Más contenido relacionado La actualidad más candente (17) Similar a Sample LBO Model Template – 2 (20) Más de Flevy.com Best Practices (20) 1. LBO of Company A

($ in millions)

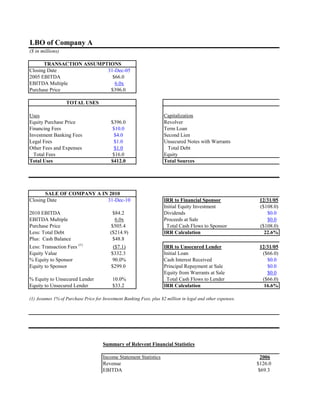

TRANSACTION ASSUMPTIONS

Closing Date 31-Dec-05

2005 EBITDA $66.0

EBITDA Multiple 6.0x

Purchase Price $396.0

TOTAL USES TOTAL SOUR

Uses Capitalization

Equity Purchase Price $396.0 Revolver

Financing Fees $10.0 Term Loan

Investment Banking Fees $4.0 Second Lien

Legal Fees $1.0 Unsecured Notes with Warrants

Other Fees and Expenses $1.0 Total Debt

Total Fees $16.0 Equity

Total Uses $412.0 Total Sources

SALE OF COMPANY A IN 2010

Closing Date 31-Dec-10 IRR to Financial Sponsor 12/31/05

Initial Equity Investment ($108.0)

2010 EBITDA $84.2 Dividends $0.0

EBITDA Multiple 6.0x Proceeds at Sale $0.0

Purchase Price $505.4 Total Cash Flows to Sponsor ($108.0)

Less: Total Debt ($214.9) IRR Calculation 22.6%

Plus: Cash Balance $48.8

Less: Transaction Fees (1)

($7.1) IRR to Unsecured Lender 12/31/05

Equity Value $332.3 Initial Loan ($66.0)

% Equity to Sponsor 90.0% Cash Interest Received $0.0

Equity to Sponsor $299.0 Principal Repayment at Sale $0.0

Equity from Warrants at Sale $0.0

% Equity to Unsecured Lender 10.0% Total Cash Flows to Lender ($66.0)

Equity to Unsecured Lender $33.2 IRR Calculation 16.6%

(1) Assumes 1% of Purchase Price for Investment Banking Fees, plus $2 million in legal and other expenses.

Summary of Relevent Financial Statistics

Income Statement Statistics 2006

Revenue $126.0

EBITDA $69.3

2. Net Income $24.2

Net Interest Expense $21.0

Cash Interest Expense $14.1

Taxes $16.1

Revenue Growth na

EBITDA Margin 55%

EBITDA Growth na

Net Income Growth na

Net Income Margin 17%

Balance Sheet / Cash Flow Statistics

Cash $0.0

Total Debt $280.2

Net Debt $280.2

Secured Debt $207.2

Capex $8.8

Increase (Decrease) in W/C ($0.6)

Leverage Ratios

Total Debt / EBITDA 4.0x

Net Debt / EBITDA 4.0x

Secured Debt / EBITDA 3.0x

EBITDA / Net Interest Expense 3.3x

EBITDA / Cash Interest Expense 4.9x

Interest Coverage Statistics

EBITDA / Net Interest Expense 3.3x

EBITDA / Cash Interest 4.9x

EBITDA - Capex / Net Interest Expense 2.9x

EBITDA - Capex / Cash Interest Expense 4.3x

EBITDA - Capex - ∆ W/C / Net Interest Expense 2.9x

EBITDA - Capex - ∆ W/C / Cash Interest Expense 4.3x

EBITDA - Capex - ∆ W/C - Taxes/ Net Interest Expense 2.1x

EBITDA - Capex - ∆ W/C - Taxes/ Cash Interest Expense 3.2x

3. TOTAL SOURCES

Amount EBITDA % of Interest Rate % of Fully

Funded Multiple Capitalization Cash Pay PIK Diluted Equity

$7.0 0.1x 1.7% 5.0% 0.0% na

$132.0 2.0x 32.0% 5.0% 0.0% na

$99.0 1.5x 24.0% 8.0% 0.0% na

$66.0 1.0x 16.0% 0.0% 10.0% 10%

$304.0 4.6x 73.8%

$108.0 1.6x 26.2%

$412.0 6.2x 100.0%

12/31/06 12/31/07 12/31/08 12/31/09 12/31/10

$0.0 $0.0 $0.0 $0.0 $0.0

$0.0 $0.0 $0.0 $0.0 $0.0

$0.0 $0.0 $0.0 $0.0 $299.0

$0.0 $0.0 $0.0 $0.0 $299.0

12/31/06 12/31/07 12/31/08 12/31/09 12/31/10

$0.0 $0.0 $0.0 $0.0 $0.0

$0.0 $0.0 $0.0 $0.0 $0.0

$0.0 $0.0 $0.0 $0.0 $108.9

$0.0 $0.0 $0.0 $0.0 $33.2

$0.0 $0.0 $0.0 $0.0 $142.1

2007 2008 2009 2010

$132.3 $138.9 $145.9 $153.2

$72.8 $76.4 $80.2 $84.2

4. $26.7 $29.2 $31.8 $34.6

$20.3 $19.6 $18.8 $18.0

$12.7 $11.4 $10.1 $8.9

$17.8 $19.4 $21.2 $23.0

5% 5% 5% 5%

55% 55% 55% 55%

5% 5% 5% 5%

10% 9% 9% 9%

15% 14% 13% 12%

$6.6 $17.3 $31.3 $48.8

$261.6 $245.1 $229.5 $214.9

$255.1 $227.8 $198.2 $166.1

$181.0 $156.0 $131.0 $106.0

$9.3 $9.7 $10.2 $10.7

$0.4 $0.4 $0.4 $0.4

3.6x 3.2x 2.9x 2.6x

3.5x 3.0x 2.5x 2.0x

2.5x 2.0x 1.6x 1.3x

3.6x 3.9x 4.3x 4.7x

5.7x 6.7x 7.9x 9.5x

3.6x 3.9x 4.3x 4.7x

5.7x 6.7x 7.9x 9.5x

3.1x 3.4x 3.7x 4.1x

5.0x 5.9x 6.9x 8.3x

3.1x 3.4x 3.7x 4.1x

5.0x 5.8x 6.9x 8.2x

2.2x 2.4x 2.6x 2.8x

3.6x 4.1x 4.8x 5.6x

59. Proforma Balance Sheet

($ in millions)

Adjustments Proforma Proforma

Balance Sheet Dec. 31 By the Seller Before New Adjustments Dec. 31

Assets 2005 Pre-Transaction Financing Financing Transaction 2005

Cash $76.9 ($76.9) $0.0 $0.0 $0.0 $0.0

Accounts Receivable $9.9 $0.0 $9.9 $0.0 $0.0 $9.9

Inventory $3.0 $0.0 $3.0 $0.0 $0.0 $3.0

Other Current Assets $1.0 $0.0 $1.0 $0.0 $0.0 $1.0

Total Current Assets $90.7 ($76.9) $13.9 $0.0 $0.0 $13.9

Gross PP&E $345.1 $0.0 $345.1 $0.0 $0.0 $345.1

Cumulative Depreciation $45.0 $0.0 $45.0 $0.0 $0.0 $45.0

Net PP&E $300.1 $0.0 $300.1 $0.0 $0.0 $300.1

Amortizable Intangibles $0.0 $0.0 $0.0 $0.0 $16.0 $16.0

Goodwill $5.0 $0.0 $5.0 $0.0 $84.7 $89.7

Total Assets $395.9 ($76.9) $319.0 $0.0 $100.7 $419.7

Liabilities

Accounts Payable $3.3 $0.0 $3.3 $0.0 $0.0 $3.3

Accrued Liabilities $2.4 $0.0 $2.4 $0.0 $0.0 $2.4

Other Current Liabilities $0.0 $0.0 $0.0 $0.0 $0.0 $0.0

Total Current Liabilities $5.7 $0.0 $5.7 $0.0 $0.0 $5.7

Revolving Credit Facility $10.6 ($10.6) $0.0 $7.0 $0.0 $7.0

Term Loan $200.0 ($200.0) $0.0 $132.0 $0.0 $132.0

Second Lien $0.0 $0.0 $0.0 $99.0 $0.0 $99.0

Unsecured Debt $100.0 ($100.0) $0.0 $66.0 $0.0 $66.0

Other Liabilities $2.0 $0.0 $2.0 $0.0 $0.0 $2.0

Total Liabilities $318.3 ($310.6) $7.7 $304.0 $0.0 $311.7

Shareholders Equity

Retainined Earnings $77.6 $0.0 $77.6 $0.0 ($77.6) $0.0

Other (Plug / Balance) $0.0 $233.8 $233.8 $0.0 ($125.8) $108.0

Total Shareholders Equity $77.6 $233.8 $311.3 $0.0 ($203.3) $108.0

Total Liabilities and Equity $395.9 ($76.9) $319.0 $304.0 ($203.3) $419.7

Check $0.0 $0.0 $0.0 $304.0 ($304.0) $0.0

60. Goodwill Calculation

Equity Purchase Price $396.0

– Book Value of Equity ($311.3)

+ Existing Goodwill $5.0

= Resulting Goodwill Balance $89.7

Intangibles Assets

Intangible Assets $0.0

+ Financing Fees $10.0

+ M&A Fees $4.0

+ Legal Fees $1.0

+ Other Fees $1.0

= Resulting Intangibles Balance $16.0

61. COMPANY A FINANCIAL MODEL

HISTORICAL FINANCIAL STATEMENTS PROJECTED FINANCIAL STATEMENTS

($ in millions) Fiscal Year Ending December 31, Pro Forma Fiscal Year Ending December 31,

2001A 2002A 2003A 2004A 2005A 2005P 2006P 2007P 2008P 2009P 2010P

Income Statement

Revenue $100.0 $105.0 $110.0 $115.0 $120.0 $126.0 $132.3 $138.9 $145.9 $153.2

% Growth na 5.0% 4.8% 4.5% 4.3% 5.0% 5.0% 5.0% 5.0% 5.0%

Cost of Goods Sold

(1)

$20.0 $21.0 $22.0 $23.0 $24.0 $25.2 $26.5 $27.8 $29.2 $30.6

COGS as % of Revenue 20.0% 20.0% 20.0% 20.0% 20.0% 20.0% 20.0% 20.0% 20.0% 20.0%

Depreciation $5.0 $5.0 $5.0 $5.0 $5.0 $7.1 $7.3 $7.5 $7.7 $7.9

Amortization $0.0 $0.0 $0.0 $0.0 $0.0 $0.8 $0.8 $0.8 $0.8 $0.8

Gross Profit $75.0 $79.0 $83.0 $87.0 $91.0 $92.9 $97.8 $102.9 $108.2 $113.8

Gross Profit 75.0% 75.2% 75.5% 75.7% 75.8% 73.7% 73.9% 74.1% 74.2% 74.3%

SG&A Expenses $25.0 $26.3 $27.5 $28.8 $30.0 $31.5 $33.1 $34.7 $36.5 $38.3

SG&A as % of Revenue 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0%

Operating Income / EBIT $50.0 $52.8 $55.5 $58.3 $61.0 $61.4 $64.7 $68.1 $71.8 $75.6

Operating Income / EBIT Margin 50.0% 50.2% 50.5% 50.7% 50.8% 48.7% 48.9% 49.1% 49.2% 49.3%

EBITDA $55.0 $57.8 $60.5 $63.3 $66.0 $69.3 $72.8 $76.4 $80.2 $84.2

EBITDA Margin 55.0% 55.0% 55.0% 55.0% 55.0% 55.0% 55.0% 55.0% 55.0% 55.0%

EBITDA Growth na 5.0% 4.8% 4.5% 4.3% 5.0% 5.0% 5.0% 5.0% 5.0%

Interest Expense $25.0 $24.5 $24.6 $24.6 $24.6 $21.0 $20.4 $19.9 $19.5 $19.3

Interest Income $0.2 $0.2 $0.5 $0.7 $1.0 $0.0 $0.1 $0.3 $0.7 $1.3

Net Interest Expense $24.8 $24.3 $24.1 $23.9 $23.6 $21.0 $20.3 $19.6 $18.8 $18.0

Other Income / (Expense) $2.0 $0.0 ($2.0) $1.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0

Pretax Income $27.2 $28.4 $29.4 $35.4 $37.4 $40.4 $44.4 $48.6 $53.0 $57.6

Taxes $10.9 $11.4 $11.8 $14.2 $15.0 $16.1 $17.8 $19.4 $21.2 $23.0

Tax Rate 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0%

Net Income $16.3 $17.1 $17.6 $21.2 $22.4 $24.2 $26.7 $29.2 $31.8 $34.6

Net Margin 16.3% 16.2% 16.0% 18.5% 18.7% 19.2% 20.1% 21.0% 21.8% 22.6%

Net Income Growth na 4.5% 3.4% 20.4% 5.7% 8.0% 10.0% 9.4% 9.0% 8.7%

(1) Excludes depreciation and amortization

Page 61

62. COMPANY A FINANCIAL MODEL

HISTORICAL FINANCIAL STATEMENTS PROJECTED FINANCIAL STATEMENTS

($ in millions) Fiscal Year Ending December 31, Pro Forma Fiscal Year Ending December 31,

2001A 2002A 2003A 2004A 2005A 2005P 2006P 2007P 2008P 2009P 2010P

Balance Sheet

Assets

Cash $5.0 $21.3 $39.9 $57.4 $76.9 $0.0 $0.0 $6.6 $17.3 $31.3 $48.8

Accounts Receivable $8.2 $8.6 $9.0 $9.5 $9.9 $9.9 $10.5 $11.0 $11.6 $12.2 $12.8

Inventory $2.5 $2.6 $2.8 $2.9 $3.0 $3.0 $3.2 $3.3 $3.5 $3.6 $3.8

Other Current Assets $1.0 $1.0 $1.0 $1.0 $1.0 $1.0 $1.0 $1.0 $1.0 $1.0 $1.0

Total Current Assets $16.7 $33.6 $52.6 $70.7 $90.7 $13.9 $14.7 $21.9 $33.4 $48.1 $66.4

`

Gross PP&E $318.9 $324.9 $329.9 $336.1 $345.1 $345.1 $353.9 $363.2 $372.9 $383.1 $393.9

Cumulative Depreciation $25.0 $30.0 $35.0 $40.0 $45.0 $45.0 $52.1 $59.3 $66.8 $74.5 $82.3

Net PP&E $293.9 $294.9 $294.9 $296.1 $300.1 $300.1 $301.9 $303.9 $306.1 $308.7 $311.5

Intangibles $16.0 $15.2 $14.4 $13.6 $12.8 $12.0

Goodwill $5.0 $5.0 $5.0 $5.0 $5.0 $89.7 $89.7 $89.7 $89.7 $89.7 $89.7

Total Assets $315.6 $333.5 $352.6 $371.9 $395.9 $419.7 $421.4 $429.8 $442.8 $459.3 $479.6

Liabilities

Accounts Payable $2.8 $3.0 $2.9 $3.3 $3.3 $3.3 $3.5 $3.7 $3.9 $4.1 $4.3

Accrued Liabilities $2.0 $2.1 $2.2 $2.3 $2.4 $2.4 $2.5 $2.6 $2.8 $2.9 $3.1

Other Current Liabilities $1.0 $0.0 $2.0 $1.0 $0.0 $0.0 $1.0 $1.0 $1.0 $1.0 $1.0

Total Current Liabilities $5.8 $5.1 $7.1 $6.6 $5.7 $5.7 $7.0 $7.3 $7.6 $8.0 $8.3

Revolving Credit Facility $8.9 $9.3 $9.7 $10.2 $10.6 $7.0 $1.2 $0.0 $0.0 $0.0 $0.0

Term Loan $200.0 $200.0 $200.0 $200.0 $200.0 $132.0 $107.0 $82.0 $57.0 $32.0 $7.0

Second Lien Debt $99.0 $99.0 $99.0 $99.0 $99.0 $99.0

Unsecured Debt $100.0 $100.0 $100.0 $100.0 $100.0 $66.0 $72.9 $80.6 $89.1 $98.5 $108.9

Other Liabilities $1.0 $2.0 $1.0 $0.0 $2.0 $2.0 $2.0 $2.0 $2.0 $2.0 $2.0

Total Liabilities $315.6 $316.4 $317.9 $316.7 $318.3 $311.7 $289.2 $270.9 $254.8 $239.5 $225.2

$6.9 $7.7 $8.5 $9.4 $10.4

Shareholders Equity

Retainined Earnings $0.0 $17.1 $34.7 $55.1 $77.6 $0.0 $24.2 $50.9 $80.0 $111.8 $146.4

Other (Plug / Balance) $0.0 $0.0 $0.0 $0.0 $0.0 $108.0 $108.0 $108.0 $108.0 $108.0 $108.0

Total Shareholders Equity $0.0 $17.1 $34.7 $55.1 $77.6 $108.0 $132.2 $158.9 $188.0 $219.8 $254.4

Total Liabilities and Equity $315.6 $333.5 $352.6 $371.9 $395.9 $419.7 $421.4 $429.8 $442.8 $459.3 $479.6

Check $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0

Page 62

63. COMPANY A FINANCIAL MODEL

HISTORICAL FINANCIAL STATEMENTS PROJECTED FINANCIAL STATEMENTS

($ in millions) Fiscal Year Ending December 31, Pro Forma Fiscal Year Ending December 31,

2001A 2002A 2003A 2004A 2005A 2005P 2006P 2007P 2008P 2009P 2010P

Cash Flow

Net Income na $17.1 $17.6 $21.2 $22.4 $24.2 $26.7 $29.2 $31.8 $34.6

Plus / (minus):

Depreciation and Amortization na $5 $5 $5 $5 $8 $8 $8 $8 $9

Changes in Working Capital

Accounts Receivable na ($0.4) ($0.4) ($0.4) ($0.4) ($0.6) ($0.5) ($0.6) ($0.6) ($0.6)

Inventory na ($0.1) ($0.1) ($0.1) ($0.1) ($0.2) ($0.2) ($0.2) ($0.2) ($0.2)

Other Current Assets na $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0

Accounts Payable na $0.3 ($0.1) $0.3 $0.0 $0.2 $0.2 $0.2 $0.2 $0.2

Accrued Liabilities na $0.1 $0.1 $0.1 $0.1 $0.1 $0.1 $0.1 $0.1 $0.1

Other Current Liabilities na ($1.0) $2.0 ($1.0) ($1.0) $1.0 $0.0 $0.0 $0.0 $0.0

Change in Other Liabilities na $1 ($1) ($1) $2 $0 $0 $0 $0 $0

Cash Flows from Operations na $21.9 $23.1 $24.1 $28.0 $32.7 $34.3 $37.0 $39.8 $42.8

Cash Flows from Investing

Capital Expenditures na ($6.0) ($7.0) ($8.0) ($9.0) ($8.8) ($9.3) ($9.7) ($10.2) ($10.7)

Asset Dispostions na $0.0 $2.0 $1.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0

Cash Flows from Investing na ($6.0) ($5.0) ($7.0) ($9.0) ($8.8) ($9.3) ($9.7) ($10.2) ($10.7)

Cash Flows from Financing

Change in Revolver na $0.4 $0.4 $0.4 $0.4 ($5.8) ($1.2) $0.0 $0.0 $0.0

Change in Term Loan na $0.0 $0.0 $0.0 $0.0 ($25.0) ($25.0) ($25.0) ($25.0) ($25.0)

Change in Second Lien $0.0 $0.0 $0.0 $0.0 $0.0

Change in Unsecured Debt na $0.0 $0.0 $0.0 $0.0 $6.9 $7.7 $8.5 $9.4 $10.4

Total Cash Flows from Financing na $0.4 $0.4 $0.4 $0.4 ($23.8) ($18.5) ($16.5) ($15.6) ($14.6)

Total Cash Flow na $16.3 $18.5 $17.6 $19.5 $0.0 $6.6 $10.8 $14.0 $17.4

Beginning Cash Position na $5.0 $21.3 $39.9 $57.4 $0.0 $0.0 $6.6 $17.3 $31.3

Change in Cash Position na $16.3 $18.5 $17.6 $19.5 $0.0 $6.6 $10.8 $14.0 $17.4

Ending Cash Position na $21.3 $39.9 $57.4 $76.9 $0.0 $6.6 $17.3 $31.3 $48.8

Page 63

64. COMPANY A FINANCIAL MODEL

HISTORICAL FINANCIAL STATEMENTS PROJECTED FINANCIAL STATEMENTS

($ in millions) Fiscal Year Ending December 31, Pro Forma Fiscal Year Ending December 31,

2001A 2002A 2003A 2004A 2005A 2005P 2006P 2007P 2008P 2009P 2010P

Cash flow before Revolver $5.8 $7.8 $17.3 $31.3 $48.8

Debt and Interest Schedule

Revolver

Beginning Revolver Balance $8.9 $9.3 $9.7 $10.2 $7.0 $1.2 $0.0 $0.0 $0.0

(Paydown) / Drawdown $0.4 $0.4 $0.4 $0.4 ($5.8) ($1.2) $0.0 $0.0 $0.0

Ending Revolver Balance $9.3 $9.7 $10.2 $10.6 $1.2 $0.0 $0.0 $0.0 $0.0

Interest Rate 6.0% 6.0% 6.0% 6.0% 5.00% 5.00% 5.00% 5.00% 5.00%

Cash Pay Interest Expense $0.54 $0.57 $0.60 $0.62 $0.21 $0.03 $0.00 $0.00 $0.00

Term Loan

Term Loan Beginning Balance $200.0 $200.0 $200.0 $200.0 $132.0 $107.0 $82.0 $57.0 $32.0

(Paydown) / Drawdown $0.0 $0.0 $0.0 $0.0 ($25.0) ($25.0) ($25.0) ($25.0) ($25.0)

Term Loan Ending Balance $200.0 $200.0 $200.0 $200.0 $107.0 $82.0 $57.0 $32.0 $7.0

Interest Rate 6.00% 6.00% 6.00% 6.00% 5.00% 5.00% 5.00% 5.00% 5.00%

Cash Pay Interest Expense $12.0 $12.0 $12.0 $12.0 $6.0 $4.7 $3.5 $2.2 $1.0

Second Lien Debt

Second Lien Debt Beginning Balance $99.0 $99.0 $99.0 $99.0 $99.0

(Paydown) / Drawdown $0.0 $0.0 $0.0 $0.0 $0.0

Second Lien Debt Ending Balance $99.0 $99.0 $99.0 $99.0 $99.0

Cash Pay Interest Rate 8.00% 8.00% 8.00% 8.00% 8.00%

Cash Pay Interest Expense $7.9 $7.9 $7.9 $7.9 $7.9

PIK Interest Rate 0% 0% 0% 0% 0%

PIK Interest Expense $0.0 $0.0 $0.0 $0.0 $0.0

Unsecured Debt

Unsecured Debt Beginning Balance $100.0 $100.0 $100.0 $100.0 $66.0 $72.9 $80.6 $89.1 $98.5

(Paydown) / Drawdown $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0

Unsecured Debt Ending Balance $100.0 $100.0 $100.0 $100.0 $72.9 $80.6 $89.1 $98.5 $108.9

Cash Pay Interest Rate 12% 12% 12% 12% 0% 0% 0% 0% 0%

Cash Pay Interest Expense $12.0 $12.0 $12.0 $12.0 $0.0 $0.0 $0.0 $0.0 $0.0

PIK Interest Rate 10% 10% 10% 10% 10%

PIK Interest Expense $6.9 $7.7 $8.5 $9.4 $10.4

Total Interest Expense $24.5 $24.6 $24.6 $24.6 $21.0 $20.4 $19.9 $19.5 $19.3

Total Cash Pay Interest Rate Expense $14.1 $12.7 $11.4 $10.1 $8.9

Total PIK Interest Rate Expense $6.9 $7.7 $8.5 $9.4 $10.4

Interest Earned on Cash $0.2 $0.5 $0.7 $1.0 $0.0 $0.1 $0.3 $0.7 $1.3

Page 64

65. COMPANY A FINANCIAL MODEL

HISTORIC VARIABLES AND ASSUMPTIONS FOR PROJECTIONS

HISTORICAL VARIABLES AND DRIVERS ASSUMPTIONS FOR PROJECTIONS

Fiscal Year Ending December 31, Fiscal Year Ending December 31,

2001A 2002A 2003A 2004A 2005A 2006P 2007P 2008P 2009P 2010P

Income Statement Drivers / Assumptions

Revenue Growth Rate na 5.0% 4.8% 4.5% 4.3% 5.0% 5.0% 5.0% 5.0% 5.0%

COGS as % of Revenue 20.0% 20.0% 20.0% 20.0% 20.0% 20.0% 20.0% 20.0% 20.0% 20.0%

Depreciation as % of Gross PP&E 1.6% 1.5% 1.5% 1.5% 1.4% 2.0% 2.0% 2.0% 2.0% 2.0%

Goodwill Amortization

Intangible Amortization Per Year 20

Intangible Amortization $0.8 $0.8 $0.8 $0.8 $0.8

SG&A as % of Sales 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0%

Other Income / (Expense) $2.0 $0.0 ($2.0) $1.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0

Tax Rate 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0%

Balance Sheet Drivers / Assumptions

Days Accounts Receivable 30 30 30 30 30 30 30 30 30 30

Days Inventory 45 45 45 45 45 45 45 45 45 45

Other Current Assets $1.0 $1.0 $1.0 $1.0 $1.0 $1.0 $1.0 $1.0 $1.0 $1.0

Amortize Goodwill? (yes or no) $0.0 $0.0 $0.0 $0.0 $0.0

Capex as % of Sales na 5.7% 6.4% 7.0% 7.5% 7.0% 7.0% 7.0% 7.0% 7.0%

Asset Disposition na $0.0 $2.0 $1.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0

Days Payable 50 52 48 51 49 50 50 50 50 50

Accrued Liabilities as % of COGS 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 10.0%

Other Current Liabilities $1.0 $0.0 $2.0 $1.0 $0.0 $1.0 $1.0 $1.0 $1.0 $1.0

Other Liailities $1.0 $2.0 $1.0 $0.0 $2.0 $2.0 $2.0 $2.0 $2.0 $2.0

Interest Rates

Revolver 2.0%+li 6.00% 6.00% 6.00% 6.00% 6.00% 5.00% 5.00% 5.00% 5.00% 5.00%

Term Loan 2.0%+li 6.00% 6.00% 6.00% 6.00% 6.00% 5.00% 5.00% 5.00% 5.00% 5.00%

Second Lien Debt (Cash) 8.00% 8.00% 8.00% 8.00% 8.00%

Second Lien Debt (PIK) 0.00% 0.00% 0.00% 0.00% 0.00%

Unsecured Debt (Cash) 12.0% 12.00% 12.00% 12.00% 12.00% 12.00% 0.00% 0.00% 0.00% 0.00% 0.00%

Unsecured Debt (PIK) 10.00% 10.00% 10.00% 10.00% 10.00%

LIBOR 4.00% 4.00% 4.00% 4.00% 4.00% 4.25% 4.50% 4.75% 5.00% 5.25%

Interest earned on cash 2% 2.00% 2.00% 2.00% 2.00% 2.00% 2.25% 2.50% 2.75% 3.00% 3.25%

Page 65

66. COMPANY A FINANCIAL MODEL

SENSITIVITIES

($ in millions) 2010 EBITDA FOR RANGE OF REVENUE GROWTH RATES AND COGS

Annual Revenue Growth Rate

$84.2 -20% -15% -10% -5% 0% 5% 10% 15% 20%

14% $24.0 $32.5 $43.2 $56.6 $73.2 $93.4 $117.9 $147.2 $182.1

16% $23.2 $31.4 $41.8 $54.8 $70.8 $90.4 $114.0 $142.4 $176.2

18% $22.4 $30.3 $40.4 $52.9 $68.4 $87.3 $110.2 $137.6 $170.2

20% $21.6 $29.3 $39.0 $51.1 $66.0 $84.2 $106.3 $132.7 $164.2

22% $20.8 $28.2 $37.6 $49.2 $63.6 $81.2 $102.4 $127.9 $158.3

24% $20.1 $27.2 $36.1 $47.4 $61.2 $78.1 $98.6 $123.1 $152.3

26% $19.3 $26.1 $34.7 $45.5 $58.8 $75.0 $94.7 $118.3 $146.3

Shading indicates base case scenario

COGSas%of

Sales

Page 66