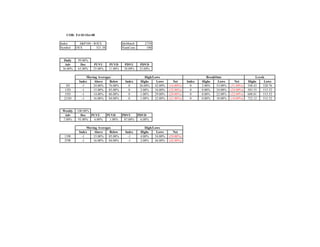

S&P, Nasdaq and Russell index performance on Oct 3, 2008

- 1. COB: Fri 03-Oct-08 Index S&P100 - $OEX IdxMatch 2729 Symbol OEX 521.38 NumCons 100 Daily 99.00% Adv Dec PUVU PUVD PDVU PDVD 36.00% 63.00% 25.00% 11.00% 38.00% 25.00% Moving Averages High/Lows BreakOuts Levels Index Above Below Index Highs Lows Net Index Highs Lows Net Highs Lows 3D -1 24.00% 76.00% 0 26.00% 42.00% (16.00%) 0 2.00% 33.00% (31.00%) 548.43 520.76 13D -1 15.00% 85.00% 0 2.00% 34.00% (32.00%) 0 0.00% 24.00% (24.00%) 583.55 515.52 55D -1 14.00% 86.00% 0 1.00% 29.00% (28.00%) 0 0.00% 22.00% (22.00%) 608.81 515.52 233D -1 16.00% 84.00% 0 1.00% 22.00% (21.00%) 0 0.00% 18.00% (18.00%) 722.12 515.52 Weekly 100.00% Adv Dec PUVU PUVD PDVU PDVD 7.00% 93.00% 6.00% 1.00% 87.00% 6.00% Moving Averages High/Lows Index Above Below Index Highs Lows Net 13W -1 15.00% 85.00% -1 4.00% 54.00% (50.00%) 55W -1 16.00% 84.00% -1 2.00% 44.00% (42.00%)

- 2. COB: Fri 03-Oct-08 Index Nasdaq100 - $NDX IdxMatch 2608 Symbol NDX--X 1470.84 NumCons 100 Daily 100.00% Adv Dec PUVU PUVD PDVU PDVD 18.00% 82.00% 14.00% 4.00% 55.00% 27.00% Moving Averages High/Lows BreakOuts Levels Index Above Below Index Highs Lows Net Index Highs Lows Net Highs Lows 3D -1 7.00% 93.00% -1 10.00% 65.00% (55.00%) -1 1.00% 57.00% (56.00%) 1584.26 1469.00 13D -1 4.00% 96.00% -1 1.00% 49.00% (48.00%) -1 0.00% 40.00% (40.00%) 1773.83 1469.00 55D -1 3.00% 97.00% -1 0.00% 43.00% (43.00%) -1 0.00% 35.00% (35.00%) 1973.56 1469.00 233D -1 7.00% 93.00% -1 0.00% 26.00% (26.00%) -1 0.00% 23.00% (23.00%) 2226.88 1469.00 Weekly 100.00% Adv Dec PUVU PUVD PDVU PDVD 3.00% 97.00% 2.00% 1.00% 86.00% 11.00% Moving Averages High/Lows Index Above Below Index Highs Lows Net 13W -1 2.00% 98.00% -1 2.00% 65.00% (63.00%) 55W -1 7.00% 93.00% -1 1.00% 42.00% (41.00%)

- 3. COB: Fri 03-Oct-08 Index S&P500 - $SPX IdxMatch 3485 Symbol SP-500 1099.23 NumCons 500 Daily 99.20% Adv Dec PUVU PUVD PDVU PDVD 25.20% 74.00% 15.40% 9.80% 47.00% 27.00% Moving Averages High/Lows BreakOuts Levels Index Above Below Index Highs Lows Net Index Highs Lows Net Highs Lows 3D -1 11.60% 88.40% -1 15.20% 54.60% (39.40%) -1 1.80% 47.20% (45.40%) 1167.03 1098.14 13D -1 6.40% 93.60% -1 1.60% 43.80% (42.20%) -1 0.00% 35.40% (35.40%) 1265.12 1098.14 55D -1 8.40% 91.60% -1 0.60% 35.20% (34.60%) -1 0.00% 28.60% (28.60%) 1313.15 1098.14 233D -1 9.80% 90.20% -1 0.40% 25.20% (24.80%) -1 0.00% 20.80% (20.80%) 1545.79 1098.14 Weekly 100.00% Adv Dec PUVU PUVD PDVU PDVD 3.80% 96.20% 3.40% 0.40% 83.40% 12.80% Moving Averages High/Lows Index Above Below Index Highs Lows Net 13W -1 7.40% 92.60% -1 1.40% 55.40% (54.00%) 55W -1 9.80% 90.20% -1 0.60% 42.00% (41.40%)

- 4. COB: Fri 03-Oct-08 Index Russell1000 - $RUI IdxMatch 3269 Symbol RUI-X 594.54 NumCons 993 Daily 99.30% Adv Dec PUVU PUVD PDVU PDVD 21.85% 77.44% 12.99% 8.86% 48.74% 28.70% Moving Averages High/Lows BreakOuts Levels Index Above Below Index Highs Lows Net Index Highs Lows Net Highs Lows 3D -1 9.16% 90.84% -1 11.28% 58.61% (47.33%) -1 1.21% 50.86% (49.65%) 634.01 593.99 13D -1 5.84% 94.16% -1 0.91% 46.73% (45.82%) -1 0.10% 38.87% (38.77%) 689.52 593.99 55D -1 8.26% 91.74% -1 0.40% 37.97% (37.56%) -1 0.00% 31.82% (31.82%) 716.82 593.99 233D -1 9.67% 90.33% -1 0.20% 26.38% (26.18%) -1 0.00% 22.36% (22.36%) 844.02 593.99 Weekly 99.90% Adv Dec PUVU PUVD PDVU PDVD 4.83% 95.07% 3.73% 1.11% 78.85% 16.21% Moving Averages High/Lows Index Above Below Index Highs Lows Net 13W -1 7.45% 92.55% -1 1.21% 56.50% (55.29%) 55W -1 9.57% 90.43% -1 0.60% 41.89% (41.29%)

- 5. COB: Fri 03-Oct-08 Index Russell2000 - $RUT IdxMatch 3272 Symbol RUT-X 619.40 NumCons 1960 Daily 98.21% Adv Dec PUVU PUVD PDVU PDVD 16.99% 81.22% 10.05% 6.94% 50.15% 31.07% Moving Averages High/Lows BreakOuts Levels Index Above Below Index Highs Lows Net Index Highs Lows Net Highs Lows 3D -1 7.91% 92.09% -1 8.78% 63.47% (54.69%) -1 0.56% 56.33% (55.77%) 676.21 619.40 13D -1 6.33% 93.67% -1 0.77% 44.95% (44.18%) -1 0.05% 38.78% (38.72%) 761.78 619.40 55D -1 14.59% 85.41% -1 0.41% 31.22% (30.82%) -1 0.05% 26.84% (26.79%) 764.38 619.40 233D -1 19.29% 80.71% -1 0.26% 16.07% (15.82%) -1 0.05% 13.62% (13.57%) 822.88 619.40 Weekly 99.90% Adv Dec PUVU PUVD PDVU PDVD 4.44% 95.51% 2.14% 2.30% 58.88% 36.58% Moving Averages High/Lows Index Above Below Index Highs Lows Net 13W -1 14.64% 85.36% -1 2.76% 36.17% (33.42%) 55W -1 19.18% 80.82% -1 1.02% 22.76% (21.73%)

- 6. COB: Fri 03-Oct-08 Index Russell3000 - $RUA IdxMatch 3268 Symbol RUA-X 635.43 NumCons 2953 Daily 98.58% Adv Dec PUVU PUVD PDVU PDVD 18.59% 79.99% 11.01% 7.59% 49.71% 30.27% Moving Averages High/Lows BreakOuts Levels Index Above Below Index Highs Lows Net Index Highs Lows Net Highs Lows 3D -1 8.30% 91.70% -1 9.58% 61.84% (52.25%) -1 0.75% 54.49% (53.74%) 679.18 634.99 13D -1 6.13% 93.87% -1 0.81% 45.55% (44.73%) -1 0.07% 38.81% (38.74%) 739.80 634.99 55D -1 12.43% 87.57% -1 0.41% 33.49% (33.08%) -1 0.03% 28.51% (28.48%) 766.82 634.99 233D -1 16.02% 83.98% -1 0.24% 19.54% (19.30%) -1 0.03% 16.56% (16.53%) 897.90 634.99 Weekly 99.90% Adv Dec PUVU PUVD PDVU PDVD 4.54% 95.39% 2.68% 1.86% 65.59% 29.77% Moving Averages High/Lows Index Above Below Index Highs Lows Net 13W -1 12.19% 87.81% -1 2.24% 43.04% (40.81%) 55W -1 15.92% 84.08% -1 0.88% 29.22% (28.34%)

- 7. COB: Fri 03-Oct-08 Index S&P400 - $MID IdxMatch 2464 Symbol MID--X 661.97 NumCons 399 Daily 99.00% Adv Dec PUVU PUVD PDVU PDVD 14.54% 84.46% 8.27% 6.27% 56.89% 27.57% Moving Averages High/Lows BreakOuts Levels Index Above Below Index Highs Lows Net Index Highs Lows Net Highs Lows 3D -1 4.76% 95.24% -1 8.52% 67.42% (58.90%) -1 0.50% 59.40% (58.90%) 727.29 661.84 13D -1 4.26% 95.74% -1 0.50% 51.88% (51.38%) -1 0.25% 44.11% (43.86%) 809.79 661.84 55D -1 10.28% 89.72% -1 0.50% 38.60% (38.10%) -1 0.00% 33.08% (33.08%) 828.09 661.84 233D -1 11.78% 88.22% -1 0.00% 20.05% (20.05%) -1 0.00% 18.05% (18.05%) 907.70 661.84 Weekly 100.00% Adv Dec PUVU PUVD PDVU PDVD 3.51% 96.49% 2.51% 1.00% 71.43% 25.06% Moving Averages High/Lows Index Above Below Index Highs Lows Net 13W -1 9.77% 90.23% -1 1.25% 46.12% (44.86%) 55W -1 11.78% 88.22% -1 0.50% 29.57% (29.07%)

- 8. COB: Fri 03-Oct-08 Index S&P600 - $SML IdxMatch 3447 Symbol SML--X 331.47 NumCons 600 Daily 99.67% Adv Dec PUVU PUVD PDVU PDVD 16.33% 83.33% 10.00% 6.33% 50.17% 33.17% Moving Averages High/Lows BreakOuts Levels Index Above Below Index Highs Lows Net Index Highs Lows Net Highs Lows 3D -1 7.17% 92.83% -1 9.83% 65.83% (56.00%) -1 1.33% 58.83% (57.50%) 359.04 331.47 13D -1 7.83% 92.17% -1 1.00% 50.33% (49.33%) -1 0.00% 43.50% (43.50%) 401.27 331.47 55D -1 15.33% 84.67% -1 0.33% 32.67% (32.33%) -1 0.00% 28.83% (28.83%) 401.27 331.47 233D -1 19.67% 80.33% -1 0.17% 15.00% (14.83%) -1 0.00% 13.00% (13.00%) 431.00 331.47 Weekly 99.67% Adv Dec PUVU PUVD PDVU PDVD 5.00% 94.67% 1.67% 3.33% 57.83% 36.83% Moving Averages High/Lows Index Above Below Index Highs Lows Net 13W -1 15.83% 84.17% -1 2.00% 35.33% (33.33%) 55W -1 19.50% 80.50% -1 0.67% 20.50% (19.83%)