Investment Funds Advisory Today- Buy Stock of State Bank of India and neutral view on Sun Pharmaceuticals Industries limited

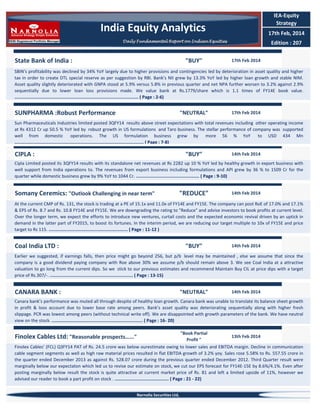

- 1. IEA-Equity Strategy India Equity Analytics 17th Feb, 2014 Daily Fundamental Report on Indian Equities State Bank of India : "BUY" Edition : 207 17th Feb 2014 SBIN’s profitability was declined by 34% YoY largely due to higher provisions and contingencies led by deterioration in asset quality and higher tax in order to create DTL special reserve as per suggestion by RBI. Bank’s NII grew by 13.3% YoY led by higher loan growth and stable NIM. Asset quality slightly deteriorated with GNPA stood at 5.9% versus 5.8% in previous quarter and net NPA further worsen to 3.2% against 2.9% sequentially due to lower loan loss provisions made. We value bank at Rs.1779/share which is 1.1 times of FY14E book value. .............................................................................................. ( Page : 2-6) SUNPHARMA :Robust Performance "NEUTRAL" 17th Feb 2014 Sun Pharmaceuticals Industries limited posted 3QFY14 results above street expectations with total revenues including other operating income at Rs 4312 Cr up 50.5 % YoY led by robust growth in US formulations and Taro business. The stellar performance of company was supported well from domestic operations. The US formulation business grew by more 56 % YoY to USD 434 Mn .................................................................................................. ( Page : 7-8) CIPLA : "BUY" 14th Feb 2014 Cipla Limited posted its 3QFY14 results with its standalone net revenues at Rs 2282 up 10 % YoY led by healthy growth in export business with well support from India operations to. The revenues from export business including formulations and API grew by 36 % to 1509 Cr for the quarter while domestic business grew by 9% YoY to 1044 Cr. ................................................ ( Page : 9-10) Somany Ceremics: "Outlook Challenging in near term" "REDUCE" 14th Feb 2014 At the current CMP of Rs. 131, the stock is trading at a PE of 15.1x and 11.0x of FY14E and FY15E. The company can post RoE of 17.0% and 17.1% & EPS of Rs. 8.7 and Rs. 10.8 FY14E and FY15E. We are downgrading the rating to "Reduce" and advise investors to book profits at current level. Over the longer term, we expect the efforts to introduce new ventures, curtail costs and the expected economic revival driven by an uptick in demand in the latter part of FY2015, to boost its fortunes. In the interim period, we are reducing our target multiple to 10x of FY15E and price target to Rs 115. ............................................................ ( Page : 11-12 ) Coal India LTD : "BUY" 14th Feb 2014 Earlier we suggested, if earnings falls, then price might go beyond 256, but p/b level may be maintained , else we assume that since the company is a good dividend paying company with Roe above 30% we assume p/b should remain above 3. We see Coal India at a attractive valuation to go long from the current dips. So we stick to our previous estimates and recommend Maintain Buy CIL at price dips with a target price of Rs.307/-. ............................................................... ( Page : 13-15) CANARA BANK : "NEUTRAL" 14th Feb 2014 Canara bank’s performance was muted all through despite of healthy loan growth. Canara bank was unable to translate its balance sheet growth in profit & loos account due to lower base rate among peers. Bank’s asset quality was deteriorating sequentially along with higher fresh slippage. PCR was lowest among peers (without technical write off). We are disappointed with growth parameters of the bank. We have neutral view on the stock. ..................................................................... ( Page : 16- 20) "Book Partial 13th Feb 2014 Profit " Finolex Cables’ (FCL) Q3FY14 PAT of Rs. 24.5 crore was below ourestimate owing to lower sales and EBITDA margin. Decline in communication cable segment segments as well as high raw material prices resulted in flat EBITDA growth of 3.2% yoy. Sales rose 5.58% to Rs. 557.55 crore in the quarter ended December 2013 as against Rs. 528.07 crore during the previous quarter ended December 2012. Third Quarter result were marginally below our expectaton which led us to revise our estimate on stock, we cut our EPS forecast for FY14E-15E by 8.6%/4.1%. Even after posting marginally below result the stock is quite attractive at current market price of Rs. 81 and left a limited upside of 11%, however we advised our reader to book a part profit on stock . ......................................... ( Page : 21 - 22) Finolex Cables Ltd: "Reasonable prospects…..." Narnolia Securities Ltd,

- 2. State Bank of India "BUY" 17th Feb, 2014 Result update CMP Target Price Previous Target Price Upside Change from Previous BUY 1473 1779 1776 21 - During quarter SBI’s profitability declined by 34% largely due to higher provisions and contingencies led by deteriorating asset quality and higher tax in order to create DTL special reserve as per suggestion by RBI. However, bank has seen growth in loan and deposits which translated into growth in profit loss to some extent. Due to higher operating expenses, operating profit growth was negative despite of 14% growth in revenue. We value bank at Rs.1779/share which would be 1.1 times of FY14E’s book value. Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Cr) Average Daily Volume Nifty 500112 SBIN 2469/1452 110126 9.44 lakh 6048 Moderate NII growth led by lower growth in interest earnings assets than interest bearing liabilities Bank reported NII growth of 13.4% YoY to Rs.12641 cr lower than our expectation of Rs. 12959 cr largely due to lower interest income from advances than higher deposits and borrowing cost. Total income was grown by 13.7% YoY to Rs.16831 cr supported by other income growth of 15% YoY to Rs.4190 cr. Other income growth was led by exchange and commission income gain of Rs.2971 cr and forex income Rs.643 cr. Stock Performance 1M Absolute -10.2 Rel.to Nifty -5.9 1yr -35.8 -37.9 YTD -35.8 -37.9 Share Holding Pattern-% Current 4QFY13 3QFY1 3 Promoters 62.3 62.3 62.3 FII 8.8 8.9 9.8 DII 17.9 17.7 16.7 Others 10.9 11.1 11.2 SBIN Vs Nifty Operating profit reported negative growth due to higher operating expenses led by employee benefit provisions Operating expenses increased by 31.4% YoY to Rs.9212 cr in which employee cost and other operating cost increased by 35% and 25.7% respectively. Employee cost was led by higher provision for pension and gratuity to the tune of Rs. 1355 cr as against Rs.743 cr in 3QFY13 and Rs.1283 cr in 2QFY14. Adjusting the same, employee cost increased by 8% YoY. Operating profit was declined by 2.2% YoY to Rs.7618 cr. Cost income ratio increased by 735 bps YoY to 54.7% from 47.4% in 3QFY13. Moderate NII growth, higher operating expenses and higher provision and tax rate led profit de growth of 34% YoY SBI’s profitability was declined by 34% YoY largely due to higher provisions and contingencies led by deterioration in asset quality and higher tax rate in order to create DTL special reserve as per suggestion by RBI. Financials NII Total Income PPP Net Profit EPS 2011 32526 48351 25336 8265 130.2 2012 43291 57643 31574 11707 174.5 Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. Rs, Cr 2013 2014E 2015E 44331 49365 58302 60366 65288 74225 31081 29105 33401 14105 10241 11765 206.2 149.7 172.0 (Source: Company/Eastwind) 2

- 3. State Bank of India Continue to report week trend of asset quality During quarter bank increased provisions and contingencies by 37% QoQ to Rs. 4150 cr due to deteriorating asset quality. In absolute term GNPA and net NPA increased by 6% and 16% sequentially. In absolute term, GNPA and net NPA stood at 5.9% and 3.2% versus 5.8% and 2.9% in 2QFY14 respectively. During quarter bank’s loan loss provision increased by 29.6% sequentially and stood at Rs.23429 cr. Standard asset provisions and depreciation provisions were Rs.196 cr and Rs.621531 cr respectively. Net provisions were declined by 4% sequentially which resulted 16% rise in net NPA in absolute term. Consequently provision coverage ratio without technical writ off was declined by 475 bps QoQ to 45.2% from 50% in previous quarter. Strong traction in loan and deposits growth Loan grew by 17.4% YoY led by across the sectors. Loan to large corporate grew by 17% YoY, mid corporate grew by 19%, SME grew by 14% and retail loan grew by 19%. Strong traction in auto loan (21.2% YoY) and house loan (19.4% YoY) led retail loan growth. Deposits grew by 17% YoY largely supported by 20% YoY growth in term deposits followed by saving deposits and demand deposits which grew by 8% and 13% respectively. Overall CASA ratio was declined by 153 bps YoY to 41%. NIM declined on account of higher deposits cost and lower yield SBI’s net interest margin was flat at 3.19% versus 3.18% in previous year. Domestic NIM declined by 2 bps to 3.49% while oversea NIM declined by 1 bps sequentially to 1.49%. Cost of deposits increased to 6.25% from 6.22% sequentially while yield on advances inch up to 10.4% from 10.3% in previous quarter. Credit deposits ratio marginally declined from 85.3% to 85.1%. Valuation & View During quarter SBI’s profitability declined by 34% largely due to higher provisions and contingencies led by deteriorating asset quality and higher tax in order to create DTL special reserve as per suggestion by RBI. However, bank has seen growth in loan and deposits which translated into growth in profit loss to some extent. Due to higher operating expenses, operating profit growth was negative despite of 14% growth in revenue. We value bank at Rs.1779/share which would be 1.1 times of FY14E’s book value. Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 3

- 4. State Bank of India Moderate NII growth led by lower growth in interest earnings assets than interest bearing liabilities Operating profit reported negative growth due to higher operating expenses led by employee benefit provisions Moderate NII growth, higher operating expenses and higher provision and tax rate led profit de growth of 34% YoY Source: Esatwind/Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 4

- 5. State Bank of India Quarterly Performance Interest/discount on advances / bills Income on investments Interest on balances with Reserve Bank of India Others Total Interest Income Others Income Total Income Interest Expended NII Other Income Total Income Employee Other Expenses Operating Expenses PPP( Rs Cr) Provisions PBT Tax Net Profit 3QFY14 26310 8228 92 241 34870 4190 39061 22230 12641 4190 16831 5867 3345 9212 7618 4150 3469 1234 2235 2QFY14 25379 8137 106 300 33922 3278 37200 21671 12251 3278 15529 5819 3399 9218 6312 3029 3283 908 2375 3QFY13 22800 7072 110 362 30344 3648 33992 19189 11154 3648 14803 4351 2661 7012 7791 2668 5123 1727 3396 Balance Sheet (Rs Cr) Deposits Borrowings Investments Loan 1349940 189969 426728 1148901 1292456 188937 398536 1103090 Asset Quality GNPA NPA % GNPA % NPA PCR(%)(w/o technical write-off) 67799 37167 5.9 3.2 45.2 64206 32151 5.8 2.9 49.9 % YoY -34.2 % QoQ 3QFY14E Variation(%) 3.7 25937 1.4 1.1 8303 -0.9 -13.0 109 -15.9 -19.7 349 -30.9 2.8 34699 0.5 27.8 3876 8.1 5.0 38575 1.3 2.6 21739 2.3 3.2 12959 -2.5 27.8 3876 8.1 8.4 16835 0.0 0.8 6364 -7.8 -1.6 3737 -10.5 -0.1 10101 -8.8 20.7 6734 13.1 37.0 3112 33.3 5.7 3622 -4.2 36.0 1087 13.6 -5.9 2535 -11.9 1156691 148374 359959 978115 16.7 4.4 28.0 0.5 18.5 7.1 17.5 4.2 53458 25370 5.5 2.6 52.5 26.8 5.6 46.5 15.6 15.4 16.3 -16.1 -33.3 14.9 14.9 14.9 15.8 13.3 14.9 13.7 34.8 25.7 31.4 -2.2 55.5 -32.3 -28.5 1337803 202402 415135 1152774 0.9 -6.1 2.8 -0.3 Source: Esatwind/Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 5

- 6. State Bank of India Income Statement 2011 2012 2013 2014E 2015E Interest/discount on advances / bills Income on investments Interest on balances with Reserve Bank of India Others Total Interest Income Others Income Total Income Interest on deposits Interest on RBI/Inter bank borrowings Others Interest Expended NII Other Income Total Income Employee Other Expenses Operating Expenses PPP( Rs Cr) Provisions PBT Tax 59976 19826 236 1356 81394 15825 97219 43235 2562 3071 48868 32526 15825 48351 15212 7804 23015 25336 17071 8265 0 8265 81078 23949 350 1144 106521 14351 120873 55644 3886 3700 63230 43291 14351 57643 16974 9095 26069 31574 13090 18483 6776 11707 90537 27200 545 1374 119657 16035 135691 67465 4124 3737 75326 44331 16035 60366 18381 10904 29284 31081 11131 19950 5846 14105 102590 32037 415 1253 136294 15923 152217 61066 10146 0 86929 49365 15923 65288 22795 13388 36183 29105 14253 14852 4611 10241 120306 39720 415 1253 161693 15923 177616 70226 11668 0 103391 58302 15923 74225 25719 15105 40824 33401 16594 16808 5042 11765 933933 16.1 461521 49 119569 295601 756719 1043647 11.7 467607 45 127006 312198 867579 1202740 15.2 539063 45 169183 350927 1045617 1383151 15.0 580923 42 215867 32037 1202459 1590623 15.0 668062 42 248248 39720 1382828 7.9 6.9 7.0 4.6 4.7 4.6 9.3 7.9 8.4 5.3 6.0 5.4 8.7 8.0 8.0 5.6 4.6 5.5 8.5 7.4 0.0 6.3 4.7 5.4 8.7 8.0 0.0 6.5 4.7 5.6 12.7 1023 2.7 13.9 1251 1.7 14.3 1446 1.4 9.3 1617 0.9 9.8 1617 0.9 Net Profit Deposits Change (%) of which CASA Dep Change (%) Borrowings Investments Loans Ratio Yield on Advances Yield on Investments Yield on Funds Cost of deposits Cost of Borrowings Cost of fund Valuation ROE(%) Book Value P/BV Source: Esatwind/Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 6

- 7. SUNPHARMA "NEUTRAL" 17th Feb' 14 Robust Performance Result Update NEUTRAL CMP Target Price Previous Target Price Upside Change from Previous 609 650 7% Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs, Cr) Average Daily Volume Nifty 524715 SUNPHARMA 650/385 126,119 535293 6048 Stock Performance-% Absolute Rel. to Nifty 1M 1.1 4.7 1yr 57.1 55.2 YTD 82.9 70 Share Holding Pattern-% Promoters FII DII Others Current 2QFY14 1QFY1 4 63.7 63.7 63.7 22.5 22.8 22.9 5.7 3.2 3.1 8.1 10.4 10.4 One Year Price vs Nifty Sun Pharmaceuticals Industries limited posted 3QFY14 results above street expectations with total revenues including other operating income at Rs 4312 Cr up 50.5 % YoY led by robust growth in US formulations and Taro business. The stellar performance of company was supported well from domestic operations as well. The US formulation business grew by more 56 % YoY to USD 434 Mn while International formulation sales outside US grew by 16 % YoY to USD 84 Mn. Overall international revenues accounted for more than 75% of total revenues for the quarter. The Sales of branded prescription formulations in India was Rs. 947 Cr up by 20% Yoy from Q3FY13 last year. The API business for the quarter witness some decline with sales falls to Rs 174 Cr translating decline of 17 % YoY. The operating EBITDA for the quarter came at Rs 1975 Cr grew by 57 % YoY and OPM stands at 46 %.There is improvement in OPM by 200 bps during the quarter owing to stronger operating metrics. The RM cost as percentage of sales was 14 % versus 15 % for the same corresponding period last fiscal. The employ cost as percentage of sales was 12 % in current quarter verses 14% for 3QFY13.The company managed to control its other expenses during the 3QFY14 and has dropped by 100 bps at 24 % of the sales. The net profit for the quarter came at Rs 1531 Cr compared to Rs. 881Cr for Q3 last year, up 74% YoY. The NPM for the 3QFY14 came at 36%.The other income for the 3QFY4 was Rs 134 Cr and Tax rate was at 12 %. The company on its R&D said that in the 3QFY14, ANDA for 5 products were filed. After counting these, and adjusting for filings that were dropped, cumulatively ANDAs for 468 products have been filed with the USFDA (as on December 31, 2013). ANDAs for 4 products received approvals in the third quarter, taking the total number of approvals to 337 (as on December 31, 2013). ANDAs for 131 products now await USFDA approval, including 14 tentative approvals. The management of the company after 3QFY14 results has revised its FY14E revenue guidance to 29 % from 25 % earlier. Guidance is at constant exchange rate. The company further said that capex for the FY14 would be on higher side of earlier guidance. The tax rate for the full year would be 15 % and R&D expected to be in the range of 6-8% of the Sales for the FY'14. View & Valuation The stock at its CMP of Rs 609 is trading at 22.1x of one year forward FY14E EPS of 27.60 and company has posted very strong 3QFY14 results however on account stretched valuations we do not see much upside to stock and therefore we turn neutral with TP 650. Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 4312 2000 1531 46.4% 35.5% 2QFY14 4207 1843 1362 43.8% 32.4% (QoQ)-% 2.5 8.5 12.4 260bps 310bps 3QFY13 2865 1275 881 44.5% 30.8% Rs, Crore (YoY)-% 50.5 56.9 73.8 190bps 480bps (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 7

- 8. SUNPHARMA Sales and PAT Trend (Rs) Total revenues including other operating income came at Rs 4312 Cr up 50.5 % YoY led by robust growth in US formulations and Taro business. (Source: Company/Eastwind) OPM % There is improvement in OPM by 200 bps during the owing to stronger operating metrics. (Source: Company/Eastwind) NPM % The NPM for the 3QFY14 came at 36%.The other income for the 3QFY4 was Rs 134 Cr (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 8

- 9. "BUY" CIPLA Result Update BUY CMP Target Price Previous Target Price Upside Change from Previous 381 440 15% Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs, Cr) Average Daily Volume Nifty 500087 CIPLA 450/354 30,591 617290 6,001 Stock Performance-% Absolute Rel. to Nifty 1M -4.5 -1.7 1yr -3 -4.3 YTD -2 -14 Share Holding Pattern-% Promoters FII DII Others Current 2QFY14 1QFY1 4 36.8 36.8 36.8 23.8 23.8 23.1 10.6 10.9 10.8 28.8 28.5 29.3 One Year Price vs Nifty 14th Feb' 14 Cipla Limited posted its 3QFY14 results with its standalone net revenues at Rs 2282 up 10 % YoY led by healthy growth in export business with well support from India operations to. The revenues from export business including formulations and API grew by 36 % to 1509 Cr for the quarter while domestic business grew by 9% YoY to 1044 Cr. The growth in export revenues was primarily due to growth in anti-retroviral, anti-cancer, anti-allergic and anti-biotic segments. The operating EBITDA for the quarter under review came Rs 403 Cr and OPM at 17.88 %.The OPM declines by more than 600 bps YoY due to the increase in the R&D and the ramp up in the Staff cost during the quarter. The employ cost as percentage of sales stands at 14 % while it was 12 % for the same time last fiscal. The other expenses as percentage of sales were 27% for the 3QFY14 versus 25 % in 3QFY13.The other expenditure increased largely due to rise in R&D expenses and rise in the cost owing to filings and setting up of the front end during the quarter. The R&D expenses 4.5% of Sales during the quarter. The net profits for the quarter came at Rs 261 Cr and NPM stands at 11.43 %. The Rs 40 Cr Forex gain is included in the other income during the quarter. The tax rate for the quarter was nearly at same rate as in corresponding last quarter at 25 %. The Company filed 10 ANDA's in the last nine months and got 6 approvals for the same period. It has 35 ANDA's under approval as on 31st December 2013. The few of the approval products are commercialized. Cipla Medpro formed as acquisition of Medpro,South Africa last year added 500 Cr to top line and 50 Cr to the operating profits during the quarter. The management of the company after the results said that the Global respiratory unit expects some of launches in the next year. It has set up new global respiratory team during the quarter. The Combination inhalers planned to launch in FY'15.Company expects to be more than 5% of Sales on the back of ramp up filings for the FY'15.The Capex is 90 Cr during the quarter and expects to be Rs 400 Cr FY'14. The Rollover Capex of previous year is Rs 150 Cr during the year. View & Valuation The stock at its CMP of Rs 381 is trading at 19.58 x of one year forward FY14E EPS of Rs 19.40.The stock has reacted negatively after 3QFY14 results however we don’t see any downside risks to our estimates. We further believe that Cipla-Medpro would be earning accretive in medium to long term horizons and we view the recent correction a good entry point for the stock. We maintain our view BUY for the stock with Target Price of Rs 440. Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 2282 403 261 17.7% 11.4% 2QFY14 2347 533 376 22.7% 16.0% (QoQ)-% (2.8) (24.4) (30.6) (500bps) (460bps) 3QFY13 2070 492 338 23.8% 16.3% (YoY)-% 10.2 -18.1 -22.8 (610bps) (490bps) (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 9

- 10. CIPLA Business Trend The revenues from export business including formulations and API grew by 36 % to 1509 Cr for the quarter while domestic business grew by 9% YoY to 1044 Cr. (Source: Company/Eastwind) Revenue Trend % Net revenues at Rs 2282 up 10 % YoY led by healthy growth in export business with well support from India operations to. (Source: Company/Eastwind) OPM & NPM Trend % The OPM declines by more than 600 bps YoY due to the increase in the R&D and the ramp up in the Staff cost during the quarter. (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 10

- 11. Somany Ceremics Ltd. V- "Reduce" 13th Feb' 14 "Outlook Challenging in near term…….." Result update Reduce CMP Target Price Previous Target Price Upside Change from Previous 131 115 95 -12.2% 21.1% Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume Nifty 531548 SOMANYCERA 61/155 452 3,109 6,001 Stock Performance-% 1M 13.2 16.0 Absolute Rel. to Nifty 1yr 59.9 58.1 YTD 103.2 97.6 Share Holding Pattern-% Promoters FII DII Others 3QFY14 63.3 2.8 1.7 32.2 2QFY14 1QFY14 63.3 63.3 0.8 0.2 1.9 2.0 34.0 34.5 The Q3FY2014 results were weak marked by a double-digit decline in the profit after tax on the back of subdued increase in fuel cost, dollar v/s rupee volatility and a pressure on the margin. The management expect improvement in the demand conditions in the near term and guided a revenue growth of 20% in FY14E-15E, however we expect the revenue growth to be somewhere arround 12-15% and financial performance to remain weak on account of margin pressure. Consequently, we are downgrading the rating to "Reduce" and advise investors to book profits at current level. Over the longer term, we expect the efforts to introduce new ventures, curtail costs and the expected economic revival driven by an uptick in demand in the latter part of FY2015, to boost its fortunes. In the interim period, we are reducing our target multiple to 10x of FY15E and price target to Rs 115. Result highlights : For Quarter Ended 2QFY14 • For the quarter ended September 2013, Somany Ceramic registered 6.5% rise in sales to Rs 284.5 crore. • OPM fell 230 basis points to 6.0% taking OP down 8.3% to Rs 17.0 crore. • Other income also rise 77.8% to Rs 48 lakh and interest cost decreased 8.9% to Rs 4.6 crore. • As depreciation increased 9.1% to Rs 5.7 crore, PBT fell 41.1% to Rs 7.1 crore. • Taxation fell 40.3% to Rs 2.3 crore (tax incidence grew from 32.5% to 32.9) and PAT fell 41.4% to Rs 4.8 crore. For Nine Month Ended 9MFY14 • For the nine month ended December 2013, Somany Ceramic registered 18.7% rise in sales to Rs 848.8 crore. • However, OPM dived from 8.5% to 6.4% taking OP down 10.7% to Rs 54.5 crore. • Other income jumped 28.1% to Rs 1 crore and interest cost decreased 8.2% to Rs 13.8 crore. • As depreciation increased 8.7% to Rs 16.5 crore, PBT fell 20.3% to Rs 25.2 crore. • Taxation fell to 15.5% to Rs 8.6 crore but tax incidence grew from 32.1% to 34.0% which finally saw PAT falling 22.5% to Rs 16.6 crore. Management Guidence FY14E Management is expected to achive a top-line growth of arround 20-25% in FY14E. 1 yr Forward P/B Valuations : At the current CMP of Rs. 131, the stock is trading at a PE of 15.1x and 11.0x of FY14E and FY15E. The company can post RoE of 17.0% and 17.1% & EPS of Rs. 8.7 and Rs. 10.8 FY14E and FY15E. We are downgrading the rating to "Reduce" and advise investors to book profits at current level. Over the longer term, we expect the efforts to introduce new ventures, curtail costs and the expected economic revival driven by an uptick in demand in the latter part of FY2015, to boost its fortunes. In the interim period, we are reducing our target multiple to 10x of FY15E and price target to Rs 115. Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 284.5 17.0 4.8 6.0% 1.7% 2QFY14 305.6 19.4 6.0 6.4% 2.0% (Standalone) (QoQ)-% -6.9% -12.8% -20.5% (40) bps (30) bps 3QFY13 267.2 22.1 8.2 8.3% 3.1% Rs, Crore (YoY)-% 6.5% -23.3% -41.4% (230) bps (140) bps (Source: Company/Eastwind Research) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 11

- 12. Somany Ceremics Ltd. Key financials : PARTICULAR 2009A 2010A 2011A 2012A 2013A 2014E 2015E 446 2 448 42 28 14 16 14 5 9 1 2.5 0.4 542 3 545 56 41 15 13 31 10 20 2 5.9 0.7 720 1 721 68 50 17 17 34 11 24 3 6.9 0.8 879 1 880 74 56 18 21 36 11 25 3 7.3 0.9 1054 3 1056 86 65 21 20 48 15 33 5 9.4 1.4 1250 3 1253 83 59 24 17 44 14 30 6 8.7 1.9 1438 3 1440 95 75 26 17 60 19 41 6 11.9 1.9 9.5% 3.0% 2.0% 28.5% 3.9% 13.5% 12.3% 10.3% 5.6% 3.8% 18.8% 2.2% 24.6% 13.8% 9.4% 4.8% 3.3% 18.0% 2.1% 23.0% 15.7% 8.4% 4.1% 2.9% 19.5% 2.5% 20.1% 16.6% 8.1% 4.5% 3.1% 14.6% 2.2% 21.3% 17.8% 6.6% 3.5% 2.4% 6.6% 1.4% 17.0% 9.8% 6.6% 4.2% 2.9% 9.1% 1.4% 19.4% 12.0% 65 138 202 3 9 83 162 245 3 31 104 158 262 3 38 126 151 276 3 38 153 142 295 3 65 177 130 307 3 131 211 130 341 3 131 18.8 0.5 1.7 3.5 2.2 6.9 24.0 1.3 3.1 5.3 2.2 6.6 30.1 1.3 2.9 5.6 2.8 6.9 36.5 1.0 2.7 5.1 3.2 7.0 Performance Revenue Other Income Total Income EBITDA EBIT DEPRICIATION INTREST COST PBT TAX Reported PAT Dividend EPS DPS Yeild % EBITDA % PBT % NPM % Earning Yeild % Dividend Yeild % ROE % ROCE% Position Net Worth Total Debt Capital Employed No of Share CMP Valuation (Ammount in crore) Book Value P/B Int/Coverage P/E Net Sales/CE Net Sales/Equity (Source: Company/Eastwind) (Source: Company/Eastwind Research) 44.4 1.5 3.3 6.8 3.6 6.9 51.2 2.6 3.4 15.0 4.1 7.1 61.2 2.1 4.4 11.0 4.2 6.8 (Figures In crore) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 12

- 13. Coal India LTD. Result Update CMP Target Price Previous Target Price Upside Change from Previous 261 307 330 18% -7% Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume (Nos.) Nifty 533278 COALINDIA 372/238 176226 17622 6001 Stock Performance-% 1M -1.3 2.8 Absolute Rel. to Nifty 1yr -21.2 8.8 YTD -21.4 8.6 Share Holding Pattern-% Promoters FII DII Others 3QFY14 90.0 5.5 2.4 2.1 2QFY14 1QFY14 90.0 90.0 5.5 5.4 2.3 2.3 2.2 2.4 1 yr Forward P/B Source - Comapany/EastWind Research "Buy" 14th Feb' 14 CIL reported Rs.16928 Cr Sales (-2% YOY) against Rs.17325 Cr in Q3FY13 due to poor off takes of the coal during the quarter. Q3FY14 PAT slipped to -11% to Rs.3894 Cr against Rs.4395 Cr in Q3FY13.Q3FY14 EBIDTA/ton remained flat YOY at Rs.350/ton while it is increased 36% through QOQ. EBIDTA margin corrected in this quarter to 24% from 18% in Q2FY14.Depriciation slipped 11% to 442Cr against 495 Cr in Q2FY14, moderating the burden on EBIDTA. On the expenditure side contractual expenses increased ~20% to Rs.154/ton from Rs.128/ton in Q2FY14.Powerfuel cost and other expenses per ton remained flat, while cost of project per ton decreased to Rs149/ton from Rs.206/ton in the previous quarter. Poor Realization of Coal India showed little uptick like 2% to Rs.1445/ton. Fluctuation in Domestic and international coal price impacted coal offtake In this quarter the international coal price were relatively down by 9% against Q2FY14 while the domestic coal price were showed upward movement. So the Major domestic consumers of coal imported coal at lower price, hence it impacted the off takes and revenue of CIL slipped -2% YOY and unable to meet the target off takes. Govt decision related labor strikes impacted the productions of CIL too. Sequential increase in tax rate further contracted the NPM%. From January we have seen a recovery in international coal price which is positive sign for CIL. Rescheduling Date of hearing stands a key concern Competition Appellate Tribunal stays Rs 1,773 Crore fine on CIL, and will decide on the matter on next hearing 16th April 2014 (Rescheduled from 11th Feb 2014). The quantum of penalty Rs 1,773.05 Crore is equal to three per cent of the PSU's average turnover for the last three years. We believe, A Rs 1800-crore fine could possibly mean less profits for the company and less dividend income for its owners. But as the main owner, the government, will pocket this amount in the form of a fine, it will not be poorer in any way. Realization gain on Revised Coal Price Meanwhile, Coal India Ltd is likely to get additional revenue of Rs 2,119 Crore in this fiscal on account of revision in dry fuel prices.CIL (Coal India Ltd) has revised and rationalized the basic notified prices of all the grades of non-coking coal except GI, G2 and G5.The estimated additional revenue due to revision of basic notified price for the current financial year is Rs 2,119 cr. Though the incremental revenue is a positive sign but it fails to change our previous valuation. Financials : Q3FY14 Y-o-Y % Q-o-Q % Q3FY13 Q2FY14 Net Revenue 16928 -2.3 9.8 17325 15411 EBITDA 4104 -4.3 46.9 2794 4288 Depriciation 442 5.2 -10.7 495 420 Interest Cost 10 0.0 25.6 8 10 Tax 1930 4.9 36.6 1412 1839 PAT 3894 -11.4 27.6 4395 3052 (In Crs) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 13

- 14. Coal India LTD. View & Outlook We revised our estimates due to sequential poor production and off takes of CIL. We expect modest increase in sales volumes growth during FY2013-15 on account of poor off take capabilities of CIL. Management showed his confidence about their coal production target and coal off take target for FY2014E, in previous quarter, which is 482mt and 492mt respectively. But Due to sequential poor production and off take we revised the target to 464mt and 475mt respectively. Also, we expect CIL’s margins to decline during FY2014 due to lower e-auction realizations and higher staff costs/other expenses. We are expecting flat sales growth for 2014.Coal India Ltd sprang a positive surprise by reporting higher-than-expected realizations as well as earnings before interest, tax, depreciation and amortization (Ebitda). Average price realizations increased by 2.3% sequentially to Rs.1,444.87 per tonne which is positive sign for future growth. Recommendation Earlier we suggested, if earnings falls, then price might go beyond 256, but p/b level may be maintained , else we assume that since the company is a good dividend paying company with Roe above 30% we assume p/b should remain above 3. We see Coal India at a attractive valuation to go long from the current dips. So we stick to our previous estimates and recommend Maintain Buy CIL at price dips with a target price of Rs.307/-. P/L PERFORMANCE Net Revenue from Operation Cost Of Projects & Contractual Power and fuel contractual expenses Employee benefit Expence Expenditure EBITDA Depriciation Interest Cost Tax PAT ROE % OPERATING MATRIX Coal Production in MT Coal Offtake in MT Revenue Generation From unit Ton Avg Man Power (in numbers) Productivity Per Man FY11 50234 7573 1755 4580 20481 40390 9843 1673 79 5595 10868 33 FY10 431 416 1073 404744 1066 FY12 62415 5123 2013 4901 26705 40857 21558 1969 54 6484 20588 51 FY11 431 425 1183 390243 1105 FY13 68303 6556 2333 5802 27943 50219 18084 1813 45 7623 17356 36 FY12 436 433 1441 377447 1155 Narnolia Securities Ltd, FY14E 69960 8372 2591 6049 28943 53705 16255 1860 34 7310 17921 40 FY13 452 465 1468 364736 1240 14

- 15. Coal India LTD. B/S PERFORMANCE Share capital Reserve & Surplus Total equity Long-term borrowings Short-term borrowings Long-term provisions Trade payables Short-term provisions Total liabilities Intangibles Tangible assets Capital work-in-progress Long-term loans and advances Inventories Trade receivables Cash and bank balances Short-term loans and advances Total Assets RATIOS P/B EPS Debtor to Turnover% Creditors to Turnover% Inventories to Turnover% CASH FLOWS Cash from Operation Changes In Working Capital Net Cash From Operation Cash From Investment Cash from Finance Net Cash Flow during year Trading At : FY10 6316 20956 27273 343 1620 2545 772 1404 5443 0 12035 2211 610 4402 2169 39078 8066 17921 FY10 0.0 0.0 4.9 1.7 1.0 FY11 6316 26998 33314 1334 33 22461 645 12387 8490 779 12065 2057 845 5586 3419 45806 11180 21646 FY11 5.7 17.3 22.8 4.3 3.7 FY12 6316 34137 40453 1305 0 28271 829 15595 9785 759 12681 1848 1017 6071 5663 58203 13478 24688 FY12 5.5 32.6 29.2 4.3 3.1 FY13 6316 42156 48472 1078 0 31144 837 20447 12385 712 12754 3496 1181 5618 10480 62236 16189 25479 FY13 4.0 27.5 52.7 4.2 2.8 FY10 FY11 FY12 10727 12819 16323 -131 -3822 3565 10596 8997 19888 950 697 -10410 2163 2911 -7382 13708 12606 2095 Down 21% from its 52week High Up 14% from its 52 week Low FY13 15948 -6839 9109 -1833 -7852 -575 Narnolia Securities Ltd, 15

- 16. CANARA BANK Result update CMP Target Price Previous Target Price Upside Change from Previous NEUTRAL 213 256 20 Market Data BSE Code NSE Symbol 532483 CANBK 52wk Range H/L Mkt Capital (Rs Cr) Average Daily Volume Nifty Stock Performance 1M Absolute -17.2 Rel.to Nifty -13.3 459/190 9427 1.93 lakh 6001 1yr -52.3 -54.1 YTD -52.3 -54.1 Share Holding Pattern-% Current 1QFY14 4QFY1 3 Promoters 69.0 67.7 67.7 FII 10.3 11.9 12.7 DII 12.9 13.1 13.3 Others 7.7 7.3 6.3 CANARA BANK Vs Nifty "NEUTRAL" 14h Feb2014 Canara bank’s performance was muted all through despite of healthy loan growth. Canara bank was unable to translate its balance sheet growth in profit & loos account due to lower base rate among peers. Bank’s asset quality was deteriorating sequentially along with higher fresh slippage. PCR was lowest among peers (without technical write off). We are disappointed with growth parameters of the bank. We have neutral view on the stock. Moderate growth in NII was due to margin compression During quarter bank’s NII grew by 12% YoY to Rs.2227 cr despite of 32% loan growth and 26% deposits growth. Moderate growth in NII was due to margin compression in YoY basis which was lead by lower base rate among peers. On NII level, bank’s interest earnings asset grew by 18% YoY while interest bearing liabilities grew by 20% due to higher share of wholesale deposits which somehow increased cost. Other income was flat from last quarter and was stood at Rs.851 cr versus Rs.846 cr. Consequently from lower support of other income, revenue grew by 8.6% YoY to Rs.3078 cr. Higher opex and moderate NII growth led muted operating profit growth Operating cost increased by 12.9% YoY was due to higher cost registered in other operating expenses which were came because of 47 new branches and 245 ATMs added on yearly basis. Employee cost was flat on YoY basis while other operating expenses increased by 26.3% YoY. Cost to income ratio 180 bps improved on YoY basis to 48.3%. With moderate NII growth and higher operating expenses led operating profit growth of 4.9% YoY. Deteriorating asset quality with higher slippage On asset quality front, gross NPA increased by 8% QoQ in absolute term whereas fresh slippage was high at Rs.2100 cr versus Rs.1520 cr in previous quarter. In percentage term, GNPA stood at 2.8% versus 2.7% in previous quarter whereas fresh slippage in annualised basis increased by 76 bps sequentially to 2.9%. During quarter, bank’s increased provisions by 19% QoQ thereby net NPA increased by 6% in absolute term. In percentage term net NPA stood at 2.4% versus 2.3% in previous quarter.PCR slightly improved from 13.6% to 14.9% (without technical write off) much lower than peers. However bank reported PCR at 57.4% in 3QFY14. Financials NII Total Income PPP Net Profit EPS 2011 7823 10526 6107 4026 90.9 2012 7689 10617 5943 3283 74.1 Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. Rs, Cr 2013 2014E 2015E 7879 8511 12169 11032 12328 15986 5890 6381 8792 2872 2399 3869 64.8 52.0 83.9 (Source: Company/Eastwind) 16

- 17. CANARA BANK Healthy loan growth led by retail sector Bank’s loan grew by 32% YoY led by retail sector growth of 55% YOY followed by SME (46% YoY), Infrastructure (24% YoY). Within infrastructure loan growth, power generation and transmission growth was strong at 63% YoY. Deposits grew by 1% YoY and 4% QoQ in which current and saving account deposits grew by 19% and 16% YoY respectively. In deposits profile, term deposits de-grew by 3% YoY which was took flat growth in overall deposits as share of term deposits reduce to 77% from 80% in last quarter. CASA ratio was declined by 123 bps QoQ to 23%. Credit deposits ratio for the quarter stood at 70.4% versus 71.8% in previous quarter and 67.4% in last quarter. Margin compression on account of higher cost of fund NIM compressed by 15 bps YoY to 2.21 largely due to lower loan yield 70 bps YoY whereas cost of fund increased by 120 bps YoY. Higher cost of fund was due to higher cost of bulk deposits. However declining share of bulk deposits and increasing CASA ratio restricted to escalate funding cost. Yield on loan declined by 70 bps YoY despite of healthy loan growth was due to lower base rate among peers. Valuation & View Canara bank’s performance was muted all through despite of healthy loan growth. Canara bank was unable to translate its balance sheet growth in profit & loos account due to lower base rate among peers. Bank’s asset quality was deteriorating sequentially along with higher fresh slippage. PCR was lowest among peers (without technical write off). We are disappointed with growth parameters of the bank. We have neutral view on the stock. Valuation Band Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 17

- 18. CANARA BANK Chart Focus Moderate growth in NII was due to margin compression Higher opex and moderate NII growth led muted operating profit growth Profitability declined due to moderate NII growth, higher provisions and higher tax rate Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 18

- 19. CANARA BANK Quarterly Performance Quarterly Result Interest/discount on advances / bills Income on investments Interest on balances with Reserve Bank of India Others Total Interest Income Others Income Total Income Interest on deposits Interest Expended NII Other Income Total Income Employee Other Expenses Operating Expenses PPP( Rs Cr) Provisions PBT Tax Net Profit 3QFY14 7360 2575 149 0 10084 851 10935 7311 7857 2227 851 3078 873 614 1488 1591 1052 539 130 409 2QFY14 6964 2597 93 0 9654 773 10427 6923 7463 2191 773 2964 933 607 1539 1425 674 751 125 626 Balance Sheet Deposits CASA(%) Loan Investments 408924 391613 323963 23.1 24.3 20.0 287700 281104 218242 130359 119481 118835 26.2 4.4 31.8 2.3 9.7 9.1 Asset Quality GNPA NPA % GNPA % NPA PCR(%) (w/o technical write-off) 8,074 6870 2.8 2.4 14.9 32.6 8.0 33.8 6.4 7,475 6459 2.7 2.3 13.6 3QFY13 5958 2460 127 0 8544 846 9390 6307 6556 1988 846 2834 831 486 1317 1516 626 891 180 711 6,090 5134 2.8 % YoY % QoQ 3QFY14E % Variation 23.5 5.7 7298 0.9 4.7 -0.9 2701 -4.7 17.1 60.3 216 -30.8 -13.5 0 18.0 4.4 10214 -1.3 0.7 10.1 1006 -15.3 16.5 4.9 11220 -2.5 15.9 5.6 0 19.8 5.3 7608 3.3 12.0 1.6 2606 -14.5 0.7 10.1 1006 -15.3 8.6 3.9 3612 -14.8 5.1 -6.3 1127 -22.5 26.3 1.2 751 -18.3 12.9 -3.4 1878 -20.8 4.9 11.6 1734 -8.2 68.0 56.0 700 50.3 -39.4 -28.2 1034 -47.8 -27.8 4.0 258 -49.7 -42.4 -34.6 775 -47.2 400424 0.0 291913 127099 2.1 -1.4 2.6 Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 19

- 20. CANARA BANK Income Statement Interest Income Interest Expense NII Change (%) Non Interest Income Total Income Change (%) Operating Expenses Pre Provision Profits Change (%) Provisions PBT PAT Change (%) 2010 2011 2012 2013 2014E 2015E 18752 13071 5681 #DIV/0! 2858 8538 #DIV/0! 3478 5061 #DIV/0! 2039 3021 3021 45.8 23064 15241 7823 37.7 2703 10526 23.3 4419 6107 20.7 2081 4026 4026 33.2 30851 23161 7689 -1.7 2928 10617 0.9 4674 5943 -2.7 1860 4083 3283 -18.5 34078 26199 7879 2.5 3153 11032 3.9 5142 5890 -0.9 2218 3672 2872 -12.5 39193 30682 8511 8.0 3817 12328 11.8 5947 6381 8.3 3347 3034 2399 -16.5 47413 35244 12169 43.0 3817 15986 29.7 7194 8792 37.8 3565 5228 3869 61.3 234651 #DIV/0! 68261 #DIV/0! 8441 69677 169335 #DIV/0! 293973 25 83117 22 14262 83700 212467 25 327054 11 79611 -4 15525 102057 232490 9 355856 9 86061 8 20283 121133 242177 4 409234 15 102878 20 24439 133305 293034 21 470620 15 118310 15 28105 168631 339919 16 8.2 6.6 5.2 9.3 8.0 6.9 4.8 7.0 10.1 6.9 6.7 7.7 10.1 7.5 7.1 4.7 9.6 7.7 7.0 7.0 10.0 7.5 6.9 7.0 358 410 1.1 452 627 1.4 512 474 0.9 562 393 0.7 639 214 0.3 710 214 0.3 Balance Sheet Deposits( Rs Cr) Change (%) of which CASA Dep Change (%) Borrowings( Rs Cr) Investments( Rs Cr) Loans( Rs Cr) Change (%) Ratio Avg. Yield on loans Avg. Yield on Investments Avg. Cost of Deposit Avg. Cost of Borrowimgs Valuation Book Value CMP P/BV Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 20

- 21. Finolex Cables Ltd. V- "Book Partial Profit" 13th Feb' 14 "Reasonable prospects…..." Book Partial Profit 81 90 73 11% 0% Result update CMP Target Price Previous Target Price Upside Change from Previous Market Data BSE Code NSE Symbol 52wk Range H/L Capital Mkt (Rs Crores) Average Daily Volume Nifty 500144 FINCABLES 41/92 1,238 94,300 6,084 Stock Performance-% 1M (4.1) (2.7) Absolute Rel. to Nifty 1yr 46.7 43.7 YTD 78.0 71.0 Share Holding Pattern-% Promoters FII DII Others 3QFY14 35.8 1.8 9.8 52.5 1 yr Forward P/B 2QFY14 1QFY14 35.8 35.8 1.1 1.0 10.2 10.5 52.9 52.8 Finolex Cables’ (FCL) Q3FY14 PAT of Rs. 24.5 crore was below ourestimate owing to lower sales and EBITDA margin. Decline in communication cable segment segments as well as high raw material prices resulted in flat EBITDA growth of 3.2% yoy. Sales rose 5.58% to Rs. 557.55 crore in the quarter ended December 2013 as against Rs. 528.07 crore during the previous quarter ended December 2012. Third Quarter result were marginally below our expectaton which led us to revise our estimate on stock, we cut our EPS forecast for FY14E-15E by 8.6%/4.1%. Even after posting marginally below result the stock is quite attractive at current market price of Rs. 81 and left a limited upside of 11%, however we advised our reader to book a part profit on stock The copper rods segment was initially set up as backward integration for the cables segment. The excess production after captive consumption is sold off to third parties at market price. However, owing to thin and declining margins from third party transactions, FCL is gradually reducing its exposure to the segment. The contribution of the segment to the top-line has decreased from 21% in FY2010 to ~5% currently. This trend is expected to continue, thereby improving the overall EBIT margin of the company. Outlook : FCL being one of the leading players in the cable industry seems well placed to capture huge opportunities considering the strengths & the industry in which the Company is operating. Derivative losses coupled with bleak performance by communication cable segment were the major reasons for de-rating of the stock in past which in our view seems to have been overdone. The company’s LT division is doing very well, they have recently entered into HT and Extra High Voltage (EHV) cable verticals. The company has market share of around 15-16 percent in both electrical and telecommunication verticals. Further the company has approved setting up a captive 5 MW solar power plant at its manufacturing facilities at Urse, Pune at an estimated cost of Rs 40 crore. Valuation : We cut our earnings estimates to factor volume decline in electrical & communication cable segment, margin decline in copper rod segment and losses in the others segment. Consequently, we cut our earnings estimates by 8.6% for FY14E (Rs. 11.6/Share) and 4.1% for FY15E (Rs. 12.6/Share). At the CMP of Rs. 81 stock is trading at PE of 7.0/6.4 of FY14E/15E. We revised our rating on stock from "Buy" to "Hold". However owing to slower pace of economic growth further we advised our readers to book part profit on stock and hold the balance with a target price of Rs. 90 Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 563.1 44.3 24.5 7.9% 4.3% 2QFY14 593.1 76.4 80.0 9.3% 12.8% (Source: Company/ Eastwind Research) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. (QoQ)-% -5.1% -42.0% -69.4% (140) bps (850) bps 3QFY13 534.3 42.9 24.0 8.0% 4.5% Rs, Crore (YoY)-% 5.4% 3.2% 2.1% (10) bps (20) bps (Standalone) 21

- 22. Finolex Cables Ltd. Key financials : PARTICULAR 2009A 2010A 2011A 2012A 2013A 2014E 2015E 1342 51 1392 100 61 39 32 -30 5 -109 -35 3 -2.3 0.2 1619 24 1643 195 157 37 19 89 32 -74 58 9 3.8 0.6 2036 26 2062 174 135 39 19 107 22 -34 85 11 5.6 0.7 2064 36 2100 175 135 39 26 109 11 -36 98 12 6.4 0.8 2271 24 2295 229 182 47 12 171 26 -23 145 18 9.5 1.2 2315 47 2362 241 191 50 14 234 56 10 178 23 11.6 1.5 2500 42 2542 258 205 53 14 233 56 0 185 23 13.1 1.5 7.4% -2.5% -12.0% 1.0% -6.0% -4.0% 12.0% 3.5% 7.4% 1.2% 9.0% 6.3% 8.5% 4.1% 11.7% 1.5% 11.9% 8.7% 8.5% 4.7% 20.6% 2.6% 12.3% 10.1% 10.1% 6.3% 20.9% 2.6% 15.7% 13.1% 10.4% 7.5% 14.3% 1.9% 16.5% 14.3% 10.8% 7.3% 16.2% 1.9% 15.4% 13.7% 596 296 892 15 19 643 275 918 15 51 717 260 978 15 47 800 172 972 15 31 924 184 1109 15 46 1079 160 1239 15 81 1249 160 1409 15 81 39.0 0.5 1.9 -8.3 42.0 1.2 8.4 13.4 46.9 1.0 7.0 8.5 52.3 0.6 5.2 4.9 60.4 0.8 14.6 4.8 70.6 1.1 13.6 7.0 81.7 1.0 14.6 6.4 Performance Revenue Other Income Total Income EBITDA EBIT Depriciation Intrest Cost PBT TAX Derrivative Loss Reported PAT Dividend EPS DPS Yeild % EBITDA % NPM % Earning Yeild % Dividend Yeild % ROE % ROCE% Position Net Worth Total Debt Capital Employed No of Share CMP Valuation Book Value P/B Int/Coverage P/E (Source: Company/ Eastwind Research) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 22

- 23. N arnolia Securities Ltd 402, 4th floor 7/ 1, Lord s Sinha Road Kolkata 700071, Ph 033-32011233 Toll Free no : 1-800-345-4000 em ail: research@narnolia.com , w ebsite : w w w .narnolia.com Risk Disclosure & Disclaimer: This report/message is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Narnolia Securities Ltd. (Hereinafter referred as NSL) is not soliciting any action based upon it. This report/message is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any from. The report/message is based upon publicly available information, findings of our research wing “East wind” & information that we consider reliable, but we do not represent that it is accurate or complete and we do not provide any express or implied warranty of any kind, and also these are subject to change without notice. The recipients of this report should rely on their own investigations, should use their own judgment for taking any investment decisions keeping in mind that past performance is not necessarily a guide to future performance & that the the value of any investment or income are subject to market and other risks. Further it will be safe to assume that NSL and /or its Group or associate Companies, their Directors, affiliates and/or employees may have interests/ positions, financial or otherwise, individually or otherwise in the recommended/mentioned securities/mutual funds/ model funds and other investment products which may be added or disposed including & other mentioned in this report/message.