Banking:Weakness Ahead

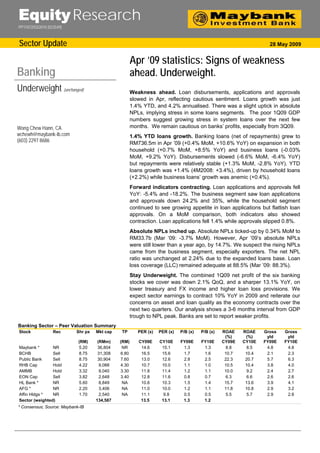

- 1. Equity Research PP11072/03/2010 (023549) Sector Update 28 May 2009 Apr ’09 statistics: Signs of weakness Banking ahead. Underweight. Underweight (unchanged) Weakness ahead. Loan disbursements, applications and approvals slowed in Apr, reflecting cautious sentiment. Loans growth was just 1.4% YTD, and 4.2% annualised. There was a slight uptick in absolute NPLs, implying stress in some loans segments. The poor 1Q09 GDP numbers suggest growing stress in system loans over the next few Wong Chew Hann, CA months. We remain cautious on banks’ profits, especially from 3Q09. wchewh@maybank-ib.com 1.4% YTD loans growth. Banking loans (net of repayments) grew to (603) 2297 8686 RM736.5m in Apr ’09 (+0.4% MoM, +10.6% YoY) on expansion in both household (+0.7% MoM, +8.5% YoY) and business loans (-0.03% MoM, +9.2% YoY). Disbursements slowed (-6.6% MoM, -6.4% YoY) but repayments were relatively stable (+1.3% MoM, -2.8% YoY). YTD loans growth was +1.4% (4M2008: +3.4%), driven by household loans (+2.2%) while business loans’ growth was anemic (+0.4%). Forward indicators contracting. Loan applications and approvals fell YoY: -5.4% and -18.2%. The business segment saw loan applications and approvals down 24.2% and 35%, while the household segment continued to see growing appetite in loan applications but flattish loan approvals. On a MoM comparison, both indicators also showed contraction. Loan applications fell 1.4% while approvals slipped 0.8%. Absolute NPLs inched up. Absolute NPLs ticked-up by 0.34% MoM to RM33.7b (Mar ‘09: -3.7% MoM). However, Apr ‘09’s absolute NPLs were still lower than a year ago, by 14.7%. We suspect the rising NPLs came from the business segment, especially exporters. The net NPL ratio was unchanged at 2.24% due to the expanded loans base. Loan loss coverage (LLC) remained adequate at 88.5% (Mar ’09: 88.3%). Stay Underweight. The combined 1Q09 net profit of the six banking stocks we cover was down 2.1% QoQ, and a sharper 13.1% YoY, on lower treasury and FX income and higher loan loss provisions. We expect sector earnings to contract 10% YoY in 2009 and reiterate our concerns on asset and loan quality as the economy contracts over the next two quarters. Our analysis shows a 3-6 months interval from GDP trough to NPL peak. Banks are set to report weaker profits. Banking Sector – Peer Valuation Summary Stock Rec Shr px Mkt cap TP PER (x) PER (x) P/B (x) P/B (x) ROAE ROAE Gross Gross (%) (%) yld yld (RM) (RMm) (RM) CY09E CY10E FY09E FY10E CY09E CY10E FY09E FY10E Maybank * NR 5.20 36,804 NR 14.6 15.1 1.3 1.3 8.8 8.5 4.8 4.8 BCHB Sell 8.75 31,308 6.80 16.5 15.6 1.7 1.6 10.7 10.4 2.1 2.3 Public Bank Sell 8.75 30,904 7.60 13.0 12.6 2.8 2.5 22.3 20.7 5.7 6.3 RHB Cap Hold 4.22 9,088 4.30 10.7 10.0 1.1 1.0 10.5 10.4 3.8 4.0 AMMB Hold 3.32 9,040 3.30 11.8 11.4 1.2 1.1 10.0 9.2 2.4 2.7 EON Cap Sell 3.82 2,648 3.40 12.8 11.6 0.8 0.7 6.3 6.6 2.6 2.6 HL Bank * NR 5.60 8,849 NA 10.6 10.3 1.5 1.4 15.7 13.6 3.9 4.1 AFG * NR 2.20 3,406 NA 11.0 10.0 1.2 1.1 11.8 10.8 2.9 3.2 Affin Hldgs * NR 1.70 2,540 NA 11.1 9.8 0.5 0.5 5.5 5.7 2.9 2.8 Sector (weighted) 134,587 13.5 13.1 1.3 1.2 * Consensus; Source: Maybank-IB

- 2. Banking Other indicators Deposits declined, LDR up slightly. System deposits declined marginally by 0.1% MoM (-6.2% YoY) to RM984.8b mainly due to purchase of equity issued by the banks. As a result, system loan-to- deposit ratio (LDR) rose slightly to 74.2% as at end-Apr ’09 (Mar ’09: 73.7%). This implies that the banks still have good capacity to lend. Lending rates stable. There was no further OPR reduction at 26 May’s Monetary Policy Committee meeting after three cuts since Nov ’08 totalling 150 bps. As the OPR reached a historic low of 2%, the same goes for lending and deposit rates. Commercial banks’ average base lending rate (BLR) stayed at a historic low of 5.53% as at 15 May ’09 with a total 119 bps reduction since Nov ‘08. Average lending rate (ALR) also touched a historic low of 5.13% as at end-Apr ’09. Impact of OPR cuts on BLR and FD Rate st nd rd 1 OPR cut 2 OPR cut 3 OPR cut (24 Nov ’08) (21 Jan ’09) (24 Feb ’09) OPR 3.25% (-25bps) 2.50% (-75bps) 2.00% (-50bps) SRR 3.50% (-50bps) 2.00% (-150bps) 1.00% (-100bps) BLR (average) 6.48% @ end-Dec 5.89% @ end-Feb 5.53% @ 15 Apr ’09 ‘08 (-24bps) ’09 (-59bps) (-36bps) FD rate: 1-month 3.00% (-10bps) 2.50% (-50bps) 2.00% (-50bps) 3-month 3.50% (-20bps) 3.00% (-50bps) 2.50% (-50bps) Source: Maybank-IB Capitalisation stayed strong. System capitalisation edged up with a core ratio of 12.3% (Mar ‘09: 11.6%) and RWCR of 14.2% (Mar ‘09: 13.5%) after capital raising exercises by the banks. The higher ratios had resulted in higher excess capital, by RM5.1b, to absorb potential losses. We estimate the system can absorb a loss of RM54.7b. Loans Momentum (% YoY) May 08 Jun 08 Jul 08 Aug 08 Sep 08 Oct 08 Nov 08 Dec 08 Jan 09 Feb 09 Mar 09 Apr 09 Gross loans +11.0 +11.7 +9.9 +11.0 +10.6 +10.3 +10.7 +12.8 +11.7 +10.9 +10.9 +10.6 - Businesses +12.6 +14.4 +9.4 +11.4 +9.5 +8.8 +7.8 +13.2 +11.8 +10.0 +9.5 +9.2 - Households +8.7 +8.9 +8.8 +8.7 +9.1 +8.9 +9.0 +9.1 +9.1 +8.9 +8.8 +8.5 Applications -9.7 -5.2 +11.9 +25.5 -5.8 -7.9 -32.6 -18.8 -21.0 +8.1 +5.4 -5.4 Approvals -19.0% -23.4 +2.3 +15.8 -2.9 -14.4 -44.0 -23.7 -35.5 -15.9 -0.7 -18.2 Source: Bank Negara Interest Rates (%) May 08 Jun 08 Jul 08 Aug 08 Sep 08 Oct 08 Nov 08 Dec 08 Jan 09 Feb 09 Mar 09 Apr 09 BLR 6.72 6.72 6.72 6.72 6.72 6.72 6.66 6.48 6.38 5.89 5.53 5.53 ALR 6.13 6.08 6.02 5.98 5.96 6.01 5.98 5.86 5.77 5.49 5.16 5.13 ADR 3.31 3.31 3.31 3.31 3.31 3.31 3.21 3.16 2.63 2.16 2.14 2.14 ALR-ADR 2.82 2.77 2.71 2.67 2.65 2.70 2.77 2.70 3.14 3.33 3.02 2.99 ALR-BLR -0.59 -0.64 -0.70 -0.74 -0.76 -0.71 -0.68 -0.62 -0.62 -0.40 -0.37 -0.40 ADR-CPI -0.49 -4.38 -5.20 -5.19 -4.90 -4.32 -2.50 -1.24 -1.27 -1.54 -1.38 -0.91 Note: ADR refers to the average of fixed deposit rates; Source: Bank Negara Asset Quality & Capitalisation May 08 Jun 08 Jul 08 Aug 08 Sep 08 Oct 08 Nov 08 Dec 08 Jan 09 Feb 09 Mar 09 Apr 09 Gross NPL 37.8 36.9 36.7 36.8 36.1 36.3 35.9 35.1 34.9 34.9 33.6 33.7 (3-mth) (RMb) Net NPL (%) 2.81 2.66 2.53 2.50 2.40 2.43 2.38 2.25 2.21 2.23 2.24 2.24 LLC(%) 80.9 82.4 84.5 85.1 86.9 86.7 86.8 89.1 89.6 89.2 88.3 88.5 Tier 1 cap (%) 9.9 10.8 10.9 10.8 10.6 10.4 10.4 10.6 11.1 11.2 11.6 12.3 RWCR (%) 13.0 13.6 13.6 13.4 13.1 12.6 12.5 12.1 13.0 13.2 13.5 14.2 Source: Bank Negara 28 May 2009 Page 2 of 3

- 3. Banking Definition of Ratings Maybank Investment Bank Research uses the following rating system: BUY Total return is expected to be above 10% in the next 12 months HOLD Total return is expected to be between -5% to 10% in the next 12 months SELL Total return is expected to be below -5% in the next 12 months Applicability of Ratings The respective analyst maintains a coverage universe of stocks, the list of which may be adjusted according to needs. Investment ratings are only applicable to the stocks which form part of the coverage universe. Reports on companies which are not part of the coverage do not carry investment ratings as we do not actively follow developments in these companies. Some common terms abbreviated in this report (where they appear): Adex = Advertising Expenditure FCF = Free Cashflow PE = Price Earnings BV = Book Value FV = Fair Value PEG = PE Ratio To Growth CAGR = Compounded Annual Growth Rate FY = Financial Year PER = PE Ratio Capex = Capital Expenditure FYE = Financial Year End QoQ = Quarter-On-Quarter CY = Calendar Year MoM = Month-On-Month ROA = Return On Asset DCF = Discounted Cashflow NAV = Net Asset Value ROE = Return On Equity DPS = Dividend Per Share NTA = Net Tangible Asset ROSF = Return On Shareholders’ Funds EBIT = Earnings Before Interest And Tax P = Price WACC = Weighted Average Cost Of Capital EBITDA = EBIT, Depreciation And Amortisation P.A. = Per Annum YoY = Year-On-Year EPS = Earnings Per Share PAT = Profit After Tax YTD = Year-To-Date EV = Enterprise Value PBT = Profit Before Tax Disclaimer This report is for information purposes only and under no circumstances is it to be considered or intended as an offer to sell or a solicitation of an offer to buy the securities referred to herein. Investors should note that income from such securities, if any, may fluctuate and that each security’s price or value may rise or fall. Opinions or recommendations contained herein are in form of technical ratings and fundamental ratings. Technical ratings may differ from fundamental ratings as technical valuations apply different methodologies and are purely based on price and volume-related information extracted from Bursa Malaysia Securities Berhad in the equity analysis. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. This report is not intended to provide personal investment advice and does not take into account the specific investment objectives, the financial situation and the particular needs of persons who may receive or read this report. Investors should therefore seek financial, legal and other advice regarding the appropriateness of investing in any securities or the investment strategies discussed or recommended in this report. The information contained herein has been obtained from sources believed to be reliable but such sources have not been independently verified by Maybank Investment Bank Bhd and consequently no representation is made as to the accuracy or completeness of this report by Maybank Investment Bank Bhd and it should not be relied upon as such. Accordingly, no liability can be accepted for any direct, indirect or consequential losses or damages that may arise from the use or reliance of this report. Maybank Investment Bank Bhd, its affiliates and related companies and their officers, directors, associates, connected parties and/or employees may from time to time have positions or be materially interested in the securities referred to herein and may further act as market maker or may have assumed an underwriting commitment or deal with such securities and may also perform or seek to perform investment banking services, advisory and other services for or relating to those companies. Any information, opinions or recommendations contained herein are subject to change at any time, without prior notice. This report may contain forward looking statements which are often but not always identified by the use of words such as “anticipate”, “believe”, “estimate”, “intend”, “plan”, “expect”, “forecast”, “predict” and “project” and statements that an event or result “may”, “will”, “can”, “should”, “could” or “might” occur or be achieved and other similar expressions. Such forward looking statements are based on assumptions made and information currently available to us and are subject to certain risks and uncertainties that could cause the actual results to differ materially from those expressed in any forward looking statements. Readers are cautioned not to place undue relevance on these forward- looking statements. Maybank Investment Bank Bhd expressly disclaims any obligation to update or revise any such forward looking statements to reflect new information, events or circumstances after the date of this publication or to reflect the occurrence of unanticipated events. This report is prepared for the use of Maybank Investment Bank Bhd's clients and may not be reproduced, altered in any way, transmitted to, copied or distributed to any other party in whole or in part in any form or manner without the prior express written consent of Maybank Investment Bank Bhd and Maybank Investment Bank Bhd accepts no liability whatsoever for the actions of third parties in this respect. This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. Published / Printed by Maybank Investment Bank Berhad (15938-H) (Formerly known as Aseambankers Malaysia Berhad) (A Participating Organisation of Bursa Malaysia Securities Berhad) 33rd Floor, Menara Maybank, 100 Jalan Tun Perak, 50050 Kuala Lumpur Tel: (603) 2059 1888; Fax: (603) 2078 4194 Stockbroking Business: Level 8, MaybanLife Tower, Dataran Maybank, No.1, Jalan Maarof 59000 Kuala Lumpur Tel: (603) 2297 8888; Fax: (603) 2282 5136 http://www.maybank-ib.com 28 May 2009 Page 3 of 3