DTZ Property Times Kuala Lumpur, Q1 2011

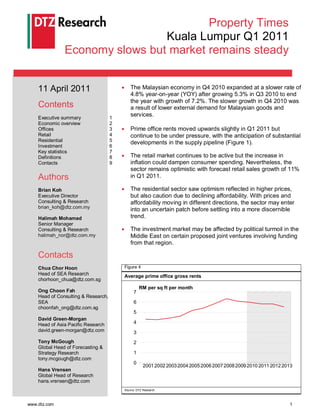

- 1. Property Times Kuala Lumpur Q1 2011 Economy slows but market remains steady 11 April 2011 The Malaysian economy in Q4 2010 expanded at a slower rate of 4.8% year-on-year (YOY) after growing 5.3% in Q3 2010 to end the year with growth of 7.2%. The slower growth in Q4 2010 was Contents a result of lower external demand for Malaysian goods and Executive summary 1 services. Economic overview 2 Offices 3 Prime office rents moved upwards slightly in Q1 2011 but Retail 4 continue to be under pressure, with the anticipation of substantial Residential 5 developments in the supply pipeline (Figure 1). Investment 6 Key statistics 7 Definitions 8 The retail market continues to be active but the increase in Contacts 9 inflation could dampen consumer spending. Nevertheless, the sector remains optimistic with forecast retail sales growth of 11% Authors in Q1 2011. Brian Koh The residential sector saw optimism reflected in higher prices, Executive Director but also caution due to declining affordability. With prices and Consulting & Research affordability moving in different directions, the sector may enter brian_koh@dtz.com.my into an uncertain patch before settling into a more discernible Halimah Mohamad trend. Senior Manager Consulting & Research The investment market may be affected by political turmoil in the halimah_nor@dtz.com.my Middle East on certain proposed joint ventures involving funding from that region. Contacts Chua Chor Hoon Figure 4 Head of SEA Research Average prime office gross rents chorhoon_chua@dtz.com.sg RM per sq ft per month Ong Choon Fah 7 Head of Consulting & Research, SEA 6 choonfah_ong@dtz.com.sg 5 David Green-Morgan Head of Asia Pacific Research 4 david.green-morgan@dtz.com 3 Tony McGough 2 Global Head of Forecasting & Strategy Research 1 tony.mcgough@dtz.com 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Hans Vrensen Global Head of Research hans.vrensen@dtz.com Source: DTZ Research www.dtz.com 1

- 2. Economic overview Malaysia’s economy registered slower growth of Figure 2 4.8% year-on-year (YOY) in Q4 2010, after 5.3% and GDP growth and unemployment rate 8.9% growth in Q3 and Q2 2010 respectively (Figure 2). According to Bank Negara Malaysia (BNM), the % growth in Q4 2010 was driven by expansion in 12 domestic demand with slower growth in external 10 demand. 8 6 In Q4 2010, most sectors maintained their positive 4 growth with the manufacturing and service sectors 2 continuing to be the drivers, both expanding by 6.2% 0 YOY respectively. The agricultural sector registered a -2 Q1 09 Q2 09 Q3 09 Q4 09 Q1 10 Q2 10 Q3 10 Q4 10 contraction of 4.3% due to a decline in the production -4 of crude oil. The mining sector shrank by 1.3%. -6 -8 Overall, the full year growth for 2010 is 7.2%, GDP growth (YOY) Unemployment rate compared to the contraction of 1.7% in 2009. Source: Department of Statistics Malaysia, Bank Negara Malaysia, DTZ Research The economy is expected to slow in 2011 to 5-6% in line with the global trend. The Malaysian Institute of Economic Research (MIER) has forecasted the economic growth for 2011 to be 5.2%. With the recent reduction in subsidies for petrol and other essential goods, inflation is likely to increase this year although the improving strength of the Ringgit will moderate prices of imported goods. The inflation rate of Malaysia was last reported at 2.9% in February 2011. Foreign Direct Investment for 2010 has improved with a total of RM21.4bn compared to RM5.7bn for the whole of 2009. The Overnight Policy Rate (OPR) has remained at 2.75% since August 2010 but liquidity has been reduced. Bank Negara will continue to pursue an accommodative monetary policy so as to be appropriate and consistent with the assessment of growth and inflation prospects. An additional nine Entry Point Projects (EPP) was implemented in March 2011 under the RM30bn Economic Transformation Plan (ETP). In June, a new financial sector blueprint will enhance the capacity and capability of the sector to serve the needs of a high-income economy. With the earthquake and tsunami disaster in Japan, and the current political turmoil in the Middle East, the Malaysian economy could see greater external uncertainty in manufacturing exports and tourism. www.dtz.com 2

- 3. Offices During the quarter, 240,000 sq ft was added to the Figure 3 office stock in Kuala Lumpur with the completion of Office net absorption and vacancy rate Hampshire Place. sq ft % (000s) 15 Enquires for office space in KL was buoyant in the 1,000 14 quarter but it is still a tenant’s market. As a result, the 13 overall occupancy rate of office buildings in Kuala 12 500 Lumpur increased marginally from 86.4% in Q4 2010 11 to 86.9% in Q1 2011 (Figure 3). 10 9 0 8 Average prime office rents, however, increased from Q1 09 Q2 09 Q3 09 Q4 09 Q1 10 Q2 10 Q3 10 Q4 10 Q1 11 7 RM5.97 per sq ft per month in Q4 2010 to RM6.12 6 -500 per sq ft per month in Q1 2011 as some existing 5 prime buildings reported higher occupancies 4 although this may be temporary with more new -1,000 3 supply coming in the later part of the year (Figure 4). Net absorption (LHS) Vacancy rate (RHS) There is approximately 13.24 million sq ft of new Source: DTZ Research office space in the pipeline between 2011 and 2014, the majority of which is scheduled for completion in Figure 4 2012 (Figure 5). Average prime office gross rents KL Eco City is expected to be launched for sale in RM per sq ft per month early Q2 2011 with stratified boutique offices and 7 office towers, bringing around two million sq ft of 6 office space into the market in three to five years’ 5 time. 4 The sale of strata titled office space seem to be 3 picking up, both in the city centre as well as suburban 2 projects, with strong response to launches and 1 developers continuing to be optimistic. A major 0 prime office, Q Sentral at KL Sentral, was soft 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 launched for sale at an indicative price of RM1,400 per sq ft. Source: DTZ Research An immediate effect noted from the EPP under the oil and gas sector is tenants in this industry expanding their office space requirement. Figure 5 Office development pipeline The outlook for the sector is likely to remain soft in the next few years as it will take time to increase demand with these new initiatives while there is a 2014 substantial amount of new supply coming up, most of which is of a speculative nature. 2013 2012 2011 sq ft (000s) 0 2000 4000 6000 8000 Prime: GT Prime: CCA Prime: decentralized area Secondary: GT Secondary: decentralized area Source: DTZ Research www.dtz.com 3

- 4. Retail With consumer sentiment on a high over much of last Table 1 year, retail sales for the whole of 2010 exceeded initial projections, with growth of 8.4% for the whole Existing retail stock (NLA) year and 8.5% for Q4 2010. Retailers remain Q4 2010 QOQ optimistic that Q1 2011 sales will grow at about 11% (sq ft) change (%) with the Lunar New Year falling within this period. Kuala Lumpur 20,973,519 0 Occupancy remains at a high and stable level of 87% Outside Kuala Lumpur 20,662,992 0 whilst no substantial movement was noted for rental Source: DTZ Research rates of most malls. However, Sunway Pyramid Shopping Mall reported a double-digit increase in rents of 17.1% on lease renewals in the Q4 2010 whilst Subang Parade reported a 2%decline over the Figure 6 same period. Retail new supply (NLA) No new space was added in the quarter with the sq ft 3,500 (000s) existing stock staying at around 41.64 million for Klang Valley (Table 1) and the potential supply 3,000 remaining the same as in the previous quarter with 2,500 most them coming in 2011 (Figure 6 & Table 2). 2,000 Inflation continued to be a concern with the 1,500 Consumer Price Index increasing to 2.4% in 1,000 January, and will have an impact on the real disposal 500 income of households. With a higher global 0 inflationary rate as a phenomenon, the appreciation 2006 2007 2008 2009 2010 2011 2012 2013 2014 of the Ringgit may not be able to mitigate rising the cost of imports. Completed supply New supply The continued Governmental efforts to control credit Source: DTZ Research card delinquency and tighten issuance will also impose a negative impact on retail sales, whilst Table 2 slower tourist inflows from the Middle East and Japan given recent events will have an adverse impact in Upcoming retail centres in 2011 the coming months. Name of development Est NLA (sq ft) Location The performance of malls is likely to be mixed going 1 Shamelin 420,000 Cheras, KL forward, with selective prime malls continuing to out- perform although at a slower pace than before. The Citta Mall 424,000 Ara Damansara rest, especially suburban malls, will be subject to Festival Mall 450,000 Setapak stronger competitive forces fragmenting their market shares and resulting in flat rental growth. Intermark 200,000 Jalan Ampang Solaris Mont’ Solaris 2 300,000 Kiara Suria KLCC 140,000 KLCC (Extension) Viva Home 688,000 Jalan Loke Yew Source: DTZ Research www.dtz.com 4

- 5. Residential The residential market entered the new year with Figure 7 both optimism as well as caution, with escalating Rents and capital values of prime condominiums in prices for new launches but declining affordability, at Kuala Lumpur least for the average house buyer. Developers are generally optimistic with planned new launches. With 700 RM per sq ft RM per sq ft per month 5 prices and affordability moving in different directions, 600 the market may enter into an uncertain patch before 4 500 settling into a more discernible trend. 400 3 Higher land prices and construction cost escalations 300 2 are major drivers of higher prices supported by the 200 continued ample liquidity and low interest 1 environment. It remains to be seen if the latest 100 revisions on finance margin on third property and a 0 0 reduction in banking liquidity through the increase in 2005 2006 2007 2008 2009 Q1 10 Q2 10 Q3 10 Q4 10 Q1 11 statutory reserve will rein in runaway prices. Capital values (LHS) Rents (RHS) With more completions of condominiums in the KLCC Source: DTZ Research area, the situation is turning into a tenant’s market, especially for the larger units. There is also ample Table 3 supply of units available in the secondary market with owners now able to transact freely unlike when the Upcoming high end condominiums in Kuala Lumpur projects are under construction. A recent survey of in 2011 completed projects around the KLCC area revealed that occupancy ranged from a low of about 10% to a Project Units high of 80%, with an average of 56%, an issue that 1 Sentul 284 investors should be wary of. Clearwater Residences 108 Capital values are relatively stable at an average of Kiara 3 160 RM603 per sq ft with KLCC properties averaging Kiara 9 192 RM910 per sq ft (Figure 7). The Caper at Sentul, an old suburb being rejuvenated, was soft launched by Sunway Palazzio (Block A) 80 YTL Land late in March at an average price of Source: DTZ Research RM600 per sq ft. It set a new benchmark for Sentul and was reported to have good response. Figure 8 Amongst the expected completions for first half of Future supply of prime condominiums in Kuala 2011 include 1 Sentul, Clearwater Residences and Lumpur Kiara 3 (Table 3) and the future supply are mostly units outside the city centre in 2011 (Figure 8). 5,000 4,500 4,000 Demand will continue to be relatively selective, with 3,500 strong latent demand building up for more affordable 3,000 properties in the more established suburbs. The 2,500 proposed billion ringgit Mass Rapid Transit (MRT) 2,000 project would hopefully enable sites located further 1,500 off the city centre to benefit by offering affordable 1,000 homes, given their lower land costs. 500 0 2011 2012 Post 2012 City centre Outside city centre Source: DTZ Research www.dtz.com 5

- 6. Investment Investment volumes dropped marginally by 2%from development joint ventures for foreign investors Q4 2010 to RM1.4bn in Q1 2011. Q4 2010 saw a which in the past were relatively scarce, given major deal of RM651.8m when CapitaMall Asia developers’ access to ample liquidity. Limited announced the purchase of Queenbay Mall, Penang from the CP Group (Figure 9). With this Given the political turmoil in the Middle East, the acquisition, CapitaLand and its related entities now impact on Malaysia is still uncertain. Some major control the two major retail centres in Penang, which announced or committed deals may be aborted or include the Gurney Plaza. delayed, whilst there could be a greater flow of hot money toward Malaysia as a safe haven. However, Reflecting a retail focus in recent months, IGB this event will add more uncertainties, and with the announced that it will inject The Gardens @ recent earthquake in Japan, add more challenges to Midvalley into KrisAsset, a majority controlled entity the local economic growth which still depends on at an indicative price of RM820m or approximately exports to a large extent. RM998 per sq ft, whilst Pramerica is looking to exit the market for one of its older retail funds, and Nevertheless, under the ETP, domestic investment is inviting offers on its three malls located in Klang, Ipoh expected to drive the projects. Thus implementation and Seremban. We also noted the purchase of 72 of the EPPs is not expected to be affected at this strata retail lots within a proposed mixed point in time. development, One South, for RM105m at Sungei Besi by South Crest Synergy (Table 4). Figure 9 Total investment sales in Malaysia Two office buildings were reported to be sold during RM (000s) the quarter, with prices achieved at between RM550- 650 per sq ft. One of them is the proposed Oilcorp 8,000 Amanah Tower, which was sold to Tenaga Nasional 7,000 Berhad (TNB), the national electricity company, for 6,000 RM554 per sq ft. The yield achieved is estimated to 5,000 be in the range of 6.4-7.0%. 4,000 3,000 The Government Linked Investment Companies continue to be hungry for domestic real estate assets 2,000 that meet their investment criteria for longer term 1,000 leases and to utilise allocated funds for the real 0 estate sector. Q1 08 Q2 08 Q3 08 Q4 08 Q1 09 Q2 09 Q3 09 Q4 09 Q1 10 Q2 10 Q3 10 Q4 10 Q1 11 With several major greenfield projects being Source: DTZ Research implemented in the near future, which include KL Eco-City, redevelopment of the former Pudu Jail, KL International Financial Centre (KLIFC), and Sungai Besi Airport, there will be opportunities for Table 4 Significant deals Property Purchaser Vendor Price The Ritz Garden Hotel, KL Leopard Holdings Bhd GSB Group Bhd RM22m One South strata lots, KL South Crest Synergy Sdn Bhd Hua Yang Bhd RM105m Oilcorp Amanah Tower , KL Tenaga Nasional Berhad Magic Coast Sdn Bhd RM233m The Gardens Mall, KL Krisassets Holding Bhd IGB Corporation Bhd RM820m Source: DTZ Research www.dtz.com 6

- 7. Key statistics Table 5 Markets QOQ YOY Q1 Q2 Q3 Q4 Q1 change change Directional 2010 2010 2010 2010 2011 outlook (%) (%) Office Net absorption (000s sq ft) 118 414 790 426 509 19.0 431.4 ◄► Occupancy rate (%) 87.2 87.9 87.1 86.4 86.9 0.6 -0.3 ◄► New supply (000s sq ft) - - 1,437 - 240 N/A N/A ▲ Prime rents (RM per sq ft per 6.02 6.00 5.98 5.97 6.12 2.5 1.7 ◄► month) Residential (non-landed resale) Average capital value of prime 569 552 600 599 603 0.67 5.98 ◄► condominiums (RM per sq ft) Source: DTZ Research Table 6 Leasing transactions Address Size (sq ft) Tenant Sector Gardens North, Kuala Lumpur 3,597 MyBiz Solutions Sdn Bhd Office Menara TM, Kuala Lumpur 25,000 Cargill (Malaysia) Sdn Bhd Office Symphony House, Petaling Jaya 11,039 Eli Lilly (M) Sdn Bhd Office Source: DTZ Research www.dtz.com 7

- 8. Definitions Development pipeline Comprises two elements: 1. Floorspace in the course of development, defined as buildings being constructed or comprehensively refurbished. 2. Schemes with the potential to be built in the future, though having secured planning permission/development certification. Net absorption The change in total occupied floorspace over a specified period of time, either positive or negative. New supply Total floorspace which is ready for occupation either now or within the next 6 months. Ready for occupation means practical completion, where either the building has been issued with an occupancy permit, where required, or where only fit-out is lacking. Prelet/pre-commit A development leased or sold prior to completion. Prime rent The highest rent that could be achieved for a typical building/unit of the highest quality and specification in the best location to a tenant with a good (i.e. secure) covenant. (NB. This is a gross rent, including service charge or tax, and is based on a standard lease, excluding exceptional deals for that particular market.) Stock Total accommodation in the commercial and public sectors both occupied and vacant. Take-up Floorspace acquired for occupation, including the following: 1. offices let/sold to an eventual occupier; 2. developments pre-let/sold to an occupier; 3. owner occupier purchase of a freehold or long leasehold. (NB. This includes subleases.) Occupancy rates The percentage of total net lettable area/units occupied with available stock. www.dtz.com 8

- 9. Contacts Consulting & Research Brian Koh +60 (0)3 2161 7228 ext 800 brian_koh@dtz.com.my Halimah Mohd Nor +60 (0)3 2161 7228 ext 814 halimah_nor@dtz.com.my Markanah Hj Mat Taib +60 (0)3 2161 7228 ext 813 markanah_taib@dtz.com.my Global Corporate Services Chua Wei Lin +60 (0)3 2161 7228 weilin_chua@dtz.com.sg Yasmine Mohd Zamirdin +60 (0)3 2161 7228 ext 612 yasmine_zamirdin@dtz.com.my Chintan Mithalwala +60 (0)3 2161 7228 ext 610 chintan_mithalwala@dtz.com.my Investment Brian Koh +60 (0)3 2161 7228 ext 800 brian_koh@dtz.com.my Sr Low Han Hoe +60 (0)3 2161 7228 ext 202 hanhoe_low@dtz.com.my Peter Chew Lye Sing +60 (0)3 2161 7228 ext 810 peter_chew@dtz.com.my Tony DeCosta +60 (0)3 2161 7228 ext 811 tony_decosta@dtz.com.my Property Management Sr Adzman Shah Mohd Ariffin +60 (0)3 2161 7228 ext 400 adzmanshah@dtz.com.my Mohd Azhan Che Mat +60 (0)3 2161 7228 ext 412 mohd_azhan@dtz.com.my Residential Eddy Wong +60 (0)3 2161 7228 ext 550 eddy_wong@dtz.com.my Chong Yen Yee +60 (0)3 2161 7228 ext 551 yenyee_chong@dtz.com.my Alex Loo Chon How +60 (0)3 2161 7228 ext 558 alex_loo@dtz.com.my Retail Ungku Suseelawati Ungku Omar +60 (0)3 2161 7228 ext 300 suseela@dtz.com.my Joseph Cheah +60 (0)3 2161 7228 ext 321 joseph_cheah@dtz.com.my Susan Yew +60 (0)3 2161 7228 ext 310 susan_yew@dtz.com.my Valuation Sr Adzman Shah Mohd Ariffin +60 (0)3 2161 7228 ext 400 adzmanshah@dtz.com.my Sr Azmi Hj Omar +60 (0)3 2161 7228 ext 200 azmi_omar@dtz.com.my Hanafi Abd Rahman +60 (0)3 2161 7227 ext 204 hanafi_rahman@dtz.com.my www.dtz.com 9

- 10. Disclaimer This report should not be relied upon as a basis for entering into transactions without seeking specific, qualified, professional advice. Whilst facts have been rigorously checked, DTZ can take no responsibility for any damage or loss suffered as a result of any inadvertent inaccuracy within this report. Information contained herein should not, in whole or part, be published, reproduced or referred to without prior approval. Any such reproduction should be credited to DTZ. © DTZ April 2011 www.dtz.com