Kallpa sab multiplos 05 julio 13.

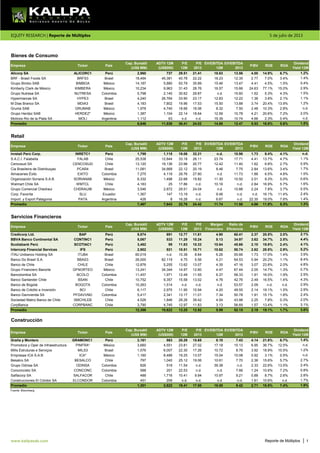

- 1. Alicorp SA ALICORC1 Perú 2,960 737 29.51 21.41 18.63 13.56 4.00 14.9% 6.7% BRF - Brasil Foods SA BRFS3 Brasil 18,494 45,381 40.78 22.22 18.23 12.35 2.77 7.0% 3.4% Grupo Bimbo SAB BIMBOA México 14,187 5,880 93.79 35.89 15.46 13.47 4.41 4.5% 1.5% Kimberly Clark de México KIMBERA México 10,234 9,963 31.43 28.76 16.57 15.66 24.63 77.1% 15.0% Grupo Nutresa SA NUTRESA Colombia 5,798 2,140 30.62 29.87 n.d. 15.60 1.52 5.3% 4.3% Hypermarcas SA HYPE3 Brasil 4,240 26,764 33.90 23.17 12.83 12.22 1.36 3.9% 2.1% M Dias Branco SA MDIA3 Brasil 4,183 7,802 19.96 17.53 15.50 13.88 3.74 20.4% 13.9% Gruma SAB GRUMAB México 1,978 4,740 18.66 16.06 8.32 7.50 2.48 10.3% 2.8% Grupo Herdez SAB HERDEZ* México 1,387 1,104 22.14 18.64 12.59 10.78 4.21 20.6% 7.2% Molinos Rio de la Plata SA MOLI Argentina 1,112 63 n.d. n.d. 19.39 10.74 4.66 2.3% 0.4% Promedio 6,846 11,538 36.41 24.02 14.86 12.47 5.53 16.8% 5.6% Inretail Perú Corp. INRETC1 Perú 1,799 1,115 19.06 32.21 n.d. 10.96 1.73 9.4% 4.1% S.A.C.I. Falabella FALAB Chile 25,538 12,844 33.18 26.11 23.74 17.71 4.41 13.7% 4.7% Cencosud SA CENCOSUD Chile 13,120 19,136 23.98 20.77 12.42 11.40 1.62 6.8% 2.7% Cia Brasileira de Distribuiçao PCAR4 Brasil 11,081 34,669 22.12 20.19 8.46 7.75 2.84 13.6% 3.4% Almacenes Éxito EXITO Colombia 7,275 4,118 29.76 27.80 n.d. 11.73 1.88 6.5% 4.8% Organización Soriana S.A.B. SORIANAB México 6,332 1,498 22.68 19.82 11.30 10.50 2.01 9.3% 5.0% Walmart Chile SA WMTCL Chile 4,183 25 17.86 n.d. 10.16 n.d. 2.84 16.9% 5.7% Grupo Comercial Chedraui CHDRAUIB México 3,546 2,872 29.51 24.04 n.d. 10.88 2.24 7.8% 3.7% Corp. Favorita SLU Ecuador 1,367 147 13.19 n.d. 9.46 n.d. n.d. 16.1% 11.4% Import. y Export Patagonia PATA Argentina 426 8 16.28 n.d. 6.67 n.d. 22.35 19.0% 7.6% Promedio 7,467 7,643 22.76 24.42 11.74 11.56 4.66 11.9% 5.3% Credicorp Ltd. BAP Perú 9,874 691 12.77 11.81 4.90 60.41 2.37 20.5% 2.0% BBVA Banco Continental SA CONTINC1 Perú 5,067 533 11.29 10.24 8.13 34.97 3.62 34.7% 2.5% Scotiabank Perú SCOTIAC1 Perú 3,482 99 11.83 10.33 10.64 45.66 2.10 19.8% 2.4% Intercorp Financial Services IFS Perú 2,902 921 10.51 10.71 10.62 50.74 2.62 28.5% 2.9% ITAU Unibanco Holding SA ITUB4 Brasil 60,019 n.d. 10.38 8.84 6.26 55.66 1.73 17.0% 1.4% Banco Do Brasil S.A. BBAS3 Brasil 26,000 82,119 4.75 5.56 4.21 64.53 0.94 20.2% 1.1% Banco de Chile CHILE Chile 12,876 5,255 13.62 13.07 4.35 47.16 3.07 23.8% 2.0% Grupo Financiero Banorte GFNORTEO México 13,241 34,344 14.97 12.60 4.47 67.44 2.05 14.7% 1.3% Bancolombia SA BCOLO Colombia 11,457 1,971 12.49 11.55 6.37 58.33 1.91 16.0% 1.9% Banco Santander Chile BSAN Chile 10,752 9,357 15.58 13.02 4.76 42.76 2.49 16.5% 1.4% Banco de Bogotá BOGOTA Colombia 10,263 1,514 n.d. n.d. n.d. 53.57 2.09 n.d. n.d. Banco de Crédito e Inversión BCI Chile 6,117 2,970 11.95 10.94 4.20 49.55 2.14 19.1% 1.5% Banco Davivienda SA PFDAVVND Colombia 5,417 2,341 13.17 11.01 7.34 50.78 1.91 15.1% 1.8% Sociedad Matriz Banco de Chile SMCHILEB Chile 4,526 1,846 29.26 39.42 4.54 43.98 2.25 7.8% 0.3% CorpBanca CORPBANC Chile 3,790 4,745 12.97 11.83 3.13 56.69 1.57 13.4% 1.1% Promedio 12,386 10,622 13.25 12.92 5.99 52.15 2.19 19.1% 1.7% Construcción Graña y Montero GRAMONC1 Perú 2,161 863 20.29 15.65 8.10 7.43 4.14 21.8% 6.7% Promotora y Oper de Infraestructura PINFRA* México 3,660 4,551 23.81 27.02 17.18 15.13 6.95 36.7% 12.5% Mills Estruturas e Serviços MILS3 Brasil 1,576 6,007 22.30 17.26 10.72 8.76 3.92 18.9% 10.5% Empresas ICA S.A.B ICA* México 1,160 8,489 19.25 13.07 15.04 10.08 0.92 3.1% 0.5% Besalco SA BESALCO Chile 797 1,040 25.12 19.06 10.61 7.70 2.36 15.6% 5.7% Grupo Odinsa SA ODINSA Colombia 826 518 11.54 n.d. 39.38 n.d. 2.33 22.6% 13.5% Conconcreto SA CONCONC Colombia 588 201 22.53 n.d. n.d. 7.66 1.24 10.6% 7.2% Salfacorp SA SALFACOR Chile 488 1,716 10.41 9.94 10.97 9.21 0.88 8.7% 2.6% Construcciones El Cóndor SA ELCONDOR Colombia 451 209 n.d. n.d. n.d. n.d. 1.61 10.6% n.d. Promedio 1,301 2,622 19.41 17.00 16.00 9.42 2.71 16.5% 7.4% Fuente: Bloomberg www.kallpasab.com 1 1.1% 1.2% n.d. 2.0% n.d. 1.5% 1.9% 3.6% 1.3% 2.0% 3.1% 1.1% 0.9% 1.7% 1.5% 0.6% 1.6% 0.5% ROE ROA Reporte de Múltiplos 2.4% 1.4% 3.9% 8.4% 4.8% 0.7% 2.9% 4.3% 2.9% 2.1% Dividend Yield 12M 0.4% 2.9% 1.5% Dividend Yield 12M Dividend Yield 12M n.d. 2.9% Ticker ADTV 12M (US$000) P/E 12M Cap. Bursátil (US$ MM) Bienes de Consumo Retail P/E 2013 P/E 12M País Cap. Bursátil (US$ MM) ADTV 12M (US$000) P/E 2013 País P/BV ROE ROA EV/EBITDA 2013 EV/EBITDA 12M EV/EBITDA 2013 EV/EBITDA 12M Empresa P/E 12M P/E 2013 País Cap. Bursátil (US$ MM) P/BV Ratio de Eficiencia EV/EBITDA 2013 P/BV ROE ROA Empresa ADTV 12M (US$000) P/E 12M Ticker Servicios Financieros Margen Financiero EV/EBITDA 12M Empresa Ticker País Cap. Bursátil (US$ MM) Empresa Ticker P/E 2013 EQUITY RESEARCH | Reporte de Múltiplos 5 de julio de 2013 P/BV ROE ROA 2.8% 1.7% 1.4% 1.2% ADTV 12M (US$000) Dividend Yield 12M 4.4% 4.1% 5.2% 1.4% n.d. 1.2% n.d. 2.7% 2.4% 2.4% 0.8%

- 2. Unión Andina de Cementos UNACEMC1 Perú 2,154 566 12.57 14.60 9.28 10.56 1.79 14.7% 5.9% Cementos Pacasmayo CPACASC1 Perú 1,441 487 24.92 20.87 13.40 11.59 2.21 9.0% 5.9% Holcim Costa Rica S.A. INCCA Costa Rica 333 34 18.56 n.d. 8.14 n.d. 3.82 19.6% 7.5% Cemex SAB CEMEXCPO México 11,819 37,580 n.d. n.d. 12.87 9.96 1.12 -10.6% -3.1% Cementos Argos SA CEMARGOS Colombia 5,543 2,775 49.84 33.95 n.d. 14.51 1.62 2.2% 1.4% Cemex Latam Holdings SA CLH España 3,838 6,100 13.94 14.21 n.d. 9.89 2.66 n.d. n.d. Corp. Moctezuma CMOCTEZ* México 2,686 289 17.90 15.23 10.86 n.d. 3.96 21.0% 17.1% Grupo Cementos Chihuahua GCC* México 1,118 37 56.87 25.86 13.19 n.d. 1.23 2.1% 1.2% Cementos BIO BIO S.A. CEMENT Chile 296 105 n.d. n.d. 19.65 n.d. 0.67 -11.6% -4.8% Melón SA MELON Chile 165 2 n.d. n.d. 10.89 n.d. 0.32 -0.1% 0.0% Promedio 2,940 4,798 27.80 20.79 12.28 11.30 1.94 5.1% 3.5% Corp. Aceros Arequipa CORAREI1 Perú 312 144 9.32 15.31 13.87 9.79 0.49 2.5% 1.3% Empresa Siderúrgica del Perú SIDERC1 Perú 69 68 n.d. n.d. n.d. 57.68 0.20 -10.7% -5.0% Gerdau SA GGBR4 Brasil 9,611 55,620 18.57 16.28 9.10 7.86 0.83 4.6% 2.4% Ternium SA TX EEUU 4,299 9,363 39.82 7.98 5.41 4.76 0.78 1.9% 1.0% CAP SA CAP Chile 2,951 7,420 15.40 9.15 7.00 6.77 1.59 10.6% 3.8% Industrias CH S.A.B. ICHB México 2,779 4,240 21.47 18.19 9.04 8.52 1.42 6.5% 4.3% Grupo Simec S.A. SIMECB México 2,124 1,587 13.48 13.39 7.04 5.88 1.17 8.8% 6.3% Siderar ERAR Argentina 1,714 361 17.93 n.d. 6.68 3.91 0.78 4.8% 3.2% Siderúrgica Venez Sivensa SVS Venezuela 209 4 6.34 n.d. n.d. n.d. 0.26 4.7% 3.0% Cintac S.A. CINTAC Chile 147 107 13.72 n.d. 10.11 n.d. 0.82 6.1% 2.9% Metisa Metalúrgica Timboense SA MTSA4 Brasil 87 35 9.70 n.d. 5.09 n.d. 1.08 11.4% 7.0% Promedio 2,209 7,177 16.57 13.38 8.15 13.15 0.86 4.7% 2.7% Ferreycorp SAA FERREYC1 Perú 570 1,260 7.31 6.60 6.78 5.61 1.33 15.3% 5.3% Finning International Inc FTT Canadá 3,667 15,254 11.17 10.87 8.28 7.27 2.39 23.0% 7.1% Seven Group Holdings Ltd SVW Australia 1,849 4,592 5.96 7.52 6.92 6.59 0.85 15.2% 6.7% Barloworld Ltd BAW Sudáfrica 1,825 8,898 10.66 10.90 n.d. 6.02 1.35 13.7% 4.9% Toromont Industries Ltd. TIH Canadá 1,719 3,920 15.03 15.75 8.86 9.00 3.81 27.4% 13.0% Randon Participações SA RAPT4 Brasil 1,116 6,841 42.96 14.94 11.43 7.45 1.94 4.6% 1.4% H&E Equipment Services Inc HEES EE.UU. 762 4,184 21.05 17.67 6.41 5.56 14.02 18.4% 3.3% Wajax Corp WJX Canadá 540 4,460 9.78 11.51 7.69 8.33 2.39 25.1% 9.0% Titan Machinery Inc TITN EE.UU. 413 12,198 12.09 9.05 11.35 9.89 1.04 9.1% 2.5% PT Hexindo Adiperkasa Tbk HEXA Indonesia 401 644 6.28 5.17 5.67 4.70 1.84 31.5% 15.0% Rocky Mountain Dealerships Inc RME Canadá 252 455 8.94 8.05 5.29 5.55 1.79 17.7% 4.2% Promedio 1,192 5,701 13.75 10.73 7.87 6.91 2.98 18.3% 6.6% Casa Grande SAA CASAGRC1 Perú 275 121 32.15 8.27 6.88 5.10 0.64 2.0% 1.3% Cartavio SAA CARTAVC1 Perú 152 7 n.d. n.d. n.d. n.d. n.d. 3.8% 2.2% Empresa Agroindustrial Pomalca POMALCC1 Perú 34 26 5.15 n.d. n.d. n.d. 0.22 3.8% 1.8% Illovo Sugar Ltd ILV Sudáfrica 1,398 1,145 16.34 10.99 10.84 6.24 2.39 15.2% 7.3% EID Parry India Ltd EID India 397 422 11.65 5.56 7.55 5.18 0.99 8.5% 1.8% Empresas Iansa SA IANSA Chile 190 883 5.79 6.85 7.74 6.02 0.53 8.7% 5.2% Shree Renuka Sugars Ltd SHRS India 188 5,257 n.d. 6.38 4.89 4.51 0.78 -13.7% -2.2% Balrampur Chini Mills Ltd BRCM India 163 1,882 6.12 6.63 5.44 4.61 0.75 12.8% 3.8% Bajaj Hindusthan Ltd BJH India 162 1,520 n.d. n.d. 18.06 n.d. 0.25 -9.3% -2.2% Promedio 329 1,251 12.87 7.45 8.77 5.28 0.82 3.5% 2.1% Copeinca ASA COP Perú 752 1,284 23.60 14.74 17.04 10.36 1.58 6.6% 3.4% Austral Group SAA AUSTRAC1 Perú 223 67 13.47 6.86 6.73 4.65 1.01 7.3% 4.3% Pesquera Exalmar S.A.A. EXALMC1 Perú 181 102 12.67 8.69 6.60 6.37 0.79 6.3% 3.1% Leroey Seafood Group ASA LSG Noruega 1,484 842 12.63 9.30 11.72 6.44 1.62 13.2% 6.2% Salmar ASA SALM Noruega 1,123 1,335 11.58 7.60 13.68 6.59 2.23 21.7% 8.6% AquaChile SA AQUACHIL Chile 706 378 n.d. 304.92 n.d. 9.42 1.82 -12.0% -5.7% Cia Pesquera Camanchaca SA CAMANCHA Chile 188 85 n.d. n.d. 58.07 10.15 0.74 -9.1% -3.6% Havfisk ASA HFISK Noruega 88 18 12.98 20.31 7.53 8.51 0.63 4.7% 1.9% Promedio 593 514 14.49 53.20 17.34 7.81 1.30 4.8% 2.3% Fuente: Bloomberg www.kallpasab.com 2 5.7% 3.3% 7.2% 4.2% 3.3% EV/EBITDA 2013 P/BV ROE ROA 7.0% n.d. n.d. 3.9% n.d. 4.7% 5.2% 9.1% 1.3% Dividend Yield 12M 2.5% 8.6% 3.1% n.d. n.d. 1.5% n.d. Empresa Ticker País Cap. Bursátil (US$ MM) ADTV 12M (US$000) P/E 12M P/E 2013 Empresa EV/EBITDA 2013 P/BV ROE ROA ADTV 12M (US$000) P/E 12M País Acero Cap. Bursátil (US$ MM) Maquinaria - Distribución ADTV 12M (US$000) P/E 12M P/E 2013 Pesca P/E 2013 EV/EBITDA 12M Cap. Bursátil (US$ MM) EV/EBITDA 12M ADTV 12M (US$000) Ticker País P/E 12M P/E 2013 Empresa Ticker 0.6% 1.5% 3.0% 6.0% 3.0% Dividend Yield 12M ROE ROA n.d. 1.8% Dividend Yield 12M Dividend Yield 12M n.d. 7.8% 2.2% n.d. n.d. 1.8% n.d. 7.5% ROE ROA ROA Cemento EV/EBITDA 12M 3.1% 4.4% 5.8% n.d. n.d. EV/EBITDA 12M 2.1% 1.2% 32.3% P/BV ROE EV/EBITDA 2013 EV/EBITDA 2013 P/BVEmpresa Ticker País Cap. Bursátil (US$ MM) 5 de julio de 2013 Azúcar Empresa Ticker País Cap. Bursátil (US$ MM) ADTV 12M (US$000) P/E 12M P/E 2013 EV/EBITDA 12M EV/EBITDA 2013 P/BV 5.3% 8.3% 5.2% 2.6% 3.3% Dividend Yield 12M 4.1% n.d. n.d. n.d. n.d. Reporte de Múltiplos

- 3. Maple Energy PLC MPLE Perú 106 47 n.d. 14.10 19.68 8.00 0.84 -28.3% -10.5% Tereos Internacional SA TERI3 Brasil 980 234 n.d. 7.56 7.26 4.39 0.66 0.0% 0.0% Andersons Inc/The ANDE EE.UU. 1,006 5,584 13.69 13.49 10.99 9.45 1.66 12.8% 3.7% CropEnergies AG CE2 Alemania 675 225 9.24 11.62 5.12 5.83 1.35 15.4% 9.4% Green Plains Renewable Energy GPRE EE.UU. 420 2,940 n.d. 20.71 8.84 7.57 0.86 5.7% 2.0% REX American Resources Corp REX EE.UU. 308 629 n.d. 9.66 18.44 n.d. 1.23 0.1% 0.1% Promedio 583 1,610 11.47 12.86 11.72 7.05 1.10 0.9% 0.8% Refinería La Pampilla SA RELAPAC1 Perú 214 190 76.28 4.64 12.43 11.11 0.43 0.5% 0.2% Ecopetrol SA ECOPETL Colombia 86,028 18,994 11.92 12.12 6.20 6.06 2.93 27.0% 12.8% YPF SA YPFD Argentina 8,589 1,237 12.00 8.20 3.68 3.07 1.37 13.0% 5.2% OGX Petróleo e Gas Participações OGXP3 Brasil 733 113,957 n.d. n.d. n.d. n.d. 0.24 -23.1% -11.1% Petrobras Argentina SAB PESA Argentina 1,087 233 9.44 6.91 2.35 2.14 0.57 6.7% 3.7% Refinaria de Petróleos Manguinhos RPMG3 Brasil 128 322 n.d. n.d. n.d. n.d. n.d. n.d. -44.0% Promedio 16,130 22,489 27.41 7.97 6.16 5.60 1.11 4.8% -5.5% Edegel SA EDEGELC1 Perú 2,211 235 16.53 n.d. 8.93 n.d. 2.44 14.9% 8.2% Enersur SA ENERSUC1 Perú 2,090 212 18.84 22.42 n.d. 9.49 3.67 21.1% 8.5% Enersis SA ENERSIS Chile 15,065 12,459 15.66 12.60 6.03 5.39 1.29 7.3% 2.6% Empresa Nacional de Electricidad ENDESA Chile 11,249 8,815 24.70 14.03 9.74 7.88 2.22 9.0% 3.6% Tractebel Energias SA TBLE3 Brasil 10,142 11,838 14.33 13.53 7.86 7.72 4.27 30.1% 13.1% Cia Energética de Minas Gerais CMIG3 Brasil 8,468 2,441 4.16 6.71 5.44 4.76 1.54 36.4% 13.1% AES Gener SA AESGENER Chile 5,169 2,686 22.47 17.30 11.07 10.05 2.02 6.6% 2.9% Colbun SA Colbun Chile 4,556 2,614 71.18 15.28 20.07 12.96 1.29 1.8% 1.1% Isagen SA ISAGEN Colombia 3,654 1,319 15.67 16.32 n.d. 14.22 1.98 13.1% 7.0% Cia Electricidade da Bahia CEEB3 Brasil 2,965 88 7.83 n.d. 7.02 n.d. 2.33 32.0% 12.5% Centrais Eletricas Brasileiras ELET3 Brasil 3,169 9,301 n.d. n.d. 23.62 11.43 0.09 -11.3% -5.3% Cia Paranense de Energia CPLE3 Brasil 3,042 399 7.85 5.41 5.29 4.21 0.49 6.3% 3.8% Cia Energetica do Sao Paulo CESP3 Brasil 2,541 40 14.81 5.04 3.70 2.89 0.50 2.7% 1.5% Edp - Energias do Brasil ENBR3 Brasil 2,324 11,708 18.03 10.10 7.15 6.05 1.15 6.3% 2.1% Equatorial Energia SA EQTL3 Brasil 1,520 6,154 16.85 12.30 9.10 8.48 1.44 4.1% 1.1% Promedio 5,211 4,687 19.21 12.59 9.62 8.12 1.78 12.0% 5.1% Luz del Sur LUSURC1 Perú 1,731 250 17.39 15.26 10.09 10.08 3.37 22.6% 11.1% Edelnor EDELNOC1 Perú 1,110 274 15.31 12.93 7.85 7.46 2.89 19.5% 7.2% Chilectra SA CHILECTR Chile 3,964 15 12.20 n.d. 12.60 n.d. 1.90 15.4% 12.7% Cia Energética do Ceará COCE5 Brasil 1,372 1,746 8.27 8.75 6.63 5.68 1.85 22.5% 10.2% CGE Distribucion SA CGEDISTR Chile 1,158 6 35.45 n.d. 18.15 n.d. 1.44 2.9% 1.3% Cia Energética do Maranhão ENMA3B Brasil 845 17 5.87 n.d. n.d. n.d. 1.53 29.0% 10.2% Cia Energética de Pernambuco CEPE5 Brasil 580 43 n.d. n.d. 11.38 n.d. 0.85 -0.9% -0.4% Eletropaulo Metropolitana ELPL4 Brasil 573 10,395 n.d. 10.05 6.81 4.08 0.59 -0.1% 0.0% Promedio 1,417 1,593 15.75 11.75 10.50 6.83 1.80 13.9% 6.6% Telefónica del Perú TELEFBC1 Perú 2,579 5,682 9.86 n.d. 3.03 n.d. 1.49 18.9% 7.7% América Móvil AMXL México 76,178 101,583 12.17 11.12 5.32 5.39 4.33 32.7% 9.1% Telefónica Brasil S.A. VIVT4 Brasil 22,852 29,719 12.43 11.86 4.16 4.30 1.22 9.8% 6.4% Embratel Participações SA EBTP3 Brasil 4,571 5 15.90 n.d. 3.04 n.d. 0.88 6.0% 2.4% Empresa Nacional de Telecom. ENTEL Chile 3,900 7,002 13.03 13.13 4.59 4.89 2.36 18.4% 9.4% Cia Anónima Nacional de Telefonía TDV/D Venezuela 2,815 10 7.85 n.d. 4.05 n.d. 2.43 32.7% 13.2% Telefónica Chile SA CTCA Chile 1,330 50 12.38 n.d. 3.84 n.d. 1.11 8.7% 3.9% Empresa de Telecom de Bogotá ETB Colombia 736 170 5.40 n.d. 2.32 2.01 0.52 9.9% 5.2% Promedio 14,370 18,028 11.13 12.04 3.79 4.15 1.79 17.1% 7.2% Fuente: Bloomberg www.kallpasab.com 3 1.9% 6.2% 4.6% 5.6% 3.6% Ticker País P/BV ROE ROA Empresa Ticker País EV/EBITDA 12M P/E 12M P/E 2013 P/E 2013 Oil & Gas Etanol Empresa Ticker País Cap. Bursátil (US$ MM) EV/EBITDA 12M ROE Dividend Yield 12M Electricidad - Distribución Cap. Bursátil (US$ MM) ADTV 12M (US$000) P/E 12M P/E 2013 Empresa P/BV ROE ROA n.d. 3.6% n.d. 1.7% 1.2% n.d. 9.3% Dividend Yield 12M Dividend Yield 12M Empresa Ticker Telecomunicaciones Cap. Bursátil (US$ MM) País Reporte de Múltiplos 4.5% 10.2% EV/EBITDA 12M EV/EBITDA 2013 ADTV 12M (US$000) P/E 12M 13.6% 5.6% 23.7% 5.2% 0.3% n.d. 2.5% 4.2% 1.4% 8.7% 8.2% n.d. 4.0% 1.1% 5.6% 8.2% 7.1% 1.0% Ticker País Electricidad - Generación ROAP/BV ROE P/E 12M P/E 2013 EV/EBITDA 12M Cap. Bursátil (US$ MM) ADTV 12M (US$000) ADTV 12M (US$000) EV/EBITDA 2013 EV/EBITDA 2013 ROAP/BV 5 de julio de 2013 EV/EBITDA 12M EV/EBITDA 2013 EV/EBITDA 2013 P/BV Cap. Bursátil (US$ MM) ADTV 12M (US$000) P/E 12M P/E 2013 Empresa 4.5% 1.3% 3.0% 0.2% 7.1% 1.5% 2.0% 6.8% n.d. 2.9% ROE ROA Dividend Yield 12M Dividend Yield 12M 2.7% 7.2% 0.7% n.d. 5.0% 3.7%

- 4. Cia de Minas Buenaventura BVN Perú 4,057 226 6.47 6.98 8.27 6.20 1.00 16.5% 13.2% Goldcorp Inc G Canadá 19,542 147,743 14.12 19.63 7.91 9.43 0.85 7.1% 5.1% Barrick Gold Corp ABX Canadá 13,787 163,931 4.17 4.81 4.09 4.66 0.61 -3.6% -1.7% Newmont Mining Corp NEM EE.UU. 13,860 283,153 8.32 11.84 5.90 7.44 0.98 12.1% 5.6% Polyus Gold International PLZLY Reino Unido 9,096 1,076 9.52 n.d. 6.36 n.d. 2.41 27.4% 18.9% Zijin Mining Group Co Ltd 2899 China 8,105 15,399 5.24 6.54 n.d. 8.25 0.97 17.7% 7.6% Newcrest Mining Ltd NCM Australia 7,456 100,103 10.56 15.60 6.69 7.54 1.13 5.2% 3.9% Yamana Gold Inc YRI Canadá 6,928 76,761 17.05 13.47 6.44 6.42 0.88 4.8% 3.2% Randgold Resources Ltd RRS EE.UU. 5,563 35,740 13.46 17.05 7.94 9.23 2.06 16.5% 14.6% Zhongjin Gold Co Ltd 600489 China 4,579 57,625 18.38 18.78 n.d. 7.75 2.69 15.9% 7.5% Agnico-Eagle Mines Ltd AEM Canadá 4,599 46,466 15.20 28.29 6.96 8.83 1.33 7.6% 5.0% Eldorado Gold Corp ELD Canadá 4,292 46,004 20.01 15.83 7.14 7.56 0.73 3.3% 2.5% Gold Fields Ltd GFI Sudáfrica 3,545 30,251 7.80 12.28 2.81 4.66 0.82 13.8% 7.8% Polymetal International PLC POLY Rusia 2,739 8,564 6.83 7.89 4.51 4.71 3.44 20.8% 10.9% Rio Alto Mining Ltd RIO Canadá 309 576 4.52 4.30 2.14 2.22 1.38 38.8% 24.9% Promedio 7,231 67,575 10.78 13.09 5.94 6.78 1.42 13.6% 8.6% Hochschild Mining Plc HOC Reino Unido 807 1,156 12.57 22.57 2.39 3.41 2.51 6.1% 3.5% Industrias Penoles SAB de CV PE&OLES* México 12,401 9,172 18.50 22.74 7.27 8.83 5.55 21.2% 10.8% Fresnillo Plc FRES México 9,726 17,322 12.86 20.56 7.28 8.73 9.63 35.9% 24.0% SLM Corp SLM EE.UU. 10,212 65,903 9.17 9.05 n.d. n.d. 1.99 25.5% 0.6% Silver Wheaton Corp SLW Canadá 6,690 70,930 11.71 13.71 11.01 11.79 3.44 19.1% 15.5% Pan American Silver Corp PAA Canadá 1,722 7,581 15.37 18.63 3.71 4.64 0.92 2.1% 1.7% First Majestic Silver Corp FR Canadá 1,257 12,132 15.37 14.64 8.93 7.28 3.03 17.7% 13.4% Hecla Mining Co HL EE.UU. 813 24,889 23.75 32.02 9.17 4.11 0.72 1.1% 1.0% Silver Standard Resources Inc SSO Canadá 498 3,588 22.82 n.d. 3.32 6.23 0.76 4.9% 3.8% Silvercorp Metals Inc SVM Canadá 444 1,771 12.38 5.25 4.46 2.14 1.61 6.4% 4.7% Fortuna Silver Mines Inc FVI Canadá 380 1,976 13.19 13.13 4.83 4.53 1.40 10.5% 8.9% Silvercrest Mines Inc SVL Canadá 158 783 4.70 9.03 2.89 3.32 2.22 39.1% 27.5% Promedio 5,454 26,136 14.91 19.24 7.11 6.97 3.47 16.1% 8.8% Southern Copper Corp SCCO EE.UU. 22,796 173 11.36 13.31 6.84 7.63 4.51 38.0% 18.8% Soc. Minera Cerro Verde CVERDEC1 Perú 7,876 466 11.61 9.59 5.58 4.82 2.18 20.8% 18.0% Freeport-McMoran Copper FCX EE.UU. 28,278 587,092 8.43 8.89 4.94 3.61 1.45 17.2% 7.7% Anglo American Plc AAL Reino Unido 25,254 102,143 n.d. 9.99 5.08 4.43 1.14 -3.9% -2.0% Grupo Mexico SAB de CV GMEXICOB México 22,917 33,258 10.16 11.28 6.01 5.57 3.54 26.5% 12.6% Antofagasta Plc ANTO Reino Unido 11,515 33,503 11.16 10.96 3.25 3.60 2.98 15.5% 8.4% First Quantum Minerals FM Canadá 8,572 64,421 12.19 12.73 9.29 6.87 1.10 8.8% 4.7% Kazakhmys Plc KAZ Reino Unido 1,962 22,995 n.d. 5.79 2.13 2.91 1.08 -30.1% -20.9% HudBay Minerals Inc HBM Canadá 1,112 9,349 52.62 117.93 4.13 5.48 0.71 -1.5% -0.9% Promedio 14,476 94,822 16.79 22.28 5.25 4.99 2.08 10.1% 5.2% Volcan Cia Minera SAA VOLCABC1 Perú 2,459 1,850 9.76 5.60 n.d. 4.14 1.16 12.5% 6.4% Sociedad Minera El Brocal BROCALC1 Perú 666 71 27.58 8.44 14.12 4.83 1.76 3.4% 2.5% Compañía Minera MILPO SA MILPOC1 Perú 500 182 18.06 3.31 2.94 2.45 1.04 5.8% 2.4% Cia Minera Atacocha SA ATACOBC1 Perú 45 50 n.d. 15.51 2.55 1.33 0.46 -13.2% -6.9% BHP Billiton BHP Australia 144,395 336,486 15.70 10.24 6.49 5.60 3.06 14.9% 7.6% Teck Resources Ltd TCK Canadá 11,777 71,361 9.26 10.69 4.86 5.05 0.68 5.0% 2.7% Boliden AB BOL Suecia 3,236 35,845 8.18 12.13 4.82 5.38 0.96 12.2% 7.0% Nyrstar NYR Bélgica 709 4,724 n.d. n.d. 5.94 4.93 0.46 -7.5% -2.7% Minmetals Land Ltd 230 Hong Kong 469 886 13.29 4.74 8.34 3.59 0.52 4.1% 1.6% Promedio 18,251 50,162 14.55 8.83 6.26 4.15 1.12 4.1% 2.3% Minsur SA MINSURI1 Perú 1,322 354 10.15 6.36 5.33 3.94 0.76 7.6% 4.4% Yunnan Tin Co Ltd 000960 China 2,362 19,853 n.d. 33.73 n.d. 23.46 2.31 -3.9% -1.0% Timah Persero Tbk TINS Indonesia 506 814 15.56 7.50 4.50 3.34 1.08 6.9% 5.2% Metals X Limited MLX Australia 150 215 90.91 10.00 n.d. 6.64 0.59 1.1% 1.0% Malaysia Smelting Corp SMELT Malasia 103 42 n.d. 6.11 n.d. 10.92 1.35 -15.6% -4.8% Promedio 889 4,256 38.87 12.74 4.92 9.66 1.22 -0.8% 1.0% Fuente: Bloomberg www.kallpasab.com 4 3.9% 3.3% 5.5% 2.6% 4.1% n.d. 5.0% 4.4% 5.0% 4.9% 0.9% 8.2% 5.1% 3.1% 8.0% 1.1% 3.1% 2.9% Dividend Yield 12M n.d. 5 de julio de 2013 4.3% n.d. 10.9% n.d. n.d. EV/EBITDA 2013 P/BV ROE ROA EV/EBITDA 2013 3.0% n.d. 1.4% n.d. 3.6% n.d. 2.2% n.d. 4.8% Minería - Estaño Minería - Polimetálica Minería - Cobre Minería - Plata Dividend Yield 12M Dividend Yield 12M Dividend Yield 12M Minería - Oro EV/EBITDA 12M 2.3% 8.0% 4.7% 2.4% 2.2% 3.4% 2.7% 0.8% 1.7% Empresa Ticker País Cap. Bursátil (US$ MM) ADTV 12M (US$000) P/E 12M P/BV ROE ROA ROE ROA P/BV ROE ROA Reporte de Múltiplos Dividend Yield 12M 3.5% ROE ROA P/BV EV/EBITDA 12M P/E 2013 EV/EBITDA 12M EV/EBITDA 2013 Empresa Ticker País Cap. Bursátil (US$ MM) ADTV 12M (US$000) P/E 12M P/BV EV/EBITDA 12M Cap. Bursátil (US$ MM) ADTV 12M (US$000) EV/EBITDA 2013 P/E 2013 EV/EBITDA 2013 EV/EBITDA 12M Empresa Ticker País Cap. Bursátil (US$ MM) ADTV 12M (US$000) P/E 12M P/E 2013 Empresa Ticker País Cap. Bursátil (US$ MM) ADTV 12M (US$000) P/E 12M P/E 2013 P/E 12M P/E 2013 Empresa Ticker País 4.0% 0.8% 1.4% 12.7% n.d. 2.4% 3.4% 3.0% 2.0% 5.6% 5.3% 3.5%

- 5. GERENCIA GENERAL Alberto Arispe Gerente (511) 630 7500 aarispe@kallpasab.com TRADING Enrique Hernández Eduardo Fernandini Javier Frisancho Jorge Rodríguez Gerente Head Trader Trader Trader (511) 630 7515 (511) 630 7516 (511) 630 7517 (511) 630 7518 ehernandez@kallpasab.com efernandini@kallpasab.com jfrisancho@kallpasab.com jrodriguez@kallpasab.com MERCADO DE CAPITALES Ricardo Carrión Gerente (511) 630 7500 rcarrion@kallpasab.com FINANZAS CORPORATIVAS Andrés Robles Gerente (511) 630 7500 arobles@kallpasab.com EQUITY RESEARCH Marco Contreras Edder Castro Humberto León Juan Franco Lazo Analista Analista Analista Asistente (511) 630 7528 (511) 630 7529 (511) 630 7527 (511) 630 7500 mcontreras@kallpasab.com ecastro@kallpasab.com hleon@kallpasab.com jlazo@kallpasab.com OPERACIONES Elizabeth Cueva Alan Noa Mariano Bazán Ramiro Misari Gerente Jefe de Operaciones Analista - Tesorería Jefe de Sistemas (511) 630 7521 (511) 630 7523 (511) 630 7522 (511) 630 7500 ecueva@kallpasab.com anoa@kallpasab.com mbazan@kallpasab.com rmisari@kallpasab.com OFICINA CHACARILLA Hernando Pastor Daniel Berger Representante Representante (511) 626 8700 (511) 626 8700 hpastor@kallpasab.com dberger@kallpasab.com OFICINA AREQUIPA OFICINA TACNA Jesús Molina Gerson Del Pozo Representante Representante (51 54) 272 937 (51 52) 241 394 jmolina@kallpasab.com gdelpozo@kallpasab.com www.kallpasab.com 5 5 de julio de 2013 KALLPA SECURITIES SOCIEDAD AGENTE DE BOLSA Este documento es exclusivamente para fines informativos. Bajo ninguna circunstancia deber ser usado o considerado como una oferta de venta o solicitud de compra de acciones u otros valores mencionados en él. La información en este documento ha sido obtenida de fuentes que se creen confiables, pero Kallpa Securities SAB no garantiza la veracidad o certeza del contenido de este reporte, o de los futuros valores de mercado de las acciones u otros valores mencionados. Los productos mencionados en este documento podrían no estar disponibles para su compra en algunos países. Kallpa Securities SAB puede tener posiciones y efectuar transacciones con valores mencionados y/o puede buscar hacer banca de inversión con ellos. Reporte de Múltiplos