Sydney Sept 2008

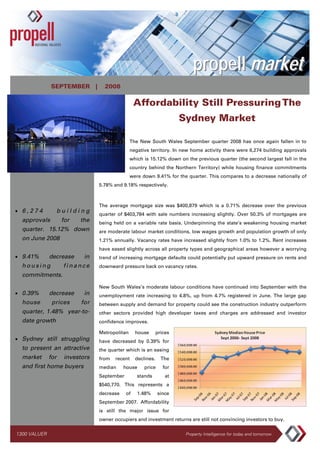

- 1. propell market SEPTEMBER | 2008 Affordability Still Pressuring The Sydney Market The New South Wales September quarter 2008 has once again fallen in to negative territory. In new home activity there were 6,274 building approvals which is 15.12% down on the previous quarter (the second largest fall in the country behind the Northern Territory) while housing finance commitments were down 9.41% for the quarter. This compares to a decrease nationally of 5.78% and 9.18% respectively. The average mortgage size was $400,879 which is a 0.71% decrease over the previous • 6,274 building quarter of $403,784 with sale numbers increasing slightly. Over 50.3% of mortgages are approvals for the being held on a variable rate basis. Underpinning the state’s weakening housing market quarter. 15.12% down are moderate labour market conditions, low wages growth and population growth of only on June 2008 1.21% annually. Vacancy rates have increased slightly from 1.0% to 1.2%. Rent increases have eased slightly across all property types and geographical areas however a worrying • 9.41% decrease in trend of increasing mortgage defaults could potentially put upward pressure on rents and housing finance downward pressure back on vacancy rates. commitments. New South Wales’s moderate labour conditions have continued into September with the • 0.39% decrease in unemployment rate increasing to 4.8%, up from 4.7% registered in June. The large gap house prices for between supply and demand for property could see the construction industry outperform quarter, 1.48% year-to- other sectors provided high developer taxes and charges are addressed and investor date growth confidence improves. Metropolitan house prices • Sydney still struggling have decreased by 0.39% for to present an attractive the quarter which is an easing market for investors from recent declines. The and first home buyers median house price for September stands at $540,770. This represents a decrease of 1.48% since September 2007. Affordability is still the major issue for owner occupiers and investment returns are still not convincing investors to buy. 1300 VALUER Property Intelligence for today and tomorrow

- 2. Propell National Valuers | Residential Overview | SEPT 2008 House and unit price growth in the top 10 suburbs for the year-to-date varied from 42.8% in Watsons Bay through to 25.1% in Dee Why for houses, and 31.5% in Tamarama to 15.1% in North Turramurra for units, with evidence showing that the top end and waterfront areas of the market are most active while the mid and lower ranges have levelled off. This is due in part to self-managed super funds purchasing property at the top end and the affordability issue holding others out of the market. Latest figures show a massive 42.6% of family income is required to meet average loan repayments in New South Wales. • Watsons Bay top The table below illustrates the top 10 Sydney growth suburbs based on median house and unit prices for the September quarter 2008 year-to-date. performing suburb with growth of 42.8% for Top 10 Growth Suburbs houses and Tamarama 31.5% for units Suburb Median Q3 Median% Suburb Median Q3 Median % (Houses) 2008 Change (Units) 2008 Change Watsons Bay $2,712,500 42.8 Tamarama $828,750 31.5 • Top end and waterfront Bronte $2,555,000 40.4 Lane Cove $476,000 26.9 properties experiencing West Cammeray $1,337,500 37.9 Beaconsfield $526,000 26.0 highest growth. Queens Park $1,640,000 36.1 Leichhardt $537,000 24.0 • 42.6% of family income Pyrmont $759,000 35.5 Gordon $697,500 19.7 required to meet Tamarama $4,000,000 30.1 Pyrmont $580,000 18.4 average loan Darling Point $5,000,000 29.9 Arncliffe $349,000 18.3 repayments. Waverley $1,340,000 29.2 Edgecliff $495,000 18.1 Cabarita $1,410,000 28.2 McMahons $595,000 16.7 Point Dee Why $937,000 25.1 North Turra- $757,500 15.1 murra Source: RRData Sydney’s house price has decreased by 1.48% for the year to September, while unit price growth has been –1.18%. This compares to South Australia(10.84% and 11.46%), Melbourne(5.80% and 4.16%), Brisbane(3.66% and 1.73%), Darwin(12.89 and 10.34%), Canberra(2.73% and 7.64%), Hobart(9.94% and –7.23%), and Perth(-4.31% and 1.26%) Source: RPData 2| QUARTERLY RESIDENTIAL REPORT—Sydney

- 3. Propell National Valuers | Residential Overview | SEPT 2008 Residential Rental Market In the September quarter vacancy rates increased to 1.2%, up from 1.0% in June 2008. The average weekly rent for a two bedroom unit in Sydney’s Inner Ring of suburbs is $495 per week. This is an increase of 1.02% over the quarter and 15.11% for the year-to- date. The average weekly rent for a three bedroom house in Sydney is $680 per week, an increase of 1.49% and 16.23% year-to-date. Current tenant demand for rental properties in Sydney is still extremely high with intense competition for properties due to a general lack of supply. Increasing mortgage defaults are adding to the level of competition for rental properties. The graph below illustrates the average residential rent growth in three bedroom houses and two bedroom units in the Sydney Inner Ring area over the last two years. • Vacancy rate increases to 1.2% for the quarter • Intense competition for Source: Housing NSW rental properties with mortgage defaults add- The table below highlights median rents within the Statistical Division of Sydney for the ing to competition September quarter 2008 while the table over the page highlights the median rent for a particular property type for the September quarter 2008. • Sydney’s Outer Ring Median rents within the Sydney Statistical Division September Quarter 2008 (3 Bedroom House) has highest rent in- crease for the quarter of Area within Median Rent p/w Qtr % Annual Statistical Change % Change 3.33% within the Statis- Division Sydney SD $365 1.3% 10.6% tical Division Inner Ring $680 1.5% 16.2% Middle Ring $450 1.1% 16.8% Outer Ring $310 3.3% 10.7% Rest of GMR $295 1.7% 9.2% New South $305 1.6% 9.7% Wales Source: Housing NSW Suburb Sales Q1 2007 Median Q1 3| QUARTERLY RESIDENTIAL REPORT—Sydney

- 4. Propell National Valuers | Residential Overview | SEPT 2008 Median weekly rent by property type (Sydney SD) Median Rent p/w Qtr % Annual % Change Change Sydney 1 Bed Unit $355 1.4% 10.9% 2 Bed Unit $385 1.3% 13.2% 3 Bed House $365 1.4% 10.6% 4 Bed House $475 0.0% 10.4% Source: Housing NSW Population As at December 2007, The Sydney Statistical Division had a population growth of 1.21%, the third lowest in the country above the Statistical Divisions of Greater Hobart (0.93%) and Adelaide (1.06%). This represented a total of 51,995 people or the equivalent of 999 • Sydney Statistical people per week. New South Wales as a whole grew by 1.05% or 71,890 people. The Division has third largest growth continued to occur in the Statistical Subdivisions of Richmond-Tweed lowest population (1.31%), Hunter(1.11%) and South Eastern(1.02%) with declines in Far West(-0.38%) and North Western(-0.29%) increase of 1.21% The latest March release from the Australian Bureau of Statistics show that both the • Net interstate migration Natural Increase and Net Overseas Migration have decreased in the two quarters to showing signs of March 2008 by 6.35% (2,155 persons) and 17.08% (6,540 persons) respectively with little prospect of reversing the trend in the short term due to the perceived stagnant state of recovery the New South Wales economy. Most people coming to the country are not selecting to reside in New South Wales. Offsetting this however, is Net Interstate Migration which • Full-time employment increased 2,484 persons or 14.03% for consecutive quarters indicating, among other things, that affordability issues in other states are driving people back to New South decreasing while part- Wales. time e m ploy me nt increasing New South Wales’s Gross State Product for the year to December 2007 was 1.8% (below the average of 2.9%), with a State Final Demand of 2.5%. This contributed to Total Domestic Demand by 0.8%, the third highest in the country behind Queensland (1.4%) and Western Australia (1.0%). There were 3,319,000 people employed in New South Wales as at March 2008. The industries with the most number of employed persons were Manufacturing (202,434), Construction(183,998) and Retail Trade(140,058). The industries employing the least amount of persons included Mining(18,322), Arts and Recreation (21,311) and Electricity, Gas and Water(23,079). One of the most notable changes in employment statistics is the number of people in full-time employment which has decreased to 69% in 2008 from 71% in 1998, while part-time employment has increased from 22% to 27% over the same time period. In terms of the participation rate for employment, female participation was at 55.6% (an 0.18% increase) while male participation was at 60.0% (an 0.67% increase). 4| QUARTERLY RESIDENTIAL REPORT—Sydney

- 5. Propell National Valuers | Residential Overview | SEPT 2008 Major Projects In December 2004, the New South Wales Government released a plan outlining the future of land releases over the following 30 years in the North West and South West of Sydney. The plan outlines expenditure of over $7.5 billion on roads, rail, bus networks, education, health, recycled water and sewerage services linked to staged land releases. Some of the early infrastructure projects being delivered are: The Redevelopment of Barangaroo (Darling Harbour): A $2.5 billion renewal of a 22 hectare port precinct on the western edge of Sydney’s central business district. The project is expected to generate 30,000 jobs during the decade long construction period. Supporting transport infrastructure could include new public transport ferry wharves, bus stations and possibly light rail, while also providing a significant foreshore park. The Great Western Highway Upgrade: $85.3 million is expected to be outlaid to upgrade and improve the link from the western corridor into the Sydney CBD. Expected time savings for commuter travel are forecast to be 20 to 30 minutes. Health : Health projects have received an injection of funds with $1.88 billion for Sydney South West Health services (up from $78.7 million), $1.34 billion for Sydney West Health services (up from $51.3 million) and $218.9 million for the Children’s Hospital at Westmead (and increase of $9.6 million) Stop Press • Over $7.5 billion At the time of publication (Nov 08) NSW had handed down a mini budget that outlined for future has curtailed public infrastructure spending and increased Land Tax. The infrastructure projects recent downward trend in interest rates and economic stimulus package, linked to land releases including first home owner grant have yet to impact. • $2.5 billion FOR MORE INFORMATION Summary CONTACT redevelopment of Darling Harbour and The September quarter has seen little improvement Peter Dorrough FAPI foreshore underway in the housing market for Sydney although the General Manager NSW / ACT decline in house prices did ease slightly as did vacancy rates. Affordability is still the biggest issue pdorrough@propellvaluers.com and an emerging trend of mortgage defaults is a 02 9955 0305 worrying factor for the already stressed rental market. A change of government has done little at this point to instill any major confidence in the state Aaron Parker although it is still early days and it will take a while to see if performance improves. State taxes are a Research Manager disincentive for development and purchase and aparker@propellvaluers.com much needs to be done in this area to bring it in line with recent changes in other states. Well located, waterfront or CBD centric properties are OR CALL producing greatest growth while the mid range stagnates. 1300 VALUER (1300 825 837) Propell National Values does not give any warranty in relation to the accuracy of the information contained in this report. If you intend to rely upon the information contained herein, you must take note that the information, figures and projections have been provided by various sources and have not been verified by us. Whilst all care has been taken in the preparation of this report, we have no belief one-way or the other in relation to the accuracy of such information, figures and projections contained herein. Propell National Valuers will not be liable for any loss or damage resulting from any statement, figure, projection or any other information that you rely upon that is contained in the material. COPYRIGHT - Propell National Valuers 2008 5| QUARTERLY RESIDENTIAL REPORT—Sydney