South African Property Forecast April 2010

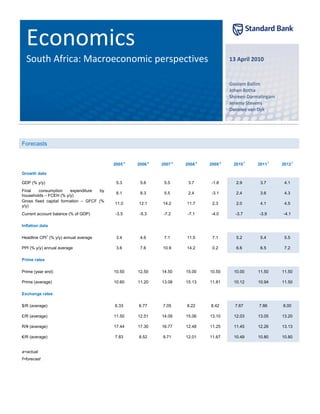

- 1. Economics South Africa: Macroeconomic perspectives 13 April 2010 Goolam Ballim Johan Botha Shireen Darmalingam Jeremy Stevens Danelee van Dyk Forecasts 2005 a 2006 a 2007 a 2008 a 2009 a 2010 f 2011 f 2012 f Growth data GDP (% y/y) 5.3 5.6 5.5 3.7 -1.8 2.9 3.7 4.1 Final consumption expenditure by 6.1 8.3 5.5 2.4 -3.1 2.4 3.6 4.3 households – FCEH (% y/y) Gross fixed capital formation – GFCF (% 11.0 12.1 14.2 11.7 2.3 2.0 4.1 4.5 y/y) Current account balance (% of GDP) -3.5 -5.3 -7.2 -7.1 -4.0 -3.7 -3.9 -4.1 Inflation data Headline CPI1 (% y/y) annual average 3.4 4.6 7.1 11.5 7.1 5.2 5.4 5.5 PPI (% y/y) annual average 3.6 7.6 10.9 14.2 0.2 6.6 6.5 7.2 Prime rates Prime (year end) 10.50 12.50 14.50 15.00 10.50 10.00 11.50 11.50 Prime (average) 10.60 11.20 13.08 15.13 11.81 10.12 10.94 11.50 Exchange rates $/R (average) 6.33 6.77 7.05 8.22 8.42 7.67 7.86 8.00 £/R (average) 11.50 12.51 14.09 15.06 13.10 12.03 13.05 13.20 R/¥ (average) 17.44 17.30 16.77 12.48 11.25 11.45 12.26 13.13 €/R (average) 7.83 8.52 9.71 12.01 11.67 10.49 10.80 10.80 a=actual f=forecast

- 2. Exchange rate forecast Quarterly averages Q2 2010 Q3 2010 Q4 2010 Q1 2011 12-month trading range EUR/USD 1.350 1.366 1.398 1.390 1.30 – 1.60 GBP/USD 1.522 1.571 1.613 1.678 1.40 – 1.90 USD/JPY 88.00 86.00 87.00 85.00 80.0 – 105.0 USD/ZAR 7.450 7.850 8.138 8.250 6.80 – 8.50 EUR/ZAR 10.058 10.723 11.376 11.468 8.84 – 13.60 GBP/ZAR 11.342 12.328 13.124 13.842 9.52 – 16.15 ZAR/JPY 11.812 10.955 10.691 10.303 10.00 – 12.35 Consumer inflation Prime rate forecasts Headline CPI - % y/y Last prime rate change: 26 March 2010 2010 2011 2007 2008 2009 2010 2011 January 6.2 a 5.5 12.50 a 14.50 a 15.00 a 10.50 a 10.00 February 5.7 a 5.5 12.50 a 14.50 a 14.00 a 10.50 a 10.00 March 5.1 5.5 12.50 a 14.50 a 13.00 a 10.00 a 10.50 April 5.0 5.4 12.50 a 15.00 a 12.00 a 10.00 10.50 May 4.9 5.4 12.50 a 15.00 a 11.00 a 10.00 11.00 June 4.9 5.3 13.00 a 15.50 a 11.00 a 10.00 11.00 July 5.1 5.2 13.00 a 15.50 a 11.00 a 10.00 11.50 August 5.2 5.1 13.50 a 15.50 a 10.50 a 10.00 11.50 a a a September 5.0 5.3 13.50 15.50 10.50 10.00 11.50 October 5.1 5.4 14.00 a 15.50 a 10.50 a 10.00 11.50 November 5.2 5.4 14.00 a 15.50 a 10.50 a 10.00 11.50 December 5.2 5.4 14.50 a 15.00 a 10.50 a 10.00 11.50 Average 5.2 5.4 Low 4.9 5.1 High 6.2 5.5 2

- 3. Introduction Ben Bernanke unambiguously warned that the arithmetic is simple: To avoid large and sustained budget deficits, the nation will ultimately Macroeconomic newsflow has finally begun to reflect genuine have to choose among higher taxes, modifications to entitlement improvements in broad economic health. However, the data remain programme, less spending or some combination of the above. consistent with a somewhat anaemic recovery in advanced economies. Treasury yields, which serve as the benchmark for lending, are already Investor sentiment, which has been buoyed by growing global business trending higher. Worryingly, the removal of these vital stimulants could and consumer confidence, realised that as the economic recovery undermine the economic recovery, given that the ability of genuine gains a foothold, paradoxically, the forces driving the recovery – cheap demand to take over the reins is, at a minimum, questionable. government funding and low interest rates – will inevitably be reversed. Expect a relatively tepid economic growth profile. The Organisation for The first-quarter earnings’ reporting season, which begins this month, Economic Co-operation and Development (OECD) seemingly agrees, will shed light on the financial health of the private sector. Against this forecasting that the US gross domestic product (GDP) will expand by uncertain background, sovereign debt vulnerabilities continue to muddy 2.4% y/y and 2.3% y/y in the first two quarters of 2010, which is the broader outlook. Simultaneously, China is in the process of significantly slower than the 5.6% y/y enjoyed in the final quarter of last gradually de-pegging its currency from the US dollar. year. Clearly, higher borrowing costs for consumers and corporates, International economy plus rising interest on government debt will prove difficult to ignore. A number of data points are suggesting that the economic recovery of The Euro-zone is facing even more difficult and complex challenges. the United States (US) is relatively sound. The Institute of Supply The Euro-zone’s economic recovery spluttered at the tail-end of last Management (ISM) manufacturing index has significantly surpassed year. Euro-zone GDP was static in the last three months of 2009, pre-Lehman collapse levels, reaching 59.6 in March. Meanwhile, the translating into a 2.2% y/y contraction for the year. The relatively poor ISM non-manufacturing index increased from 53 in February to a three- performance illuminates the fundamental weakness in domestic year high of 55.4 in March. Hence, to some extent the recovery is demand across continental Europe. The perilous position was further spreading beyond the export-orientated manufacturing sector. exacerbated by the withdrawal of government support, which began at the tail-end of last year. The situation was further compounded by poor Financial markets responded particularly positively to the gain of weather in Northern Europe during the first months of 2010, which will 162 000 non-agriculture jobs in March. Not only is the addition a inevitably provide a headwind to the Q1 2010 growth print. dramatic improvement from the 14 000 decline experienced in February, but it is an even more dramatic improvement considering the The European Central Bank (ECB) left official interest rates on hold in average 700 000 jobs lost each month in 2009. That said, 48 000 of April and left its unconventional liquidity-supportive policies intact. The the positions were temporary hires linked to the US census. decision reflects the sombre assessment of the Euro-zone economic prognosis. The Federal Reserve (Fed) chairman, Ben Bernanke, recently stressed that the unemployment rate of 9.7% remains a serious concern – Promisingly, much like the US, some recent macroeconomic newsflow especially given the large share that has been out of the labour force has bolstered sentiment. In fact, the Euro-zone’s Purchasing for more than six months. While labour shedding has clearly slowed Managers’ Index (PMI), having found support from a softer euro and (perhaps even halted), hiring is likely to remain weak throughout the improved external environment, increased from 53.7 in February to year, containing economic activity over the near term. 55.9 in March – the largest monthly gain in nearly three years. The housing market has shown few signs of meaningful recovery. Unfortunately, Germany experienced stagnation in industrial production Granted, the 7.8% month-on month (m/m) fall in the pending home (in month-on-month terms) in both January and February. Worryingly, sales index during January was reversed by the 8.2% m/m increase in the manufacturing sector – specifically Germany’s – is essential for the February. However, the figures remain depressed relative to pre-crisis Euro-zone’s economic recovery given the weakness in the household levels. sector. Consider that Euro-zone retail sales, having declined by 0.2% m/m in January, contracted by 0.6% m/m in February. Perhaps of most concern is the fact that the important drivers of the recovery are wilting. First, re-stocking is in all likelihood complete, meaning the strength of underlying demand matters most looking ahead. Second, broad access to cheap government funds has become unsustainable and is likely to end soon. Similarly, improving economic data and increasing prices at the factory gate indicate that keeping the Fed Funds Rate at “excessively low levels for an extended period of time” is likely to cease at year-end. 3

- 4. Figure 1: German industrial production downgraded the outlook of both foreign and domestic long-term currency ratings to negative. In light of the higher costs, the ECB’s 4 15 president, Jean-Claude Trichet, is encouraging Greece to pursue 2 10 bilateral loans, which could come with a lower repayment cost. 5 0 0 However, by mid-April, a number of proposals were under discussion, Per cent Per cent -2 -5 aiming to provide clarification of the terms attached to the funds that -4 -10 Greece can access in emergency. -15 -6 -20 The fiscal troubles facing Greece are not confined to Greece; -8 -25 elsewhere, Portugal and Spain have recently seen their 10-year bonds 2002 2004 2006 2008 m/m (LHS) y/y (RHS) spike at 4.33% and 3.89%, respectively. The deterioration of fiscal positions across the developed world has proven so severe that deficit Source: Bloomberg reduction initiatives will impinge on economic growth. Recognising the The sovereign debt vulnerabilities of most Euro-zone nations are inevitable fiscal tightening across the region, economic growth will holding continental Europe’s economic vista hostage. Most prove sluggish and interest rates will remain on hold throughout 2010. prominently, Greece’s, but also Spain and Portugal’s, fiscal The United Kingdom’s (UK) Monetary Policy Committee (MPC) held vulnerabilities have sapped the swagger out of any positive interest rates steady in early April. Given the consensus, which macroeconomic news. suggests that UK inflation will weigh in at 1.3% in 2010 and remain The generalised appreciation of Greece’s fiscal challenges and the below 2% in 2011, the possibility of an additional rate cut cannot be insecurity are best articulated by the spread between the Greek 10- excluded. However, the MPC is still trying to determine the full impact year bond and the German 10-year Bund, which increased by 100 of the USD300 bn of asset purchases made under the quantitative basis points in less than a month, surpassing 4.5% in April. The spread easing programme. is currently at its widest since Greece joined the Euro-zone. In the UK, election campaigning began in the first week of April as the Figure 2: Spread between Greek and German 10-yr government general election will occur on 6 May 2010. Predictably, the discussions bonds immediately focused on how to resolve the nation’s fiscal position, which is currently at a post-war high of 11.8% of GDP. At this juncture, Percentage points 5.0 7.5 the Gordon Brown-led Labour Party is trailing in the polls to David 4.0 6.5 Cameron’s Conservative Party. However, as the economic recovery 3.0 gains momentum, the tide will gradually turn in favour of the Labour 5.5 2.0 Party. Hence, the Q1 2010 growth print and other macroeconomic 1.0 4.5 news could shape the election results. 0.0 3.5 GDP growth in Q4 2009 was upwardly revised from 0.3% to 0.4%. In 2006 2007 2008 2009 addition, some survey indicators are pointing to stronger growth in Q1 Greece vs. German Spread (LHS) 2010. Furthermore, while industrial production contracted by 0.1% y/y Greece yield (RHS) Source: Bloomberg in February, the figure is a dramatic improvement from the -3.8% y/y and -1.6% y/y recorded in December and January, respectively. Over the past month, the Euro-zone members have committed funding Moreover, the Halifax house price index, after declining by a support to the Greek government. Using seemingly similar logic to that seasonally adjusted 1.6% m/m in February, increased by a seasonally used when the then Treasury Secretary, Hank Paulsen, faced a severe adjusted 1.1% m/m in March, implying that last month’s decline was freeze in US repo markets, the government’s re-assurance was meant merely a stumble in a positive trend. Meanwhile the three-month to be sufficient to divert disaster and enable market rates to normalise moving average increased from 4.5% y/y in February to a 27-month without an actual intervention. However, as in the case of the US repo high of 5.2% y/y in March. market, the guarantee has done little to alleviate uncertainty. Recall the old adage: if you have to defend your credibility, your credibility is Most commodity prices have already returned to the levels that already gone. prevailed before the financial crisis. Growing optimism about the sustainability of the global recovery in emerging markets – led by Most worrying, the support package failed to provide an interest rate China, India and Brazil – has proven supportive. Adding to the tailwind, ceiling, meaning the funding was likely to be priced at market rates, speculators anticipating commodity demand growth in 2011, when the which are elevated. Given that Greece’s debt burden is expected to global economic activity is uniformly positive, have also played their breach 120% of GDP this year and trend towards 150% by 2015, the part in pushing commodity prices higher. sheer size of the borrowing requirement and the elevated repayment costs fuel the risk of Greece’s default. Fitch Ratings Agency 4

- 5. Figure 3: Commodity prices broadly trending higher Figure 4: Share of export value-added originating from elsewhere Index Jan 2007=100 Brazil 300 Japan 250 US 200 France Germany 150 China 100 Italy 50 Spain 0 5 10 15 20 25 30 35 2007 2008 2009 2010 Per cent Gold Copper Tin 2005 1995 Nickel Lead Source: Bloomberg Source: OECD Furthermore, China is in the process of gradually de-pegging its South Africa currency from the US dollar, which has also proved supportive for commodity prices. Recall, commodity prices are typically inversely The extent of economic slack is reducing with the recent, albeit slow, related to the US dollar. Last month, the People’s Bank of China’s improvement in spending levels of households. Evidence is gathering chairman stated that the dollar-peg would end sooner or later. that the middle-income mass market is freeing itself up from its Furthermore, it is widely accepted that China’s policy makers are trying overextended debt positions, providing early signs of a self-sustaining to curb bank lending and inflation; both goals will benefit from a recovery in economic activity. stronger Renminbi. Already, discussions of widening the daily trading Detailed breakdown of the expenditure approach to GDP range of the Renminbi are being held. At present, the Renminbi is Household demand: allowed to move within a range of 0.3% either side of a fixed exchange rate to the US dollar, limiting the rate of adjustment. Perhaps Household consumption expenditure rose by an annualised anticipating the change in tides, US Treasury Secretary Timothy quarterly rate of 1.4% in 2009 Q4 – the first increase in six Giethner decided to postpone a report scheduled for mid-April that quarters – driven by advances in durable goods (15.2%) and would have had to make an unambiguous classification of whether or services (1.1%). The rate of decline in non-durable and semi- not China is a “currency manipulator”. durable goods slowed significantly in the quarter to below a 1% Once more it is worth stressing that currency appreciation will fail to contraction, from high single-digit declines in previous quarters. prove to be the silver bullet to global imbalances. For a start, a large Consumer confidence more than doubled in Q1 this year to 15 share of the value of China’s final exports is originally imported from index points from 6 index points in 2009 Q4. The recovery was elsewhere. In an extreme example, the Sloan Foundation estimates largely driven by increased optimism among middle-income that a mere USD4 (less than 3%) of the final value of an iPod earners, which have lagged other income cohorts owing to their assembled and exported from China is organically produced in China. comparatively high levels of indebtedness. Unsurprisingly, China’s surplus with the US falls by 30% if only the value-added components are included. In contrast, Japan’s surplus Households have become less pessimistic over the expands by 25%. More broadly, lower tariff barriers and transport costs appropriateness of the current time to purchase durable goods have enabled a larger share of the value of a nation’s exports to and have become increasingly optimistic over expected originate from elsewhere. Therefore, a stronger currency will make economic conditions and the state of their own finances in 12 imports cheaper. months’ time. Increasing evidence of deleveraging is being obtained as households’ savings as a ratio to disposable income improved to -0.1% in Q4 from -0.4% in Q3 last year. This comes despite evidence that household debt as a ratio to income rose to 79.8% in Q4 from 78.4% in Q3; the rise was spurred by a decline in the growth rate of nominal household income relative to Q3, as inflation is receding. Excluding the impact of inflation, real disposable income grew by a quarterly annualised rate of 2.7% in Q4, on the back of rising compensation to workers when compared to the previous year. This signals that household demand will become stronger 5

- 6. within the next few months, reining in the sluggishness of retail Figure 7: Household real income growth inversely related to sales growth over the past few months. inflation Figure 5: Household consumption expenditure on goods and % q/q annualised % -9 17 services -6 14 % y/y -3 30 0 11 3 8 20 6 10 5 9 0 12 2 2000 2002 2004 2006 2008 2010 -10 Real disposable income (LHS - inverse scale) -20 Targeted inflation (CPIX to '08, CPI from '09) 2000 2002 2004 2006 2008 Sources: SARB, Stats SA, Standard Bank Group Semi-durables Durables Non-durables Services The better-than-expected Q4 figures, the recent rate cut and Source: SARB more benign inflation profile support the revision in household consumption expenditure growth to 2.4% this year (previously New passenger car sales rose by 16.5% y/y in Q1 from -10.5% 2%). y/y in Q4 last year. New motor sales are expected to rise by between 12% and 18% this year, following -23.8% y/y in 2009. Gross fixed capital formation: House price growth has also recovered, albeit belatedly, Private sector capital formation declined by a less-than-expected increasing to 0.5% y/y in March – the first time since early 2008 – quarterly annualised growth rate of 2.3% in Q4 from -14.5% in following a decline of -1.9% y/y in February. Nominal house price Q3. This together with an improved profit prognosis in the mining growth of between 5% and 10% is expected this year, from industry on the back of rising commodity prices and rising -4.2% in 2009. business confidence in select manufacturing industries could see a slower rate of decline in private sector investment this year. Figure 6: Household consumption expenditure, house price and This has been corroborated by improved commercial vehicle vehicle sales’ growth sales’ statistics; particularly of light and extra heavy vehicles, % q/q annualised % y/y which are up 10% y/y and 13% y/y, respectively, in Q1. We 15 45 anticipate a milder contraction of 1.7% this year, from -7% y/y in 10 30 2009. 5 15 Figure 8: Fixed capital formation by type of organisation 0 0 % q/q annualised % q/q annualised -5 -15 48 80 -10 -30 2000 2002 2004 2006 2008 2010 24 40 Household consumption expenditure Car sales (RHS) House price growth (RHS) 0 0 Sources: NAAMSA, SARB, Standard Bank Group -24 -40 Household earnings’ potential: 2000 2002 2004 2006 2008 A swift recovery in several industries has seen rising wage Private business enterprises (58.1% of total) General government (15.6% of total) - smoothed demands from labour unions of up to 20% in the metals industry. Public corporations (26.2% of total) - smoothed (RHS) Wage growth may be rigid on the downside this year, which, Source: SARB together with a more benign inflation profile averaging 5.2% in Confirmation of parastatals’ project continuity will see the 2010, could see real wage gains of up to four percentage points. contribution to fixed capital formation remaining strong, however with the rate of growth slowing down from last year’s 40.7% growth. 6

- 7. Table 1: Average annual public spending on infrastructure from Detailed breakdown of the production approach to GDP 2010/11 to 2012/13 Mining and quarrying sector (4.6% of GDP; 6% of formal non- State- agricultural employment): General Public-private owned government partner-ships entities Current performance: In February, mining output rose by 5.8% Annual value R132.6 bn R144.8 bn R9.1 bn y/y from 9.7% y/y in January, supported by diamond output Share of total (149.2% y/y), chromium ore production (123.4% y/y), 43% 53% 3% spend manganese ore (64.6% y/y) and nickel output (58.4% y/y). Nominal 13% 8% -19.8 growth Top contributors to growth: Platinum group metals, nickel, Source: SA National Treasury diamonds, iron ore and copper. Given the improved prognosis for private sector investment Emerging trends: Rising commodity prices, especially copper, participation, bolstered by the recent rate cut, we have raised our could see mines tap into old lower grade ores, which may raise forecast for real capital formation to 2% this year (previously input costs. Investment interest in coal and copper continues to 1.3%). dominate. Net exports: Risks: Dollar prices of input costs, for example, oil and steel, are rising. Sustained rand appreciation will hurt export earnings; Sustained positive income growth in our major trading partner however, the sector remains supported by low rand-denominated countries supports a relatively improved outlook for exports this domestic input costs. Following delayed maintenance during the year, which is critical in light of the rand’s sustained strength. We recession, mines are refocusing on these tasks, but output deem strong global growth as the chief driver of export volumes, growth could subsequently be sluggish. Recovery may stimulate despite the rand’s strength. job creation, but skills remain in short supply. Mines have Commodity bias in SA’s export basket, together with rising expressed concerns over future water supply security and some commodity prices, should ensure that terms of trade remain have placed investment on hold owing to electricity cost and the supportive of the trade balance. Export volumes are supported supply crisis. by strong growth in Asia. Table 2: Share of top mining exports With capital goods accounting for 50% of the import basket, 2004 2006 2008 imports should remain sluggish until a broad-based recovery in the economy unfolds. Capital and machinery-based imports will Platinum group metals 26% 27% 27% remain limited to parastatals’ infrastructure programmes as Gold and uranium ore 37% 28% 25% private sector imports are likely to improve during 2010 H2. Coal and lignite 17% 16% 15% Inventory building probably only accounts for a quarter to a third Source: Department of Trade and Industry of the import basket. Figure 10: Mining Gross Value Added (GVA) vs employment As such, these trends generally support mildly positive to mildly negative trade balances, with more substantial deficits likely from % q/q annualised Number '000 30 550 2010 H2. 20 510 10 Figure 9: Trade volumes and price indices 470 0 -10 430 Index (2000=100) -20 190 390 170 -30 150 -40 350 130 2000 2002 2004 2006 2008 2010 110 Employment (RHS) Mining and quarrying 90 70 Sources: SARB, Stats SA 50 2000 2002 2004 2006 2008 The mining sector reported a decrease of 33 000 jobs in 2009 Volume of exports Prices of exports Q4 compared to 2008 Q4. However, relative to Q3, the sector Volume of imports Prices of imports shed a smaller 2 000 jobs, which is markedly lower than the Source: SARB 18 000 jobs shed in Q1. In total, 114 000 jobs were lost in 2009, reversing total jobs created between 2007 Q4 and 2008 Q4. 7

- 8. Manufacturing sector (14.4% of GDP; 14.8% of formal non- pressure from World Cup consumption could place strain on the agricultural employment): grid, reducing the reserve margin further. Current performance: Output growth eased to 2.7% y/y in Figure 12: Utilities GVA vs employment February from 3.5% in January, with export-related industries, % q/q annualised Number '000 automotive industries, iron and steel, and metals and machinery 15 70 supporting growth. 10 60 Top contributors to growth: Output of motor vehicles and 5 accessories, basic iron and steel products, and chemicals and 50 0 plastic products. 40 -5 Emerging trends: New orders remain lively, but manufacturers -10 30 may be hesitant to bolster inventories in fear of faltering demand. 2000 2002 2004 2006 2008 2010 Optimism over future business expectations a year from now Employment (RHS) Electricity, gas and water remains firm, and has supported employment creation of late. Increasing evidence is obtained that consumer-related sectors Sources: SARB, Stats SA are scaling up production. Historically, consumer-goods- producing output has recovered six months following sustained Relative to 2008 Q4, employment in the utilities sector remained interest rate stimulus. unchanged in Q4 after 1 000 jobs were slashed in the previous quarter. Risks: Despite firm long-term business expectations, current business confidence remains low despite recent recovery in Construction (4.1% of GDP; 5.5% of formal non-agricultural output. The rand is denting optimism in export and import- employment): competing markets. Input costs are rising at a faster pace than Current performance: The rate of growth in real building plans selling prices, keeping profits capped. This may prevent rising passed of residential property eased to -12.1% y/y in January, capacity utilisation rates and delay investment prospects. from -36.8% y/y in 2009. For non-residential buildings, the rate of Figure 11: Manufacturing GVA vs employment decline increased to -55.3% y/y in January from -6.6% y/y in 2009. However, real residential building plans passed in the % q/q annualised Number '000 20 1350 three months to January, compared to the three months to 1300 October 2009, rose by 0.4% y/y, confirming a bottoming in the 10 1250 sector. An increase was also reported for additions and 0 alterations at 4.6% over the corresponding period. In respect of 1200 -10 buildings completed, the non-residential sector is still adding new 1150 supply to the market, which aggravates existing oversupply and -20 1100 vacancy rates. -30 1050 2000 2002 2004 2006 2008 2010 Table 3 illustrates the detail of building plans passed when Employment (RHS) Manufacturing compared to the corresponding period the year before, and confirms that the lower turning point may have been reached in Sources: SARB, Stats SA building plans passed for residential property above 80 square Employment shrank by 91 000 in 2009 Q4 compared to the metres as well as for additions and alterations. However, as same period in 2008. In total, the sector shed 349 000 jobs in expected, non-residential building plans continue to slide. 2009, following job declines of 84 000 in 2008. Electricity, gas and water (2% of GDP; 0.7% of formal non- agricultural employment): Current performance: Electricity consumption rose by 8.5% y/y in February up from 8.3% y/y in January. On a quarterly basis, electricity consumption has accelerated this year relative to the final months of 2009. Risks: Electricity consumption has returned to pre-recession levels, and increasing winter demand along with additional 8

- 9. Table 3: Growth in building plans passed (in square metres, y/y) Job losses gathered pace in Q4, with a total of 61 000 jobs lost (compared to 2008 Q4) versus 51 000 and 33 000 in Q3 and Q2, November 2009 – January 2010 vs November 2008 – January 2009# respectively. Further job losses are on the cards this year Residential: following the maturity of several World Cup-related infrastructure < 80 square metres -39.7% (-16.9%) projects. > 80 square metres -13.6% (-19.4%) Wholesale and retail trade (13.8% of GDP; 20.1% of formal non- Flats and townhouses -38.1% (-30.9%) agricultural employment): Other* -44.9% (-70.7%) Current performance: Real retail sales contracted by 1.7% y/y in Non-residential: January, from -3.8% y/y in December and -4.9% y/y in 2009. Office and banking space -58.6% (-56.9%) Shopping space -53.3% (-33.9%) Top performing industries: In nominal terms, general retailers; retailers of textiles, clothing and footwear; retailers of medical Industrial and warehouse space -27.4% (-5.7%) goods, cosmetics and toiletries; and retailers of food, beverages Other** 2% (24.6%) and tobacco performed positively over the past three months. The growth laggards remain in the hardware and “other” retail Additions and alterations: categories. Dwelling houses -7.8% (-14.1%) Other buildings -13.4% (-19.5%) Emerging trends: In response to a mild improvement in overall # Previous three months’ data in brackets retail sales’ volumes and rising input prices, retailers have upped * Includes hotels, motels, guest houses, entertainment centres, and their selling prices in Q1, which has reduced pressure on profits. B&Bs ** Includes schools, hospitals, and sports and recreation facilities This trend has been pronounced in the durable goods market, Source: Stats SA where more substantial restocking has occurred of late. The Top performing industries: Civil engineering supported by semi-durable goods market has shown the first growth in sales’ government infrastructure. volumes and profitability in Q1 since late 2007. Emerging trends: According to the South African Federation of Risks: Sluggish improvement in household fundamentals such as Civil Engineering and Construction (SAFCEC), civil engineering tardy employment and income growth and high debt remain turnover is expected to decline in real terms by 25% in 2010 from problematic. -11.0% in 2009. However, strong demand is seen starting in Figure 14: Trade GVA vs employment 2011, which could see increased employment again. In this environment price volatility cannot be ruled out. % q/q annualised Number '000 15 2000 Risks: The overall sector remains burdened by limited new 10 1600 projects coming on stream and an oversupply of construction 5 firms. This may see liquidations remaining high in this sector. In 1200 the interim, steel prices of select steel grades are rising. Oil 0 refinery shutdowns for maintenance procedures have caused 800 -5 shortages in the supply of bitumen, which will result in a delay of -10 400 road construction, aggravating cash flow problems. 2000 2002 2004 2006 2008 2010 Figure 13: Construction GVA vs employment Employment (RHS) Wholesale and retail trade % q/q annualised Number '000 Sources: SARB, Stats SA 24 510 20 450 The annual increase in job losses rose in Q4 when 80 000 jobs 16 390 were shed, following 76 000 jobs in Q3. This brings the total 12 330 decline for 2009 to 268 000. 8 270 Finance, real estate and business services (20.5% of GDP; 22.1% 4 0 210 of formal non-agricultural employment): -4 150 Finance and insurance (45% of total sector): Deleveraging in 2000 2002 2004 2006 2008 2010 Employment (RHS) Construction the corporate retail banking space continues to weigh on asset growth. However, a mild improvement has been noticed in the Sources: SARB, Stats SA personal banking space, particularly in mortgage advances. Firm 9

- 10. asset markets continue to support growth in the investment and Relative to the same period in 2008, the transport and commercial banking space. communication sector shed 7 000 jobs in Q4 2009. This brings the total of labour layoffs in 2009 to 29 000 compared to an Real estate (35% of total sector): Banks are reporting increase of 22 000 in 2008. increased appetite for mortgage loans, with volumes of applications and new grants slowly improving. This has seen a General government and personal services (18.7% of GDP; 26.4% recovery in house prices; however, sluggish growth envisaged of formal non-agricultural employment): over the next few years suggests that profits on resale values will Figure 17: General government and personal services GVA vs remain ailing. employment Figure 15: Financial intermediation and business services GVA vs % q/q annualised Number '000 employment 10 2520 % q/q annualised Number '000 2240 20 2500 5 15 2000 1960 0 10 1500 1680 5 1000 -5 1400 0 500 2000 2002 2004 2006 2008 2010 Employment (RHS) General government -5 0 Personal services 2000 2002 2004 2006 2008 2010 Employment (RHS) Finance and business services Sources: SARB, Stats SA Employment in the community, social and personal services Sources: SARB, Stats SA industry rose by 39 000 in 2009 Q4 compared to 2008 Q4. In The broader finance sector reduced its workforce by 118 000 in total, 270 000 jobs were added in 2009 compared to an increase the fourth quarter of last year, bringing the total jobs lost in 2009 of 320 000 in 2008. to 361 000 relative to 2008. This exceeds the 261 000 jobs created in this sector in 2008 and brings employment back to Conclusion levels prevailing at the end of 2006. The final cost of the global financial crisis and the associated recession Transport, storage and communication (10.3% of GDP; 4.3% of it induced is difficult to quantify. According to the Bank of England, the formal non-agricultural employment): fact that global output fell 6.5 percentage points below its long-run trend in 2009 has cost the world USD4 trillion. Global trade is believed Emerging trends: Recovery in retail and wholesale trade will see to have fallen by 12% last year and volumes won’t surpass 2008 demand for road transport improve. Transnet is focusing on numbers until 2011. While such estimates are debatable and can be expanding private sector participation, with the chief aim of contested, the swiftness with which confidence in the global financial expanding key commodity export corridors. system collapsed in late 2008 will prove an enduring lesson of the Risks: Rising fuel prices and still-high logistic costs pose a risk to financial crisis. Psychological forces continue to drive markets in the the sector’s profitability. recovery period. Figure 16: Transport and communication GVA vs employment Recent data in the domestic economy reveal that a mild recovery in household demand is underway. The recent cut in interest rates will % q/q annualised Number '000 serve to bolster confidence and the degearing cycle in future months. 12 400 In addition, monetary policy relaxation will contribute to stabilising 9 350 conditions in the labour market, which augurs well for the recovery in 6 300 household demand. Favourable conditions in export markets have 3 250 begun to permeate the domestic private sector, which has seen 0 200 optimism over future investment prospects gaining traction. As a result, -3 150 the economic growth prognosis for 2010 has been raised to 2.9%. 2000 2002 2004 2006 2008 2010 Employment (RHS) Transport and communication Sources: SARB, Stats SA 10

- 11. Group Economics Goolam Ballim – Group Economist +27-11-636-2910 goolam.ballim@standardbank.co.za International Jeremy Stevens +27-11-631-7855 Jeremy.Stevens@standardbank.co.za South Africa Johan Botha Shireen Darmalingam Danelee van Dyk +27-11-636-2463 +27-11-636-2905 +27-11-636-6242 Johan.botha@standardbank.co.za Shireen.darmalingam@standardbank.co.za Danelee.vanDyk@standardbank.co.za Rest of Africa Yvette Babb Jan Duvenage Anita Last Yvonne Mhango +27-11-631-1279 +27-11-636-4557 +27-11-631-5990 +27-11-631-2190 Yvette.Babb@standardbank.co.za Jan.duvenage@standardbank.co.za Anita.last@standardbank.co.za Yvonne.Mhango@standardbank.co.za Kenya Botswana Malawi Angola Tanzania Lesotho Mauritius DRC Uganda Namibia Mozambique Ghana Zimbabwe Swaziland Nigeria Zambia Simon Freemantle +254 (20) 3269 027 Freemantles@stanbic.com Kenya Uganda Tanzania All current research is available on the Standard Bank Group Economics home page. In order to receive Group Economics’ research via email, all clients (new and existing) are required to register and select publications on the website. Click on http://www.standardbank.com/Research, select Register and enter your email address. A username and password will then be emailed to you. 1. Analyst certification The authors certify that: 1) all recommendations and views detailed in this document reflect his/her personal opinion of the financial instrument or market class discussed; and 2) no part of his/her compensation was, is, nor will be, directly (nor indirectly) related to opinion(s) or recommendation(s) expressed in this document Disclaimer This document does not constitute an offer, or the solicitation of an offer for the sale or purchase of any investment or security. This is a commercial communication. If you are in any doubt about the contents of this document or the investment to which this document relates you should consult a person who specialises in advising on the acquisition of such securities. Whilst every care has been taken in preparing this document, no representation, warranty or undertaking (express or implied) is given and no responsibility or liability is accepted by the Standard Bank Group Limited, its subsidiaries, holding companies or affiliates as to the accuracy or completeness of the information contained herein. All opinions and estimates contained in this report may be changed after publication at any time without notice. Members of the Standard Bank Group Limited, their directors, officers and employees may have a long or short position in currencies or securities mentioned in this report or related investments, and may add to, dispose of or effect transactions in such currencies, securities or investments for their own account and may perform or seek to perform advisory or banking services in relation thereto. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. This document is not intended for the use of private customers. This document must not be acted on or relied on by persons who are private customers. Any investment or investment activity to which this document relates is only available to persons other than private customers and will be engaged in only with such persons. In European Union countries this document has been issued to persons who are investment professionals (or equivalent) in their home jurisdictions. Neither this document nor any copy of it nor any statement herein may be taken or transmitted into the United States or distributed, directly or indirectly, in the United States or to any U.S. person except where those U.S. persons are, or are believed to be, qualified institutions acting in their capacity as holders of fiduciary accounts for the benefit or account of non U.S. persons; The distribution of this document and the offering, sale and delivery of securities in certain jurisdictions may be restricted by law. Persons into whose possession this document comes are required by the Standard Bank Group Limited to inform themselves about and to observe any such restrictions. You are to rely on your own independent appraisal of and investigations into (a) the condition, creditworthiness, affairs, status and nature of any issuer or obligor referred to and (b) all other matters and things contemplated by this document. This document has been sent to you for your information and may not be reproduced or redistributed to any other person. By accepting this document, you agree to be bound by the foregoing limitations. Unauthorised use or disclosure of this document is strictly prohibited. Copyright 2004 Standard Bank Group. All rights reserved. 11