Más contenido relacionado La actualidad más candente (20) Similar a NewBase 620 special 07 June 2015 (20) Más de Khaled Al Awadi (20) 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 1

NewBase 07 June 2015 - Issue No. 620 Khaled Al Awadi

NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE

UAE: TOTAL and EAD partnering for Dugong Conservation

WAM + NewBase

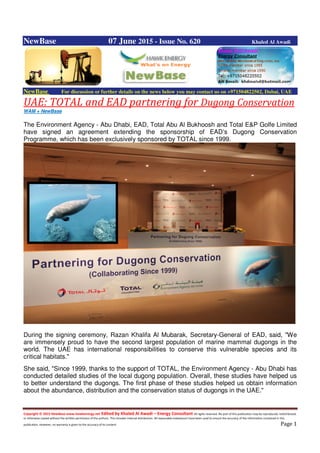

The Environment Agency - Abu Dhabi, EAD, Total Abu Al Bukhoosh and Total E&P Golfe Limited

have signed an agreement extending the sponsorship of EAD’s Dugong Conservation

Programme, which has been exclusively sponsored by TOTAL since 1999.

During the signing ceremony, Razan Khalifa Al Mubarak, Secretary-General of EAD, said, "We

are immensely proud to have the second largest population of marine mammal dugongs in the

world. The UAE has international responsibilities to conserve this vulnerable species and its

critical habitats."

She said, "Since 1999, thanks to the support of TOTAL, the Environment Agency - Abu Dhabi has

conducted detailed studies of the local dugong population. Overall, these studies have helped us

to better understand the dugongs. The first phase of these studies helped us obtain information

about the abundance, distribution and the conservation status of dugongs in the UAE."

2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 2

"The second and third phase helped us understand more about the biological and ecological

status of dugongs and their habitats. Threats to the dugong population were identified by

investigating causes of dugong mortality as well as habitat degradation, fragmentation and loss.

Data has been collected including local movement patterns through satellite telemetry. In addition,

Marine Protected Areas were monitored and regional cooperation with other entities working in

dugong conservation enhanced," Al Mubarak added.

Hatem Nusibeh, Total UAE President, said, "Total is committed to create a better environment

wherever it operates. In the UAE, and since 1999, our partnership with EAD has helped the

Dugong conservation project grow.

With emphasis on educating the local community, we are confident that this combined effort will

prove successful to the continued growth of the Dugong population in the region. In addition, I

would like to thank the EAD for its awareness campaigns targeted towards youth and student

communities which are contributing to the long term protection plans for the region."

Amer Al Shaikh Ali, CEO, Total Abu Al Bukhoosh, said, "At Total Abu Al Bukhoosh, we are proud

to be associated with EAD in the conservation of Dugong. We have considered it as one of our

key social responsibility activities.

We will continue our joint efforts with Total and EAD to protect conserve and manage Dugong

habitats to maintain a healthy growth rate. Raising more awareness on Dugongs in the regions is

therefore a significant challenge for their protection and we should strive to achieve this."

Dr. Shaikha Salem Al Dhaheri, Executive Director of the Terrestrial and Marine Biodiversity

Sector, said, "If the dugong, its habitat and other important wildlife species living therein are to

survive and maintain their role as an important part of our environment, we need to ensure that we

not only actually implement the conservation measures adopted, but also continue to remain alert

by educating ourselves and enhancing our understanding on the requirements of the species

across the entire region, including Bahrain, Qatar and Saudi Arabia in particular and the Western

Indian Ocean region in general."

She added, "Throughout their range, which includes at least 48 countries from East Africa to the

Pacific Islands, dugongs are under pressure from a range of human activities. Dugongs are

vulnerable to human-related influences due to their dependence on seagrasses that are restricted

to coastal habitats, and which are often under increased pressure from human activities."

3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 3

Oman’s natural gas output grows 5.5 per cent

Oman Times + NewBase

Muscat: Oman's natural gas production and imports rose 5.5 per cent to 12,402 million cubic metres

(MNCM) for the first four months of this year, from 11,750 MNCM for the same period last year.

Of this, while non-associated gas showed a growth of 7.6 per cent to 10,216MNCM, associated gas

production declined 3.1 per cent to 2,185MNCM, according to statistics released by the National Centre for

Statistics and Information (NCSI).

Industrial projects

A sizeable portion of the natural gas in Oman is used by various mega industrial projects, which stood at

7,267MNCM for the first four months of 2015, against 6,946MNCM for the same period last year. Natural

gas is also used in oilfields either as fuel or for re-injection. For instance, in the first four months, as much

as 2,613 MNCM of natural gas was used in oil fields, against 2,406 MNCM units consumed for the same

period in 2014.

Other major consumers of natural gas in the country include power producers, small-scale industries and

liquefied natural gas plants. Natural gas used by power and desalination plants stood 3.9 per cent higher at

2,303 MNCM for the first four months of this year. The Oman Power and Water Procurement Company

(OPWP), estimates gas consumption in the electricity and water desalination sector to rise substantially in

the next five years, mainly due to higher production to support growing demand for power and water.

While the national demand for gas will rise sharply over the coming five years, the rate of increase is by no

means evenly distributed, with requirements set to spike in some regions. In fact, the Ministry of Oil and

Gas is responsible for supplying gas to various consumers and the obligations are set out in within the

agreements.

The Sultanate's natural gas production this year is projected at 120 million cubic metres per day, which is 15

million cubic metres higher than that of last year. Oman produced and imported 37,687 million cubic metres

of natural gas last year (equivalent to 105 million cubic metres per day).

4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 4

Saudi- Bahrain crude oil pipeline revamp on track

Gulf Daily News + NewBase

NEW crude oil pipelines between Bahrain and Saudi Arabia will be ready by the end of 2017 with

up to 400,000 barrels per day (bpd) delivered to Bapco, it was revealed. Energy Minister Dr

Abdulhussain Mirza told parliament, in writing, that the new network, which will be operational in

the first quarter of 2018, will replace the existing land pipelines between Bapco and Aramco in

Dhahran, Saudi Arabia.

The GDN reported in

January that the new

30-inch diameter,

115km-long pipeline

will run onshore for

74km, with the

remaining 42km being

sub-sea. Dr Mirza said

an agreement with the

winning contractor will

be signed in August.

'The existing network

will be removed and

the route will be

cancelled, but we

have to test the new

network first to ensure

there are no technical faults,' he said. 'We expect to have the new network opened in the first

quarter of 2018, and dismantling of the existing pipelines is expected to begin in the second half of

2018, which will depend on contractors that will be selected.

'The new network will give us up to 350,000bpd day from Saudi Arabia that will reach up to

400,000 depending on flexibility, which is a significant increase from the current 230,000 daily

barrels transferred from Aramco.'

The minister was responding to a question by MP Khalifa Al Ghanim on project updates, which will

be discussed during parliament's weekly session on Tuesday. An Aramco official told the GDN

last year that the cost of the project is estimated at $350 million.

The front-end engineering and design of the pipeline was completed last year. It was done by

WorleyParsons of Australia. The pipeline is a key prerequisite for Bapco's planned Sitra refinery

expansion up to 500,000bpd total capacity, which is estimated to cost up to $6 billion.

Meanwhile, parliament is set to vote on a proposal on Tuesday to have four specialised dentistry

centres, one in each of Bahrain's four governorates. Parliament's services committee has

recommended the proposal, but said that equipment and furniture in dentistry sections at health

centres could be moved there instead of forcing the government to shoulder additional expenses.

The Health Ministry said in its meeting with the committee last week that under its strategy to

develop the dentistry sector it has opened 16 specialised clinics in health centres across Bahrain

to reduce waiting lists and provide better services.

5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 5

Jordan: Aqaba Gas Port would generate surplus for export to Egypt

WAM + NewBase

Minister of Energy and Mineral Resources Ibrahim Saif has predicted that the Aqaba Gas Port

and the power generation sector would experience a "quantum leap" that will not only cover

Jordan’s needs for electricity, but might also result in a surplus that can be exported to Egypt,

which suffers a scarcity of gas.

Saif told Jordan News Agency,

Petra, that it was agreed,

during the Jordanian-Egyptian

Higher Committee joint

meetings held recently in

Amman, that the Egyptians

could benefit from a gas

surplus, which the Kingdom

now imports.

With regard to using gas to

generate electricity, Saif said:

"Absolutely. It's cheaper than

the use of heavy fuel oil and

diesel, especially in light of

global oil prices, as it is

environmentally cleaner and

more efficient. "

He also pointed to the

possibility of expanding the use

of imported natural gas for industry, hospitals, hotels and houses, after preparing the necessary

infrastructure. Aqaba Gas Port is set up to import liquefied natural gas and petroleum gas, which

is used in residential homes, he explained.

The minister added that the efficiency of the energy sector has recently increased and the cost of

renewable energy production has dropped. He noted that there is an urgent need to complete the

Green Corridor to expand the electricity transmission network's ability to absorb the productive

capacity of renewable energy.

The Green Corridor of Jordan is a sustainable agro forestry project that calls for the planting of

millions of native trees to create a permanent band of greenery from one end of the country to the other.

In this regard, Saif said that the ministry has secured funding for the project through a soft loan of

more than 100 million Euros and a tender will be issued before the end of this year to improve the

capacity of the network in the southern regions.

As for the oil pipeline with Iraq, the minister explained that Jordanian technical committees

participated in meetings in Baghdad to discuss this issue and returned to Amman a few days ago,

stressing that the Iraqis showed much flexibility on the subject of building the pipeline, which will

carry oil through Jordan to the port of Aqaba and from there abroad.

He noted that the pipeline is a mutual strategic interest of both countries and the project's

technical studies have been completed. Also, an alternative path for the project, along the border

with Saudi Arabia, are now being examined.

6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 6

Reliance Power to set up $3bn plant in Bangladesh

Gulf Times + NewBase

Reliance Power said yesterday that it will set up a 2mn tonnes per annum floating natural gas

(LNG) import terminal and a 3,000 megawatt power plant in Bangladesh. A Memorandum of

Understanding (MoU) to this effect was signed by Reliance Power “during Prime Minister

Narendra Modi’s visit to Dhaka”, on his two-day official tour to the country, the company said in a

stock exchange filing here.

Reliance Power will use the

equipment it had contracted for its

Samalkot project in Andhra Pradesh

for setting up the power plant in

Bangladesh in three years from the

date of signing the power purchase

agreement (PPA).

The company was earlier

implementing a 2,400 MW gas-based

power project at Samalkot in Andhra

Pradesh, which has got stalled owing

to lack of supplies of allocated gas

from Reliance Industries’ KG-D6

block.

The equipment will be under appropriate warranties from General Electric (GE), USA and the

other global suppliers “Reliance is proposing to utilise these brand new equipment from Samalkot

project, including advanced class 9FA machines supplied by GE, for the proposed project at

Bangladesh, under appropriate warranties from GE and the other equipment suppliers. This will

help set up the project on a fast-track basis,” the statement said.

The equipment for the project has been procured and is ready with the company, it added.

Reliance Power will invest $3bn in an integrated facility comprising a 3,000 MW LNG-based

combined cycle power plant and an LNG terminal with a floating storage and regasification unit

(FSRU), making it the largest foreign investment in Bangladesh, it said.

The Bangladesh Power Development Board (BPDB)

will provide land for the project, the statement added.

The FSRU terminal shall be set up at Maheshkhali

Island in Cox’s Bazar district of Bangladesh.

“The project can be set up quickly and can power the

country’s rising demand for electricity and will provide

clean and green power,” the statement said. The

project is in line with Bangladesh’s master plan of

2010 for meeting the country’s growing power

demands as well as to supplement domestic gas reserves in the country.

India’s Prime Minister Narendra Modi shakes hands with Bangladesh’s Prime Minister Sheikh Hasina at Shahjalal

International Airport in Dhaka. Reliance Power said yesterday that it will set up a 2mn tonnes per annum floating

7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 7

Baker Hughes: Rigs in May down from end to end

Baker Hughes Incorporated announced today that the international rig count for May 2015

was 1,158, down 44 from the 1,202 counted in April 2015, and down 192 from the 1,350

counted in May 2014.

The international

offshore rig count for May

2015was 284, down 16

from the 300 counted

in April 2015, and down

42 from the 326 counted

in May 2014.

The average U.S. rig

count for May 2015 was

889, down 87 from the

976 counted in April

2015, and down 970

from the 1,859 counted

in May 2014.

The average Canadian

rig count for May

2015 was 80, down 10

from the 90 counted in April 2015, and down 82 from the 162 counted in May 2014.

The worldwide rig count for May 2015 was 2,127, down 141 from the 2,268 counted

in April 2015, and down 1,244 from the 3,371 counted in May 2014.

8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 8

Oil Price Drop Special Coverage

Oil prices rise after Opec keeps low output target

Reuters + NewBase

Oil prices rose on Friday, breaking a two-day losing streak, after Opec ministers maintained their

existing oil production target for another six months at a level below current output.

Speaking on his way out of Opec’s biannual ministerial meeting in Vienna, Saudi Arabia's oil

minister Ali Al-Naimi said the 12-member group had agreed to maintain their production target at

30 million barrels per day (bpd).

The Organization of the Petroleum Exporting Countries (Opec) had rolled over its target, he said.

Opec has been pumping over 31.2 million bpd in recent weeks, a Reuters survey has shown with

Saudi Arabia production near record levels.

Brent crude oil for July rose 80 cents to a high of $62.83 before easing back to around $62.40 by

1150 GMT. US crude futures were up 30 cents at $58.30. A trader at a large London house said

there was some relief that Opec had not raised its output target to reflect current production, a

possibility raised by some officials.

But the market remained oversupplied.

"The decision was pretty much in line with the consensus expectations," said Olivier Jakob at

Swiss consultancy Petromatrix in Zug. "It does not really change anything from the current market

situation."

Andy Brogan, Global Oil & Gas Transactions Advisory Services Leader at EY, said:

"If this morning has taught us anything it is that the journey back to a high oil price world will be a

9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 9

long one if it happens at all," he said. Oil prices tumbled 5 percent in the previous two sessions as

investors expected world oversupply to continue.

With oil prices having rebounded by more than a third after hitting a six-year low of $45 a barrel in

January, Opec officials in Vienna saw little reason to tinker with what they see as a successful

production strategy.

Lower oil prices have helped support growth in fuel consumption and put a damper on the US

shale boom.

Prices in last week vs. Opec output target

World oil prices slid last week as Opec decided against cutting its output target, while a boost for

the dollar. Oil Prices fell throughout the week on expectations that the Organisation of Petroleum

Exporting Countries would maintain its crude oil output ceiling, which turned out to be the case

following a meeting on Friday.

Opec stuck to its strategy of preserving market share faced with cheaper competition from the US

shale energy boom. Opec, which has traditionally defended price levels by cutting output if

needed, dramatically switched strategy last November when it opted to leave production

unchanged—despite a dramatic oil price collapse that slashed revenues for its members.

Member countries however declared this week they would be happier with higher prices than is

currently the case, to between $75 and $80 a barrel, to boost revenues and help their public

finances. Opec is also mindful however that high prices can weigh on economic growth.

“Yesterday’s Opec meeting did nothing to help oil prices push higher after Opec oil ministers held

production quotas at current levels of 30mn bpd,” said Michael Hewson, chief market analyst at

traders CMC Markets UK.

By Friday on London’s Intercontinental Exchange, Brent North Sea crude for delivery in July slid to

$61.15 a barrel from $64.35 a week earlier. On the New York Mercantile Exchange, West Texas

Intermediate (WTI) or light sweet crude for July dropped to $57.54 a barrel from $58.52 a week

earlier.

The OPEC Role

The last time Opec met, its decision to leave output unchanged cast doubt on the group’s

relevance.That was a little premature.

From the ministers’ market-moving comments to the array of oil executives gathered in Vienna to

court new ventures, the Organisation of Petroleum Exporting Countries showed no loss of stature

in the run-up to Friday’s meeting, at which it again decided to maintain its current output target.

While Opec has ceded the role of adjusting supply to balance the market, its strategy of keeping

up production is still driving prices lower now - and possibly higher later on.

“Reports of their death are greatly exaggerated,” Harry Tchilinguirian, head of commodity markets

strategy at BNP Paribas in London, said in an e-mail. “Opec is still relevant because by driving

down prices, and crowding out investment in higher-cost basins, they are sowing the seeds of the

future price rally.”

10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 10

Brent crude, the global benchmark, rose 2.1% to $63.31 a barrel on Friday, compared with

$108.79 a year ago. It was down 3.4% last week. West Texas Intermediate crude, the US,

benchmark rose 1.9% to $59.13 on Friday.

Historically, Opec - led by its largest member, Saudi Arabia - would curtail output to lift prices,

playing the role of a swing producer. But the unprecedented surge of US shale oil output sparked

a battle for market share with, and within, the 12-nation group. Opec is trying to squeeze out

higher-cost producers.

“They’re still holding meetings, but if the meetings are not about controlling output, then they don’t

matter in the same sense that they’ve mattered for 40 years,” said George Perry, a senior fellow in

Washington at Brookings Institution. “Now they’re just trying to force someone else to do the

cutting.”

Opec lost the ability to control prices because of internal divisions and the rise of shale, Francisco

Blanch, Bank of America Corp’s New York-based head of global commodity research, said in an

e-mail.

“It’s too early to write the obituary for Opec,” Ed Morse, Citigroup Inc’s New York-based head of

global commodities research, said by phone. The Saudis “chose to collapse oil prices, but they did

it as a defensive measure.”

Ali al-Naimi, the Saudi oil minister, said on June 1 that the strategy is working. There are signs

he’s right: The number of rigs drilling for oil in the US plunged 60% since October to the lowest in

almost five years; shale production started falling in May; and drillers’ stocks underperformed the

broader equity market.

Yet the gambit has been costly for Opec, too. Saudi Arabia burned through currency reserves at a

11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 11

record pace. And prices are too low for most member countries to break even, according to the

International Monetary Fund and ING Bank.

“The strategy failed to bring frackers to their knees and has been hugely costly to Opec,” Giovanni

Staunovo, a Zurich-based analyst at UBS AG, said by phone. “They still matter, but they are not

anymore the swing producer so they have a different role now than before.”

12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 12

Volatility likely to prevail for some time to come

SG+ Syd Rashid Hussain+NewBase

WHILE some clamoring to cut output, and others speculating that the ministers could even opt for

raising the production bar, the Opec ministers' last Friday decided to adopt - rather consensually -

a 'wait and see' strategy by rolling over its current target of 30 million barrels per day (bpd) - for at

least until December.

And despite conflicting interests, interestingly enough, the ministerial was short and pleasing. 'You

would be surprised to see how pleasing this meeting was,' a visibly relieved Saudi Oil Minister Ali

Al-Naimi asserted in the end while announcing the outcome of the much-awaited, and indeed

followed, Opec moot.

Ahead of the meeting, some, including Morgan Stanley and Barclays Plc analysts, have been

speculating that the ministers might resort to even increase the output target, so as to

accommodate incremental production from Iraq, Libya and post-sanction Iran.

Opec however opted not to go this way and spring surprises - at this stage. Crude producers are

confronted with a number of issues.

With weakening oil markets, the pain within the producers' group is more than visible. Despite the

call on oil revenues growing in most member states, Opec crude revenues are set to fall by 46%

this year - to around $446 billion, the Energy Information Administration is estimating.

And then there is a growing speculation that the output of some key Opec members is also set to

go up - sooner rather than later. Iranian Oil Minister Bijan Zanganeh appeared confident in

Vienna that his country will pump an additional 1 million barrels per day (bpd) of crude within

months of nuclear sanctions being lifted by the West.

Zanganeh insisted in Vienna that Iran could bring around half a million barrels of oil per day to the

market within the next one or two months, upping that to around 1 million per day for exports over

the next 6 months (of the lifting of the sanctions).

13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 13

A flood of Iranian crude into an already oversupplied market would certainly exert overwhelming

downward pressure on oil prices, most agree. Zanghaneh however, differed.

"I don't believe we will witness a new fall in the oil price in the market (when additional Iranian

crude enters the market), but the main issue for us, I should emphasize, is to achieve the

traditional market share of Iran in the oil market," he told CNBC in Vienna.

Not everyone is however is optimistic on that count. Bill Farren-Price of Petroleum Policy

Intelligence is of the view that the influx of Iranian oil could have a rather big impact on prices.

"I think that is going to be the big question whether Iran can actually deliver these barrels, whether

the deal is done by the end of June, but I do expect Iran will come back – it's got a lot of oil in

storage that will be released, they may make a bit of a splash when they start up again and that

could have a big impact on the market certainly," Farren-Price told CNBC.

Libya too hopes to double production to some 1 million bpd by September if key ports resume

working. However, many are still skeptic about its full return to normalcy as all past efforts have

failed to deliver a sustained recovery in shipments.

And Baghdad is not far behind either. Iraq is also endeavoring to increase its crude output.

Speaking about Iraq's oil output, Iraqi Oil Minister Adel Abdel Mahdi said: "We are less than our

normal production.

Last year exports should have been 3.4 million bpd, this year it should have been 3.3 million bpd,

we are still below this." And then he stressed: "I think we should be approaching 3.2 million bpd

within 2-3 months," adding Iraq was capable of producing at least 6 million barrels per day by

2020.

However, many within Opec are still of the view that the possibility of additional crude from within

its ranks is still considerably away.

“When (the additional) production comes, this matter will settle itself,” one OPEC delegate told

Reuters. That may not occur until 2016, according to analysts questioning how quickly Tehran will

win relief from sanctions and be allowed to sell more crude.

And thus the market reaction to Opec move was bearish. Oil in New York headed for the first

weekly decline as Opec moved to maintain its crude production target, leaving the market

oversupplied.

West Texas Intermediate oil for July delivery dropped 99 cents, or 1.7 per cent, to $57.01 a barrel

at 9:36 a.m. on the New York Mercantile Exchange. It has decreased 5.5% this week, set to snap

a record 11-week rally. It was trading above $60 earlier this week.

Brent for July settlement decreased 95 cents, or 1.5%, to $61.08 a barrel on the London-based

ICE Futures Europe exchange. The contract is down 6.9 per cent this week. The European

benchmark crude traded at a $4.06 premium to WTI, down from $5.26 at the end of last week.

The growing market glut is also fueling spare capacity debate. Despite being a capital intensive

industry, persistent market glut and the gloomy mid-term horizon, seems brewing reluctance in the

industry to invest in the sector in a big way.

14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 14

The scenario has slammed strong brakes on the much required global investment in the sector -

sowing the seeds of another supply squeeze and market upheaval some time in near future.

When Oil Minister Naimi was asked about the possible Saudi investment in the sector to boost the

kingdom's capacity and hence the global spare cushion, he had a quick answer: 'show me the

return.'

And then he quipped: "Is there demand for Saudi crude? Can you guarantee it? If I go and put a

dollar, will you guarantee that I would get 10 percent on that dollar?" He then added: "I don't want

16 percent, just 10 - can you guarantee that?"

In the meantime, Abu Dhabi's quest to take it capacity to a record 3.5 million bpd, has also been

delayed by at least another year, Abu Dhabi National Oil Co (Adnoc) officials were quoted as

saying.

With a current capacity of about 3 million bpd, the company was targeting an increase of 500,000

by the end of 2017. The company will now probably add the final 100,000 barrels of daily

additional capacity in 2018, Qasem Al Kayoumi, the offshore exploration chief at Adnoc told a

conference in Abu Dhabi recently.

This lowering spare cushion and the application of breaks on a number of capacity expansions

projects do not bode well for the long-term stability of the markets, one could say with some sense

of conviction. Volatility seems to be in the driving seat - for some time to come!

15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 15

North Dakota refuses to flinch as Opec keeps output high

Reuters + NewBase

Oil executives in North Dakota, a Centre of the US shale revolution, say Opec made a

questionable bet when it decided on Friday to stick with a policy that aims to push higher cost

American producers out of the market by keeping output high.

Here, in the top US oil state after Texas, oil companies have slashed costs over the last seven

months to reach fighting weight — one that will allow them to profit despite the more-than 40 per

cent drop in prices over the past year and solidify the new American role as the world’s swing

supplier.

The policy Opec first adopted in November has brought stress, but not catastrophe. Oil companies

say they have recalibrated their operations to survive even if prices stay lower for a long while.

“High commodity prices hide a lot of inefficiencies in the system,” said Tommy Nusz, chief

executive of Oasis Petroleum Inc, which pumps about 58,000 barrels per day in North Dakota.

“Most companies will come out of this cycle stronger.” Indeed, while the number of North Dakota

drilling rigs has plunged sharply so far this year — the count sat at 81 on Friday, down from 146 in

early February — the state’s oil production has proven resilient.

Output fell slightly in January and February, but jumped in March, highlighting the potential of

shale wells to ramp up or down quickly, regardless of the group’s actions. “Opec still is our main

competition,” Lynn Helms, head of North Dakota’s Department of Mineral Resources and the state

oil industry’s main regulator and promoter, said in an interview.

“But what you’re seeing now is the Bakken becoming the swing producer, something that has

happened relatively quickly because of efficiencies in drilling and completion technology.” Saudi

Arabia, Venezuela and the 10 other Opec members have, for their part, seen their strategy of the

past half year as successful. Saudi Arabian oil minister Ali al-Naimi and others described Friday’s

meeting as “amicable,” and showed little sign of wanting to change an approach that has

dampened the US.

16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 16

shale boom.

WPX Energy Inc, which pumps about 37,000 barrels per day from North Dakota, said oil prices

around $40 per barrel are too low, though $100 prices could be too high and that OPEC’s moves,

among other market factors, will help set a “happy medium.” “This is the new reality, and it’s

driven positive change at WPX and made us more efficient,” said WPX Energy spokesman Kelly

Swan.

Whiting Petroleum Corp, the state’s largest oil producer, and EOG Resources Inc declined to

comment on OPEC’s decision.

Continental Resources Inc and Hess Corp did not respond to requests for comment.

Helms, the state oil regulator, said North Dakota producers are reacting to a “new normal” reality

where they are the new global oil swing producers, constantly needing to react to the “Bakken

call.” With about 1.2 million barrels of oil produced each day in the state, North Dakota output may

actually be exceeding what the world needs, Helm said, pegging the demand from the state at

roughly 1.1 million barrels per day.

“I think that’s reflected in the price weakness and the amount of oil that’s in storage,” Helms said.

North Dakota and other US oil-producing regions likely won’t see production slip moving forward,

but rather see the rate of growth ebb, said Ann-Louise Hittle, lead oil market analyst at Wood

Mackenzie.

“From OPEC’s perspective, the strategy is working,” Hittle said. “But they can also act as a price-

supportive player, which in the long run can only help North Dakota.”

17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 17

NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE

Your partner in Energy Services

NewBase energy news is produced daily (Sunday to Thursday) and

sponsored by Hawk Energy Service – Dubai, UAE.

For additional free subscription emails please contact Hawk Energy

Khaled Malallah Al Awadi,

Energy Consultant

MS & BS Mechanical Engineering (HON), USA

Emarat member since 1990

ASME member since 1995

Hawk Energy member 2010

Mobile: +97150-4822502

khdmohd@hawkenergy.net

khdmohd@hotmail.com

Khaled Al Awadi is a UAE National with a total of 25 years of experience in

the Oil & Gas sector. Currently working as Technical Affairs Specialist for

Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy

consultation for the GCC area via Hawk Energy Service as a UAE

operations base , Most of the experience were spent as the Gas Operations

Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility &

gas compressor stations . Through the years, he has developed great

experiences in the designing & constructing of gas pipelines, gas metering & regulating stations

and in the engineering of supply routes. Many years were spent drafting, & compiling gas

transportation, operation & maintenance agreements along with many MOUs for the local

authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE

and Energy program broadcasted internationally, via GCC leading satellite Channels.

NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE

NewBase 07 June 2015 K. Al Awadi

18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 18