Understanding the NUA rule.

•

1 recomendación•1,969 vistas

For people who have significant holdings of highly appreciated company stock in their qualified employer plans, an obscure IRS rule may lead to big tax savings.

Denunciar

Compartir

Denunciar

Compartir

Descargar para leer sin conexión

Recomendados

Recomendados

@9999965857 🫦 Sexy Desi Call Girls Janakpuri 💓 High Profile Escorts Delhi 🫶

Delhi Russian Escorts provide clients with the opportunity to experience an array of activities - everything from dining at upscale restaurants to watching the latest movies. Hotel call girls are available year-round to offer unforgettable experiences and fulfill all of your erotica desires. Escort services go beyond the traditional notion of call girls by providing clients with customized experiences beyond dinner companionship to social events. (27-April-2024(PSS)

Mahipalpur | Majnu Ka Tilla | Aerocity | Delhi,Noida | Gurgaon | Paharganj | GTB Nagar | Sarita Vihar | Chattarpur | Dwarka | Rajouri Garden | Connaught Place | Janakpuri

▂▃▄▅▆▇█▓▒░░▒▓█▇▆▅▄▃▂📢N-C-R⭐VIP⭐GENUINE🅰️█▬█⓿▀█▀💋 𝐆𝐈𝐑𝐋 💥ANAL SEX💥 BDSM💥69 POSE💥LIP KISS💥 DEEP SUCKING WITHOUT CONDOM💥 CUM ON FACE💥 NUDE DANCE💥 BOOBS RUBBING💥 LICKING💥HAND JOB 💏GIRLFRIEND EXPERIENCE💏 ❣️College girls, ❣️Russian girls, ❣️Working girls, ❣️North-east girls, ❣️ Punjabi girls, etc........................

EROTIC MASSAGE💥@9999965857 🫦 Sexy Desi Call Girls Janakpuri 💓 High Profile Escorts Delhi 🫶

@9999965857 🫦 Sexy Desi Call Girls Janakpuri 💓 High Profile Escorts Delhi 🫶Call Girls In Delhi Whatsup 9873940964 Enjoy Unlimited Pleasure

Más contenido relacionado

Más de Putnam Investments

Más de Putnam Investments (20)

Putnam Perspectives: Capital Market Outlook Q1 2014

Putnam Perspectives: Capital Market Outlook Q1 2014

Fostering innovation to improve retirement security

Fostering innovation to improve retirement security

Taxes after the fiscal cliff: Planning opportunities in 2013

Taxes after the fiscal cliff: Planning opportunities in 2013

Último

@9999965857 🫦 Sexy Desi Call Girls Janakpuri 💓 High Profile Escorts Delhi 🫶

Delhi Russian Escorts provide clients with the opportunity to experience an array of activities - everything from dining at upscale restaurants to watching the latest movies. Hotel call girls are available year-round to offer unforgettable experiences and fulfill all of your erotica desires. Escort services go beyond the traditional notion of call girls by providing clients with customized experiences beyond dinner companionship to social events. (27-April-2024(PSS)

Mahipalpur | Majnu Ka Tilla | Aerocity | Delhi,Noida | Gurgaon | Paharganj | GTB Nagar | Sarita Vihar | Chattarpur | Dwarka | Rajouri Garden | Connaught Place | Janakpuri

▂▃▄▅▆▇█▓▒░░▒▓█▇▆▅▄▃▂📢N-C-R⭐VIP⭐GENUINE🅰️█▬█⓿▀█▀💋 𝐆𝐈𝐑𝐋 💥ANAL SEX💥 BDSM💥69 POSE💥LIP KISS💥 DEEP SUCKING WITHOUT CONDOM💥 CUM ON FACE💥 NUDE DANCE💥 BOOBS RUBBING💥 LICKING💥HAND JOB 💏GIRLFRIEND EXPERIENCE💏 ❣️College girls, ❣️Russian girls, ❣️Working girls, ❣️North-east girls, ❣️ Punjabi girls, etc........................

EROTIC MASSAGE💥@9999965857 🫦 Sexy Desi Call Girls Janakpuri 💓 High Profile Escorts Delhi 🫶

@9999965857 🫦 Sexy Desi Call Girls Janakpuri 💓 High Profile Escorts Delhi 🫶Call Girls In Delhi Whatsup 9873940964 Enjoy Unlimited Pleasure

Call Girl Kashmir Indira Call Now: 8617697112 Kashmir Escorts Booking Contact Details WhatsApp Chat: +91-8617697112 Kashmir Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable. Independent Escorts Kashmir understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(INDIRA) Call Girl Kashmir Call Now 8617697112 Kashmir Escorts 24x7

(INDIRA) Call Girl Kashmir Call Now 8617697112 Kashmir Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Vip Call Girls South Ex ➡️ Delhi ➡️ 9999965857 No Advance 24HRS Live

Booking Contact Details :-

WhatsApp Chat :- [+91-9999965857 ]

The Best Call Girls Delhi At Your Service

Russian Call Girls Delhi Doing anything intimate with can be a wonderful way to unwind from life's stresses, while having some fun. These girls specialize in providing sexual pleasure that will satisfy your fetishes; from tease and seduce their clients to keeping it all confidential - these services are also available both install and outcall, making them great additions for parties or business events alike. Their expert sex skills include deep penetration, oral sex, cum eating and cum eating - always respecting your wishes as part of the experience

(29-April-2024(PSS)Vip Call Girls South Ex ➡️ Delhi ➡️ 9999965857 No Advance 24HRS Live

Vip Call Girls South Ex ➡️ Delhi ➡️ 9999965857 No Advance 24HRS LiveCall Girls In Delhi Whatsup 9873940964 Enjoy Unlimited Pleasure

Rohini Sector 15 Call Girls Delhi 9999965857 @Sabina Saikh No Advance

Booking Contact Details :-

WhatsApp Chat :- [+91-9999965857 ]

The Best Call Girls Delhi At Your Service

Russian Call Girls Delhi Doing anything intimate with can be a wonderful way to unwind from life's stresses, while having some fun. These girls specialize in providing sexual pleasure that will satisfy your fetishes; from tease and seduce their clients to keeping it all confidential - these services are also available both install and outcall, making them great additions for parties or business events alike. Their expert sex skills include deep penetration, oral sex, cum eating and cum eating - always respecting your wishes as part of the experience

(27-April-2024(PSS)

Two shots with one girl: ₹4000/in-call, ₹7000/out-call

Body to body massage with : ₹4500/in-call

Full night for one person: ₹7000/in-call, ₹12000/out-call

Delhi Russian Escorts provide clients with the opportunity to experience an array of activities - everything from dining at upscale restaurants to watching the latest movies. Hotel call girls are available year-round to offer unforgettable experiences and fulfill all of your erotica desires. Escort services go beyond the traditional notion of call girls by providing clients with customized experiences beyond dinner companionship to social events. (27-April-2024(PSS)

Mahipalpur | Majnu Ka Tilla | Aerocity | Delhi,Noida | Gurgaon | Paharganj | GTB Nagar | Sarita Vihar | Chattarpur | Dwarka | Rajouri Garden | Connaught Place | Janakpuri

▂▃▄▅▆▇█▓▒░░▒▓█▇▆▅▄▃▂📢N-C-R⭐VIP⭐GENUINE🅰️█▬█⓿▀█▀💋 𝐆𝐈𝐑𝐋 💥ANAL SEX💥 BDSM💥69 POSE💥LIP KISS💥 DEEP SUCKING WITHOUT CONDOM💥 CUM ON FACE💥 NUDE DANCE💥 BOOBS RUBBING💥 LICKING💥HAND JOB 💏GIRLFRIEND EXPERIENCE💏 ❣️College girls, ❣️Russian girls, ❣️Working girls, ❣️North-east girls, ❣️ Punjabi girls, etc........................

EROTIC MASSAGE💥Rohini Sector 15 Call Girls Delhi 9999965857 @Sabina Saikh No Advance

Rohini Sector 15 Call Girls Delhi 9999965857 @Sabina Saikh No AdvanceCall Girls In Delhi Whatsup 9873940964 Enjoy Unlimited Pleasure

@9999965857 🫦 Sexy Desi Call Girls Vaishali 💓 High Profile Escorts Delhi 🫶

Delhi Russian Escorts provide clients with the opportunity to experience an array of activities - everything from dining at upscale restaurants to watching the latest movies. Hotel call girls are available year-round to offer unforgettable experiences and fulfill all of your erotica desires. Escort services go beyond the traditional notion of call girls by providing clients with customized experiences beyond dinner companionship to social events. (27-April-2024(PSS)

Mahipalpur | Majnu Ka Tilla | Aerocity | Delhi,Noida | Gurgaon | Paharganj | GTB Nagar | Sarita Vihar | Chattarpur | Dwarka | Rajouri Garden | Connaught Place | Janakpuri

▂▃▄▅▆▇█▓▒░░▒▓█▇▆▅▄▃▂📢N-C-R⭐VIP⭐GENUINE🅰️█▬█⓿▀█▀💋 𝐆𝐈𝐑𝐋 💥ANAL SEX💥 BDSM💥69 POSE💥LIP KISS💥 DEEP SUCKING WITHOUT CONDOM💥 CUM ON FACE💥 NUDE DANCE💥 BOOBS RUBBING💥 LICKING💥HAND JOB 💏GIRLFRIEND EXPERIENCE💏 ❣️College girls, ❣️Russian girls, ❣️Working girls, ❣️North-east girls, ❣️ Punjabi girls, etc........................

EROTIC MASSAGE💥@9999965857 🫦 Sexy Desi Call Girls Vaishali 💓 High Profile Escorts Delhi 🫶

@9999965857 🫦 Sexy Desi Call Girls Vaishali 💓 High Profile Escorts Delhi 🫶Call Girls In Delhi Whatsup 9873940964 Enjoy Unlimited Pleasure

Russian Call Girls Rohini Sector 3 💓 Delhi 9999965857 @Sabina Modi VVIP MODELS 24/52

Booking Contact Details :-

WhatsApp Chat :- [+91-9999965857 ]

The Best Call Girls Delhi At Your Service

Russian Call Girls Delhi Doing anything intimate with can be a wonderful way to unwind from life's stresses, while having some fun. These girls specialize in providing sexual pleasure that will satisfy your fetishes; from tease and seduce their clients to keeping it all confidential - these services are also available both install and outcall, making them great additions for parties or business events alike. Their expert sex skills include deep penetration, oral sex, cum eating and cum eating - always respecting your wishes as part of the experience

(27-April-2024(PSS)

Two shots with one girl: ₹4000/in-call, ₹7000/out-call

Body to body massage with : ₹4500/in-call

Full night for one person: ₹7000/in-call, ₹12000/out-call

Delhi Russian Escorts provide clients with the opportunity to experience an array of activities - everything from dining at upscale restaurants to watching the latest movies. Hotel call girls are available year-round to offer unforgettable experiences and fulfill all of your erotica desires. Escort services go beyond the traditional notion of call girls by providing clients with customized experiences beyond dinner companionship to social events. (27-April-2024(PSS)

Mahipalpur | Majnu Ka Tilla | Aerocity | Delhi,Noida | Gurgaon | Paharganj | GTB Nagar | Sarita Vihar | Chattarpur | Dwarka | Rajouri Garden | Connaught Place | Janakpuri

▂▃▄▅▆▇█▓▒░░▒▓█▇▆▅▄▃▂📢N-C-R⭐VIP⭐GENUINE🅰️█▬█⓿▀█▀💋 𝐆𝐈𝐑𝐋 💥ANAL SEX💥 BDSM💥69 POSE💥LIP KISS💥 DEEP SUCKING WITHOUT CONDOM💥 CUM ON FACE💥 NUDE DANCE💥 BOOBS RUBBING💥 LICKING💥HAND JOB 💏GIRLFRIEND EXPERIENCE💏 ❣️College girls, ❣️Russian girls, ❣️Working girls, ❣️North-east girls, ❣️ Punjabi girls, etc........................

EROTIC MASSAGE💥Russian Call Girls Rohini Sector 3 💓 Delhi 9999965857 @Sabina Modi VVIP MODEL...

Russian Call Girls Rohini Sector 3 💓 Delhi 9999965857 @Sabina Modi VVIP MODEL...Call Girls In Delhi Whatsup 9873940964 Enjoy Unlimited Pleasure

Último (20)

slideshare Call girls Noida Escorts 9999965857 henakhan

slideshare Call girls Noida Escorts 9999965857 henakhan

@9999965857 🫦 Sexy Desi Call Girls Janakpuri 💓 High Profile Escorts Delhi 🫶

@9999965857 🫦 Sexy Desi Call Girls Janakpuri 💓 High Profile Escorts Delhi 🫶

(INDIRA) Call Girl Kashmir Call Now 8617697112 Kashmir Escorts 24x7

(INDIRA) Call Girl Kashmir Call Now 8617697112 Kashmir Escorts 24x7

Collective Mining | Corporate Presentation - April 2024

Collective Mining | Corporate Presentation - April 2024

Nicola Mining Inc. Corporate Presentation May 2024

Nicola Mining Inc. Corporate Presentation May 2024

Vip Call Girls South Ex ➡️ Delhi ➡️ 9999965857 No Advance 24HRS Live

Vip Call Girls South Ex ➡️ Delhi ➡️ 9999965857 No Advance 24HRS Live

CALL ON ➥8923113531 🔝Call Girls Vineet Khand Lucknow best Night Fun service 🧦

CALL ON ➥8923113531 🔝Call Girls Vineet Khand Lucknow best Night Fun service 🧦

Collective Mining | Corporate Presentation - May 2024

Collective Mining | Corporate Presentation - May 2024

Vijayawada ( Call Girls ) Pune 6297143586 Hot Model With Sexy Bhabi Ready F...

Vijayawada ( Call Girls ) Pune 6297143586 Hot Model With Sexy Bhabi Ready F...

VIP 7001035870 Find & Meet Hyderabad Call Girls Abids high-profile Call Girl

VIP 7001035870 Find & Meet Hyderabad Call Girls Abids high-profile Call Girl

✂️ 👅 Independent Goregaon Escorts With Room Vashi Call Girls 💃 9004004663

✂️ 👅 Independent Goregaon Escorts With Room Vashi Call Girls 💃 9004004663

VIP Call Girl Amritsar 7001035870 Enjoy Call Girls With Our Escorts

VIP Call Girl Amritsar 7001035870 Enjoy Call Girls With Our Escorts

Rohini Sector 15 Call Girls Delhi 9999965857 @Sabina Saikh No Advance

Rohini Sector 15 Call Girls Delhi 9999965857 @Sabina Saikh No Advance

@9999965857 🫦 Sexy Desi Call Girls Vaishali 💓 High Profile Escorts Delhi 🫶

@9999965857 🫦 Sexy Desi Call Girls Vaishali 💓 High Profile Escorts Delhi 🫶

Russian Call Girls Rohini Sector 3 💓 Delhi 9999965857 @Sabina Modi VVIP MODEL...

Russian Call Girls Rohini Sector 3 💓 Delhi 9999965857 @Sabina Modi VVIP MODEL...

Call Girls In Amritsar 💯Call Us 🔝 76967 34778🔝 💃 Independent Escort In Amritsar

Call Girls In Amritsar 💯Call Us 🔝 76967 34778🔝 💃 Independent Escort In Amritsar

Ambala Escorts Service ☎️ 6378878445 ( Sakshi Sinha ) High Profile Call Girls...

Ambala Escorts Service ☎️ 6378878445 ( Sakshi Sinha ) High Profile Call Girls...

CALL ON ➥8923113531 🔝Call Girls Fazullaganj Lucknow best sexual service

CALL ON ➥8923113531 🔝Call Girls Fazullaganj Lucknow best sexual service

VIP 7001035870 Find & Meet Hyderabad Call Girls Miyapur high-profile Call Girl

VIP 7001035870 Find & Meet Hyderabad Call Girls Miyapur high-profile Call Girl

Understanding the NUA rule.

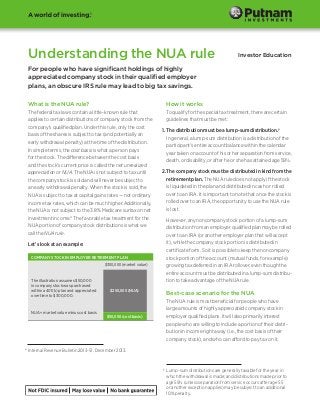

- 1. Understanding the NUA rule Investor Education For people who have significant holdings of highly appreciated company stock in their qualified employer plans, an obscure IRS rule may lead to big tax savings. What is the NUA rule? How it works The federal tax laws contain a little-known rule that applies to certain distributions of company stock from the company’s qualified plan. Under this rule, only the cost basis of the shares is subject to tax (and potentially an early withdrawal penalty) at the time of the distribution. In simple terms, the cost basis is what a person pays for the stock. The difference between the cost basis and the stock’s current price is called the net unrealized appreciation or NUA. The NUA is not subject to tax until the company stock is sold and will never be subject to an early withdrawal penalty. When the stock is sold, the NUA is subject to tax at capital gains rates — not ordinary income tax rates, which can be much higher. Additionally, the NUA is not subject to the 3.8% Medicare surtax on net investment income.* The favorable tax treatment for the NUA portion of company stock distributions is what we call the NUA rule. To qualify for the special tax treatment, there are certain guidelines that must be met: Let’s look at an example: COMPANY STOCK IN EMPLOYER RETIREMENT PLAN $300,000 (market value) The illustration assumes $50,000 in company stock was purchased within a 401(k) plan and appreciated over time to $300,000. NUA = market value minus cost basis $250,000 (NUA) $50,000 (cost basis) 1. The distribution must be a lump-sum distribution.† In general, a lump-sum distribution is a distribution of the participant’s entire account balance within the calendar year taken on account of his or her separation from service, death, or disability, or after he or she has attained age 59½. 2. The company stock must be distributed in kind from the retirement plan. The NUA rule does not apply if the stock is liquidated in the plan and distributed in cash or rolled over to an IRA. It is important to note that once the stock is rolled over to an IRA, the opportunity to use the NUA rule is lost. However, any noncompany stock portion of a lump-sum distribution from an employer qualified plan may be rolled over to an IRA (or another employer plan that will accept it), while the company stock portion is distributed in certificate form. So it is possible to keep the noncompany stock portion of the account (mutual funds, for example) growing tax deferred in an IRA rollover, even though the entire account must be distributed in a lump-sum distribution to take advantage of the NUA rule. Best-case scenario for the NUA The NUA rule is most beneficial for people who have large amounts of highly appreciated company stock in employer qualified plans. It will also primarily interest people who are willing to include a portion of their distribution in income right away (i.e., the cost basis of their company stock), and who can afford to pay tax on it. * Internal Revenue Bulletin 2013-51, December 2013. † Lump-sum distributions are generally taxable for the year in which the withdrawal is made; and distributions made prior to age 59½ (unless separation from service occurs after age 55 or another exception applies) may be subject to an additional 10% penalty.

- 2. Suppose you have retired at age 60 after working for a company for many years. Let’s assume that you have accumulated 5,000 shares of your company’s stock in a 401(k) plan and the stock is trading at $60 per share. The total market value of your company stock is therefore $300,000. If the stock’s cost basis were $10 per share, your total NUA on the stock would be $50 per share, or $250,000. Scenario one — roll the stock into an IRA: If you were to liquidate your stock and withdraw it from the plan in cash (or roll your company stock into an IRA and then withdraw it), the entire $300,000 would be taxed at your ordinary income tax rate. Assuming this rate is 39.6% (and there is no other income), your total federal tax bill on the company stock would be $118,800. Scenario two — use the NUA rule: If you were to take a lump-sum distribution of your stock in kind, the NUA rule would apply, and you would pay two different tax rates. You would pay ordinary income tax (39.6% in this example) on the $50,000 cost basis of the stock ($10 per share, times 5,000 shares). That tax would be $19,800. NUA or Rollover IRA? Below are some high-level considerations you should keep in mind when deciding between the NUA strategy or a Rollover IRA. As always, you should consult your financial representative to determine what may be best for your individual needs. IF YOU: NUA Are in a high tax bracket IRA ROLLOVER 3 3 3 Are leaving stock to heirs Tax on NUA Realize significant market appreciation in company stock Are considering an immediate distribution TAX SAVINGS USING NUA RULE* Tax on cost basis But if you immediately sold the shares after they were distributed from the plan, you would pay only 20% capital gains tax on the other $250,000, or $50,000. Your total tax bill therefore would be $69,800 — almost $50,000 less than if you had not taken advantage of the NUA rule. It is important to note that the market value and tax implications would vary if you decided to hold on to the shares after they were distributed from the plan and/or sold them at intervals over a period of years. 3 $120,000 Want to defer taxes as long as possible 80,000 3 Wish to diversify your holdings out of company stock 100,000 3 60,000 $118,800 40,000 $50,000 20,000 $19,800 0 IRA rollover without NUA rule and 39.6% income tax bracket applied to total market value of stock. Lump-sum distribution using NUA rule and 39.6% tax on cost basis, 20% on NUA portion. 1Example based on highest marginal tax rates of 39.6% for ordinary income and 20% for long-term capital gains. Note that the 3.8% Medicare surtax on net investment income does not apply to retirement plan distributions, including NUA. Using the net unrealized “depreciation” strategy in a down market Participants holding company stock within a retirement plan that has decreased sharply in value may want to consider resetting the cost basis of that stock by selling the stock within the plan and repurchasing it shortly thereafter. Unlike stock transactions outside of a retirement plan, the “wash sale” rule does not apply. Lowering the cost basis of the stock might improve the potential benefit of applying NUA treatment when distributing the stock from the plan in the future. For more information, contact your financial representative or call the Putnam IRA Hotline at 1-888-661-7684. This information is not meant as tax or legal advice. Tax laws are complex and subject to change. Please consult the appropriate professional advisor to see how these tax laws apply to your situation. Putnam Investments | One Post Office Square | Boston, MA 02109 | putnam.com Putnam Retail Management IR665 286359 2/14