Homestead Funds Serves Shareholders for 20 Years

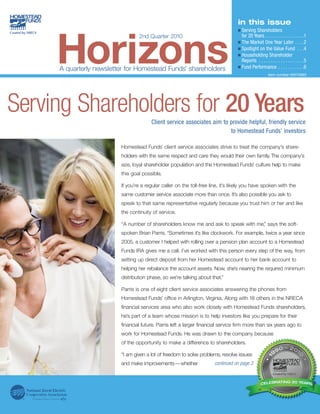

- 1. eServing Shareholders eThe Market One Year Later . . . .2 eSpotlight on the Value Fund . . .4 eHouseholding Shareholder e in this issue for 20 Years . . . . . . . . . . . . . . . . .1 Horizons 2nd Quarter 2010 Reports . . . . . . . . . . . . . . . . . . .5 A quarterly newsletter for Homestead Funds’ shareholders Fund Performance . . . . . . . . . . .6 Item number 00073893 Serving Shareholders for 20 Years Client service associates aim to provide helpful, friendly service to Homestead Funds’ investors Homestead Funds’ client service associates strive to treat the company’s share- holders with the same respect and care they would their own family. The company’s size, loyal shareholder population and the Homestead Funds’ culture help to make this goal possible. If you’re a regular caller on the toll-free line, it’s likely you have spoken with the same customer service associate more than once. It’s also possible you ask to speak to that same representative regularly because you trust him or her and like the continuity of service. “A number of shareholders know me and ask to speak with me,” says the soft- spoken Brian Parris. “Sometimes it’s like clockwork. For example, twice a year since 2005, a customer I helped with rolling over a pension plan account to a Homestead Funds IRA gives me a call. I’ve worked with this person every step of the way, from setting up direct deposit from her Homestead account to her bank account to helping her rebalance the account assets. Now, she’s nearing the required minimum distribution phase, so we’re talking about that.” Parris is one of eight client service associates answering the phones from Homestead Funds’ office in Arlington, Virginia. Along with 18 others in the NRECA financial services area who also work closely with Homestead Funds shareholders, he’s part of a team whose mission is to help investors like you prepare for their financial future. Parris left a larger financial service firm more than six years ago to work for Homestead Funds. He was drawn to the company because of the opportunity to make a difference to shareholders. “I am given a lot of freedom to solve problems, resolve issues and make improvements—whether continued on page 3 RAT NG 20 YE EBRATING 20 YEARS RA AT EA CELEB

- 2. 2 Then and Now: The Market One Year Later For stock investors, the past few years have So, investors are left wondering how to respond certainly lived up to the comparison that invest- to recent events. To shed light on this subject, ing is a lot like riding a roller coaster. In 2007, Horizons spoke with Homestead Funds before the first cracks appeared in the real President Peter Morris. estate bubble, few investors could have foreseen “Investors should make sure that their asset the steep descent that lay ahead. By the end of allocation is in line with their financial goals,” 2008 after a widespread decline in asset values, Morris explained. “That allocation should many investors were so discouraged that they be consistent with their time horizon and risk were afraid to open their year-end statements. tolerance.* Finally, in March 2009, the latest bear market hit what some believe to be its bottom. “Looking ahead to the rest of 2010, there are obstacles on the path forward, U.S. unemploy- Then, in a remarkable about-face, the stock ment and the uncertain impact of European market, as measured by the Standard & Poor’s debt chief among them. What we can usually 500 Index, climbed nearly 69% over the next expect, regardless of the economic environ- 12 months from its lows. Although past perform- ment, is a certain degree of market volatility.” ance cannot predict future results, for investors Morris concluded, “But investors for the long who wondered if there would be light at the end term can be rewarded for their patience.” of the tunnel, the turnaround from March 2009 to March 2010 was a welcome change. *While asset allocation may help reduce the overall volatility of your portfolio, there can be no guarantee that this or any strategy or investment can eliminate risk, including the possible loss of principal. Putting volatility in perspective This chart shows that while daily moves of 1% or more have been relatively common over the last 30 years, there have been wide variations from year to year. Investors should keep this in mind when evaluating daily changes in stock prices. Source: Standard & Poor’s Financial Communications 30% Percentage of trading days with 1% or more increase 25% Percentage of trading days with 1% or more decline 20% 15% 10% 5% 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 For the period from January 1, 1990, through December 31, 2009. Stocks are represented by the daily price change of Standard & Poor's Composite Index of 500 Stocks, an unmanaged index that is generally considered representative of the U.S. stock market. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

- 3. 3 Serving Shareholders for 20 years, continued from page 1 that is modifying forms or working on a mailing. “I’m always training phone reps to have their We are close to our shareholders and can work own unique style, while delivering a uniform to address concerns fairly easily, Parris explains. ” message, says Allen. “Our phone reps don’t ” work from a script. Instead, we meet as a group The emphasis on service never changes weekly and talk about shareholders’ needs and The company’s longest-serving client service hammer out any problems.” associate, Brian Allen, is the phone group’s team In between those weekly meetings, Allen monitors leader. Over the eight years phone calls to ensure quality control; then he he’s been with Homestead reviews each client service associate monthly Funds, the assets under to make sure that everyone is working in line with management have dou- industry standards. In addition to ongoing regular bled, and the fund lineup training, each team member must earn a FINRA has been modified to Series 6 and Series 63 license. better meet shareholders’ Just the right size needs. But some things Since the company was founded 20 years ago haven’t changed. with one stock fund and one money market “When I started at fund, it has grown its assets under management Homestead Funds, our to approximately $1 billion today. Of course, in Brian Parris and Brian Allen interact daily No. 1 goal was to assist shareholders. That is an industry that controls over $11 trillion, that’s to brainstorm pressing still our goal today, and it’ll be the same tomorrow, shareholder issues. still small by comparison to many fund compa- too. We can put shareholders first because we nies. In this era of megastores and megabanks, are a no-load mutual fund company — that means Homestead Funds may be the just the right we have a customer-first, no-pressure environment. size for shareholders. We never pressure shareholders to buy funds Team leader Brian Allen views the firm’s smaller because we don’t work on commission. We serve size as a positive. “Our size gives us more control the needs of the shareholders only, Allen explains. ” over customer service, so we can quickly adapt “There is a shareholder who calls and asks for me to changing shareholder needs, he says. “Being ” every six months or so, Allen recalls. “He calls to ” a smaller fund company makes us different. do an investment check-up — he wants guidance We can reach out to shareholders more often.” reviewing his portfolio. We review the funds, the Brian Parris agrees. “We’re small enough that we returns, what’s in his best interests, his needs and can create individual relationships with our share- the suitability of each investment. Going through holders, says Parris. “This year, as we mark our ” this process helps him feel more comfortable.” 20th year, many shareholders are telling us that As team leader, Allen wears a lot of hats, particu- they were among our first investors. It’s a good larly the “trainer” hat, in which he helps to ensure feeling having shareholders who have been with that the phone representatives provide sharehold- us since the beginning.” ers with correct information.

- 4. 4 THE ABCS OF INVESTING Spotlight on Stuart Teach the Value Fund Sr. Equity Portfolio Manager Long-time Homestead Funds’ The Value Fund promotes a which are listed on a national prices of the stocks will even- shareholders probably know the long-term outlook. The fund’s securities exchange. The tually rebound, resulting in a Value Fund is the firm’s flagship primary objective is to seek Value Fund focuses on stocks healthy return. capital growth over the long of established companies equity fund. Aptly named, the fund The risks term. Its second objective with market capitalizations reflects many of traits sharehold- As with any investment, the is income. It invests mostly of $2 billion or greater. Market ers have come to associate with Value Fund carries risk. There in stocks whose prices fluctu- capitalization is a measure is a chance that the value of Homestead Funds. ate with business, market of the company’s total stock any of the fund’s holdings will and economic conditions. market value, which is calcu- decline in response to a com- Because the fund is made lated by multiplying the share pany, industry or market set- up mostly of stocks, its share price by the number of shares back. In addition, the Value price can rise and fall even outstanding. Fund carries other risks related over the short term, reflecting The fund’s value approach to its value orientation, such changes in the value of The word “value” in the fund’s as the possibility value stocks the underlying investments. name means that the fund will trail returns of stocks rep- “Investing in stocks often favors stocks of companies resenting other styles or the involves ups and downs in selling below what the portfolio market overall. share price. Investors saw manager believes to be the Outlook an extreme example of that stocks’ true price — meaning Along with Peter Morris and in the recent bear market, ” they are selling at a bargain. Mark Ashton, the fund’s co- explains portfolio manager Some reasons a stock may managers,Teach is pragmatic Stuart Teach. “Because of the be trading at a discount in his approach to picking inherent volatility involved with include the possibility that the securities for the Value Fund, stock investing, the Value Fund issuer is experiencing a tem- opting not to speculate about is best suited for long-term porary earnings decline, its short-term moves in the mar- investors.” industry may be out of favor ket. He says, “Regardless due to short-term market or How the fund invests of market conditions, we con- economic conditions, or it may Under ordinary conditions, tinue to search for investment have drawn unfavorable pub- the Value Fund will invest opportunities that have the licity. In any event, the portfolio at least 80% of its total assets potential to reward sharehold- manager believes the share in common stocks of estab- ers over the long term.” lished companies, most of Investors should carefully consider fund objectives, risks, charges and expenses before investing. The prospectus contains this and other information and should be read carefully before investing. To obtain a prospectus, call 1-800-258-3030 or visit homesteadfunds.com.

- 5. 5 C U S TO M E R S E R V I C E T I P Comparing Education R E S P O N D I N G TO YO U Accounts Shareholders like you call our client service associates with a lot of good questions. In this column, we’ll share our responses to some of those questions with the Next to retirement, education thought that for every shareholder who calls to ask, there are a hundred who didn’t! is the most popular savings We encourage you to call our helpful associates with your questions, as well as to goal. If you are investing check here each quarter to see if your question is featured. to pay for tuition, consider accounts that offer tax bene- fits. (Of course, consult a tax Householding professional for information Shareholder Reports specific to your situation.) I recently received a letter from Homestead Funds Homestead Funds offers two about “householding” shareholder reports and would accounts that provide tax like to know what this means for me as a shareholder. advantages: the Education Savings Account and the In May, we sent Homestead Funds’ shareholders a letter saying UGMA/UTMA account, which we will start “householding” shareholder reports with the semi-annual is named for the Uniform report dated June 30, 2010. Householding refers to mailing share- Gifts/Transfers to Minors Act. holders just one copy of the shareholder report The choice of which type to an address with two or more Homestead Funds’ of account is best for you accounts. So, for example, if you have both an IRA may depend on how much and a Coverdell ESA with Homestead Funds regis- you plan to invest and how you tered to the same address, we will be sending will be making contributions — you just one copy of our reports, which include all at once or periodically over the prospectus, annual and semi-annual reports. time. For a side-by-side com- We are making this change to reduce the volume parison of these two accounts, of mail you receive from us and to help keep read the Helpful Tips article expenses low. This change reduces the amount “Saving for Education” at of paper required for printing. homesteadfunds.com under the “Find a Document” tab. Remember that we also offer electronic document For more information, please delivery, which allows you to bypass the printed call 1-800-258-3030 to speak booklets entirely. With this option, we send you with a client service associate. an e-mail notice when documents are posted Will Cunningham online and available for you to view. You can sign Registered Representative up for electronic delivery when you log into your account at homesteadfunds.com. Go to the Portfolio Overview page and select “Sign up for electronic document delivery.” If you do not want the mailing of these documents to be combined with those of other accounts at the same address or you need additional copies of financial reports, please call Homestead Funds at 1-800-258-3030. At any time, shareholders with multiple accounts at one address may call and request to be sent more than one report per address.

- 6. 6 Fund Total Returns For Period Ending 3/31/10 Aggregate Average Annual Average Annual Average Annual Average Annual Year-to-Date 1 Year 5 Year 10 Year Since Inception (date) Daily Income 0.00% 0.18% 2.69% 2.43% 3.42% (11/90) Short-Term Govt. Securities 0.86% 2.85% 3.91% 3.89% 4.29% (5/95) Short-Term Bond 2.07% 15.83% 5.08% 4.77% 5.21% (11/91) Stock Index* 5.34% 48.92% 1.33% -1.31% -0.18% (10/99) Value 5.45% 53.16% 2.87% 5.59% 9.44% (11/90) Growth** 3.59% 54.30% 4.76% N/A -4.96% (1/01) Small-Company 9.62% 75.40% 6.35% 10.47% 7.09% (3/98) International Value -0.83% 46.78% 4.78% N/A 2.75% (1/01) For performance data current to the most recent month-end, call Homestead Funds at 1-800-258-3030 or visit homesteadfunds.com. Fund Annual Operating Expenses Management Acquired Fund Fees Total Annual Fund Expenses Waived Fees Other Expenses and Expenses Operating Expenses by RE Advisers Net Expense a Daily Income 0.50% 0.23% 0.02% 0.75% 0.26% b 0.49% Short-Term Govt. Securities 0.45% 0.33% 0.01% 0.79% 0.03% c 0.76% Short-Term Bond 0.60% 0.23% 0.01% 0.84% 0.03% c 0.81% Stock Index* 0.05% d 0.70% 0.00% 0.75% 0.00% 0.75% Value 0.56% 0.24% 0.00% 0.80% 0.00% 0.80% Growth** 0.65% 1.09% 0.00% 1.74% 0.79% c 0.95% Small-Company 0.85% 0.38% 0.01% 1.24% 0.00% 1.24% International Value 0.75% 0.31% 0.01% 1.07% 0.07% c 1.00% Daily Income Fund: Current Yield Seven-Day Effective Yield as of 06/01/2010 0.0100% The total returns shown above represent past quotation more closely reflects the Fund’s cur- and the Fund. The contractual waiver is for a performance, which does not guarantee future rent earnings than the total return quotation. one-year period ending April 30, 2011. At that results. Investment return and principal value a Net time, the waiver may be renewed. Expense shown here differs from the ratio of an investment will fluctuate. An investor’s d The fees for the Stock Index Fund shown in this of expenses to average net assets shown in shares, when redeemed, may be worth more the Financial Highlights section of the prospectus table reflect expenses of both the feeder fund and or less than their original cost. Current because the expenses shown on this page the Master Portfolio. The management fee repre- performance may be higher or lower than include Acquired Fund Fees and Expenses, and sents the total expenses of the Master Portfolio. the performance data quoted. amounts shown in the Financial Highlights reflect e “Other Expenses” for the Stock Index Fund include Investments are subject to risk and market the operating expenses and do not include the a 0.25% administrative fee paid to RE Advisers. fluctuation. Losses could occur. Call us at Acquired Fund Fees and Expenses. 1-800-258-3030 to speak with one of our client b Expenses are to be waived pursuant to an * Performance information for the Stock Index service associates and request a prospectus. Fund reflects its investment experience in the expense limitation agreement between RE Advisers Investors are advised to consider fund objec- S&P 500 Index Master Portfolio from October 15, and the Fund. This contractual waiver is for a one- tives, risks, charges and expenses carefully 2007 to period end. Prior to October 15, 2007 , , year period ending April 30, 2011. At that time, before investing. The prospectus contains this the Stock Index Fund invested all of its assets in the waiver may be renewed. In addition, effective and other information. Read the prospectus a different master portfolio. August 14, 2009, RE Advisers has voluntarily carefully before you invest or send money. agreed to waive fees or reimburse expenses to ** Performance information for the Growth Fund An investment in the Daily Income Fund is not the extent necessary to assist the Fund in attempt- (formerly the Nasdaq-100 Index Tracking StockSM insured or guaranteed by the Federal Deposit ing to maintain a positive yield. There is no guar- Fund) reflects its previous investment strategy of Insurance Corporation or any other government antee that the Daily Income Fund will maintain matching, as closely as possible, before expenses, agency. Although the Fund seeks to preserve a positive yield. This voluntary arrangement may the performance of the Nasdaq-100 Index®. On the value of your investment at $1.00 per share, be revised, discontinued or recontinued at any time. November 18, 2008, by the approval of sharehold- it is possible to lose money by investing in this c Expenses are waived pursuant to an expense ers, the Fund revised its investment objective and Fund. The Daily Income Fund is a money mar- this change became effective on December 5, 2008. limitation agreement between RE Advisers ket fund. For money market funds, the yield Distributor RE Investment Corporation. 6/10