Forex In Practice Lecture & Ch 19 & 20 (Final Modified Fall 2007

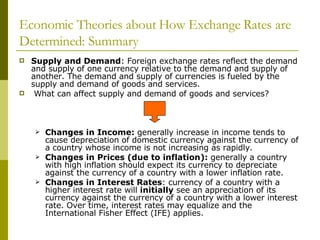

- 1. Economic Theories about How Exchange Rates are Determined: Summary Supply and Demand: Foreign exchange rates reflect the demand and supply of one currency relative to the demand and supply of another. The demand and supply of currencies is fueled by the supply and demand of goods and services. What can affect supply and demand of goods and services? Changes in Income: generally increase in income tends to cause depreciation of domestic currency against the currency of a country whose income is not increasing as rapidly. Changes in Prices (due to inflation): generally a country with high inflation should expect its currency to depreciate against the currency of a country with a lower inflation rate. Changes in Interest Rates: currency of a country with a higher interest rate will initially see an appreciation of its currency against the currency of a country with a lower interest rate. Over time, interest rates may equalize and the International Fisher Effect (IFE) applies.

- 2. Economic Theories about How Exchange Rates are Determined: Summary Investor psychology and “bandwagon” effects: people can influence exchange rates through their involvement in the foreign exchange market (speculative actions, capital flight). Actions of government: actions to influence international trade and investment and monetary and fiscal policies which will impact employment, income growth, inflation, and interest rates.

- 3. Foreign Exchange Issues: International Trade and FDI Selected topics in lecture and selected topics from Chapter 10 (pages 357-361) Foreign Exchange Chapter 19 (pages 650-660) Accounting Chapter 20 (pages 681-682) International Financial Management

- 4. Forex Issues: International Trade & Foreign Direct Investment Recall→ International Trade occurs when a company in one country sells its goods or services to consumers in another country. Foreign Direct Investment occurs when a company invests money, resources, time, etc. in productive business operations in another country. Companies will convert one currency into another currency using the foreign exchange market in order to execute transactions of paying or receiving payments involved in international trade and foreign direct investment. Foreign exchange risk is the likelihood that unpredictable or unexpected changes will adversely affect the value of transactions involved in international trade and foreign direct investment. One method to hedge against uncertainty, especially if home currency is expected to depreciate, is to secure forward contracts to lock in exchange rates for currencies required in future transactions.

- 5. Your bid of US $10,000 for one of the two Maseratis for sale EXAMPLE: FORWARD was accepted by CSUEBAY. You can take delivery now or in thirty days. You check both Spot and the Forward exchange EXCHANGE CSUE B AY rates to decide when you want to take delivery. What will you do? Recall→ Forward exchange contract: An agreement to buy/sell a foreign currency for future delivery at a price set now (the quot;forward exchange ratequot;). Purpose: to hedge against the possibility that future exchange movements will make a transaction unprofitable by the time that transaction has been executed. Discount on forward: the spot rate is stronger than the forward NOW rate (the target currency as valued by the forward rate is weaker than the spot rate); the 30 DAYS expectation is that the currency is depreciating. Premium on forward: the spot rate is weaker than the forward rate (the target currency as valued by the forward rate is stronger than the spot rate);the expectation is that the currency is appreciating.

- 7. Selected Issues in Foreign Exchange and International Trade Export Pricing Strategies to Manage International Trade in the face of changing exchange rates Level of Pass-Through Impacts on Consumers

- 8. Forex and Export Pricing Export pricing, as one of the fundamental components in International Trade, can be impacted by exchange rate fluctuations. One of the most basic and major decisions in International trade is how to price products and services. Examples of basic questions: Should a company price products and require payment in domestic currency or foreign currency? When there are exchange range fluctuations, how do you manage your international trade? ? Or

- 9. Impacts of Forex on International Trade Recall→ what the impact of the current value of a domestic currency is on International Trade: Domestic currency is appreciating: imports increase because foreign goods are less expensive and exports decrease because they cost more to foreigners. (country’s exports are less competitive) Domestic currency is depreciating: exports increase because domestic goods cost less for foreigners and imports decrease because they cost more to local consumers in the domestic market. (country’s exports are more competitive)

- 10. Export Management & Price Strategies in relation to Foreign Exchange When Domestic Currency is When Domestic currency is strong (appreciating) weak (depreciating) In order to remain competitive, Emphasize price benefits. emphasize non price product Expand product line and characteristics, such as quality, more-costly features. delivery, after sale service, etc. Shift sourcing and manufacturing to domestic Seek vigorous cost reductions market. through more efficient Exploit export opportunities operations and distribution in all markets. systems. Use conventional cash-for- Shift sourcing and goods trade. manufacturing overseas. Use full-costing approach Deal in counter trade with weak- but marginal cost approach currency countries or accept to penetrate payments in foreign currencies. new/competitive markets. Accept lower profit margins and use marginal-cost pricing when possible. Extracted and restated from: Chapter 71 Levy, Frerichs, and Gordon, eds. Marketing Manager’s Handbook, Dartnell Corporation, Chicago, IL. Fig 2.

- 11. M2 CALLS IN: PASS THROUGH OR NO PASS? M2: Hello, HQ 4670? This is M2. We have a situation you need to follow-up on. I am at our diamond supplier in Randia (a country in Africa) inspecting samples of the diamonds we have purchased under contract with payment and pricing in randos at time of delivery.” A big shipment of those special “blue” diamonds is coming in to the U.S. so that our company can sell them for Valentine’s Day. The exchange rate of Randian randos (RO) to US $ has appreciated since our last meeting where we talked about these special “blue” diamonds. As you might recall, we wanted to hit the mass market with these blue diamonds and price these out competitively to get more market penetration/recognition in order to set up the market for our big June diamond wedding ring promotion. Our Marketing people need to determine what % of Pass-Through we are going to allow. Are we going to Pass-through or not?

- 12. Pricing Issues in International Trade: Exchange Rate Pass-Through Pass-through: the degree to which the prices of imported and exported goods change as a result of exchange rate changes. (Will prices be changed to include or reflect exchange rate changes?) Pass-through? Or no Pass-through? The degree to which exchange rates fluctuations are “passed through” to product pricing depends on the price elasticity of a given product.

- 13. Pricing Issues in International Trade: Exchange Rate Pass-Through Remember that a price is considered elastic if the quantity of demand for a product changes significantly when there are price changes. Remember that a price is considered inelastic if the quantity of demand for a product does not change significantly when there are price changes.

- 14. Pricing Issues in International Trade: Exchange Rate Pass-Through Generally speaking, if a product is relatively price inelastic, it may often have a high degree of pass- through. The higher price of certain products may not have any noticeable impact on the quantity demanded by consumers, so a company can “pass- through” (passing on to the consumer the burden of the foreign exchange rate fluctuation) the increase (or decrease) in price. If, however, products do have price elasticity, their demand may be impacted by changes in prices due to foreign currency fluctuation. The degree of pass- through may be considerably less, depending on how much the consumer market can sustain.

- 15. Other Factors impacting Pricing and Pass-Through Decisions Government actions and regulations Productivity and production capacity of a county Sophistication of product development and quality of marketing techniques Unique characteristics of a particular industry

- 16. Pricing Issues in International Trade: Exchange Rate Pass-Through Example: Blue diamonds from Randia When blue diamonds from Randia are exported from Randia to the U.S., the price should be: P ROBDR x S = P$BDR where P$BDR is the price of Blue diamonds from Randia in dollars, P is the price of Blue diamonds from Randia in RO BDR randos and S is the current spot exchange of the number of U.S. dollars per Rando.

- 17. Pricing Issues in International Trade: Exchange Rate Pass-Through Example: Blue diamonds from Randia Let’s assume that the price of the Blue Diamond in dollars is as follows based on exchange rate of US$ 2 /rando: P ROBDR x S = P$BDR RO 200 x US$ 2 = US$400 What happens to the price of the Blue Diamonds in dollars if the Rando appreciates by 20%? (i.e. U.S.$ depreciates by 20%). What happens to the price of the Blue Diamonds in dollars? The exchange rate is now US$2.40/rando. RO 200 x US$2.40 = US$480 The company must decide if it can pass the change in the dollar/rando exchange rate on to the consumer or if it can absorb it in costs. If the company decides that it can only ask customers to pay a price of US$460, what is the rate of pass-through?

- 18. Pricing Issues in International Trade: Exchange Rate Pass-Through Example: Blue diamonds from Randia, with 20% appreciation of rando price: P ROBDR x S = P$BDR 200 x US$2.40 = US$480 The company will price at US$ 460. What is the Rate of pass-through? 1) Determine Rate of increase in price in country doing the importing: P$BDR2/ P$BDR1 US$460 ÷ US$400 = 1.15 or, in other words a 15% increase in the U.S. price of Blue Diamonds from Randia. 2) Compare percentage increase of new price of import is to % increase (or decrease) of exporting country currency. 15% ÷ 20% = .75 or a Pass-through of 75%

- 19. Example of Pricing decision due to foreign exchange rate PASS-THROUGH WITH A REDUCTION IN PRICE

- 20. Examples of Pass-Through Levels Levels of Pass-Through vary by industry, product, country, etc. If you are a company and must face changes in exchange rates, you must consider what is going on in specific product markets and industry trends, not as much what is going on in the overall economy. c. 1988 Source: Exchange Rates and Pass-Through

- 21. To Pass-Through or Not Pass- Through—that is the question The Impacts of Pass-Through decisions If a company changes prices in response to fluctuations in the exchange rate, the decision can have a big impact on price competitive and effectiveness (depending on elasticity or inelasticity of the product or services being traded) If a company does not change prices in response to fluctuations in the exchange rate, the decision can have a big impact on the profitability of a product line, export sales, etc.

- 22. Other Impacts of Forex fluctuation Fluctuations in Forex can impact markets/consumers in other ways. An error in accounting.

- 23. Foreign Exchange Issues in Foreign Direct Investment Foreign Exchange Issues in Foreign Direct Investment involve issues related to the foreign exchange risk which can affect the value of normal transactions of making or receiving payments (as in international trade), change the effect of transferring cash and profits among subsidiaries, and change the long-term value of these investments. Selected Foreign Exchange Issues in FDI include: Foreign Exchange Exposures Transfer Pricing Budgeting and Control systems

- 24. Issues in Foreign Direct Investment: Types of Foreign Exchange Risk (Chapter 10) Managing Foreign Exchange Issues Risk that future unpredictable changes in a country’s exchange rate will hurt the firm. Transaction exposure: extent to which income from transactions is affected by currency fluctuations. Translation exposure: impact of currency exchange rates on consolidated results and balance sheet. Economic exposure: extent to which a firm’s future international earning power (from future prices, sales and costs, etc ) is impacted by currency fluctuations.

- 25. Transaction Exposure Transaction exposure: risk of gain or losses in cash flows which come from contractual obligations due to changes in foreign exchange rates. (critical issue in both International Trade and Foreign Direct Investment) Buying goods or services whose prices are in foreign currencies Selling goods or services whose prices are in foreign currencies Borrowing or lending funds requiring payment in foreign currencies

- 26. Translation Exposure Translation Exposure ( also known as Accounting Exposure): Risk that the conversion of financial statements expressed in foreign currency to parent’s reporting currency for consolidation purposes will result in an adverse change in a parent’s net worth and reported net income. Subsidiaries of multinationals are separate legal entities but not separate economic entities. Accounting information about a group of companies that recognizes economic interdependence (subsidiaries) must be “translated” into a common currency to generate consolidated statements.

- 27. Translation Exposure Management of FDI’s is also made more complicated due to national differences in accounting systems and methods. Comparability of financial reports is made more difficult as a result. The International Accounting Standards Board (IASB) is working on harmonizing accounting standards across countries. Current estimate is that no new major standards will be effective before 2009. Preparing consolidated financial statements is the norm for multinational corporations. It is necessary to get an overall “big picture” of how the MNC is doing as a business entity.

- 28. Translation Exposure Transactions among members of a corporate family not included in consolidated financial statements. Only assets, liabilities, revenue and expenses statements with external trade parties are shown. If financial statements of a subsidiary’s activities are prepared in the local currency, they have to be converted into the currency of Multinational’s home country in order to be included in the consolidated accounts of the Multinational Corporation. Basic question: Is foreign affiliate an integrated entity (uses parent company currency as currency of operation [functional currency] ) or is it a self-sustaining entity which uses local currency as currency of operation [functional currency]?

- 29. Translation Exposure If a different exchange rate is used for different items on an individual financial statement, an imbalance may result. Translation methods identify what exchange rate is to be used to remeasure each individual balance sheet and income statement item and also indicate where any imbalances are to be recorded. Companies can use two main methods (there are others) to determine what exchange rate should be used when translating financial statements: Current Rate Method Temporal Method

- 30. Currency Translation The current rate method: Exchange rate at the date on the balance sheet is used to translate foreign subsidiary financial statements into home country currency. Incompatible with ‘historic cost principle’, used in U.S., Germany, Japan, and other countries. This principle assumes that currency unit used in reporting is not losing/gaining value due to inflation. (e.g. purchase of land) Gains or losses due to currency translation adjustments are not included in consolidated net income but are accumulated in a separate equity account (CTA = cumulated translation adjustment)

- 31. Currency Translation The temporal method: Translates foreign subsidiary assets into home-country currency at the time of purchase of the asset. Changing exchange rates may mean the balance sheet may not balance. Translation adjustments are carried in the current consolidated income, not to equity reserves, thus introducing more volatility into income statements.

- 32. Current U.S. Practice Statement 52 “Foreign Currency Translation” Self-sustaining autonomous subsidiary: Functional currency is local currency. Balance sheet uses exchange rate at end of financial year. Income statement is financial year average. Integral subsidiary: Functional currency is US currency. Financial statements use the temporal method. Dangling credit or debit increases or decreases consolidated earnings for the period.

- 33. Current U.S. Practice SOURCE: Eitman, David K., Stonehill, Arthur L., Moffet, Michael H. MULTINATIONAL BUSINESS FINANCE. Addison Westley: New York, 2001. p.92

- 34. Reducing Transaction & Translation Exposure Secure Forward Exchange contracts and currency swaps Apply lead and lag strategies: accelerate outflows from weak-currency to strong currency countries and delay inflows from strong-currency to weak countries. Lead strategy: collecting foreign currency receivables early when currency devaluation is anticipated and paying foreign currency payables early when currency may appreciate. Lag strategy: delaying foreign currency receivable collection when anticipating currency appreciation and delaying foreign currency payables when currency depreciation is expected.

- 35. Example: Lead & Lag Companies tries to minimize foreign exchange problems through Lead [early] and Lag [late] strategies. LEAD: If U.S. company has a receivable in foreign currency (100 FX) and that foreign currency is expected to depreciate: current rate: 2 FX/1US$ = US$50.00 expected rate: 5FX/1US$ = US$20.00 If U.S. company has a payable in foreign currency (100 FX) and that foreign currency is expected to appreciate: current rate: 5FX/1US$ = US$20.00 expected rate:2FX/1US$ = US$50.00 LAG: If U.S. company has a receivable in foreign currency (100 FX) and that foreign currency is expected to appreciate: current rate: 5FX/1US$ = US$20.00 expected rate:2FX/1US$ = US$50.00 If U.S. company has a payable in foreign currency (100 FX) and that foreign currency is expected to depreciate: current rate: 2 FX/1US$ = US$50.00 expected rate: 5FX/1US$ = US$20.00

- 36. Reducing Economic Exposure Economic exposure (also known as economic, competitive, strategic exposure): more long term, has to do with the risk of change in the present value of the firm resulting from changes in future operation cash flows. Reduce Economic exposure: Implement operating policies which serve to protect the company. e.g. Establish re-invoicing centers which function as a management center for all currency exposure Seek diversification in strategy: distribute productive assets to various locations so firm is not severely affected by exchange rate changes. e.g. Japanese automobile makers shift in production locations

- 37. Reducing Economic Exposure Reduce Economic exposure: Seek diversification in financing and investment: e.g. Seek out financing in global capital markets to take advantage of different exchange rates and interest rates; e.g. Retain earnings in different currencies and repatriate when conditions are most favorable.

- 38. FOREX & FDI: Transfer Pricing Transfer price is the price set for goods and services “transferred” intracompany. Transfer prices can introduce significant distortions into the control process. Transfer price must be taken into account when setting budgets and evaluating a subsidiary’s performance.

- 39. FOREX & FDI :Transfer Pricing The manipulation of transfer pricing can be used to gain advantage for multinational corporation. Transfer pricing is a way of positioning funds within a multinational company. Move founds out of country by setting high transfer fees or into a country by setting low transfer fees Movement can be within subsidiaries or between the parent and its subsidiaries There are several areas in which companies can gain advantage: Reduce tax liabilities by using transfer fees to shift from a high- tax country to a low-tax country. Reduce foreign exchange risk exposure to expected currency devaluation by transferring funds. Use to move funds out of a foreign country where dividends are restricted or blocked by host-government policy. Reduce import duties (ad valorem) by reducing transfer prices and the value of the goods.

- 40. FOREX & FDI :Transfer Pricing Few governments like it. Believe (rightly) that they are losing revenue. Has an impact on management incentives and performance evaluations. Inconsistent with a ‘profit center’. Managers can hide inefficiencies.

- 41. FOREX & FDI: Budget and Control Systems Most multinational businesses require that their foreign units submit budgets and performance goals which are expressed in the corporate currency, normally the home currency of the company. This brings up several issues: Which exchange rates should be used to prepare the budgets and compare actual to budgeted results? Transfer prices must be taken into account when setting budgets and evaluating a subsidiary’s performance. How do you evaluate performance of foreign subsidiaries when there is large volatility in exchange rates which can impact financial performance numbers being reported.

- 42. General Guidelines for Policies to Manage Forex Exposure Enforce a valid annual budget process which includes: Joint determination and agreement by Head office and subunit management about subunit goals for the coming year. Continual monitoring of subunit performance against agreed goals. If goals not met, analysis, identification of reasons for shortfall and determination and implementation of corrective actions when appropriate. Make a distinction between valuation of a subsidiary and the evaluation of the subsidiary manager. Manager’s evaluation should take into consideration how hostile or benign the country’s environment is for business and make allowances over items for which the manager has no control, e.g. inflation or interest rates, exchange rates.

- 43. General Guidelines for Policies to Manage Forex Exposure Multinational Corporations with foreign units should follow basic guidelines. Maintain central control of exposure. Distinguish between transaction, translation exposure and economic exposure. Forecast future exchange rate movements. Establish good reporting systems to monitor firm’s exposure to exchange rate changes. Produce monthly foreign exchange exposure reports.