Guide to Charitable Remainder Trust Tax Benefits and Calculations

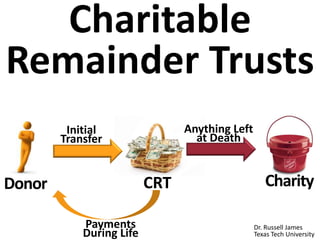

- 1. Donor CRT Charity Initial Transfer Anything Left at Death Payments During Life Charitable Remainder Trusts

- 2. All slides are taken from this book which includes detailed explanations of all concepts. Available from Amazon.com Full color version available at www.createspace.com/4707238

- 3. Donor CRT Charity Initial Transfer Anything Left at Death Payments During Life

- 4. Donor CRT Charity Initial Transfer Anything Left at Death 5% of trust assets

- 5. Donor CRT Charity Initial Transfer Anything Left at Death Payments during life or lives

- 6. Donor CRT Charity Initial Transfer Anything Left at Death Payments for 20 years

- 7. Donor CRT Charity Initial Transfer Anything Left at Death $1,000 Per Year for Life

- 8. Donor CRT Charity Initial Transfer Anything Left at Death 5% of trust assets

- 9. Donor CRT Charity Initial Transfer Anything Left at Death 5% of trust assets

- 10. The donor creates the rules in a Charitable Remainder Trust, but once created it is irrevocable

- 11. Donor CRT Charity Initial Transfer Anything Left at Death 5% of trust assets

- 13. Donor CRT Charity Initial Transfer Anything Left at Death 5% of trust assets

- 15. Donor CRT Charity Initial Transfer Anything Left at Death 5% of trust assets ?

- 16. Donor CRT Charity Initial Transfer Anything Left at Death Payments During Life

- 17. I would like to use $50,000 per year from my assets. The rest, I want to go to my favorite charity.

- 18. I want to control my own investments and spend about 5% of my assets each year. After death I want it all to go to charity.

- 19. I want to retire today, but my pension doesn’t start paying for 9 more years. I want to give assets to charity, but I still need $65,000 per year for 9 years.

- 20. However, the biggestreason for donors to use Charitable Remainder Trusts is…

- 21. Tax Benefits

- 22. Donor CRT Charity Initial Transfer Anything Left at Death Payments During Life

- 23. With a charitable gift in a will, there is no income tax deduction

- 24. There are no capital gains taxes when a donor makes a transfer to a CRT

- 25. A CRT is itself a nonprofit entity and pays no capital gains tax when it sells appreciated property

- 26. Donor CRT Charity Initial Transfer Anything Left at Death Payments During Life

- 27. A client holds low-basis appreciated assets that generate little income (e.g., developable land or small business growth stock). How can she convert to diversified income- generating investments?

- 28. Option 1: Sell it. Pay the capital gains tax. Invest the remaining amount. $1,000,000 zero basis asset $238,000 tax (23.8% federal) $762,000 left to invest

- 29. Option 1: Even worse in many states $1,000,000 zero basis asset $339,350 tax (33.935% Calif. + Fed.) $660,650 left to invest

- 30. Option 1: Or with certain assets $1,000,000 zero-basis art $408,706 tax (40.87% Calif. + Fed.) $591,294 left to invest

- 31. Option 1: Or certain holding periods $1,000,000 zero-basis short- term capital gain $509,280 tax (50.928% Cal. + Fed.) $490,720 left to invest Note that gifts of short-term capital gain are deductible only at basis

- 32. Option 2: Transfer to a CRT $1,000,000 zero-basis asset _____$0 tax (CRT pays no tax) $1,000,000 left to invest

- 33. You can produce more income with $1,000,000 Than with $762,000 or $660,650 or $591,294 or $490,720

- 34. CRT Advantages • Immediate income tax deduction • No capital gains tax on transfer to CRT • No capital gains tax when CRT sells • Lifetime income CRT Concern? • Remainder goes to charity not to family How can we address this limitation?

- 35. Inheritance replacement by purchasing ILIT life insurance with tax deduction or part of payments

- 37. Charitable deduction is the value of what you give less the value of what you get back (CRT payments)

- 38. $100,000 Cash ─ Value of CRT payments CharitableDeduction Donor gives $100,000 CRTpays age55 donor $4,000per yearforlife $4,000 Payment $100,000 Cash Tax deduction is amount gifted less value of annuity/unitrust payments

- 39. What is the value of CRT payments?

- 40. Find the §7520 rate http://www.irs.gov/Businesses/Small-Businesses-&-Self- Employed/Section-7520-Interest-Rates Multiply payment by annuity factor in IRS Pub. 1457http://www.irs.gov/Retirement-Plans/Actuarial-Tables Value of CRAT payments

- 41. Find the §7520 rate http://www.irs.gov/Businesses/Small-Businesses-&-Self- Employed/Section-7520-Interest-Rates I can choose current or one of last two month’s rate $4,000/year CRATage55 donoron 10/31/13 Aug 2.0% Sept 2.0% Oct 2.4%

- 42. Value of annuity

- 43. Find the §7520 rate 2.4%http://www.irs.gov/Businesses/Small-Businesses-&-Self- Employed/Section-7520-Interest-Rates $4,000/year CRATage55 donoron 10/31/13 I want the lowest annuity valuation [highest charitable deduction] so I select Oct. 2.4%

- 44. Section 1 Table S - Based on Life Table 2000CM Interest at 2.4 Percent Life Life Age Annuity Estate Remainder Age Annuity Estate Remainder 0 34.2376 0.82170 0.17830 55 18.1993 0.43678 0.56322 1 34.3011 0.82323 0.17677 56 17.7570 0.42617 0.57383 2 34.1418 0.81940 0.18060 57 17.3129 0.41551 0.58449 3 33.9727 0.81534 0.18466 58 16.8678 0.40483 0.59517 4 33.7967 0.81112 0.18888 59 16.4213 0.39411 0.60589 Find the §7520 rate 2.4%www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Section- 7520-Interest-Rates Multiply annual payment by annuity factor in IRS Pub. 1457 $4,000 X 18.1993www.irs.gov/Retirement-Plans/Actuarial-Tables $4,000/yearCRAT age55donoron 10/31/13

- 45. Find the §7520 rate 2.4%www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Section- 7520-Interest-Rates Multiply annual payment by annuity factor in IRS Pub. 1457 $4,000 X 18.1993www.irs.gov/Retirement-Plans/Actuarial-Tables Value of annuity $72,797 If annuity pays more than annually, add adjustment factor from Table K $4,000/yearCRAT age55donoron 10/31/13

- 46. $100,000 Cash Donor gives $100,000 CRATpays age55 donor $4,000per yearforlife $4,000 Annuity $100,000 Cash ─ $72,797 Annuity $27,203 Deduction

- 47. $100,000 Cash Donor gives $100,000 CRUTpays age55 donor5% peryear forlife 5% of CRUT Payment CRUT calculation process

- 48. Section 1 Table U(1) - Based on Life Table 2000CM Adjusted Payout Rate Age 4.2% 4.4% 4.6% 4.8% 5.0% 5.2% 5.4% 5.6% 5.8% 6.0% 55 .37183 .35635 .34166 .32773 .31450 .30194 .29001 .27868 .26791 .25768 56 .38390 .36841 .35370 .33971 .32642 .31378 .30175 .29032 .27943 .26907 57 .39618 .38069 .36596 .35194 .33859 .32588 .31377 .30224 .29125 .28077 5%peryearage 55donoron 10/31/13with annual paymentson 10/31 Multiply transfer by remainder interest factor in IRS Pub. 1458 $100,000 X .31450 www.irs.gov/Retirement-Plans/Actuarial-Tables Charitable deduction $31,450 CRUT deduction calculation

- 49. Ifpaymentsotherthanannualgiven immediatelyafterannualvaluation, calculateadjustedpayoutrate(APR)as payoutrateXtableF(www.irs.gov/Retirement-Plans/Actuarial-Tables) reductionusingappropriate§7520rate. Iffactorforadjustedpayoutrate (APR)isnotonunitrusttable, use: Factor above APR – [(factor below APR – factor above APR) X ((APR-rate below APR) /.002 )] CRUT calculation for differing payments

- 50. Donor CRT Charity Anything Left at Death Payments During Life Initial Transfer

- 51. Rule: 10% of present value minimum to charity Reality: Share of CRT assets to charity, 1.59% Split interests trusts, filing year 2007, Lisa Schreiber, IRS Statistics of Income The IRS tax deduction is actuarially too large because CRT donors live longer Annuity purchasers live longer (i.e., sick people don’t buy lifetime annuities) Wealthy people live longer (CRT donors are very wealthy) Charitable bequest donors live longerSee: James, R.N., (2013) American Charitable bequest demographics.

- 52. STEP 1: Using §7520 rate, at what age will the CRAT exhaust? Using a financial calculator solve for n (number of time periods) after entering present value (initial CRAT assets), rate (§7520 rate), payments, and setting future value to 0. The underlying formula is STEP 2. Is there >5% chance the donor will live that long? (lx@age-of-exhaustion / lx@current-age, using Table 2000CM at www.irs.gov/Retirement-Plans/Actuarial-Tables ) CRAT disqualified if >5% chance of exhaustion due to annuitant longevity

- 53. So what happens if it doesn’t qualify as a CRT?

- 54. Retained interest gifts are not otherwise deductible. Trust isn’t charitable and pays taxes on any gain or income. No tax benefits

- 55. How are distributions from a CRT taxed?

- 56. When the trust makes a payment, it opens the spigot. Ordinary income is paid first, then capital gain and so forth. Return of Principal Exempt Income Capital Gain Ordinary Income

- 57. Donor gives $100,000 of stock ($10,000 basis) to CRT. The CRT sells the stock, buys corporate bonds generating $3,000 of income and municipal bonds generating $2,000 of tax exempt income. Return of Principal Exempt Income Capital Gain Ordinary Income

- 58. Donor gives $100,000 of stock ($10,000 basis) to CRT. The CRT sells the stock, buys corporate bonds generating $3,000 of income and municipal bonds generating $2,000 of tax exempt income. $10,000 $2,000 $90,000 $3,000 Return of Principal Exempt Income Capital Gain Ordinary Income

- 59. What is the tax treatment of a $2,000 distribution? $10,000 $2,000 $90,000 $3,000 Return of Principal Exempt Income Capital Gain Ordinary Income

- 60. What is the tax treatment of a $2,000 distribution? Recipient pays taxes on: $2,000 of ordinary income $10,000 $2,000 $90,000 $3,000 Return of Principal Exempt Income Capital Gain Ordinary Income

- 61. What is the tax treatment of a $5,000 distribution? $10,000 $2,000 $90,000 $3,000 Return of Principal Exempt Income Capital Gain Ordinary Income

- 62. What is the tax treatment of a $5,000 distribution? Recipient pays taxes on: $3,000 of ordinary income $2,000 of capital gain $10,000 $2,000 $90,000 $3,000 Return of Principal Exempt Income Capital Gain Ordinary Income

- 63. What is the tax treatment of a $10,000 distribution? $10,000 $2,000 $90,000 $3,000 Return of Principal Exempt Income Capital Gain Ordinary Income

- 64. What is the tax treatment of a $10,000 distribution? Recipient pays taxes on: $3,000 of ordinary income $7,000 of capital gain $10,000 $2,000 $90,000 $3,000 Return of Principal Exempt Income Capital Gain Ordinary Income

- 65. If CRT ordinary income earnings are always higher than distributions, no capital gain tax will ever be paid. Return of Principal Exempt Income Capital Gain Ordinary Income

- 67. Donor CRT Charity Initial Transfer Anything Left at Death Lesser of trust income or 5% of trust assets

- 68. When would you want this limitation?

- 69. Suppose you want the trust to hold a non-income producing asset A normal payout requirement could force a sale land, art, non-dividend or closely-held stock

- 70. Donor CRT Charity Initial Transfer Anything Left at Death Lesser of trust income or 5% of trust assets

- 71. Past payments are made up whenever net income is sufficient

- 72. NIMCRUTs may be problematic when later returns are consistently less than payout rates. There isn’t enough income to make normal payouts or make-up past deficiencies.

- 73. “Flip CRUT”: A NICRUT/NIMCRUT that converts to a CRUT at a trigger event NICRUT/ NIMCRUT Standard CRUT Trigger Event

- 74. Common trigger events are sale of hard-to-value property or reaching retirement age

- 75. 2015 2016 2017 2018 2019 … Death Initial Transfer Anything Remaining at Death 2014 TriggerEvent Incomeupto 5% Incomeupto 5% Incomeupto 5% 5% 5%

- 76. 2015 2016 2017 2018 2019 … Death Initial Transfer Anything Remaining at Death 2014 TriggerEvent $0.00 Ex: Trigger is sale of $1,000,000 of non-income producing land funding CRT $0.00 $0.00 $50,000 $51,000

- 77. CRT “spigot” trusts Trustees flip income off and on at will by investment choice • Commercial deferred annuities* • Limited partnership interests • Non-dividend paying growth stocks • Delay realizing gains (post- transfer capital gain can count as income) *Limits on this activity currently “under review” by IRS

- 78. Conrad Teitell suggests triggering a FLIP-CRUT using a small, but hard-to-market, asset such as one share of closely-held stock Then trustee sells whenever the flip is desired Flip when sold

- 79. A donor can give part of an undivided interest (e.g., 75% as tenants in common) to a CRT. Subsequent sale generates capital gain for the retained share, but the contribution generates a tax deduction.

- 80. Charitable Remainder Trust Flexible & Expensive • CRTs are individually created according to the specific desires of each client Charitable Gift Annuity Simple & Cheap • CGAs from a charity are usually identical except for the dollar amount

- 81. The flexibility of CRTs • Unlimited number of public charity or private foundation beneficiaries (income limitations pass through) • Open choice on payout years and amounts • Unlimited number of income beneficiaries • Special restrictions on income beneficiaries allowed (where violation gives income to alternate beneficiary) – Spendthrift trusts – Match earned income to prevent “trust fund” kids – Require random drug tests

- 82. “Notwithstanding any provision of this Will to the contrary, my grandchildren DAVID PANZIRER and WALTER PANZIRER shall not be entitled to any distributions from any trust established for such beneficiary's benefit under this Will unless such beneficiary visits the grave of my late son JAY PANZIRER, at least once each calendar year, preferably on the anniversary of my said son's death (March 31, 1982) (except that this provision shall not apply during any period that the beneficiary is unable to comply therewith by reason of physical or mental disability as determined by my Trustees in their sole and absolute discretion).” Leona Helmsley’s Charitable Remainder Unitrust created in her will includes

- 83. What kind of property can a CRT hold?

- 84. Subchapter S corporation rules do not allow CRT shareholders

- 85. 100% excise tax on Unrelated Business Taxable Income (UBTI), where CRT is running a business (e.g., owning as a sole proprietor or partner) instead of being a passive investor

- 86. Not UBTI Dividends, interest, annuities, royalties, rents from real estate, and capital gains, so long as none of them involve debt-financing UBTI Net income from running a hotel, parking lot, convenience store, coin operated laundry or Debt financed net income

- 87. Ex: CRT receives a $1,000,000 home ($100,000 basis). Trustee makes improvements using a $100,000 mortgage (acquisition indebtedness) and sells for $1,200,000. Result?

- 88. Ex: CRT receives a $1,000,000 home ($100,000 basis). Trustee makes improvements using a $100,000 mortgage (acquisition indebtedness) and sells for $1,200,000. Due to debt financing $1,000,000 capital gain is UBTI, taxed at 100%, and lost.

- 89. Self-Dealing CRT can’t sell, lease, loan, or allow use of assets by CRT creator, contributor, trustee, or their ancestors, descendents, or spouses

- 90. If all parties agree can a CRT be broken and distributed?

- 91. If all parties agree can a CRT be broken and distributed? IRS has allowed termination & distribution of present value of all interests PLR 200208039

- 92. Donor plans to create CRT with remainder value sufficient to build a building, but charity needs building now. Solutions?

- 93. Donor plans to create CRT with remainder value sufficient to build a building, but charity needs building now. Solutions? CRT may segregate and pledge funds as collateral for a loan taken out by the charity. (Charity can pay off loan with remainder at death.) PLR 8807082

- 94. Donor CRT Charity Initial Transfer Anything Left at Death Payments During Life Charitable Remainder Trusts

- 95. Help me HERE convince my bosses that continuing to build and post these slide sets is not a waste of time. If you work for a nonprofit or advise donors and you reviewed these slides, please let me know by clicking

- 96. If you clicked on the link to let me know you reviewed these slides… Thank You!

- 97. This slide set is from the curriculum for the Graduate Certificate in Charitable Financial Planning at Texas Tech University, home to the nation’s largest graduate program in personal financial planning. To find out more about the online Graduate Certificate in Charitable Financial Planning go to www.EncourageGenerosity.com To find out more about the M.S. or Ph.D. in personal financial planning at Texas Tech University, go to www.depts.ttu.edu/pfp/ Graduate Studies in Charitable Financial Planning at Texas Tech University

Notas del editor

- Creative commons picture from http://commons.wikimedia.org/wiki/File:Leona_Helmsley.jpg