector. I argue that we market. would be ploughed back into the can create a powerful alternative - a company to expand its outreach and social-consciousness-driven private To enable a social stock-exchange to improve the quality of its product or perform properly, we will need to create sector, created by social entrepreneurs. service. A social business will be a non- rating agencies, standardization of loss, non-dividend company. terminology, definitions, impact Grameen's Social Business measurement tools, reporting formats, Once social business is recognized in law, Even profit maximizing companies can and new financial publications, such as, many existing companies will come be designed as social businesses by The Social Wall Street Journal. Business forward to create social businesses in giving full or majority ownership to the schools will offer courses and business addition to their foundation activities. poor. This constitutes a second type of management degrees on social Many activists from the non-profit social business. Grameen Bank falls businesses to train young managers sector will also find this an attractive under this category of social business. It how to manage social business option. Unlike the non-profit sector is owned by the poor. enterprises in the most efficient manner, where one needs to collect donations to and, most of all, to inspire them to keep activities going, a social business The poor could get the shares of these become social business entrepreneurs will be self-sustaining and create surplus companies as gifts by donors, or they themselves. for expansion since it is a non-loss could buy the shares with their own enterprise. Social business will go into a money. The borrowers buy Grameen Role of Social Businesses in Globalization FirstBank Impact Series 19

- 21. Muhammad Yunus Debates Microfinance Models at Annual Meeting of Clinton Global Initiative (CGI) At the annual meeting of the Clinton Global August 16, 2010. Equity investors include Initiative, a forum on international development Quantum Hedge Fund, Sequoia Capital, Vinod founded in 2005 by former US President Bill Khosla, Small Industries Development Bank of Clinton, Nobel laureate Muhammad Yunus and India, Bajaj Allianz, Yatish Trading, Kismet Vikram Akula, founder of Indian SKS Capital, Sandstone Capital, Silicon Valley Bank Microfinance, which recently went public, and Unitus. SKS Microfinance reported total discussed different models for microfinance assets as of March 31, 2010, of USD 791 million. institutions (MFIs). As of March 2010, according to the Microfinance Information Exchange (MIX), the microfinance Dr Yunus claims that he does not oppose MFIs information clearinghouse, SKS Microfinance making a profit, but stresses that there should reported a return on assets of 4.96 percent, be a cap on profits. In addition, Dr Yunus also return on equity of 21.56 percent, gross loan urges SKS Microfinance to convert from being a portfolio of USD 961 million and 5.8 million non-bank finance corporation (NBFC) into a bank, a process that would enable SKS Microfinance to accept deposits and place them under the deposit guarantee scheme of the Reserve Bank of India (RBI). On the other hand, Mr Akula emphasizes that having access to commercial capital markets is the only way to raise sufficient funds to meet the needs of the poor. In addition, he argues that it is extremely difficult to secure a banking license in India. In response, Dr Yunus warns of the volatility of the commercial capital markets and argues that the “microcredit is not about exciting people to make money off the poor.” About SKS Microfinance: SKS Microfinance is an Indian microlender that delivers microfinance products through a group- lending model to impoverished women in India. It is a for-profit, non-banking finance company which converted to a public limited company in May 2009 and launched an initial public offering on July 28, 2010, after which trading commenced on the Bombay Stock Exchange and the National Stock Exchange of India on 20 FirstBank Impact Series

- 22. FirstBank Impact Series 21

- 23. Profile Dr. Dalvinder Singh D r. Dalvinder Singh is the Associate Professor of Bank Resolution, London: Informa Law, Lloyds Commercial Law at the University of Warwick's School of Law Library; D Singh with W Shan & P Simons (eds) Law, 2007. He has given technical assistance Redefining Sovereignty in International Economic Law, to the IMF on micro-finance legislation for the Oxford: Hart Publishing 2008; D Singh with A Campbell, JR Republic of Guinea and has also participated in a bank LaBrosse & DG Mayes (eds) Deposit Insurance, Basingstoke: insolvency workshop organized by CARTAC. He is also Palgrave Macmillan (2007). Senior Associate Research Fellow, Institute of Advanced Legal Studies, University of London; Managing Editor of Articles and Chapters: D Singh, 'The US Architecture of Bank the Journal of Banking Regulation, since 2003 and Regulation and Supervision: Recent Reforms in their Historical Context', in D Singh with JR LaBrosse and R Financial Regulation International, since 2006; Editorial Olivares-Caminal (eds) Managing Risk in the Financial Advisory Board Member, Journal of Financial Regulation System, Cheltenham, Edward Elgar, (2011); D Singh, 'The UK and Compliance (Emerald). He has acted as a technical Banking Act 2009, pre-insolvency and early intervention: advisor to the International Monetary Fund. He was policy and practice' Jan, Journal of Business Law, (2011) 20 – invited in 2008 to be a member of the International 42; D Singh, 'UK approach to financial crisis management,' Association of Deposit Insurers, Research and Guidance, Transnational Law and Contemporary Problems, Iowa Law Expert Advisory Panel. He is also External Examiner at the School, Vol. 19 (Winter), (2011) 872 – 926; D Singh & JR LaBrosse, 'Northern Rock, Depositors & Deposit Insurance Centre for Commercial Law Studies, Queen Mary, Coverage: Some Critical Reflections' Jan, Journal of Business University of London, for several of their postgraduate Law, 2010 55-84; D Singh & D Walker 'The European Deposit programmes, and the University of Strathclyde, Scotland. Guarantee Directive: An Appraisal of the Reforms', in Financial Crisis Management and Bank Resolution, D Singh, He is author and editor of several monographs: D Singh, with RJ LaBrosse, & R Olivares-Caminal, London, Informa Law Banking Regulation of UK and US Financial Markets, (2009); D Singh 'The Role of the IMF and World Bank in Aldershot: Ashgate Publishing 2007; D Singh with R Financial Sector Reform and Compliance? ', in Redefining 22 FirstBank Impact Series

- 24. The Role of the IMF and World Bank in Financial Sector Reform and Compliance DALVINDER SINGH The IMF and the World Bank have crisis resolution and macro-policy purposes to ascertain whether they responsibility respectively for advice; and the Bank on longer-term pose a risk to the stability of the exchange rate and currency stability, development—including micro- international monetary system. It and reconstruction and economics and trade and industry seeks to provide financial assistance development. The post-war agenda issues—and poverty reduction'. This to members experiencing balance of of exchange rate stability and move from the traditional remits of payment problems, on the basis that reconstruction has been broadened responsibility is evidence of a the individual member complies to assist members with their efforts growing influence of the two in the with the conditions set for such to achieve monetary and financial arena of a country's domestic policy; assistance so the IMF can be assured stability, create sustainable this is achieved through the the money will be repaid. economic growth to reduce poverty, conditions attached to their financial and enhance development; focusing and technical assistance when This invariably requires the member on their capacity to improve the domestic policies and legal and country to adjust its economic and domestic infrastructure that is regulatory infrastructure are not monetary policies, giving rise to a necessary in most cases to deal with sufficient to prevent or manage a considerable level of coercive and the prescribed assistance the crisis. unfettered leverage by the IMF to institutions provide. The evolving role of the IMF and ensure changes are indeed made. World Bank The final function of the IMF is to The responsibilities of the two are The responsibilities and functions of provide technical assistance to its distinguishable by the period over the IMF centre on its key purpose: to members, but without the same which they assist their members. The deal with 'international monetary degree of compulsion as is attached IMF's assistance has tended to be on problems' by acting as the forum for to the other activities. Conditionality a short-term basis, focusing on its members to 'consult' and which generally refers to the macro-economic matters; whereas 'collaborate' with it so as to 'facilitate' designated policy and procedures the World Bank has concentrated on and 'promote' 'international attached to the assistance the IMF long-term development projects monetary co-operation', 'growth of provides ensures to a certain extent that focus on the micro-economic international trade' and 'exchange the objectives of the assistance is side. In the pursuit of these rate stability' to achieve financial and achieved. It has, in many respects, interdependent goals a considerable economic stability. The IMF seeks to generated a considerable level of level of cooperation between the achieve these broad purposes controversy in light of the expansion two institutions has evolved, through its core functions: of its policy remit to include matters notwithstanding an inevitable surveillance, financial assistance and at a micro level such as degree of tension on occasion when technical assistance to ensure its infrastructural reform. As Lastra their policies seem to conflict with members continuously adhere to its notes the rationale for this one another; this occurred especially underlying purposes. expansion was the fact that the crisis during the 1990s and the financial stricken countries discussed above crises experienced by a number of The traditional objective of exposed considerable problems in countries. surveillance is ensuring orderly this area thus exacerbating the exchange arrangements' among financial problems they experienced. This has resulted in more formal members. The IMF, in 'consultation' coordination over the years to deal with its members by both bilateral The traditional functions as noted with such matters, although both and multilateral means, assesses above have expanded considerably still concentrate on their 'core asks'. individualmembers' economic and over the years, both formally Gilbert et al propose the core foci as monetary policies against its through amendments of the Articles 'the Fund on macro-economic and FirstBank Impact Series 23

- 25. of Agreement and informally regulation reform—especially given through policy pronouncements, to However, when a country is seeking that weaknesses in this area were encompass a broader set of issues financial support from the IMF the part of the reason for the Asian that underpin the stability of the picture is very different: here the financial crisis. international monetary system. This issue of financial sector reform The World Bank is primarily made up has widened the IMF's role from features frequently, in addition to of two main agencies: the macro-economic policy matters to the traditional areas of IMF International Bank for include microeconomic policy, to responsibility, in the Letters of Intent Reconstruction and Development achieve inter alia 'financial and prepared by the member seeking (IBRD), and the International economic stability in its broadest support. For example, the Letter of Development Association (IDA) and sense' by acting as a forum for Intent of the government of affiliate agencies. The role of the 'international cooperation to Thailand dated 1997 contained IBRD is aimed at reduction of monitor economic developments on numerous references to its intention poverty and sustainable a global scale' and specifically of making changes in the financial development, although its initial addressing weaknesses in the sector, such as legal and regulatory responsibility was for assistance with overseeing of domestic financial reforms. the reconstruction of countries markets. affected by war. The World Bank acts To obtain financial support from the for its members as a facilitator for The key issue highlighted is the risks IMF these changes were of a short- investment and technical assistance, now posed by such weaknesses in and long-term nature, and designed broadly speaking to assist with the the financial system, both internally ultimately to restore confidence in 'development of productive facilities and externally to others. The the financial system by closing and resources in less developed traditional role of surveillance has insolvent banks, putting in place a countries'. The investment (or loans been broadened from what Lastra deposit protection system and as the case may be) it provides coins ' “macro-surveillance” to improving the approach to comes from both private means and microsurveillance” specifically enforcement sanctions. These issues its own resources, but the principal focusing on financial system form part of the adjustment policy objective is to give financial soundness by placing particular the member seeking assistance must assistance to members on the most attention on 'weak financial put in place and adhere to in order reasonable terms and conditions. institutions, inadequate bank to give the IMF the assurance to The IBRD raises most of its funds by regulation and supervision, and lack provide such assistance. selling its AAA-rated bonds to of transparency' as a result of its financial intermediaries in the broad discretionary mandate The IMF's technical assistance international markets. The traditional articulated in the Articles of function has also evolved in light of objectives it tries to 'promote' are of Agreement, These issues form part its broader agenda to include a long-term nature: the 'growth of of the broader agenda of bilateral financial sector reform, which international trade', 'equilibrium of and multilateral surveillance the IMF incorporates the FSAP, by providing balance of payments' and undertakes periodically with technical assistance on a voluntary 'investment for the development of members to 'lessen the frequency basis. In more recent Letters of the productive resources of and diminish the intensity of Intent, such as Turkey in 2006, the members, focusing on raising potential financial system problems'; letter not only referred to the productivity, the standard of living members are required to cooperate measures put in place to effect and conditions of labor in their with the IMF, outlining how they will financial sector reform, but also territories', but avoiding interfering attempt to deal with any issues by expressed the intention to 'use the in the political affairs of the country. drawing up a programme of reform. findings of the FSAP for Turkey to The purpose of the IBRD is relatively For example, the Article IV staff guide our future reform efforts in the narrow in terms of its Articles of report for Tunisia in 2002 illustrated financial sector'. This indicates the Agreement, but has obviously been the work the authorities were link between the compulsory and interpreted broadly to cover the undertaking in the financial sector the voluntary parts of the IMF's role whole spectrum of development, area and progress towards and the importance attached to from economics to health, implementing the findings from a financial sector reform, if necessary, education, environment, Financial Sector Assessment in seeking financial support from the infrastructure and poverty Program (FSAP) assessment. IMF. The voluntary aspect is alleviation: 'The Articles must important because not all members receive a great measure of Despite the perception that financial will require formal assistance but purposive interpretation to reflect sector reform is a 'wholesale' part of may nevertheless pose a threat to the Bank's changing role as a Article IV consultation, in fact only domestic or international stability, so development institution'. The two reports explicitly refer to some form of voluntary assessment objectives are continuously financial sector matters, namely programme was needed that evolving rather than static and rigid, Tunisia and Iceland. specifically focused on bank and need to be interpreted in the 24 FirstBank Impact Series

- 26. broad spirit rather than to the letter. The IMF and World Bank Financial For example, in the period Sector Assessment Program: The primary functions of the World 1993–2003 the World Bank provided A Diagnostic Tool Bank as a whole are said to be to act $56 billion of assistance for financial The FSAP diagnostic tool was as a financial intermediary, a sector reform projects, which introduced by the IMF and World development research institution equates to about 24 per cent of its Bank after the Asian financial crisis and a development agency.66 The budget, to improve economic on a voluntary basis. This prompted IBRD and the IDA provide long-term growth and reduce poverty by the international community to finance for specific programmes enhancing the mobility of savings respond with a whole host of over 15–20 years and 35–40 years and investment across as broad a initiatives to mitigate the risk of respectively, depending on whether sector of the economy as possible to such episodes occurring again. The the individual country is classified as make it more inclusive. The size and IMF and the World Bank set up the middle-income or low-income—the complexity of the projects mean that FSAP so their respective strengths former do not have the financial the World Bank acts as the overall and specialisms could be harnessed need to seek assistance from the 'lead manager', with other donors, together to identify financial sector IBRD. The World Bank also assists especially regional development 'vulnerabilities' and deal with the members by providing what are banks, providing assistance such as 'development needs' of their termed 'knowledge services' technical and financial support. In members to reduce the likelihood through assessments and technical these projects the state is at the of further financial crises and the assistance on development matters; centre and advocates the reforms, disruption they cause to financial this is one of its most important while the central bank and stability. Another objective of the roles. The loans provided by the government departments are FSAP is to determine the extent to World Bank fall into two broad responsible for implementing the which members comply with categories: goods and services, and changes; this is in contrast to the international standards of financial adjustment loans or 'structural general perception that changes in regulation and supervision in adjustment loans'. The latter are for banking regulation and supervision banking, securities and insurance policy and institutional reforms: the are implemented by the central business; this is either incorporated 'programme of reforms . . . proposed bank rather than being state led. under the Assessment of Financial by the country and negotiated with Sector Standards or in an individual the World Bank to ensure the Support has focused on numerous Report on Observance of Standards objective of the projects and the projects relating to the infrastructure and Codes (ROSC). The joint outcomes are achieved under the of the financial system; for instance, programme aims, 'to help countries aegis of conditionality'.67 Non- in the case of Egypt in 2006, which is to enhance their resilience to crises compliance can ultimately lead to no exception, the goal was to and cross-border contagion, to the withdrawal of a loan, or in most modernise bank regulation and its foster growth, by promoting cases the threat of it being enforcement so as to comply with financial system soundness and withdrawn, notwithstanding the international standards. The changes financial sector diversity'; its fact that a country is not obliged to were aimed at improving the synergy connects the macro/micro fulfill the measures set out in the efficiency of the banking system by prudential aspects of financial programme; this is seen as its enhancing market confidence and stability by linking it with the sovereign prerogative given the accountability of individual banks. In regulatory infrastructural needs of a political, social and economic Paraguay in 2002 the focus was on country. The diagnostic focus of the implications of the programme for mechanisms to deal with efficient FSAP then forms a platform for the country. Financial sector reform bank resolution and provide an remedial work under the direction has been on the World Bank's effective safety net to avoid small of the assessed country. agenda for a considerable length of depositors losing their money when time (a lot longer than it has a bank fails or is closed. In Mexico in a) FSAP process and tools featured at the IMF), either through 199575 and the Philippines in 1998, The FSAP process has focused on financial support for structural technical assistance to strengthen the needs of developing, emerging reform projects or technical financial sector oversight by and industrialized countries. It assistance to a country's authorities improving their capabilities to deal concentrates on what it terms to develop this area of the economy with financial crisis was one of the 'systemically important countries', and improve the capacity to main features of the loan. In the case as well as countries at various oversee the financial system of Pakistan where the reform efforts stages of development that pose a through legislative changes and have been in place for a significant systemic threat to international training. Structural adjustment length of time compliance with the financial stability. For example, in loans have focused on a broad Basel Core Principles now stands at the case of developed countries a range of areas, including reducing 22 out of the 25 Core Principles. 'vulnerability assessment' is government ownership and undertaken to gauge the extent to strengthening bank supervision. FirstBank Impact Series 25

- 27. which the banking system can 'mission chief'. The assessment of financial sector withstand macro-economic shocks; standards is the other significant In the case of emerging economies The mission involves an in-country part of the overall assessment of the the FSAP process has to pay Financial System Stability financial system. The focus of the particular attention to the quality of Assessment (FSSA) of the banking FSAP is on three areas: '(i) financial regulation after financial crises and system and its regulation and sector regulation and supervision; the diversity of the financial system, supervision. The team hold (ii) institutional and market to assess whether the non-bank discussions with institutions such as infrastructure; (iii) policy sector, for instance, can pose the central bank and the bank transparency'. It consists of systemic risks to the overall well- regulator and supervisor, and have assessing countries' financial being of the financial system. The meetings with figureheads in the systems in light of a variety of priority set for developing countries banking industry. international standards in banking, is different, focusing on building securities and insurance business. the infrastructure of the financial The stress test forms a significant system. part of the FSAP process. It consists The international banking of assessing the extent to which a standards devised by the Basel The response by those deemed country's financial system can Committee are a significant part of systemically important differs from withstand instability arising from the FSAP process, which adopts the that of countries at other stages of 'plausible shocks to key Basel Committee methodology to development. For example, the macroeconomic variables'. The evaluate compliance with the Core former consider the FSAP as an assessment focuses on macro- Principles. Through the assessments external review from an economic shocks to the financial a number of issues have over time international perspective to gauge system to judge its robustness to been identified which would call whether they could weather withstand them. Stress tests could into question the effectiveness of episodes of international financial examine the implications of the regulatory regime in a country: instability; the latter consider it as changes to interest and exchange examples are political interference an opportunity for identifying gaps rates for financial services firms. in the authorization process or lack in existing regulation and of legal immunity from law suits; a supervision and initiating reforms The stress test is not a single, lack of powers to deal with with development objectives in uniform model that is simply unauthorised activities; a lack of mind. applied to all countries, ignoring criteria to ascertain whether a bank, the level of development; each shareholders or individual director According to observations made assessment is designed around the are fit and proper; capital adequacy after the pilot programme, most country relative to the 'complexity rules which are not adhered to or countries that participated wanted of the financial system, and data monitored effectively on either an more attention to be paid to the availability, while also being individual bank basis or a 'implications of missing, mindful of the resource burden consolidated basis; large exposures incomplete, or informal markets for imposed on the central bank and which are not monitored or the stability and the development supervisory authorities'. reported; insufficient on-site of a assessment of banks; limited diversified financial sector'. The For example, in the case of Gabon consolidated supervision of cross- most recent review highlights the stress tests focused on issues sector or cross-border activities; similar sentiments wanting such as a government default on ineffective enforcement by the improvements in the assessment to domestic debt repayments as a regulators of standards and rules reflect the development issues that result of changes to oil production that actually exist; and limited are integral to the reform process. in the country and their effect on cooperation between respective commercial banks servicing their regulators to oversee banks that The process of assessing debts. In Mexico the focus was on operate across borders. observance of codes and standards the resilience of the banking sector consists of a premission, the to withstand a slowdown to the US The degree of compliance with the mission and a post-mission economy, which would have a Basel Core Principles makes assessment involving an significant effect on banking interesting, yet unsurprising, international team of consultants profitability. The position in Sweden reading. The level of compliance is and IMF and World Bank officials. was assessed by testing the in many respects commensurate The country first completes a resilience of the banking sector to with the stage of development the questionnaire on its system of bank real estate, exchange and interest country is at. Indeed, the forms of regulation in conformity with the rate shocks; it was found that banks 'noncompliance' are also associated Basel Core Principle methodology; were resilient to such changes. with the stage of development. this is then submitted to the Developing countries evidence a 26 FirstBank Impact Series

- 28. BRIEF Microinsurance: What Can Donors Do? Poor people in developing countries enjoy few safeguards against the numerous perils of life-illness or injury, natural disasters, and loss of property. Microinsurance is growing in popularity among donors as one means of Governments in developing countries are often unable provide adequate social Few donors agencies have insurance protection for their poorer citizens. At the expertise. Agencies that make significant same time, formal insurers in many markets investments in micrinsurance should have do not see low-income people as viable access to staff with appropriate technical clients. (However, there has been recent skills. Donors can either invest in in-house progress with some simple products, such as expertise or ensure program staff have life insurance.) enough “insurance literacy” to outsource intelligently and select the best implementing HOW CAN DONORS EFFECTIVELY SUPPORT partners. Some funders, like the Aga Khan MICROINSURANCE? Agency for Microfinance, have recruited full- time experts from leading insurance In most countries, reaching scale and companies. providing real value to clients will likely require donor involvement in the medium Determining when and how to deploy the term. donors will need appropriate expertise appropriate instrument-from technical and resources to engage effectively in assistance to grants, loans, equity, guarantees, microinsurance because it is relatively new, and policy support-requires good knowledge complex, and risky. of market conditions. In many instances, relatively small amounts of funding provided Donors have diverse reasons for wanting to over longer periods are needed. In markets support micrinsurance. Even within the same where commercial insurers show interest, agency, different units may have varying donors should focus on brokering views on how subsidies can be used best, how relationships with organizations close to much clients should pay for insurance target clients. services, and what roles the government and Donors can also support public goods like the private sector should play. Strategic clarity research and consumer education. However, on the reasons for engaging in in the numerous markets where formal microinsurance affects how a donor’s insurers are not yet willing to step in, donor objectives are set, how expertise is recruited, funding can help build the institutional and what type of monitoring is implemented. capacity to provide insurance services. the Bill FirstBank Impact Series 27

- 30. PAULINE WANDOO A. NSA FirstBank Impact Series 29

- 31. Profile PAULINE WANDOO NSA P auline Nsa is the pioneer MD/CEO of FBN Microfinance Bank Ltd. She was actively involved Microfinance Bank Limited, a fully owned in the market research that led to UBA/AfriCap subsidiary of First Bank Nigeria Plc, the decision to invest in a microfinance initiative. leading financial services institution in Nigeria. She holds a BSc degree in Business Pauline Nsa has attended numerous training Administration from the Ahmadu Bello programmes within and outside the country University, Zaria, Nigeria (1983) and a Masters in including the Risk Management course Business Administration (MBA) in Finance from organized by Euromoney, London (1986); Best the University of Ibadan (1992). and Brightest Bankers Programme of IFESH/USAID in New York (2002); WAIFEM She has over 25 years work experience spanning Microfinance programme for Technical Service Bank Examination, Credit Risk Management, Providers in Accra, Ghana (2004); Boulder Consumer Banking, Training and Microfinance microfinance course by ILO in Turin, Italy (2005); Operations. Her experience in financial analysis Cracking the Capital Markets, sponsored by the follows her 12 years in the Risk Management Grameen Foundation, New York (2007); Building function, first at International Merchant Bank new ventures in established companies at the (IMB) Plc, and then United Bank for Africa (UBA) Harvard Business School (2008); Strategic Plc. These followed four years experience in Leadership in Microfinance by Accion/ Harvard Nigeria Deposit Insurance Corporation (NDIC) as Business School (2009) to name a few. an examiner. Her key strengths are strong leadership abilities, Prior to joining the First Bank Plc, Pauline was presentation and analytical skills. Pauline is responsible for the set up of the defunct UBA passionate about microfinance and works 30 FirstBank Impact Series

- 32. FirstBank Impact Series 31

- 33. Corporate Profile 32 FirstBank Impact Series

- 34. v i s i o n To be Nigeria's micro finance services provider of 'first' choice FirstBank Impact Series 33

- 35. Mission 34 FirstBank Impact Series

- 36. FBN Microfinance Bank Ltd incorporated Key (FBNMFB) March 2008 and duly licensed by the Central Bank of Nigeria under the BOFIA (Banks Strengths and Other Financial Institutions Act No 25 of 1999) commenced operations January 2009 with a fully paid up capital of one billion naira. FBNMFB is a state microfinance bank, licensed to operate in the 36 states of the federation including FCT. A fully owned subsidiary of FirstBank, FBNMFB is committed to providing financial access to small scale industries, petty traders, artisans and individuals to meet their day- to-day business aspirations and create wealth. FBNMFB is also dedicated to providing financial and business advisory services to serve this target segment with a range of financial products designed for the growth of their businesses. The bank as at December 31, 2009 had a customer for the country's economically active poor. Thus, base of 36,654 and disbursed micro loans we serve the family income earners and the self amounting to N2,308,568.81 to 7,539 clients. employed micro entrepreneurs with our stock of financial products aimed at growing their As a commercially sustainable microfinance businesses and consequently producing institution FBNMFB is committed to delivering key significant economic multipliers with positive infrastructure to help build up financial inclusion FirstBank Impact Series 35

- 37. BRANCH The Bank currently operates in seventeen (17) locations within Lagos state, due to NETWORK regulatory requirement to cover two-third of its chosen state before launching out to AND other states of the federation. Our CONTACT approach to branch expansion is systematic, growing organically until we PERSONS provide microfinance services to every Branch/Customer Agege Branch/Customer Ketu Meeting Points Meeting Points contact persons Adetokunbo Ope contact persons Olawale Oluyemi Address 77, Old Abeokuta Road, Agege, Lagos Address Ketu Market, Yam Section Telephone numbers +234-1-8103327, +234-7029082131 Telephone numbers +234-7029743501 Branch/Customer Ikotun Branch/Customer Iyana Ipaja Meeting Points Meeting Points contact persons Oderinde Remi contact persons Ihuoma C. Chuks-Ugwuegbu Address Block YK 10, Irepodun Market, Ikotun Lagos Address Old Iyana Ipaja Road, Iyana Ipaja, Lagos. Telephone numbers +234-1-8103325, +234-7029082111 Telephone numbers +234-7028145494 36 FirstBank Impact Series