Tax Credit Information

•

0 recomendaciones•124 vistas

This is information on the Stimulus $8,000 Tax Credit.

Denunciar

Compartir

Denunciar

Compartir

Descargar para leer sin conexión

Recomendados

Más contenido relacionado

La actualidad más candente

La actualidad más candente (18)

A Complete Guide to the 2010 California Homebuyer Tax Credit

A Complete Guide to the 2010 California Homebuyer Tax Credit

Destacado

Analisaremos as funções normais da glândula hipofisária, dos mecanismos de controle neuroendócrinos do hipotálamo e os distúrbios desses mecanismos. As células nervosas e células endócrinas, ambas estão envolvidas na comunicação entre as células, compartilham certas características de secreção de mensageiros químicos (neurotransmissores ou hormônios) e atividade elétrica.DEFICIÊNCIA EIXO HIPOTÁLAMO-HIPOFISÁRIO E SUAS CONSEQUÊNCIAS NO GH/SNC EM CRI...

DEFICIÊNCIA EIXO HIPOTÁLAMO-HIPOFISÁRIO E SUAS CONSEQUÊNCIAS NO GH/SNC EM CRI...Van Der Häägen Brazil

A redução normal da proporção entre o segmento superior e o inferior com a progressão da idade é retardado, sendo esta proporção aumentada devido ao crescimento inadequado dos membros inferiores no hipotireoidismo. Lamentavelmente este fato acaba induzindo a uma desproporção entre os segmentos superiores e inferiores que são observadas de forma leve, mas anormal (SS/SI) podendo ser mais característica segundo a etnia segundo McKusick V. Hereditable Disorders of Connective Tissue.Paradoxo no Crescer: Infantil,Baixa Estatura Linear- Hipotireoidismo Após Fas...

Paradoxo no Crescer: Infantil,Baixa Estatura Linear- Hipotireoidismo Após Fas...Van Der Häägen Brazil

O IGF-1 desempenha um papel importante no crescimento e continua a ter efeitos anabólicos em adultos, o que significa que ele pode induzir à hipertrofia do músculo esquelético e de outros tecidos alvos. Roedores sem o receptor de IGF-1 dado mais tarde no desenvolvimento mostram uma redução dramática na massa corporal, atestando o forte efeito de promoção do crescimento deste receptor. Mutações Gene do Receptor do Fator de Crescimento Insulina Símile 1; Baixa Es...

Mutações Gene do Receptor do Fator de Crescimento Insulina Símile 1; Baixa Es...Van Der Häägen Brazil

Destacado (19)

DEFICIÊNCIA EIXO HIPOTÁLAMO-HIPOFISÁRIO E SUAS CONSEQUÊNCIAS NO GH/SNC EM CRI...

DEFICIÊNCIA EIXO HIPOTÁLAMO-HIPOFISÁRIO E SUAS CONSEQUÊNCIAS NO GH/SNC EM CRI...

Paradoxo no Crescer: Infantil,Baixa Estatura Linear- Hipotireoidismo Após Fas...

Paradoxo no Crescer: Infantil,Baixa Estatura Linear- Hipotireoidismo Após Fas...

San Diego International Airport Sustainability Policy

San Diego International Airport Sustainability Policy

Mutações Gene do Receptor do Fator de Crescimento Insulina Símile 1; Baixa Es...

Mutações Gene do Receptor do Fator de Crescimento Insulina Símile 1; Baixa Es...

Similar a Tax Credit Information

Similar a Tax Credit Information (20)

A Complete Guide to the Expanded And Extended Homebuyer Tax Credit - 11/10/09

A Complete Guide to the Expanded And Extended Homebuyer Tax Credit - 11/10/09

Último

Último (20)

From Event to Action: Accelerate Your Decision Making with Real-Time Automation

From Event to Action: Accelerate Your Decision Making with Real-Time Automation

Mastering MySQL Database Architecture: Deep Dive into MySQL Shell and MySQL R...

Mastering MySQL Database Architecture: Deep Dive into MySQL Shell and MySQL R...

Bajaj Allianz Life Insurance Company - Insurer Innovation Award 2024

Bajaj Allianz Life Insurance Company - Insurer Innovation Award 2024

Why Teams call analytics are critical to your entire business

Why Teams call analytics are critical to your entire business

Top 10 Most Downloaded Games on Play Store in 2024

Top 10 Most Downloaded Games on Play Store in 2024

The 7 Things I Know About Cyber Security After 25 Years | April 2024

The 7 Things I Know About Cyber Security After 25 Years | April 2024

Apidays New York 2024 - The value of a flexible API Management solution for O...

Apidays New York 2024 - The value of a flexible API Management solution for O...

Bajaj Allianz Life Insurance Company - Insurer Innovation Award 2024

Bajaj Allianz Life Insurance Company - Insurer Innovation Award 2024

Understanding Discord NSFW Servers A Guide for Responsible Users.pdf

Understanding Discord NSFW Servers A Guide for Responsible Users.pdf

Apidays New York 2024 - Scaling API-first by Ian Reasor and Radu Cotescu, Adobe

Apidays New York 2024 - Scaling API-first by Ian Reasor and Radu Cotescu, Adobe

Scaling API-first – The story of a global engineering organization

Scaling API-first – The story of a global engineering organization

Exploring the Future Potential of AI-Enabled Smartphone Processors

Exploring the Future Potential of AI-Enabled Smartphone Processors

Workshop - Best of Both Worlds_ Combine KG and Vector search for enhanced R...

Workshop - Best of Both Worlds_ Combine KG and Vector search for enhanced R...

Cloud Frontiers: A Deep Dive into Serverless Spatial Data and FME

Cloud Frontiers: A Deep Dive into Serverless Spatial Data and FME

Strategies for Unlocking Knowledge Management in Microsoft 365 in the Copilot...

Strategies for Unlocking Knowledge Management in Microsoft 365 in the Copilot...

Tax Credit Information

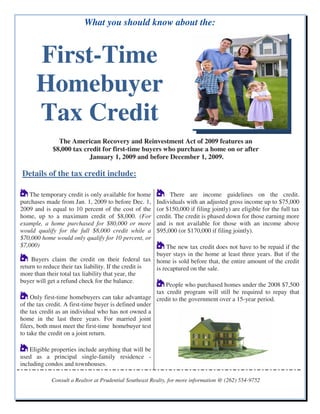

- 1. What you should know about the: First-Time Homebuyer Tax Credit The American Recovery and Reinvestment Act of 2009 features an $8,000 tax credit for first-time buyers who purchase a home on or after January 1, 2009 and before December 1, 2009. Details of the tax credit include: The temporary credit is only available for home There are income guidelines on the credit. purchases made from Jan. 1, 2009 to before Dec. 1, Individuals with an adjusted gross income up to $75,000 2009 and is equal to 10 percent of the cost of the (or $150,000 if filing jointly) are eligible for the full tax home, up to a maximum credit of $8,000. (For credit. The credit is phased down for those earning more example, a home purchased for $80,000 or more and is not available for those with an income above would qualify for the full $8,000 credit while a $95,000 (or $170,000 if filing jointly). $70,000 home would only qualify for 10 percent, or $7,000) The new tax credit does not have to be repaid if the buyer stays in the home at least three years. But if the Buyers claim the credit on their federal tax home is sold before that, the entire amount of the credit return to reduce their tax liability. If the credit is is recaptured on the sale. more than their total tax liability that year, the buyer will get a refund check for the balance. People who purchased homes under the 2008 $7,500 tax credit program will still be required to repay that Only first-time homebuyers can take advantage credit to the government over a 15-year period. of the tax credit. A first-time buyer is defined under the tax credit as an individual who has not owned a home in the last three years. For married joint filers, both must meet the first-time homebuyer test to take the credit on a joint return. Eligible properties include anything that will be used as a principal single-family residence - including condos and townhouses. Consult a Realtor at Prudential Southeast Realty, for more information @ (262) 554-9752